Best Spread Betting Demo Accounts

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, If you are too busy to read the entire article and want a quick answer, the best spread betting demo account is Plus500. Why? Here are its key advantages:

- Is legit in your country (Identified as United States

)

- Has a good user satisfaction score

- Risk-free way to become familiar with the subtleties of spread betting

- Opportunity to test new trading strategies

Best Spread Betting Demo Accounts:

- Plus500 - Best premium client support (personal manager, exclusive analysis, webinars)

- Pepperstone - Best for scalping strategies (spread from 0 pips)

- OANDA - Best for trading with advanced technical analysis tools (TradingView charts support)

- FOREX.com - Diverse range of tradable assets (80+ currency pairs)

- Interactive Brokers - Best broker for international investors (assets from 33 countries, 150+ markets)

Choosing the best demo account for spread betting is a crucial step for new traders aiming to learn the basics of trading without the risk of losing real money. Demo accounts offer valuable experience with different brokers' platforms, allowing users to evaluate their functionality and trading conditions. In this article, we will review the best spread betting demo accounts to help you make an informed choice and start your trading career successfully.

Best spread betting demo accounts

A spread betting demo account is a practice account provided by brokers, allowing traders to try spread betting without risking real money. These accounts use virtual funds, giving traders a realistic environment to learn and test their strategies. While the market data and trading conditions in demo accounts are similar to real accounts, the psychological impact of trading real money is absent. This can lead to riskier behavior in demo trading, which traders must be aware of when switching to real funds.

Fast Note: Spread betting allows you to speculate on the price movements of financial instruments without actually owning them. This method lets you bet on various assets, such as stocks, currencies, indices, commodities, and even events like sports outcomes or political elections. Unlike traditional trading, where you buy and sell assets, spread betting involves betting on price changes.

We have selected brokers that provide the best spread betting demo accounts. These companies provide a wide range of trading instruments, such as stocks, bonds, cryptocurrencies, on which you can try your luck in spread betting.

Also we explain how to choose the best spread betting demo account.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Spread betting demo accounts |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Instruments |

CFDs on stocks, Forex, cryptocurrencies, indices and commodities, real stocks, options, ETFs (not available for all countries), futures (for U.S. residents only) | CFDs on Forex, Index, Stocks, Currency Indices, Commodities, ETFs, Crypto | FX, Indices, Bullion, Commodities, Crypto | Forex, cryptocurrencies, indices, commodities, stocks | Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds, forecast contracts (Product availability is dependent on IBKR affiliate and client country of residence) |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Choosing the best spread betting demo account involves considering several factors to ensure the platform meets your learning and trading needs. Here are key aspects to consider when selecting a spread betting demo account:

Reputation and reliability - ensure the broker offering the demo account is regulated by a reputable financial authority (e.g., FCA in the UK). Also research the broker’s reputation by reading reviews and checking their standing in the trading community.

Realistic trading environment - the demo account should simulate real market conditions as closely as possible to give you a realistic trading experience. Check if the demo account provides realistic order execution times and spreads similar to those in live trading.

Educational resources - a good demo account should come with access to educational resources such as tutorials, guides, webinars, and articles. Ensure that the platform offers reliable customer support to assist you with any questions or issues that arise while using the demo account.

Asset coverage - ensure the demo account offers access to a wide range of markets and assets, including Forex, indices, commodities, and stocks. The more instruments available, the better you can practice and diversify your trading strategies.

Platform features - Choose a platform with an intuitive and user-friendly interface, making it easy to navigate and execute trades. Look for platforms that offer a comprehensive suite of trading tools, including charting tools, technical indicators, and risk management features.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

MT4 |

No | Yes | Yes | Yes | No |

|

MT5 |

No | Yes | Yes | Yes | No |

|

cTrader |

No | Yes | No | No | No |

|

WebTrader |

Yes | Yes | Yes | Yes | Yes |

|

NinjaTrader |

No | No | No | No | No |

|

Proprietary platform |

Yes | Yes | Yes | Yes | Yes |

|

Android |

Yes | Yes | Yes | Yes | Yes |

|

iOS |

Yes | Yes | Yes | Yes | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

By carefully evaluating these factors, you can select a spread betting demo account that best suits your learning needs and trading objectives, helping you develop the skills and confidence needed for successful live trading.

Why should I use spread betting demo accounts?

Learning the basics: Get familiar with the fundamental principles of spread betting and how the trading platform works.

Testing strategies: Develop and refine trading strategies without any risk of financial loss.

Understanding risk management: Learn to use risk management tools and techniques.

Evaluating brokers: Assess the broker’s platform and service quality before committing to a real account.

A demo account is essential for beginners in spread betting, providing a safe space to gain experience and build confidence.

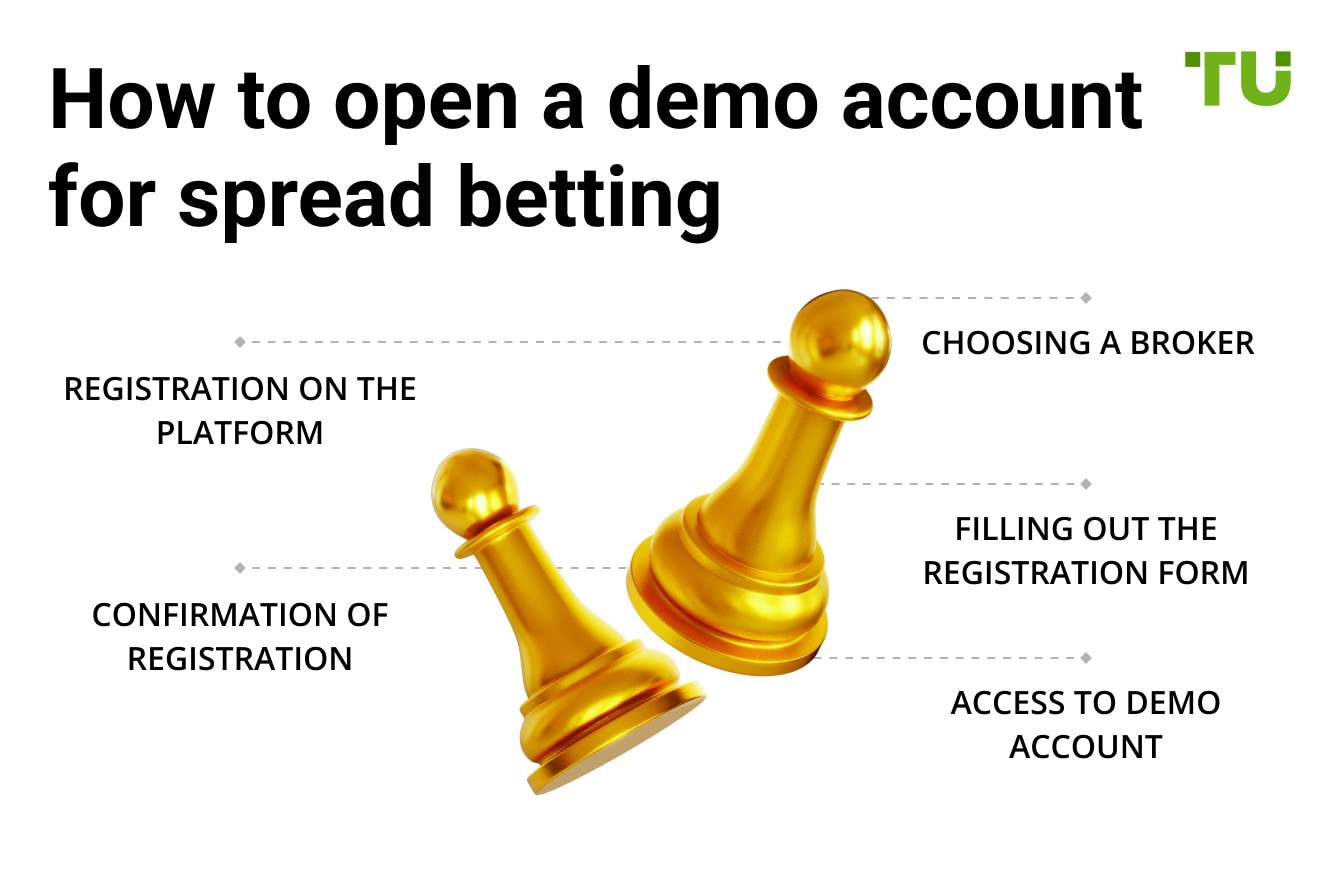

Choosing a broker

First of all, a trader should choose a reliable broker that offers spread betting services and provides the opportunity to open a demo account. There are many brokers on the market that offer demo accounts with different conditions and functionality.

We gather reviews from people who visit our website to rate brokers that offer demo accounts for spread betting. These reviews are based on users' actual trading experiences. The scores given by users help others understand what they can expect from different brokers.

Registration on the platform

After choosing a broker, you should go to its official website and find the section dedicated to demo accounts. Typically, this section can be found in the main menu of the site or in the “Open Account” section and click on the link to open a demo account.

Filling out the registration form

A new trader will need to fill out a simple registration form, providing basic information such as first name, last name, email and phone number. Some brokers may also ask you to indicate your country of residence and create a password to access your demo account.

Confirmation of registration

After filling out the form, a letter will be sent to the trader’s email address confirming registration and instructions for activating a demo account. By clicking on this link, registration will be completed.

Access to demo account

After activating your account, the trader will have access to the broker's trading platform with virtual funds in the account. After this, the trader will have the opportunity to start trading using all the functions and tools of the platform, which will help to study the interface and work out trading strategies without financial risks.

Demo account is an ideal option for testing ideas without the risk of losses

As a trader who actively trades in financial markets and tests various brokers, I would like to share my experience in choosing demo accounts for spread betting. Research brokers thoroughly, paying attention to their reputation, regulation and platform quality. Make sure the demo account provides access to all the necessary tools and features, such as technical analysis and chart customization.

Use a demo account to safely test your trading strategies. This is an ideal platform for developing ideas without the risk of losses. It is important to evaluate how much a demo account simulates real trading conditions so that the results are as close to reality as possible.

Good customer support also plays an important role. Choose brokers with prompt and competent support service, ready to help in case of questions or problems. My experience with demo accounts has been positive and I recommend them as the first step to successful trading in the financial markets.

Our Methodology

Traders Union applies a rigorous methodology to evaluate brokers using over 100 both quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Brokers are evaluated on the breadth and depth of assets/markets available to trade.

Fees and commissions. A comprehensive analysis is done of all trading costs to analyze overall cost to clients.

Trading platforms. Brokers are assessed based on the variety, quality and features of platforms offered to clients.

Other factors like brand popularity, customer support, education resources are also evaluated

Conclusion

Choosing a suitable demo account for spread betting is an important step to successfully start trading. It is a safe and effective way to study the market, develop and test strategies. When choosing a demo account, pay attention to the reputation of the broker, the functionality of the platform and the quality of customer support. These factors will help you get the most out of your training and preparation for real trading. Using a demo account allows you to minimize risks and increase confidence in your actions in the market.

FAQs

What advantages does a demo account offer for experienced traders?

For experienced traders, a demo account provides the opportunity to test new trading strategies and approaches without the risk of financial loss. It allows them to experiment with new markets and instruments, and to evaluate the effectiveness of different technical and fundamental indicators. Additionally, it’s a convenient way to get accustomed to new features and updates of the trading platform.

How long can you use a demo account for spread betting?

The duration of a demo account usage depends on the broker's terms. Some brokers offer demo accounts with unlimited usage, while others may impose time limits, such as 30 or 60 days. It’s important to clarify this before registration to ensure you have sufficient time for learning and practice.

What are the common mistakes traders make when using a demo account?

One common mistake is not taking demo trading seriously. Traders might take excessive risks, knowing they won't lose real money, which can lead to a false sense of confidence. It is crucial to treat demo trading as seriously as real trading to better prepare for real money trading. Another mistake is not thoroughly testing strategies or fully utilizing the platform’s capabilities.

Can a demo account be used for learning team trading?

Yes, a demo account can be effectively used for learning team trading. Trading teams can jointly develop and test strategies, share results, and analyze mistakes without the risk of financial loss. This helps improve team coordination and consistency in trading decisions before transitioning to real accounts.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.