How Geopolitics Impacts The Stock Market And Investor Strategy

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Geopolitical risk affects markets by disrupting trade, supply chains, and investor confidence. Conflicts, sanctions, and political instability can cause oil prices to spike, tech stocks to fall, and investors to shift money into safer assets like gold or government bonds. Markets don’t just respond to headlines — they react when global tension changes where money flows and what companies can earn.

Most people ignore geopolitics until it slams into their portfolio. But it’s not just headlines that matter — it’s how military tensions, shifting alliances, or trade barriers directly affect what companies can actually earn. A single blockade can stall a chipmaker’s entire supply chain. Sanctions can upend a commodity deal in a flash. It doesn’t hit everything — it hits where it counts. If you’re not tracking how these moves quietly reshape the playing field, you’re not seeing the full picture.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

How geopolitics influences financial markets

Markets don't move just on earnings or economic data — they also react strongly to what's happening in the world. Political decisions, conflicts, and global tensions can all move prices, sometimes in unpredictable ways. For beginners, learning how political news shapes financial trends can make investing feel less confusing and more grounded in real-world events.

Understanding geopolitical risk

Geopolitical risk is the chance that political situations around the world will affect markets. It covers everything from wars and sanctions to changes in leadership or international trade policies.

What counts as geopolitical risk?

Wars and military conflicts. Events like the Russia-Ukraine war or Israel-Gaza tensions don't just trigger humanitarian crises — they ripple through oil prices, defense stocks, currency markets, and safe-haven assets like gold. For example, the Ukraine war led to a spike in global wheat and energy prices due to supply disruptions from a key exporter.

Trade wars and tariffs. The U.S.-China trade war showed how tariffs on steel, tech, and agricultural goods could affect everything from commodity markets to global supply chains. Companies reliant on imports or exports often see earnings shrink or expand depending on how trade relationships evolve.

Political instability or regime change. Sudden leadership changes, mass protests, or coups (e.g., in Sri Lanka, Venezuela, or Turkey) tend to weaken currencies, raise bond yields, and scare off foreign investors. These shifts often cause short-term outflows of capital until stability returns.

Regulatory crackdowns and sanctions. When governments impose stricter rules — like China’s crackdown on tech giants or Western sanctions on Iran and Russia — it immediately impacts market value, especially for companies exposed to those regions. Sanctions can cut off access to international banking systems (like SWIFT) or freeze assets, severely limiting business operations.

Why it matters to markets

Uncertainty causes quick reactions. When investors aren't sure what’s coming, they tend to pull back from riskier bets.

Supply chains can break. Political trouble can stop the flow of key parts or materials, hurting company profits.

Money moves to safer places. During unrest, investors often shift funds to places they see as more stable.

The globalized market connection

Because economies are so linked, a decision made in one country can shake markets in many others. This makes geopolitics more important than ever for investors to follow.

How these links show up

Products made across borders. If one country blocks exports, companies around the world can feel the impact.

Nervous investors react together. A crisis in one part of the world can cause sell-offs in another — even if they’re not directly connected.

Currency shifts hit trade and profits. Political news often changes currency values fast, which affects companies that buy or sell overseas.

Sectors that often feel it first

Oil and energy. These prices jump quickly when there’s unrest in major producing regions.

Defense and security. These stocks often rise during global tension or after threats.

Food and raw materials. Trade issues or wars can limit supplies and raise prices worldwide.

Historical sensitivity of stocks to political events

Looking at past events shows how strongly markets can respond to political changes — and how those reactions often unfold.

Real-world examples

Brexit in 2016. Markets dropped sharply after the surprise vote, especially in the UK and Europe.

The U.S.-China trade war. Investors faced months of swings as new tariffs and policies were announced and rolled back.

The Gulf War. Oil prices shot up, and defense companies gained ground.

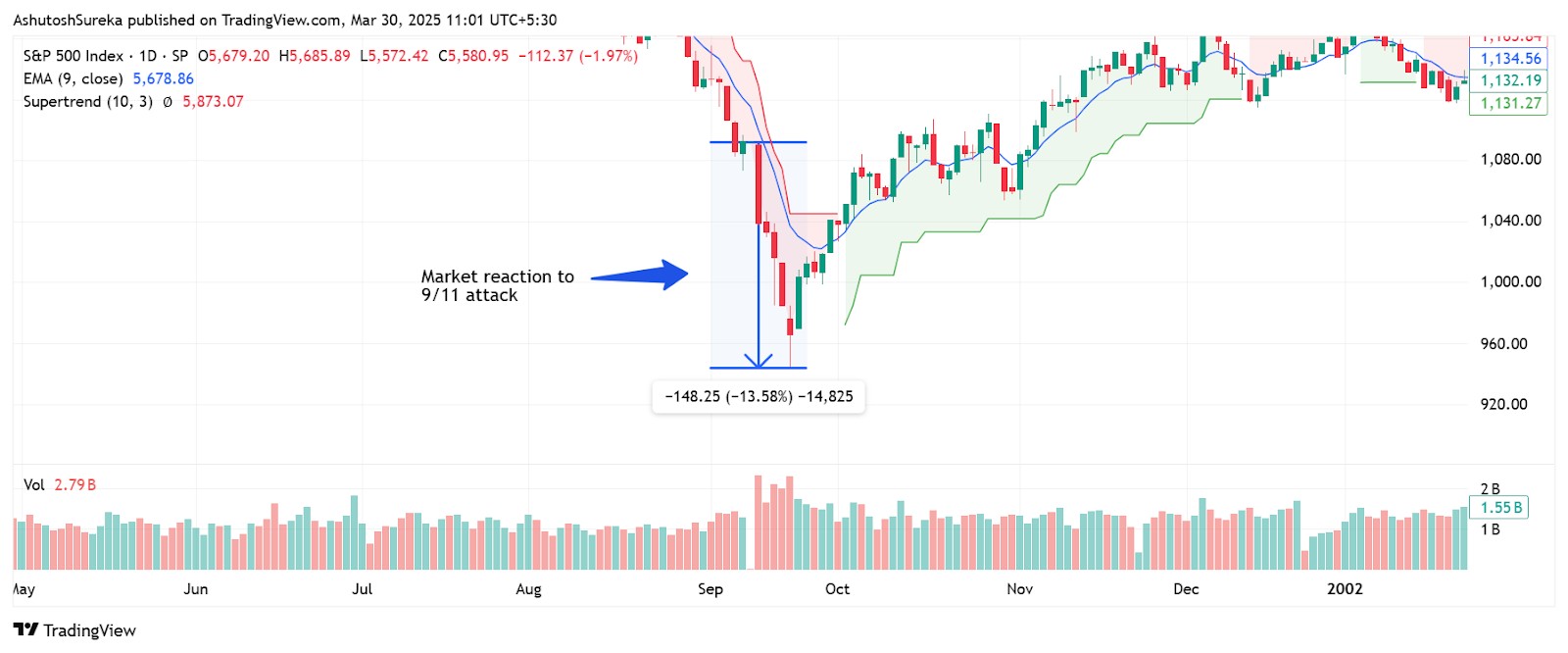

September 11 attacks. Markets were closed for days, and when they reopened, airline and financial stocks fell fast.

What we can learn

Big drops often happen quickly. Fear causes fast reactions, but markets may settle after the dust clears.

Some assets hold up better. Things like gold and government bonds tend to go up when there’s global uncertainty.

Spreading your investments helps. A well-balanced portfolio can reduce the damage from sudden global news.

Key types of geopolitical events affecting stocks

Not all political events hit the markets the same way. Some cause instant reactions, while others quietly shift investor behavior over time. For anyone investing — or just trying to understand why the market is moving — it's useful to know which global events tend to shake things up and how they usually play out.

Military conflicts and wars

Armed conflict is one of the most direct ways politics can move markets. From large wars to smaller clashes, these events often lead to sudden changes in investor mood and asset prices.

What kind of events have an impact?

Wars and invasions. Big conflicts like Russia’s invasion of Ukraine affect energy, trade, and regional stability.

Border clashes. Even short-lived military tensions between countries can cause nervousness among investors.

Terrorist activity or unrest. These can lead to spending on security or defense, shifting focus within markets.

How markets usually respond

Investors look for safer bets. Gold, U.S. government bonds, and other lower-risk assets tend to rise.

Oil prices often climb. Conflicts near oil-producing regions usually push energy prices higher.

Defense stocks benefit. Companies that supply the military may see gains when tensions rise.

Economic sanctions and trade restrictions

Sanctions and trade rules might seem like quiet political moves, but they can hit businesses and markets hard.

What happens when sanctions are announced?

Companies lose access. Businesses tied to sanctioned countries or products may lose sales or face supply issues.

Global chains get tangled. Sanctions on one country often create ripple effects for firms in other countries.

Tariffs lead to tit-for-tat moves. A trade war can grow quickly, bringing pain to industries far beyond the original dispute.

Industries that usually feel it first

Tech and chips. Restrictions on exports to China, for example, have affected big names in tech.

Banks. Financial institutions linked to targeted regions may need to exit deals or write down assets.

Energy and raw materials. Blocking exports from places like Russia creates global shortages in oil and metals.

Diplomatic breakdowns and alliances

Markets don’t just react to wars or sanctions — they also watch what happens in high-level talks between countries.

When talks go badly

Markets get nervous. Failed peace or trade discussions can cause quick sell-offs.

Global deals fall apart. Exiting international pacts often creates new uncertainty and raises business risks.

Less cooperation means more risk. If global leaders stop working together, it’s harder to solve shared economic problems.

When diplomacy works

Investors feel more confident. New trade agreements or peace deals often boost stocks.

Money returns to old markets. Countries seen as too risky may suddenly attract investors again after positive talks.

Regime changes and political instability

When governments fall or shift sharply, markets often react before the dust even settles.

What kind of changes matter?

Coups and uprisings. Sudden leadership changes can freeze investment and shake economic growth.

Surprise election outcomes. Unexpected leaders often cause short-term market swings as investors reassess their plans.

Moves toward tighter control. Countries that clamp down on freedoms or markets may see investors pull out.

What investors should watch for

Developing economies are more exposed. Political chaos tends to hit smaller or emerging markets harder.

Currency losses are common. Local money often drops in value when a government looks unstable.

Unclear policy adds risk. Businesses may delay plans when they don’t know what rules are coming next.

Sector-specific impact of geopolitical events

Not every part of the market responds the same way when the world gets politically tense. Some industries are more likely to feel the heat — or benefit — depending on what’s happening globally. For investors, understanding which sectors are more exposed can help guide smarter choices during uncertain times.

Defense and aerospace

When global tensions rise, companies in this space often gain momentum. It’s one of the few sectors that tends to do well during conflict.

Why this sector holds up

Governments spend more on security. Rising threats usually lead to bigger defense budgets and more orders for equipment and aircraft.

Steady demand during conflict. Wars or ongoing tensions often keep contracts flowing even if the rest of the economy slows down.

Alliances boost exports. Countries that work together politically often buy from each other, which helps sales.

What to keep an eye on

New government deals. Announcements of defense contracts can quickly push stock prices higher.

Prolonged conflicts. The longer tensions last, the more spending tends to follow.

Export rules. Shifts in policy about selling arms can also move these stocks.

Energy and commodities

This sector reacts quickly to conflict or unrest in parts of the world rich in oil, gas, and raw materials.

Why it moves fast

Crucial supply routes at risk. Trouble near key oil transport zones often pushes prices up.

Sanctions squeeze supply. Blocking exports from countries like Russia cuts into global fuel availability.

Governments tap reserves. When things get tight, countries release oil from storage, changing short-term prices.

Other key materials respond too

Food and metals. Wars or droughts in key areas can raise prices for wheat, copper, or fertilizer.

Fast price changes. The market tends to swing quickly based on headlines or new developments.

Technology and semiconductors

This sector is highly global, and it often finds itself at the center of trade disputes or export bans.

What makes it vulnerable

Chips mostly come from one place. Taiwan makes many of the world’s most advanced semiconductors, putting it under the spotlight during tensions.

Limits on trade hurt sales. U.S. restrictions on doing business with Chinese tech firms often reduce revenue.

Harder to work across borders. Political stress makes international collaboration and R&D more difficult.

What this means for investors

Sales can drop fast. When restrictions hit, affected companies often miss targets.

Production risks stay high. Moving factories out of sensitive regions isn’t quick or cheap.

Stocks react sharply. Tech tends to be among the most reactive sectors when political news breaks.

Travel, tourism, and airlines

This group depends on peace, stable fuel prices, and open skies — so it often suffers during geopolitical tension.

How conflict disrupts travel

People skip trips. Wars or terror threats often lead to cancellations or delays.

Flight paths change. Airlines may need to avoid certain regions, increasing costs.

Fuel gets expensive. When oil prices rise due to conflict, it directly hits airline budgets.

Tourism takes a broader hit

Regions near conflict lose business. Tourists usually avoid areas close to unrest.

Luxury travel slows down. Wealthier travelers tend to pull back during times of uncertainty.

Costs rise across the board. Insurance and security become more expensive, which affects profits.

Long-term vs short-term effects of geopolitical events

Political shocks don’t all leave the same kind of mark on markets. Some create short-term stress that fades quickly. Others change how industries work or how countries trade for years to come. For investors, it’s helpful to know which events are likely to blow over — and which ones call for a fresh look at strategy.

Temporary dips vs. structural changes

Some events shake things up for a few weeks. Others leave lasting scars. Telling the difference helps you stay calm during fast-moving news and act wisely when things shift for good.

Events that often pass quickly

Election results. When the outcome is a surprise, markets might drop at first, but they often bounce back once policies become clear.

Limited military actions. If tensions don’t grow, the market reaction may fade in days or weeks.

Targeted sanctions. When they’re short-term or limited in scope, the broader market usually moves on quickly.

Events that stick around

Major wars. These can reshape economies, damage global trade, and change long-term spending patterns.

Long trade fights. Prolonged tension between big economies can permanently shift where companies manufacture and sell.

Political upheaval. When a country changes direction dramatically, it can lead to deep and lasting changes in how money moves.

How to read the signs

Time is a big clue. Short events usually fade fast, but long ones tend to leave deeper marks.

Watch for new laws or deals. If countries respond with major policy changes, markets may take longer to adjust.

Focus on the industries hit hardest. If a whole sector has to change how it works, the effect may not be temporary.

Historical recovery patterns

History shows that markets have been through many political shocks — and often recovered. That doesn’t mean every event is minor, but it does help put things in perspective.

What history tells us

World War II. After an early selloff, the U.S. market started to climb again, helped by wartime production and the post-war boom.

Cuban Missile Crisis. Stocks dropped on fear of nuclear war but bounced back within weeks once tensions cooled.

1970s oil crisis. This event led to high inflation and years of economic stress, changing how countries think about energy.

September 11 attacks. Markets reopened with losses but began to recover within months, especially after policy support kicked in.

Russia-Ukraine conflict. Some markets dropped quickly, but others adjusted. Energy and defense sectors saw lasting shifts.

To help investors navigate geopolitical risks with confidence, we’ve selected a list of trusted brokers that offer reliable access to global markets, strong risk management tools, and sector-specific exposure tailored for volatile times.

| Foundation year | Account min. | Demo | Deposit Fee | Withdrawal fee | Inactivity fee | Android | iOS | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | No | Yes | No | $25 for wire transfers out | $50 | Yes | Yes | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| 2014 | No | No | No | No charge | No inactivity fees | Yes | Yes | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| 1919 | No | No | No | $25 | No | Yes | Yes | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| 2015 | No | No | No | No charge up to a limit | Not specified | Yes | Yes | FCA, SEC, FINRA | 7.69 | Study review | |

| 1978 | No | Yes | No | No | No | Yes | Yes | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Tracking capital shifts and supply chokepoints during geopolitical tension

If you want to figure out how world events really hit stocks, stop watching speeches and start watching who controls the choke points. It’s not about diplomacy — it’s about who has the power to block chips, rare earths, gas, or food.

Take Taiwan — it’s not just a chipmaker, it’s the chipmaker. So when China does anything that hints at tension in the Strait, the real reaction isn’t in headlines — it’s in the quieter, second-layer supply chain stocks that depend on that flow. Skip the noise. Track the friction.

Another tactic that works? Line up geopolitical tension with where the money quietly moves. When one country flares up, investors don’t just pull out — they move into the next best spot. Think of it like capital hopping fences. Brazil’s energy boom during Russia sanctions? Or India catching flows during US-China flare-ups? That wasn’t a coincidence. Money doesn’t disappear — it finds a new home. And if you’re watching where it’s easiest to park capital next, that’s where the tradable opportunities show up.

Conclusion

Markets don’t react to politics just for the drama — they respond when there’s real economic impact. Disruptions to trade routes, currency fluctuations, and changes in corporate earnings are what move the needle. By the time a war breaks out or election results roll in, most of the market shift has already happened.

The real advantage lies in spotting early signs — when geopolitical tension starts to influence capital flows, shift trade dynamics, or weigh on specific sectors.

Understanding these shifts helps investors stay ahead, not react late. If you want to navigate the impact of geopolitics on financial markets, learn to connect the dots before they hit the headlines.

FAQs

What is the ‘flight to safety’ in finance?

A flight to safety happens when investors move their money from riskier assets to safer ones like gold, government bonds, or the U.S. dollar during times of uncertainty or market stress.

Can geopolitical crises create investment opportunities?

Yes, geopolitical crises can lead to sharp market movements, creating buying opportunities in undervalued sectors or regions. However, these situations also carry high risk and require careful analysis.

Why do oil prices rise during geopolitical conflicts?

Oil prices often rise during conflicts because of fears of supply disruptions, especially if key producers or trade routes are affected. Uncertainty about future availability drives up prices.

Are sanctions bad for all companies?

Not all companies lose out during sanctions. While those directly targeted may take a hit, others — especially in alternative markets or industries — often benefit from disrupted supply chains or less competition.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Insider trading is the illegal practice of buying or selling a company's securities (such as stocks or bonds) based on non-public, material, and confidential information about the company. This information is typically known only to insiders, such as company executives, employees, or individuals with close connections to the company, and it gives them an unfair advantage in the financial markets.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

A short squeeze is a situation in which short sellers are forced to close their positions at a loss, which leads to a sharp rise in the price of an asset.