Retail vs Institutional Investors In Modern Markets

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Retail investors have become a visible force in today’s markets, thanks to trading apps and social media. While they can drive short-term price moves, long-term market direction is still shaped by institutional investors, who trade with deeper resources, larger capital, and strategic planning. The most effective trading strategies now involve understanding where retail momentum meets institutional backing — and how to spot when the pros are quietly buying or selling.

The line between retail and institutional investors isn’t as distinct as it once was. With trading apps offering real-time market access, retail traders aren’t just following the crowd — they’re influencing prices and showing up in size. But visibility doesn’t equal control. The real story lies in how their trades align — or conflict — with institutional flows. Now that retail activity can be tracked almost instantly, the real question is how much of it holds when the professionals step in.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding investor categories

The stock market isn’t made up of just one type of trader. It includes a mix of individuals investing their own money and large institutions managing money on behalf of others. Knowing the difference between these two groups — retail and institutional investors — helps explain why markets behave the way they do.

Retail investors

Retail investors are individuals who trade using their personal capital, typically through online trading platforms designed for ease of access and low entry barriers.

They usually trade with smaller amounts of capital compared to institutions.

Decisions are often influenced by news, social media, or trending stocks.

Many aim for short-term gains, though long-term investors are common too.

They use public tools or free research, rather than advanced financial models.

Example. The 2021 GameStop surge showed the collective impact of retail investors organizing through platforms like Reddit.

Institutional investors

Institutional investors are professional entities like pension funds, hedge funds, mutual funds, and insurance companies. They manage large pools of capital for clients or shareholders.

They use deep research, financial models, and large teams of analysts.

Their trades are so large that they can impact market prices and liquidity.

Most have a long-term investment approach, focusing on consistent growth.

Institutions must comply with strict regulations and fiduciary responsibilities.

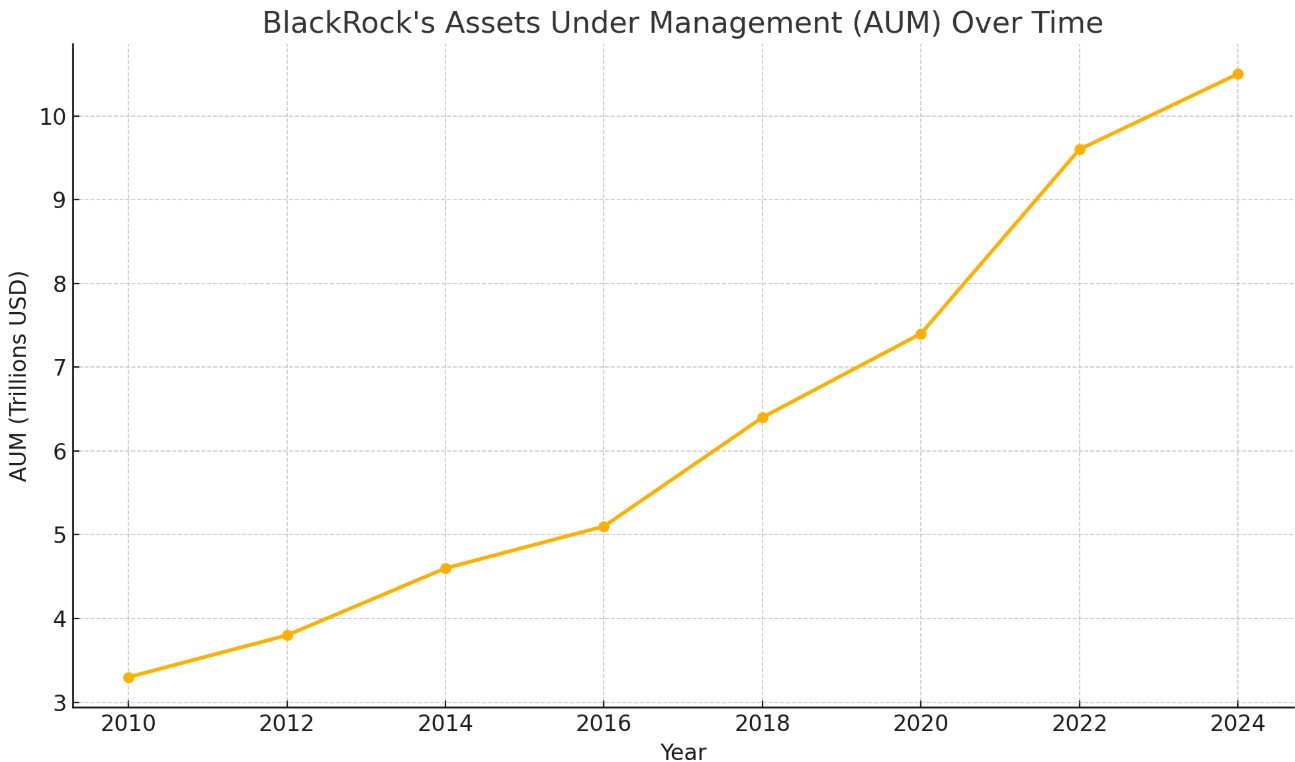

Example. Firms like BlackRock and Vanguard manage trillions of global assets, influencing nearly every part of the market.

Market influence of institutional investors

When it comes to market movement, institutional investors have serious weight. Their trades are big, their strategies are carefully planned, and their reach goes well beyond what most individual investors can imagine. Whether buying in bulk or reallocating across sectors, their decisions can move entire markets.

Trading volume and market impact

Institutional investors are behind a huge share of the action in the stock market. In fact, they’re often responsible for more than half of the total daily trading volume.

Because their trades are so large, they can shift stock prices without meaning to.

To avoid jolting the market, they often break orders into smaller pieces.

When big players make a move, other investors tend to follow, which can start major trends.

Real-world impact. If a large fund starts pulling out of tech and buying up energy stocks, that shift can ripple across the market and drive sector rotation.

Access to resources

Institutions don’t just trade with more money — they trade with better information and stronger tools.

They have teams of analysts, custom data feeds, and tools that dig deeper than most public sources.

Their decisions come from in-depth analysis, not just market chatter.

Many even talk directly to company executives or attend private events, giving them early insight into changes that may affect a company’s outlook.

While an individual investor might check the news and earnings reports, institutions are already several steps ahead — tracking supply chains, monitoring geopolitical risks, and watching market flows in real time.

Emergence and impact of retail investors

Retail investors have gone from sitting on the sidelines to stealing the spotlight. Thanks to mobile apps and social media, more individuals are jumping into the market — and they’re not just following the trends anymore. Sometimes, they’re setting them.

Rise of trading platforms

Trading platforms have changed the game, making it simple for anyone to start trading. You don’t need a finance degree or a large bankroll — just a phone and an internet connection.

With zero-commission trades, there’s no cost to get started.

The apps are easy to use, even if you’ve never traded before.

You can buy tiny pieces of big-name stocks, making the market more approachable.

This kind of access has welcomed millions of new investors, many of whom are learning, trading, and building wealth from their phones.

Collective influence

Retail investors used to trade alone. Now, they share strategies, hype stocks, and coordinate moves in real-time through social media. That’s added a whole new layer of energy — and unpredictability — to the market.

Online communities like WallStreetBets have shown that when retail traders work together, they can move stock prices in a big way.

Real-time chat, live streams, and short-form videos make it easy to spread trade ideas and news fast.

From GameStop to meme stocks, retail investors have proved that they’re a force to be reckoned with.

This kind of collective action has forced even the biggest institutional players to pay attention — and sometimes rethink their approach.

Emergence and impact of retail investors

Retail investors have gone from sitting on the sidelines to stealing the spotlight. Thanks to mobile apps and social media, more individuals are jumping into the market — and they’re not just following the trends anymore. Sometimes, they’re setting them.

If you're a retail trader looking to better understand market behavior, it’s important to choose a broker that offers transparency, real-time data access, and strong analytical tools. We’ve selected a list of brokers that cater to both beginners and experienced traders — helping bridge the knowledge gap between retail and institutional activity.

| Foundation year | Account min. | Demo | Deposit Fee | Withdrawal fee | Inactivity fee | Android | iOS | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2007 | No | Yes | No | $25 for wire transfers out | $50 | Yes | Yes | FINRA, SIPC | 7.63 | Open an account Via eOption's secure website. |

|

| 2014 | No | No | No | No charge | No inactivity fees | Yes | Yes | FCA, FSCS, OSC, BCSC, ASC, MSC, IIROC, CIPF. | 7.39 | Open an account Via Wealthsimple's secure website. |

|

| 2015 | No | No | No | No charge up to a limit | Not specified | Yes | Yes | FCA, SEC, FINRA | 7.69 | Study review | |

| 1978 | No | Yes | No | No | No | Yes | Yes | FCA, ASIC, MAS, CFTC, NFA, CIRO | 7.45 | Open an account Your capital is at risk. |

|

| 2011 | No | No | No | $25 for wire transfers out | $25 | Yes | Yes | FINRA, SIPC, FinCEN | 7.33 | Study review |

Comparative analysis retail vs institutional investors

Retail and institutional investors often look at the same market — but they play the game in very different ways. Institutions bring strategy and size. Retail investors bring speed and emotion. Each group reacts differently to opportunities and risks, which is part of what keeps markets moving.

Decision-making processes

Institutional investors usually have teams of analysts, risk managers, and portfolio strategists guiding every move. Their trades are often the result of long discussions, data crunching, and big-picture thinking.

Their approach is based on research and long-term objectives.

Decisions are made methodically — not on gut feeling or hype.

They invest with patience and discipline, even when markets get noisy.

Retail investors, meanwhile, often make choices on the fly. Some do plenty of research — but many are influenced by news headlines, Reddit threads, or trending charts.

They’re more likely to jump into trades quickly, especially when something’s getting attention.

Emotions play a bigger role — excitement or fear can lead to fast decisions.

Some aim to grow wealth over time, but many are just trying to catch the next big move.

Market reaction

Institutional trades tend to be slow, steady, and under the radar. Even when they’re moving millions, they often do it in a way that doesn’t rattle the market.

Their buying and selling adds stability and liquidity, which helps prices stay grounded.

Big moves from institutions can still shift prices — but it’s usually measured and intentional.

Retail investors, on the other hand, can cause big short-term swings, especially when they move together.

A rush of retail buying can send a stock soaring in hours.

Panic selling can trigger sharp drops in a matter of minutes.

Even small trades can make a big impact when thousands of retail traders act at once.

Case studies

Some events have reshaped how we think about retail investors. Two in particular — the GameStop short squeeze and the surge in trading during the COVID-19 pandemic — show just how much individual traders can influence the market when they move together.

GameStop short squeeze

In January 2021, a group of retail investors rallied behind GameStop, a struggling video game retailer. What started as a discussion on Reddit quickly turned into a full-blown market moment.

Big hedge funds had heavily shorted the stock, betting its price would fall.

Retail traders started buying shares en masse, driving the price up and forcing short sellers to buy back in — sending the stock even higher.

GameStop went from a forgotten stock to one of the most talked-about assets in the world, soaring more than 1,500% in just weeks.

This wasn’t just about profits — it was about retail investors proving they could move markets too.

COVID-19 pandemic trading surge

When the pandemic hit, millions of people were stuck at home, some with stimulus checks and time to spare. Many turned to the stock market — and trading apps made it easy to jump in.

Stocks tied to stay-at-home life — like Zoom and Peloton — became retail favorites.

Crypto and meme stocks gained steam, thanks to viral content and online communities.

Platforms like Robinhood saw millions of new accounts, as trading became more social, more accessible, and more popular.

During this time, retail traders weren’t just following the market—they were helping lead the charge, often outpacing institutional activity.

The hidden gap between retail momentum and institutional strategy

One of the biggest misconceptions new traders have is thinking retail buyers can outmuscle the big players. Retail traders can absolutely move prices in the short term — just look at meme stock rallies — but unless big institutions get behind those moves, they usually fizzle out.

Institutional investors aren't following hype — they’re tracking things like liquidity, slippage, and execution. If you want to understand what really drives a stock longer-term, don’t follow social trends. Dig into where funds are shifting — 13F filings, ETF rotation, or even sudden volume in dark pools can tell you where the real money’s going.

Another thing beginners often overlook is the difference in timeframes. Retail traders usually think in hours or days, while institutions are planning months ahead. That mismatch is where a lot of smaller traders get caught. A stock might look like it’s on fire because of sudden interest online, but if big funds are selling quietly into that strength, it’s already losing steam.

The trick isn’t just spotting volume — it’s understanding who’s behind it. If the buying looks strong but institutional selling is happening under the surface, it won’t last. Knowing the difference can save you from getting in late and exiting even later.

Conclusion

Retail traders have never been more visible, but institutions still carry the most weight when it comes to long-term market direction. The key isn’t picking a side — it’s knowing how and when their strategies overlap. Retail can drive big short-term moves, but it’s the institutional follow-through (or lack of it) that decides whether those moves stick. If you’re just following what’s hot online, you’re reacting, not reading the real play. But if you learn to watch how the big money responds — and when it doesn’t — you’ll be trading with a lot more clarity than most people on the screen.

FAQs

How has technology affected retail investing?

Technology has made retail investing more accessible by removing high fees and providing easy-to-use trading platforms. This has encouraged more individuals to participate in the stock market directly.

Are institutional investors always more successful than retail investors?

Institutional investors are not always more successful than retail investors because outcomes depend on timing, discipline, and strategy. Even with fewer resources, retail investors can still outperform with smart decisions.

What risks do retail investors face?

Retail investors face risks like emotional trading, limited access to deep research, and following market trends without proper analysis. These challenges can lead to poor investment choices and higher losses.

How can retail investors mitigate risks?

Retail investors can reduce risks by learning the basics, spreading their investments across sectors, and avoiding impulsive decisions based on trends or news. Staying disciplined helps protect long-term gains.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A short squeeze is a situation in which short sellers are forced to close their positions at a loss, which leads to a sharp rise in the price of an asset.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.