How To Set Take Profit And Stop Loss In Forex?

4 Steps to trade Forex with a demo account:

For a new trade. Press F9. In the order window specify TP and SL values for the trade you are going to open. TP and SL will be set immediately when the trade is opened.

For an existing trade. right-click on an open trade in the Terminal window, select “Modify or Delete Order”, and enter your desired price levels in the “Stop Loss” and “Take Profit” fields before confirming the changes.

In Forex trading, managing risk is the cornerstone of sustainability. This article tackles the critical strategy of implementing stop loss (SL) and take profit (TP) orders in MetaTrader 4 (MT4). Understanding the mechanics of these orders not only safeguards investments but also secures the profits of traders, ensuring they don't leave their fortunes at the mercy of market swings.

Stop losses and take profits are vital for traders looking to maintain a tight rein on their potential losses and desired gains. As a trader, these tools allow you to set boundaries where positions automatically close, thus executing a disciplined trading strategy without the need to monitor positions constantly.

How do you set up TP and SL?

To set up TP and SL, determine your exit points based on your trading strategy and risk tolerance, and enter these values in the 'Stop Loss' and 'Take Profit' fields when you place a new order or modify an existing one in your trading platform.

How do you put a stop-loss and take profit on mt4?

On MT4, you can put a stop-loss and take profit by right-clicking on an open trade in the Terminal window, selecting 'Modify or Delete Order,' and then entering your desired price levels for each in the respective fields.

How do you set a perfect stop-loss in forex?

Though perfection is not really possible, a good stop-loss in Forex is set by analyzing market volatility, using technical indicators, and aligning it with your risk management rules and trading strategy.

How do I choose SL and TP?

To choose SL and TP, consider the current market conditions, your risk-reward ratio, and technical analysis to select levels that maximize potential profits while minimizing losses.

Below you will find all the information.

How to set stop loss and take profit using the order window

There are a few ways to set stop loss and take profit orders using MT4, and doing it using the order window is arguably the most common one.

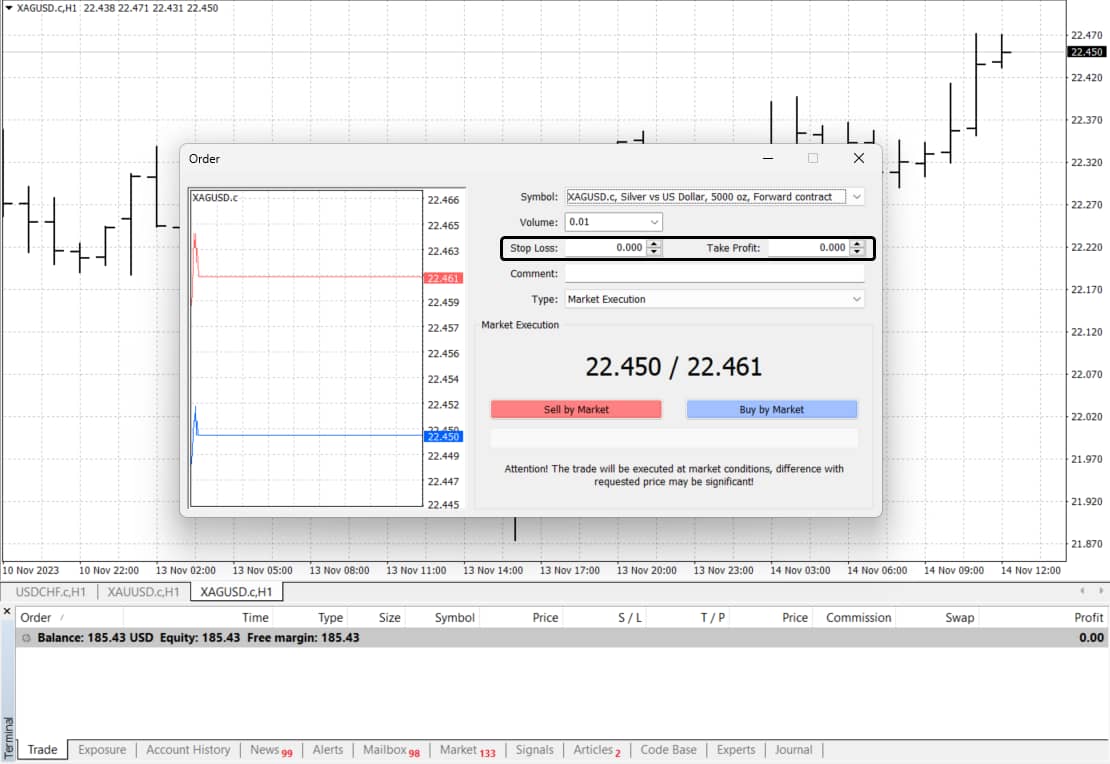

Setting SL and TP using the order window. Source: Metatrader4

Here are the steps to do so:

- 1

To initiate a new trade with SL and TP parameters, click the "New Order" button on the MT4 toolbar (or press F9 hotkey). This action brings up the order window, i.e.a command center for your trades;

- 2

Determine the direction of your trade by selecting either “Buy” or “Sell”. This choice is the fundamental premise of your trade setup.

- 3

Specify the volume of your trade in the “Volume” field. This is where you define the size of your position, known as the lot size.

- 4

Next, navigate to the “Stop Loss” and “Take Profit” fields, as shown in the picture below. Here you will input the prices at which you wish these orders to trigger. Precision is key.

- 5

With your SL and TP set, click “Place Order”. This final step dispatches your trade into the live market, complete with your predefined exit points.

Upon execution, the MT4 trade panel will display your active trade, including the stop loss and take profit values you've assigned. It’s a transparent way to see your trade parameters in real time, giving you peace of mind and control over your trading activity.

How to set stop loss and take profit using the MT4 terminal window

MetaTrader 4’s Terminal window is a dynamic control panel for managing existing trades.

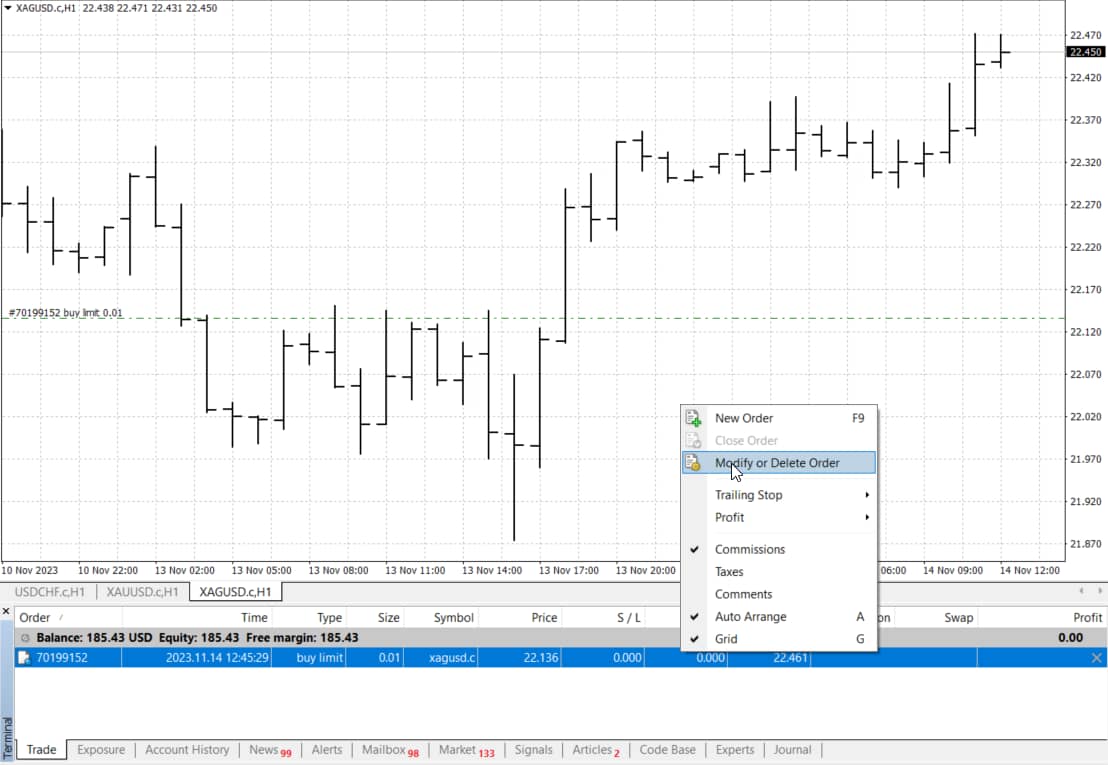

Setting SL and TP using the MT4 terminal window. Source: Metatrader4

To add and adjust SL and TP for an ongoing trade, simply follow these streamlined steps:

- 1

Navigate to the Terminal window, which lists your current trades;

- 2

Locate the trade you wish to modify;

- 3

Right-click on the desired trade. A context menu will appear with several options;

- 4

From the available choices, select "Modify or Delete Order." This opens a new window, dedicated to updating your trade parameters;

- 5

Within this window, you can input new values for both SL and TP;

- 6

Once you have entered your preferred SL and TP levels, confirm the changes. Your modifications will be instantly reflected in the Terminal window, alongside your order details.

Using the Terminal window for SL and TP adjustments is an efficient way to manage trades after you have already placed them, allowing for flexibility in response to changing market conditions. This method ensures that you maintain control over your trades and can adapt your strategy as needed to protect your capital and lock in profits.

Best Forex brokers

How to adjust stop loss and take profit by dragging lines on the chart

MetaTrader 4 streamlines the trading experience by enabling the intuitive adjustment of SL and TP directly from the chart. This hands-on method appeals to traders who prefer a visual approach to trade management.

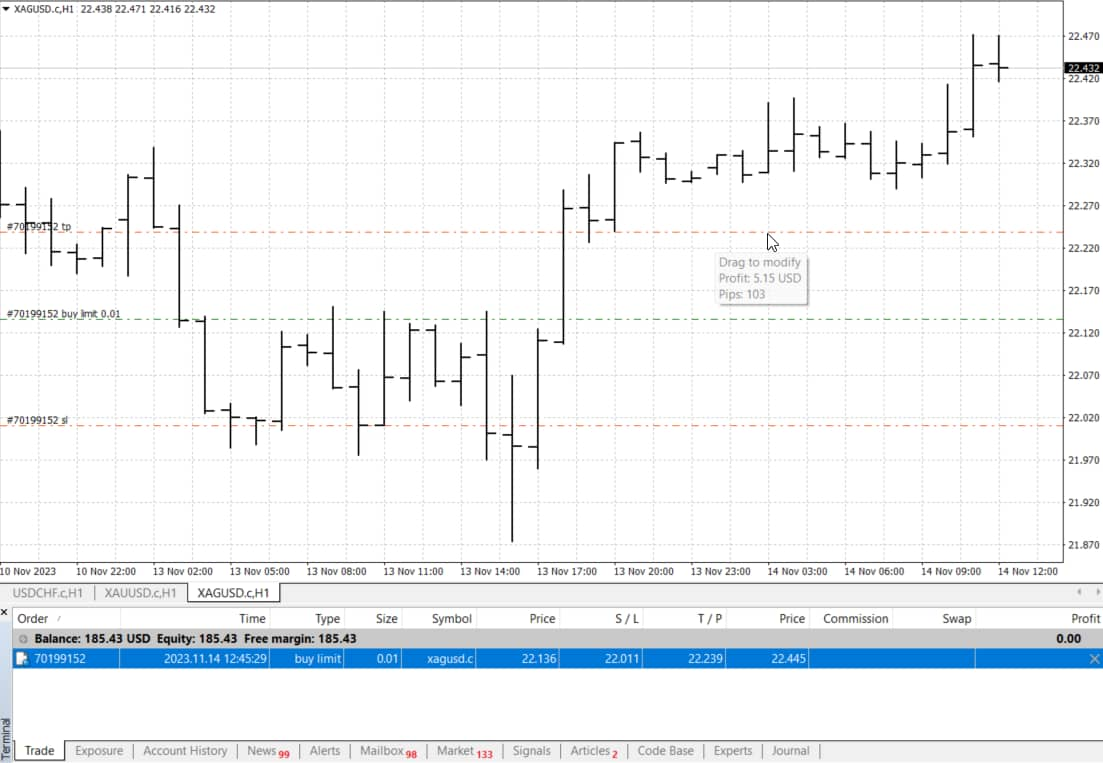

regulation of SL and TP by dragging the line on the chart Source: Metatrader4

To do this, simply use your mouse to drag and drop the trade line either up or down to a particular level (depending of course on where you want to put SL and TP).

This method not only simplifies the process but also provides immediate visual feedback, making it easier to adjust orders in accordance with your trading strategy and market analysis. The ability to click and drag to set SL and TP allows for very quick and visually enhanced adjustments.

Tips for setting stop loss and take profit

Setting stop loss and take profit levels is an art that balances risk with reward. The key to effective SL and TP placement is aligning them with your trading strategy and risk tolerance. Here are some foundational tips for setting these critical parameters.

- 1

Positioning your stop loss. Your stop loss serves as an acceptance of reality - not all trades will be winners. It should be placed at a price level that represents an acceptable loss, in line with your risk management strategy. Consider technical factors such as support and resistance levels, moving averages, or percentage retracements. The idea is to allow the position some room to “breathe” and avoid the market's natural volatility, without exposing you to undue risk. A too-tight stop loss can be triggered by normal price fluctuations, leading to a loss even if the overall trade idea was correct.

- 2

Determining your take profit. Conversely, your take profit should be set at a level where you can comfortably lock in profits without succumbing to greed. This involves identifying a realistic target based on historical price movements and expected market trends. Technical analysis can help here too. Look for previous highs and lows, trendlines, and Fibonacci levels. The TP should reflect a realistic return in accordance with the volatility of the currency pair and the timeframe of your trade.

- 3

Realism in SL and TP levels. Setting SL and TP levels too far from the current price can lead to missed opportunities or unnecessary losses. Your levels should be based on logical and analytical reasons derived from market conditions and your trading plan. Unrealistic stop loss and take profit levels may also reflect emotional trading, which can be detrimental to your trading results.;

- 4

Regular reviews and adjustments. The Forex market is dynamic, and what worked yesterday may not work today. Therefore, regularly reviewing and adjusting your SL and TP levels is crucial. Economic events, market sentiment, and new price patterns all warrant a reassessment of your exit points. Moreover, as your trade moves in your favor, consider moving your stop loss to break even or using a trailing stop to protect profits.

Conclusion

In conclusion, placing stop loss and take profit orders on MT4 is a relatively simple process. By following the steps outlined in this article, you can quickly and easily set these orders to protect your profits and limit your losses.

It is important to note that the placement of stop loss and take profit orders is a personal decision. There is no one-size-fits-all approach, and the best way to determine where to place these orders will vary depending on your trading strategy and risk tolerance.

However, by taking the time to understand the basics of stop loss and take profit orders, you can improve your trading performance and reduce your risk.

Glossary for novice traders

-

1

Risk Management

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

-

2

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

3

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

4

Forex Trading

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

-

5

Trailing Stop Order

A Trailing Stop Order is a type of order that automatically adjusts the stop-loss level as the market price moves in a favorable direction, helping to protect profits.

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).