Brokerage Fees Definition And Comparison

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Brokerage fees are charges traders pay to brokers for executing trades and providing services. Here's a comparison of key fee types:

Commission fees. Charged per trade or per lot.

Spread costs. Difference between buy and sell price.

Inactivity fees. Charged for dormant accounts.

Withdrawal fees. Cost to withdraw funds.

Platform fees. Charges for using trading software.

A broker acts as the middleman between buyers and sellers, helping both sides trade smoothly. But have you ever wondered how brokers make money? It’s pretty straightforward — every trader pays a fee to the broker to execute trades online.

This fee can be a flat rate or a percentage of the transaction, depending on the broker’s policy. Traders and investors use brokerage services to manage their investments and reach financial goals through trading.

Let’s break down brokerage fees, their types, and the best online brokers for trading.

What is a brokerage fee?

A brokerage fee is what a broker charges to help you trade and manage money. This includes costs like transaction fees, withdrawal fees, inactivity fees, research fees, and annual charges. Knowing how fees work is key to smart money management while trading.

Brokerage fees usually fall into two types: trading fees and non-trading fees. Trading fees apply when you place a trade and can include commissions, spreads, or currency conversion costs. Non-trading fees have nothing to do with your trades and may include charges for withdrawals, deposits, or account inactivity.

When picking a broker, always check their full fee list and compare it with others to make sure it suits your trading style. Clear fee rules help you avoid surprise costs, plan your trades wisely, and keep more of your profits.

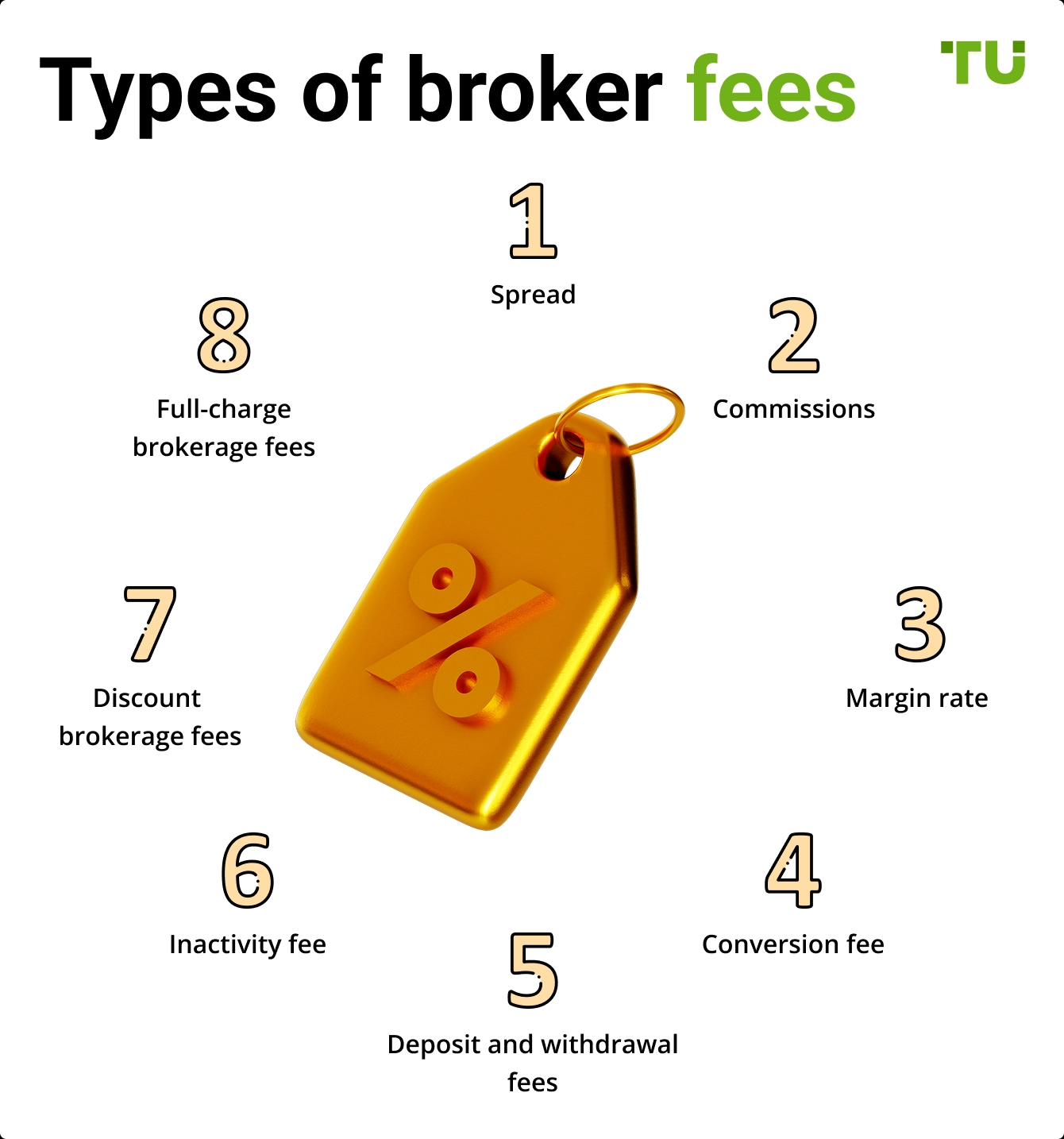

Main types of broker fees

Bear in mind; that it's not necessary if one broker charges a fee for a particular service, then all the others will do the same. There are different types of brokerage fees, and you need to understand each of them to manage your funds better and perform more educated trading. Here's a breakdown of broker fees that we have created for your convenience.

Commissions

Commissions are what brokers charge for each trade, either as a fixed fee or based on trade size. Fixed fees are predictable, but per-trade charges can add up fast with cheap stocks.

If you trade low-priced shares, commissions can eat into your profits. You should check fee structures and make sure they fit how you trade and the stocks you buy.

Spread

Spread means the gap between the bid price (sell) and the ask price (buy). Say a stock's buy price is $101 and the sell price is $100 — the $1 gap is the spread. A bigger spread means higher costs for traders.

Most stockbrokers offer raw spreads with no extra fees, making them more cost-effective. CFD brokers add hidden fees by widening spreads, increasing trading costs. In Forex, brokers make money by tweaking spreads, marking up the price difference in currency pairs.

Inactivity fee

Some brokers charge a fee if you don’t trade for a while, usually after 1-2 years of inactivity. It can cost $5-$20 a month after that time passes. To skip this fee, stay active or pick a broker that doesn’t have one. This matters most for long-term investors who rarely trade.

Deposit and withdrawal fees

Some brokers let you deposit and withdraw for free, while others charge differently depending on how you pay or set a minimum amount to deposit. Withdrawal fees vary based on the broker’s rules.

You should always compare brokers' deposit and withdrawal terms to find one that fits your needs. Low or no withdrawal fees help you keep more of your profits.

Margin rate

Margin trading means borrowing money from your broker to trade more than your actual investment. It lets you trade bigger, but brokers charge interest on what you borrow, usually between 1% and 5%.

Different brokers have different rates, and trading with borrowed money adds more risk. Always check margin costs and policies before using margin so you don’t end up in financial trouble.

Conversion fee

If you trade instruments in a currency different from your account's base currency, brokers may charge a conversion fee. This fee is typically a percentage of the traded amount and varies by broker.

For example, some brokers charge 1% of the transaction amount for currency conversion. It’s important to consider this cost, especially if you frequently trade international instruments.

Discount brokerage fees

Discount brokers offer limited services, such as basic trading platforms without expert advice, which keeps their fees low. Typical costs range from $0 to $0.01 per share, making them ideal for cost-conscious traders.

While affordable, discount brokers lack advanced tools and resources. They are best suited for experienced traders who don’t require extensive guidance or educational materials.

Full-charge brokerage fees

Full-service brokers offer many services, like advice, research, and learning tools. Because of these extras, they usually charge 1% to 2% of what they manage.

They’re best for investors who want personal guidance and full support. But their higher fees aren’t great for budget-conscious traders.

Example

For example, if you want to buy 1,000 shares of a certain company XYZ, with a 10 US dollar share price. Your brokerage will typically make 200 US dollars to allow you to perform that transaction.

Total amount = 10 dollar per share x 1,000 = 10,000

Commission = 10,000 x 0.02 = 200

So, the total cost that you’ll need to pay will be 10,200 US dollars.

Stock brokers fee comparison

If you're interested in stock trading, then the first step is to choose the right online brokerage that offers the best stock trading environment. Searching the whole market can be cumbersome and can cost you a whole lot of time and energy. That’s why we have compiled the following table that contains the best online stock brokerages along with their trading fee comparison.

| Account min. | Interest rate | Basic stock/ETF fee | Min. stock/ETF fee | Basic futures fee | Min. futures fee | Basic options fee | Min. options fee | Avg. EURUSD spread | Withdrawal fee | Inactivity fee | Deposit Fee | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| No | No | $3 per trade | $3 per trade | No | No | $3 plus $0,15 | $3 | No | $25 for wire transfers out | $50 | No | Open an account Via eOption's secure website. |

|

| No | 1 | Zero Fees | Zero Fees | No | No | No | No | No | No charge | No inactivity fees | No | Open an account Via Wealthsimple's secure website. |

|

| No | No | Zero Fees | Zero Fees | No | No | $0,50 | $0,50 | No | $25 | No | No | Study review | |

| No | 0,15-1 | Standard, Plus, Premium, and Metal Plans: 0.25% of the order amount. Ultra Plan: 0.12% of the order amount. | £1.00 in the UK, €1.00 in the Eurozone | No | No | No | No | ~1 pips | No charge up to a limit | Not specified | No | Study review | |

| No | 4,83 | 0-0,0035% | $1,00 | $0,25 | $0,25 | $0,65 | $1,00 | 0,1 | No | No | No | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Forex brokers fee comparison

Forex trading is one of the most popular trading types. Because of its nature and high volatility, it's critical to choose the brokerage that not only offers a great trading environment but also comes with an affordable and reasonable fee structure. The following tables contain the Forex fee structure of the best Forex brokers available in the market, and you can choose the one that fits your needs and financial goals the best.

| Min. deposit, $ | Standard EUR/USD spread | Standard GBP/USD spread | ECN Commission | ECN Spread EUR/USD | ECN Spread GBP/USD | XAU/USD spread, pips | XAU/USD commission, $ | Deposit fee, % | Withdrawal fee, % | Inactivity fee, $ | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 100 | 0,7 | 0,8 | No | No | No | 45 | 3 | No | No | 10 | Open an account Your capital is at risk. |

|

| No | 0,6 | 0,9 | 3 | 0,1 | 0,15 | 22 | 3,5 | No | No | No | Open an account Your capital is at risk.

|

|

| No | 0,3 | 0,3 | 3,5 | 0,15 | 0,2 | 30 | 3 | No | No | No | Open an account Your capital is at risk. |

|

| 100 | 1,0 | 1,2 | 5 | 0,2 | 0,4 | 35 | 2,5 | No | No | 15 | Study review | |

| No | 0,5 | 1,0 | 2 | 0,2 | 0,3 | 15 | 2 | No | Yes | No | Open an account Your capital is at risk. |

Hidden brokerage fees from spread manipulation, slippage, and order flow sales

Most traders focus only on commission fees, but the real hidden drain on your profits comes from spread manipulation and order execution tricks. Some brokers widen spreads when markets get volatile, making it more expensive to trade. Others use "asymmetric slippage", where your losses get worse price execution, but your wins don’t get better fills. To fight this, don’t just look at listed spreads — check execution quality reports. Some regulators require brokers to show how often traders get good or bad pricing. Picking a broker with better execution can save you more money than chasing slightly lower commissions.

Another sneaky way brokers profit is through "payment for order flow" (PFOF) — they sell your trade orders to market makers who might fill them at a worse price. Over time, this small difference adds up, costing you more than visible fees. To avoid this, check if your broker uses PFOF — many U.S. brokers do, but some in Europe and Australia don’t. If they do, use limit orders instead of market orders to avoid bad fills. Understanding these hidden brokerage tricks helps you keep more of your money while others lose it to fine print.

Conclusion

Understanding brokerage fees isn’t just about knowing the numbers — it’s about seeing how they shape your trading strategy. A broker’s fee structure can subtly push you toward certain trading habits, like making more trades to justify flat fees or holding positions longer to avoid commission costs. The real edge comes from picking a broker whose fee model aligns with how you trade, not just the lowest-cost option on paper. Smart traders don’t just compare fees — they factor in execution quality, hidden costs, and whether the broker’s pricing structure nudges them into decisions that don’t fit their strategy.

FAQs

Do you need to pay a fee on all brokerages?

Yes, almost all the legit and reliable online brokers, discount brokers, and full-service brokers charge fees. The charged fee is mostly the primary way of earning profit, and brokers also use it to maintain your account and grow their financial activities.

Is it possible to refund your broker’s fee?

You might be entitled to claim full broker fee refunds if your brokerage acted with dishonesty or incompetency. Moreover, you can also contact the local financial body of your area, such as the Department of Insurance, if you have any unresolved disputes regarding your non-funded brokerage fee.

What is the typical brokerage fee?

The brokerage fee varies from platform to platform. The standard commission that you’ll need to pay to a full-service brokerage is somewhere between one to two per cent of your managed assets. The per-trade flat fee of a discount broker usually ranges between 5 to 30 US dollars along with a 0.5 per cent maintenance fee.

How much money do you need to create a working brokerage account?

Depending upon your selected brokerage, you'll need to meet the minimum deposit policy then can be 1,000 to 2,000 US dollars. But some legit online brokers allow you to open an account with only 10 US dollars of minimum deposit. In the latter scenario, you might need to agree to the policy to deposit money regularly.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.