Jesse Livermore's Trading Strategy and Philosophy

The basis for Jesse Livermore's trading strategy was the concept behind "market trend analysis”. Livermore made extensive use of technical analysis and market psychology and became known for his uncanny ability to foresee market trends and reversals.

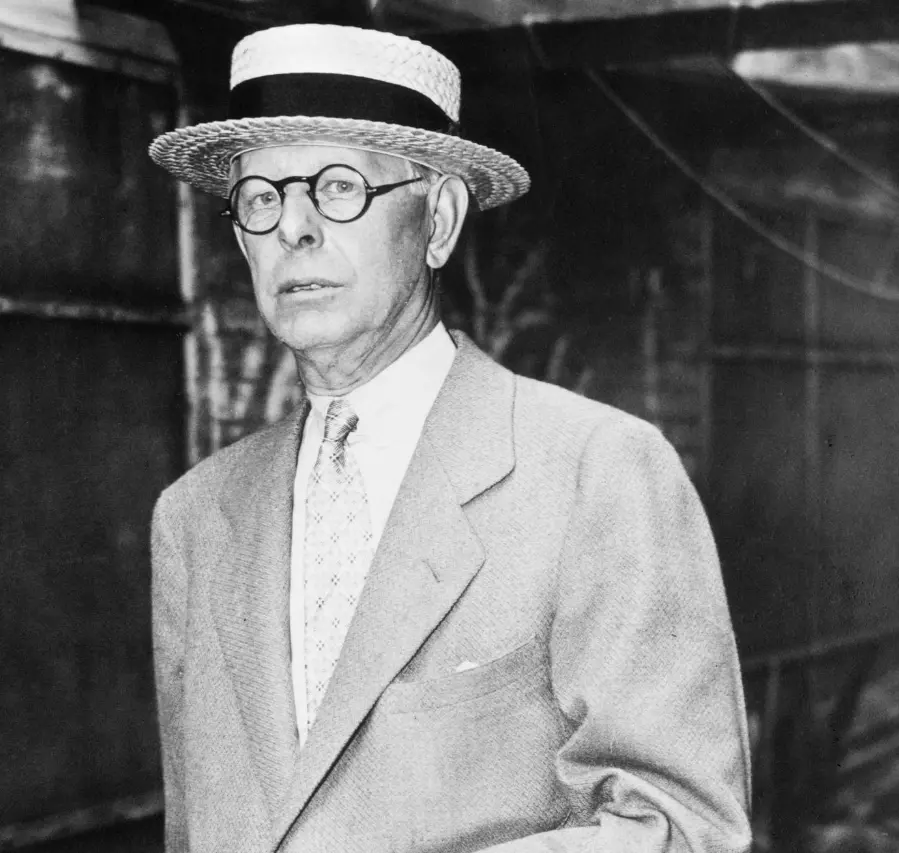

Jesse Livermore is a name you must not overlook when enumerating the top stock traders whose accomplishments to date continue to serve as a great inspiration for young traders. Jesse Livermore is remembered in the annals of Wall Street as one of the most well-known and significant traders, both in the positive and difficult facets of stock trading. If you have never been excited when reading about the legends of stock trading, Jesse Livermore's trading strategy and general investing lifestyle will thrill and motivate you.

For beginners, the experience of Jesse Livermore can help them in different aspects of stock trading, starting with selecting shares to purchase and understanding how to sell them for a profit. Professionals will benefit from knowing how to make wise choices and which stocks will withstand various economic meltdowns.

The tale of Jesse Livermore, who gained notoriety on Wall Street for foreseeing market declines, contains additional lessons. This article will reveal everything you need to know about Jesse Livermore's trading strategy, books, and quotes.

Who is Jesse Livermore?

| Name | Jesse Lauriston Livermore |

Date of birth |

July 26, 1877 |

Country |

United States of America, Massachusetts |

Education |

Elementary level |

Marriage status |

Married |

Occupation |

Stock trader |

Date of Death |

November 28, 1940 |

Jesse Livermore is an American stock trader notable for his extraordinary trading successes and financial failures. Livermore, who was born on July 26, 1877, in Shrewsbury, Massachusetts, could only attend elementary school before joining Paine Webber & Co. in Boston at age 14.

At a very young age, he began his career in stock trading while performing tasks for local stockbrokers and writing the share prices from ticker tape recordings from the stock exchange onto a blackboard. As a result, he was able to gain sufficient knowledge of the stock market before beginning to formulate his trading plans.

When Livermore was 15 years old, he borrowed $5 from his mother and made his first trade, which was successful because he anticipated a price movement correctly. He made a profit of $3.12 on this transaction.

After turning 16, Jesse Livermore left Paine Webber & Co. and started trading independently. When betting on stock prices at this time, customers frequently used significant amounts of leverage, and bucket stores were frequently used for sales.

He was forced to relocate to New York City after being expelled from Boston's bucket shops due to his sustained success. His career in trading officially began at that point. He amassed a sizable fortune between 1907 and 1940, profiting from market shifts.

Trading Career

Livermore held the records for the highest daily profit total and the highest daily loss total. His greatest trading successes occurred in 1929 when the stock market crashed, and he greatly benefited from them. He made about $100 million after the 1929 Wall Street Crash. He shorted stocks and correctly predicted the crash, making millions of dollars.

He gained wide recognition for his profitable short positions during this turbulent time. Livermore made purchases during bull markets and sold them when the market's momentum changed.

However, Livermore's trading career was not without hardships and tragedies; as a result of risky trading and excessive leverage, he went bankrupt multiple times. He frequently attributed these financial setbacks to his inability to adhere to his own trading rules.

Even after his death, traders and investors worldwide continue to study and debate Livermore's insights into market psychology, risk management, and trend analysis. The fictional "Larry Livingston" in Edwin Lefèvre's book "Reminiscences of a Stock Operator" was modeled after Jesse Livermore's trading career.

How did Jesse Livermore die?

When it came to controlling his emotions outside of stock trading, Livermore struggled with depression. Tragically, on November 28, 1940, he committed suicide in a hotel room in New York. Soon after 5:30 of the clock in the evening, Livermore shot himself in the head with an automatic Colt pistol in the cloakroom of the Sherry-Netherland hotel in Manhattan.

The experience of Jesse Livermore serves as a lesson in the hazards of trading. This is particularly relevant to the value of emotional restraint, serving as a reminder of the psychological difficulties that traders may encounter in the high-stakes world of finance.

How much was Jesse Livermore worth when he died?

When Jesse passed away in 1940, his net worth was reportedly over $100 million. Jesse's trading methods, which traders are still analyzing today, were a testament to his extraordinary wealth and success. Jesse Livermore is a genuine legend, and most traders carry on his trading legacy today.

What was Jesse Livermore's trading strategy?

The basis for Jesse Livermore's trading strategy was the concept behind "market trend analysis”. He believed that stock prices moved in trends, so he bought and held shares during bull markets before selling them when the market's momentum changed. He observes price trends along with volume analysis before selling.

Livermore made extensive use of technical analysis and market psychology and became known for his uncanny ability to foresee market trends and reversals. Livermore traded stocks that were trending and shunned markets that were fluctuating.

Jesse Livermore's quotes and advice for beginners

Beginners in the stock market frequently struggle with decision-making when it comes time to trade stocks. However, Jesse Livermore, a well-known stock trader from the early 20th century, asserts that any trader can improve their skills if they are willing to learn new things.

According to Livermore, establishing the practice of monitoring price changes and trading volume and adapting strategies to the current market environment aids in the discovery of market trends. The trend is your friend, he famously said, implying that following the current market trend increases the likelihood of success.

Livermore emphasized the significance of tracking market trends, but he is best known for refusing to vote for a trade until the market concurred with his presumption. Jesse Livermore asserts that to increase your chances of outperforming the market in the long run, invest in the strongest stocks. Below are some Jesse Livermore tips on money management.

Jesse Livermore's tips on money management, investing, and trading:

Think of your trading capital as your sole resource, so protecting it requires you to refrain from taking unnecessary risks that could result in sizable losses

Trade only when you are mentally stable, and avoid getting overexcited and trading too much. This might lead to expensive errors and needless losses

Learn to always take a deep breath before opening a position. Patience is a virtue in stock trading; construct fresh plans while you wait for the ideal occasion

Regardless of how much you think you understand trading, keep learning. Maintaining your knowledge and adjusting to shifting circumstances requires constant learning about market dynamics and trends

If a trade goes against you, do not delay in cutting losses. By exiting losing trades as soon as possible, you can preserve your capital for better opportunities and stay active in the market

Do not be in a hurry to stop profitable trades; you can maximize gains by allowing them to run longer to make up for losses from losing trades

Making rational decisions requires removing emotions from the equation and remaining impartial; this is instrumental when trading stocks

Even though you might receive some excellent suggestions from a third party, have faith in your abilities and resist the urge to follow their lead without evaluation

Livermore's principles can offer insightful guidance: integrate them based on the modern financial environment and trading platforms.

Famous Quotes of Jesse Livermore

Nothing new ever occurs in the business of speculating or investing in securities and commodities. ~Jesse Livermore

Money cannot consistently be made trading every day or every week during the year. ~Jesse Livermore

Don’t trust your own opinion; back your judgment until the action of the market itself confirms your opinion. ~Jesse Livermore

What has happened in the past will happen again. This is because markets are driven by humans, and human nature never changes. ~Jesse Livermore

It is what people did in the stock market that counts, not what they said they were going to do. ~Jesse Livermore

As long as a stock is acting right and the market is right, do not be in a hurry to take profits. ~Jesse Livermore

Never buy a stock because it has had a big decline from its previous high. ~Jesse Livermore

It is not good to be too curious about all the reasons behind price movements. ~Jesse Livermore

"There is nothing new on Wall Street; there can't be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again". ~Jesse Livermore

Jesse Livermore's books

Jesse Livermore's books are a benchmark of rules and methods for investors looking to execute investment decisions. Among the popular Jesse Livermore books, investors can benefit from reading the ones listed below:

How to Trade in Stocks by Jesse Livermore

My Life in Wall Street by Jesse Livermore

How I Made Three Fortunes in the Stock Market, by Jesse Livermore

Reminiscences of a Stock Operator by Edwin Lefèvre

Among all the books written about Jesse Livermore, Edwin Lefèvre's Reminiscences of a Stock Operator includes his trading methods, perceptions, and experiences.

Although the book was initially published in 1923, it is still one of the most popular and recommended investment books for new traders. The excellent information about financial markets provided by the logic in these books has greatly benefited generations of readers. Larry Livingston's role in the Reminiscences of a Stock Operator helped make it more understandable.

This book describes how Livermore began to master the markets at the age of 14 by making predictions about the direction that numbers would go. Starting with a five-dollar investment, he builds up a fortune by his early twenties and becomes a significant player on Wall Street. It shows how, in the early 1900s, Jesse Livermore gambled tens of millions of dollars on the stock and commodities markets. And also how he made over $10 million in a single trading month.

Although Livermore did not write this book, his experiences, and trading philosophy are heavily referenced. Anyone who wants to comprehend the mindset and tactics of successful traders should read it. After reading Reminiscences of a Stock Operator by Edwin Lefèvre, you will gain insight into Livermore's trading methods and his comprehension of market trends, trading psychology, and discipline.

Best stock brokers 2024

Summary

For those new to trading, reading the success story of Livermore, a stock trader who amassed a huge fortune worth $100 million, is essential. Among the essential details traders should be aware of is Jesse Livermore's trading strategy. This includes how he used market trend analysis to trade stocks when prices were about to change and how he evaluated price patterns with volume analysis to decide whether a trade should be left open.

Jesse Livermore's trading strategy is still applicable in modern-day stock trading. Jesse Livermore's trading experiences and story continue to be very important for stock traders, especially newcomers. The engrossing narrative and perceptive descriptions of a stock market speculator's thoughts, strategies, and experiences will teach traders how to make decisions and unleash their inner potential as stock traders.

FAQs

Who taught Jesse Livermore stock trading?

Jesse Livermore may have picked up some basics while running errands and watching market movements. He did not receive any formal training in trading or investing, so he learned these skills primarily on his own.

How much money did Jesse Livermore make?

The biggest win for Jesse Livermore came in 1907, when he wagered that Wall Street stocks would recover from the Panic of 1907, a wager that brought him over $1 million in profits.

Was Jesse Livermore a day trader?

Jesse Livermore started as a day trader in the stock market but quickly transitioned to swing trading with a longer-term mindset.

How did Jesse Livermore make his money?

Jesse Livermore earned money by trading stocks and taking advantage of arbitrage opportunities. He used his extraordinary ability to read the markets to bet on market drops and eventually became one of the wealthiest traders in history. He became one of history's most prosperous traders by using this skill.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options. He has also worked on the ratings of brokers and many other materials.

Dr. BJ Johnson’s motto: It always seems impossible until it’s done. You can do it.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.