8 Best Trading Platforms in India 2024

Gone are the days when you'd have to call a broker to initiate a trade. Now, you can use online trading brokers to invest in everything from stocks to cryptocurrencies. However, it's essential to select the best trading platform if you want to be safe and comfortable.

Our guide below will help you select the best trading platform in India. We've made this list after considering the following things about each platform: usability, reliability, trading features. Firstly, we only picked the brokers that provide services and features for Indian citizens.

Secondly, we ensured the reliability of each broker by checking their regulations and financial licenses. Lastly, we only picked the brokers that had extensive trading features.

Below, we discuss the best trading platforms in India with their highlighting features.

Do you want to start trading Forex? Open an account on RoboForex!Trading Platforms in India: Comparison

Here is an overview of the best trading platforms in India.

| Trading platform | Minimum deposit | Account for beginners | Copy trading | Education | Regulation |

|---|---|---|---|---|---|

$10 |

Yes |

No |

Yes |

International Financial Services Commission (IFSC) |

|

$200 |

No |

Yes |

Yes |

CySEC, ASIC, and the FSA |

|

$200 |

Yes |

Yes |

Yes |

Financial Services Commission (FSC) |

|

$100 |

No |

No |

Yes |

Hong Kong Securities and Futures Commission, member of the SEHK and the HKFE |

|

$100 |

Yes |

Yes |

Yes |

Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority (FRSA) |

|

Angel Broking (Speed PRO) |

50,000 and Rs. 3 Lakhs |

No |

No |

Yes |

Registered with SEBI, NSE, BSE, MCX, and NCDEX. |

$0 |

Yes |

Yes |

Yes |

SEBI |

|

$250 |

No |

No |

Yes |

Bundesanstalt für Finanzdienstleistungsaufsicht and the Deutsche Bundesbank |

RoboForex - Best trading platform for cheap stock trading

RoboForex is a versatile platform with over 4.56 million clients in nearly 169 countries. This award-winning platform offers assets such as indices, stocks, CFDs, commodities, metals, and ETFs.

Features:

RoboForex does not charge commissions fees when using a Pro account. It offers simplified EA integration, copy trading platform, a lot of bonuses, over 12.000 trading instruments, and low fees. It is considered the best and very cost-effective, as one of the cheapest brokers available.

Incredibly education friendly, RoboForex offers resources such as economic calendars and analytics centers, as well as various other educational tools. This platform is regulated by the Financial Services Commission (FSC) in Belize, and has a Civil Liability insurance program for a limit of 5,000,000 EUR, It offers a wide array of products, account types, and learning resources for. The platform offers premium quality trading conditions that are highly unique, when compared to other such platforms.

👍 Pros

•Platforms Offered: RoboForex offers the MetaTrader Suite (Plus Other Platforms) and R StocksTrader platform.

•Extra low fees and spreads. The commission for trading US stocks ranges from 0.009 to 0.025 cents per share. The average EURUSD spread on a Row spread account is 0.3 pips with a commission of just $1.5 per lot

•Over 12.000 trading instruments. RoboForex offers over 3000 US Stocks for direct stock trading and over 8.000 of different CFDs including Forex and commodities.

•Trading Conditions: Those who use Prime, ECN, and R StocksTrader Accounts gain access to amazing Trade Conditions with an award-winning record.

•Account Options: RoboForex also offers a wide range of accounts which includes Islamic, Copy accounts, and more.

👎 Cons

•Pro Conditions: One of the negative aspects of RoboForex is that pro conditions are not as great as Prime/ECN

•Withdrawal Fees: Users may be charged fees for withdrawals.

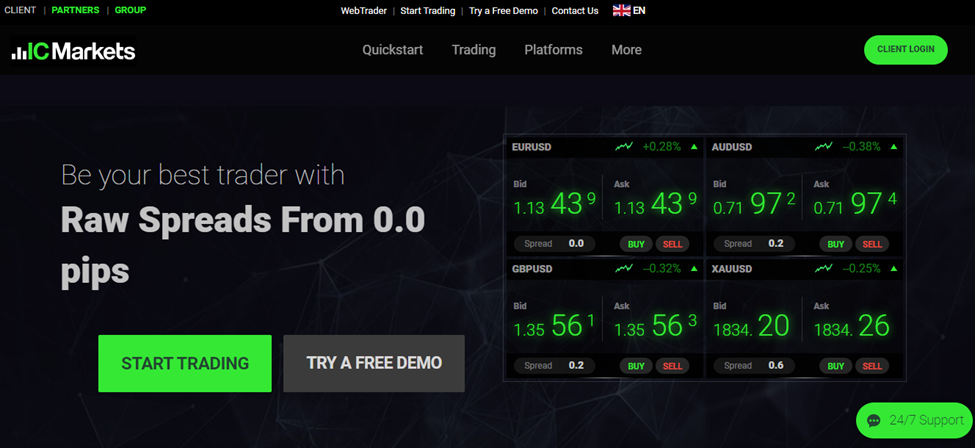

IC Markets (MT4) - Best for Forex Trading

Founded in 2007, I.C. Markets is an Australian broker that offers a wide range of financial instruments and trading features.

IC Markets platform

Usability

You can start trading on I.C. Markets with just $200. The platform allows you to invest in currency pairs CFDs on indices, metals, bonds, stocks, futures, commodities, and other instruments.

The account currencies available on I.C. Markets are USD, AUD, GBP, CHF, JPY, NZD, SGD, CAD, HKD, BTC.

Safety and Regulation

I.C. Markets is regulated by the following authorities:

-

Australian Financial Services License (AFSL)

-

Australian Securities and Investment Commission (ASIC)

I.C. Markets is also a member of the Australian Financial Complaint Authority (AFCA). It is the governing body that sets the market standards for resolving disputes and conflicts between financial service providers and consumers.

Trading Features

I.C. Markets provides favorable trading conditions for traders due to a comprehensive availability of features. For one, there are more than 90 financial instruments for you to invest in. The platform also has low spreads, ranging from 0 pips.

Its order execution is also one of the highest in the market. Novice investors can use analytical training materials on the platform to learn about trading strategies. Other useful resources on the platform include a risk calculator and a risk depth indicator.

EXNESS - best trading platform for beginners

When searching for the best trading platform for beginners, Exness easily outshines most of the competition. It offers accounts for practicing in the real market, unlimited leverage, low entry threshold, classic platform MT4/MT5 and proprietary browser terminal, as well as a copy trading service.

Features

In terms of the key features offered by Exness, some of them are as follows:

Mobile Trading: Exness offers the full mobile trading experience, unlike other platforms that offer only a limited number of features on mobile apps.

Account Management: Exness makes account management simple. The platform provides a simplified method of managing all trading accounts including trading accounts, and demo accounts.

Execute Transaction on the go: Exness makes it possible to transact on the go. Users can make deposits, withdrawals, and transfers from the comfort of their own phones.

Live Chat: Exness offers Live Chat support that enables you to get the answers to pressing questions in real time.

Educational Tools: Exness offers economic news features that come complete with articles, analysis, and more.

Multi-Lingual: Exness also offers an array of languages on its mobile app.

👍 Pros

•Tight spreads in forex pairs.

•Third-party tools.

•24/7 support.

•Several account types.

•Virtual Private Server (VPS).

•Social Trading.

•Minimal Fees.

👎 Cons

•Limited regulatory oversight for some clients.

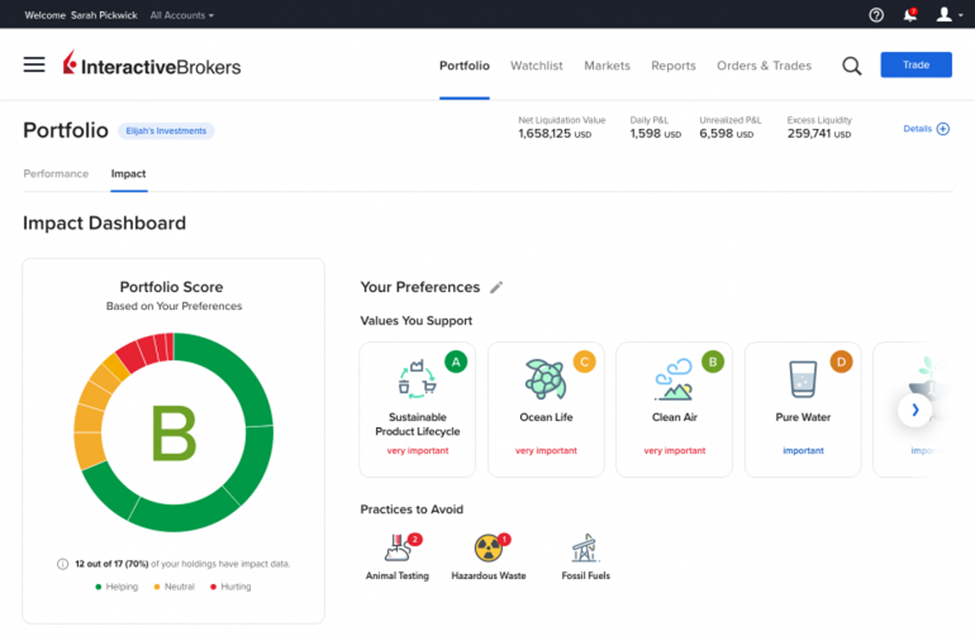

Interactive Brokers - Best for Advanced Stock Trading

Interactive Brokers is one of the best trading platforms for Indian citizens since it has been operational since 1977. Although you can trade currency pairs on the platform, too, it's known for indices, metals, ETFs, futures, and stocks.

Usability

Interactive Brokers has a huge selection of training materials for new traders to learn and take inspiration from. Plus, you can trade in 33 countries and 135 markers. Some trade instruments available on the platform include bonds, futures, options, and stocks.

Since Interactive Brokers has a "SmartRouting" platform, it offers the best price execution compared to other brokers. Simply put, you get access to the best combination of prices, stocks, and options.

Plus, there's no minimum deposit required to get started.

Safety and Regulation

Interactive Brokers is regulated by the following authorities:

-

U.S. Securities and Exchange Commission (SEC)

-

U.S. Financial Industry Regulatory Authority (FINRA)

-

U.K. Financial Regulatory Authority (FCA)

Trading Features

Interactive Brokers has a number of useful tools and features, such as advanced charting, stock symbol performance, heat maps of financial sectors, and volatility lab. Users can leverage these features to identify the right instruments to invest in.

The platform also has an Impact Dashboard where investors can choose personal investment criteria from 13 different principles, including gender equality, LGBTQ inclusion, and clear air quality.

Interactive Brokers platform

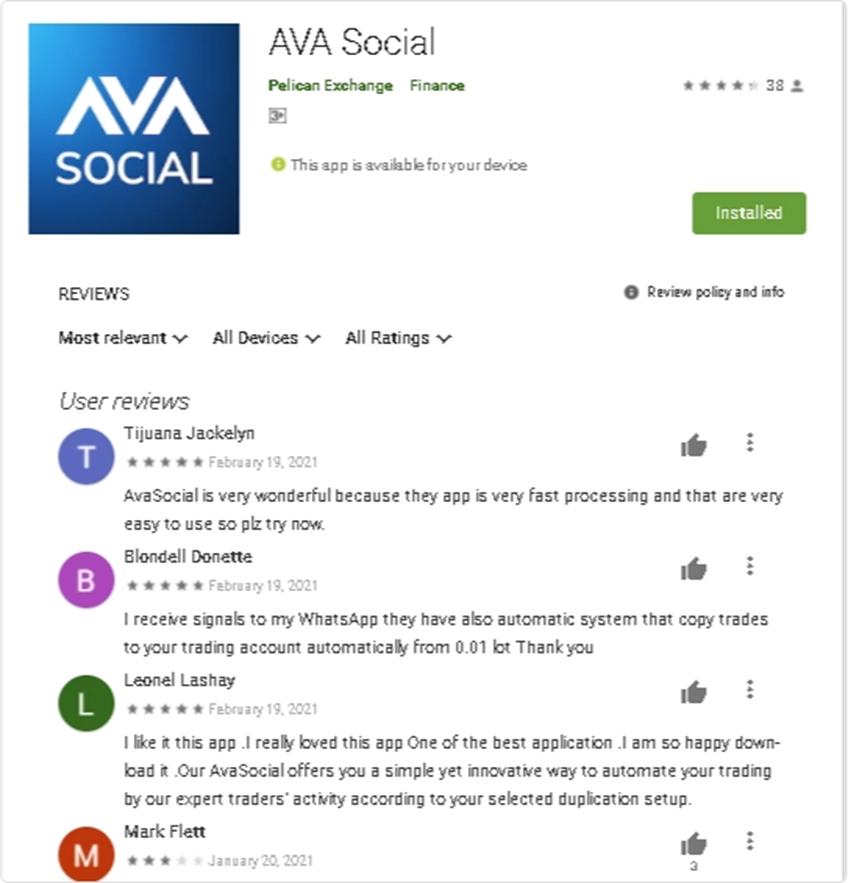

AvaTrade (AvaTradeGo) - Best Mobile App

Founded in 2006, AvaTrade is among the best trading platforms in India for investors who want to trade in different instruments, including commodities, cryptocurrencies, stocks, indices, and Forex.

AvaTrade mobile app

Usability

AvaTrade has its offices in 150 countries worldwide. With over two million monthly transactions, the broker is one of the most widely used platforms in the world.

You need a minimum deposit of $100 to get started. AvaTrade lets you trade stocks, indices, currency pairs, securities, and cryptocurrencies.

Safety and Regulation

AvaTrade is regulated by the following authorities:

-

Australian Securities and Investment Commission (ASIC)

-

Japanese FSA, and the South African FSCA.

AvaTrade also has accreditation by:

-

Central Irish Bank

-

Abu Dhabi Financial Services Regulatory Authority

-

British Virgin Islands Financial Services Commission

Trading Features

AvaTrade gives its users access to other social trading platforms, including MQL5 Signal, ZuluTrade, and DupliTrade. The platform also has tutorials that are categorized according to beginner, intermediate, and pro topics.

With AvaProtect, investors can get insurance on their trade. Besides that, the broker also provides negative balance protection, which ensures that you do not lose more than the balance in your account, irrespective of the market's direction.

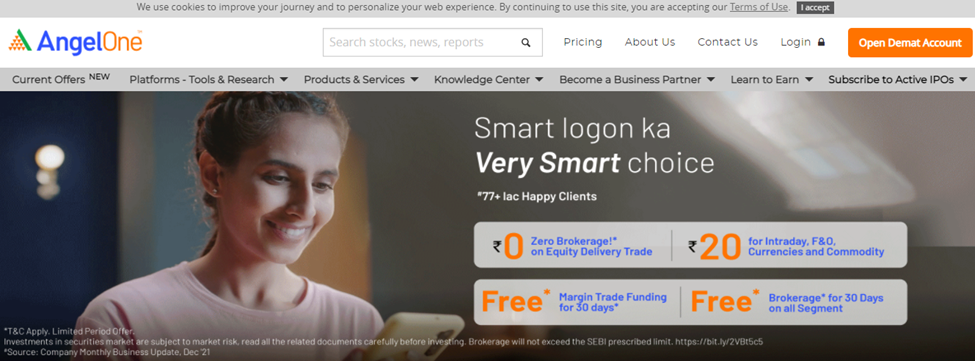

Angel Broking (Speed PRO) - Best for Indian stoсks

If you're looking for the best share trading platform in India, Angel Broking is the right platform for you. It's a full-service broking house that provides tools and features for online share traders.

Angel Broking platform

Usability

Angel One is ideal for Indian investors who want to trade in international stocks. With zero commission investments, you can invest in stocks from all over the world and benefit from ready-made curated portfolios.

Unlike most other investment platforms, you don't need a minimum deposit to get started.

Safety and Regulation

Angel One is regulated by:

-

Securities and Exchange Board of India

-

Central Depository Services

-

National Stock Exchange of India Limited

-

Bombay Stock Exchange

Trading Features

Angel One allows investors to make informed decisions across currency segments, commodities, and equities with the platform's event-based reports issues every week and month.

The broker also has a Knowledge Center where investors can learn about trading strategies and equity-related investment concepts.

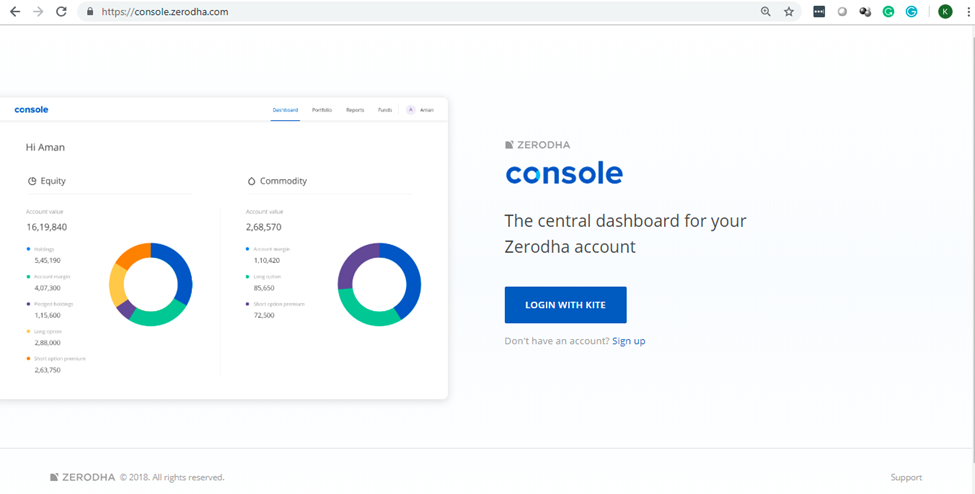

Zerodha KITE - Best Multi-Platform Broker

Zerodha is one of the leading trading platforms in India, with millions of users. Besides basic account services, the broker also allows mutual fund investments.

Zerodha platform

Usability

The major benefit of using Zerodha is that you don't need a minimum investment. With just $0, you can start investing in different instruments, including but not limited to stocks, commodities, and futures.

Zerodha's website runs like any regular web-based broker with features like advanced charts, streaming quotes, and keyboard shortcuts. The platform also has an interactive user interface.

The Zerodha mobile app is available for iOS and Android users. You can get access to all features available on the web version of the platform.

Safety and Regulation

Zerodha is regulated by the Securities and Exchange Board of India (SEBI).

Trading Features

Zerodha allows users to see charts from ChartIQ and TradingView. Using these charts, traders can make better financial decisions. Moreover, there are six chart types and more than 100 indicators for the users' convenience.

You can choose more than 20 drawing tools to make the charts. Plus, Zerodha Kite charts can be arranged on your screen in such a way that you can view four of them simultaneously.

The platform also has advanced order types, such as cover and Brackets. Meanwhile, the Dashboard shows you your account summary and transaction history. Another exciting feature of this platform is the Floating Order Entry.

It's a detached window that you can put anywhere on your screen. You can then place orders through this window for the Order Books, Spread Matrix, Quote Board, Market Grid, or Autotrader.

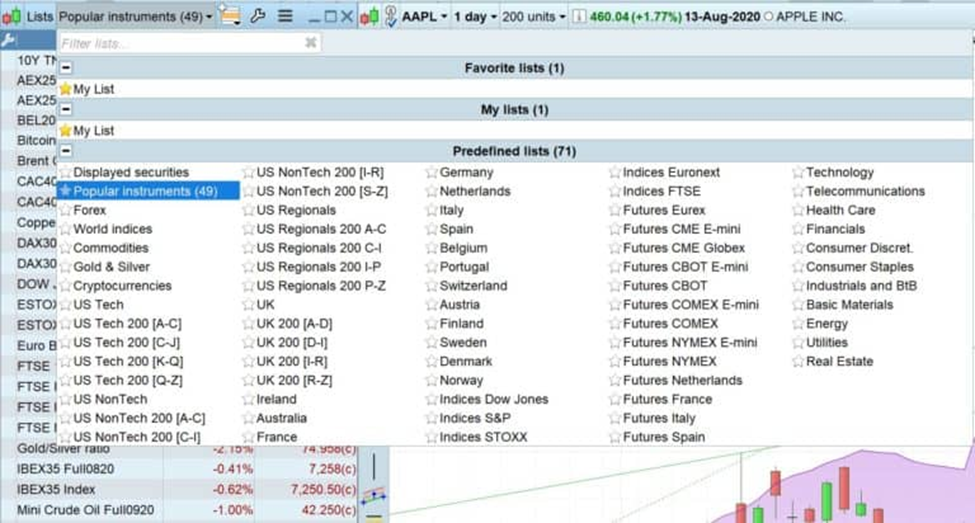

IG (ProRealTime) - For Advanced Charting

I.G. is the best trading platform in India for investors who need advanced charting features to make informed decisions. The platform's analytical tools, market data display, and high-quality charts make it a good option for such investors.

IG Markets platform

Usability

I.G. serves clients from around the world, allowing them to invest in multiple asset classes, such as ETFs, bonds, options, commodities, shares, indices, and Forex.

With a minimum investment of $250, you can get started on the platform. However, it's important to note that the platform does not offer negative balance protection. Additionally, it does not have in-platform copy trading features.

Safety and Regulation

I.G. is regulated by the following authorities:

-

Financial Conduct Authority in the U.K.

-

Commodity Futures Trading Commission in the U.S.

Since these authorities are considered preeminently reliable in both countries, I.G. is a safe platform for trading.

Trading Features

The main feature of I.G. is that it lets you trade multiple assets automatically. You can automatically trade any financial instruments, from bonds and options to futures.

Moreover, the platform has technical charting options that display three types of charts for every asset. With 130 indicators, users can easily customize the charts with regard to display colors and other parameters.

I.G. has many drawing tools, including head and shoulder patterns, Triangles, channels, and Fibonacci retracements that you can use to set price alerts.

Types of Broker's Trading Platforms

Nowadays, there are different types of trading platforms, and investors can choose the best type based on their preferences.

Desktop

Desktop trading platforms come with desktop apps that you can download on your computer. You can find a range of features on these platforms, such as advanced charting options and order types.

However, desktop platforms are vulnerable to server crashes and computer crashes. They may also slow down your computer and function ineffectively based on the capacity of your computer.

You should only opt for a desktop trading platform if your computer can handle the load and won't be slowed by the storage constraints.

Mobile

Some trading platforms have mobile apps for Android and iOS users. Typically, the mobile app versions have the same features as the web or desktop version of the platform. However, some users may find the mobile screen to be too small to see detailed charts properly.

For instance, Zerodha lets you see four charts simultaneously on a screen. But you won't be able to benefit from such a feature on your phone's screen.

If you prefer trading on the go, a mobile trading platform should be ideal for you. But if you like to open multiple charts and order screens, you should opt for a web-based or desktop trading platform.

Web

A web-based trading platform is software that allows you to place orders and initiate trades through a website. You don't have to download a desktop or a phone app since you can just open your account on the website and start trading.

Web-based trading platforms are suitable for traders who don't want to download any apps on their computer or phone due to viewing or storage limitations.

| Broker | Unique features of trading platform | desktop platform | mobile platform | browser-based platform |

|---|---|---|---|---|

RoboForex |

Copy trading, R Trader |

Yes |

Yes |

Yes |

IC Markets |

Copy trading, cTrader |

Yes |

Yes |

Yes |

EXNESS Group |

Copy trading, MetaTrader 4/5 |

Yes |

Yes |

Yes |

Interactive Brokers |

Trading in stocks, options and futures |

Yes |

Yes |

Yes |

AvaTrade |

Multilingual support, AvaTradeGO |

Yes |

Yes |

Yes |

Angel Broking |

Speed PRO |

Yes |

Yes |

Yes |

Zerodha KITE |

Zerodha Coin |

Yes |

Yes |

Yes |

IG |

ProRealTime |

Yes |

Yes |

Yes |

Main Features of the Best Trading Platform

The best trading platform in India should have the following features:

Regulated

A platform that is regulated by noteworthy national or international authorities is deemed reliable and safe. You should look for trading platforms that have licenses from top regulatory authorities in the U.K., E.U., and the U.S. When searching for trading platforms in India, make sure the broker is licensed by the SEBI.

Order Execution Tools

Besides basic orders, you should also have the option to place bracket orders, reserve orders, times orders, hidden orders, and other types of orders. It's also beneficial if the platform has hotkeys since they allow you to place active trades in instruments where even split seconds count.

Scanning Tools

A good trading platform also has scanning tools that you can use to look for the best trades. For instance, you should be able to search for the most active stocks or certain investment patterns.

Fundamental Research

The fundamental research tools in a platform let users look up information about any company, such as its historical earnings, latest news, and metrics. These tools also give you access to financial reports and analysts' ratings.

Charting

The best trading platforms also have charting tools that let users build bar charts, line charts, and candlestick charts, among other options. Some advanced features available in good trading platforms are line break charting, point and figure, Ichimoku, wave studies, and Fibonacci plotting.

Which platform is best for day trading in India?

The best platform for day trading in India is RoboForex. This is because it offers a wide range of training materials, access to over 12.000 trading instruments. The platform also provides lots of educational resources and a demo trading account, that enables users to learn how to invest without risking their money.

What trading platforms accept Indian Rupee (INR)?

There are various brokers that accept the Indian Rupee. Some of them are as follows:

There are several Forex brokers that accept the Indian Rupee (INR) as a deposit currency. This allows Indian traders to deposit and withdraw funds in their local currency, reducing the impact of currency exchange rates and associated fees. Here are a few examples of Forex brokers that accept INR:

Zerodha KITE

Angel Broking

IC Markets

Exness

RoboForex

Should I pay taxes as a Forex trader?

As a Forex trader, you are required to pay taxes to the government. There are two types of taxes that a Forex trader must pay:

Direct Tax: This is a tax rate on gains applicable based on your income tax slab. The rate of tax will depend on your total income, including any Forex trading gains, and will be calculated based on the tax slab you fall under.

Indirect Tax: This refers to taxes such as Goods and Services Tax (GST) which may be applicable on the Forex transactions you make. It's important to declare all Forex-related income on your tax returns and to keep records of all Forex trades. It's also recommended to consult a tax professional to understand the specific tax implications and to ensure compliance with tax laws in your country.

Can I trade with internationally regulated brokers?

Yes. But you should check to make sure this broker should accept Indian clients. Moreover, you should seek out those adhering to the best international regulations such as ASIC (Australia), FCA (UK), and CySec (Cyprus).

How to Choose A Trading Platform For Beginners?

As a beginner, the following tips can help you select a good trading platform.

-

Look for a platform that facilitates you in earning passive income. For instance, RoboForex offers copy trading that you can use to emulate the trading strategies of other experienced traders and make a passive income without much trading knowledge.

-

Opt for a platform with a user-friendly interface. It will allow you to learn basic trading concepts easily without getting overwhelmed by advanced options.

-

Being a beginner, you don't need advanced charting features or functionalities that you don't comprehend. Instead, look for a simple platform that meets your needs.

-

Some brokers, such as RoboForex, have training sections on their platform where you can learn about trading strategies and market analytics. Choose a platform that has informational tools, resources, guides, or training sessions.

Summary

Whether you're a beginner or a pro, you'll find the right financial instruments and trading features in the seven trading platforms in India mentioned above. When you're choosing the right platform for yourself, consider your experience level, the features you need, and the trade instruments you prefer.

Moreover, check the platform's licenses, order execution quality, charting features, fundamental research, and other characteristics before making a decision.

FAQs

Which is the No 1 trading app in India?

Zerodha Kite is the number one trading app in India.

Which is the best trading platform for beginners in India?

Zerodha Kite is also considered the most beginner-friendly trading platform in India.

Which is the best trading platform?

Upstox Pro App is also considered the best trading platform overall.

Is Zerodha the best trading platform?

Technically, Zerodha Kite is considered the best trading platform. This is because it offers a wide array of stocks to trade, as well as an easy-to-use mobile app. Moreover, it also offers 6 chart types to enable users to evaluate the market conditions. It also offers advanced options in terms of placing orders, such as After Market Order (AMO), Brackets and covers, and more.

What is the Best Trading Platform for Beginners in India?

Beginners will find Zerodha to be a helpful trading platform since it has a $0 minimum investment and offers many features, like advanced charts, streaming quotes, and keyboard shortcuts.

Is Zerodha Safe?

Yes, Zerodha is safe as it's regulated by the Securities and Exchange Board of India. As for your account on the platform, you can use two-factor authentication to keep it secure.

What is the Best Trading Platform for Charting?

Both Interactive Brokers and I.G. are great trading platforms for charting. Traders can draw different types of charts for every asset and benefit from the vast number of indicators available on both platforms.

Which is the Best Share Trading Platform?

Zerodha is a good trading platform for India. But if you're looking on a global scale, Interactive Brokers is an ideal option. Both these platforms have sophisticated charting features and order types that traders can use to maximize their profits.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!