What Is The Best Time To Trade NAS100?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best time to trade NAS100 is typically during the U.S. market hours. The morning session (9:30 AM - 11:30 AM EST) and the afternoon session (1:30 PM - 4:00 PM EST) are particularly active and volatile, offering ample trading opportunities. After-hours trading (4:00 PM - 8:00 PM EST) can also provide opportunities, though with lower liquidity.

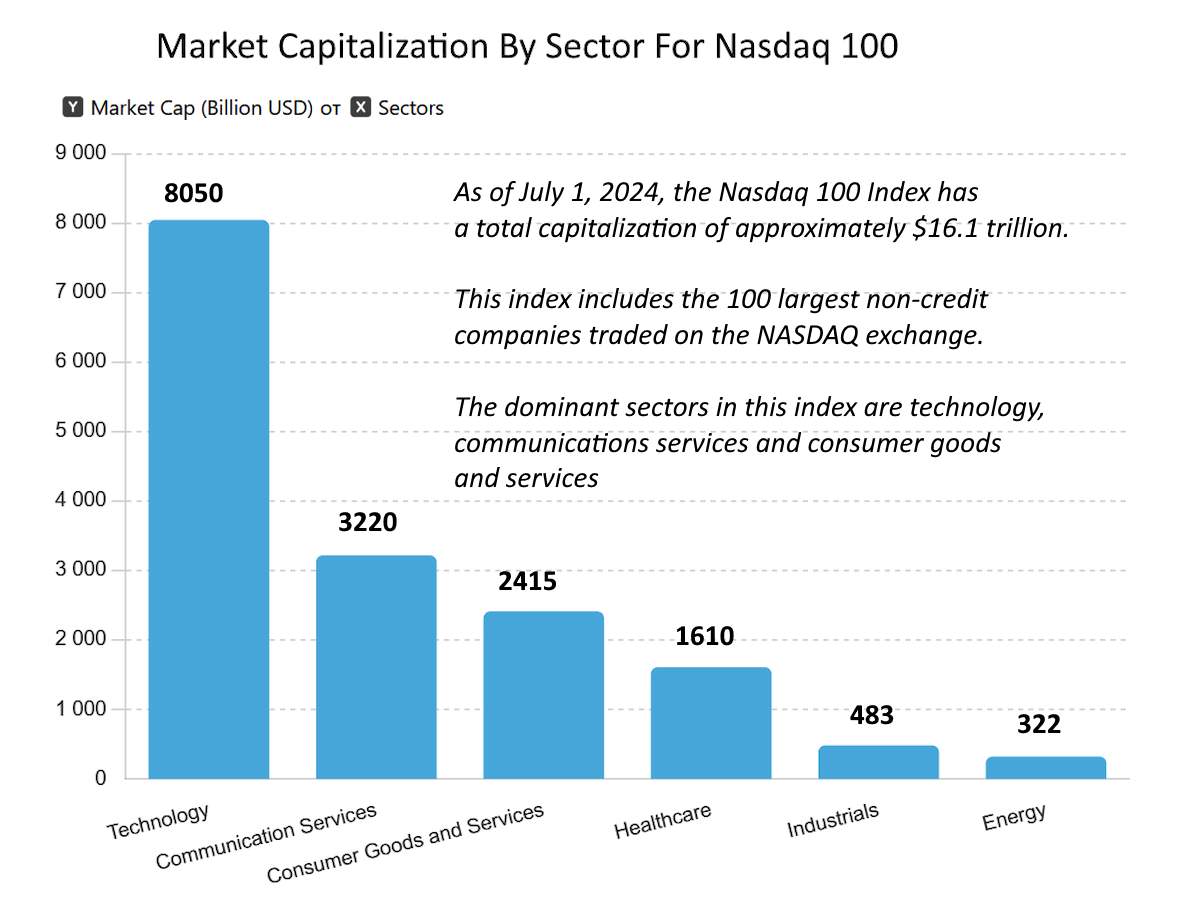

The NAS100, or Nasdaq 100, is a stock market index made up of the 100 largest non-financial companies listed on the Nasdaq stock exchange. This index is significant due to its heavy weighting towards technology and innovation-driven companies, making it a popular choice among traders. From this article you will learn what is the best time to trade NAS100.

Best time to trade NAS100: optimize your trading schedule

Understanding the best times to trade NAS100 is crucial for maximizing profits and minimizing risks.

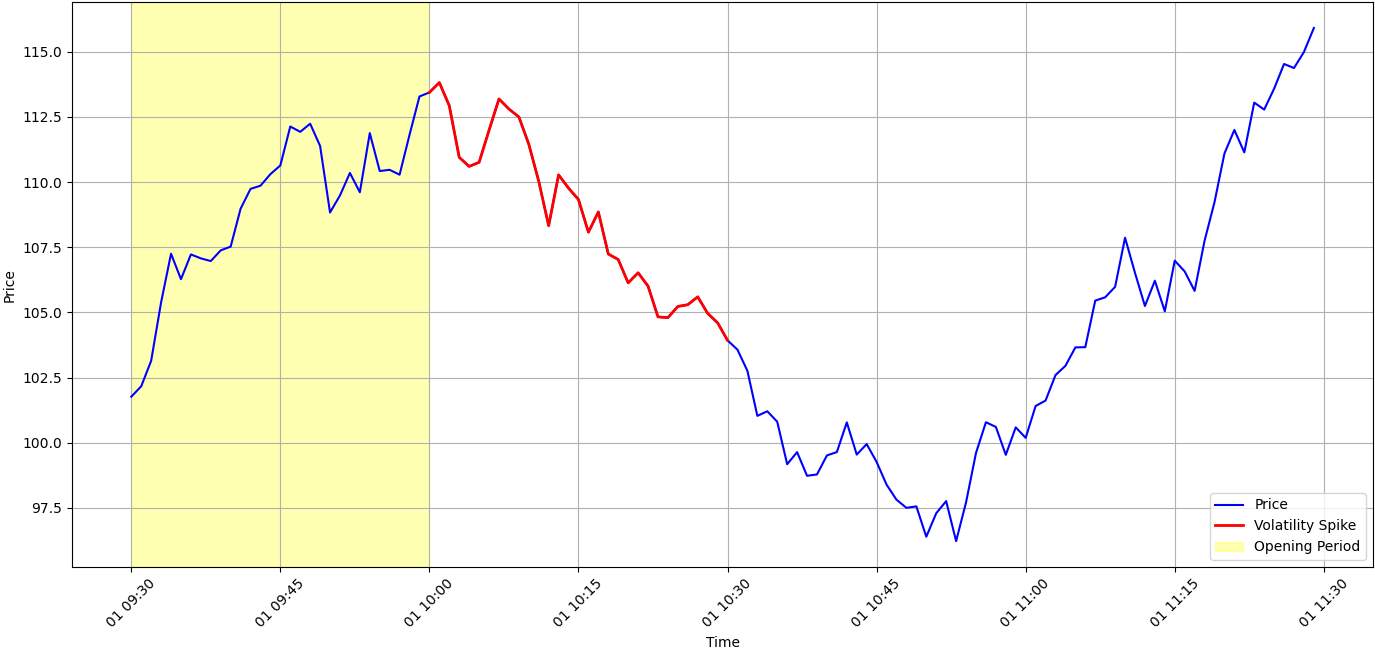

Morning session (9:30 AM - 11:30 AM EST)

The morning session is often marked by high volatility as traders react to overnight news and economic reports. This period offers significant price movements, providing ample opportunities for day traders. The NAS100 market opens at 9:30 AM EST, and the initial 30 minutes to an hour are known for their rapid price fluctuations. This is because traders are reacting to news that came out after the previous market close and before the current opening. For example, if a major tech company listed in the NAS100 announces better-than-expected earnings after the market closes, traders will rush to buy its stock as soon as the market opens, causing a spike in its price and increased volatility in the index.

Trading strategies to use:

Scalping. This involves making quick trades to take advantage of small price movements.

News trading. Traders can capitalize on news events such as earnings announcements and economic data releases by entering trades based on the anticipated market reaction.

Momentum trading. As the market opens and volatility spikes, momentum traders look for stocks or indices moving strongly in one direction and try to ride the trend.

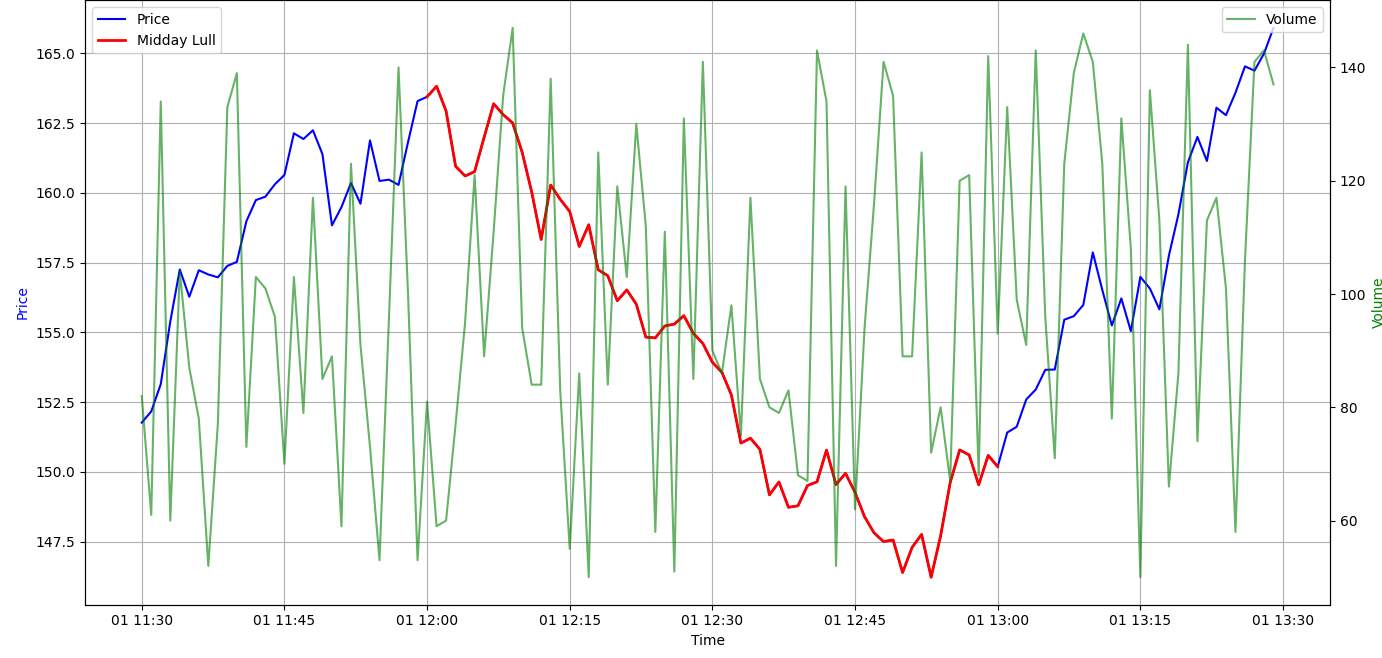

Midday lull (11:30 AM - 1:30 PM EST)

During the midday lull, trading activity and volatility tend to decrease as traders take a break for lunch. This period is often characterized by lower trading volumes and narrower price ranges. The midday lull typically starts around 11:30 AM EST and lasts until 1:30 PM EST. During this time, many traders step away from their desks for lunch, leading to a drop in trading activity. This decrease in activity is reflected in lower trading volumes and reduced price volatility.

For example, if the NAS100 experiences a sharp upward movement during the morning session, the momentum often slows down as the midday lull approaches. This can be seen in narrower price ranges, where the difference between the highest and lowest prices within a specific time frame becomes smaller.

Trading strategies to use:

Scalping. Some traders might still engage in scalping, aiming to profit from very small price movements. However, due to lower volatility, opportunities might be limited.

Range trading. Traders can take advantage of the narrower price ranges by employing range trading strategies. This involves buying at the lower end of the range and selling at the higher end, or vice versa.

Strategy review. Use this time to review your trading strategy and morning performance. Analyze what worked well and what didn’t, and make adjustments as needed for the afternoon session.

Afternoon session (1:30 PM - 4:00 PM EST)

Volatility often picks up again in the afternoon as traders position themselves for the close of the market. This period can be ideal for entering or exiting trades based on the day’s trends. The last hour of trading, often referred to as the "power hour," can be particularly volatile.

The afternoon session begins at 1:30 PM EST and lasts until the market closes at 4:00 PMEST. This period is characterized by a resurgence in trading activity as traders digest the developments of the day and make their final moves. The increase in activity can lead to significant price movements, making it a prime time for both day traders and swing traders.

Trading strategies to use:

Trend following. During the afternoon session, traders can use trend-following strategies to capitalize on the continuation of the morning’s trend.

Reversal trading. If there are signs that the morning trend is reversing, traders can use reversal trading strategies.

Volume analysis. By analyzing trading volume, traders can get a sense of the market’s strength. For instance, a surge in volume might indicate strong interest in a particular direction, signaling potential trading opportunities.

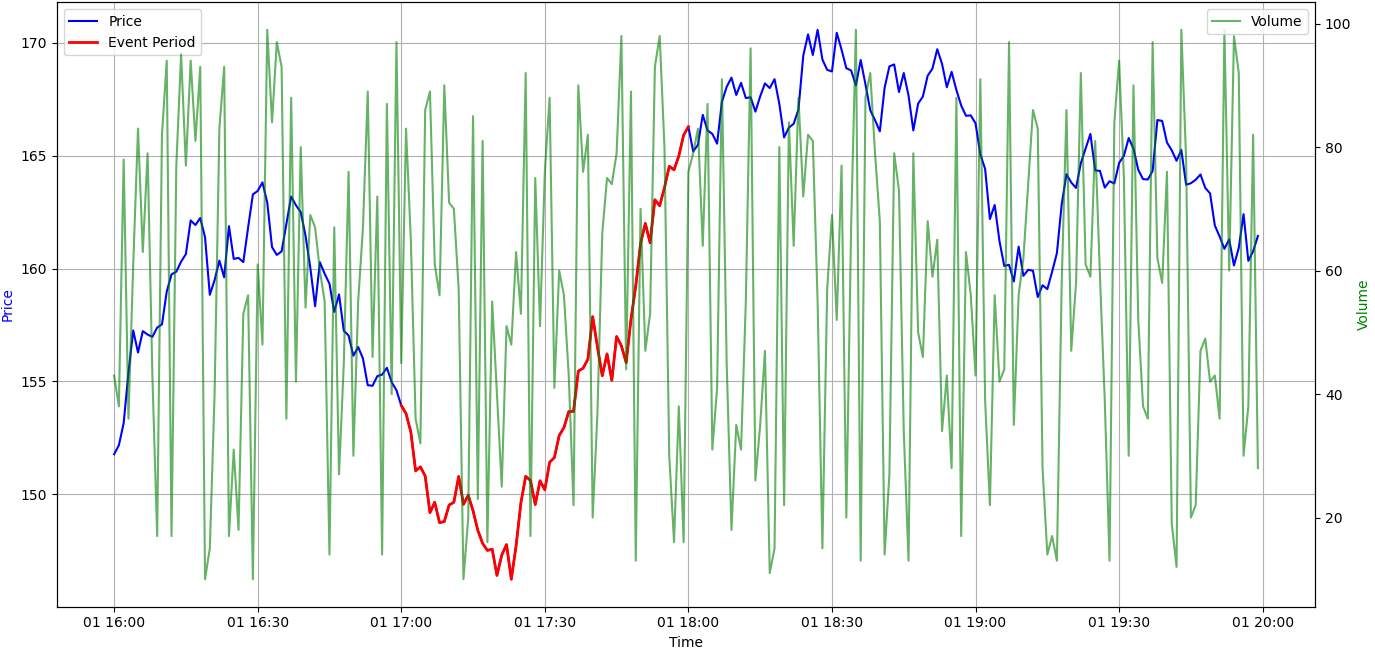

After-hours trading (4:00 PM - 8:00 PM EST)

After-hours trading, which occurs from 4:00 PM to 8:00 PM EST, offers a unique set of opportunities and challenges for traders. This period is characterized by lower liquidity compared to regular trading hours, but it allows traders to react to late-breaking news and earnings reports that are released after the market closes.

During after-hours trading, fewer traders are active, leading to reduced trading volumes. This lower liquidity can result in wider bid-ask spreads and more pronounced price movements, both of which present opportunities and risks for traders. For example, if a trader expects positive news to drive the market higher overnight, they might buy NAS100 futures or related ETFs during after-hours to benefit from the anticipated price increase by the next morning.

Trading strategies to use:

News-based trading: Traders can capitalize on after-hours news releases by quickly entering trades based on the news impact.

Earnings reactions: Monitoring earnings announcements and the subsequent price reactions can provide trading opportunities. Traders can look for significant earnings surprises and trade accordingly.

Price gap exploitation: Due to lower liquidity, price gaps can occur more frequently in after-hours trading. Traders can exploit these gaps by entering trades at favorable prices and potentially closing them when liquidity improves.

Risks and considerations must be counted:

Wider bid-ask spreads. The lower trading volumes in after-hours sessions often lead to wider bid-ask spreads. This can increase the cost of entering and exiting positions and requires traders to be more cautious with their order placements.

Higher volatility. Reduced liquidity can also result in higher volatility, with prices moving more abruptly than during regular trading hours. Traders need to be prepared for sudden price swings and manage their risk accordingly.

Limited market participants. With fewer traders active, the influence of large trades can be more pronounced, leading to exaggerated price movements. This can create both opportunities and risks, depending on the direction of the trades.

For trading NAS100 you need to choose the best brokers that offer competitive spreads, low fees, robust trading platforms, and excellent customer support. In this section, we will explore the top brokers that are recommended for trading NAS100.

| Demo | Min. deposit, $ | Max. leverage | Indices | Futures | ETFs | Investor protection | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | 100 | 1:300 | Yes | Yes | Yes | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | No | 1:500 | Yes | No | Yes | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | No | 1:200 | Yes | No | No | £85,000 SGD 75,000 $500,000 | Open an account Your capital is at risk. |

|

| Yes | 100 | 1:50 | Yes | Yes | Yes | £85,000 | Study review | |

| Yes | No | 1:30 | Yes | Yes | Yes | $500,000 £85,000 | Open an account Your capital is at risk. |

Risk and warning section

When trading NAS100, it's crucial to be aware of the various risks involved. Understanding and managing these risks is key to maintaining a sustainable trading practice.

Market risks. Trading NAS100 involves market volatility and liquidity risks. Understanding these risks and having a risk management strategy is crucial. This might include setting stop-loss orders, diversifying your portfolio, and staying informed about market conditions.

Trading psychology. Emotional control is vital in trading. Traders must manage their emotions and avoid making impulsive decisions based on fear or greed.

Regulatory and compliance risks. Adhering to trading regulations and compliance requirements is essential to avoid legal issues and ensure safe trading practices.

Focus on trading NAS100 during the overlapping hours of major financial markets

Choosing the best time to trade NAS100 essential for your trading success. For best results, focus on trading NAS100 during the overlapping hours of major financial markets, especially when the New York Stock Exchange (NYSE) and NASDAQ are open. As I saw on a practice, this is typically the period with the highest liquidity and volatility, offering more trading opportunities and better chances for profit.

Also, always use stop-loss orders to protect your investments and avoid significant losses. A well-balanced portfolio can help you mitigate risks effectively. Never risk more than you can afford to lose on a single trade. Set realistic trading goals and regularly review your performance and adapt your strategy as market conditions change.

By focusing on these key aspects, you can make more informed decisions and improve your chances of success when trading NAS100.

Conclusion

To recap, trading NAS100 can be highly profitable if done at the optimal times. Understanding market hours, managing risks, and continuously learning are key to success. Apply the strategies discussed, stay disciplined, and focus on long-term goals to optimize your trading schedule. By following this comprehensive guide, traders can build effective habits and strategies for long-term success in the NAS100 market.

FAQs

Why is it important to understand market hours?

Understanding market hours is crucial because trading activity and volatility vary throughout the day. Knowing when the market is most active helps traders make informed decisions and optimize their trading strategies for better results.

How can beginners start trading NAS100?

Beginners should start by learning the basics of trading and understanding market hours. Using a demo account to practice trading without risking real money is highly recommended. Additionally, beginners should focus on developing a trading plan, managing risks, and continuously learning from educational resources and market research.

What should advanced traders consider when trading NAS100?

Advanced traders should consider using algorithmic trading systems, which require robust hardware and software. They should also analyze market research to evaluate the success of their strategies and stay informed with insights from trading experts. Managing costs and understanding potential difficulties in setting up and maintaining algorithmic systems are also crucial.

What are the risks involved in trading NAS100?

Trading NAS100 involves market risks such as volatility and liquidity risks, regulatory and compliance risks, and the psychological impact of trading decisions. It is important to have a risk management strategy, maintain emotional control, and adhere to trading regulations to mitigate these risks.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.