The Fastest Growing Crypto In 2025: A Comprehensive Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The top 5 fastest growing cryptocurrencies are:

Pepe (PEPE): a meme-based cryptocurrency gaining popularity due to its strong community and viral marketing.

ArcBlock (ABT): focuses on simplifying blockchain development, attracting interest in the growing dApp market.

Mantra (OM): a DeFi platform offering staking, lending, and governance, driven by the increasing demand for decentralized finance.

AERO (AERO): aims to innovate the aviation industry with blockchain solutions for payments and loyalty programs.

Dogwifhat (WIF): a meme coin with a humorous twist and charitable focus, supporting animal shelters through community engagement.

Cryptocurrency continues to be one of the rapidly evolving markets in the world. With its potential for massive gains — and equally massive losses — it captures the interest of both novice and experienced investors. As we move through 2025, some cryptocurrencies have emerged as the fastest growing, offering significant opportunities for those who can navigate the complexities of the market.

In this article, we will discuss the risks involved and offer expert recommendations on how to choose the right cryptocurrency for your portfolio.

Fastest growing cryptocurrencies in 2025

As of 2025, the following cryptocurrencies have shown exceptional growth:

Pepe (PEPE): a meme-based cryptocurrency that has surged due to its viral popularity on social media platforms. PEPE has seen a year-to-date growth of over 600%.

ArcBlock (ABT): a blockchain platform designed to simplify the development of decentralized applications (DApps). ABT’s price has increased by nearly 800% this year, making it one of the top performers.

Mantra (OM): operating within the Cosmos ecosystem, Mantra focuses on regulated tokenization of real-world assets. Its native token, OM, has grown by about 1 700% in 2025.

AERO (AERO): has shown impressive performance in 2025, with a massive 600% increase in value year-to-date, establishing itself as a market leader in terms of growth.

Dogwifhat (WIF): a meme coin on the Solana blockchain, Dogwifhat has gained popularity despite lacking a defined utility or roadmap. Its strong community support and speculative trading have driven a remarkable YTD growth of 1000%.

Why are these cryptocurrencies growing fast?

The growth of cryptocurrencies in 2025 can be attributed to several key drivers:

Technological innovations: Upgrades to blockchain networks, the introduction of new consensus mechanisms, and advancements in scalability have played a significant role.

Adoption by major institutions: As more financial institutions, corporations, and even governments adopt cryptocurrencies, the market has seen increased legitimacy and investor confidence.

Regulatory developments: Positive regulatory developments, such as the approval of crypto ETFs, have also contributed to the growth of specific cryptocurrencies.

Key tips for identifying fastest growing cryptocurrencies

Identifying the next big cryptocurrency can be challenging but rewarding. Here’s a step-by-step guide:

Use crypto tracking tools. Platforms like CoinMarketCap and CoinGecko offer real-time data on the performance of various cryptocurrencies. Set filters to track those with the highest growth percentages over different time frames.

Analyze market trends. Look for emerging trends within the crypto space, such as new blockchain technologies, rising interest in specific sectors like DeFi or NFTs, and increasing adoption by major companies.

Monitor social media and community sentiment. Many fast-growing cryptocurrencies gain momentum through strong community support and viral social media campaigns. Twitter, Reddit, and Telegram are key platforms to watch.

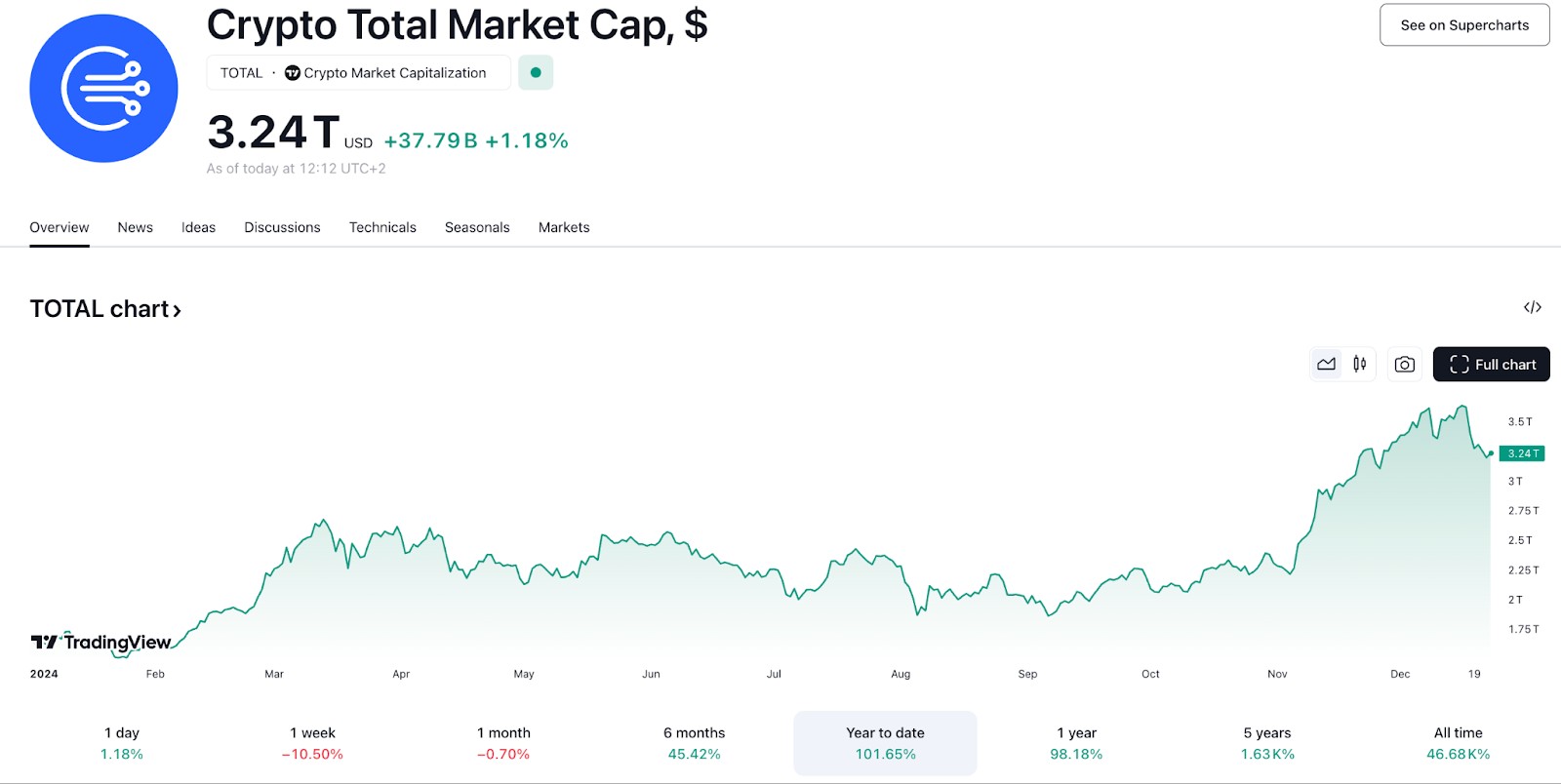

Overview of the cryptocurrency market in 2025

The cryptocurrency market in 2025 has been marked by a blend of optimism and caution. On one hand, we’ve seen the rise of new blockchain technologies, increased institutional adoption, and a growing acceptance of digital assets across various sectors. On the other hand, regulatory challenges and market volatility continue to pose significant risks.

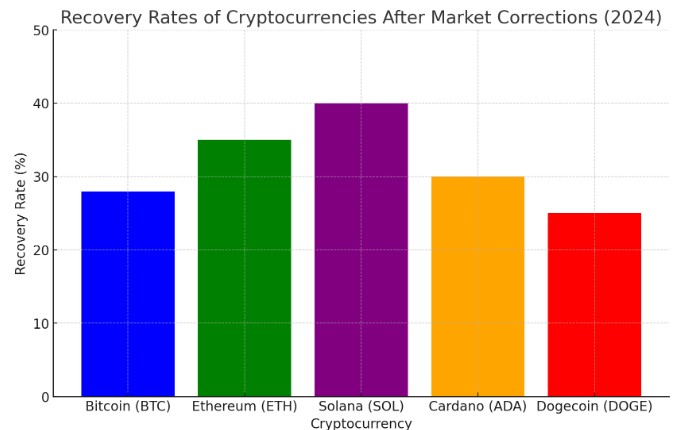

Which crypto will recover the fastest?

While predicting the exact recovery rate of a cryptocurrency is difficult, certain factors can indicate a strong potential for rebound:

Strong fundamentals. Cryptocurrencies with solid use cases, active development teams, and growing adoption are more likely to recover quickly after market downturns.

Community support. A robust and engaged community can help sustain a cryptocurrency through difficult times.

Technological upgrades. Upcoming network upgrades or new feature releases can act as catalysts for recovery.

Examples include Ethereum (ETH), which has consistently recovered well due to its wide adoption and ongoing upgrades, and Bitcoin (BTC), known for its resilience and dominant market position.

Risks and warnings

Market volatility

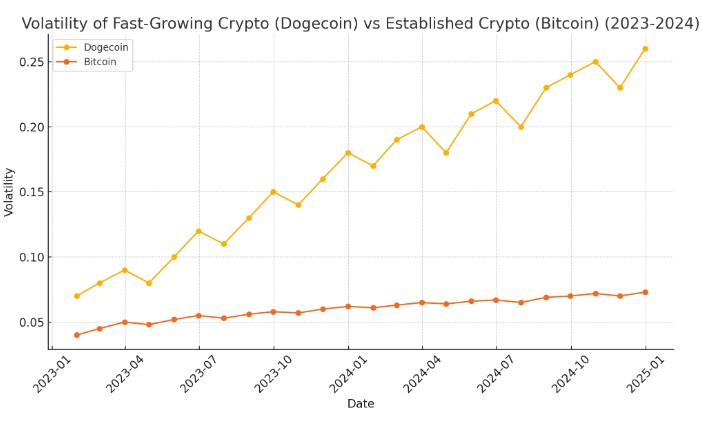

Fast-growing cryptocurrencies are often highly volatile, leading to both potential gains and losses:

Volatility example: Consider the case of Dogecoin (DOGE), which experienced a massive surge followed by a significant decline in 2023. While early investors saw huge gains, those who bought at the peak suffered substantial losses.

Risk management: Use tools like stop-loss orders and limit your exposure to highly volatile assets.

Regulatory risks

The regulatory environment can have a significant impact on cryptocurrencies:

Government actions: Countries like China and India have implemented strict regulations on crypto trading, leading to market disruptions.

Compliance: Ensure the cryptocurrencies you invest in comply with relevant regulations to avoid legal issues and potential losses.

Scams and fraudulent projects

The crypto space is rife with scams, especially among projects that appear to be fast-growing:

Warning signs: Promises of guaranteed returns, lack of transparency, and pressure to invest quickly are red flags.

Protect yourself: Always conduct thorough research before investing. Verify the legitimacy of the project team, check for audits, and read reviews from trusted sources.

Pros and cons

- Pros

- Cons

High potential returns. Fast-growing cryptocurrencies can offer significant gains in a short period.

Innovation and early adoption. Investing in emerging cryptos allows you to be part of the early adopters, potentially benefiting from future success.

Diversification. Including high-growth cryptos in your portfolio can provide diversification beyond traditional assets.

High risk and volatility. These assets are subject to extreme price swings, leading to the potential for significant losses.

Market manipulation. Fast-growing cryptos are often more susceptible to market manipulation, such as pump-and-dump schemes.

Regulatory uncertainty. The evolving regulatory landscape can pose risks to the long-term viability of certain cryptocurrencies.

Keep an eye on government reports, policy talks

When identifying the fastest-growing cryptocurrencies, don’t just rely on surface metrics like market cap or recent price spikes. Instead, dig into what the developers are actually doing on platforms like GitHub. If you see lots of consistent updates, bug fixes, and community engagement, it's usually a sign that the project has some real staying power. It’s not about catching the next hype train but finding coins with real, under-the-hood momentum before they hit mainstream attention.

Another often overlooked factor is the regulatory landscape around cryptocurrency. Take a look at how new laws or rules in big markets might change things for a cryptocurrency. If a country is moving toward crypto-friendly regulations, projects that are already compliant and operating within those legal frameworks could see a surge. Keep an eye on government reports, policy talks, and even the lobbying efforts of certain projects. This can give you an edge in spotting which cryptocurrencies are set to thrive, rather than just following market trends.

Conclusion

Investing in fast-growing cryptocurrencies can be both exciting and risky. The potential for high returns attracts many traders, but the volatility and unpredictability of the market require careful consideration. If you're new to crypto, start small, diversify, and avoid getting caught up in the hype. For experienced traders, using advanced strategies like technical analysis and portfolio management can help you navigate the fast-moving market.

Remember, the key to success in this space is research, patience, and managing your risks effectively. Keep an eye on market trends, stay informed about regulatory changes, and don't forget that even the fastest-growing cryptocurrencies can experience sudden downturns. If you make decisions based on solid fundamentals and stay disciplined, you’ll be better positioned to capitalize on the opportunities in the cryptocurrency market.

FAQs

Can I invest in fast-growing cryptocurrencies with a small budget?

Yes, you can invest in fast-growing cryptocurrencies with a small budget. Many platforms allow you to start with as little as $10-20. It's important to diversify your investments and only invest what you can afford to lose due to the high volatility in the crypto market.

Is it safe to buy fast-growing cryptocurrencies using a credit card?

While many exchanges allow credit card purchases, it’s important to be cautious. Using a credit card can lead to higher fees and potential debt if the investment doesn't go as planned. It’s recommended to use funds you already have, such as through a bank transfer, to avoid overspending.

What should I do if my fast-growing cryptocurrency crashes after I buy it?

If your cryptocurrency crashes, it’s important to avoid panic selling. Assess the reasons for the crash — whether it’s due to market-wide corrections or issues specific to that cryptocurrency. Consider holding your position if the fundamentals remain strong, or set stop-loss orders to minimize further losses.

What are the tax implications of investing in fast-growing cryptocurrencies?

Tax laws vary by country, but generally, profits from cryptocurrency investments are considered taxable income. It's important to keep detailed records of all transactions and consult with a tax professional to ensure compliance with local tax regulations.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.