Which Stocks To Buy In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best stocks to invest in right now:

MSFT - Cloud computing and productivity leader.

NVDA - AI and gaming powerhouse with rapid growth.

META - Social media giant shifting to the metaverse.

V - Global leader in digital payments.

APH - Steady growth in electronic components.

UNH - Healthcare leader with diversified revenue.

LLY - Pharma innovator excelling in diabetes treatments.

COST - Retail giant with consistent growth.

TSLA - EV and clean energy pioneer.

NFLX - Streaming leader expanding globally.

Finding hidden gems to supercharge your portfolio isn’t easy in today’s markets. As recession fears mount, which companies will emerge unscathed? This report identifies 10 stocks built to take uncertainty. These industry leaders thrive on strong fundamentals, diverse revenue streams, and innovative strategies, offering a haven amid economic storms.

From tech pioneers to consumer powerhouses, these stalwarts combine staying power with attractive valuations, positioning them as long-term growth engines. A deep dive into their financials, strategies, and outlooks reveals why they deserve a spot in your portfolio, even as macroeconomic headwinds.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Best stocks to buy now compared

In this analysis, we compared leading stocks based on key financial metrics to identify the best investment opportunities. Metrics such as market capitalization, EPS growth for next year, sales growth over the past five years, and 1-year and 5-year returns were evaluated. These factors provide insights into a company’s financial health, growth potential, and ability to deliver consistent returns to investors.

Our review focuses on delivering a balanced perspective on each stock’s performance, making it easier for you to understand the unique value they bring to the table. Whether you’re looking for high growth, steady dividends, or long-term potential, these stocks offer diverse opportunities for every type of investor.

| Stock | Market Cap (Billion $) | Growth Estimate (Next Year) | 1-Year Return | 5-Year Return |

|---|---|---|---|---|

| Microsoft Corporation (MSFT) | 2,670 | 14.89% | -15.86% | 124.33% |

| NVIDIA Corporation (NVDA) | 2,382 | 50.03% | -27% | 1,736.21% |

| Meta Platforms, Inc. (META) | 1,279 | 7.4% | 46.45% | 226.46% |

| Visa Inc. (V) | 595.978 | 13.0% | 26.87% | 72.95% |

| Amphenol Corporation (APH) | 81.84 | 14.50% | 5.39% | 237.64% |

| UnitedHealth Group (UNH) | 479.95 | 9.54% | 23.23% | 122.24% |

| Eli Lilly and Company (LLY) | 683.699 | 32% | -5.96% | 428.10% |

| Costco Wholesale Corporation (COST) | 400.914 | 9.1% | 28.37% | 231.53% |

| Tesla, Inc. (TSLA) | 750.39 | 37.08% | -42.12% | 462.38% |

| Netflix, Inc. (NFLX) | 368.858 | 24% | 38.51% | 134.53% |

Top 10 stocks to invest in right now

Here are the top 10 stocks to invest in right now:

Microsoft Corporation (MSFT)

Microsoft stands tall with a market cap of around $2.67 trillion, maintaining its place among the most valuable companies in the world. Its projected EPS growth of 14.89% over the next year is driven by strong demand for cloud solutions, AI-powered productivity tools, and ongoing enterprise digital transformation. Despite broader market volatility, Microsoft has held firm — posting a 5-year return of 124.33%, even though its 1-year return is slightly negative at -15.86% following a tech-sector cooldown.

What keeps Microsoft strong is its deep moat across multiple verticals — Azure cloud, Office 365, GitHub, and enterprise security tools continue to dominate. Its modest dividend yield of 0.75% isn’t flashy, but its consistency and balance sheet strength offer peace of mind to long-term investors. Microsoft’s product stickiness and adaptability make it more than just a growth stock — it's a foundation for anyone looking to invest in tech with staying power.

NVIDIA Corporation (NVDA)

NVIDIA remains at the forefront of the AI and semiconductor industries with a market cap of $2.26 trillion. After a meteoric rise last year, the stock has cooled slightly, showing a 1-year return of -6.52%, but the 5-year return still stands tall at 673.21%. Its projected EPS growth of 80.57% next year signals that the AI-driven momentum is far from over — thanks to high demand for GPUs powering everything from machine learning models to cloud infrastructure.

While the dividend yield sits at a minimal 0.02%, it’s clear NVIDIA isn’t being bought for passive income — it’s a growth engine. With continued leadership in AI chips, automotive computing, and high-performance data centers, NVIDIA is a cornerstone for investors betting on the future of intelligent computing. Even after a slight dip, many still view pullbacks in NVDA as buying opportunities in a long-term uptrend.

Meta Platforms, Inc. (META)

Meta holds a market cap of $1.28 trillion, reflecting some cooling from last year’s highs. Despite the recent pullback, its 1-year return stands at 43.14%, with a solid 5-year return of 153.47%. The company’s EPS growth projection of 18.7% points to ongoing momentum fueled by cost-efficiency, AI integration, and deeper monetization of its platforms like Instagram and WhatsApp.

Meta's push into the metaverse is still in early stages, but it has recalibrated to focus more on profitable growth, especially in advertising and AI-driven content curation. The company doesn’t offer a dividend, but its blend of innovation, scale, and earnings potential continues to make META a compelling growth stock for investors who believe in the long game.

Visa Inc. (V)

Visa holds a market cap of approximately $576 billion, reflecting steady performance in a cooling but resilient financial services environment. The company shows an EPS growth estimate of around 11.8% for the next year. It delivered a 1-year return of 18.92% and a 5-year return of 69.41%, reinforcing its status as a consistent compounder. The dividend yield stands at 0.81%, adding a modest income cushion to its growth profile.

Visa’s global dominance in payment processing continues to pay off, especially as cash usage declines and digital payments expand. Its wide moat, strong margins, and capital-light model make Visa an ideal pick for long-term investors seeking both stability and gradual capital appreciation.

Amphenol Corporation (APH)

Amphenol commands a market cap of approximately $67.6 billion, reflecting moderate price corrections in the tech manufacturing sector. Despite that, it maintains a projected EPS growth of around 10.7%, while delivering a 5-year return of 142.4% and a 1-year return of 12.6%. Its dividend yield holds steady at 0.89%.

Amphenol’s wide reach across aerospace, automotive, and industrial electronics continues to fuel demand for its high-performance connectors and sensors. Its ability to quietly innovate within essential industries makes it a stable compounder for investors who value long-term growth with low volatility.

UnitedHealth Group Incorporated (UNH)

UnitedHealth holds a market cap of roughly $474 billion, reinforcing its role as a dominant force in the U.S. healthcare sector. While its 1-year return has seen a slight decline of -1.4%, the 5-year return stands at 68.3%, reflecting solid long-term performance. The company’s EPS is projected to grow by 11.9% over the next year, signaling ongoing strength despite recent market headwinds.

With its powerful integration of health insurance and data-driven care services through Optum, UnitedHealth offers diversified, recession-resistant revenue. Its 1.47% dividend yield, paired with consistent earnings growth, makes it a solid anchor for investors seeking exposure to healthcare with a dependable long-term outlook.

Eli Lilly and Company (LLY)

Eli Lilly holds a market cap of approximately $814 billion, cementing its position as one of the most valuable pharmaceutical companies globally. With a 1-year return of 36.7% and a 5-year return surpassing 558%, it continues to outperform broader healthcare and biotech indices. The company’s projected EPS growth of 26.4% reflects strong momentum fueled by its innovative drug pipeline.

Much of Eli Lilly’s surge is powered by high-demand treatments for diabetes and obesity, including its leading GLP-1 therapies. Although the dividend yield remains modest at 0.74%, the stock appeals to growth-focused investors seeking exposure to high-performing healthcare innovation with global relevance.

Costco Wholesale Corporation (COST)

Costco commands a market cap of approximately $482 billion, reinforcing its position as one of the most trusted names in retail. With a 1-year return of 45.2% and a 5-year return of 252.1%, Costco has delivered strong, consistent performance across various market cycles. Its projected EPS growth of 11.2% signals ongoing operational expansion.

Costco’s success lies in its resilient business model — anchored by high membership renewal rates and a reputation for quality at value pricing. While its dividend yield sits at a modest 0.49%, the company compensates with reliable growth and defensive appeal, making it a smart pick for investors seeking long-term retail exposure with limited downside risk.

Tesla, Inc. (TSLA)

Tesla holds a market cap of approximately $1.12 trillion, maintaining its status as a global leader in electric vehicles and energy innovation. With a 1-year return of 76.3% and a 5-year return of 467.9%, Tesla continues to deliver for long-term believers in its vision. Its EPS growth forecast of 30.8% reflects strong momentum in EV sales, energy storage, and AI-powered autonomous driving.

Tesla's edge comes not just from its vehicles, but from its integration of hardware, software, and energy ecosystems. While it still doesn’t offer a dividend, the company’s bold strategy and scalable growth model keep it a magnet for investors with high risk appetite and long-term focus.

Netflix, Inc. (NFLX)

Netflix commands a market cap of approximately $439.2 billion, reinforcing its position as the global powerhouse in streaming. Its 1-year return has surged to 108.3%, while the 5-year return sits at 165.1%, reflecting its strong comeback and content-driven growth. The company’s EPS growth forecast of 21.9% points to continued expansion, fueled by international markets and a thriving ad-supported tier.

Netflix’s strategic push into live content, gaming, and regional storytelling has helped it stay ahead in an increasingly competitive media landscape. Despite not offering a dividend, its aggressive growth and adaptable business model make it a smart pick for investors seeking exposure to the digital entertainment sector.

Best brokers to buy stocks

After reviewing all the brokers, TU experts have carefully selected the top platforms for stock trading based on fees, user experience, features, and customer support. Here's a comparison of the best brokers to help you make an informed choice

| Foundation year | Account min. | Demo | Deposit Fee | Withdrawal fee | Forex | Android | iOS | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | No | Yes | No | $25 for wire transfers out | No | Yes | Yes | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| 2014 | No | No | No | No charge | No | Yes | Yes | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| 1919 | No | No | No | $25 | No | Yes | Yes | FDIC, FINRA, SIPC, SEC, CFTC, NFA | 6.61 | Study review | |

| 2015 | No | No | No | No charge up to a limit | Yes | Yes | Yes | FCA, SEC, FINRA | 7.69 | Study review | |

| 1978 | No | Yes | No | No | Yes | Yes | Yes | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

Is it a good idea to buy stocks now?

Investing in stocks depends on your goals and risk tolerance. The U.S. economy is resilient, and key companies show growth potential, but high valuations and recession risks warrant caution. Diversify and invest regularly to balance long-term gains with short-term volatility.

- Pros

- Cons

Resilient economy. The U.S. economy and job market remain robust compared to other major nations.

Corporate earnings. Companies like Microsoft and Google dominate industries with strong growth opportunities in AI, cloud, and digital transformation.

Federal Reserve. Lowering interest rates could support economic expansion.

High valuations. Elevated stock prices may limit short-term upside.

Economic risks. Persistent inflation, high interest rates, and recession risks loom.

Market vulnerability. Heavy reliance on mega-cap tech companies increases risk if their performance falters.

What are the best stocks to buy now?

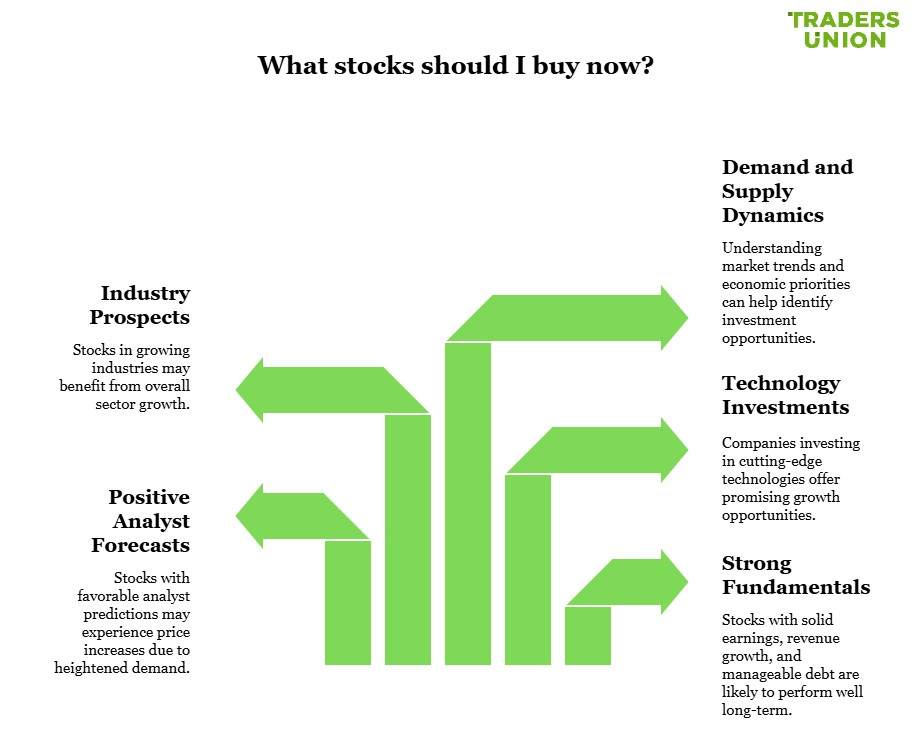

The best stocks to buy now are those with strong fundamentals — solid earnings, revenue growth, and manageable debt — paired with positive analyst forecasts. Diversify across sectors to mitigate risks and focus on long-term potential.

Strong fundamentals

Companies with solid earnings growth, healthy cash flow, and manageable debt tend to be better positioned for long-term performance. For example, Netflix has emerged as a top pick in the media space due to consistent subscriber growth and strong brand value. Micron Technology is gaining attention for its exposure to AI infrastructure and memory chip demand, with analysts highlighting its recovery potential in the semiconductor cycle.

Analyst forecasts

Analysts' predictions about a stock’s future performance can influence investor behaviour. Positive forecasts may lead to increased buying and higher stock prices, while negative predictions can result in selling pressure.

In some cases, strong analyst consensus creates a self-fulfilling cycle, driving prices up due to heightened demand. However, forecasts are not always accurate and can be affected by unexpected market or company events. To evaluate forecasts effectively, consider the track record of the analyst and treat their predictions as educated guesses rather than certainties.

Investments in technology

Companies investing in cutting-edge technologies often present promising growth opportunities. Areas like artificial intelligence, cloud computing, blockchain, 5G networks, and autonomous vehicles are examples of sectors driving innovation. Investors should stay informed about advancements to identify stocks with long-term potential in this rapidly evolving landscape.

Industry prospects

The growth potential of an industry can significantly impact stock performance. In growing sectors, stocks across the board may benefit, as strong industry prospects attract investor interest. Conversely, in declining industries, even solid companies might face reduced demand and lower prices. Assess the overall outlook of an industry before making investment decisions.

Demand and supply

Stock prices are influenced by the forces of demand and supply. High demand for a stock can push prices up as investors compete to buy shares, while low demand may drive prices down. These dynamics can shift quickly, so staying updated on market trends and understanding current economic priorities is essential for identifying investment opportunities.

Are stock investments profitable?

Historically, the stock market has always grown in the long run, with a 10 percent average annual growth rate for the SP 500 over the past 50 years. Corrections may be an opportune time to purchase stocks; however, keep in mind that there is no guarantee of future success with any investment, and sometimes corrections take longer than anticipated.

Overall, investing in stocks may be a lucrative option, but it is important to do your research and take into account the risks associated with stock market investing.

Finding hidden winners through quiet trends and insider moves

If you’re new to the market, don’t just chase the obvious picks everyone’s talking about. Look for companies quietly powering the big stories — like the lesser-known chip makers or software firms helping run AI data centers, or the small players refining the lithium that goes into EV batteries. These stocks don’t usually make it to viral posts, but they’re often the backbone of huge trends. Getting in early on these kinds of names gives you a shot at real upside without paying inflated prices for stocks that have already run up.

Here’s another underrated trick — track what company insiders are doing, especially when they’re buying their own stock during a slump. If the CEO or CFO is buying while the news is negative, it usually means they believe the company is stronger than it looks. Combine that with improving cash flow or new deals under the radar, and you might find a gem others are ignoring. Investors who follow these quiet signals often get in before the crowd.

Conclusion

The best stocks to buy now are those with strong fundamentals, innovation-driven growth, and industry resilience. From tech giants like Microsoft and NVIDIA to healthcare leaders like Eli Lilly and UnitedHealth, these companies offer both stability and long-term upside. Diversifying across sectors such as retail, finance, and clean energy adds balance to your portfolio while capturing emerging trends. Whether you’re a seasoned investor or just starting out, focus on quality, consistency, and strategic timing. With the right approach, these stocks can serve as powerful building blocks for future financial growth.

FAQs

What is the timeframe for investing in these stocks?

Ideally, investors would hold onto these stocks for the long term, at least 3-5 years or longer to fully benefit from their growth potential.

How often should I review my holdings?

Investors should review their portfolio at least quarterly to check that stocks still fit their strategy and rebalance if needed. Events could change a company's outlook.

Which sectors seem most resilient currently?

Industries like technology, healthcare and consumer staples tend to hold up better than others during downturns thanks to consistent demand.

How can I minimize my risk?

Diversifying across different companies, maintaining a long-term perspective, and dollar cost averaging are strategies that can help reduce risk over time.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

In trading, a supply and demand zone refers to specific price levels on a chart where there is an imbalance between buyers (demand) and sellers (supply). A demand zone represents a price area where buying interest is strong, potentially leading to price increases, while a supply zone indicates an area where selling interest is significant, possibly resulting in price declines.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.