Guide To Forex Sentiment Analysis: How To Read Market Mood

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Forex sentiment analysis measures the overall mood of market participants by looking at data from institutional positioning, retail traders, options markets, news, social media, and order book analytics. It shows whether traders are generally optimistic or pessimistic. This information helps identify trend changes, confirm trade setups, and find contrarian opportunities. It works alongside technical and fundamental analysis by providing early warnings of reversals or trend continuations and improving risk management.

In my experience, sentiment analysis is one of the most powerful and overlooked tools for traders. By measuring the collective mood of market participants, it helps identify trend shifts, confirm setups, and spot contrarian opportunities. Sentiment analysis offers deep insights into market psychology that go beyond traditional technical and fundamental analysis. In this article, we explore how it works, its benefits, and the tools used to measure it.

Sentiment analysis in Forex

Market sentiment reflects the overall mindset of the market, including the emotional and behavioral factors that drive buying and selling. Sentiment analysis seeks to measure this psychology by examining data on positioning, news flow, social discussions, and options activity. This analysis helps indicate whether traders generally feel positive or negative about a particular currency pair. While it cannot predict price direction by itself, it highlights extremes, such as overbought, oversold, or conditions that are ripe for a reversal. Often, these signals appear before they show up on charts or in economic reports.

Unlike stocks, where company news shapes investor mood, Forex sentiment is driven by broader economic factors, such as central bank statements, political developments, and global risk appetite. Since currencies are interconnected, strong positive or negative feelings toward one currency can affect many others. By looking at these overriding market feelings, sentiment analysis improves on traditional fundamental and technical methods. Incorporating sentiment analysis helps identify when a trend may be ending or continuing; insights that purely numerical models might miss.

Best sentiment analysis tools and data sources for traders

Forex sentiment comes from five key data sources, each showing how different groups of traders feel about a currency pair.

Institutional positioning (COT report)

The Commitment of Traders (COT) report, published weekly by the CFTC, shows the futures market positions of large speculators, commercial hedgers, and small traders. Large speculators often follow trends. Their significant long or short positions confirm market momentum. In contrast, commercial hedgers usually act as contrarian indicators. They signal possible reversals when their positions are opposite to those of speculators. Small speculators provide further sentiment clues but are less reliable. Tracking these changes helps traders understand market psychology and assist in spotting trend continuations or reversals.

Retail trader data

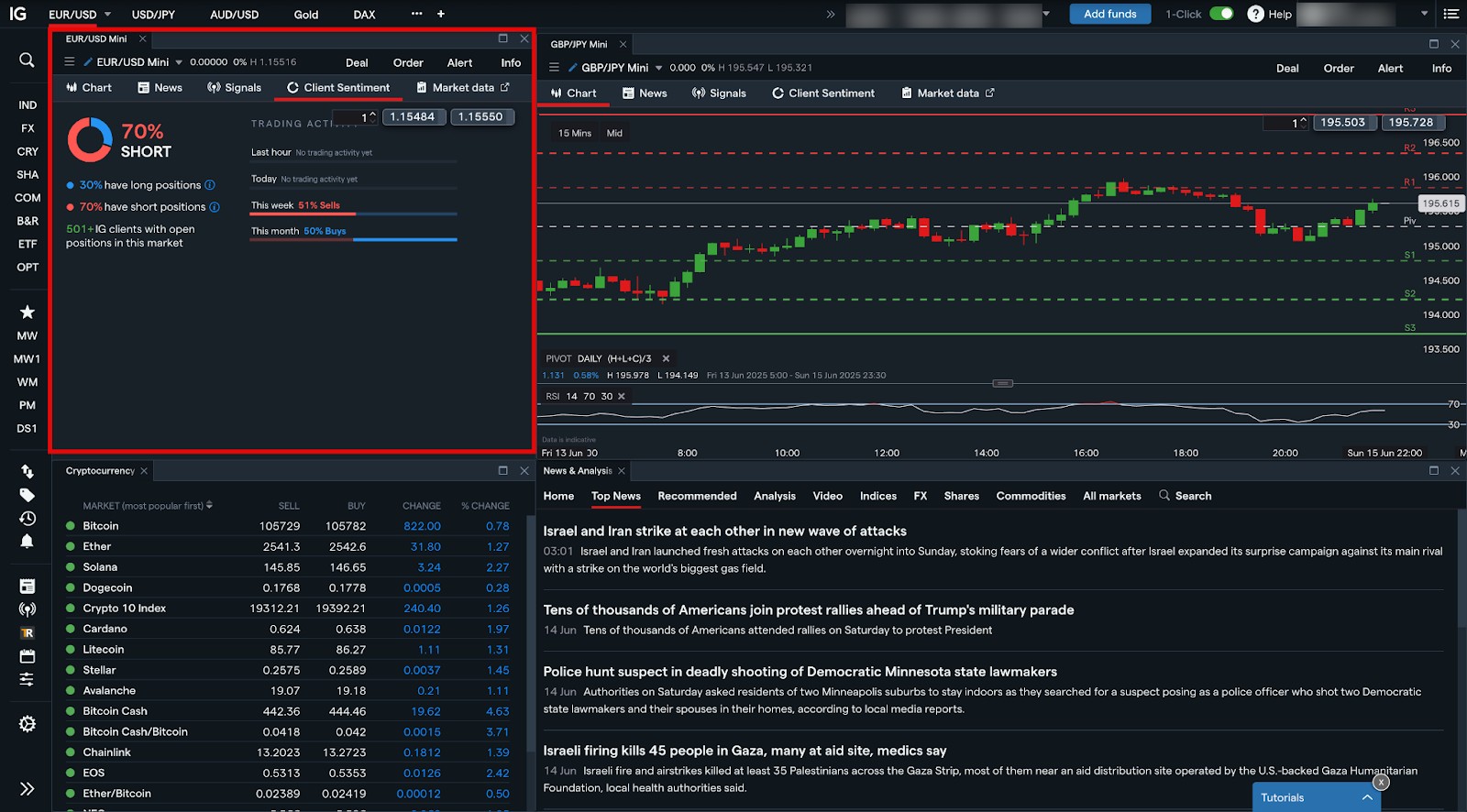

Retail trader sentiment data, accessible through leading Forex and CFD brokers like IG, OANDA, and FXCM, provides real-time ratios of long-to-short positions. These brokers offer valuable insight into the prevailing sentiment among smaller market participants. Since retail traders often enter trades during late-stage moves, an extreme majority on one side can signal that the market is overextended and ready for a reversal. This crowd behavior tends to reflect herd mentality and can serve as a contrarian indicator, helping traders anticipate potential turning points. I personally use the IG Client Sentiment tool, which draws from its large global client base of active traders. In my trading I look for extremes of over 90% being long or short along with confirmation from an oscillator like stochastics or RSI in identifying potential reversals.

Options-market signals

Options-market signals like put-call ratios, risk reversals, and implied volatility skews reveal how large traders position themselves, either buying protection or betting on big moves. A strong skew toward puts, for example, indicates rising bearish sentiment and expectations of downward price pressure. Conversely, more call buying suggests bullish sentiment. Monitoring these signals helps traders understand market expectations, anticipate volatility spikes, and spot potential trend reversals before they appear in spot or futures markets.

News & Social-media NLP feeds

AI-powered news and social media NLP (natural language processing) feeds analyze headlines, central bank speeches, Twitter (X) posts, Reddit threads, and more, quickly assigning bullish or bearish sentiment scores. By processing large amounts of data in real time, these tools show sudden changes in market mood. A fast rise in positive or negative consensus often suggests that the crowd is fully committed. This can signal a sharp market snapback or reversal. Tracking these sentiment extremes helps traders predict potential turning points and adjust their strategies. Permutable AI is an example of an AI-driven sentiment analysis platform.

Order book & Volume analytics

Real-time order book and volume data provide traders with a clearer view of where buyers and sellers are placing their orders at various price levels. This helps reveal hidden demand or supply that may not appear on standard price charts. By observing how orders and trading volume shift, especially during sudden spikes, traders can determine whether market sentiment is genuinely strong or simply responding to short-term news. This information aids in identifying true support and resistance levels, predicting price movements more accurately, and avoiding deception from false signals.

Combining all these inputs gives traders a deeper understanding of market sentiment, helping them make better decisions about when to enter or exit trades. It also helps spot contrarian opportunities that technical charts or economic data alone might miss.

Practical application

Contrarian edge

When crowd sentiment becomes very one-sided and most traders are either long or short, it often signals herd exhaustion and that a market reversal is more likely. Contrarian traders use this information to take positions that go against the majority, expecting that the trend has gone too far. For instance, if 90% of retail traders are long, it might mean that buying pressure is at its peak, which could lead to a pullback. Contrarian signals are most powerful when they are combined with technical confirmations like price divergence or key support or resistance breaks.

Trend validation

When bullish or bearish sentiment increases along with price, it confirms the trend's strength and suggests that it will likely continue. This alignment gives traders assurance to remain in the trade and avoid leaving too early, even during small pullbacks or consolidations. Watching sentiment alongside price helps to spot real momentum rather than false moves. Combining sentiment with technical and fundamental analysis further strengthens trend validation.

Risk management

Tracking extreme sentiment levels helps traders manage risk by signaling when a market move may be overextended and could quickly reverse. When sentiment becomes extremely positive or negative, traders can reduce their trade sizes, set tighter stop-loss limits, or take some profits to protect their gains and avoid big losses. Adding sentiment analysis to risk management provides useful insight beyond price action, helping traders make better and quicker decisions in volatile markets.

Early warning

AI tools quickly analyze massive amounts of data from news, social media, and central banks in real time. They can detect sudden changes in sentiment faster than traditional methods. A quick rise in negative sentiment might indicate upcoming policy changes or political risks that lead to significant market swings. Sudden shifts in sentiment can also suggest trend changes before price charts reflect them. Using AI sentiment analysis helps traders stay ahead, improving their timing and risk management.

Challenges and limitations

Sentiment analysis is a valuable tool, but has important limitations. Some sources, like the Commitment of Traders (COT) report, are published with a lag, making them less useful for short-term trading. Other data, such as social media sentiment, can be highly volatile, noisy, or even deliberately manipulated through coordinated messaging or bot activity. This can muddy the reflection of the real state of prevailing market psychology and lead to false signals.

Additionally, extreme sentiment readings, like extraordinary bullishness or bearishness, do not always lead to immediate market reversals. Markets can stay in overbought or oversold conditions for a long time, particularly during strong trends. Traders who are over-reliant on sentiment signals risk entering contrarian positions too early and getting caught on the wrong side as the trend endures.

The best way to use sentiment analysis is to combine it with technical and fundamental insights. In this way traders can confirm trade setups from varying sources and better understand crowd psychology within the broader market context.

I recommend using tools like Myfxbook Sentiment for quick market insights

If you are starting out with sentiment analysis I would recommend referring to tools like Myfxbook market sentiment (based on all live accounts that are connected to Myfxbook), IG Client Sentiment, and the FXCM Speculative Sentiment Index (SSI). This market sentiment data drawn from retail traders represents the ratio of long to short positions, but is not always reliable, especially in sideways or range-bound markets. In my view it is best used along with an oscillator like the Relative Strength Index (RSI). For example, if market sentiment is heavily bullish in EUR/USD, with 90% of traders holding long positions, and RSI crosses from above to below the overbought line of 70, this represents a potential bearish trade set up.

OANDA's Order Book is another valuable sentiment tool that you can easily access. It displays open orders and positions, revealing how OANDA traders are currently positioned in the market. By showing the distribution of these orders across price levels, it helps identify areas of support and resistance.

Conclusion

Sentiment analysis reveals a psychological layer missing from purely technical or fundamental studies. Used alongside charts and macro data, it exposes crowd driven extremes, sharpens timing, and enhances risk management, yet still demands caution against data lags and false signals. In today’s AI-powered, hyper-connected Forex landscape, mastering sentiment tools such as COT reports, client sentiment data within broker platforms, and real-time NLP feeds can provide a significant advantage.

FAQs

How do different timeframes (intraday vs weekly) affect the reliability of sentiment indicators?

Forex sentiment indicators vary by timeframe. Short intraday charts capture rapid shifts but are noisy, while longer timeframes like 4-hour or daily offer more reliable signals. Combining timeframes gives a clearer view.

Can sentiment analysis be effectively applied to emerging market currencies, or is it more reliable in major pairs?

Major pairs offer more reliable sentiment signals due to better data quality, liquidity, and stable macro drivers. Sentiment data from emerging market currencies is less reliable due to lower liquidity, limited transparency, and political instability.

What role do central bank interventions play in abruptly shifting market sentiment?

Central banks influence Forex sentiment through policy signals and direct interventions. Hawkish tones boost currencies; dovish ones weaken them. Their actions can trigger sharp volatility, override technical patterns, and impact global markets, making them key drivers of sentiment shifts.

How do sentiment signals differ between spot Forex markets and futures markets?

Spot Forex reflects real-time demand but lacks centralized data, making sentiment harder to measure. Futures offer clearer institutional positioning via exchange-traded data like volume and COT reports.

Related Articles

Team that worked on the article

Dan Blystone began his trading career in 1998 as an arbitrage clerk on the floor of the Chicago Mercantile Exchange (CME). He later traded bond and Eurex futures at proprietary firms such as Altea Trading, gaining valuable experience in high-frequency trading and risk management.

After earning his Series 3 license, Dan worked as a broker at Infinity Futures, where he advised clients on futures trading and provided real-time support. In 2008, he founded TradersLog.com to share high-quality market analysis and educational content, helping traders around the world develop their skills and gain a deeper understanding of the financial markets.

Financial markets reward discipline, not emotion. The more you learn to manage your risk, the more you control your future.

In 2025, Dan joined the team of authors at Traders Union.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Social trading is a form of online trading that allows individual traders to observe and replicate the trading strategies of more experienced and successful traders. It combines elements of social networking and financial trading, enabling traders to connect, share, and follow each other's trades on trading platforms.

Fundamental analysis is a method or tool that investors use that seeks to determine the intrinsic value of a security by examining economic and financial factors. It considers macroeconomic factors such as the state of the economy and industry conditions.