Richest Traders In Switzerland: Insights And Success Stories

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The richest Forex traders in Switzerland are:

Urs Schwarzenbach: a billionaire Forex trader and art collector known for his significant wealth in Swiss financial circles.

Felix Zulauf: a prominent hedge fund manager and forex strategist with decades of experience in global markets.

Marc Rich: legendary commodities and forex trader, founder of Glencore, and a pioneer in global trading strategies.

Tito Tettamanti: a seasoned investor and forex enthusiast with a diversified portfolio spanning multiple industries.

Hans-Peter Wild: a successful entrepreneur and forex investor, known for his ownership of Capri-Sun and business acumen.

Switzerland, with its robust financial system, strong currency, and reputation for stability, has emerged as a key hub for successful Forex traders. But who are these individuals, and how did they achieve their fortunes? In this article, we’ll explore the lives and strategies of the richest Forex traders in Switzerland, offering insights that can inspire both novice and experienced traders.

Richest Forex traders in Switzerland

Urs Schwarzenbach

Urs Schwarzenbach is arguably the most renowned Forex trader in Switzerland. Born in 1948, Schwarzenbach’s journey to wealth began in the 1970s when he started trading currencies. He leveraged the Swiss Franc’s stability and his sharp understanding of global markets to build a fortune estimated to be over $1 billion.

Key strategies and achievements:

Long-term investments: Schwarzenbach is known for his long-term perspective on currency trading. Unlike many traders who focus on short-term gains, he often holds positions through market fluctuations, betting on broader economic trends.

Diversification: Beyond Forex, Schwarzenbach has diversified his wealth into real estate, particularly in the UK, and owns valuable art collections.

Philanthropy: Despite his wealth, Schwarzenbach remains somewhat of a private individual but is known for his contributions to cultural and charitable causes.

Felix Zulauf

Another prominent name in the Swiss Forex trading landscape is Felix Zulauf. With decades of experience, Zulauf has made a name for himself as both a trader and an investor. His career began in the 1970s when he joined Swiss Bank Corporation as an analyst, eventually moving into trading.

Key strategies and Achievements:

Macro trading: Zulauf is a macro trader, focusing on the big picture of global economic trends. He uses his deep understanding of macroeconomics to make strategic bets on currency movements.

Founder of Zulauf Asset Management: In 1990, he founded Zulauf Asset Management, where he managed a global macro hedge fund that delivered strong returns for his clients.

Media presence: Zulauf is also known for his insightful commentary on financial markets, often appearing in global financial media to share his views.

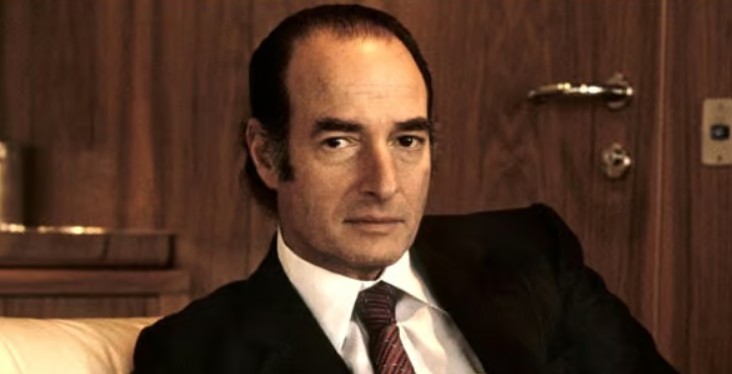

Marc Rich

Marc Rich, though originally from Belgium, made his mark on the global financial scene from Switzerland. Rich was involved in commodities trading but also had significant dealings in Forex markets due to his international trading operations. He played a crucial role in modernizing commodity and currency trading.

Key strategies and achievements:

Commodities and Forex integration. Marc Rich's approach blended commodity trading with currency hedging, making him a key figure in Forex markets, especially during volatile times for currencies like the Swiss Franc.

Founder of Glencore. Rich founded Glencore, a trading powerhouse, which involved a vast number of Forex deals due to its global operations.

Impact on global trade. Despite controversies, Rich's methods shaped modern trading and currency exchange, influencing how multinational corporations hedge their currency risks today.

Tito Tettamanti

Tito Tettamanti is a well-known Swiss financier with significant influence in both equity and Forex markets. His wealth stems from his strategic investments and his deep knowledge of global currency flows, making him a notable figure in the Swiss financial landscape.

Key strategies and achievements:

Global macro trading. Tettamanti’s ability to assess and anticipate global macroeconomic shifts, including currency movements, has made him successful in Forex.

Founder of Lupa Systems. Through his investment firm, Lupa Systems, he has traded a wide range of asset classes, including currencies, contributing to his overall wealth.

Philanthropy and legacy. Despite his low profile, Tettamanti has been influential in shaping Swiss financial markets, including currency trading, and is known for his philanthropic efforts in Switzerland.

Hans-Peter Wild

Hans-Peter Wild, a Swiss entrepreneur and investor, is known for his involvement in various industries and his influence in global financial markets, including Forex. Although primarily recognized for his role in the food industry, Wild has diversified into multiple asset classes, including currencies, due to his international business dealings.

Key strategies and achievements:

Hedging and currency management. Wild’s companies, including the famous Wild Flavors, operate across multiple countries, requiring effective currency hedging strategies to manage risks in Forex markets.

Diversified portfolio. His investments span industries and include currency trading as part of a broader strategy to grow his wealth and protect his business from Forex volatility.

Global reach. His international business dealings, particularly in emerging markets, have positioned him as a key player in managing currency risks and trading opportunities.

How to evaluate and emulate successful traders

What makes these traders successful? The common thread among them is a deep understanding of macroeconomic trends, a long-term perspective, and a diversified approach to investment. They also share a strong connection to Switzerland’s stable financial environment, which provides a secure base for their global trading activities.

To emulate their success, consider the following:

Get a good handle on your own risk-reward balance. Don’t just stick to the standard 1:3 ratio. Instead, track how much risk you’re willing to take based on your past trades and adjust accordingly.

Skip the common setups everyone talks about. Perfect patterns are overrated because everyone else is seeing the same thing. Try something different, like focusing on volatile market moves that others might overlook.

Create a personal way to manage emotions. Trading can be emotional, but telling yourself to "stay calm" isn't enough. Know your triggers and have a way to step back when emotions run high, like taking a quick break after a loss.

Learn smartly from mentors. Don’t just copy trades - dig into why certain moves are made and figure out when to follow indicators, and when to ignore them. This makes you much more adaptable.

Key tips for beginners

Leverage price action analysis for better entry points. Instead of just relying on typical indicators, take the time to understand price action – like how the market reacts to levels of support and resistance. Candlestick patterns can tell you a lot about what buyers and sellers are up to, and this insight helps you choose smarter entry and exit points. Trust your gut when the market shows its cards.

Build a personal risk profile based on your emotions. Forex isn't just numbers on a screen; it’s about your mental resilience. Before diving into trades, think about how much loss you can personally handle. You don't want to be in a position where a losing streak makes you panic. Success here isn't about huge wins but avoiding moves that make you act impulsively out of frustration or fear.

Backtest your strategy against crazy market events. Instead of backtesting your trades in calm markets, put your strategy to the test during wild times – like the financial crisis in 2008 or the volatility during 2020. If your strategy can survive those shocks, you’re in good shape. This shows if your plan can handle the market’s unexpected twists and turns.

Understand how interest rates mess with currency pairs. A lot of people skip over this, but how countries’ interest rates compare can really mess with currency pairs. Learning about central bank policies and staying ahead of their rate hikes or cuts can give you some serious insight into where the market might go long-term.

Choosing a reliable broker. Look at how easy it is to get your money out. It’s not just about getting low spreads or fancy trading platforms. What really matters is whether the broker makes it easy for you to pull your money out when you need it. Look for brokers who are straight-up about their withdrawal process. The last thing you want is to fight with customer support when you’re trying to get your cash during a market dive. The best options have been shortlisted and presented for you below:

| FINMA | Demo | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | No | 1:30 | 0,2 | 0,9 | £85,000 €20,000 CHF 100,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 1:200 | 0,1 | 0,3 | CHF 100,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 1:400 | 1,1 | 1,7 | £85,000 €20,000 SGD 75,000 HKD 500,000 CHF 100 000 | Open an account Between 70 and 80%

of retail investors are losing money when trading forex instruments and CFDs. |

|

| Yes | Yes | 100 | 1:1000 | 0,1 | 0,3 | £85,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 1 | 1:200 | 0,6 | 1,2 | £85,000 €100,000 SGD 75,000 | Study review |

Risks and warnings

Forex trading, while potentially profitable, is fraught with risks. Even in a stable environment like Switzerland, traders must be aware of the inherent volatility in currency markets.

Key risks to be aware of:

Market volatility. Currency values can fluctuate rapidly, leading to significant potential losses.

Regulatory risks. Changes in financial regulations, both in Switzerland and globally, can impact trading activities.

Fraud and scams. Be cautious of unregulated brokers or trading schemes that promise guaranteed returns.

Pros and cons of trading Forex in Switzerland

- Pros

- Cons

Stable economy: Switzerland’s economic stability offers a secure environment for Forex trading.

Advanced financial infrastructure: traders have access to world-class banking and trading services.

Regulation: strict regulations by FINMA ensure a fair trading environment.

High competition: the Swiss market is competitive, requiring traders to be highly skilled.

Regulatory challenges: navigating the strict regulatory environment can be complex.

Tax implications: understanding and complying with Swiss tax laws is essential for traders.

Choose FINMA-regulated brokers to play it safe

For traders in Switzerland, a powerful but less-discussed approach is to take advantage of the Swiss Franc’s reputation as a safe-haven currency. Switzerland’s economy is super stable, and during times of global chaos - like political conflicts or big market crashes - the Swiss Franc often gets stronger. By keeping an eye on world events and how they impact the demand for CHF, you can make smart moves with pairs like USD/CHF or EUR/CHF. Essentially, you’re looking to ride the wave of money flowing into Switzerland when things get rocky around the world.

Another key tip is to choose FINMA-regulated brokers to play it safe. Switzerland’s financial watchdog, FINMA, enforces some of the toughest rules out there, so working with these brokers can give you peace of mind. Use this advantage to reduce risk by keeping leverage under control. Also, many Swiss brokers offer advanced platforms like MetaTrader 5, where you can set up custom trading strategies tailored to your needs, especially when trading Swiss Franc pairs.

Summary

Switzerland, with its robust financial system and strong currency, has produced some of the most successful Forex traders in the world. By studying their strategies and understanding the unique aspects of trading in Switzerland, you can improve your chances of success in this challenging yet rewarding market.

FAQs

What are the most popular currency pairs traded by Swiss Forex traders?

Swiss traders often trade major currency pairs like EUR/CHF, USD/CHF, EUR/USD, and GBP/CHF due to their liquidity and the strong presence of the Swiss Franc in these pairs.

Can I use leverage in Forex trading in Switzerland?

Yes, leverage is available, but it is regulated. The maximum leverage offered by Swiss brokers typically ranges from 1:30 to 1:100, depending on the broker and the type of account.

Can I open a Forex trading account in Switzerland as a non-resident?

Yes, non-residents can open a Forex trading account in Switzerland, but they may need to provide additional documentation and comply with Swiss anti-money laundering regulations.

What is the minimum deposit required to start trading Forex in Switzerland?

The minimum deposit varies by broker, but it typically ranges from CHF 100 to CHF 1,000, depending on the broker's account types and services.

Related Articles

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.