How To Use Apple Pay To Invest In Stocks

Apple Pay is a payment method integrated by stockbrokers and cannot be used as a stand-alone app to purchase stocks. Using Apple Pay to purchase stocks must be done through a brokerage, and the process is as follows:

-

Register or Log in to the stock broker client area

-

Click on Deposit

-

On the list of payment methods, select Apple Pay and enter the amount you are depositing into your account (Ensure that you are already registered for Apple Pay on the iOS device you are using for this function).

-

Follow the onscreen instructions on the next prompt to complete the transaction.

Apple Pay is a mobile payment service that offers users a low-cost, fast, and secure payment gateway to purchase several assets globally. The widespread usage of iPhones, iPads, and other Apple-made mobile devices has fueled the rising popularity of Apple Pay as a payment method for all kinds of financial transactions. Apple Pay provides a convenient way to pay for stocks: funds are typically transferred to a brokerage account, and then those funds can be used for stock trading.

So, if you are wondering how to trade stocks and shares using Apple Pay, this article is for you. You will learn how to buy stock using Apple Pay on global stock exchanges. Continue reading.

-

How to buy stock with Apple Pay?

You must utilize an Apple Pay-accepting stock trading app or platform to purchase stocks using Apple Pay. Typically, Apple Pay can be used to fund your account, and then you use those funds to purchase stocks

-

Does Apple have a stock app?

Yes, Apple does have a stock app called "Stocks app," which comes pre-installed on iPhones and iPads. This app allows users to track stock prices, view financial news, and even add stocks to their watchlists for easy monitoring.

-

How do I add stocks to my Apple App?

Adding stocks to your Apple Stocks app is easy. Simply open the Stocks app on your iPhone or iPad, tap the search icon, type in the name or ticker symbol of the stock you want to add, and then tap the "+" button next to the stock to add it to your watchlist.

Can I buy stocks with Apple Pay?

Yes. Investors can buy stocks with a reputable broker using the Apple Pay payment method. You can move money from your linked bank account or card to your investment account and use that money to purchase stocks by connecting your Apple Pay to the app.

However, not all investing platforms accept Apple Pay, so you must find out if this feature is available from your particular brokerage or app. The range of stocks you can access should be unlimited, provided the stockbroker you have chosen takes Apple Pay as a form of payment.

Let's quickly glance through one of the top brokers that traders can use to buy stock using the Apple Pay payment method.

How do I buy Stocks with Apple Pay?

You cannot purchase stocks directly with Apple Pay, but you can technically fund your trading account with Apple Pay and then purchase your preferred stocks with the funded account. Below are steps on how to buy stocks with Apple Pay.

Step 1:

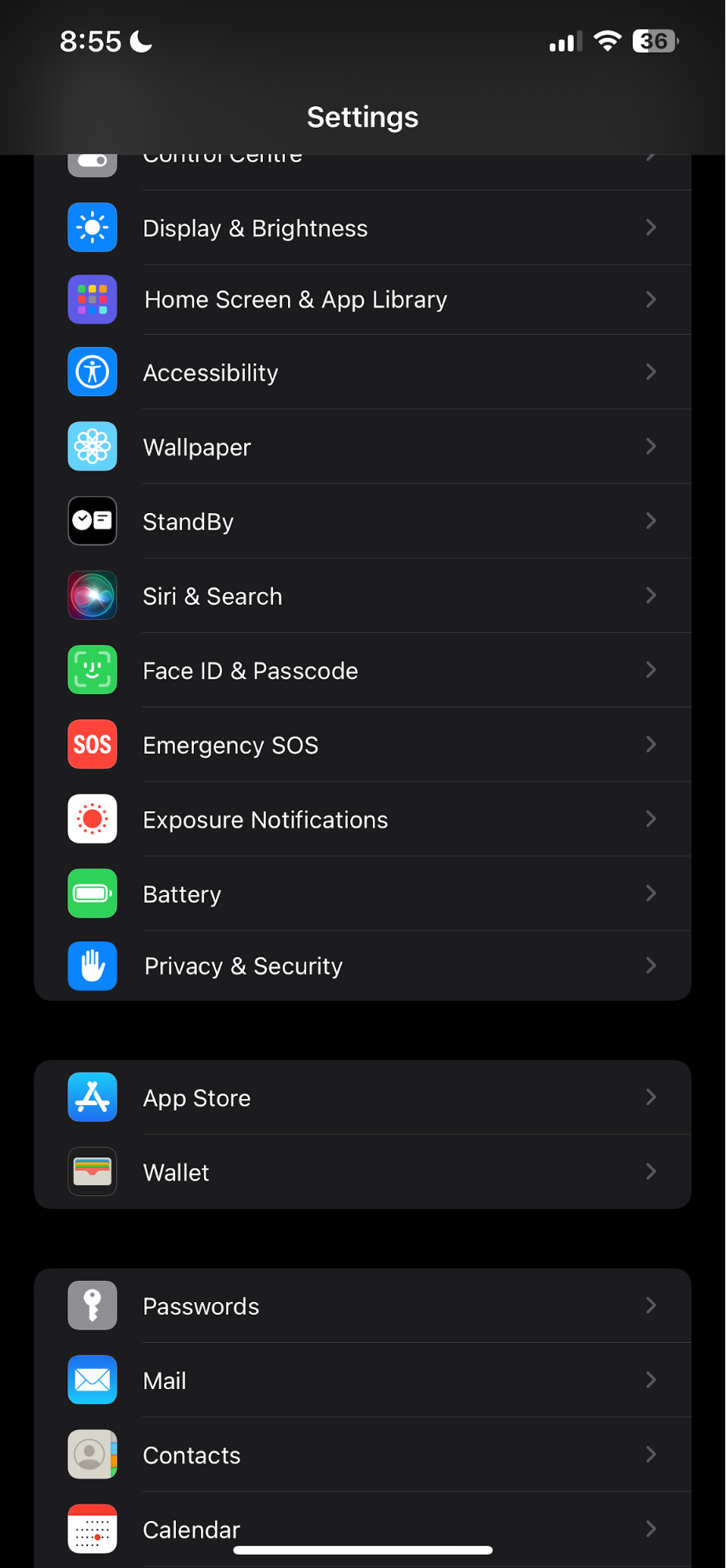

Start by configuring your iOS device's Apple Pay wallet. If you have not set up Apple Pay on your iOS devices, go to settings, find wallets, click, and enter your Apple details to add your card

Setting up Apple Pay (Click on the wallet option)

Step 2:

Proceed to add card details following the onscreen instructions to capture your credit card number, accept terms and conditions, and wait for your bank to verify your card.

Step 3:

Log in to your brokerage, click “deposit,”

Step 4:

Select Apple Pay from the list of payment options if it is available in your jurisdiction, enter the amount you wish to deposit, and confirm to be redirected to the Apple Pay payment page.

Note:

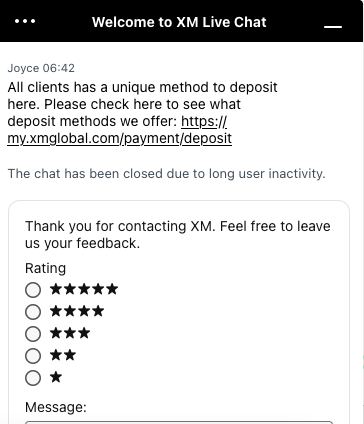

Apple Pay may not be available in all jurisdictions on some trading platforms. For example, the information provided by XM customer service when enquiring about payment options says Apple Pay will be among the options listed for clients to make payments at locations where it is available.

XM customer service response on Apple pay availability

Step 5:

Open your trading platform to buy your preferred stock as soon as the funds are available in your account. Every stock has a different ticker symbol when it trades. For instance, the stock symbol for Apple is AAPL.

Best Stock Brokers

How do I choose a stock broker?

Traders need to realize that the ease of use of Apple Pay for stock purchases depends on the broker they select. Hence, choosing a stock broker that integrates Apple Pay involves considering several factors to ensure compatibility with your preferred payment method.

Most of the brokerages that let customers purchase stocks with Apple Pay are among those governed by top-tier regulators. These brokers are user-friendly, provide the best trading services for customers, and adhere to the trading standards set by their respective regulators. XM, FP Markets, Plus500, and AvaTrade are among the top brokers that accept Apple Pay

Step 1: Research Broker Options

Begin by researching stock brokers that offer Apple Pay as a payment method. Seek out trustworthy brokers who have a solid security record. Examine the broker's track record, dependability, and adherence to regulations. Consider brokerages that have a track record of prudent financial management, are registered with respectable regulatory bodies, and place a high priority on safeguarding client funds and information. The broker's adherence to all relevant regulations and lawful operations is ensured if regulated. Verify whether the broker keeps customer funds apart from their operating accounts and whether they offer any extra security or insurance.

Step 2: Check Payment Options

For a simpler and more precise method of checking payment options, consider visiting the broker's website or reaching out to their customer support to confirm Apple Pay compatibility.

Step 3: Read Reviews

Study the feedback and endorsements left by other traders who have made use of the broker's services. Note any remarks regarding the ease of use and speed of the various payment options.

Step 4: Compare Fees and Features

Analyze the fees and commissions that different brokers are providing. Take into account elements like the caliber of the trading platform, the research and educational tools, and the customer service.

Consider whether the broker allows you to access stocks from various countries and stock indices. This could aid in portfolio diversification and allow you to keep tabs on broader market trends.

Step 5: Review the account funding procedure and the mobile application

Consider using the broker's mobile app if you trade while on the go. To fund your account and easily complete trades from your mobile device, find out if the app accepts Apple Pay. Recognize the steps involved in using Apple Pay to fund your trading account. Check to see if using Apple Pay is subject to any limitations, minimum deposit requirements, or additional costs.

Note:

It is important to choose a trading platform that is governed by top financial authorities, such as ASIC, FCA, CySEC, etc. This is because they provide a more seamless payment method, which is part of what is expected of them by these regulators. Trading platforms like XM, FP Markets, Plus500, and AvaTrade integrate numerous transparent payment methods, and Apple Pay is a top option for iOS users.

Expert opinion

Apple Pay provides individuals with iOS devices (iPhone, iPad, and Mac) an easy and convenient method for making instant deposits on stock trading platforms. It is safer for traders to deal with regulated brokers that support Apple Pay. Apple Pay offers robust security features, instilling confidence that the service's high level of security extends to online stock trades. Thus, if you already utilize Apple Pay for everyday purchases, transitioning to using it for online stock trading is seamless.

Apple maintains built-in security measures at each transaction stage, encompassing the login process, card addition, and payment or depositing to trading accounts. While Apple Pay payments are unlimited, brokers may impose caps on maximum deposits or withdrawals. Moreover, brokerages might restrict the number of transactions within a specific period. If a payment fails, refer to the broker's terms for clarification.

Summary

Apple Pay is a vital tool for contemporary investors, helping them to effectively navigate the intricacies of the stock market thanks to its user-friendly interface and broad acceptance among brokers.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).