What Is A Binary Trader? What Do Binary Traders Do?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A binary trader makes predictions about the price movements of assets such as currencies, stocks, commodities, or indices within a specific time frame using binary options. They decide between "Call" or “Up” options (predicting price increases) and "Put" or “Down” options (predicting price decreases), aiming to profit from their predictions upon the option's expiration. Traders either receive a fixed payout for correct predictions or lose their investment for incorrect ones.

Binary traders predict whether the price of assets will rise or fall within a specific period. They use binary options, where outcomes are limited to two possibilities: profit or loss. Their decisions rely on market analysis, economic indicators, and strategic risk management to maximize returns. This article will help you learn everything you need to know about binary trading.

What does a binary trader do?

The work of a binary trader involves several key activities:

Market analysis. Binary traders analyze financial markets to predict the price movements of various assets. This involves studying charts, trends, news, and other market indicators.

Choosing assets. Traders select the assets they want to trade, which can include currencies, stocks, commodities, or indices.

Making predictions. Based on their analysis, traders predict whether the price of a chosen asset will rise or fall within a specified period. This decision is represented by buying a "Call" or “Up” option if they predict an increase, or a "Put" or “Down” option if they predict a decrease.

Managing trades. Traders set the amount they want to invest in each trade and determine the expiration time of the option, which can range from minutes to hours or days.

Executing trades. Once predictions and parameters are set, traders execute the trade and wait for the option to expire.

Risk management. Disciplined binary traders also implement strategies to manage risk, such as limiting the amount invested in a single trade or diversifying their trades across different assets.

Reviewing results. After the expiration of the option, traders review the outcome to see if their prediction was correct. A correct prediction results in a fixed payout, while an incorrect prediction results in a loss of the invested amount.

Continuous learning. Successful binary traders continually educate themselves about market trends, trading strategies, and economic news to improve their prediction accuracy and overall trading performance.

Pros and cons of binary trading

Understanding these pros and cons is crucial for anyone considering a binary trading career, as it helps to set realistic expectations and develop effective risk management strategies.

- Pros

- Cons

Simplicity. Binary trading is straightforward, involving a simple "yes or no" decision regarding the price movement of an asset.

Limited risk. The potential loss is limited to the amount invested in a trade, which allows traders to manage their risk effectively.

High returns. Successful trades can offer high returns, often between 60% to 90% of the invested amount, depending on the broker and the asset.

Fixed payouts. Traders know the potential payout and loss before entering a trade, providing clear financial expectations.

Diverse asset choices. Binary trading allows access to a wide range of assets, including stocks, currencies, commodities, and indices.

Short-term trading opportunities. Traders can profit from short-term price movements with options that expire in as little as 60 seconds.

Accessibility. Many brokers offer user-friendly platforms, making binary trading accessible to beginners with minimal capital.

High risk. While the potential loss is limited to the investment, the all-or-nothing nature of binary options means that incorrect predictions result in a total loss of the investment.

Market volatility. Binary trading is highly susceptible to market volatility, which can lead to unpredictable price movements and increased risk.

Regulatory concerns. The binary options market is often less regulated compared to other financial markets, leading to potential issues with untrustworthy brokers and fraudulent schemes.

Addictive nature. The quick turnaround and potential for high returns can make binary trading addictive, leading to irresponsible trading behavior and significant financial losses.

Limited analytical tools. Binary trading platforms often provide fewer analytical tools and resources compared to traditional trading platforms, making in-depth market analysis more challenging.

Potential for overtrading. The ease and speed of executing trades can lead to overtrading, where traders make too many trades without sufficient analysis, increasing the likelihood of losses.

Misleading marketing. Some brokers may use aggressive and misleading marketing tactics, creating unrealistic expectations about the profitability of binary trading.

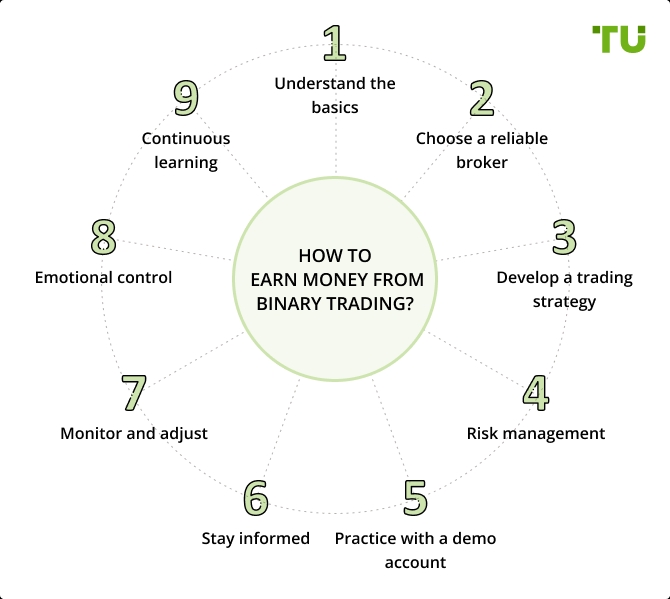

How to earn money from binary trading?

Earning money from binary trading involves a combination of strategy, discipline, and market knowledge. Here are the key steps to increase your chances of success:

Understand the basics

Learn how binary options work, including the concepts of "Call" and "Put" options, expiration times, and payout structures.

Choose a reliable broker

Regulation. Select a broker that is regulated by a reputable financial authority to ensure fair practices.

Platform. Choose a trading platform that is user-friendly and provides the necessary tools for analysis.

We have analyzed existing binary brokers, evaluating their performance based on more than 120 parameters, using a unique and uniform evaluation methodology. The top options have been presented in the table below:

| Demo | Min. deposit | Min. trade size | Min. Payout (%) | Max. Payout (%) | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 5 | 1 | 17 | 95 | Open an account Your capital is at risk. |

|

| Yes | 100 | 0.01 | 70 | 95 | Open an account Your capital is at risk. |

|

| Yes | 250 | 0.01 | 70 | 95 | Open an account Your capital is at risk. |

|

| Yes | 250 | 1 | No | 100 | Study review | |

| Yes | 5 | 1 | 50 | 128 | Open an account Your capital is at risk. |

Develop a trading strategy

Market analysis. Use technical analysis (charts, indicators) and fundamental analysis (news, economic data) to identify trading opportunities.

Time frame. Decide on the expiration times that suit your trading style, whether short-term (60 seconds to a few minutes) or longer-term (hours to days).

Risk management

Investment size. Never invest more than you can afford to lose. A common rule is to limit each trade to a small percentage of your total capital (e.g., 1-5%).

Diversification. Avoid putting all your money into a single trade. Spread your investments across different assets to reduce risk.

Practice with a demo account

Simulation. Use a demo account to practice your strategy without risking real money. This helps you refine your approach and build confidence.

Stay informed

Market news. Keep up with global financial news and events that could impact the assets you trade.

Economic calendar. Use an economic calendar to track important data releases and announcements.

Monitor and adjust

Track performance. Keep a trading journal to record your trades, strategies, and outcomes. This helps you identify what works and what doesn’t.

Adapt. Be prepared to adjust your strategy based on market conditions and your performance analysis.

Emotional control

Discipline. Stick to your trading plan and avoid impulsive decisions based on emotions.

Patience. Understand that not all trades will be winners. Focus on long-term profitability rather than short-term gains.

Continuous learning

Education. Continuously improve your knowledge and skills by reading books, attending webinars, and following expert traders.

Community. Join trading forums and communities to exchange ideas and strategies with other traders.

Judging market sentiment is an important skill

When starting out in binary options trading, I suggest you get a feel for market sentiment. Instead of just looking at charts and numbers, try to understand what traders are feeling and thinking about a particular asset. This sentiment is often influenced by news events, economic reports, and even rumors. By keeping an eye on the news and sensing the general mood, you can make better guesses about where an asset's price might go.

Another smart strategy is to stick to the 5% rule to manage your risk. This means you shouldn't put more than 5% of your total trading money into a single trade. This way, you won't lose everything if a few trades go wrong. Also, try to spread your trades across different types of assets like currencies, commodities, stocks, and indices. This not only reduces your risk but also helps you find more opportunities to make money in different markets. The key to successful trading isn't just making profits; it's also about protecting your money and handling losses wisely.

Summary

A binary trader makes predictions about the price movements of financial assets such as stocks, currencies, commodities, or indices within a specific time frame using binary options. They analyze market trends and news to decide whether to place a "Call" option if they expect prices to rise or a "Put" option if they expect prices to fall. The outcome of each trade is binary. traders either receive a fixed payout for correct predictions or lose their investment for incorrect ones. Effective binary trading involves strategic analysis, risk management, and disciplined execution.

FAQs

Can I be a millionaire by binary trading?

It's not impossible to become a millionaire through binary trading, but it requires extensive knowledge, disciplined risk management, and consistent strategy. Moreover, it's highly risky and not guaranteed, and most traders face significant losses.

Is binary trading real or fake?

Binary trading is a legitimate trading system. Binary traders make predictions on the price movements of underlying assets such as commodities, stocks, or currencies, based on market analysis and conditions.

Is binary trading like gambling?

Binary trading is not gambling, although it is speculative in nature. Unlike gambling, binary traders make informed predictions based on technical and fundamental analysis, considering market conditions to guide their decisions.

Can I improve my binary trading?

Yes, you can improve your binary trading skills. Utilize online resources from market leaders, practice with demo accounts, and continuously educate yourself about market trends and trading strategies to enhance your proficiency.

Related Articles

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.