Fetch.ai: A Smarter Blockchain Or Just Another AI Crypto?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Fetch.ai blends blockchain with AI to enable autonomous decision-making and decentralized automation. Here are its key features:

AI-powered smart contracts. Automates complex blockchain transactions.

Autonomous economic agents. Executes tasks without human input.

Decentralized machine learning. Trains AI models on-chain.

Real-world automation. Optimizes supply chains and data.

Efficient AI-driven transactions. Reduces costs and speeds up trades.

Blockchain’s next big step isn’t just decentralization — it’s smart automation. Fetch.ai brings AI to blockchain, creating digital agents that trade, negotiate, and make decisions on their own. Unlike regular smart contracts, these AI-driven agents can adapt and optimize without human input.

Fetch.ai’s network lets businesses, machines, and individuals interact autonomously, making transactions faster and more efficient. But what makes Fetch.ai stand out as an AI coin? How does it actually work? And is it worth investing in?

Let’s dive into Fetch.ai’s real-world use cases and how it stacks up against other AI-focused cryptocurrencies.

| Month | Minimum Price, $ | Average Price, $ | Maximum Price, $ |

|---|---|---|---|

| August 2025 | 0.464 | 0.516 | 0.567 |

| September 2025 | 0.469 | 0.521 | 0.573 |

| October 2025 | 0.474 | 0.527 | 0.58 |

| November 2025 | 0.48 | 0.533 | 0.586 |

| December 2025 | 0.485 | 0.539 | 0.593 |

The Role of AI in Fetch.ai

Unlike regular blockchains that rely on fixed smart contracts, Fetch.ai introduces AI-driven agents that think and act on their own. These agents handle trades, logistics, payments, and mobility services without needing human input.

So how does this work in real life? Fetch.ai uses machine learning and decentralized computing to create a network where AI agents negotiate deals and complete tasks automatically. Whether it’s optimizing supply chains or automating payments, Fetch.ai lets businesses run smarter, cutting costs and removing middlemen.

When it comes to AI in crypto, Fetch.ai doesn’t just use AI — it operates like an AI-powered economy. Machines on the network trade, predict outcomes, and make autonomous decisions. The real question? Is this just an AI coin, or the start of something bigger?

Fetch.ai isn’t just using AI — it’s creating a digital world where AI agents trade, negotiate, and automate complex tasks without human involvement.

AI-powered microtransactions. Smart agents can settle payments in real time, removing delays in financial transactions.

Self-learning economic agents. Fetch.ai’s AI agents don’t just follow rules — they evolve based on past transactions.

Autonomous supply chain optimization. AI agents predict logistics demand and adjust routes without human input.

Decentralized AI training. Fetch.ai allows machine learning models to train without centralized control, keeping data secure.

Predictive AI for crypto trading. AI agents analyze market trends and execute trades based on real-time signals.

Smart city automation. AI-driven energy grids and mobility systems adjust usage based on real-time demand.

Is Fetch.ai an AI Coin?

Yes, Fetch.ai (FET) is an AI-focused cryptocurrency. It powers a decentralized AI network that enables autonomous agents to perform tasks like data sharing, automation, and optimization across industries. Fetch.ai combines machine learning, blockchain, and smart contracts to create AI-driven applications in finance, supply chains, and mobility.

What makes Fetch.ai different from traditional blockchains?

Most blockchains rely on pre-programmed smart contracts, which require manual execution and predefined conditions. Fetch.ai replaces traditional smart contracts with AI-powered autonomous agents, allowing transactions and agreements to happen without human involvement.

Key differences between Fetch.ai and traditional blockchains:

AI-driven smart contracts. Unlike traditional blockchains, Fetch.ai replaces static smart contracts with AI-powered agents that make independent decisions.

Self-learning transactions. Fetch.ai’s agents adjust to market conditions, while traditional blockchains follow preset contract rules.

No manual execution. Users don’t have to trigger transactions — AI agents autonomously complete tasks based on real-time data.

Scalable microtransactions. Fetch.ai enables cost-effective, instant micropayments, while traditional chains struggle with high fees.

Decentralized AI marketplace. Fetch.ai has a built-in system where AI models, predictions, and services can be traded on-chain.

Autonomous data sharing. Traditional blockchains store static data, but Fetch.ai agents analyze and exchange information in real time.

Real-world applications of Fetch.ai

The true power of Fetch.ai AI lies in its real-world applications. Unlike speculative AI projects that focus on theoretical models, Fetch.ai’s autonomous agents are already being used across industries to streamline processes, reduce costs, and improve efficiency.

How Fetch.ai AI is transforming industries

Fetch.ai isn’t just improving industries — it’s replacing outdated systems with AI-driven automation.

Self-negotiating freight contracts. AI agents automatically bid for and finalize logistics deals, cutting costs and delays.

Predictive energy trading. Fetch.ai helps energy grids anticipate demand shifts and buy power at the lowest rates.

AI-driven decentralized finance. Smart agents optimize lending, borrowing, and trading decisions in real time.

Hyper-personalized travel bookings. Fetch.ai tailors flights, hotels, and routes based on real-time price trends and user behavior.

Autonomous smart parking. AI agents reserve, pay, and manage parking spots, eliminating manual payments.

Fraud-proof supply chain tracking. Fetch.ai records every transaction on a trustless AI network, preventing tampering.

How AI agents work in Fetch.ai

Fetch.ai’s Autonomous Economic Agents (AEAs) are self-operating AI-powered bots designed to handle complex tasks in digital markets. These agents work independently, meaning they don’t require human intervention to execute transactions, analyse data, or optimize processes.

Self-learning negotiation. Agents don’t just follow preset rules; they adapt and negotiate based on market conditions.

Real-time data trading. Fetch.ai agents can buy and sell data instantly, cutting out the need for centralized marketplaces.

Micropayments on demand. AI agents handle instant, feeless transactions for services, reducing costs for businesses.

Predictive automation. These agents don’t just respond to commands — they analyze patterns to take action before a user even asks.

No human intervention needed. Agents in Fetch.ai execute trades, optimize routes, and manage tasks with zero manual input.

Decentralized coordination. Multiple AI agents work together without a central authority, creating efficient, trustless economies.

Is Fetch.ai a good investment?

Yes, Fetch.ai (FET) has solid potential, but like any crypto, it comes with risks. Its AI-powered blockchain is built for automation and DeFi, and big-name backers are paying attention.

In March 2023, DWF Labs poured $40 million into the project, signaling strong institutional interest. However, the past trend has been mostly bearish. So going forward, Fetch.ai’s growth depends on real-world adoption, AI integration, and how well it competes with other blockchain AI projects. If its tech takes off, it could be a big winner — but crypto is volatile, so always do your homework before investing.

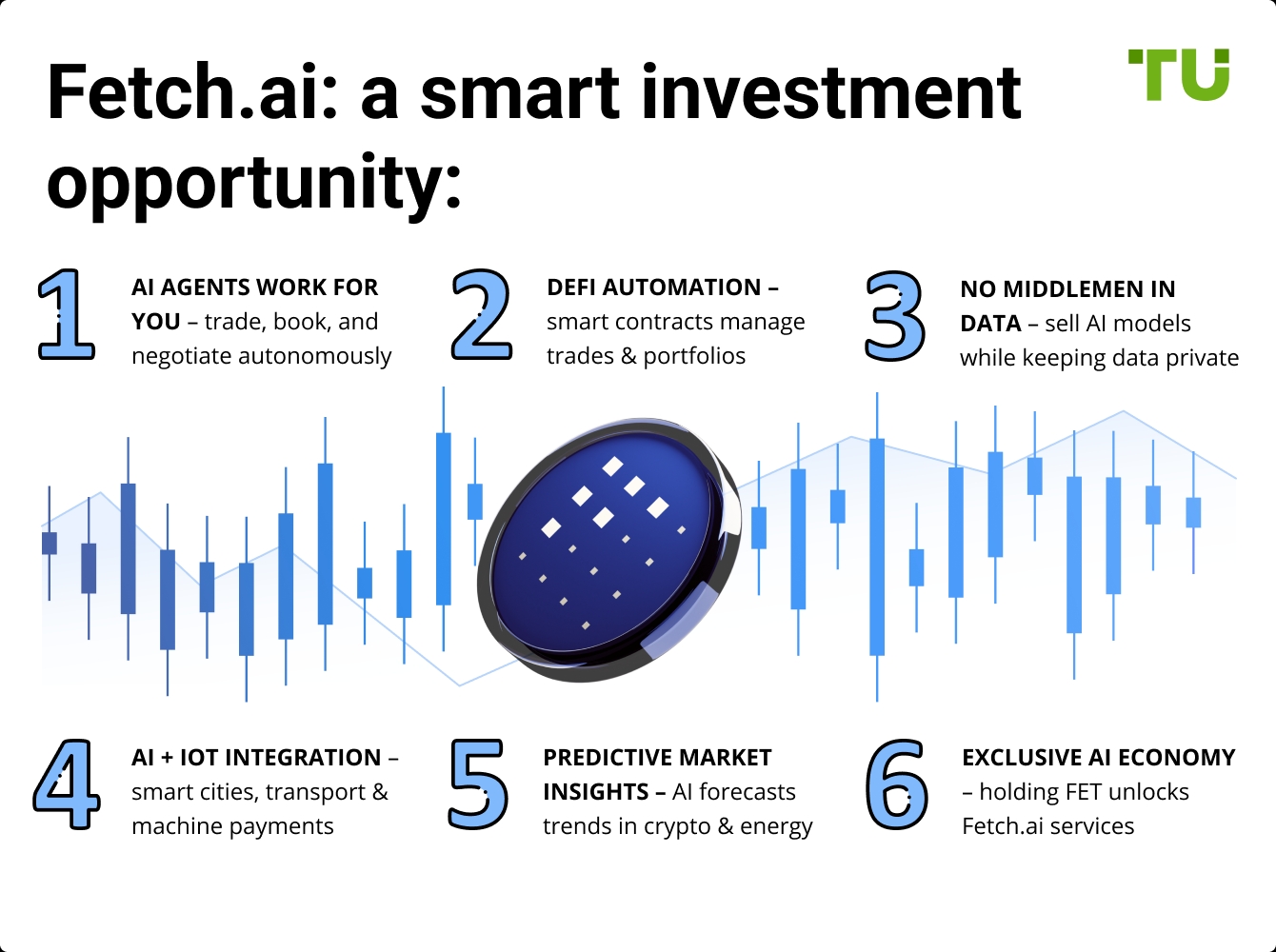

Why Fetch.ai has strong investment potential

Fetch.ai may still be a great investment despite its recent bear run, mainly because of the following factors:

AI agents earn for you. Fetch.ai’s autonomous agents can make trades, book services, and negotiate prices without manual input.

AI-powered DeFi automation. The network allows smart contracts to execute trades, stake tokens, and rebalance portfolios based on live data.

No middlemen in data sharing. Businesses and individuals can sell AI-trained data models without handing over raw data, ensuring privacy and direct earnings.

AI + IoT in one ecosystem. Fetch.ai integrates AI with IoT devices, enabling smart cities, automated transport, and machine-to-machine payments.

Predictive market insights. Fetch.ai’s AI models analyze real-world events, predicting demand surges for assets like energy, crypto, and even ride-sharing.

Exclusive AI economy access. Holding FET tokens gives access to Fetch.ai’s AI services, creating demand beyond just speculation.

Investment risks to consider

Investing in Fetch.ai isn’t just about potential profits — hidden risks could catch beginners off guard.

AI adoption isn’t guaranteed. If businesses don’t embrace AI-driven automation, Fetch.ai’s demand could stall.

Smart agents face competition. Other AI blockchains like SingularityNET and Ocean Protocol could outpace Fetch.ai’s adoption.

Low liquidity spikes volatility. FET’s trading volume fluctuates, leading to sudden price swings that can trap investors.

Tech upgrades could break compatibility. Fetch.ai’s frequent updates may cause disruptions, making older integrations obsolete.

Token utility depends on real-world use. If Fetch.ai’s AI agents don’t get widely adopted, the FET token could struggle for value.

Centralized exchanges control most liquidity. If a major exchange delists FET, liquidity could dry up, making exits difficult.

If you have made up your mind to invest in FET after going through the risks and rewards, we suggest you do so through one of the crypto exchanges listed below. We have carefully researched the market to curate this list, making it easy for you to company and begin your investment journey:

| FET Supported | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Demo account | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | No | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Fetch.ai vs. other AI crypto projects: How does it compare?

The AI crypto space is crowded with projects claiming to revolutionize automation, machine learning, and data processing. But how does Fetch.ai AI stack up against its competition? Let’s compare it to SingularityNET (AGIX), Ocean Protocol (OCEAN), and Render Network (RNDR) — three of the biggest AI-powered blockchain projects.

| Feature | Fetch.ai (FET) | SingularityNET (AGIX) | Ocean Protocol (OCEAN) | Render Network (RNDR) |

|---|---|---|---|---|

| Core Focus | AI-powered automation and autonomous agents | AI marketplace for services and model training | AI-driven data monetization and sharing | AI-enhanced cloud rendering and computing |

| Autonomous AI agents negotiate, execute transactions, and optimize processes in real time | Decentralized AI network where users buy and sell AI services | AI-enhanced data exchange for analytics and machine learning | AI-driven rendering for 3D graphics, metaverse, and gaming | |

| Use Case | Smart contracts, supply chain automation, DeFi, and IoT automation | AI applications across industries like finance, healthcare, and robotics | AI-based data marketplaces for researchers and businesses | AI-powered cloud computing for visual processing and machine learning models |

| Real-world AI automation with no human input | AI service hub where businesses can buy AI models | AI-powered decentralized data economy | AI-powered GPU computing for creative and scientific industries |

Fetch.ai is building a self-sustaining AI economy on blockchain

Most AI tokens just slap AI onto a blockchain, but Fetch.ai is making AI an independent player. Instead of just using AI for automation, Fetch lets AI agents trade, negotiate, and make decisions on their own. These Autonomous Economic Agents (AEAs) work like self-learning bots that can handle deals and transactions without human input. That means Fetch.ai isn’t just another project using AI — it’s creating an entire digital economy where AI systems interact like real businesses.

Here’s what makes this a big deal. Regular AI models depend on cloud giants like Google and Amazon, which control the infrastructure. But Fetch.ai’s AI agents run on a decentralized blockchain, cutting out Big Tech entirely. This means AI can train, process transactions, and optimize logistics without anyone in control. If Fetch.ai takes off, it could completely change how AI is owned and monetized in a Web3 world.

Conclusion

Fetch.ai is AI-first blockchain that enables real-world automation. By merging artificial intelligence, blockchain, and machine learning, it powers self-learning digital agents that can trade, negotiate, and execute transactions without human involvement. This makes Fetch.ai one of the most advanced AI-integrated blockchain projects in the Web3 space.

From DeFi and smart cities to logistics and healthcare, its Autonomous Economic Agents (AEAs) are solving real-world problems today. Fetch.ai offers strong long-term potential due to its growing adoption, institutional interest, and AI-driven economy. However, investors should consider competition, market risks, and adoption speed before making any decisions.

FAQs

Is Fetch.ai related to AI?

Yes, Fetch.aiAI is built around artificial intelligence. Unlike traditional blockchains that rely on pre-programmed smart contracts, Fetch.ai uses AI-powered autonomous agents to execute transactions, optimize supply chains, and automate business processes without human input.

Is Fetch.ai an AI coin?

Yes, Fetch.ai is one of the most AI-integrated cryptocurrencies. Unlike AI projects that offer AI services or computing power, Fetch.ai creates self-learning AI agents that interact without human control, making it an AI-first blockchain designed for real-world automation.

How does Fetch.ai compare to other AI crypto projects?

Unlike SingularityNET (AGIX), which sells AI services, or Ocean Protocol (OCEAN), which focuses on AI-powered data monetization, Fetch.ai creates autonomous AI-driven digital agents. These agents act like AI-powered smart contracts, enabling automated DeFi, logistics, and IoT solutions.

Is Fetch.ai a good investment?

Fetch.ai has strong market potential due to its real-world AI applications, growing adoption, and self-learning automation capabilities. However, like all cryptocurrencies, it faces risks such as competition from other AI-focused projects and market volatility. Investors should consider long-term adoption trends before making a decision.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.