Key Lessons From Rich Dad Poor Dad

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Key lessons from "Rich Dad Poor Dad" by Robert Kiyosaki:

"Rich Dad Poor Dad" by Robert Kiyosaki is a personal finance classic that has influenced millions of readers worldwide. The book contrasts the financial philosophies of Kiyosaki's two "dads" – his biological father (Poor Dad) and his best friend's father (Rich Dad). This narrative serves as a foundation to impart crucial financial lessons, highlighting the differences between working for money and making money work for you. Understanding these lessons is crucial in today's economy, where financial literacy is often the key to financial independence.

Key lessons from "Rich Dad Poor Dad"

1. The rich don't work for money; they make money work for them

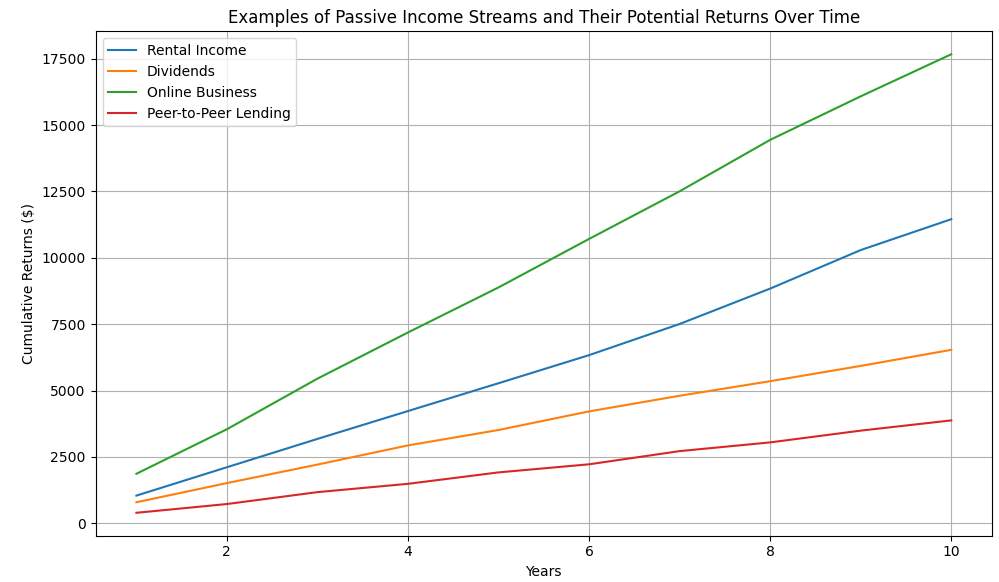

Kiyosaki explains that wealthy individuals focus on creating systems that generate passive income, unlike those who work for a paycheck. Passive income streams, such as rental properties, dividends from stocks, and businesses, can provide financial security and independence.

Steps to generate passive income:

Invest in real estate. Purchase properties that can generate rental income.

Invest in stocks and bonds. Create a diversified portfolio that includes dividend-paying stocks.

Start a business. Develop a business that can run independently of your daily involvement.

2. Importance of financial literacy

A fundamental principle in "Rich Dad Poor Dad" is the distinction between assets and liabilities. Assets put money in your pocket, while liabilities take money out. Kiyosaki emphasizes that many people struggle financially because they do not understand this difference.

Steps to improve financial literacy:

Read financial books. Start with "Rich Dad Poor Dad" and expand to other financial literature.

Take courses. Enroll in courses on finance and investment.

Use financial tools. Utilize apps and tools for budgeting and investment tracking.

3. Mind your own business

Kiyosaki advises focusing on building and acquiring assets rather than just increasing income from a job. He suggests thinking of your dollars as employees working hard to earn more money for you.

Steps to start your own business or invest wisely:

Identify opportunities. Look for gaps in the market where you can offer a unique product or service.

Business planning. Develop a comprehensive business plan outlining your goals and strategies.

Wise investments. Research and invest in assets that have the potential to appreciate over time.

4. The power of corporations

One of the key lessons is understanding how the rich use corporations to protect and grow their wealth. Corporations offer tax advantages and legal protections that individuals do not have.

Steps to create and leverage a corporation:

Consult a professional. Speak with a lawyer or accountant to understand the legal and financial implications.

Incorporate your business. Choose the right type of corporation for your business needs.

Leverage tax benefits. Use the corporation's ability to deduct expenses before taxes to minimize tax liability.

5. The rich invent money

Kiyosaki emphasizes the importance of seeing opportunities where others see obstacles. Innovation and creativity are crucial for financial success.

Steps to develop a mindset for innovation:

Brainstorm regularly. Set aside time for brainstorming new ideas and solutions.

Learn continuously. Stay updated with industry trends and new technologies.

Network. Connect with other entrepreneurs and innovators to exchange ideas.

To invest comfortably, you need to find a reliable broker. Compare brokers based on fees, services, and reliability. Look for brokers with good reputation, user-friendly trading platforms, and customer support. Compare brokers based on fees, services, trading assets, and reliability.

| Demo | Min. deposit, $ | Max. leverage | PAMM | Managed | Investor protection | Open account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | No | No | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | Yes | No | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | No | No | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | No | No | £85,000 | Study review | |

| Yes | No | 1:30 | No | Yes | $500,000 £85,000 | Open an account Your capital is at risk. |

6. Work to learn, not to earn

Instead of working solely for a paycheck, Kiyosaki advises working to learn. This approach leads to acquiring skills that can provide financial benefits in the long run.

Steps to acquire new skills for financial success:

Take on challenging roles. Look for job roles that challenge you and help you learn new skills.

Attend workshops. Participate in workshops and seminars relevant to your career.

Seek mentorship. Find mentors who can provide guidance and knowledge.

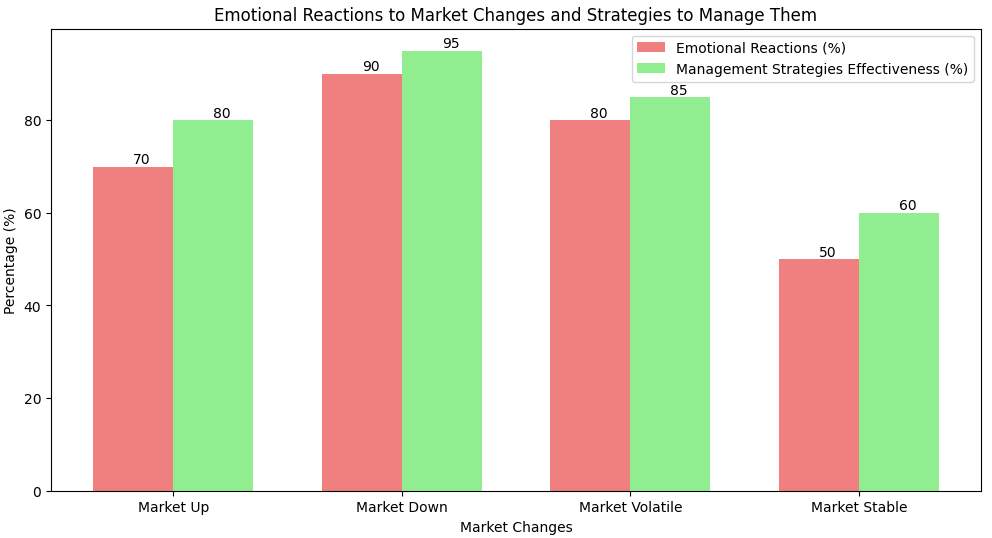

7. Overcoming emotional barriers

Investing and managing money often involves dealing with emotions like fear and greed. Kiyosaki stresses the importance of emotional resilience.

Steps to develop emotional resilience:

Mindfulness practices. Engage in activities like meditation to maintain emotional balance.

Set clear goals. Define your financial goals to stay focused during market fluctuations.

Long-term perspective. Maintain a long-term view to avoid making impulsive decisions.

Additional key insights

Robert Kiyosaki emphasizes several key insights beyond the primary lessons in "Rich Dad Poor Dad." These findings underscore the importance of teaching children early on how to handle money properly, developing effective psychological patterns of an abundance mentality rather than a scarcity.Real-life examples of individuals who have successfully applied these lessons can provide additional inspiration and practical insights.

Teaching children about money early

Kiyosaki stresses that financial education should start at a young age. Teaching children about money management, savings, investments, and the value of financial independence can set them up for future success. Simple activities like like spending pocket money wisely, encouraging saving, and explaining basic financial concepts can be incredibly beneficial.

Mindset of abundance vs. scarcity

The mindset you adopt can significantly impact your financial success. An abundance mindset focuses on opportunities and growth, while a scarcity mindset is rooted in fear and limitation. Kiyosaki encourages readers to embrace an abundance mindset to unlock their full potential and achieve financial freedom.

How much can I earn?

Setting realistic expectations for earnings and understanding the factors that influence potential income is crucial. The potential earnings from applying the lessons from "Rich Dad Poor Dad" can vary widely based on several factors including the investment strategy, initial capital, market conditions, and individual skills and efforts. Here, we will explore different investment strategies and provide case studies to illustrate the range of possible outcomes.

Initial capital. The amount of money you start with can significantly impact your potential earnings. Larger investments typically yield higher returns.

Market conditions. Economic and market conditions can influence the performance of investments. Diversification can help mitigate risks.

Skill and knowledge. Your understanding of the market and investment strategies plays a critical role in maximizing returns.

Time horizon. Investments generally perform better over the long term. Patience and a long-term perspective can enhance potential returns.

Risk tolerance. Higher risk investments can offer higher returns, but they also come with a greater chance of loss.

Keep in mind: all of these factors were nearly optimal for Kioisaki personally to form his current financial principles and abundance mentality. These factors may be less favorable, so the path to financial abundance and the challenges along the way are individual to each individual.

Valuable lessons to transform your financial life

"Rich Dad Poor Dad" offers valuable lessons that can transform your financial life. By understanding the difference between working for money and making money work for you, improving financial literacy, and focusing on building assets, you can set yourself on the path to financial independence. The book also emphasizes the power of corporations, the importance of continuous learning, and overcoming emotional barriers in investing.

I think that "Rich Dad Poor Dad" is not just a book about financial success; it's a guide to changing your mindset and adopting principles that can lead to long-term wealth. By reading this book, you gain valuable insights into managing money. The most important advice from this book that is worth listening to is: “The rich invent money.” The minimum investment that I personally make monthly is 10-20% of the income.

Conclusion

Incorporating these lessons into your life can lead to a more secure financial future. Teaching these principles to children early on can set them up for success as well. By following the expert advice and staying informed, you can effectively apply these lessons and achieve your financial goals.

Remember, the journey to financial freedom requires patience, continuous learning, and a proactive approach to managing your finances. Start today, and take control of your financial destiny.

FAQs

How can I start investing in real estate with little money?

You can start investing in real estate with limited funds by exploring options like Real Estate Investment Trusts (REITs), which allow you to invest in real estate properties through shares, or by participating in real estate crowdfunding platforms that pool money from multiple investors to fund property investments.

Is it better to pay off debt or invest my money first?

It depends on the interest rates and your financial goals. Generally, if the interest rate on your debt is higher than the expected return on investments, it makes sense to pay off debt first. However, balancing debt repayment with investing can also help build wealth over time.

What are the best assets to invest in for passive income?

Some of the best assets for generating passive income include rental properties, dividend-paying stocks, bonds, peer-to-peer lending, and creating digital products like eBooks or online courses that can generate ongoing revenue.

How do I protect my investments during a market downturn?

To protect your investments during a market downturn, consider diversifying your portfolio across different asset classes, maintaining a long-term investment strategy, and having a portion of your portfolio in safer investments like bonds or cash equivalents. It’s also important to avoid panic selling and stick to your investment plan.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.