Best Options Trading Software in 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best option trading software in 2025 is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Strategy development and backtesting

- Advanced analytical tools

Top options trading software and tools:

eToro - simplified trading platform, social trading feature

eOption - low cost option trading, many analytical tools

Interactive Brokers - 200+ supported countries, advanced analytical tools

Market Chameleon - options screeners and metrics with over 1M data points

The Trading analyst - real time options SMS alerts, proved profitability record

TrendSpider - automated chart patterns detection, multiple time frames analysis

Options trading software, encompassing platforms, alert services, filters, and AI tools, greatly assists traders in navigating the intricacies of the options market. Premium platforms provide intuitive interfaces for real-time analysis, trade execution, and position monitoring. Integrated alert services keep traders updated on market shifts, while customizable alerts cater to specific criteria. Filters and screeners enhance data analysis, uncovering patterns and trends, aiding in informed decision-making.

Traders Union reviewed such useful services, offering traders insights into optimal solutions. By assessing factors like features, usability, and data driven tools integration, the reviews empower traders to select platforms aligned with their goals, enhancing their options trading success.

Best Options Trading Platforms

Selecting the optimal options trading platform hinges on a trader's experience and objectives. Traders' Union has identified platforms that cater to both beginners and experienced traders, recognizing the importance of a tailored approach to suit diverse skill levels and goals in the options trading arena.

eToro - best options social trading platform

| Options trading platform features | Copy trading service, options alerts, simplified options trading app |

| Demo account | Yes |

| Options trading fee | Free |

eToro Options presents an enticing prospect for newcomers entering the world of options trading. With a focus on simplicity and an intuitive interface, the platform is tailored to ease beginners into the complexities of options trading.

eToro

eToroThe platform's commitment to simplification shines through its user-friendly design, making it a valuable asset for those navigating the learning curve. Furthermore, eToro Options' copy trading feature provides an unparalleled advantage. Beginners have the opportunity to glean insights and strategies from seasoned traders, fostering a collaborative atmosphere that accelerates learning and strategy development.

One of eToro Options' most notable draws is its commission-free structure, making it particularly appealing to those conscious of initial costs. However, diversifying accessibility by introducing a desktop or web version alongside the mobile app could enhance user convenience and adaptability to varied preferences.

On the other hand eToro Options is limited by its availability exclusively to US clients and is comparatively less suitable for experienced traders.

This is due to its limited range of analytical tools and its focus on a simplified platform.

- Pros

- Cons

- Intuitive interface

- Unique social trading feature

- Commission-free options trading

- The platform's simplicity may not fully satisfy experienced traders seeking advanced features

- eToro's options trading is exclusive to US clients

eOption - low-cost options trading feature

| Options trading platform features | Automated trading, advanced screener, news feeds, customizable interface, desktop and mobile apps |

| Demo account | Yes |

| Options trading fee | $0.1 per contract |

eOption trading platform offers traders a wealth of advanced features coupled with minimal commissions, starting at $0 for stocks and ETFs, and $0.1 per options trade.

With eOption desktop trading platform traders gain access to an array of tools, including news, charts, real-time quotes, research, watchlists, option chains, positions, and account information. The platform facilitates seamless order entry for single or multi-leg option trades, with a fully customizable screen layout.

eOption Mobile delivers real-time streaming quotes, market news, intuitive charting, and account management for stocks, ETFs, and options.

Notably, eOption provides the free OptionsPlay strategy tool, offering historical analysis of thousands of stocks for potential trade ideas and strategies, suitable for traders of all levels. The platform further features an integrated stock screener with customizable search criteria to match trading strategies, offering both pre-defined screens and user-created search options.

- Pros

- Cons

- Competitive pricing structure with low trading commissions

- OptionsPlay and Auto-Trading, catering to experienced traders

- eOption may have fewer analytical tools compared to some other platforms

Interactive Brokers - advanced platform for international clients

| Options trading platform features | Customizable interface, Write Options tool, Options Portfolio, Advanced analytics, over 200 supported countries and over 30 supported markets |

| Demo account | Yes |

| Options trading fee | $0.15-$0.65 per contract for US Options |

Interactive Brokers, with its presence in over 200 countries and access to markets in more than 30 countries, emerges as a versatile platform catering to traders of all categories. Its options trading platform offers a plethora of analytical functionalities, making it a comprehensive tool for traders seeking to navigate the complex world of options trading.

One notable feature is the IBKR Write Options tool, which starts with a holistic view and allows filtering by symbol down to individual underlying stocks. Traders can effortlessly analyze and adjust option-to-stock volume ratios by inputting expiration dates and strike criteria for their positions.

OptionTrader, encapsulated in a single screen, provides a comprehensive display of market data for the underlying asset. It enables the creation and management of options orders, including combination orders, offering a holistic view of available option chains.

Options Portfolio feature constantly scans market data to align the portfolio with user-defined objectives for Greek risk dimensions (Delta, Gamma, Theta, and Vega). This ensures that the portfolio adheres to traders' specific risk tolerance and objectives.

Interactive Brokers' options trading platform stands as a versatile and powerful solution for traders across the globe, offering an array of analytical tools and functionalities to navigate the complexities of options trading with confidence.

- Pros

- Cons

- Available in over 200 countries, offering access to markets in more than 30 countries

- Advanced analytical tools

- Comprehensive options order management and option chain views

- Might be challenging for beginners to grasp initially

- Complicated fee structure, costly non-US markets

Webull - best for zero fee options trading

| Options trading platform features | Zero fees, beginner friendly options trading app, OPRA data, multiple options trading strategies |

| Demo account | Yes |

| Options trading fee | $0 |

Similar to eToro, Webull stands out for its user-friendly app, making it a good choice for novice traders, and it offers commission-free options trading. However, Webull distinguishes itself with an array of analytical features, including a customizable option chain, multi-leg option quotes and multiple research tools.

Webull boasts a comprehensive selection of 11 option trading strategies, catering to a wide range of trading preferences. These strategies include single options, covered stock, straddle, butterfly, and iron condor, among others.

A significant advantage is Webull's provision of real-time OPRA data upon opening an option trading account. Moreover, the platform has forged a partnership with Cboe, ensuring access to the Cboe Global Indices Feed, enhancing the quality and depth of market data available to traders.

- Pros

- Cons

- Intuitive interface is suitable for both beginners and experienced traders

- Customizable option chain, multi-leg option quotes, and real-time charts

- Commission-free options trading

- Options trading app allowed only in the US

TD Ameritrade - advanced options trading features

| Options trading platform features | Customizable interface, Advanced charting tools, Options Statistics tool, Option Probabilities tool, Analyze Tab, desktop and mobile apps |

| Demo account | Yes |

| Options trading fee | $0.65 per contract |

TD Ameritrade's thinkorswim platform, available on both desktop and mobile, stands as a powerful tool tailored for experienced traders, offering a myriad of analytical functionalities and a high degree of customization to cater to diverse trading strategies. Geared towards seasoned traders, this platform is a treasure trove of features that facilitate comprehensive analysis and strategy refinement.

One standout feature is the Options Statistics tool, which empowers traders to fine-tune their options strategies. By examining the put-call ratio, traders can discern potential directions of underlying securities. Evaluating the IV% aids in determining buying or selling strategies, while the Sizzle Index identifies unusual option activity. The platform's Option Probabilities tool, seamlessly integrated into the option chain, enables traders to assess trade risk versus reward, enhancing decision-making.

Options Statistic Tool

Options Statistic Tool The Analyze Tab adds another layer of depth, allowing traders to visualize risk/reward graphs. These graphs offer insights into potential profit and loss based on "what if" scenarios, thereby fostering confidence in crafting options strategies.

Thinkorswim's emphasis on robust analytics and customization might be slightly overwhelming for beginners, yet it serves as a haven for adept traders seeking a comprehensive toolset.

- Pros

- Cons

- Wide array of advanced analytical features

- Advanced charting

- Highly customizable platform, allowing traders to tailor their interface to their strategies

- Comprehensive educational resources for traders at all levels

- The advanced features of thinkorswim might require time for beginners to fully grasp

Best Options Trading Analytical Tools And Alerts Services

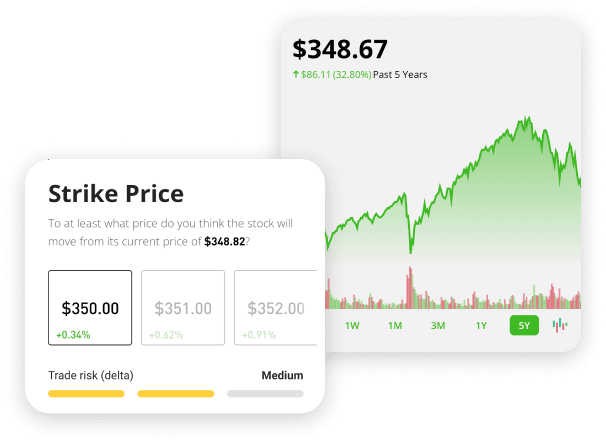

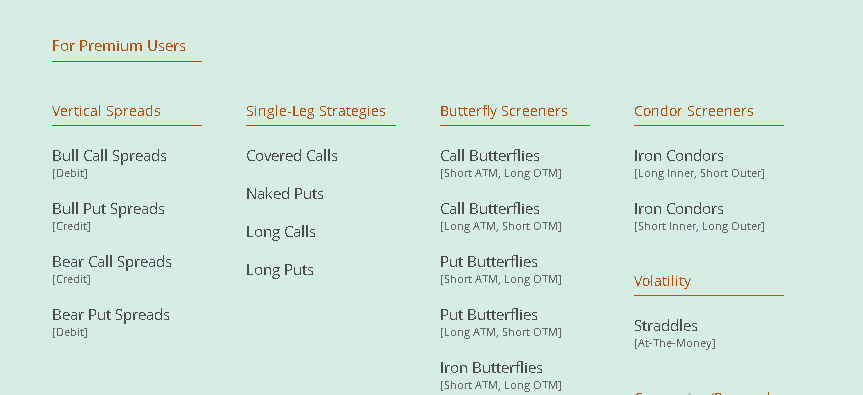

Market Chameleon - in-depth analytics with over 1M data points

| Options trading tools | Options alerts, options filters, options screeners, options reports |

| Free trial version | Yes |

| Premium account fee | $99 per month |

Market Chameleon is a valuable tool for traders seeking advanced filters and alerts to optimize their options trading strategies. This platform offers a range of highly useful filters, such as the Unusual Options Activity filter, which highlights equities with significant spikes in options volume. Another useful feature is the Option Implied Volatility Rankings filter, which gauges traders' expectations of future stock movements based on option implied volatility.

Market Chameleon extends to premium subscribers access to over two dozen screeners, each designed to amplify your market comprehension. These screeners encompass a diverse array of metrics and criteria, empowering you to delve deeper into market trends and identify potential opportunities.

Market Chameleon

Market ChameleonFor traders subscribing to the paid service, Market Chameleon provides in-depth analytical reports. These reports include insights on the largest implied volatility gainers and decliners for the current trading day, organized by underlying symbol and expiration. The Zero Days to Expiration (0 DTE) Options Straddle Tracker report assists in analyzing option straddles for symbols expiring on the day, by comparing current straddle data against historical option premiums with zero days to expiration. Overall, Market Chameleon equips traders with comprehensive tools to enhance their options trading decisions by offering advanced filters, real-time alerts, and insightful reports for more effective and informed trading strategies.

The platform features a complimentary trial version for users to explore. By becoming a Premium Member, you gain instant access to comprehensive Market Alert information. This membership enables you to view top trade concepts meticulously scanned from millions of data points, providing a granular perspective on market trends.

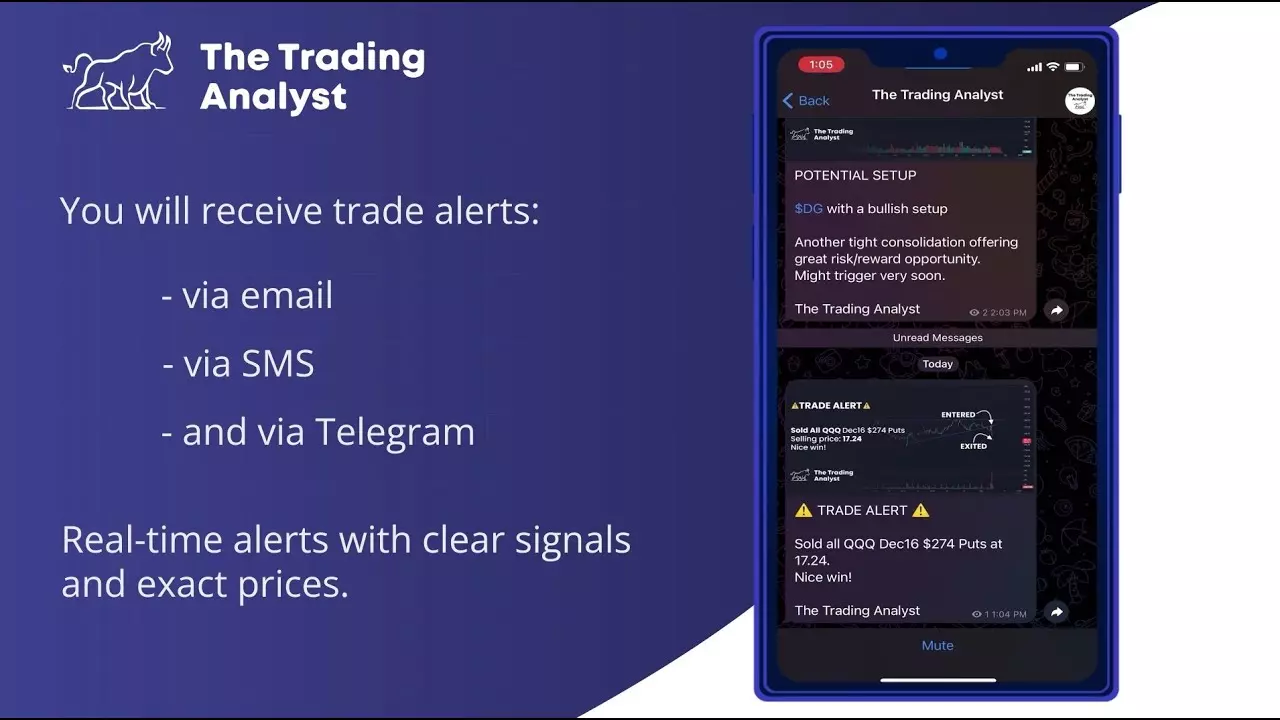

The Trading Analysts - real time SMS-alerts for swing traders

| Options trading tools | SMS-Alerts, Swing trading alerts, educational tools |

| Free trial | No |

| Cost | $147 per month |

The Trading Analyst offers a dynamic options alert service, delivering real-time trading alerts through SMS. The service's standout feature is its real-time SMS alerts, promptly notifying traders about new options positions (buy alerts) and exits (sell alerts), ensuring no opportunities are missed.

The Trading Analysts Youtube

The Trading Analysts YoutubeThe Trading Analyst adheres to a swing-trading strategy emphasizing consistent, long-term profits, targeting 10% - 25% gains per trade. This risk-conscious methodology has yielded impressive results since July 2018, with a win rate surpassing 53% through 331 wins and 289 losses. Notably, the service's net profitability stands out, underpinned by a profit factor of 1.67-attributed to a remarkable average win of $4,383.25 compared to an average loss of -$2,619.59. A comprehensive approach involving an array of data sets guides The Trading Analyst's decision-making, strictly adhering to a meticulous formula that safeguards against risk, ultimately contributing to their sustained profitability and reputation.

Subscribers, at $147 per month, receive 2-5 weekly trade alerts, making it suitable for busy professionals. Moreover, an annual subscription at $787 per year provides cost-effective access to insights, along with real-time portfolio tracking.

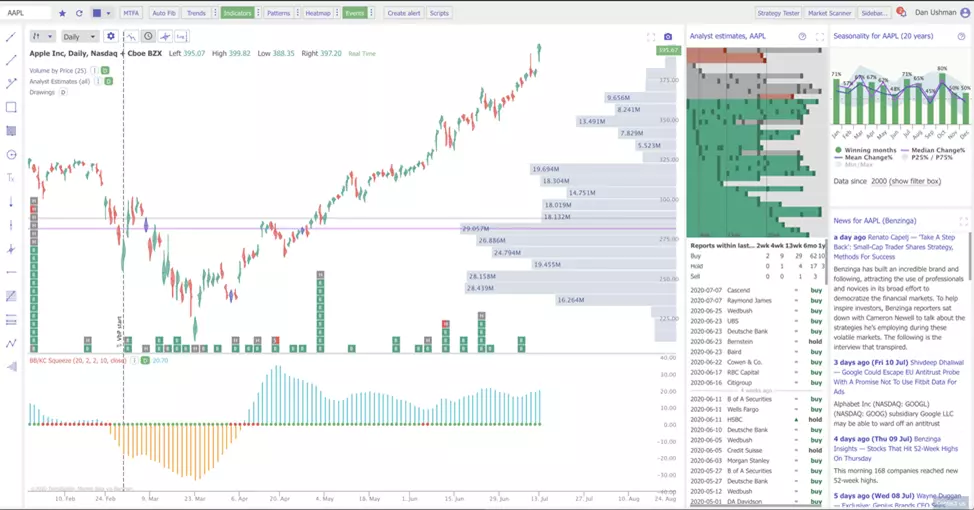

TrendSpider - advance chart patterns detection for options traders

| Options trading tools | Price alerts, Automated chart patterns detection, multi time frames analysis, educational database |

| Free trial | Yes |

| Price | $From $27.20 to $67.50 per month |

TrendSpider, a groundbreaking technical analysis platform, utilizes automation and patented algorithms to deliver data-driven insights. The platform’s interface is built around charts enhanced by filters and indicators. A distinguishing feature is the automation of pattern detection, eliminating the need for manual identification.

Trend Spider Charts

Trend Spider ChartsSimultaneous analysis of multiple charts, historical comparisons, diverse time frames, and instant predictions highlight the platform's potency. Notably, TrendSpider’s customization of alerts allows users to instantly respond to optimal trading opportunities. This feature, combined with mobile access, saves traders significant time.

Key features encompass Asset Insights, blending technical and fundamental analysis, Analyst Action Stacking's automatic recommendations, and the integration of news headlines. Automated short position volume data display, asset yield insights, dividends, and data on trading platforms further enhance the platform’s prowess.

Multiple time frame analysis (MTFA) aids traders in comprehensive assessments. By overlaying two time frames in one chart, the platform offers a holistic view. Scanning capabilities set TrendSpider apart, allowing criteria specification across three time frames. Alerts ensure optimal trade entry points are captured, and Strategy Tester facilitates strategy testing against historical data.

Educational resources are rich, with TrendSpider University offering comprehensive guides, videos, webinars, and technical documentation. The platform provides robust support via phone, email, LiveChat, and Discord.

TradingView - best for charting

| Options trading tools | Price alerts, extensive charting tools, trading from the chart |

| Free trial | Yes |

| Price | $12.95 - $49.95 |

TradingView offers a comprehensive and versatile platform for options trading, catering to both beginners and experienced traders. The platform's intuitive interface and customizable features make it suitable for users of all skill levels. TradingView provides real-time data, advanced charting tools, and technical indicators, enabling traders to conduct thorough technical analysis and identify potential entry and exit points. The ability to create custom watchlists, set alerts, and access a wide range of financial instruments adds to its functionality.

TradingView Charts

TradingView ChartsFurthermore, TradingView's social community aspect allows users to share insights and trading ideas, fostering collaborative learning. Its option analytics and risk management tools help traders assess and strategize their positions effectively. While TradingView offers robust charting capabilities and access to a vast array of markets, its options-specific tools are more limited compared to specialized options platforms. Despite this, the platform's versatility, user-friendly interface, and social interaction make it a valuable option for traders seeking a comprehensive trading experience that combines technical analysis, community engagement, and various trading opportunities.

- Pros of TradingView

- Cons of TradingView

- Offers a wide range of indicators and analytical tools for in-depth chart analysis

- Substantial amount of functionality for free

- Boasts a strong and active trading community where users can share insights and strategies

- Allows users to customize charts and layouts according to their preferences

- To trade directly from charts, users need to integrate their broker accounts, which might be cumbersome for some

- Not all brokers are supported for trading integration, which could limit the options available to some traders

What is options trading?

The trading industry is growing and several new methods and opportunities have surfaced over the past years. Options trading has been around for some time, but has seen increased interest in the last few years. This is a trading opportunity that has a lot in common with CFDs but still differs enough to fall into its own category.

An option is essentially a contract. The obligation to buy or sell an asset is eliminated when switching to options instead of some of the traditional trade options. Instead, the person initiating the options trade will gain the right to initiate a buy or sell at a specific position. These are financial contracts related to a specific asset - called the “underlying asset”.

When initiating an options trade, you do not own the asset that you are buying a contract for. Options work with estimations. You may estimate that a value will increase over a specific period of time - and then profit if your prediction was correct.

There are different types of option trading terms that you should understand. Many of these relate to the type of trades or positions that you initiate - and knowing them can help you avoid disappointing trades.

Call and Put

Call and PutCall and Put - When you want to initiate a trade, you can press “call” or “put”. Call options mean you think the value of the stock or commodity will increase within the specified timeframe. With a put option contract, you estimate that the value will fall instead. You can profit if your prediction was correct, but you will lose money if the value goes the other way.

Hedging

HedgingHedging - Another term sometimes used. By utilizing a hedging strategy, it is possible to minimize potential losses that may come from other open positions that you have on a platform. If you have stock in an open position and find that the value is falling, options can be used as a hedge to minimize the risks of losing a significant amount of money.

The Money

The MoneyThe Money - There are three terms used to describe the current position of your trade. These include in the money, out of the money, and at the money. In the money means the value of the stock has moved in the direction you predicted; thus leaving you with a positive balance. Out of the money means the opposite. If the term “at the money” is used, it means that the contract has ended at an equal value compared to the initiation.

- Is Option Trading Risky?

Yes, options trading has risks involved, just like CFDs and other trade methods that are offered on online platforms. Sufficient research and limited leverage can, however, be used to reduce your risks and eliminate the need to worry about losing large investments at once.

Pros and Cons of Trading Options

With options trading comes a series of benefits but, at the same time, also some negative factors that should not be overlooked. We will take a closer look at what the benefits and drawbacks are when talking about options trading. This should give you a better understanding of whether or not options trading might be for you.

- Pros of Options Trading

- Cons of Options Trading

- You are not required to buy actual assets or stock in the commodity you trade with. Instead, a financial contract is opened, which gives you an opportunity to estimate whether a specific asset value would increase or decrease over a period of time.

- There is a significant number of brokers and trading platforms that can be utilized for options trading. The popularity of options trading has caused numerous platforms to start offering this as an opportunity.

- Options trading can be used as a hedge. This limits your losses if other positions you hold open start to fall in terms of value.

- There are several demo trading accounts that can be used to help you get used to how option trading works.

- Some companies require a large initial investment if you want to perform options trading. This can be a drawback as many beginners want to start with just a small amount of money at first.

- Options trading can sometimes have more limited variations of assets that you can use when initiating a financial contract.

- Even though there are methods to reduce the risks, you can still lose a significant amount of money.

- While leverage can be used to boost your earnings, this also creates an opportunity to lose much more of your investment.

How to choose an options trading platform?

Choosing an options trading platform involves several steps to ensure the best fit for your trading needs:

Determine your trading experience level . If you're a beginner, prioritize platforms with user-friendly interfaces and educational resources.Advanced traders should seek platforms with intricate analytical tools and features to accommodate their sophisticated trading strategies. Both novice and experienced traders should also consider incorporating additional services that enhance their analytics and decision-making capabilities

Analyze analytical tools . Research platforms offering advanced analytical tools, such as alert services, automated signals, and screeners. These tools enhance your market analysis and decision-making

Consider cost . Compare commission structures and options trading fees across platforms to ensure they align with your budget. In general, commission-free options trading platforms are a favorable option for many traders. However, it's important to assess a combination of factors as low cost doesn't always equate to satisfactory quality, and some brokers might have hidden fees

Explore educational resources . Look for platforms that offer educational materials, tutorials, and support to help you understand options trading concepts and strategies better

Evaluate research capabilities . Check for comprehensive research tools like real-time quotes, option chains, and historical data. These tools are essential for making informed trading decisions

Test user experience . Try out options trading platforms with demo accounts if available. This lets you experience the platform's interface, features, and execution speed before committing real funds

By following these steps, you can confidently choose an options trading platform that suits your skill level, trading preferences, and financial goals.

How to start trading options?

Getting started with options trading is not a difficult process, as most online trading platforms now offer these types of trade opportunities. Your first step, however, should be to get yourself acquainted with how the process works. This is why setting up a demo account first is useful. The majority of options trading platforms will give you a chance to trade on a demo account. The account will not hold any real money, which means there’s nothing to lose.

Once you get the hang of options trading, you can make your first deposit and start trading with real money.

It is also useful to equip yourself with an arsenal of tools. Being able to investigate the latest news-related events and having graphs to analyze can be tremendously helpful when you are setting up a trading strategy.

How To Get Started Trading Options

How To Get Started Trading Options- How Much Money Do I Need To Begin?

There are a few companies out there that give you an opportunity to start trading with as little as $10 or even $5 sometimes. While this may be an attractive way to begin your journey, with options trading, these are generally considered too low. You need a larger initial investment if you wish to take full advantage of options trading and aim for a good amount of profit.

It is recommended to invest at least $5,000 when you get started with a real account. Some beginners prefer funding their account with as much as $10,000. This gives you more funds to invest and bigger profits when you complete a successful trade. It does, however, also mean you have more to lose.

Should I subscribe to options alerts and analytical tools?

Opting for options trading alerts and analytical tools can be beneficial for both beginners and professionals, but careful consideration is key. It's advisable to thoroughly research and evaluate the service before subscribing. Checking reviews from other traders and assessing the service's proven effectiveness is crucial. If the service offers a free demo version, taking advantage of it to test it out can help you determine whether it's a suitable choice for your individual needs.

What is the Best Options Trading Software for Beginners?

For beginners, excellent options trading platforms include eToro and Webull, as they offer user-friendly interfaces that are easy to navigate, making them ideal choices for newcomers. These platforms prioritize simplicity while providing essential trading tools. Additionally, subscribing to a swing trading alerts service like The Trading Analysts can be beneficial. This service delivers swing trading signals with clear risk management rules, helping beginners avoid overtrading and allocate their time efficiently during their initial stages of trading.

Summary

Options trading is complex, as it involves predicting price movements within specific timeframes while considering factors like volatility and various pricing variables. The intricate nature of options can be overwhelming for beginners and even experienced traders. Successful options trading requires a comprehensive understanding of market dynamics and a mastery of different trading strategies.

However, the difficulty of options trading can be mitigated by leveraging specialized tools and platforms. Options trading platforms provide intuitive interfaces for placing trades and monitoring positions. They also offer charting and technical analysis tools that assist in identifying trends and patterns. Additionally, options alert services notify traders of potential opportunities or changes in market conditions, enabling timely responses. Advanced analytics services provide insights into risk and reward, helping traders make well-informed decisions. By utilizing these tools, traders can navigate the complexities of options trading more effectively and increase their chances of success.

FAQs

Which is the best tool for option trading?

The best tool for option trading depends on your preferences and needs. Platforms like thinkorswim, eToro, and Interactive Brokers offer advanced options trading features, while TradingView provides powerful charting and analysis tools.

What is the best broker for day trading options?

Brokers like Interactive Brokers, thinkorswim by TD Ameritrade, and eOption are often considered top choices for day trading options due to their advanced platforms, low fees, and tailored features for active traders.

Can I trade options on TradingView?

While TradingView offers robust charting and analysis capabilities, it doesn't offer direct options trading. However, you can integrate your brokerage account with TradingView to execute trades based on your analysis.

Which strategy builder is best for options trading?

The strategy builder in thinkorswim is widely regarded as one of the best for options trading. It allows traders to create and analyze complex options strategies, making it a popular choice for those who utilize various options combinations.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Risk management in Forex involves strategies and techniques used by traders to minimize potential losses while trading currencies, such as setting stop-loss orders and position sizing, to protect their capital from adverse market movements.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.