What is Day Trading & How to Get Started

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

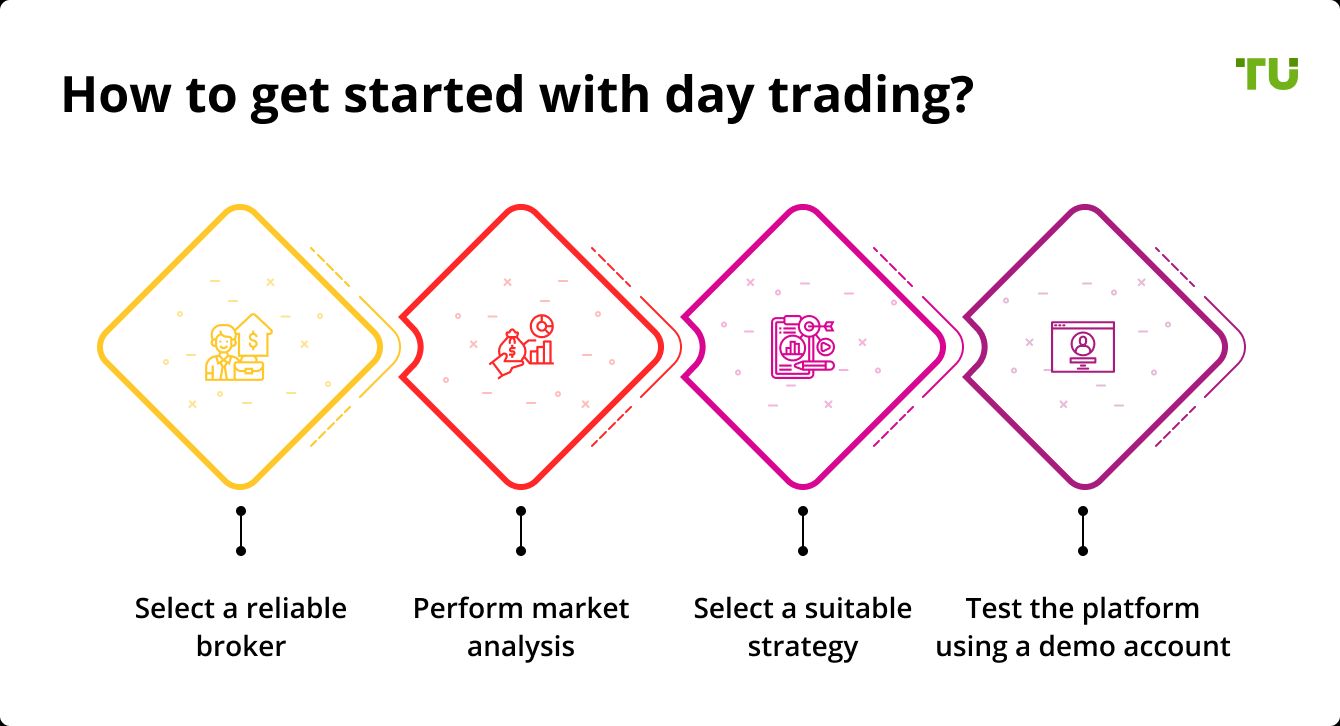

Day trading is a short-term trading style where positions are opened and closed within the same day to profit from small market moves. To start day trading, choose a regulated broker, learn technical analysis, practice with a demo account, and apply a disciplined strategy with strong risk management.

Day trading has seen a surge in popularity thanks to zero-commission platforms and the rise of retail trading communities. Whether you're looking to trade Forex, stocks, or crypto, getting started requires more than just enthusiasm - it takes discipline, a tested strategy, and risk control. In this expert guide, you’ll find a clear roadmap to day trading: from selecting the right market to using professional tools and proven strategies. Let’s break down how to begin and thrive as a day trader in today’s fast-moving markets.

What is day trading?

A day trader buys and sells stocks for a small profit throughout the trading day. It is a speculative trading style where traders open and close a position within the same day. For example, you can open a new position at 10 a.m. and close it by 2 p.m. on the same day. You can’t call it a day trade if you close a position the following day. Many traders use the “10 AM rule,” which states that movements in the U.S. stock market between 9:30 a.m. and 10 a.m. are a strong indication of how prices will move for the rest of the day, which means that trades should not be made before 10 a.m.

It is a day trading practice because you buy and sell stocks in a short timeframe, typically a day. The goal is to end every transaction with a net profit after commission. You must buy and sell stocks based on current events.

Day traders will trade during the opening hour and close 30 minutes of each market session. It is the period when price volatility is at its highest. For example, they will open trade between 9:30 and 10:30 a.m. Eastern and closes 30 minutes before four p.m Eastern.

- Pros

- Cons

- Day trading can be luxurious when done correctly.

- Making day trading your full-time job gives you control over your investment and profits. You can set your hours and govern your actions.

- You can use multiple-day trading strategies to earn profits. It promises flexibility that is difficult to find in other investments.

- The steady rise of online brokers and investing apps makes it easy for anyone with a Smartphone to engage in day trading.

- Day trading helps you avoid overnight risks. You don’t have to hold a position overnight and experience unexpected movies.

- Day trading is extremely risky for anyone. You can’t easily predict which direction the stocks will move throughout the day. Traders can easily lose their investments.

- Day trading is also expensive. You must have at least $25000 in the brokerage account before day trading. If the balance falls below this amount, you must deposit more cash into the account before continuing to trade.

- Day trading can also have costly commissions and transfer fees. They can eat into your earnings unless you have high profits to cover the costs.

- The practice requires split-second timing. It doesn’t suit people who are not in deciding and commitment.

- It is an emotional practice compared to other trading types. You must control your emotions to succeed.

How does it work

Day traders depend on stock and market fluctuation to earn profits. It is a volatile industry with price fluctuations. As a day trader, attune to events that cause short-term market movements. The ideal situation is to buy low and sell high while completing many sales on the same day.

You must capitalize on short-term price movement in stock by actively buying and selling shares. If the stocks might go higher, you buy and then sell them once the value goes up. However, you’ll lose money if the stock value drops and you sell them.

Day trading requires high liquid stocks that allow moving in and out of position without affecting the stock price. A day trader can buy a stock if it’s moving higher or sell it if it is moving lower. The focus is to profit on stocks fall. You can decide to short-sell a stock if you believe that it will take a nosedive that day.

A day trader will use technical analysis and trading strategy to make a profit in a short time. Experienced traders often use margin to increase their buying power. Therefore, it is possible to trade the same stock many times a day.

Best brokers for day trading on Forex

Day trading success starts with the right broker. Whether you trade stocks, Forex, or cryptocurrencies, your broker must offer fast execution, low fees, and a stable trading platform. Each market has its own requirements — stock brokers often enforce higher capital thresholds, while Forex and crypto brokers allow smaller accounts with higher leverage. A good day trading broker should provide real-time data, tight spreads, and risk management tools. Below, we break down the key features of brokers across different markets to help you choose the one that fits your trading style.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Currency pairs |

60 | 90 | 68 | 80 | 100 |

|

Crypto |

Yes | Yes | Yes | Yes | Yes |

|

Stocks |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Day trading |

Yes | Yes | Yes | Yes | Yes |

|

TU overall score |

6.83 | 7.17 | 6.8 | 6.95 | 6.9 |

|

Open an account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

How to day trade: Top 5 strategies

Day trading entails are executing intraday strategies based on price changes. You can use a variety of strategies and techniques to capitalize on the market inefficiencies.

1. Scalping

Scalping is a technique where you buy and sell an individual’s talk multiple times in the same day. Engage in helping to ensure you make a small profit over many short trades. It is a more manageable and easier technique to execute under pressure.

You should read and interpret the short-term stock charts, then decide based on these charts. The success of this strategy lies in spotting trends, anticipating upticks and downswings, and understanding the psychology behind the market.

2. News trading

This strategy involves trading based on market expectations. You need a certain skilled mindset to trade or news announcements because the news can travel quickly. For example, you must assess the news immediately and quickly judge how to trade it.

News trading is common in day trading. This technique entails knowing differences in market expectations and making a wise decision.

3. Range trading

Range trading is a strategy in day trading that entails understanding the history of security. When using this strategy, you start by looking at the price and volume of chatting. Identify the typical highs and lows during the day and the differences between the two prices. This information can help you buy low and sell high depending on the prices.

The order to sell goes in when prices rise when the order to buy goes in and tries faults. Experienced traders use stop and limit strategies to keep their trading in line. These strategies help limit your loss if the security drops below your entry point. You use range trading in a normal market with enough volatility.

4. Swing trading

Swing trading entails buying a security when you suspect that the market will rise. You also sell when you suspect the price will fall. The market requires trading both sides of the financial market movement. Swing Traders take advantage of the market oscillations as they monitor the back-and-forth price swings.

It is a technical approach to analyzing markets. You must study charts and evaluate the individual movements to comprise the big picture. Successful swing trading depends on interpreting the length of each swing as it defines the momentum. Identify if the momentum is increasing or decreasing within each swing while monitoring the trade.

5. Trend trading

Trend trading entails using technical analysis to define a trend. You only enter a trade based on the direction of a predetermined trend. You need to have a flexible view of where the market should go when defining a trend. The strategy entails using equities, currencies, and commodities to analyze specific markets.

You need an accurate system to determine the trend and the discipline to follow them. You must stay alert and adaptable as the trains can change quickly. However, trendsetters must know the risk of market reversals. The strategy suits people with limited time and offers many opportunities to enter and exit a trade.

Day trading is about maintaining focus and discipline at all times. Start with a market, stick with it, and build you a skill. When selecting a trading strategy, choose based on your risk tolerance, available capital, and level of discipline.

Key tips for successful day trading

Manage risk first. Risk control is essential. Always define your risk-to-reward ratio before entering a trade. Use stop-losses and never risk more than you can afford to lose. Start with a demo account to practice safely.

Master your emotions. Emotional discipline is non-negotiable. Stick to your strategy and avoid impulsive decisions. Stress and fear often lead to poor trades — logic should always guide your actions.

Time your trades wisely. Focus on periods of high liquidity, such as market open and close. Know your entry and exit points in advance. Beginners should watch and learn market behavior before trading live.

Take strategic breaks. Don’t overtrade. Step away when the market gets too volatile or when you feel overwhelmed. Concentrate on a few instruments and smaller positions to stay focused.

How much money do you need to start day trading?

Your starting capital depends on the market and your trading goals. Full-time traders need more funds than those trading part-time. Ask yourself: how much can you invest, and what daily profit do you expect?

For U.S. stocks, FINRA rules require at least $25,000 to qualify as a Pattern Day Trader. In contrast, Forex and crypto markets allow you to start with as little as $500.

Short beginner’s guide:

1. Choose a reliable broker

Your broker must offer fast order execution, low commissions, and a user-friendly platform. Pick one that fits your trading style and ensures minimal delays.

2. Learn to analyze the market

Strong knowledge of technical analysis is key. Day trading requires quick, data-driven decisions — without solid training, losses are likely.

3. Use a clear strategy

Start with one tested strategy. Master it, follow it precisely, and avoid jumping between methods. Consistency beats complexity.

4. Practice with a demo account

Before trading real money, use a demo account. It helps you refine your strategy and build confidence — without financial risk.

What I’ve learned after years of day trading

I’ve spent over a decade trading full-time, and one lesson stands out: most beginners fail not because they lack strategy, but because they chase every market at once. When I first started, I tried juggling Forex, stocks, and crypto in a single day. It didn’t work. My results only stabilized when I committed to learning the structure and behavior of one market — in my case, Forex.

Day trading is not about reacting; it’s about anticipating. And anticipation only comes from deep familiarity. I always advise beginners to pick one market and commit to it for 6–12 months. Get used to how it reacts to news, how liquidity flows during sessions, how spreads behave during volatility. That’s where consistency starts.

If you’re torn between Forex, stocks, or crypto — don’t ask which one is “best.” Ask which one fits your daily schedule, capital size, and emotional tolerance. For example, I prefer Forex because of the predictable session cycles and leverage options, but someone with a 9-to-5 job might benefit more from the 24/7 nature of crypto.

Focus, routine, and risk discipline — that’s the real edge in day trading. Everything else is just noise.

Conclusion

A day trader will enter and exit trades multiple times, depending on the stock price. They focus on capturing profit from short-term price movements in assets such as bonds, stocks, and exchange-traded funds. Closing positions during the day helps avoid the risk of holding market positions open overnight.

Day trading is profitable when properly. However, novices who lack a brilliant strategist can struggle. If you are interested in this business, you must gain valuable skills and knowledge. For example, you must learn how to minimize risk and maximize profits.

While you can’t learn everything about day trading in a day, this article can help you learn about day trading to make profits. You need a long learning commitment to succeed in this industry. It is because new strategies emerge every time, helping Traders to increase their profits.

FAQs

Is day trading worth it?

It is much more difficult to succeed in day trading in today’s market. The hedge funds run sophisticated algorithms that increase the difficulty. Day traders are severely undercapitalized. They have to pay for expensive chartroom memberships, educational courses, and newsletter subscriptions. However, with experience in day trading, you can make good profit.

Is day trading illegal?

Day trading is allowed in the United States. However, you must have at least a $25,000 minimum account balance to become a Pattern Day Trader. Every trader must strive to get approval as a Pattern Day Trader. Once classified as a PDT, you get access to a 4:1 margin intraday.

What are the risks of day trading?

Since you have to buy and sell using borrowed capital, it is inherently risky. Like poker, you can lose vast amounts of money. Each day traders must take undisciplined risks to earn profit.

Can you day trade on multiple platforms?

It is possible to trade on multiple platforms.Most day traders have multiple brokerage accounts and use several trading platforms simultaneously.

Can you start day trading with $500?

While you can trade with $500 a day, your account can become restricted over a short time. For instance, you can only place four-day trades over five days before your account becomes restricted. Pattern Day Trader needs at least 25,000 dollars margin approval. Therefore, you can only trade with $500 in the Forex market. In the stock, you need to meet the paid $25000 minimum equity requirement.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Trend trading is a trading strategy where traders aim to profit from the directional movements of an asset's price over an extended period.