Cryptocurrencies With The Most Potential To Invest Now

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top cryptocurrencies with the most potential to grow:

Ethereum (ETH) - is the leading platform for DeFi and NFT applications, making it attractive to investors;

Solana (SOL) - offers high throughput and low fees, making it popular among DeFi and NFT developers;

Cardano (ADA) - focus on sustainability and energy efficiency makes it attractive to environmentally conscious investors;

Binance Coin (BNB) - is used to pay trading fees on Binance with discounts, participate in token sales, and more.

Avalanche (AVAX) - attracts attention with its speed and efficiency, making it appealing for DeFi developers and corporate solutions.

In anticipation of a continued bull market in 2025, the appeal of cryptocurrencies continues to remain strong. Investors are constantly looking for innovative projects with high growth potential.

We have selected the best crypto projects based on blockchain technology that have high liquidity and significant growth potential in the long term. The innovation and environmental friendliness of these projects also make them attractive for investment right now.

Top cryptocurrencies with the most potential to grow

The cryptocurrency market evolves rapidly, with new opportunities emerging daily. While some coins rise and fall, a few stand out for their growth potential. Below are the top cryptocurrencies poised to make significant gains.

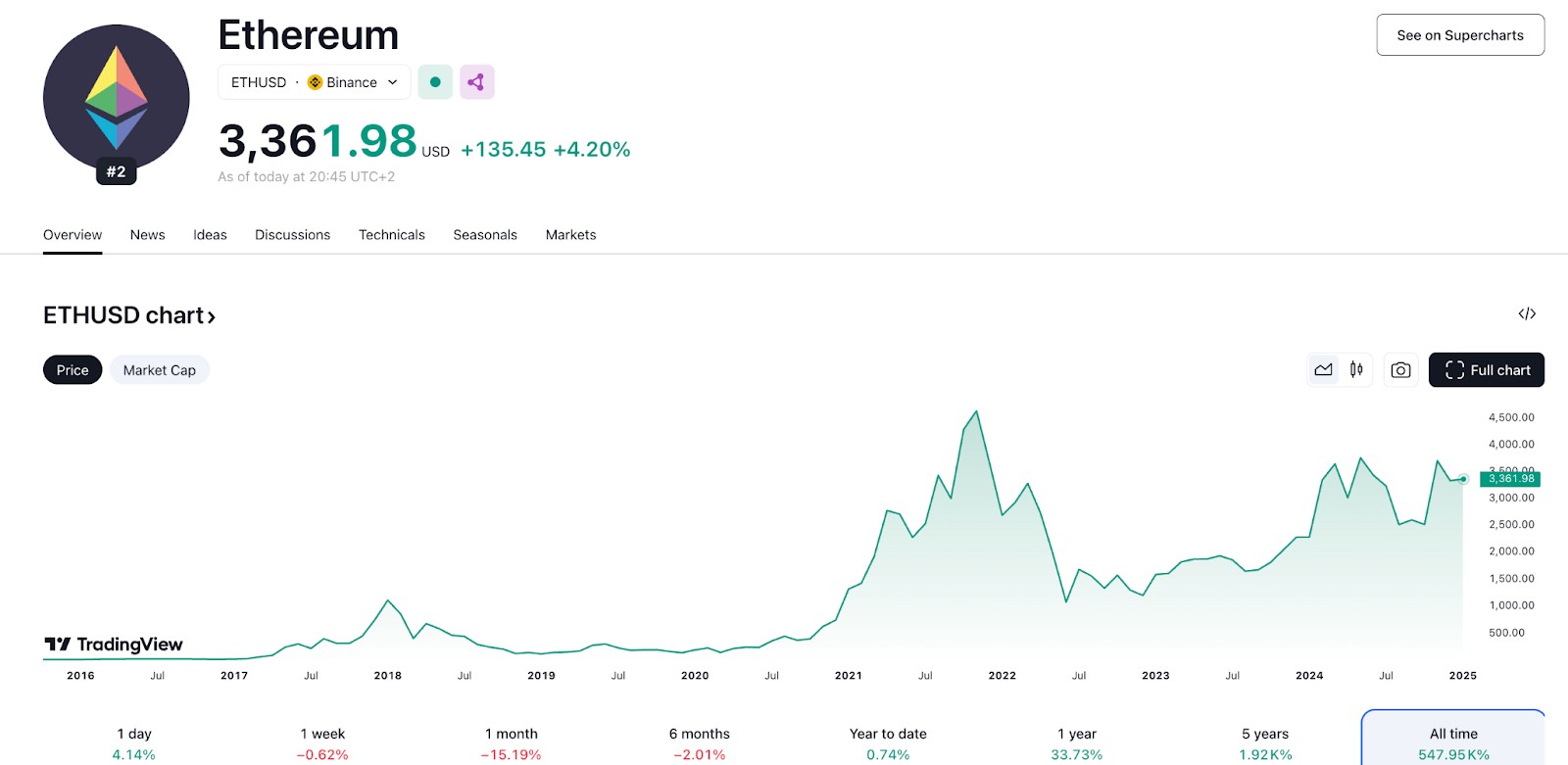

Ethereum (ETH)

Ethereum is a blockchain platform supporting smart contracts and decentralized applications (DApps). Proposed by Vitalik Buterin in 2013 and launched in 2015, Ethereum allows developers to create decentralized applications that run without the risk of fraud, censorship, or third-party interference.

Growth potential of Ethereum: Ethereum is the leading platform for DeFi and NFT applications, making it attractive to investors. The transition to Ethereum 2.0 using Proof-of-Stake (PoS) will improve the network's scalability and energy efficiency, further strengthening its market position. The recent approval of Ether ETFs by the U.S. Securities and Exchange Commission (SEC) is a big thumbs-up from regulators, potentially attracting institutional investors and boosting adoption and price.

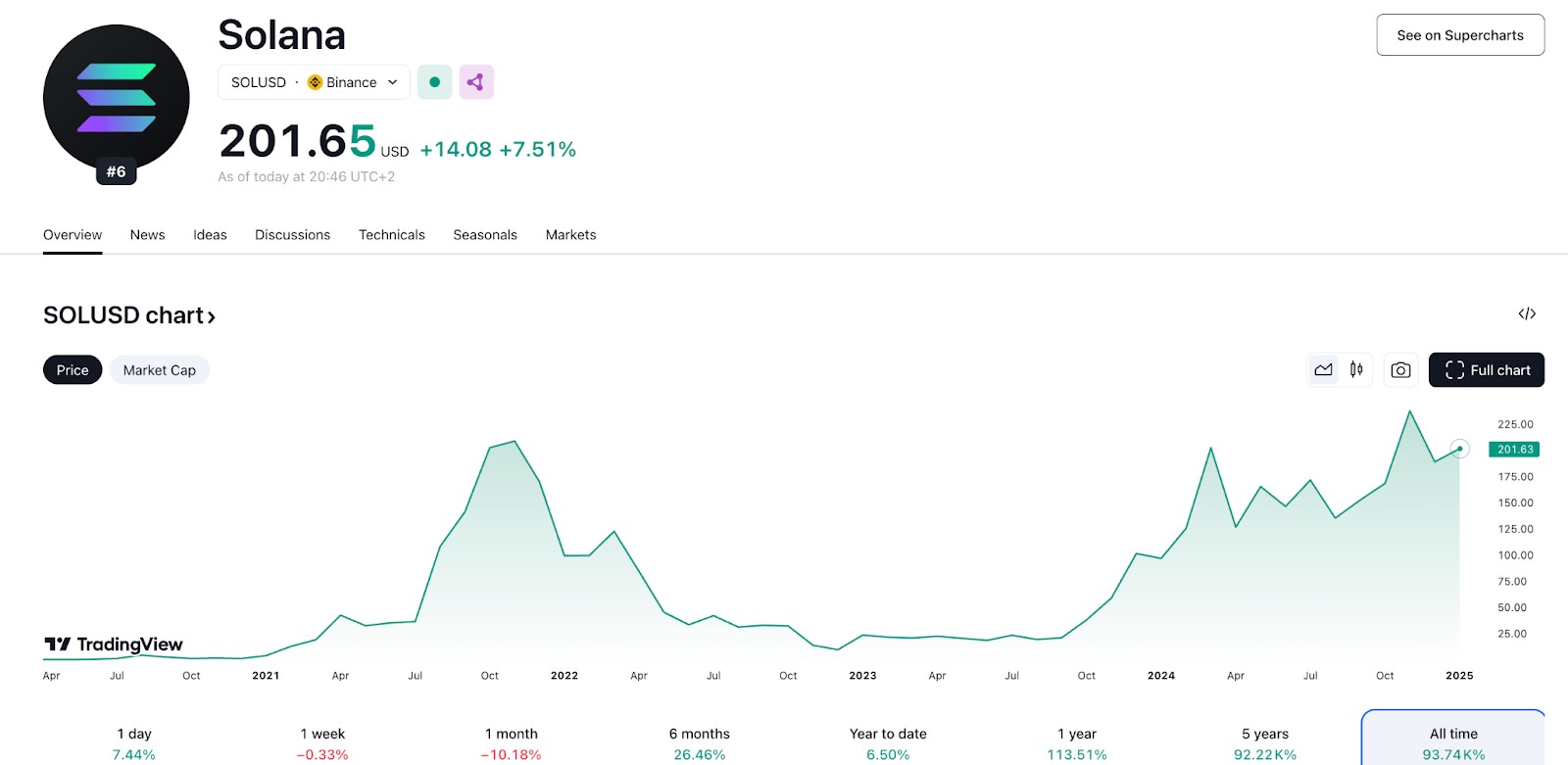

Solana (SOL)

Solana is a high-performance blockchain platform designed to provide scalability without compromising decentralization. Launched in 2020, it uses a unique combination of Proof-of-Stake (PoS) and Proof-of-History (PoH) to process transactions.

Growth potential of Solana: Solana offers high throughput and low fees, making it popular among DeFi and NFT developers. The Solana ecosystem is rapidly growing, attracting numerous projects and investors, which enhances its growth potential. Solana's network has become more decentralized than Ethereum's, indicating greater resilience, which could enhance investor confidence and drive growth.

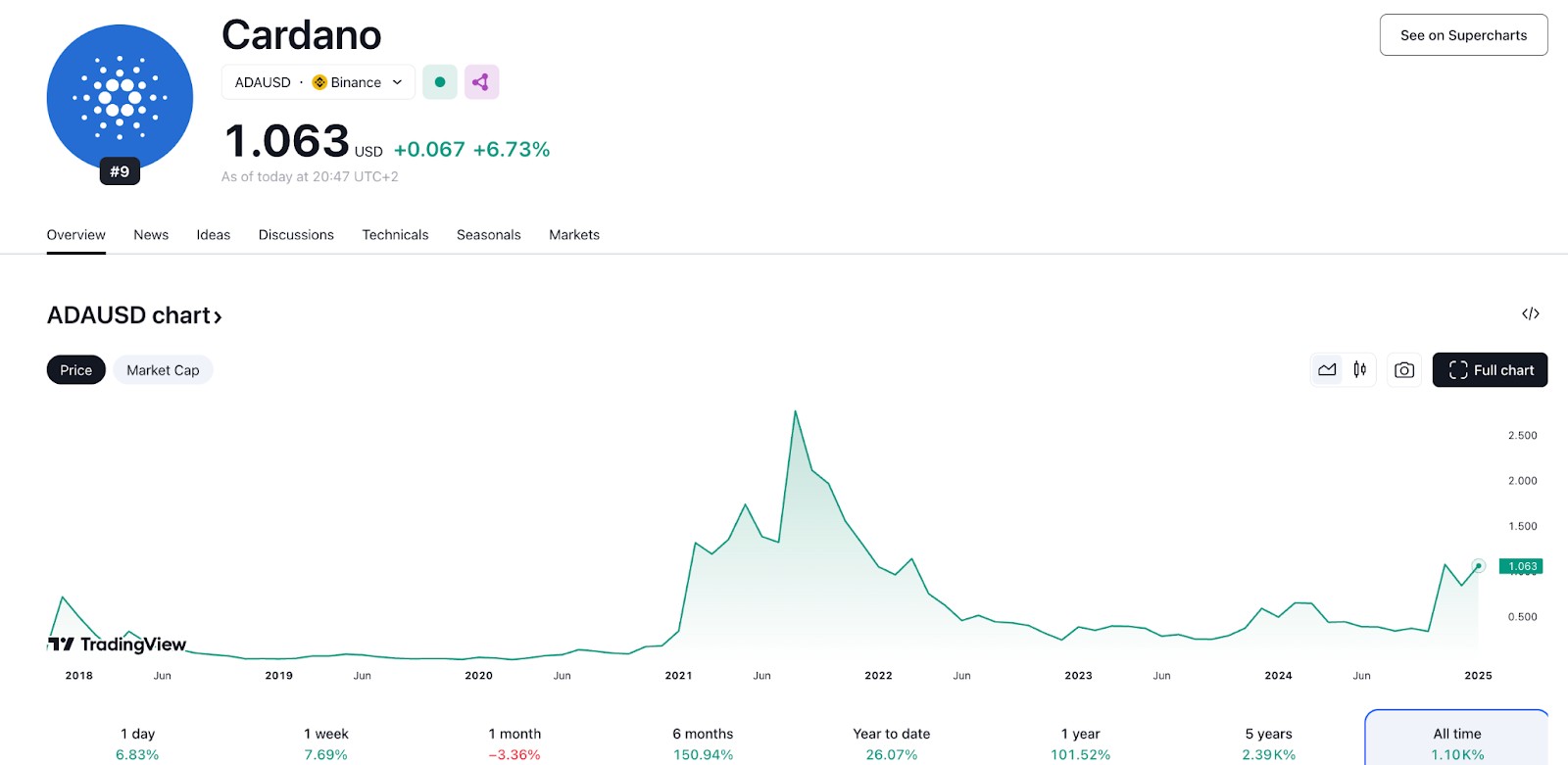

Cardano (ADA)

Cardano is an open-source blockchain platform using the Proof-of-Stake (PoS) consensus algorithm. Launched in 2017, the project focuses on security and sustainability, supporting smart contracts and decentralized applications.

Growth potential of Cardano: Cardano's focus on thorough academic research and scalability positions it uniquely among blockchain platforms, potentially leading to increased adoption in academic and institutional sectors. Further, Cardano's focus on sustainability and energy efficiency makes it attractive to environmentally conscious investors. The platform is also actively developing and implementing innovations such as Hydra to enhance scalability.

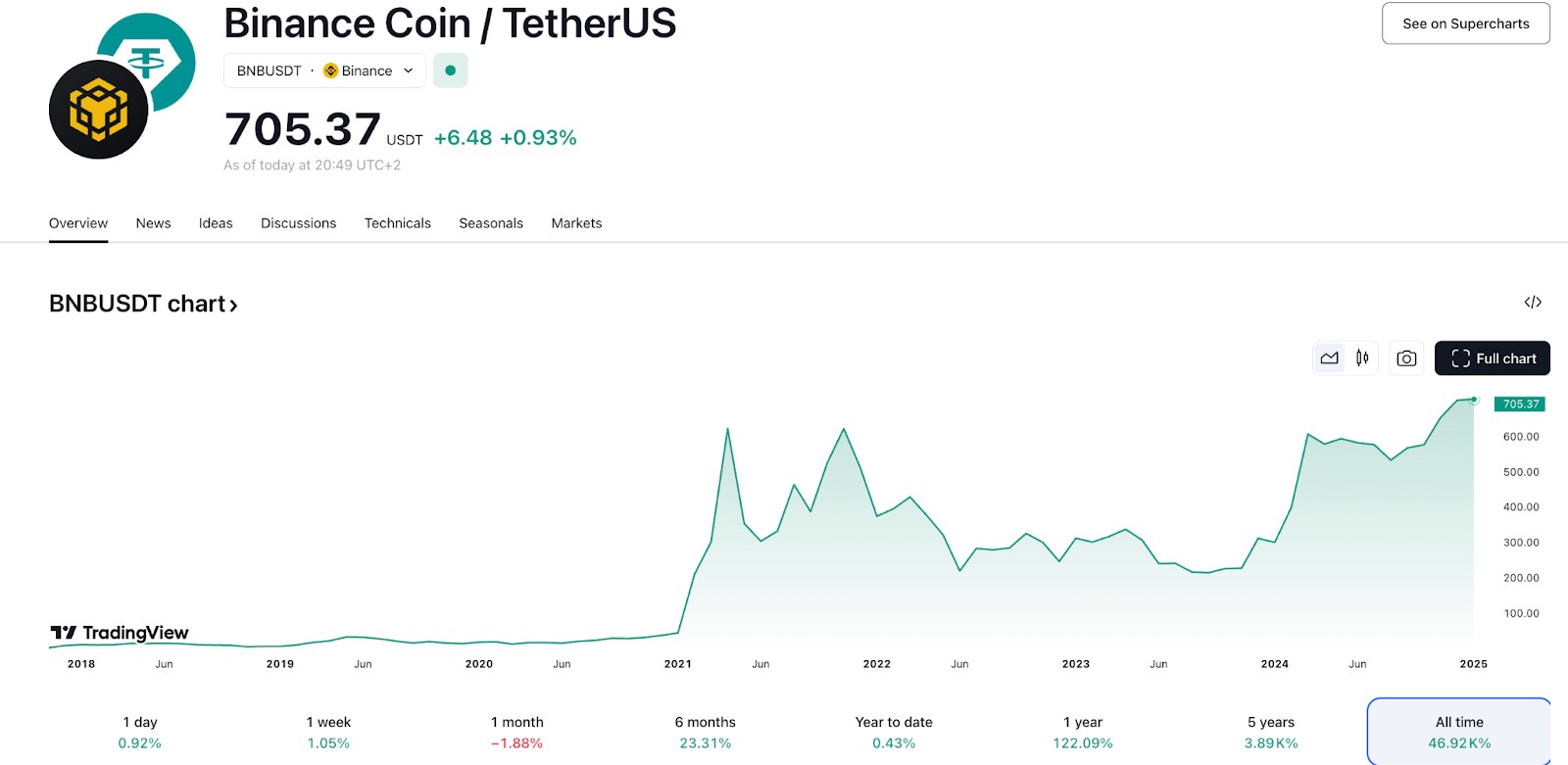

Binance Coin (BNB)

Binance Coin is the native token of Binance, one of the largest cryptocurrency exchanges in the world. Initially launched on Ethereum in 2017, it later migrated to its own Binance Chain.

Growth potential of Binance Coin: BNB is used to pay trading fees on Binance with discounts, participate in token sales, and more. Regular token burns increase its scarcity, potentially boosting its value over time.

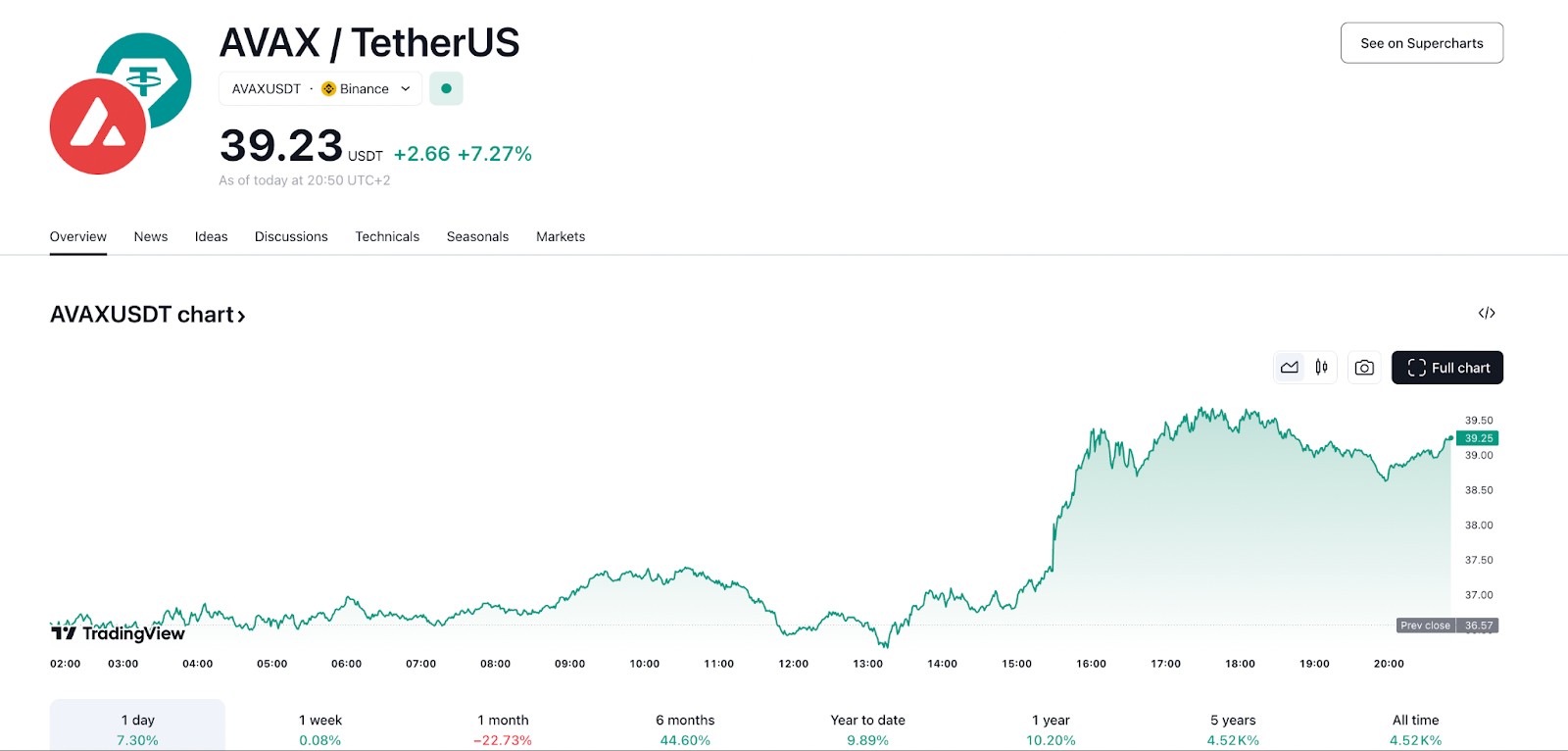

Avalanche (AVAX)

Avalanche is a blockchain platform launched in 2020, offering high transaction speed and smart contract support. It uses its proprietary Avalanche Consensus protocol, providing high scalability and low fees.

Growth potential of Avalanche: Avalanche attracts attention with its speed and efficiency, making it appealing for DeFi developers and corporate solutions. The platform is actively growing, attracting many new projects, which enhances its growth potential.

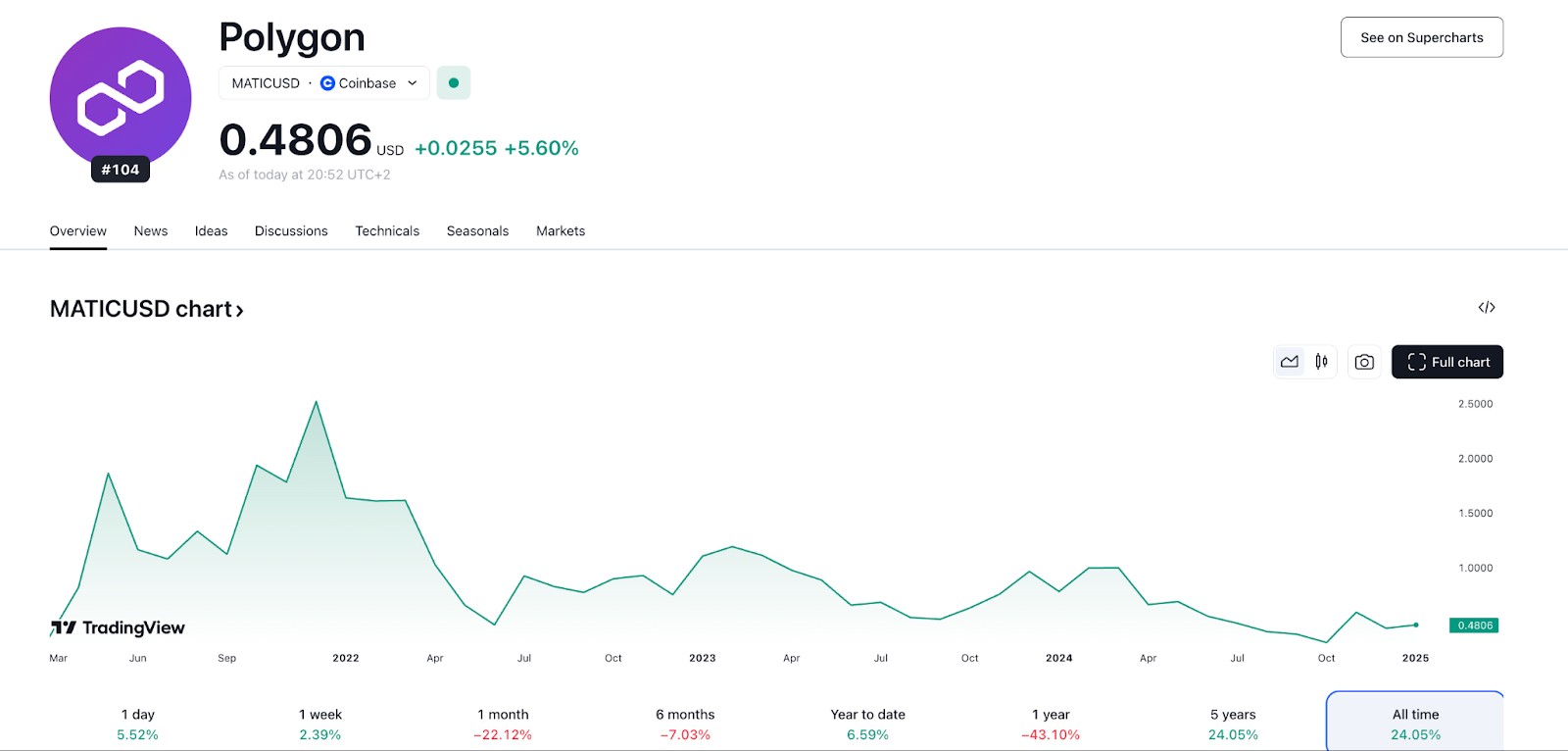

Polygon (POL, ex-MATIC)

Polygon, formerly known as Matic Network, is a scaling solution for Ethereum, providing layer-2 solutions for faster and cheaper transactions. Launched in 2017, it has become popular among DApps and DeFi developers.

Growth potential of Polygon (POL): Polygon offers low fees and high performance, making it attractive for projects operating on Ethereum. The platform is actively integrating with various projects and expanding its ecosystem, contributing to its growth.

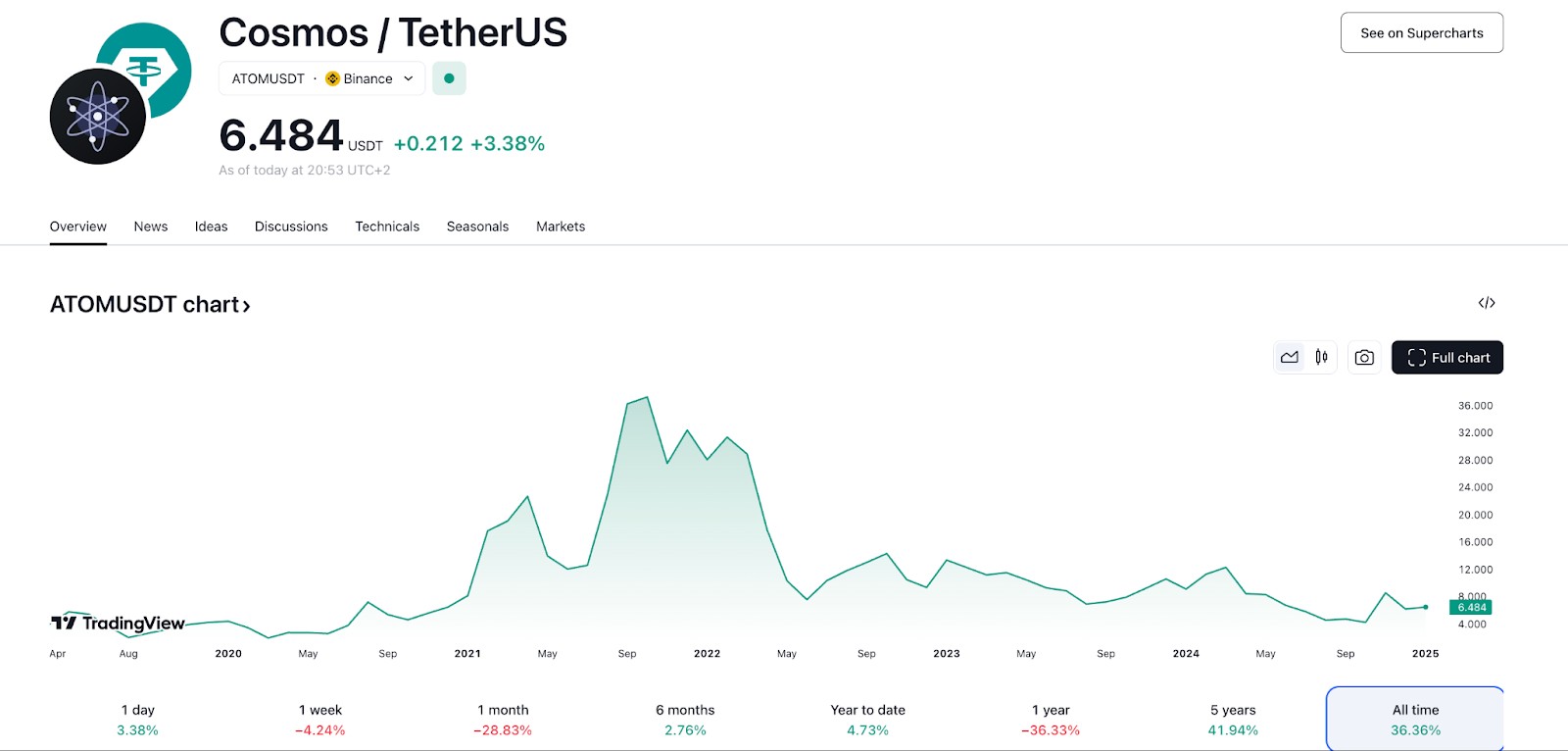

Cosmos (ATOM)

Cosmos is a platform for creating interconnected blockchains, launched in 2019. It uses the Tendermint consensus algorithm and offers a flexible architecture for building and scaling blockchain solutions.

Growth potential of Cosmos (ATOM): Cosmos ensures blockchain interoperability and supports a wide range of applications, making it attractive for developers and investors.

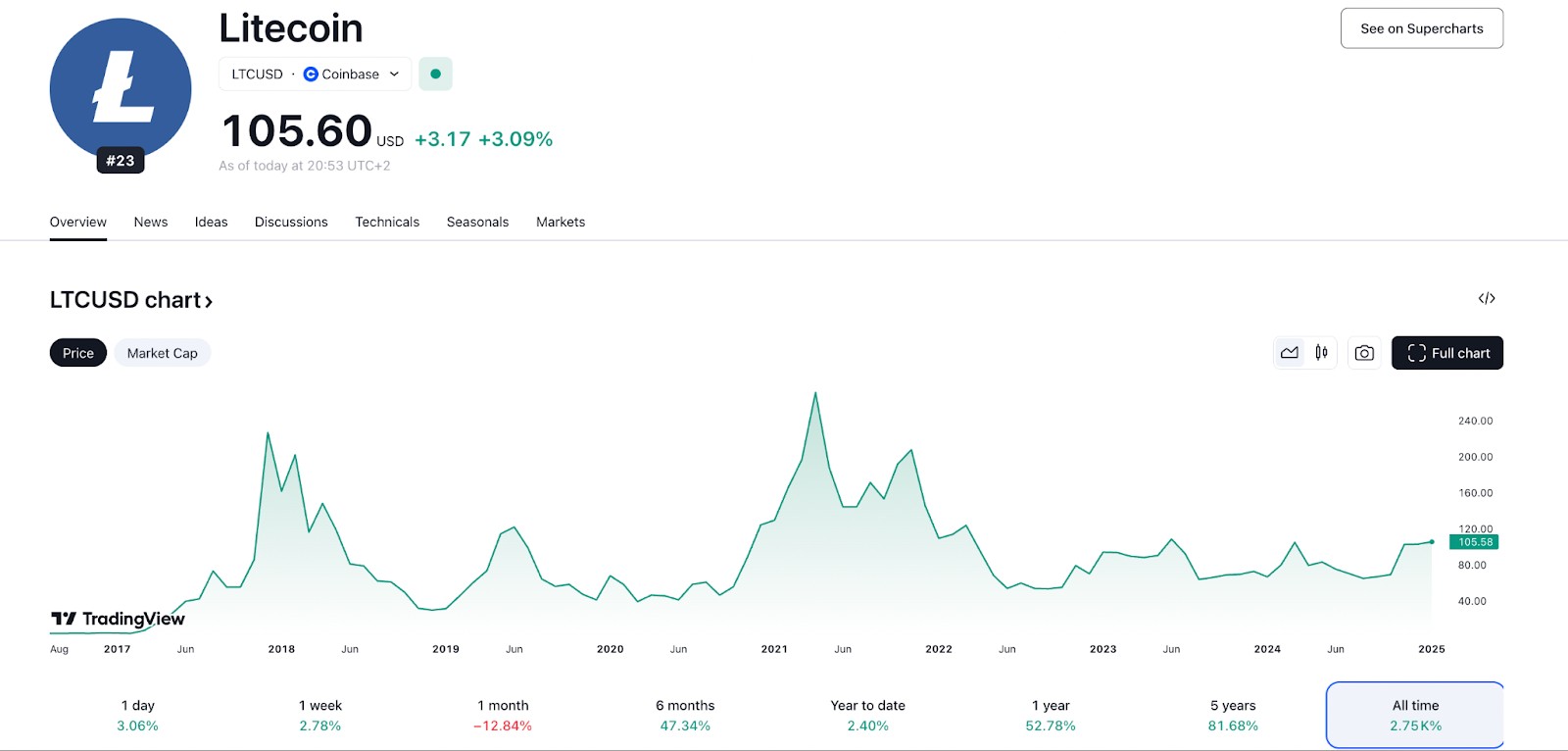

Litecoin (LTC)

Litecoin is a cryptocurrency created in 2011 by Charlie Lee as a "lighter version" of Bitcoin. The platform offers faster transactions and lower fees compared to Bitcoin.

Growth potential of Litecoin: Litecoin maintains high liquidity and popularity among investors due to its reliability and resilience. Its integration with Ethereum and use in DeFi makes it even more attractive.

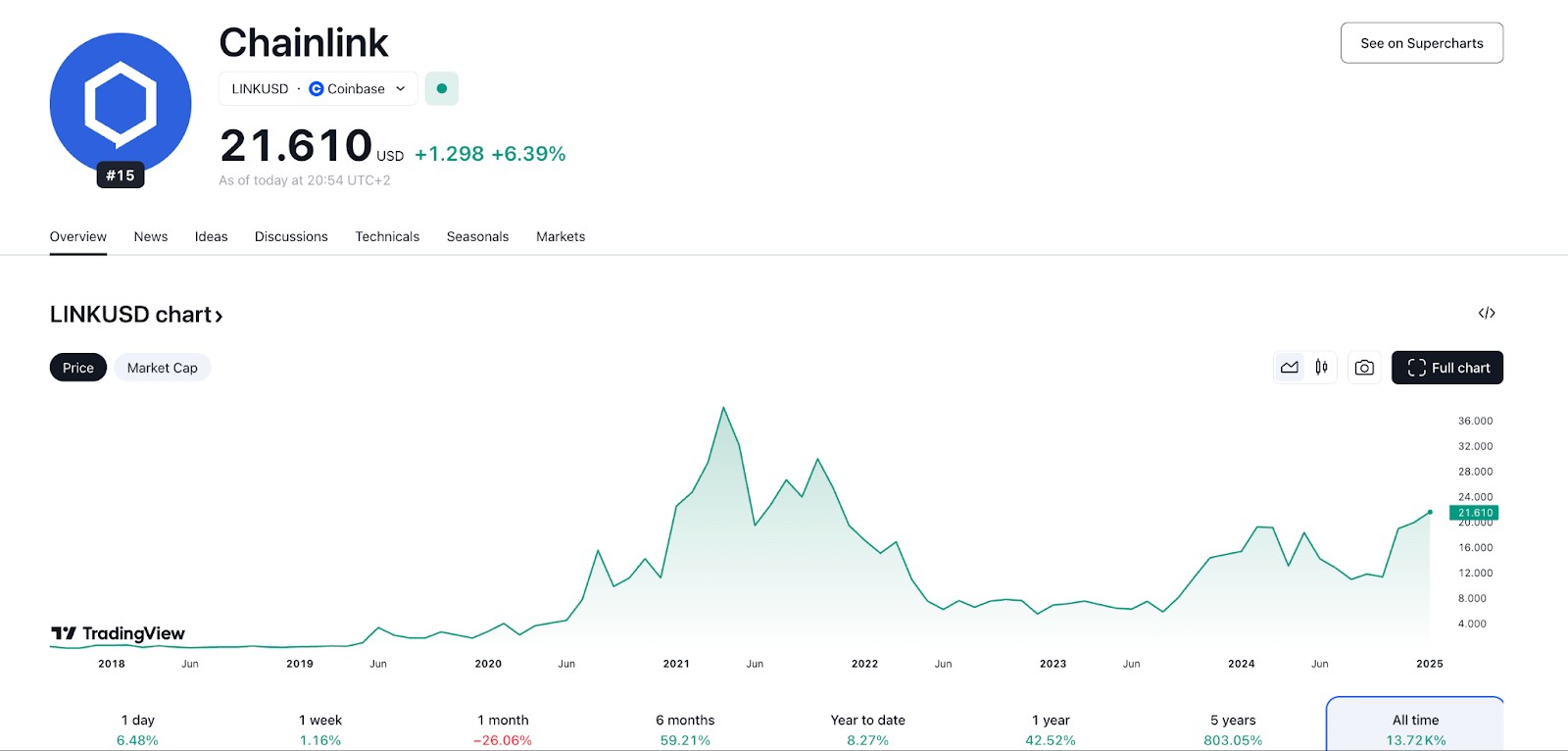

Chainlink (LINK)

Chainlink is a decentralized oracle network launched in 2017. The project provides external data for smart contracts, enabling them to interact with the real world.

Growth potential of Chainlink: Chainlink is the leader among oracles and is used in many DeFi projects, making it highly in demand. The platform is actively developing and integrating with new projects, contributing to its growth.

All these tokens can be purchased on cryptocurrency exchanges. Finding the best cryptocurrency exchanges is crucial for successful trading and investing. The right platform offers security, low fees, and a variety of coins. Let’s explore top exchanges to help you make the best choice.

| Min. Deposit, $ | Coins Supported | Spot leverage | Spot Taker fee, % | Spot Maker Fee, % | Foundation year | Tier-1 regulation | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 10 | 329 | 1:10 | 0,1 | 0,08 | 2017 | No | Open an account Your capital is at risk. |

|

| 10 | 278 | 1:5 | 0,4 | 0,25 | 2011 | Yes | Open an account Your capital is at risk. |

|

| 1 | 250 | 1:3 | 0,5 | 0,25 | 2016 | Yes | Open an account Your capital is at risk. |

|

| 1 | 72 | 1:5 | 0,2 | 0,1 | 2018 | Yes | Open an account Your capital is at risk. |

|

| No | 1817 | No | 0 | 0 | 2004 | No | Open an account Your capital is at risk. |

How to look for cryptos with high growth potential

Finding cryptocurrencies with high growth potential requires research and strategy. Not all coins are built to last, so understanding the key factors that drive growth is crucial. Below, we will break down simple steps to identify promising projects, from analyzing market trends to evaluating real-world use cases.

Technology research and project team. Study the cryptocurrency's technology and innovation. Focus on its consensus algorithms (like PoS or PoH) and their benefits. Evaluate the development team’s experience. A strong, proven team boosts project credibility.

Roadmap and project goals. Review the project’s roadmap to see completed milestones and future plans. Clear, realistic goals show thoughtful planning. Stay updated with news to confirm ongoing progress and development.

Market capitalization and trading volume. Check the cryptocurrency’s market capitalization and trading volume. High values signal strong liquidity and investor interest.

Partnerships and integrations. Explore the cryptocurrency’s partnerships and integrations. Collaborations with big companies or blockchain alliances improve success potential.

Community and project support. Analyze the project’s community activity and size. An engaged community helps promote growth. Look for open communication channels like forums or social networks.

Competitors and market niche. Study competitors to assess your cryptocurrency’s advantages. Compare it within its niche to understand its unique strengths.

How staking rules and developer activity can predict crypto growth

Investing in new crypto projects isn’t just about picking well-known names — it’s about figuring out how useful a token really is and whether big companies are starting to use it. For example, Solana’s deals with payment providers or Polygon working with top companies suggest long-term potential. Don’t just watch prices — check developer activity on platforms like GitHub. If developers are fixing bugs and releasing new features often, it means the project is being built to last.

Also, keep an eye on staking rules. If a project offers staking rewards but locks up your tokens for 21 days, it shows the developers are betting on long-term success. Compare how much you can earn with how long your tokens are locked. If rewards are high but your tokens are tied up for months, it could mean big future payouts. Watch out for large withdrawals from staking pools too — they can signal that insiders expect prices to drop before the rest of the market reacts.

Conclusion

Investments in cryptocurrencies with high growth potential provide opportunities to increase your capital. Their growth is based on technological innovation, sustainability, and high liquidity. Also, these projects are transforming the financial sector right now, providing more convenient solutions for users. With the most promising projects already discussed in this article, you can now undertake further research and choose the right one based on your personal goals.

FAQs

Which types of cryptocurrencies are most attractive for long-term investments?

The most attractive cryptocurrencies for long-term investments are those with innovative technologies, high liquidity, and a strong development team.

Why is it important to pay attention to the market capitalization of a cryptocurrency?

Market capitalization reflects the overall size of the cryptocurrency market and can indicate its stability and attractiveness to large investors.

How to assess risk when investing in cryptocurrencies?

To assess risk, it is important to analyze the volatility of the cryptocurrency, its market trends, regulatory risks, and news related to the project.

What resources will help you stay up to date with cryptocurrency news and analysis?

To track news and analyze cryptocurrencies, you can use resources such as Traders Union, CoinMarketCap, CoinGecko, cryptocurrency exchange news, and specialized forums.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.