How Stable Are Stablecoins And Why Do Their Prices Wobble?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Yes. Stablecoins are stable but not risk-free. Their stability depends on reserve assets, liquidity, and regulatory oversight. Fiat-backed stablecoins like USDT and USDC maintain a close 1:1 peg to the US dollar, while algorithmic stablecoins like USTC failed due to flawed price control mechanism. Their price wobble due to market volatility, arbitrage, and liquidity mismatches, but major stablecoins have improved transparency and reserves to maintain trust. With a $220 billion market cap, stablecoins remain essential for crypto-to-fiat transactions, though regulatory challenges continue to evolve.

Crypto has a tradition: every time the market is in panic people start to question if stablecoins are stable and what would happen if they depeg. Fear and Greed Index is at all time «FEAR» for both crypto and stock market, MiCA tries to force USDT to keep 60% of the supply in European banks and we’re doing a dive into how bad the real situation with stablecoins are — time to cut through FUD.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

What does the real stablecoin depegging look like?

Terra Luna had a stablecoin, but it was insolvent and used its own LUNA coin as a reserve asset along with «clever math» to stabilize the USTC — or UST — price. Logic went like this: LUNA worth 50 USD, therefore, it supplies the price for 50 USTC tokens.

In July 2022 USTC peg got violated by a liquidity attack: one person took a loan in UST so huge it tore apart LP pools (the ones who keep price of an asset stable) and caused a cascade reaction. Things went real bad real quick: UST and LUNA got wiped out of the market, erasing billions of dollars in the process along with people’s lives. Allegedly, at least one person unalived themselves due to this event. This is why you can’t use «clever math» as the only solution to solvency problems.

Let’s recap: USTC, an Algostable, depegged because it used another crypto as a collateral, not the real world asset it wanted to represent. Real depeg happens when stablecoin is insolvent by design.

Why stablecoin prices wobble from time to time?

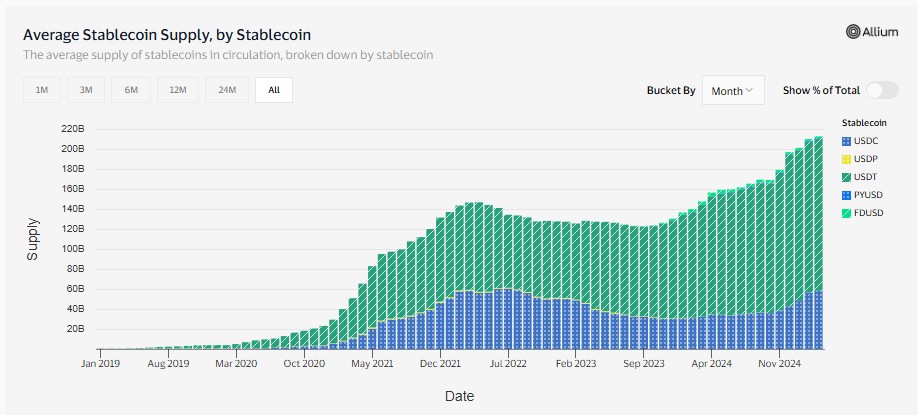

Top 3 Stablecoins are USDT, USDC and USDe, in total they share $206B FDV — fully diluted value — also known as Market Cap. That’s around $61B daily trading volume, minus USDe which has measly $65M. In total, Tether alone has 48440 trading pairs — that is a lot of pressure at once for a single currency.

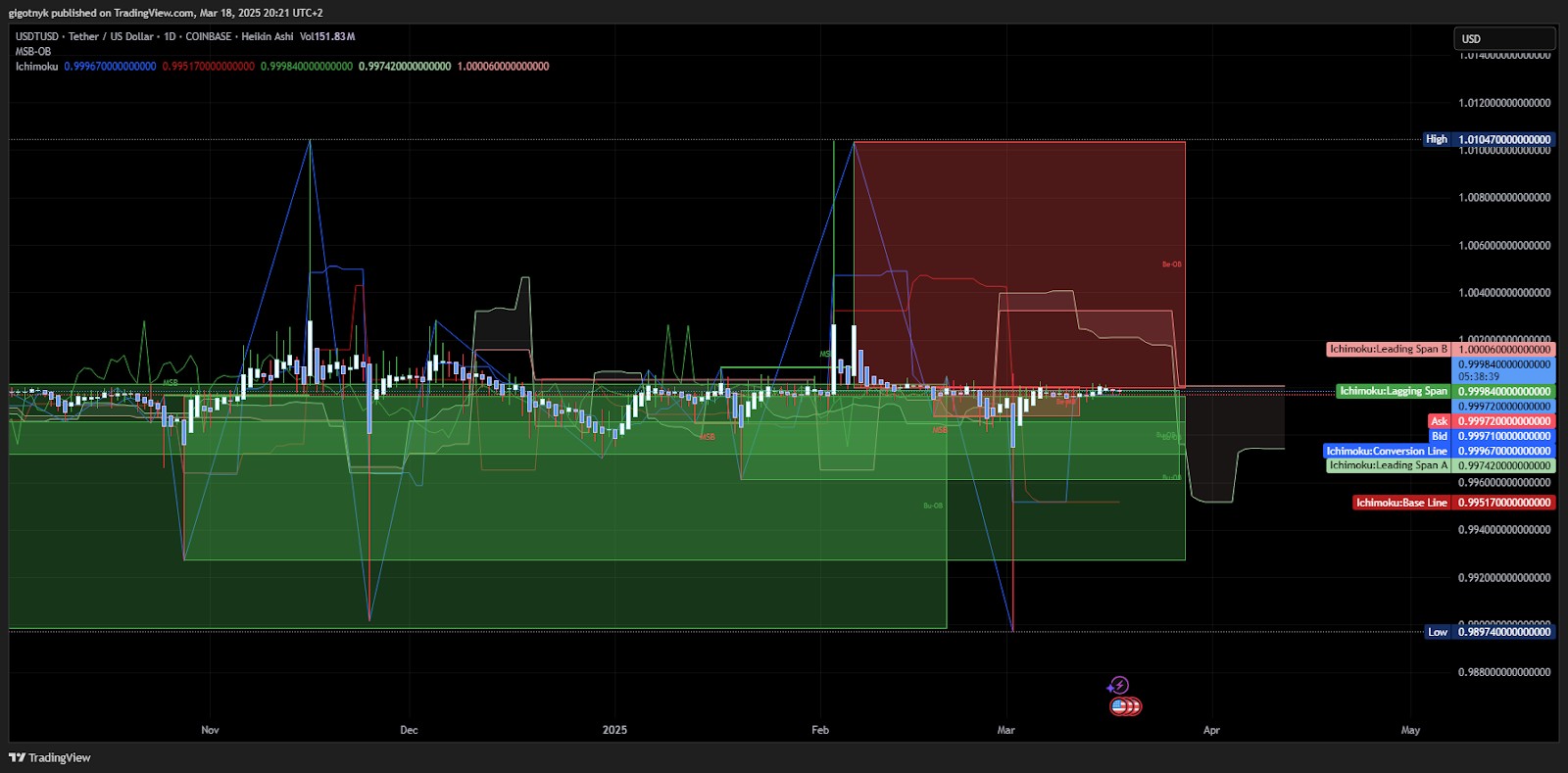

If you look up USDT price chart on daily graph it’ll look like this:

This is natural behaviour: thousands of people buy and sell USDT at any given second, thousands more try to profit off the price fluctuations by doing arbitrage. Pressure is immense, as the price fluctuates in the orders of millicents, which isn’t something unheard of: it happens all the time, but people don’t look close enough to see it.

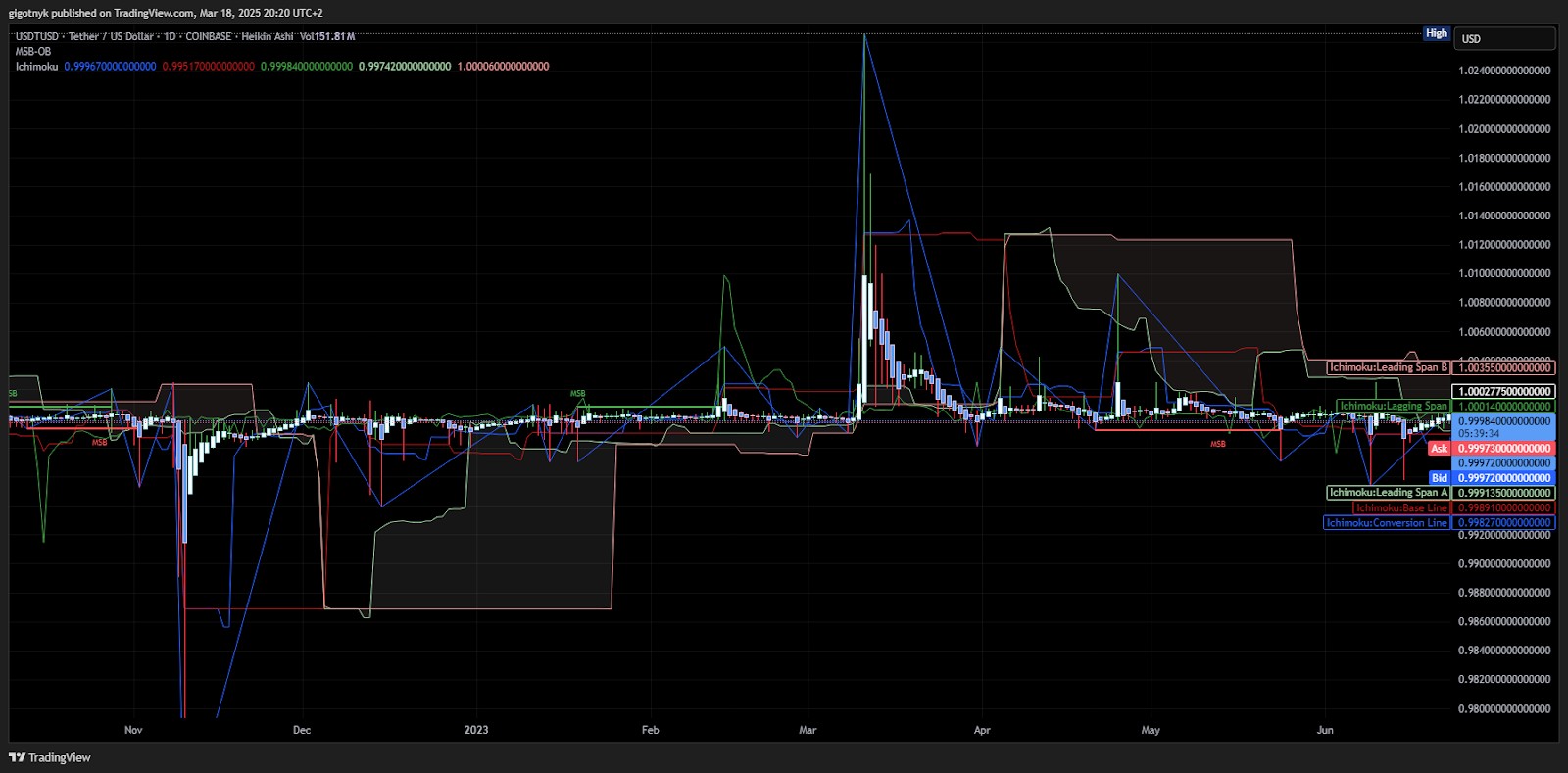

Here how’s real chart of the stablecoin looks like:

Notice the bumps from 2017 to 2021? Those are when people had real fears of USDT depegging, because TetherFoundation really hasn't had enough reserve assets to cover up the demand at a time, but quickly resolved this. See how flat that price line is after 2022? That’s it, the quality mark of the stablecoin.

Here’s what the USDT price chart looks on close-up from TradingView — notice the spikes? Those are price arbitrage opportunities. Green zones are the strongest support levels for the price movements.

Let’s take another look, this time — into 2023.

Each time the market is in turmoil — people try to profit off price fluctuations of the stablecoin. With over 48000 currency pairs, it’s really hard to keep the price purely flat and stable, because one market prices USDT 0.0001 cents higher, and another one 0.0001 lower, which creates a window of opportunity to profit off — naturally, people exploit it. Now, multiply that by at least 5 — because that’s how many major players there are, and you get the full picture.

Does real world money do that? Absolutely:

Price Arbitrage was a thing before crypto: people use macro second intervals to trade currency pairs like USD/CNY;

You don’t notice the price fluctuations, because for fiat money it’s called «inflation» and it kills the value of the national currency overtime.

Why does crypto need stablecoins?

Stablecoins are a class of cryptos backed at 1 to 1 rate to fiat money, the cash. They represent the fiat money inside the crypto — dollars, euros — the eddies.

Before stablecoins were made you had to go through long cycles of crypto-to-crypto-to-crypto-to-fiat exchange routes, with stablecoins it’s «crypto-to-stablecoin-to-fiat» — pretty straightforward.

Each stablecoin represents its own fiat counterpart:

USDT is backed by USD, the one it represents in crypto. It’s reserve assets go in gold, Bitcoin, government bonds and obligations;

EURC is backed by EUR; cash, digital counterparts, etc;

And so on — if it bears the name of «Stablecoin» it has to have reserve assets, period.

People use stablecoins as a tether: to swap a volatile crypto into a less volatile one, and — if needed — quickly exit the market into fiat currency.

Stablecoins serve as the easiest way to swap crypto into fiat: they are backed 1 to 1 with real assets. Exchanges like OKX, Binance, Kraken and others use USDT as an easy way to swap crypto into a local currency (Except the European region, because the EU demanded to delist USDT).

Logic goes like this: every corporate entity can withdraw funds from Tether Foundation treasury in order to swap them to USD. Same goes for all other stablecoins.

How stablecoin emitents earn? Fees, long and complicated fee chains possible thanks to blockchain tech.

Stablecoins are to anchor crypto in cash money.

Are stablecoins trustworthy or are they hoaxes?

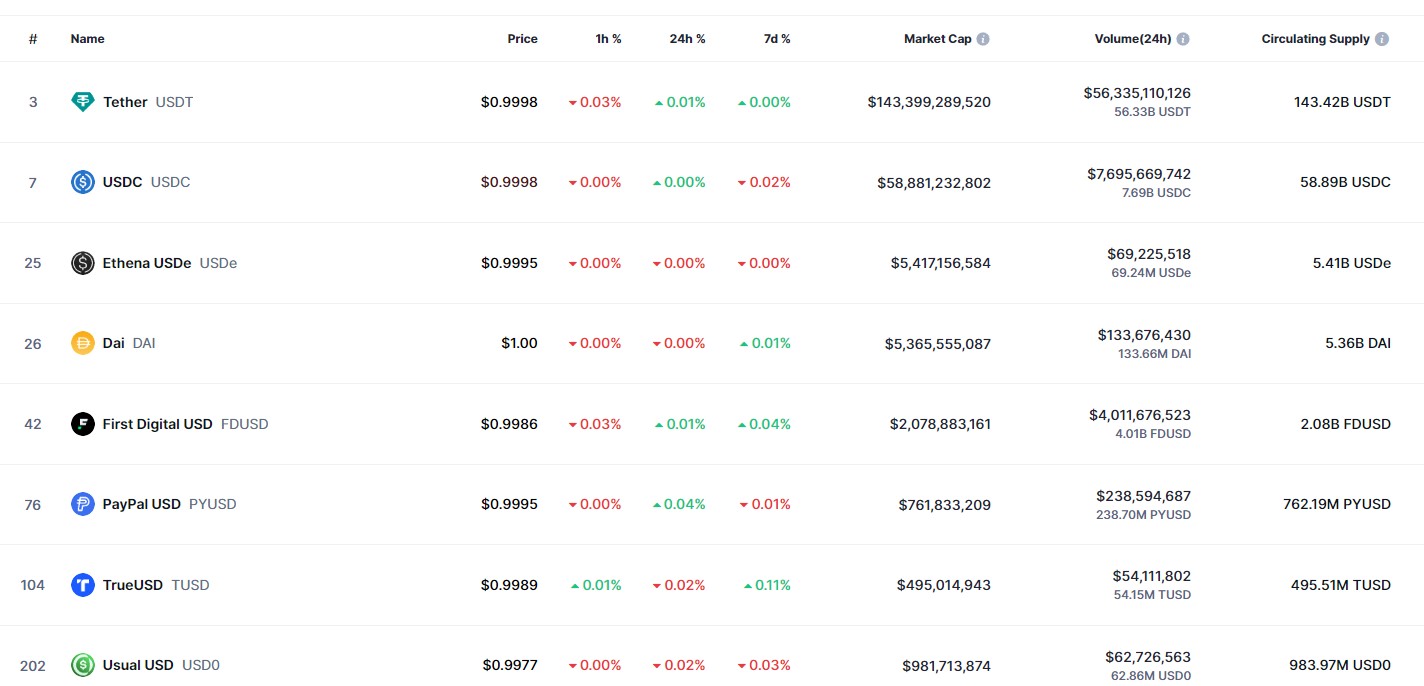

Here's the top 8 stablecoins by price, the closer to $1 — the better. Notice how they all fluctuate all the time? That’s because the market is overheated.

Now big questions:

Is Tether solvent? Yes, they fixed issues with reserves.

Are there any reports about USDT solvency? Yes.

Same goes for every other stablecoin: they either can prove having reserves, or get wiped out of the market.

The oldest known stablecoin is USDT — it pre-dates Solana, Base, and many other chains released after 2020, that’s why people trust it so much that it has $150B in active circulation. At the moment, USDT is 11 years old, and in 7 years time it could order itself a beer at the bar.

Why do regulators seem to want to get rid of stablecoins?

Why does MiCA want USDT down and why does European CEX'es delist it? MiCA requires 60% of the assets to be kept in European banks. Tether can’t allow that, that’s why regulators are unhappy — they can’t control as much money as they want to, and can’t profit from it as much as they want to. Stablecoin regulatory laws each country has — or tries to make — can conflict with each other. Simply put — one party demands to issue currency locally, the other wants it to be kept in their banks only, but stablecoins are made to be a universal exchange unit for the whole world. That is a tug-tie situation, and until everybody decides who keeps the golden cow, who milks it and who caters it the situation will remain wobbly.

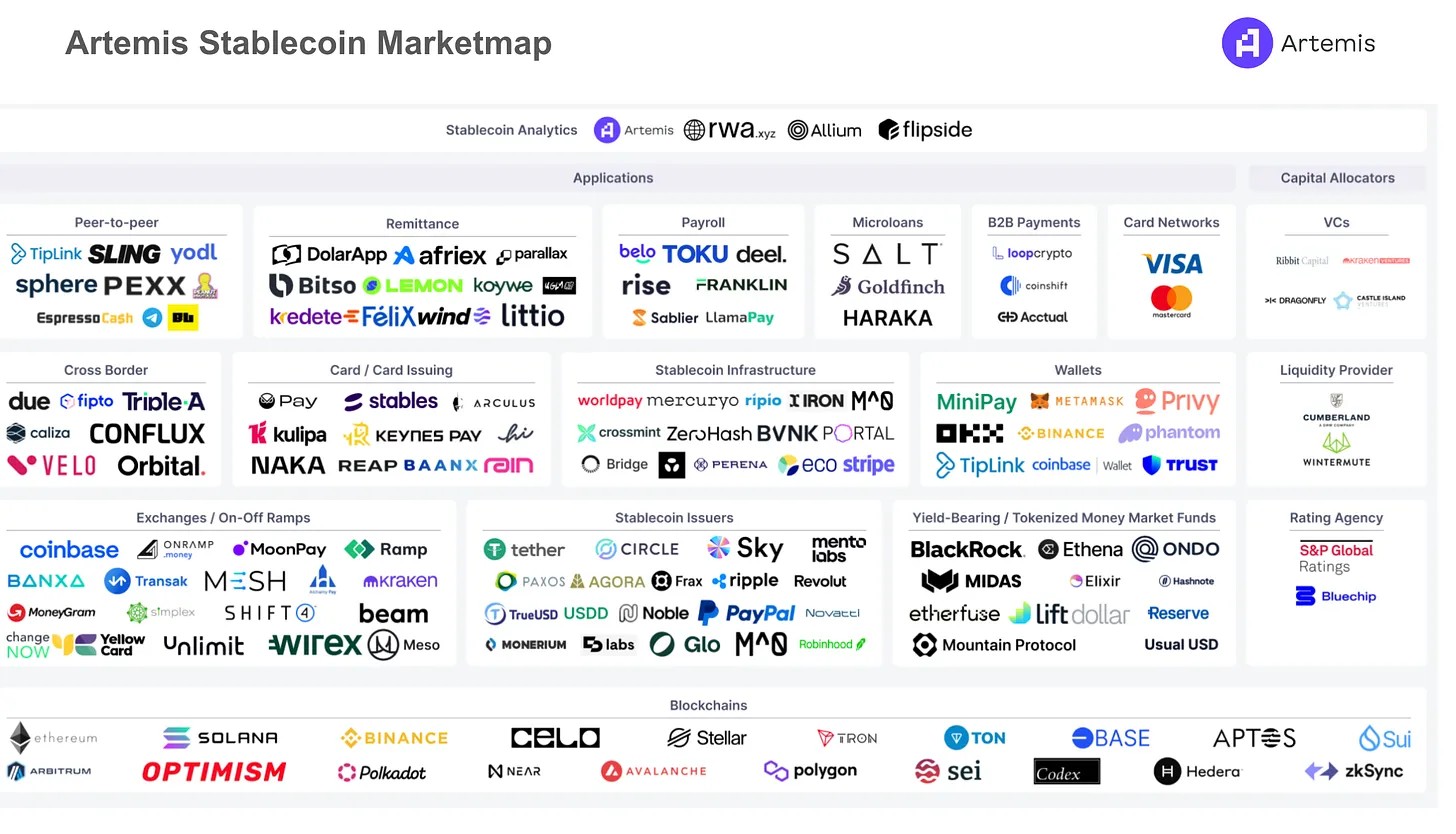

Here’s how big the stablecoin market is: $220B and grows, imagine having a fat cut of that in taxes.

Some quickly catched up and started to talk about replacing stablecoins with CBDC — a whole another class of money, designed to use both: robustness of blockchain and versatility of central bank controlled currency. But that’s ain’t all: USA claims to make their own stablecoin, Japan considers purchasing them as reserve assets and plans to make their own stablecoin too.

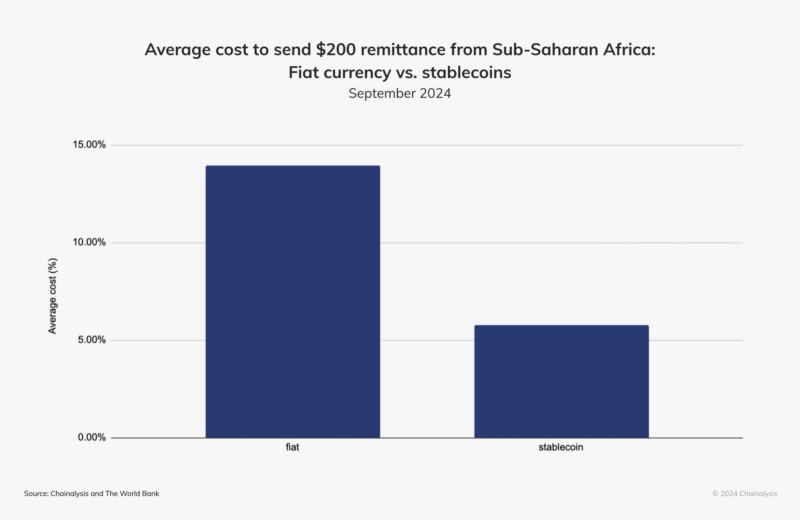

According to the recent Chainalysis report, stablecoins grow in popularity year over year with the speed of 237%, surpassing even Visa and Mastercard transfers. Companies like PayPal started to kick in with PYUSD, and as you noted — USA and EU started to pick up, with talks about making their own stablecoins.

Conclusion: What would happen if stablecoins lose trust?

Black swan event. That’s why the market is heated up with the «depegging» topic, that’s why news outlets throw FUD left to right: because panic makes it easier to profit off price arbitrage of the stablecoin. When dust settles it’s usually the opposite: something breaks, but it’s not the stablecoins.

For that reason, major stablecoins do everything in their power to remain trustworthy, even if it means freezing stablecoins dead in the event they are stolen. Circle (USDC), Tether (USDT), Paxos (BUSD) and Techteryx (TUSD) can do that once you provide enough evidence: like screenshots of an attack verified by an independent lawyer. TetherFoundation actually has a mechanism that allows it to freeze stolen currency and it works, this is one of the best tools out there to prevent money laundering.

Here’s some fancy stablecoin facts:

In 2024 alone stablecoins exceeded Visa and Mastercard transfers by 7%;

Average stablecoin trading volume since 2024 grew by 237%;

Stablecoins account only for 1% of the total USD supply.

What would happen with the stablecoin market? As usual, it will go on, governments will try to regulate it, again, and will fail to control the free market, again. Nothing unusual — in crypto it happens every year.

FAQs

What should you do if you think USDT or another stablecoin is insolvent?

Diversify your portfolio, pick assets you trust more and swap value to them.

Is price fluctuation normal for stablecoins?

It is a natural part of the market, as people want to profit on price differences and exploit that opportunity. Every time the market is in turmoil — stablecoins start to wobble.

Are stablecoins backed by real world assets?

Yes, Tether Foundation and other major players in the field regularly perform audits by third parties to ensure people have the money.

Can stable coins flop?

Only if they are not backed by reserve assets and use math to algorithmically adjust the price. Terra Luna black swan killed trust in the algostables and they are now considered risky.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

The fear and greed index is a tool that measures the sentiment of the crypto market based on various indicators. It assigns a value between 0 and 100, where 0 represents extreme fear while 100 represents extreme greed. The index can help investors avoid emotional overreactions and make rational decisions.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Black swans are a term that was introduced by Nassim Taleb, denoting global unpredictable events that can radically change the situation.