Top 10 Weakest Currencies In The World

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The weakest currencies in the world are:

Currencies affect countries' economies, playing a role in business and travel. While strong currencies like the US Dollar and Euro dominate international money markets, some struggle with much lower value due to struggling economies, inflation, or government and policy struggles. These weaker currencies often reflect deeper national issues, from poor handling of budgets to unstable international trade. Understanding why some currencies lose value can reveal shifts in the world economy and how different nations cope with financial challenges.

In this article, we explore the top 10 weakest currencies in the world in 2025, highlighting their value compared to others, the reasons behind their decline, and the financial conditions shaping them.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Top 10 weakest currencies in the world

1. Iranian Rial (IRR)

The Iranian Rial is one of the weakest currencies in the world. Years of sanctions, economic struggles, and poor financial policies have caused its value to plummet.

The exchange rate against the US dollar is so extreme that people need stacks of Rials just to buy basic goods. Even though the government tries to stabilize it, ongoing inflation and declining oil exports keep pushing its value lower.

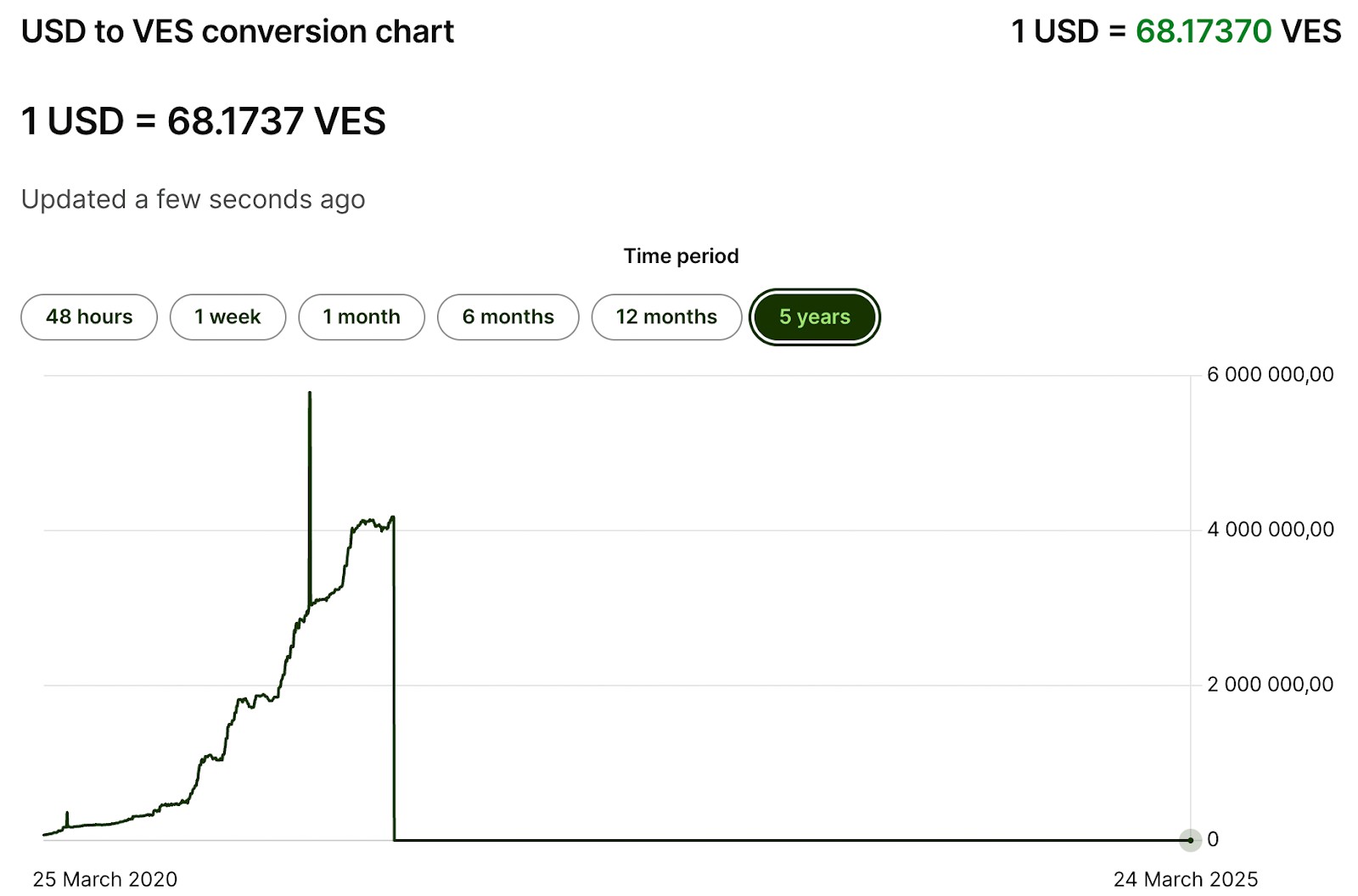

2. Venezuelan Bolívar (VES)

Venezuela’s Bolívar is one of the most extreme cases of inflation ever seen. Years of government mismanagement, corruption, and overdependence on oil wrecked the economy. This resulted in a financial disaster that wiped out people’s savings and made everyday life a struggle.

To cope, the government has removed zeros from the currency multiple times, but the Bolívar still holds little value. With the current exchange rate, even basic purchases require stacks of cash, making daily life incredibly difficult.

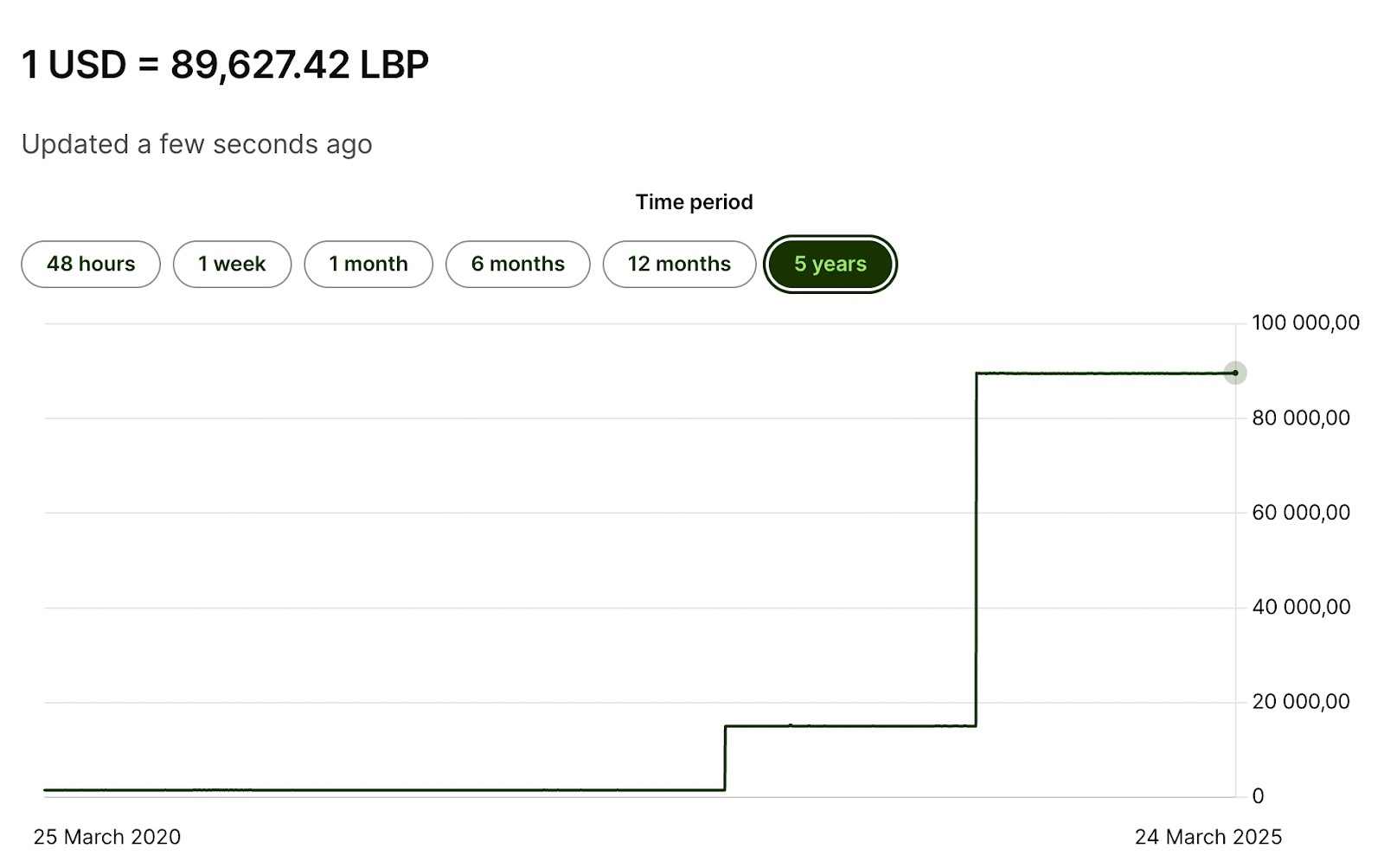

3. Lebanese Pound (LBP)

Lebanon’s Pound has lost much of its value as political chaos and financial mismanagement continue. Banks have imposed severe withdrawal limits, making it nearly impossible for people to access their own money.

The official exchange rate is nowhere near what people actually get on the street, where the Pound trades for a fraction of its supposed value. Without major economic changes, trust in the currency will only continue to erode.

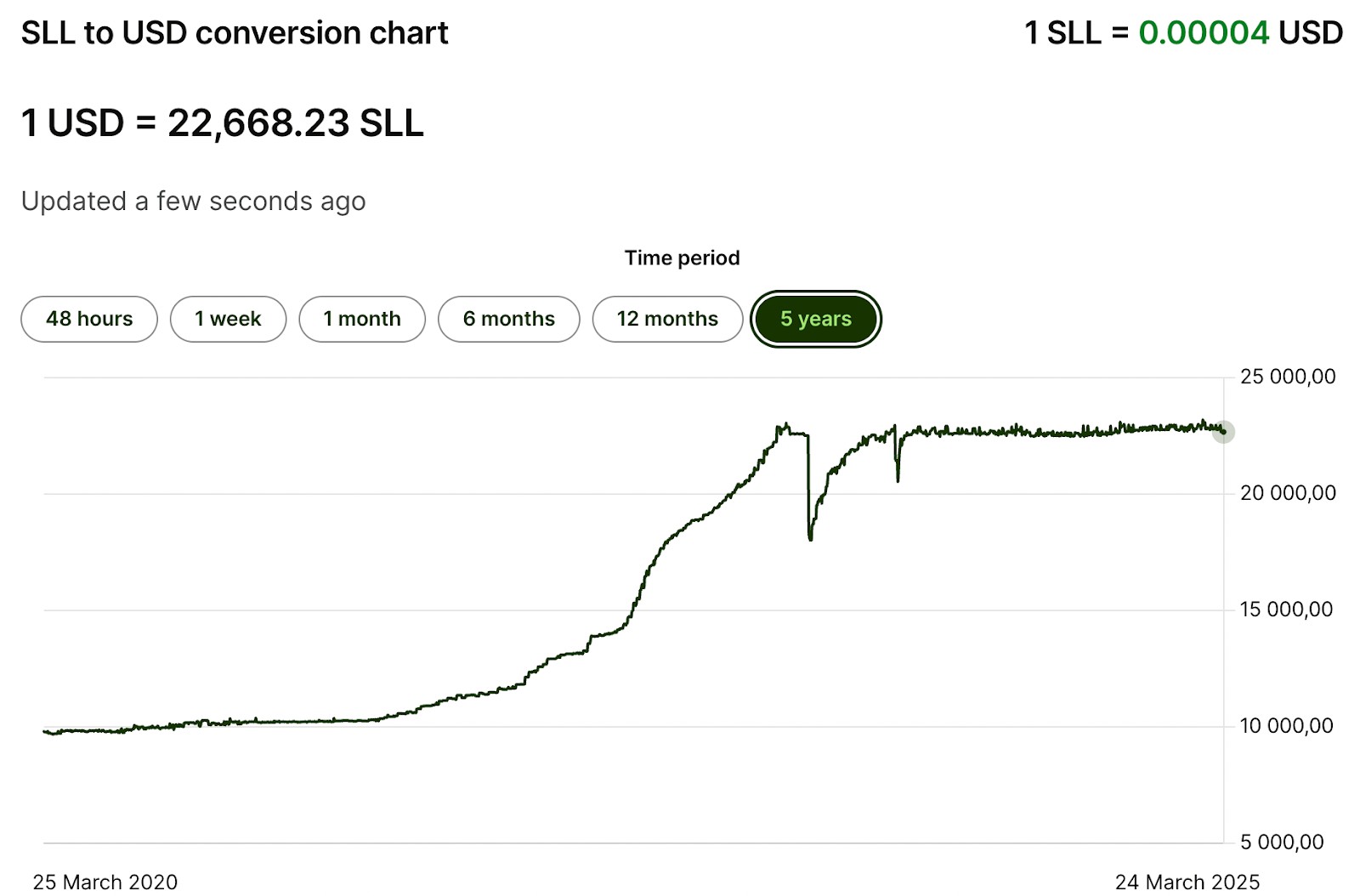

4. Sierra Leonean Leone (SLL)

The Leone has faced constant inflation and slow economic growth. Sierra Leone depends heavily on diamond mining, which means its economy takes a hit when global prices drop.

Because there’s little economic variety and a lot of debt, the Leone struggles to gain value. That’s why it remains one of the weakest currencies in the world.

5. Laotian Kip (LAK)

The Kip has struggled for years against stronger global currencies because Laos has a small economy and limited international trade.

Since much of the country’s income comes from farming and foreign reserves are low, the Kip doesn’t hold much weight on the global stage. Although the government is trying to modernize the economy, the Kip is still one of the weakest currencies in the world.

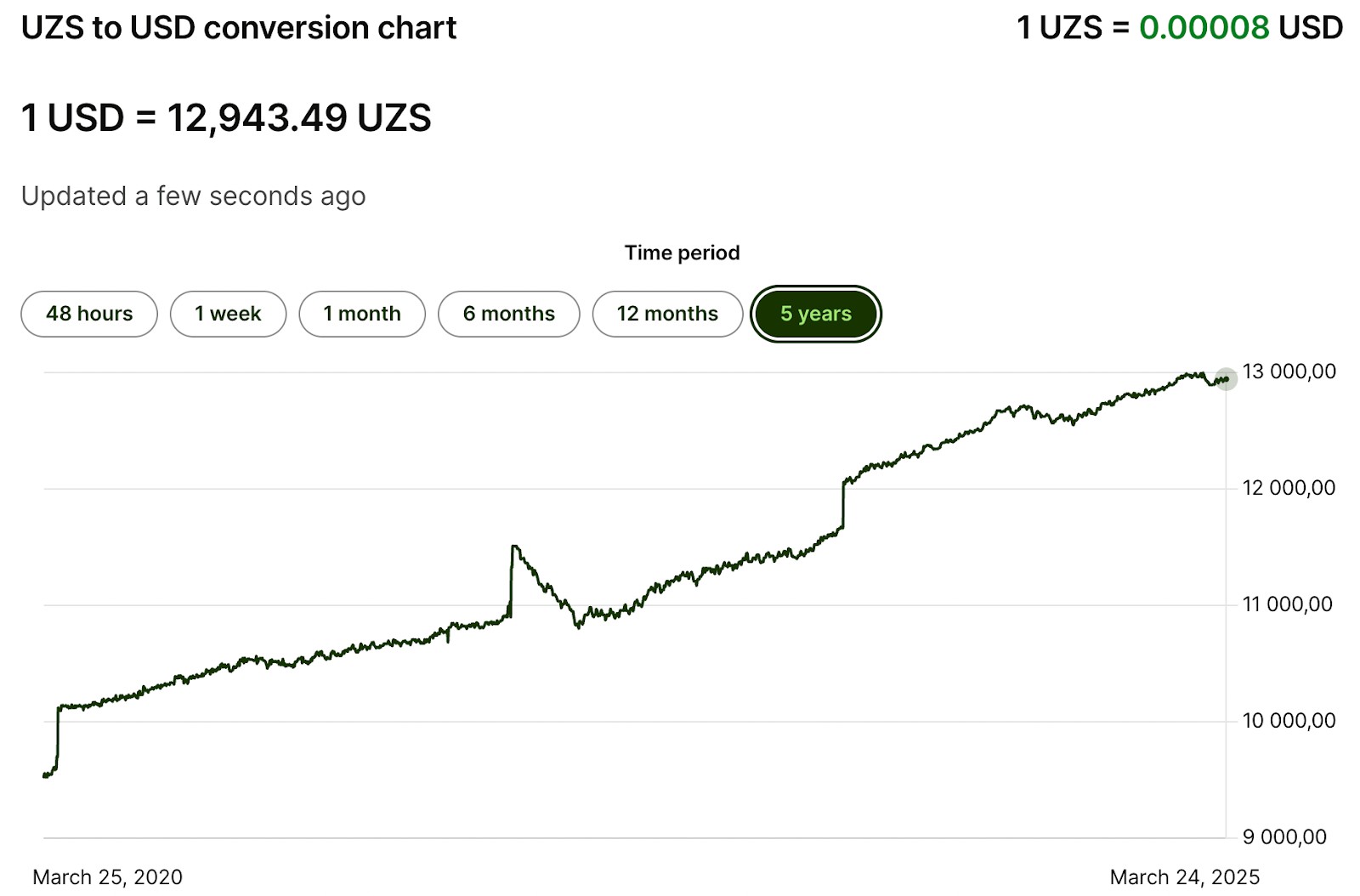

6. Uzbekistani Som (UZS)

The Uzbek Som has struggled for years due to strict currency controls and economic isolation. Even after recent efforts to open up the economy and lift foreign exchange restrictions, the Som is still weak. High inflation and a lack of foreign investment keep the Som from gaining strength.

7. Guinean Franc (GNF)

Guinea’s Franc stays weak because the country depends heavily on bauxite and gold exports. Ongoing political instability and poor infrastructure make it even harder for the economy to grow.

With low investor confidence and constant inflation, the Franc isn’t bouncing back anytime soon.

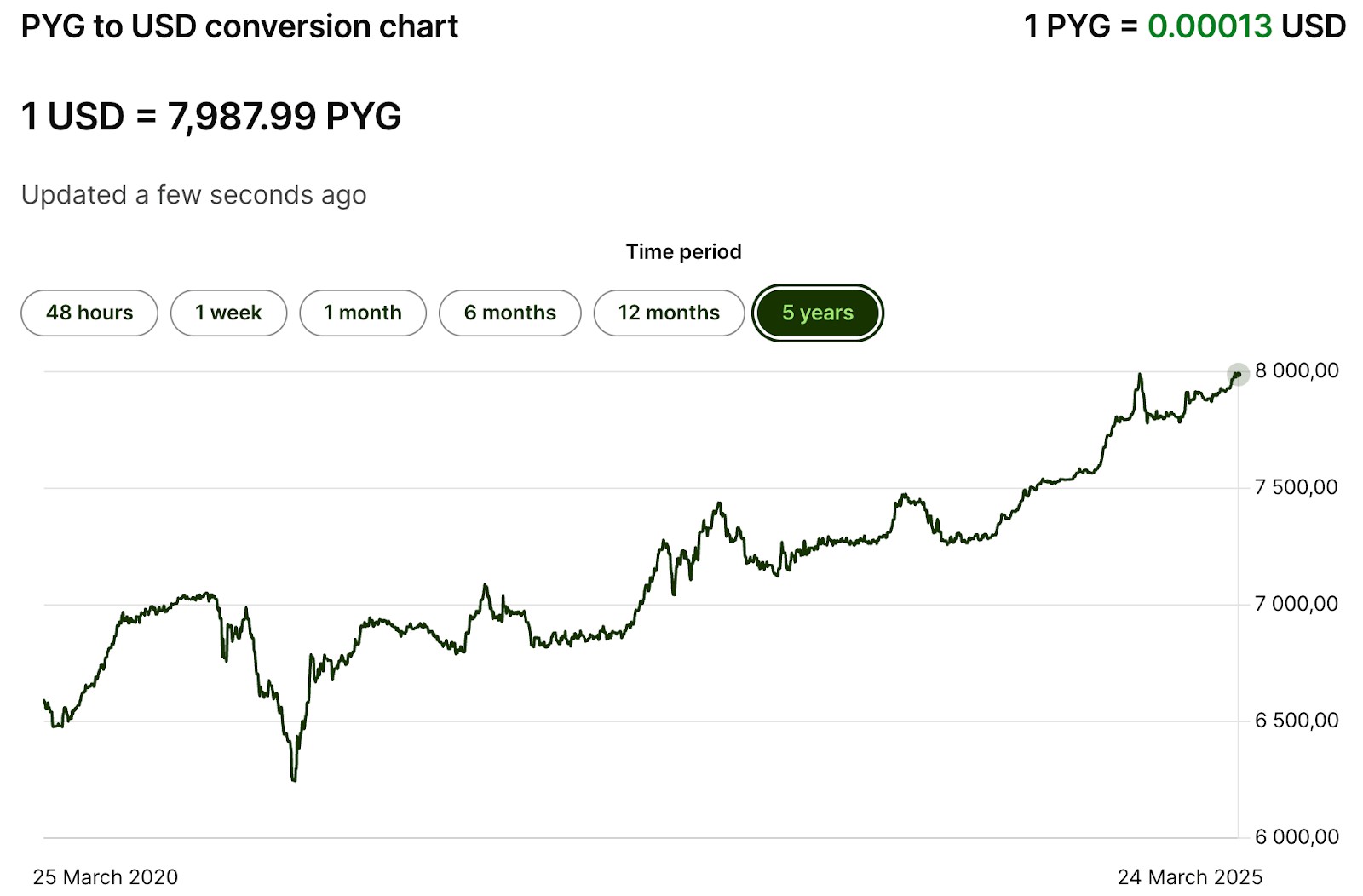

8. Paraguayan Guarani (PYG)

While Paraguay has shown moderate economic growth, the Guarani remains undervalued. A heavy dependence on agriculture makes it vulnerable to climate fluctuations and international market shifts.

Efforts to stabilize the Guarani have yet to significantly impact its global standing.

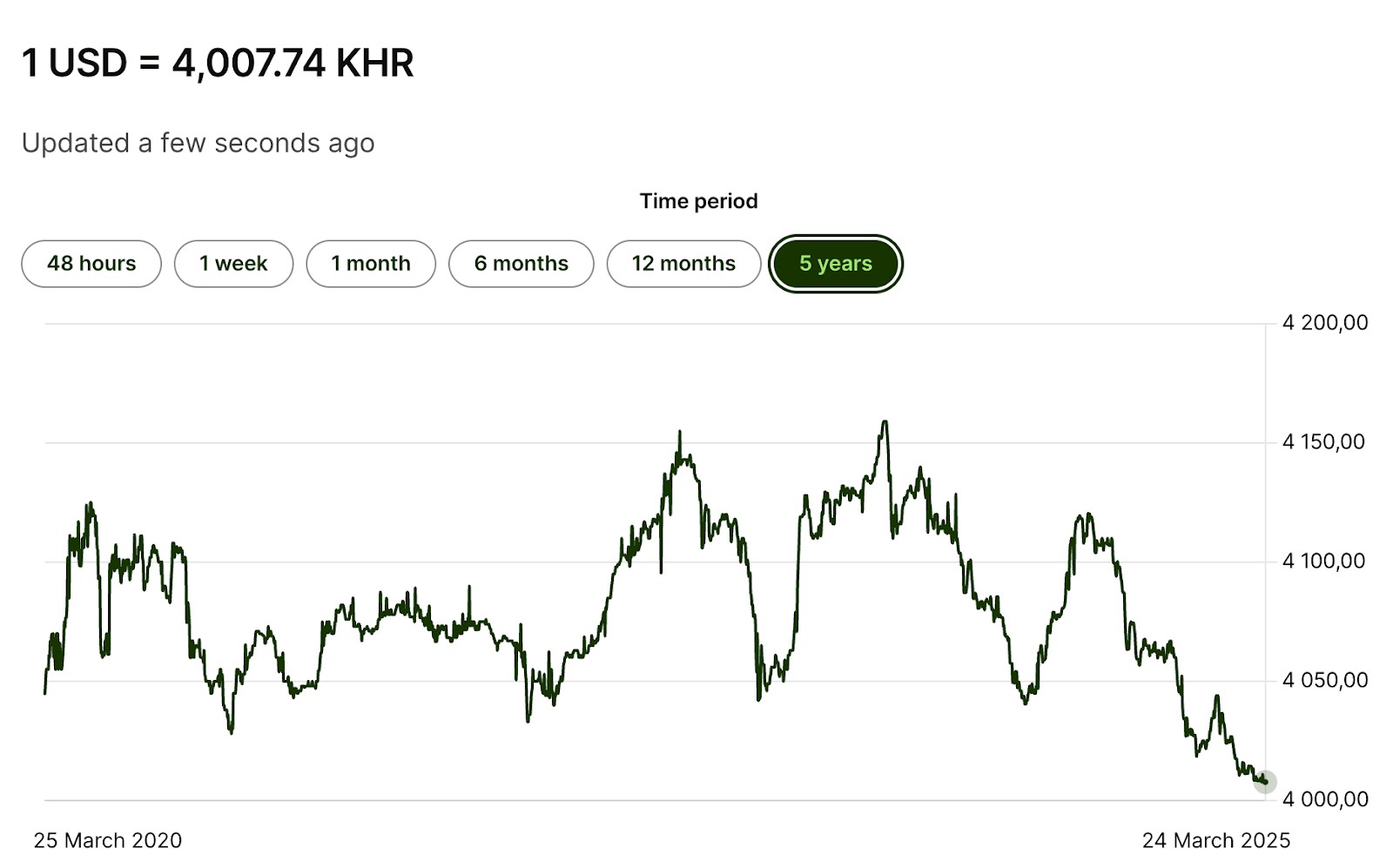

9. Cambodian Riel (KHR)

The Riel takes a backseat to the US Dollar, which dominates daily transactions in Cambodia. With little demand outside the country and not much use locally, it struggles to gain strength.

The government wants more people to use the Riel, but many citizens and businesses don’t trust it enough to switch.

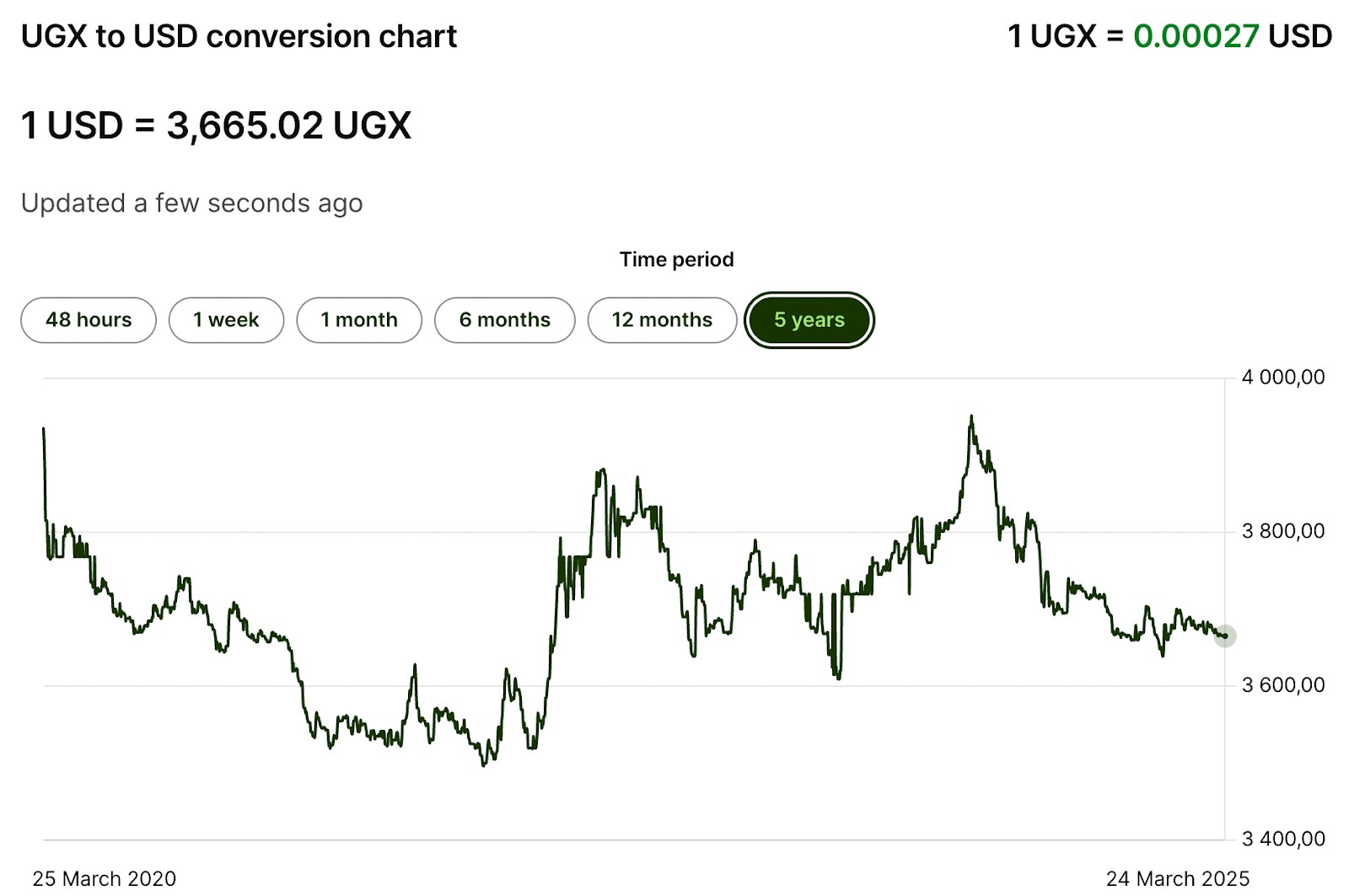

10. Ugandan Shilling (UGX)

Uganda’s Shilling has had a tough time, hit hard by inflation and its reliance on farming. Heavy debts and trade issues make it even harder for the currency to hold its value.

Even though Uganda’s economy is improving, the Shilling is still one of the world’s weakest currencies.

What defines a weak currency?

A weak currency isn’t just about low exchange rates — it’s a signal of deeper economic issues that can destabilize entire regions. One of the most overlooked factors is how central banks manipulate interest rates to prop up failing currencies. Countries with persistent inflation, like Venezuela and Lebanon, often raise interest rates to slow down currency devaluation. However, when inflation spirals too far, these measures backfire, leading to even more volatility. In extreme cases, black-market currency rates emerge, creating a parallel economy where real exchange values differ drastically from official ones.

Another hidden driver of currency weakness is the reliance on a single volatile export. Nations like Iran and Nigeria, which depend heavily on oil, experience severe currency fluctuations when global oil prices drop. This “commodity trap” weakens their financial stability, as their national income is directly tied to unpredictable global demand. When commodity prices plummet, governments struggle to maintain currency reserves, forcing them to print more money, which leads to rapid devaluation. Countries that fail to diversify their exports often find themselves trapped in a cycle of currency weakness that is nearly impossible to break.

Geopolitical risks also play a major role in determining whether a currency remains stable or collapses. Nations facing international sanctions, such as Russia in 2022 or Afghanistan after the Taliban takeover, experience immediate currency freefall as foreign reserves become inaccessible. In some cases, local businesses and citizens abandon the national currency entirely, opting to trade in stronger foreign currencies like the U.S. dollar or euro. This phenomenon, known as “dollarization,” further weakens the native currency, reducing its importance in daily transactions and making economic recovery even harder.

Why are some currencies so weak?

A currency isn’t just weak because of inflation or poor governance — sometimes, it’s designed to stay weak on purpose. Countries that rely heavily on exports often deliberately undervalue their currencies to keep their products cheap for foreign buyers. China’s tight control over the yuan is a well-known example, but even smaller economies do this to stay competitive. Vietnam, for instance, has been accused of artificially suppressing the dong’s value to boost manufacturing and attract foreign companies. This tactic makes imported goods expensive for local citizens, but it helps industries that depend on selling goods abroad.

Another surprising reason currencies stay weak is the lack of a stable banking system. In some countries, citizens simply don’t trust their own banks enough to save money in local currency. In Zimbabwe, for example, years of hyperinflation destroyed confidence in the Zimbabwean dollar, forcing people to rely on US dollars instead. When most people refuse to hold a country’s currency, its value plummets, no matter what the government does. This creates a vicious cycle where weak banks lead to weak currencies, and weak currencies further weaken banks — making recovery nearly impossible.

How to leverage weak currencies for trading opportunities

Most traders avoid weak currencies, but with the right strategy, they can create massive opportunities for profit. Here’s how you can turn currency weakness into trading strength:

Spot high-yield carry trades. Weak currencies often come with high interest rates as central banks try to control inflation. Traders can borrow in low-interest currencies and invest in high-yield weak currencies to pocket the difference, but only if they monitor inflation risks carefully.

Watch for government intervention. Countries with struggling currencies often impose capital controls or adjust exchange rate policies overnight. Smart traders track policy announcements and central bank meetings because a single decision can cause a sharp price swing that creates huge trading openings.

Time your entries with inflation cycles. Inflation weakens a currency, but it also forces central banks to take action, often leading to short-term rebounds. Instead of betting against weak currencies all the time, traders can ride the price recoveries triggered by sudden monetary tightening.

Use remittance flows as indicators. Currencies of nations with high expatriate populations often see periodic surges due to remittances. These seasonal trends can create predictable price swings, offering opportunities for well-timed trades during inflows.

Exploit export-driven recoveries. A weak currency makes exports cheaper and more competitive globally. Traders can identify countries where weak exchange rates boost manufacturing and tourism, leading to stronger trade balances and eventual currency rebounds.

It might be tough to find Forex trading pairs with one of these currencies, so you must look for them with Forex brokers that support a high number for Forex pairs. We have presented the top options in the table below. You can compare them and make a choice for yourself:

| Currency pairs | Min. deposit, $ | Max. leverage | Deposit fee, % | Withdrawal fee, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 60 | 100 | 1:300 | No | No | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| 90 | No | 1:500 | No | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| 68 | No | 1:200 | No | 0-15 | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| 80 | 100 | 1:50 | No | No | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| 100 | No | 1:30 | No | Yes | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA | 6.9 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Collapsing currencies and commodities create big trading opportunities

Most people assume that weak currencies simply mean a struggling economy, but that’s only part of the story. Some of the world’s weakest currencies — like the Iranian Rial (IRR) and Lebanese Pound (LBP) — didn’t just decline gradually; they collapsed in a matter of months due to government mismanagement, hyperinflation, and economic sanctions.

What many beginners miss is that these sudden crashes create massive trading opportunities. While shorting a weak currency might seem obvious, smart traders track government policies and capital flight patterns to predict when a currency will hit rock bottom — then profit when it rebounds. For example, when the Lebanese central bank adjusted its official exchange rate in early 2023, the black market rate swung by over 40% in a single week — a goldmine for traders who saw it coming.

Another overlooked factor is how commodity prices impact weak currencies. Many fragile economies rely on oil, gold, or agricultural exports, meaning their currencies are directly linked to global commodity prices. The Venezuelan Bolívar (VES), for example, often rises and falls with crude oil prices.

A beginner's mistake is thinking that a weak currency will always stay weak — when in reality, a commodity price surge can trigger a sharp appreciation. Traders who watch these trends can enter early and catch rapid swings before the broader market reacts. This approach isn’t about gambling on struggling economies — it’s about identifying the hidden cycles that drive weak currencies and using them to your advantage.

Conclusion

Understanding the factors behind weak currencies offers valuable insights into global economics. While these currencies often face severe challenges, they also present unique trading opportunities for informed investors. By staying updated and using strategic approaches, you can navigate these markets effectively.

FAQs

Why do currencies lose value?

Currencies lose value because of factors like inflation, political instability, and poor economic policies.

Can weak currencies recover?

Recovery is possible but requires significant reforms, including improving governance, stabilizing inflation, and diversifying the economy.

Are weak currencies good for tourism?

Yes, weak currencies can make travel cheaper for foreign tourists, boosting tourism revenues for the country.

How can I invest in weak currencies?

Investing in weak currencies requires careful monitoring of market trends, economic policies, and using tools like currency trading platforms for strategic investment.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.