How Interest Rate Hikes Impact Growth And Value Stocks

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Rising interest rates affect growth and value stocks differently. Growth stocks, which rely on future earnings, tend to decline as higher rates reduce the present value of those earnings. Meanwhile, value stocks, which generate steady profits and dividends, often outperform due to their financial stability. The best investments during rate hikes are companies with strong pricing power, low debt, and the ability to buy back shares. Investors should look beyond stock categories and focus on businesses that can adapt to changing economic conditions.

When the Fed raises interest rates, not all stocks react the same way. Growth stocks, which are valued on their future earnings potential, take a hit because higher borrowing costs make those future profits less appealing. Meanwhile, value stocks — companies making strong profits right now — tend to do better, especially if they don’t rely on debt to grow.

But the real story isn’t just about picking growth or value stocks — it’s about finding companies that can adapt. Businesses that buy back shares to offset rising costs or those with the power to raise prices without scaring off customers often come out ahead. Instead of just assuming “higher rates hurt growth stocks,” smart investors dig deeper to see which companies actually stand to benefit.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding growth and value stocks

When it comes to investing, not all stocks perform the same way. Some companies focus on fast growth, while others offer stability and steady returns. This is where growth stocks and value stocks come in. Knowing the difference helps investors make smarter choices based on their financial goals.

Definition of growth stocks

Growth stocks are companies that are expanding quickly, often beating the rest of the market in terms of sales and earnings growth. Instead of paying dividends, these companies reinvest profits into new projects, technology, and expansion.

What makes a stock a growth stock?

Revenue and earnings are rising fast. These companies are constantly growing their sales and profits.

They don’t pay big dividends. Instead, they reinvest in research, innovation, and market expansion.

They often trade at high valuations because investors expect strong future growth.

Popular in tech, biotech, and emerging industries, where new ideas drive rapid expansion.

Examples of growth stocks

Amazon. Started as an online bookstore and became an e-commerce giant with cloud computing dominance.

Tesla. A leader in electric vehicles and renewable energy, with a history of rapid expansion.

Nvidia. A major player in AI and computer graphics, driving innovation in multiple industries.

Who should invest in growth stocks?

Investors looking for big long-term gains.

Those comfortable with higher risk and stock price swings.

Anyone willing to hold stocks for years rather than short-term trading.

Growth stocks do well when the economy is strong, but they can drop sharply in a downturn as investors shift to safer assets.

Definition of value stocks

Value stocks are solid companies that trade at lower prices than they should. Investors see them as undervalued opportunities, expecting the market to eventually recognize their true worth.

What makes a stock a value stock?

They trade at lower prices compared to earnings and sales.

Often well-established companies that have been around for decades.

They pay dividends, giving investors a steady income stream.

They hold up better during market downturns, making them a defensive investment.

Examples of value stocks

Johnson & Johnson. A trusted healthcare company with steady earnings and dividend payouts.

Coca-Cola. A globally recognized brand with stable revenue and strong cash flow.

Bank of America. A financial powerhouse trading below its true value based on earnings potential.

Who should invest in value stocks?

Investors who want steady, long-term returns.

Those looking for dividend income instead of just stock price growth.

Anyone who prefers less risk during market downturns.

Impact of interest rate hikes on stock valuations

When interest rates rise, stocks often take a hit. Higher rates make borrowing more expensive, lower the value of future earnings, and put pressure on company profits. Investors need to understand how this affects stock valuations to make smarter decisions.

Discounted cash flow analysis

Investors use discounted cash flow (DCF) analysis to figure out how much a company’s future profits are worth in today’s dollars. When interest rates go up, the discount rate rises, which lowers the present value of those future earnings.

How this impacts stock valuations

Higher discount rates mean lower valuations. Investors expect higher returns, which reduces the price they’re willing to pay for stocks.

Growth stocks suffer the most. Companies that won’t be profitable for years see their future earnings discounted more heavily, lowering their stock prices.

Investors demand better returns. When rates rise, investors move money to safer assets like bonds, reducing demand for stocks.

Example

If a company expects to make $1 million a year in profits for the next 10 years, its total value depends on how much those future earnings are worth today.

At a 5% discount rate, its value might be $7.7 million.

If the discount rate jumps to 8%, its value drops to $6.7 million — even though the company’s profits haven’t changed.

This is why rising interest rates drag stock prices lower, especially for high-growth companies.

Cost of capital

Businesses need money to fund operations, expand, and invest in growth. They get that money through debt or selling stock — but when interest rates rise, borrowing gets more expensive.

How higher rates impact companies

More expensive loans. A company paying 3% on a $100 million loan will see its interest payments double if rates rise to 6%.

Lower profits. If companies are spending more on interest, that means less money for new projects and shareholders.

Fewer stock buybacks and dividends. When debt costs more, companies cut back on stock buybacks, reducing support for share prices.

Growth stocks struggle, value stocks shine. Companies that rely on cheap debt for expansion lose their edge, while stable, dividend-paying value stocks become more attractive.

Effect of rate hikes on growth stocks

When interest rates go up, growth stocks often take the biggest hit. Since these companies rely on future earnings to justify their stock prices, anything that reduces the value of those future profits hurts their valuations. Understanding why growth stocks are so sensitive to rate hikes can help investors navigate changing market conditions.

Sensitivity to interest rates

Growth stocks are priced based on what investors expect them to earn in the future. Higher interest rates reduce the value of those future earnings, making these stocks less attractive.

How higher rates hurt growth stocks

Investors demand better returns. When interest rates rise, stocks have to compete with safer investments like bonds, leading investors to move money out of high-risk growth stocks.

Borrowing costs go up. Many growth companies use debt to expand, and higher rates make that more expensive, slowing growth.

Market sentiment changes. In low-rate environments, investors chase high-growth opportunities, but when rates rise, they become more cautious and focus on stable, profitable businesses.

This is why growth stocks tend to struggle when interest rates are rising — their future earnings simply don’t look as valuable in a high-rate world.

Historical performance

Looking at past rate hike cycles, we see the same pattern: growth stocks struggle, especially when rates rise sharply.

Major examples

Dot-Com bubble (1999–2000)

Tech stocks soared in the late ‘90s, but when the Fed raised rates, the bubble burst.

The NASDAQ fell nearly 80%, while value stocks held up better.

2015–2018 rate hikes

Growth stocks held up early on but struggled as rates kept rising.

By 2018, tech stocks took a hit, and value stocks outperformed.

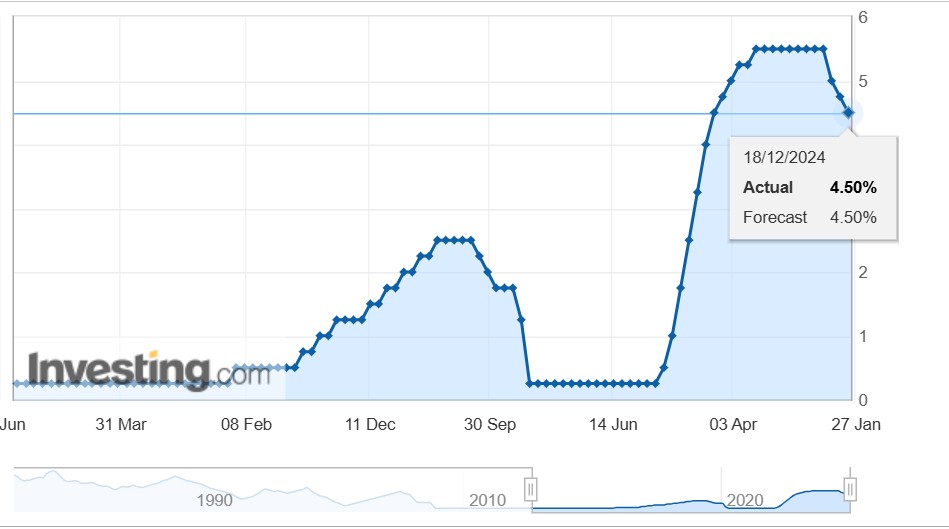

2022–2023 rate hikes

The Fed raised rates from near 0% to over 5%, leading to major declines in high-growth stocks.

Big names like Meta, Tesla, and Amazon saw steep drops.

What history shows

Frequent rate hikes hit growth stocks the hardest.

Tech-heavy markets feel the most pain.

Slower rate hikes give growth stocks some breathing room, but they still underperform value stocks.

Effect of rate hikes on value stocks

When interest rates rise, not all stocks react the same way. While growth stocks tend to struggle, value stocks often perform better. These companies already have steady earnings and dividends, making them less vulnerable to rising borrowing costs.

Resilience to interest rate changes

Value stocks aren’t priced based on big future earnings projections like growth stocks. Instead, their value comes from current earnings, dividends, and solid fundamentals — things that don’t change much when interest rates rise.

What makes value stocks more stable?

Steady cash flow. These companies are already profitable, so they don’t rely on cheap debt to expand.

Dividends provide income. When rates rise, investors look for reliable income sources, making dividend-paying stocks more attractive.

Lower valuations mean less risk. Value stocks don’t trade at inflated price levels, so their prices don’t drop as sharply when markets get shaky.

Financials and defensive stocks hold up better. Many value stocks are in sectors like banking, healthcare, and consumer goods, which tend to be less affected by rate hikes.

This is why value stocks are often seen as a safer bet in high-rate environments.

Historical performance

Looking back at previous rate hike cycles, we can see a clear pattern: value stocks tend to do better than growth stocks when interest rates rise.

Major examples

Dot-Com crash (2000–2002)

The tech bubble burst when the Fed raised rates, and growth stocks collapsed.

Value stocks held up better as investors shifted into companies with stable earnings.

2015–2018 rate hike cycle

The Fed raised rates gradually, and growth stocks initially kept up.

By 2018, value stocks began outperforming, as rising rates weighed more heavily on growth companies.

2022–2023 rate hikes

The Fed raised rates from near zero to over 5% to fight inflation.

Growth stocks plummeted, while value stocks in energy, financials, and consumer staples outperformed.

Dividend-paying stocks gained popularity as investors sought reliable income streams.

Investor sentiment and behavioral factors

When the Federal Reserve raises interest rates, investor sentiment shifts. People start worrying about risk, leading to major changes in how money moves through the market. Investors become more cautious, and certain types of stocks fall out of favor while others gain momentum.

Risk aversion

Higher interest rates create uncertainty, and when investors aren’t sure what will happen next, they move their money into safer assets. Growth stocks, which depend on future earnings, become less attractive, while value stocks and dividend-paying companies gain favor.

How investors react to rate hikes

They pull money out of high-risk assets. Tech stocks and speculative companies lose investor interest as borrowing costs rise.

Dividend stocks become more attractive. Investors want steady returns, so they move into stocks that offer reliable income.

Bonds start looking better. As bond yields go up, some investors shift away from stocks altogether.

Markets get more volatile. Investors adjust their portfolios, leading to big price swings and temporary sell-offs.

Market rotation

Every time interest rates rise, we see a familiar trend. Growth stocks lose steam, and investors rotate into value stocks that hold up better when borrowing costs increase.

What market rotation looks like during rate hikes

Investors sell growth stocks

High-flying tech stocks start losing momentum.

Stocks with high price-to-earnings (P/E) ratios get hit the hardest.

Money shifts into value stocks

Value stocks — especially in financials, industrials, and consumer staples — see more demand.

Lower-priced stocks with steady earnings and dividends gain investor interest.

Some sectors benefit more than others

Banks do well because they earn more from higher interest rates.

Energy stocks often benefit from inflation-driven price increases.

Consumer staples and healthcare stocks remain strong because people still need essential goods and services.

Momentum drives even more rotation

As more investors move into value stocks, the trend builds on itself.

Growth investors looking for lower risk start following the shift, adding even more strength to value stocks.

If you have understood how rate hikes affect different types of stocks and want to execute your investment strategy, you can do so through any stock broker. We have researched the market and narrowed down to a list of best options available. You can compare them through the table below and make a choice for yourself:

| Stocks | Foundation year | Account min. | Demo | Research and data | Basic stock/ETF fee | Deposit Fee | Withdrawal fee | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2007 | No | Yes | Yes | $3 per trade | No | $25 for wire transfers out | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| Yes | 2014 | No | No | Yes | Zero Fees | No | No charge | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| Yes | 1919 | No | No | Yes | Zero Fees | No | $25 | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| Yes | 2015 | No | No | Yes | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | No | No charge up to a limit | FCA, SEC, FINRA | 7.69 | Study review | |

| Yes | 1978 | No | Yes | Yes | 0-0,0035% | No | No | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

How to play rate hikes smarter

A common mistake investors make when rates rise is automatically dumping growth stocks and piling into value stocks without looking at the details. Some high-growth companies have strong cash reserves and little debt, meaning they’re less vulnerable to rising borrowing costs than people assume. At the same time, not every value stock is a safe bet — many companies in industries like utilities or consumer staples rely on cheap loans to fund their operations, and higher rates can put serious pressure on them.

Instead of following the crowd, investors should look for companies that are buying back their own shares. Businesses that use their profits to reduce the number of shares available tend to stay more stable during rate hikes because they aren’t dependent on outside financing to grow.

Another factor many overlook is pricing power. When rates go up, the companies that can raise prices without losing customers tend to come out ahead. This is why well-known brands, subscription-based tech companies, and manufacturers of essential products often do well even when borrowing costs rise. Meanwhile, companies that compete by offering the lowest prices, like budget retailers or commodity-based manufacturers, can get squeezed because they have no room to adjust.

Instead of focusing only on whether a stock is classified as “growth” or “value,” investors should be looking for companies that control their own margins and don’t rely on cheap debt to survive. That’s where the strongest investments tend to be.

Conclusion

When interest rates rise, the best investments aren’t always the obvious ones. Some growth companies can keep winning if they have strong financials, while some value stocks can struggle if they rely too much on cheap debt. The real winners are the companies that know how to manage their costs, buy back their shares, and adjust their pricing without driving customers away. Instead of assuming rate hikes mean growth stocks are doomed and value stocks will thrive, smart investors look beyond the labels and focus on what really drives a company’s success.

FAQs

Do rate hikes always cause growth stocks to fall?

Not always. If the economy is strong and earnings grow fast enough, some growth stocks can still perform well — even with rising rates.

What is the difference between a value stock and a growth stock?

Value stocks trade at lower prices relative to their fundamentals, often seen as undervalued. Growth stocks, on the other hand, have higher valuations due to expectations of strong future earnings growth.

Should I switch from growth to value stocks during rate hikes?

Not necessarily. A balanced portfolio with both growth and value stocks can help you handle different rate environments without making big, risky shifts.

Is growth investing better than value investing?

Growth investing offers higher potential returns but comes with more risk and volatility. Value investing provides more stability and can be a safer option, especially during economic downturns.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Benchmark indices, like the S&P 500, track overall market performance; sectoral indices, such as the Nasdaq-100, focus on specific industries; market-cap based indices, like the Russell 2000, classify stocks by size; coverage-based indices span global to country-specific markets; indices by weighting method vary in how they assign component weights; and ethical indices consider ESG factors alongside financial performance.