The Truth About The Success Rate And Win Rate Of The Forex Robot

In trading, success rates of 50-60% for long-term trading systems and 70-80% for intraday trading systems are considered to be good values. However, some Forex trading robots on the market claim a success rate of 95% or even higher, in which case you should be wary, because:

-

it could be a marketing gimmick. The higher the success rate of a Forex robot, the more likely people will want to buy it

-

the deposit decrease from 5% of losing trades may exceed the frequent and small deposit increases from 95% of profitable trades

Many traders are drawn by Forex robots, believing they can effortlessly profit while letting the system do all the work. However, the majority of robots fail to produce sustainable returns in the long term. They may advertise impressive winning percentages, but beneath the surface, they use hazardous strategies that can quickly wipe out accounts after an initial period of gains.

Attracted by claims of easy passive income, traders are often attracted to Forex robots that promise high, consistent profits with little effort required. However, most automated systems lack the risk management necessary for lasting success. While good short-term results can be obtained, excessive risks usually lead to catastrophic losses over time. This article discovers the truth about the Forex robot's success rate.

-

What is the success rate in Forex?

The success rate of a Forex robot can be interpreted as the percentage of profitable trades. Estimates suggest that only 5% to 10% of Forex traders succeed, indicating that most lose money.

-

What is the win rate in Forex?

The win rate is typically used to describe the percentage of winning trades out of the total trades. For Forex traders, aiming for a win rate between 50% and 70%, a win/loss ratio above 1.0, and a risk/reward ratio below 1.0 is generally favorable.

-

Are Forex bots successful?

Forex trading robots often generate profits in the short term, but their long-term performance is mixed. This variation occurs because these robots are automated to operate within specific ranges and follow trends. Consequently, sudden price movements can erase the short-term profits they make.

-

Can a Forex robot make money?

Forex robots' effectiveness in generating profits varies significantly based on several factors, such as the robot's quality, its trading strategy, market conditions, and its ability to identify and follow a strong trend.

What is the success rate and win rate of the Forex robot

The success rate shows the percentage of profitable trades for the robot. It is calculated by dividing the profitable trades by the total trades and converting them to a percentage.

Win Rate of this Forex robot is very optimistic

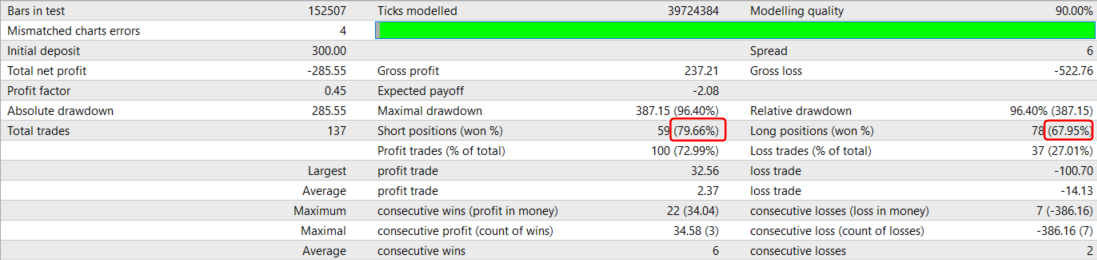

In the image, there were 137 total trades made by the robot. Of those, 100 trades were profitable. 100 divided by 137 is 0.7299. Converted to a percentage, this is 72.99%. So, the success rate is 72.99%, meaning about 73% of all trades resulted in a profit.

The win rate looks specifically at the percentage of winning short and long trades. Short trades are when the robot bets the price will fall. Long trades bet the price will rise.

For short positions, the robot won 59 out of 74 trades. 59 divided by 74 is 0.7966, or 79.66%. This means the robot won about 80% of the time when taking short positions.

For long positions, 78 out of 115 trades were profitable. 78/115 is 0.6795, or 67.95%. So, the win rate for long trades was around 68%.

The success and win rates show how accurately the robot predicts price movement. However, high percentages do not guarantee overall profitability. If losing trades have large losses, they can outweigh many smaller wins. Here, the net profit was negative, suggesting poorer risk management.

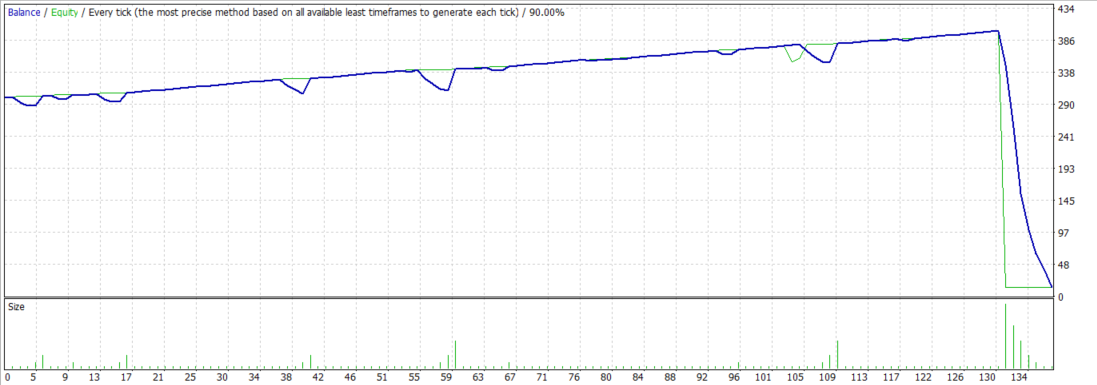

The Forex robot failed to succeed

What not to confuse the concepts of success rate and win rate, let us explain the essence without using them - in simple words, if a Forex trading robot demonstrates frequent profitable trades, it is not a guarantee that this will continue for a long time. Sooner or later conditions may arise under which the robot will make only a few trades with a catastrophically large loss.

Best Forex Brokers in 2024

How to increase the success rate and win rate of the Forex robot?

Rather than focusing solely on win rate, traders should extensively backtest robot performance across many years of historical data focusing on risk-adjusted returns. Forex robots can generate lasting profits with prudent risk controls and avoiding systems that promise unrealistically high win rates. But this requires appropriate logical design and development. Impressive short-term metrics alone are meaningless if the underlying strategies rely on excessive risk, inevitably leading to failure. Sustainable success comes from managing risk, not simply entering winning trades.

Here are some tips to improve the long-term profitability of Forex robots:

-

Don't chase high win rates over sound logic. A 60% win rate with strict risk controls can easily outperform 90%+ systems in the long run

-

Avoid strategies like martingale and grid trading that inevitably blow accounts despite short-term profits

-

Thoroughly backtest the robot over long historical periods encompassing many market conditions

-

Be sure to include in the robot's algorithm elements of fundamental analysis, of news and economic indicators, as well as options of robot's actions in force majeure situations

-

Use programming languages like Python or AI tools like ChatGPT to code robots with robust logic and money management. This way you will better understand the logic of how the robot works and will be able to avoid buying from unscrupulous sellers

-

Implement strong risk management rules, including position sizing, stop losses, maximum drawdown limits, and proper leverage

The problem is that many Forex robot sellers optimize systems with inflated short-term win rates to make sales. But these often rely on risky strategies that lead to account blow-ups after the initial winning period. True sustainable success comes from managing overall risk, not simply entering consistently profitable trades.

To get ideas on how to choose the best forex trading robot for you, read the article: Best Forex EA | Forex Expert Advisors Review.

Conclusion

While Forex robots can generate high percentages of winning trades in the short term, their overall long-term success rate is typically poor. With proper implementation of money management, risky strategies produce sustainable results - accounts may grow quickly at first but are prone to suffer catastrophic losses in the long run.

Team that worked on the article

Upendra Goswami is a full-time digital content creator, marketer, and active investor. As a creator, he loves writing about online trading, blockchain, cryptocurrency, and stock trading.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).