CeFi vs DeFi - A Comprehensive Comparison

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

CeFi and DeFi represent two financial worlds. CeFi offers control and regulation, while DeFi provides transparency and self-custody. The real challenge is not choosing sides, but understanding which risks you are willing to accept and how quickly trust can be lost.

The fight between CeFi and DeFi is not just about who holds the keys. It is about how people trust systems and how quickly that trust can disappear. CeFi works like traditional banking but on a blockchain. It gives you safety that feels familiar, while often hiding flaws behind closed doors. DeFi offers freedom, but also comes with hidden traps most beginners do not see. This is not just a tech shift. These are two fundamentally different ways of thinking, and the rules are changing as we watch. If you are making decisions based only on hype, you are missing the real story.

Risk warning: Cryptocurrency markets are highly volatile, with sharp price swings and regulatory uncertainties. Research indicates that 75-90% of traders face losses. Only invest discretionary funds and consult an experienced financial advisor.

Understanding CeFi and DeFi

The financial world is undergoing a major shift as two distinct models, Centralized Finance (CeFi) and Decentralized Finance (DeFi), compete to define the future of money. CeFi builds on the traditional system of financial intermediaries, while DeFi uses blockchain and smart contracts to eliminate the need for middlemen. Understanding the differences between the two is essential for anyone navigating today’s evolving financial landscape.

What is Centralized Finance (CeFi)?

CeFi refers to financial systems where intermediaries like banks, exchanges, and brokerages handle your money. Users deposit their funds with these institutions, and all transactions pass through centralized systems.

Key features of CeFi include

Trust in middlemen. Whether it is a bank or a crypto exchange like Coinbase, you rely on an organization to hold your assets and process transactions.

Regulation and oversight. CeFi is closely tied to financial regulations, including KYC (Know Your Customer) and AML (Anti-Money Laundering) rules.

Ease of use. These platforms usually offer user-friendly interfaces and better customer support.

Custodianship. The platform, not the user, holds the private keys to crypto assets in many CeFi setups.

Examples of CeFi platforms include Binance (CeFi services), Coinbase, Kraken, and BlockFi (before its closure). CeFi is familiar and regulated, but it reduces user control and may involve higher fees or risks from centralized mismanagement.

What is Decentralized Finance (DeFi)?

DeFi is built on public blockchains like Ethereum and allows users to access financial services without traditional middlemen. Everything operates through smart contracts, which are lines of code that execute automatically when certain conditions are met.

Key features of DeFi include

No intermediaries. You interact directly with protocols like Uniswap, Aave, or Compound without needing to go through a bank or broker.

You control your funds. With DeFi, users keep custody of their crypto using wallets like MetaMask or Ledger.

Open access. Anyone with internet and a wallet can use DeFi — no bank account required.

Transparency. All transactions are recorded on the blockchain, and the code behind most projects is open-source.

Examples of DeFi platforms include Uniswap, Aave, Compound, MakerDAO, and Curve Finance. DeFi offers more freedom and lower barriers to entry, but it also introduces risks such as smart contract bugs, price volatility, and the absence of formal customer support.

Key differences between CeFi and DeFi

While both centralized finance (CeFi) and decentralized finance (DeFi) aim to expand access to financial services, they rely on very different models. CeFi is built around trusted intermediaries, regulatory compliance, and platform-based control. DeFi removes the middleman, using smart contracts and blockchain to give users direct control over their assets. The table below highlights how these two approaches compare across core features.

| Feature | CeFi | DeFi |

|---|---|---|

| Custody | Platform holds funds | User holds private keys and funds |

| Regulation | Regulated and licensed, follows KYC/AML | Largely unregulated and permissionless |

| Accessibility | Requires registration and identity verification | Open to anyone with a crypto wallet |

| Transparency | Limited visibility into operations | Transactions are publicly recorded on the blockchain |

| Speed | Slower due to internal processing | Faster, with near-instant on-chain settlement |

| Support | Customer service is typically available | No direct support; users must troubleshoot themselves |

| Main risk | Platform failure, custodial mismanagement | Smart contract bugs, rug pulls, user error |

Case studies: Lessons from CeFi failures

FTX collapse

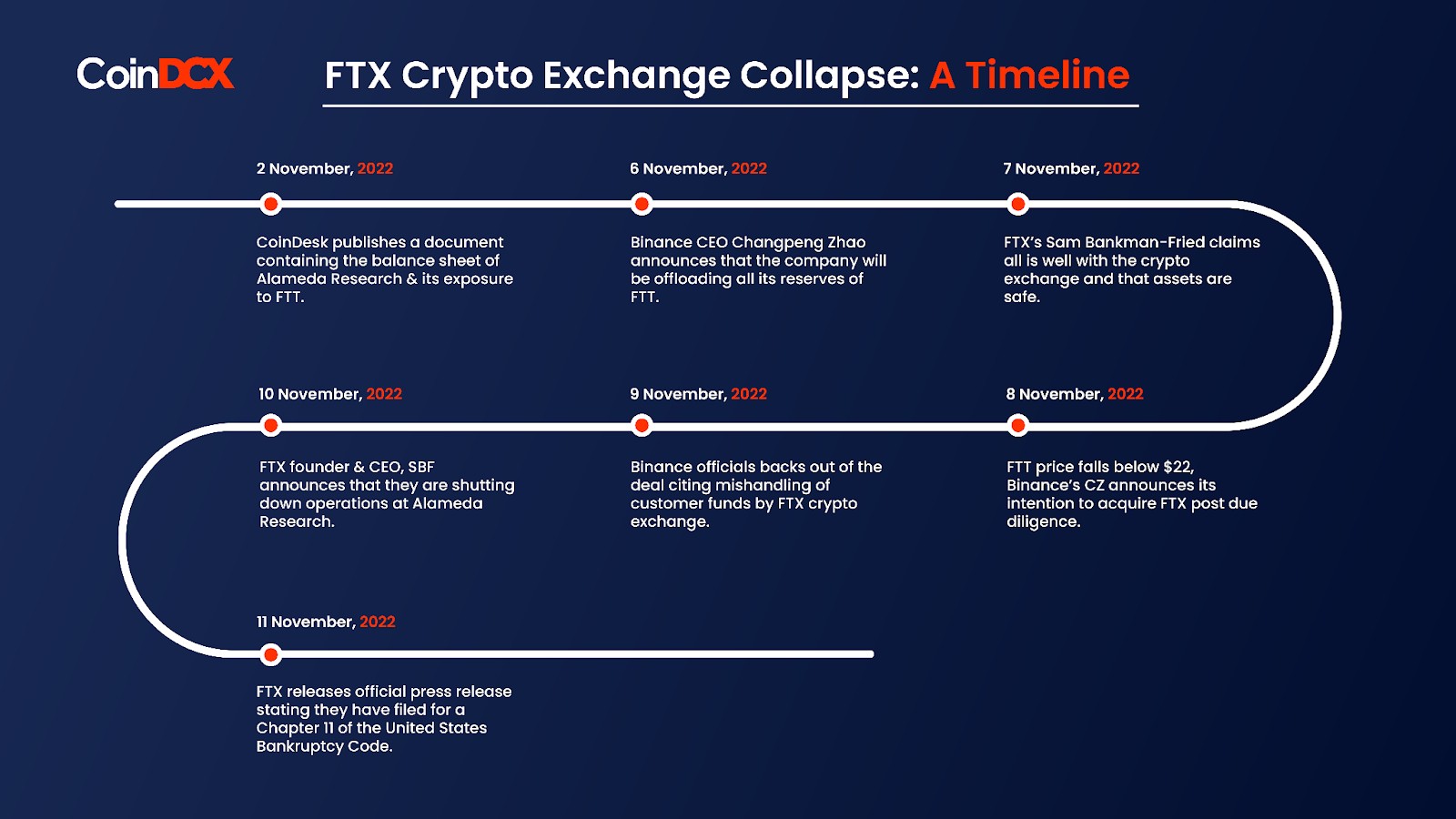

The downfall of FTX in November 2022 stands as one of the most significant failures in the cryptocurrency industry, highlighting the vulnerabilities inherent in centralized financial systems. Understanding the factors that led to FTX's collapse provides valuable insights into the risks associated with centralized finance (CeFi).

What happened

FTX, once the third-largest cryptocurrency exchange by volume, experienced a rapid collapse due to a combination of factors.

Interconnected finances. A report revealed that Alameda Research, a trading firm affiliated with FTX, held a significant amount of FTX's native token, FTT. This raised concerns about the financial stability of both entities.

Liquidity crisis. Following the report, Binance announced it would sell its FTT holdings, leading to a sharp decline in FTT's value and a surge in customer withdrawals from FTX.

Bankruptcy filing. Unable to meet withdrawal demands, FTX filed for Chapter 11 bankruptcy on November 11, 2022, with over 130 affiliated companies affected.

Legal consequences. Founder Sam Bankman-Fried was arrested and later convicted of fraud for misusing customer funds, resulting in a 25-year prison sentence.

Key lessons from the FTX collapse

Lack of transparency. FTX's non-transparent financial practices and undisclosed affiliations contributed to its downfall. Transparency is crucial in maintaining trust in financial institutions.

Risks of centralized control. The concentration of control within FTX allowed for the misuse of customer funds without adequate oversight.

Importance of regulatory oversight. The absence of stringent regulatory frameworks enabled FTX to operate with significant autonomy, underscoring the need for effective regulation in the crypto industry.

Impact on the broader market. FTX's collapse led to a significant decline in cryptocurrency prices and eroded investor confidence, demonstrating how the failure of a major CeFi platform can have widespread repercussions.

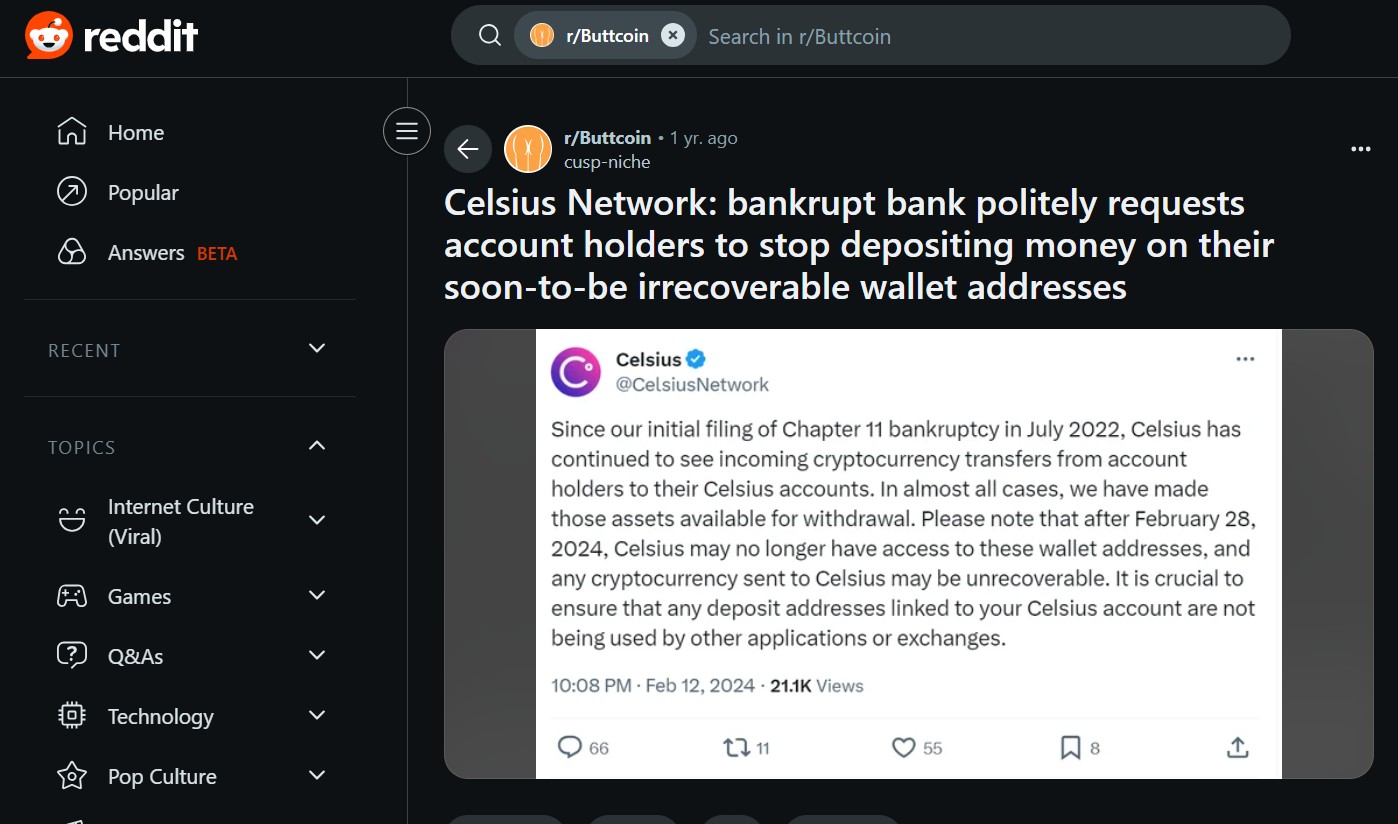

Celsius Network's bankruptcy

Celsius Network was once one of the most popular platforms in the crypto lending space, promising high returns on digital assets. But in mid-2022, it suddenly froze customer withdrawals and filed for bankruptcy soon after. Its collapse exposed the core risks of centralized finance and highlighted just how fast trust can disappear when transparency is lacking.

What happened

Celsius offered users up to 17 percent returns on crypto deposits, attracting more than 1.7 million users and managing around $25 billion in assets at its peak. But things changed fast.

In June 2022, Celsius paused withdrawals, citing extreme market conditions.

By July 2022, the company filed for Chapter 11 bankruptcy, with a $1.2 billion hole in its balance sheet.

More than $4.7 billion in user funds were stuck or lost in the process.

CEO Alex Mashinsky later resigned after criticism of mismanagement, misleading communication, and alleged risky trading activity.

Key lessons from the Celsius collapse

No transparency, no trust. Celsius gave users little insight into how funds were used, which led to shock when the platform failed.

Too much power at the top. The firm’s leadership had near-total control over operations and risk management, with no checks from users or independent oversight.

No guardrails without regulation. Operating outside clear legal frameworks gave Celsius flexibility — but it also meant there were no safeguards when things went wrong.

One failure can shake the whole system. Celsius didn’t fall alone. Its collapse triggered a chain reaction, affecting prices, confidence, and other platforms across the crypto market.

The future of finance - CeFi, DeFi, or a hybrid approach?

The financial landscape is rapidly evolving, with Centralized Finance (CeFi) and Decentralized Finance (DeFi) each offering distinct advantages and challenges. As the industry matures, a hybrid approach that blends the strengths of both models is emerging as a viable path forward.

Recent developments suggest increasing convergence between CeFi and DeFi. Decentralized exchanges such as Uniswap and Aave have grown in popularity by allowing users to control their assets without intermediaries. The adoption of stablecoins like DAI (now USDS) has introduced price stability to DeFi, helping facilitate broader use. Meanwhile, regulatory engagement is advancing. Institutions such as the Cambridge Centre for Alternative Finance are working with regulators to explore how DeFi technologies can integrate with traditional financial systems.

The hybrid model combines CeFi’s usability with DeFi’s transparency and autonomy. CeFi platforms offer accessible interfaces and customer support, while DeFi gives users direct control over their assets through blockchain transparency. Traditional financial institutions are beginning to collaborate with DeFi projects to offer tokenized assets and decentralized lending solutions.

Key considerations for investors and the broader ecosystem include:

Diversification: portfolios that combine traditional and decentralized assets may offer broader exposure and resilience.

Risk management: understanding both the regulatory environment and technical risks in DeFi is critical for informed decisions.

Market evolution: the integration of CeFi and DeFi could produce a more inclusive, innovative, and robust financial system for global users.

Potential for integration and collaboration

The potential for integration between CeFi and DeFi lies in their complementary strengths. CeFi platforms are designed for ease of use, offering features such as customer support and familiar interfaces that appeal to a broad user base. DeFi, on the other hand, enables direct control over assets and operates with greater transparency by recording all transactions on public blockchains.

This hybrid approach is already taking shape. Traditional financial institutions are beginning to collaborate with DeFi protocols to offer new products, including tokenized assets and decentralized lending. These partnerships signal a shift toward more flexible, adaptive financial systems.

For investors and the financial ecosystem at large, this evolution brings a range of opportunities and challenges:

Diversification: a mix of centralized and decentralized assets may improve portfolio resilience and market exposure.

Risk management: investors must understand both regulatory factors and the technical risks unique to DeFi, such as smart contract vulnerabilities.

Market evolution: a blended system could support broader financial inclusion and enable the delivery of next-generation financial services on a global scale.

Risk management in CeFi and DeFi

Both CeFi and DeFi platforms face significant security challenges, but they approach those risks in fundamentally different ways. From system hacks to regulatory blind spots, understanding how each model handles vulnerabilities can help users make more informed decisions about where and how they store their assets.

CeFi platforms like Binance and Coinbase implement a range of security measures. These include cold storage for crypto assets, multi-factor authentication, and regular security audits. Many also carry insurance policies to cover potential breaches. However, because these platforms centralize user funds, they are high-value targets for attackers. In 2024 alone, CeFi hacks led to more than $690 million in losses. Weak internal controls, employee access, and vulnerable APIs remain common entry points for security breaches.

DeFi operates differently. Applications are powered by smart contracts, which move funds automatically based on prewritten code. This eliminates human intermediaries but introduces a different type of risk. A single flaw in the code can be exploited, leading to significant losses. In 2022, DeFi platforms lost more than $1.3 billion to exploits. By 2024, that number dropped sharply as platforms began investing in stronger audits and formal verification processes. Flash loan attacks and logic bugs still exist, but the time to identify and patch them has improved.

CeFi is vulnerable to human error and centralized mismanagement.

DeFi is vulnerable to software bugs and smart contract failures, though security practices are improving rapidly.

Regulatory oversight and legal protections

Regulation plays a major role in shaping the user experience on CeFi and DeFi platforms. The level of legal protection and recourse available varies widely between the two models, and users need to understand what support, if any, is in place when something goes wrong.

CeFi platforms are typically required to comply with government regulations. These include Know Your Customer (KYC) identity checks and anti-money laundering (AML) policies. In the event of a dispute or loss, users may have legal options or insurance coverage, depending on the platform. However, not all CeFi platforms consistently meet regulatory expectations. Binance, for instance, has come under scrutiny in multiple countries over the past year for compliance issues.

DeFi, in contrast, operates largely outside formal legal systems. Most DeFi platforms are not registered or licensed. They do not offer customer service, chargeback mechanisms, or legal remedies for lost funds. If something fails, the user is typically on their own. That said, some jurisdictions are beginning to explore regulatory frameworks for DeFi through controlled environments such as "DeFi sandboxes" to balance innovation with oversight.

CeFi offers stronger legal protections but depends on trusting the platform to follow the rules.

DeFi offers greater autonomy but places full responsibility on the user, especially those unfamiliar with technical risks.

Why your first step into DeFi should not be a trade

What new users usually get wrong about DeFi is thinking it is just another trading app. But DeFi is not really about swapping tokens - it is about how the system itself reacts when things get messy. Before you touch a trade, spend time watching the protocol. What happens when prices move fast? Do fees go crazy? Does liquidity dry up? Using DeFi without understanding how it behaves is like using a fast car without knowing if it can stop.

CeFi feels safer, but not because it is. The real danger is not just about handing over control - it is about losing sight. These platforms can fall apart not just from hacks, but from choices made behind the curtain. If you see a platform offering high returns, ask why. Is it using your funds for risk you never agreed to? What happens if things go bad? Most people ask these questions too late. In DeFi, you can see the code but not always read it. In CeFi, you feel safe - until it breaks.

Conclusion

What really matters in CeFi versus DeFi is not which one wins. It is about what kind of risk you are okay with. CeFi asks you to trust the team behind the curtain. DeFi asks you to trust the programming behind the scenes. Both can fail. One keeps you in the dark. The other makes you work to understand it. If you want to make smart moves in this space, stop choosing camps and start looking deeper. The worst mistake is feeling confident when you should be asking more questions.

FAQs

Can CeFi and DeFi coexist in the financial system?

Yes, CeFi and DeFi can coexist by serving different user needs. CeFi offers regulatory protection and customer service, while DeFi provides open access, transparency, and automation through smart contracts.

Which is safer, CeFi or DeFi?

CeFi is generally safer for average users due to regulation and centralized control, but it carries custodial and trust risks. DeFi offers more control and transparency but is vulnerable to smart contract bugs and exploits.

What is the difference between CeFi and TradFi?

CeFi (Centralized Finance) operates within crypto but relies on centralized platforms, while TradFi (Traditional Finance) includes banks and legacy institutions with strict regulatory oversight. CeFi bridges the gap between crypto and mainstream finance.

What is the difference between DeFi and DAO?

DeFi refers to decentralized financial services like lending, trading, or staking run by smart contracts. A DAO (Decentralized Autonomous Organization) is a governance structure that manages decisions in DeFi and other blockchain projects.

Related Articles

Team that worked on the article

Anton Kharitonov is an active trader and analyst. He employs both short- and long-term trading strategies, primarily based on fundamental factors, supported by technical indicators and intermarket analysis. Anton trades major and minor currency pairs, while his primary focus is on oil futures and index CFDs.

As a financial expert and analyst at Traders Union since 2013, Anton performs thorough internal broker evaluations, referred to as “test drives.” He examines website and account interfaces, client support, software stability, deposit and withdrawal processing speed, legal documentation, and additional broker services such as VPS, affiliate programs, contests, bonuses, and training programs.

New knowledge is the key to expanding our horizons and unlocking new opportunities. Every step in learning, every new understanding empowers us become better, smarter, and stronger. Knowledge provides an advantage, enabling informed decisions, confident actions, and forward momentum. In a changing world, only those who embrace learning and adaptation can truly thrive.

Based on these evaluations, Anton prepares expert reports on the operation of Forex, stock, binary options, and cryptocurrency exchanges.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.