FXCM is among the world's leading brokers, founded in 1999 in the UK. The company is licensed by the UK Financial Conduct Authority (FCA) and is therefore considered reliable.

In addition to a wide range of services for active trading, FXCM offers to start copying trades of professional traders in automatic mode. The broker offers the services in partnership with one of the world's leading social trading platform providers ZuluTrade.

We’ve prepared an overview of copy trading from FXCM. Learn how to start copying professional traders, trading terms and commissions for copying trades, as well as all the pros and cons of this type of investing.

What is copy trading?

Copy trading allows novice traders on the financial markets to copy professional traders’ trades in automatic or manual mode. Professional traders connected to the platform for social trading develop strategies, make deals and tweak models. Novice traders have the opportunity to subscribe to copy trades.

After that, trades and orders on the manager's account will be copied to the investor's account in the proportion specified.

Copy trading solves several problems for novice traders, such as it:

-

Allows him to enter the financial market and start investing immediately;

-

Provides potential earnings at the professional level;

-

Provides a low entry threshold.

Important!

The main copy trading disadvantage is that great results from professionals in the past don’t guarantee the replication of the results in the future. Always remember that this type of trading is associated with poor risks.

FXCM copy trading pros and cons

👍 Pros

• Cooperation with a large number of signal providers

• Minimum deposit of $50

• Wide range of trading instruments

• UK regulation

👎 Cons

• Work only through the Trade Station platform

• Signal provider subscription fee is $30 per month

• Medium to high spreads

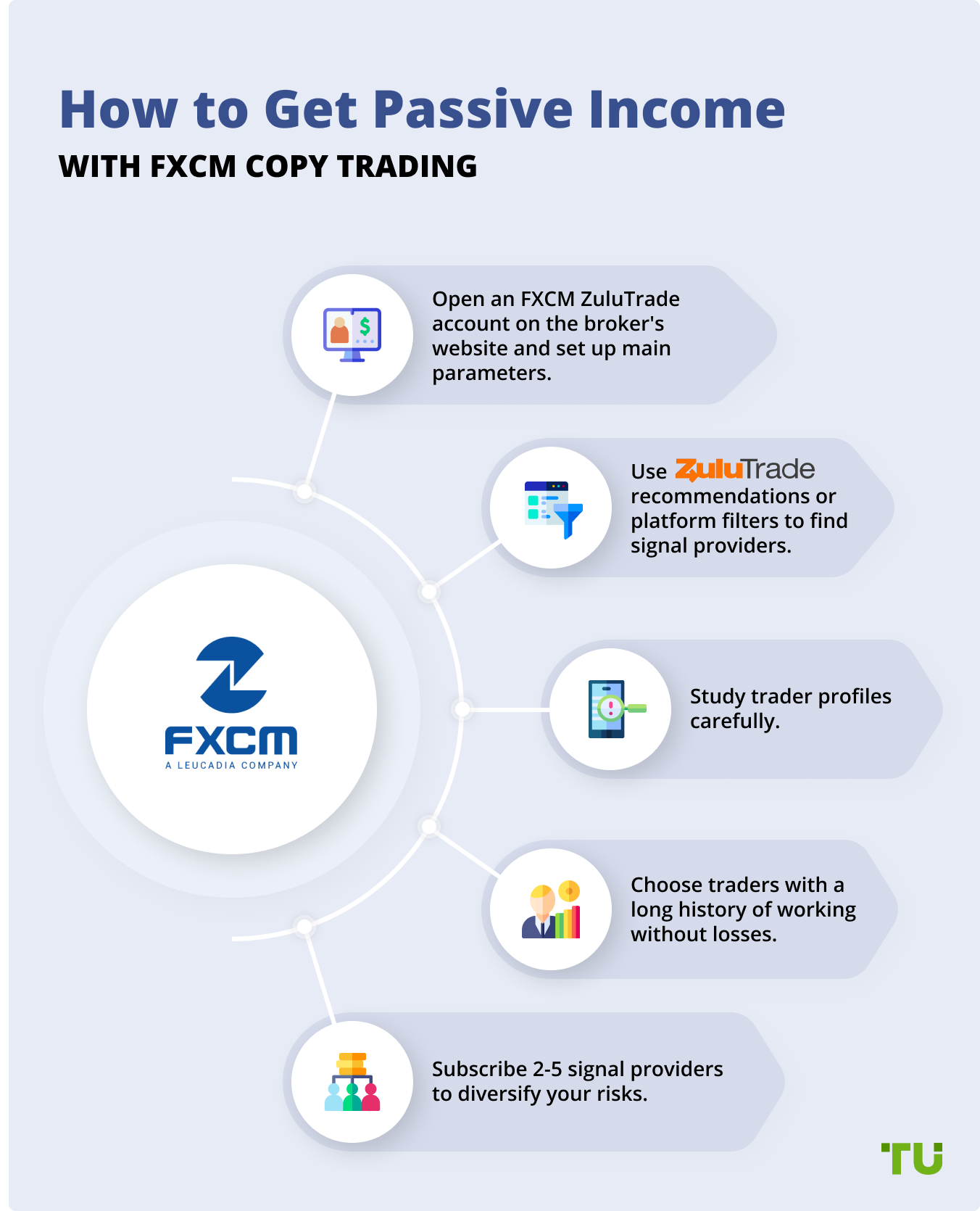

How to start copy trading using FXCM?

There are two categories of brokers offering copying services. Some of them offer their clients their proprietary platform for copy trading. These include eToro, RoboForex, FXTM, Forex4You.

The second category is FXCM. These brokers offer the services of social trading platform providers. FXCM cooperates with one of the leading providers, ZuluTrade.

To get started with ZuluTrade via an FXCM broker, complete these three steps:

-

Apply to open an FXCM ZuluTrade account on the broker's website.

-

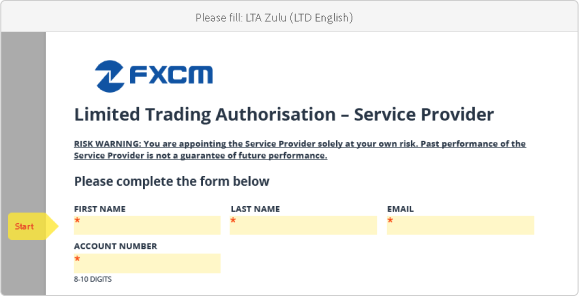

Complete the authorization form and allow copying trades on your account.

FXCM Copy Trading - Registration

-

Activate your ZuluTrade account after the FXCM broker team contacts you to clarify the details.

Copy trading using a demo account

You can test the copying trades option in demo mode by going through a simple registration on the ZuluTrade website.

You will get a virtual $100,000 and can subscribe to trades from top traders. If you are satisfied with all the cooperation terms, go back to the FXCM website and open an account to work with ZuluTrade.

What is the ZuluTrade copy trading network

ZuluTrade today is among the largest social and copy trading platforms. It offers copy access to over 1,000 service providers.

Platforms for copy trading |

ZuluTrade |

Regulation |

Greece and EU (HCMC), USA (CFTC), and Japan (KFB) |

Terminals |

MT4, MT5, ZTP |

Top brokers |

34 |

The number of brokers offered |

AvaTrade, FXCM, IC Markets, TickMill, EverFx, Weltrade, Axi, InstaForex, FX Open, AAAFx, Oanda, and Swissquote |

The minimum investment for copying trades |

Is indicated by the broker and ranges from $50 to $1,000. Combos service - from $2,000 |

Commission for using the service |

Profit-Sharing Plan: $30 monthly subscription + 25% share of profits Classic Plan - depends on the broker chosen. On average, $20 per standard lot in a currency pair |

Brokerage commission |

Execution fees are charged according to your broker's terms |

Types of accounts |

Profit Sharing, Classic |

Network scale |

Over 1,000 strategy providers |

Markets |

Forex, CFDs, cryptocurrencies, stocks, commodities. The markets list depends on the broker chosen. |

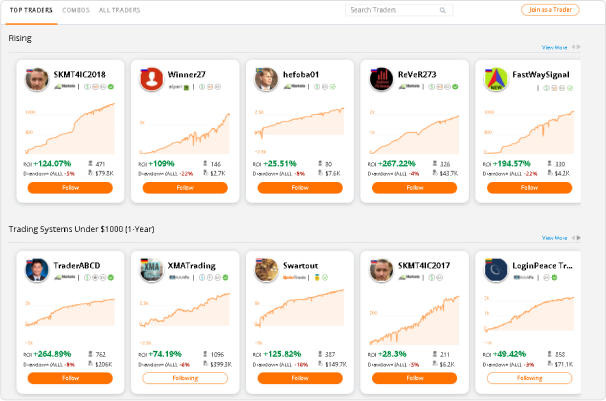

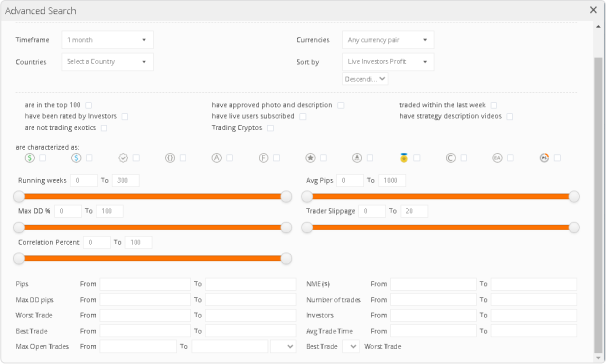

How to find the right trader to copy

When FXCM clients search for traders to copy on the ZuluTrade platform, there are a few options to employ:

How to start copying trades

It is quite easy to start copying trades from ZuluTrade’s signal providers to an account with an FXCM broker. After you have found a strategy provider, just subscribe to him. After that, the professional trader’s trades will be copied to the FXCM trading account.

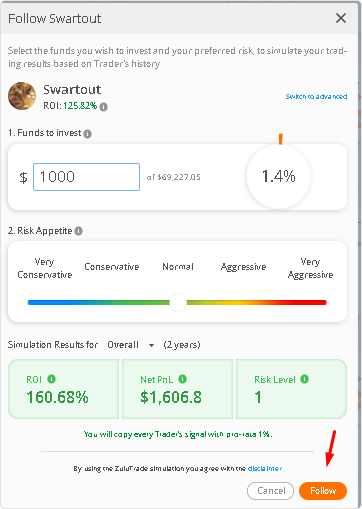

To subscribe to traders on ZuluTrade, just click on the Follow button in your profile. In a pop-up window set the amount to copy trades.

ZuluTrade Copy Trading - Rating

FXCM’s minimum investment amount is $50, however, some managers may set a higher threshold for getting started on their own. Also, the minimum amount depends on the leverage size you are using. As a result, the starting amount can range from several hundred to $2-8 thousand for the most successful managers.

You can subscribe to several traders at once, thereby creating a portfolio. We also recommend you note that advanced copying features are available on ZuluTrade and ZuluGuard allows you to protect your capital from a drawdown below a certain set level.

You can also manually stop copying traders, reduce or increase the amount to copy in your account at ZuluTrade.

Can I make money by copying traders on FXCM?

Yes, it is possible to make money by copying trades with FXCM. For this purpose, this broker has the following conditions:

-

A license from a leading regulator, confirming the transparency of its operations.

-

Cooperation with one of the leading providers of copy trading platforms.

-

A wide range of trading assets.

Important!

However, remember that the impressive financial results of traders in the past don’t guarantee the replication of those results today or in the future. Therefore, there may be losses when copying traders. Moreover, all trading costs shall be taken into account.

How much does FXCM copy trading cost?

FXCM doesn’t charge extra fees for copy trading services. Clients copying traders on ZuluTrade pay the spread according to the terms of their trading plan. FXCM commissions range from medium to high. Thus, the average spread in the EUR/USD pair is 1.3 pips.

Moreover, investors should take into account additional payments:

-

$30 per month is the cost of a ZuluTrade service subscription;

-

25% of the profit is the management’s commission. This commission shall be paid only if the signal provider is trading profitably.

Is FXCM copy trading safe?

Yes, we believe FXCM is a safe broker. It is registered in the UK and regulated by the Financial Conduct Authority (FCA), one of the world’s largest and most reputable regulatory organizations. Its license number is 217689.

Copy-trading platform provider ZuluTrade is also licensed and operates under European Union rules under the supervision of the Cyprus Securities and Exchange Commission (CySEC).

Thus, the main risk of cooperating with copy trading from FXCM is trading.

Summary

FXCM broker doesn’t offer its own service for copying trades but relies on a partnership with ZuluTrade. There are both pros and cons to this arrangement.

As for advantages, ZuluTrade is among the largest providers of such services in the world and there are over 1,000 strategy providers on its platform. This makes it easy enough even for novice traders to enter the market and choose a professional signal provider.

However, such a system also has disadvantages. Thus, clients will have to pay $30 for ZuluTrade services monthly. You also have to pay 25% of the profits to managers. This fact reduces the earning potential of FXCM as it does not have the lowest fees on the market.

For example, the leader in our social trading platforms ranking is eToro. It is notable for the absence of management fees and there are no commissions for trading in US stocks or ETFs.

Expert’s opinion

The main advantage of FXCM is its reliability and licensing in the UK. The broker also has a good selection of trading instruments. However, in terms of copy trading services, it certainly lags behind the clear leader eToro, but also AvaTrade, which offers three copy trading services at once.

While ZuluTrade is a fairly large and reputable social trading platform provider, it has its disadvantages. In particular, the filters for searching managers there don’t work very well, and the fees are high.

It is possible to make money on copying trades with FXCM, but if you want to get better terms, you should consider other options on the market.

Antony Robertson

Traders Union financial analyst

FXCM social and copy trading reviews

Although formally the minimum deposit to start copying traders with FXCM is just $50 you should have at least $1,000- $2,000. In this case, you don’t have to use margin beyond the clouds, which can ruin you at any time, and find a pretty good manager. I didn't expect that amount, so it was an unpleasant surprise for me when it turned out that there were no chances with my GBP 500 on ZuluTrade.

Casey Smith

novice investor

UK

I am satisfied with the FXCM and ZuluTrade work. I managed to make 34% here during the year, which could be considered an excellent result. Of course, I could have just invested everything in Bitcoins, but this option is also quite acceptable as portfolio diversification.

Sibonakaliso Waller

banker

South Africa

Three months ago, I carefully studied all the terms for working with copy trading with this broker, analyzed the terms of ZuluTrade, and decided to invest 3,000 euros. Look, traders on ZuluTrade make money, but my profit barely reached 5% taking into account all the commissions I had to pay. And this is taking into account a growing market!

Camille Garnier

trader

France

FAQ

What is the minimum deposit for copy trading on FXCM?

The minimum deposit with a broker is $50. However, ZuluTrade’s strategy providers may have individual requirements. Also, the minimum amount to get started depends largely on the margin size used. It is more realistic to find good options for copying trades with at least $1,000.

Can I copy trades with FXCM via the MT4 terminal?

No, the broker offers only the Trade Station terminal for copy trading.

How much can I earn from copy trading?

There is no unitary value. As with any investment genre, you can make good money or lose money. Success depends on the choice of the strategy provider, broker commissions, and market conditions.

When should I stop copying a trader?

It is better to refuse to cooperate with a trader if he regularly makes significant drawdowns and trades in the red. You can cancel your subscription in your personal account on the ZuluTrade website.