Key technical indicators for trading binary options

The application of technical analysis in binary options trading is generally done by the use of the following indicators

-

-

-

-

-

-

-

Commodity Channel Index (CCI)

Binary options trading is a popular form of financial trading that involves predicting whether the price of an asset will rise or fall within a specific time frame. Technical analysis is an important tool for binary options traders as it helps them evaluate the historical price movements of an asset and predict its future price movements. In this article, the experts at TU will explore the concept of technical analysis and its significance in binary options trading. They will also highlight the benefits of using technical analysis for binary options trading.

Start trading binary options right now with Pocket Option!Introduction

Technical analysis is the go-to analytical approach for binary options trading, and the reason behind the same can easily be understood through the meaning, significance, and benefits of technical analysis for binary trading.

Technical analysis and its significance in binary options trading

At its core, technical analysis uncovers an asset's historical price movements, employing tools like price charts and indicators to uncover patterns and trends. For binary options traders, it enables the assessment of underlying asset values and the prediction of their future price dynamics.

If you are interested in learning about Trend Reversal Patterns In Binary Options, read the Traders Union article.

Benefits of using technical analysis for binary options trading

The advantages of integrating technical analysis into binary options trading are manifold. Firstly, it excels in predicting short-term price movements, offering insights for traders navigating the rapid twists and turns of the market. Additionally, it helps traders to identify trends and patterns, providing valuable cues for strategic decision-making. Lastly, it assists in pinpointing optimal entry and exit points, a critical aspect of maximizing profits and minimizing losses in the binary options arena.

Understanding technical indicators

Technical indicators can broadly be classified into the following categories

Trend indicators

At the core of technical analysis are trend indicators, crucial for assessing the direction and strength of a trend. Moving averages, a stalwart in this category, provide a smoothed average of past prices. Parabolic SAR and Moving Average Convergence Divergence (MACD) further complement the toolkit, offering insights into trend dynamics. For instance, when MACD lines converge, signaling a potential new trend, traders are alerted to shifts in market sentiment.

Momentum indicators

Momentum indicators play a pivotal role in identifying the rate of change in an asset's price, aiding traders in recognizing overbought or oversold conditions. The Relative Strength Index (RSI), stochastic oscillator, and the Rate of Change (ROC) are key players in this type. RSI, for instance, acts as a signal for potential reversals, helping traders determine optimal entry or exit points.

Volatility indicators

Volatility indicators, such as Bollinger Bands and Average True Range (ATR), offer insight into the magnitude and rate of price movements. Bollinger Bands dynamically generate upper and lower levels based on recent price moves, allowing traders to gauge potential reversals. Meanwhile, ATR serves as a reliable indicator of volatility, crucial for risk management in binary options trading.

Volume indicators

Understanding market interest and trend strength is facilitated by volume indicators like On-Balance Volume (OBV) and Volume Rate of Change. These indicators provide an insight into the trading activity surrounding an asset, generating hints of the prevailing sentiment.

Best technical analysis indicators for binary trading

Moving averages

Moving averages

Moving averages, whether simple (SMA) or exponential (EMA), validate trends by presenting averages of past prices. While SMAs offer a straightforward mean average, EMAs lend more weight to recent values, catering to traders keen on short-term contracts. These indicators, often used in conjunction with others, contribute to a holistic market analysis.

Average True Range (ATR)

Average True Range (ATR)

Calculated by analyzing the price range over a set period, ATR reflects the potential market movement. Higher ATR values indicate increased volatility, guiding traders in navigating the binary options landscape with a keen awareness of potential market shifts.

Moving Average Convergence/Divergence (MACD)

Moving Average Convergence/Divergence (MACD)

MACD, with its fast and slow lines, signifies the relationship between two moving averages. Convergence heralds the potential onset of a new trend, while divergence indicates a reversal. This nuanced insight empowers traders to anticipate market movements and make informed decisions in the binary options arena.

Relative Strength Index (RSI)

Relative Strength Index (RSI)

RSI serves as a valuable momentum indicator, signaling whether a market is overbought or oversold. This critical information aids traders in deciding when to buy or sell, aligning their actions with potential trend reversals. In the context of binary options contracts, RSI guides traders in selecting optimal expiry times.

Stochastic Oscillator

Stochastic Oscillator

Functioning in a manner akin to RSI, the stochastic oscillator offers a unique perspective on market conditions. With two lines delineating trends, stochastics indicate potential reversals when exceeding 80 (overbought) or falling below 20 (oversold).

Bollinger Bands

Bollinger Bands

A distinctive feature of volatility analysis, Bollinger Bands dynamically set upper and lower levels based on recent price moves. Contraction and expansion of these bands offer vital reversal signals, aiding traders in positioning themselves strategically within the binary options market.

Commodity Channel Index (CCI)

Commodity Channel Index (CCI)

Calibrating the current price level relative to the average price, CCI is a versatile tool for identifying trends and extreme market conditions. With values above +100 indicating a robust uptrend and below -100 signaling a potent downtrend, CCI enables traders to take trading calls for short-term binary options trading.

Applying technical analysis to binary options trading

In this section, experts have broken down the entire technical analysis process for aspiring binary options traders. The core building blocks for same are as follows

Identifying potential trading opportunities using technical indicators

To uncover potential trading opportunities, traders delve into past market data, understanding price and volume to spot patterns and trends. If the analogy of decoding a map were to be taken – technical indicators would act as guides, revealing potential paths. For instance, let’s say that you identify an upward trend through technical analysis; this could prompt you to opt for a call option, anticipating the upward trend to persist.

Strategies for using technical indicators to make informed trading decisions

Analyzing price charts and technical indicators reveals patterns and trends that can form base for most trading decisions. For instance, the use of moving averages unveils trends, while support and resistance levels guide entry and exit points. Combining these varied pieces of information with conviction can result in a high-performing trading set-up.

Using charts to analyze price movements

Charts are like visual storytellers in technical analysis. Whether it's a line chart, bar chart, or candlestick chart, these tools show trends and patterns clearly. For example, candlestick charts comprehensively display how prices change over time with their open, close, high, and lows, giving a snapshot of market dynamics.

Identifying support and resistance levels

In technical analysis, finding support and resistance levels is like figuring out a market's strengths and weaknesses. Imagine support as a historical barrier stopping prices from dropping further, and resistance as a limit to upward movement. Traders strategically position themselves, expecting price changes at these crucial levels.

Using indicators to identify trends and patterns

Apart from charts, technical analysts use indicators as mathematical helpers. Whether it's moving averages, Bollinger Bands, or the Relative Strength Index (RSI), these indicators provide different perspectives on market movements. Like skilled musicians blending different notes, traders combine indicators to spot potential trades.

Managing risk

Providing for the risks of binary options trading is non-negotiable. Risk management strategies, like diversification and setting stop-loss orders, act as a shield against potential losses. Using stop-loss orders is like having an emergency exit plan, automatically triggered to protect against unexpected market turns. Experts lay special focus on the advice that traders should only invest what they are comfortable losing, ensuring that the excitement of trading remains enjoyable rather than stressful. If you want to learn about the best chart patterns for binary trading, read the Traders Union article.

Advanced technical analysis techniques

How can advanced technical analysis techniques enhance trading performance?

Advanced technical analysis techniques serve as enhanced tools for traders aiming to elevate their performance. These techniques go beyond conventional tools, offering deeper insights into market dynamics and aiding in making well-informed trading decisions. By using these advanced methods, traders are likely to unlock a new level of precision in identifying entry and exit points.

Fibonacci Retracements: How do they identify support and resistance levels?

Fibonacci retracements, rooted in the mathematical elegance of the Fibonacci sequence, emerge as a widely used tool for pinpointing potential support and resistance levels in an asset's price movement. Picture this as a financial compass – traders leverage Fibonacci retracements to navigate the market terrain, strategically identifying optimal moments to enter or exit trades. For example, if a trader spots a retracement level aligning with historical price patterns, it could signify a compelling entry point.

Suppose a trader observes a downtrend in an asset's price chart and anticipates a potential retracement. Applying Fibonacci retracements, the trader identifies key levels – 50% and 61.8% – as potential resistance zones. If the retracement aligns with historical patterns, the trader might consider this an entry signal for a put option, anticipating a pull-back.

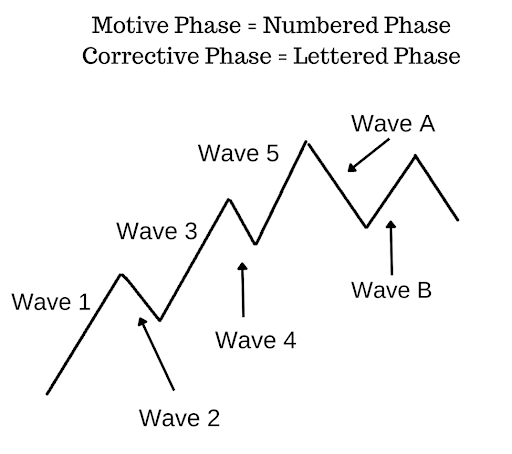

Elliott Wave Theory: How does it forecast price movements?

Elliott Wave Theory

Elliott Wave Theory, based on the idea of trading the rhythmic patterns of market trends, offers a sophisticated lens for predicting price movements. Based on the notion that market trends unfold in a series of waves, each comprising smaller waves, this theory becomes a roadmap for traders. Visualize this as a musical score – traders employing Elliott Wave Theory judge the rhythm of market trends, trying to find well-timed entries and exits. Suppose a trader identifies a corrective wave about to conclude; this could signal an opportune moment to enter a trade.

Elliott Wave Theory

Imagine a trader scrutinizing an asset's price movements and recognizing the completion of a motive wave, poised for a corrective wave. Leveraging Elliott Wave Theory, the trader gauges the rhythm of the potential downward movement. With this insight, the trader strategically enters a put option, aligning with the projected bearish wave.

Fractal Analysis: How does it uncover patterns in price charts?

Fractal analysis is based on the assumption that market trends unfold like patterns in a constantly repeating kaleidoscope. This analytical tool operates on the idea that market trends show fractal characteristics, repeating patterns on different scales. It's similar to identifying recurring themes in a masterpiece. Traders who use fractal analysis aim to recognize these patterns, gaining insights into when to enter or exit the market. For example, if a trader spots a fractal pattern similar to a historical upward movement, it might prompt them to enter a long-side trade.

Fractal Analysis

Imagine a trader using fractal analysis who identifies a repeating pattern resembling a historical market surge. Understanding the fractal nature of this pattern, the trader would interpret it as a signal to enter a call option, anticipating a repeat of the previous positive trend.

Combining technical analysis with other forms of analysis

For any trader, a holistic approach that integrates various forms of analysis is often the key to informed decision-making. By combining technical analysis with fundamental analysis and market sentiment analysis, traders can gain a more comprehensive understanding of market movements, mitigating risks and enhancing the precision of their trades.

Importance of combining technical analysis

While technical analysis excels in decoding price charts and identifying patterns, its power amplifies when complemented by other analytical dimensions. Fundamental analysis, focused on the intrinsic value of assets, and market sentiment analysis, which incorporates the prevailing mood of traders, offer crucial layers of insight.

Insights from fundamental analysis

Fundamental analysis focuses on the core factors influencing an asset's value. Economic indicators, company financials, and global events are the key branches of this study. For instance, if a binary options trader is assessing a tech company's stock, fundamental analysis might involve studying its earnings reports. If the company reports robust earnings, this positive fundamental indicator could align with a bullish technical trend, reinforcing the decision to enter a call option.

Deciphering market sentiment

Market sentiment analysis taps into the collective psychology of traders. It gauges whether the prevailing mood is bullish, bearish, or neutral. Suppose technical analysis reveals an asset approaching a key resistance level. Concurrently, market sentiment analysis indicates a widespread bullish sentiment. In such a scenario, a binary options trader might interpret this convergence as a potent signal to enter a call option, anticipating a potential breakout.

Summing it all up

Consider a hypothetical scenario involving a binary options trader eyeing a currency pair. Technical analysis unveils a clear uptrend, supported by the emergence of a bullish chart pattern. However, before finalizing the trade, the trader turns to fundamental analysis. Economic indicators suggest a potential interest rate hike in the currency's home country. This fundamental insight aligns with the upward technical trend, increasing the trader's confidence in entering a call option. However, the prevailing market sentiment is bearish given the geopolitical scenario, especially for the two currencies involved. In that case, the trader is less likely to execute the trade and more likely to look for other opportunities.

Conclusion

Technical indicators like Bollinger Bands, MACD, Moving Averages, and RSI help binary traders to take trades successfully. And though getting good at technical analysis is crucial, the real skill comes from using different analytical tools together. This article has stressed the importance of blending technical analysis with fundamental analysis and market sentiment analysis to create a solid trading strategy. By combining these different ways of looking at the market, traders get a more detailed understanding of how prices move, making it easier to make smart decisions.

Top 3 binary options brokers

FAQs

How to learn technical analysis for options trading?

To learn technical analysis for options trading, start by understanding the basics of technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI). Explore educational resources, online courses, and books dedicated to technical analysis. Practice analyzing price charts and identifying trends using these indicators. Additionally, consider joining trading communities and participating in discussions to gain insights from experienced traders.

How do you predict binary trading?

Predicting binary trading involves a combination of technical analysis, fundamental analysis, and market sentiment analysis. Use technical indicators like moving averages and RSI to analyze price charts. Incorporate fundamental analysis by assessing economic indicators and news events. Consider market sentiment by observing trader behavior. A comprehensive approach, considering all these factors, enhances your ability to predict binary trading outcomes.

How do you analyze over and under market in binary trading?

Analyzing overbought and oversold conditions in binary trading involves using momentum indicators like the Relative Strength Index (RSI) or stochastic oscillator. When an asset is overbought (RSI above 70), it might be due for a downward correction. Conversely, when oversold (RSI below 30), it could indicate a potential upward correction. Monitoring these conditions helps in making informed decisions about entry and exit points.

What is the best strategy for binary option trading?

The best strategy for binary option trading depends on various factors, including your risk tolerance, trading style, and market conditions. A popular strategy is trend following, where you identify and follow existing market trends. Another strategy involves using technical indicators for precise entry and exit points. Additionally, risk management is crucial; strategies like setting stop-loss orders and diversifying your portfolio can contribute to a successful binary option trading strategy. It's essential to continuously adapt and refine your approach based on market dynamics.

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

3

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

4

Binary options trading

Binary options trading is a financial trading method where traders speculate on the price movement of various assets, such as stocks, currencies, or commodities, by predicting whether the price will rise or fall within a specified time frame, often as short as a few minutes. Unlike traditional trading, binary options have only two possible outcomes: a fixed payout if the trader's prediction is correct or a loss of the invested amount if the prediction is wrong.

-

5

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).