Top Forex Charting Software

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best Forex charting software are:

TradingView. Offers diverse chart types and a large community for shared insights.

Metatrader 4 (MT4). Simple, reliable, and packed with essential indicators for beginners.

Metatrader 5 (MT5). Adds more timeframes and an integrated economic calendar for advanced users.

cTrader. User-friendly with fast execution and built-in support for automated trading.

ProRealTime. Cloud-based with customizable tools for detailed technical analysis.

Choosing the right free Forex charting tool is important for traders of all levels. In 2025, popular tools in the market lead the way by offering powerful features without any cost. These tools provide everything you need to analyze the market, whether you're just starting or have years of experience.

In this article, we will discuss platforms that support detailed charting, real-time data, and advanced technical analysis, making them indispensable for modern Forex trading.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

Best free Forex charting software in 2025

The best Forex charting software currently are:

TradingView

TradingView remains one of the most popular charting platforms out there, offering a powerful combination of user-friendly design and professional-grade features. Here’s a detailed breakdown of its key aspects:

Key features

Comprehensive charting tools. TradingView supports over 20 chart types, including candlestick, Renko, Heikin Ashi, and more, making it versatile for different trading styles.

Technical indicators. It offers over 100 built-in indicators, covering everything from moving averages to custom scripts through its Pine Script language.

Drawing tools. The platform provides tools like trendlines, Fibonacci retracements, and geometric shapes, ideal for technical analysis.

Community and collaboration

Public ideas and scripts. Traders can publish their charts and ideas or use community-generated indicators and strategies.

Social engagement. TradingView acts like a social network for traders, allowing you to comment, like, and follow other users.

Accessibility

Cross-platform compatibility. Available on web, desktop, and mobile apps, ensuring seamless use across devices.

Cloud syncing. Your saved charts and settings sync across all devices, making transitions effortless.

Additional highlights

Alerts and automation. You can set custom alerts for price movements, indicator triggers, or trendline breaks, available via push notifications and SMS.

Market coverage. Beyond Forex, TradingView offers data for stocks, crypto, commodities, and indices, making it a one-stop charting solution for multi-asset traders.

Subscription plans. It offers a free version with basic features, while paid plans unlock advanced tools, more simultaneous charts, and indicator slots.

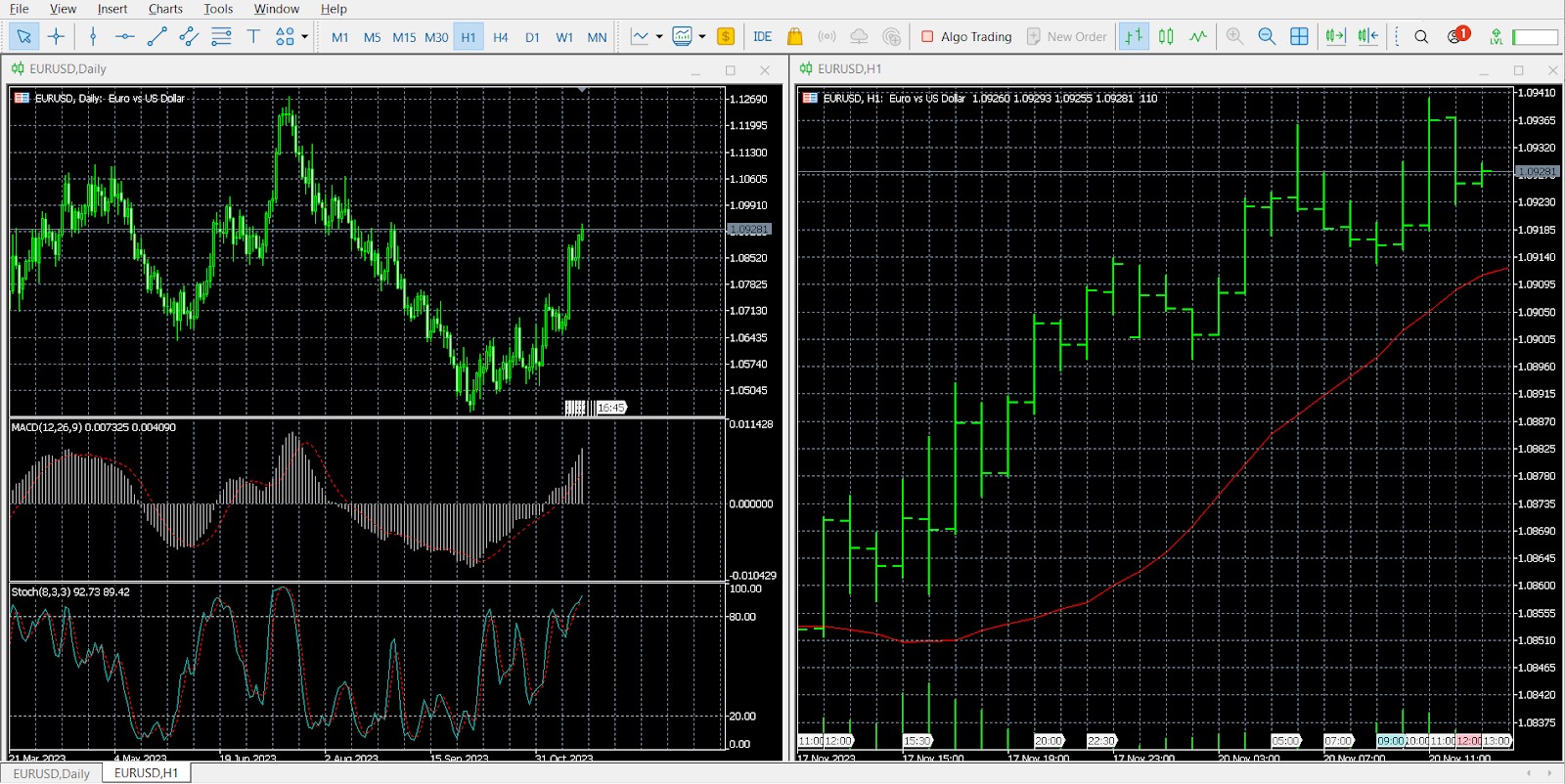

Metatrader 4 (MT4)

MetaTrader 4 continues to be a trusted choice for Forex traders due to its simplicity, reliability, and important trading features. Here’s an in-depth look at what makes it stand out:

Key features

User-friendly interface. MT4’s clean layout and intuitive design make it easy for both beginners and experienced traders.

Comprehensive technical tools. Includes 30+ built-in technical indicators, 9 timeframes, and multiple chart types (line, bar, and candlestick).

Customizable. Supports Expert Advisors (EAs) for automated trading and custom indicators to suit personalized strategies.

Performance and execution

Reliable order execution. Known for its stability and fast execution, even during volatile market conditions.

Low resource usage. MT4 runs smoothly on most systems without lag, even on older devices.

Accessibility

Cross-platform availability. Available on desktop (Windows and macOS), web, and mobile (iOS and Android), ensuring you can monitor trades anywhere.

Offline analysis. Charts and historical data can be analyzed offline without needing a live connection.

Additional highlights

One-click trading. Allows instant order placement directly from the chart, useful for fast-moving markets.

Custom scripts and tools. Traders can code their own tools using the MQL4 programming language, enabling deeper customization.

Global broker support. Most Forex brokers support MT4 due to its widespread adoption and simplicity.

Metatrader 5 (MT5)

MetaTrader 5 has solidified its position as a go-to platform for advanced traders, offering enhanced features compared to its predecessor, MT4. Here’s a detailed look at why MT5 continues to stand out:

Key features

Expanded timeframes. MT5 offers 21 timeframes compared to MT4’s 9, allowing for more granular analysis.

Additional order types. Supports six types of pending orders, making it versatile for complex trading strategies.

Comprehensive technical tools. Comes with 38 built-in technical indicators and over 40 graphical objects for detailed charting and analysis.

Performance and execution

Multi-threaded processing. Unlike MT4, MT5 uses multi-threaded processing, making it faster and better equipped to handle large amounts of data.

Market depth (DOM). Displays real-time order book information, useful for understanding market liquidity and order flow.

Accessibility

Cross-platform support. MT5 is available on desktop (Windows and macOS), web, and mobile apps, ensuring seamless trading across devices.

Economic calendar integration. Built-in economic calendar with real-time updates helps traders stay informed about global financial events.

Additional highlights

Advanced automated trading. MT5 supports algorithmic trading with MQL5, an upgraded programming language with more features than MQL4.

Hedging and netting modes. Offers both position accounting systems, making it flexible for different trading styles.

Multi-asset support. In addition to Forex, MT5 supports stocks, commodities, indices, and crypto, making it ideal for multi-asset trading.

cTrader

cTrader remains a top choice for traders seeking a modern, user-friendly platform with advanced charting and execution capabilities. It’s especially favored by traders who prioritize transparency and customization. Here’s a detailed breakdown:

Key features

Advanced charting tools. cTrader offers multiple chart types, over 70 technical indicators, and robust drawing tools for precise technical analysis.

Detachable charts. You can create separate windows for charts, allowing multi-screen setups for an enhanced trading experience.

Level 2 market depth. Displays real-time bid and ask prices, offering a clear view of market liquidity.

Performance and execution

Lightning-fast execution. Known for its fast order processing, cTrader ensures minimal slippage, even during high volatility.

Order types. Supports advanced order types, including stop-limit orders and server-side trailing stops for better control.

Accessibility

Cross-platform availability. cTrader is available on desktop, web, and mobile, with seamless syncing of data across all devices.

Cloud saving. User profiles, preferences, and chart layouts are saved in the cloud, making them accessible from any device.

Additional highlights

cAlgo for algorithmic trading. Supports custom bots and indicators through the C# programming language, providing flexibility for automated strategies.

Copy trading. The cTrader Copy feature allows users to follow and replicate successful traders' strategies.

Transparency. Unlike some platforms, cTrader emphasizes transparency by clearly displaying commission costs, spreads, and order execution details.

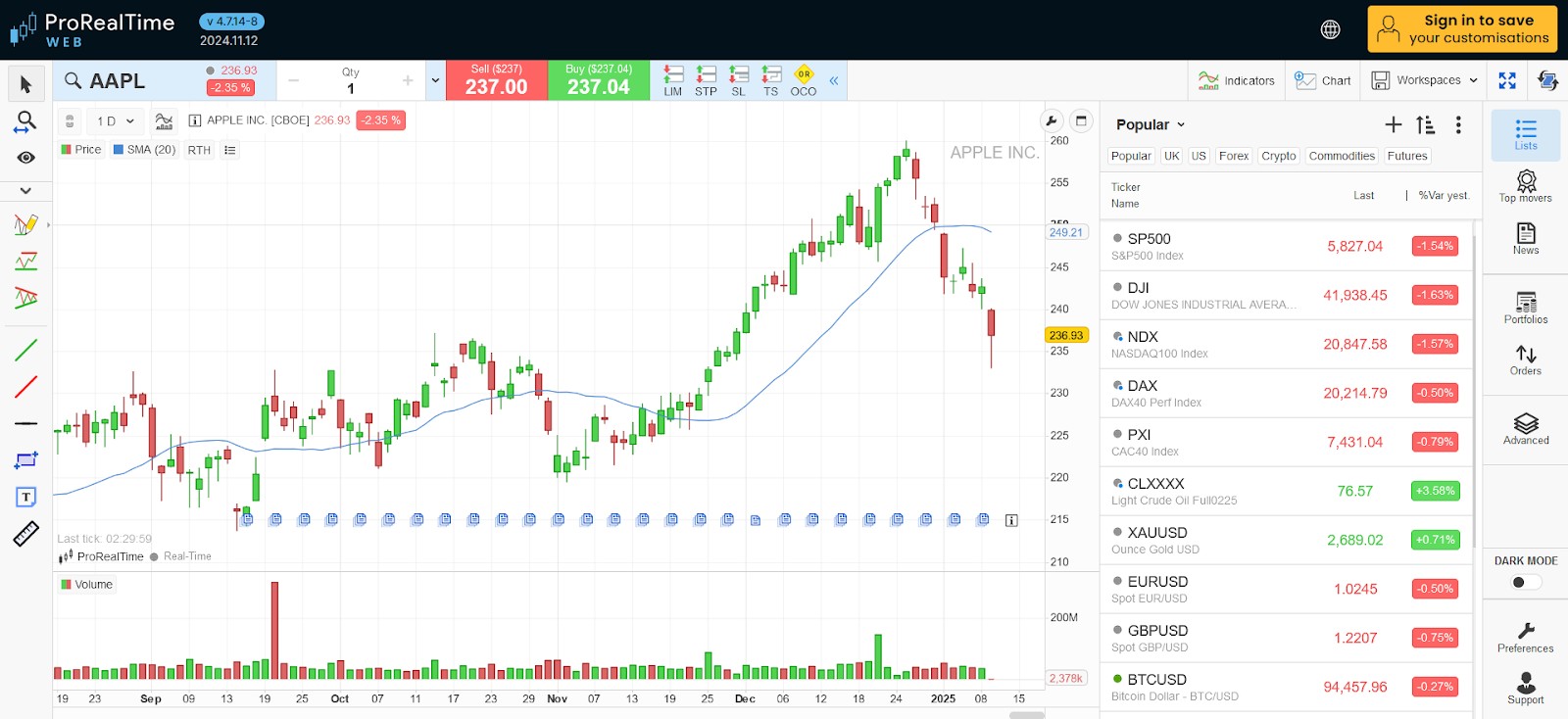

ProRealTime

ProRealTime offers precise charting and in-depth analysis. Its cloud-based infrastructure ensures reliability and fast performance, making it a go-to platform for professional and retail traders alike. Here's a closer look at its features:

Key features

Extensive technical indicators. ProRealTime offers over 100 pre-installed indicators and supports custom scripting for personalized analysis.

Charting precision. The platform excels in providing detailed, zoomable charts with tick-by-tick data for highly accurate analysis.

Drawing tools. Comprehensive drawing tools, including trendlines, Fibonacci tools, and Gann fans, allow for precise annotations.

Performance and execution

Cloud-based performance. ProRealTime's cloud servers ensure smooth performance without heavy demands on local system resources.

Fast data processing. Handles large volumes of historical data for backtesting and real-time analysis without lag.

Accessibility

Multi-device support. Accessible on web and desktop, with seamless cloud syncing of layouts and preferences.

Offline mode. Charts and past analyses can be reviewed offline, making it convenient for strategy refinement.

Additional highlights

ProBuilder scripting language. Supports custom indicators and trading algorithms with its built-in coding language, ProBuilder.

Backtesting and optimization. Offers robust backtesting tools with detailed performance metrics to fine-tune trading strategies.

Multi-asset support. Covers Forex, stocks, indices, commodities, and more, making it ideal for diversified portfolios.

What is a Forex charting software?

Forex charting software is a tool for traders that shows price changes of currency pairs through charts like candlestick, bar, or line charts. It’s crucial for analyzing markets and making informed decisions.

Charting software is central to technical trading. It lets traders spot trends, patterns, and key levels like support and resistance. Whether using a free or paid version, this software allows you to set alerts, customize your setup, and integrate indicators to match your style.

Some platforms are simple and user-friendly, while others come with advanced features like automated trades and strategy testing. For example, MetaTrader 4 is highly flexible and popular among Forex traders. TradingView, on the other hand, is known for its community-focused features, where traders share ideas and strategies in real time.

What are the main types of Forex charts?

The main types of Forex charts are line charts, bar charts, and candlestick charts. Each type serves a different purpose and helps traders analyze price data in unique ways.

Line charts. These charts are the simplest and show a line connecting the closing prices over a set period. They’re great for identifying general trends but lack detail.

Bar charts. Bar charts add more depth by displaying the opening, high, low, and closing (OHLC) prices for each period. They’re ideal for traders who need more information for analysis.

Candlestick charts. The most popular choice, candlestick charts provide a comprehensive view of price movements, including opening, closing, highs, and lows. They’re visually intuitive and help identify patterns like Dojis, hammers, and engulfing candles.

Candlestick charts, in particular, are indispensable for technical analysis. They offer an easy way to interpret market sentiment and potential price reversals. Bar charts, while less visually appealing, are favoured by traders focused on detailed OHLC data. Line charts, although basic, remain useful for quickly identifying long-term trends.

Benefits of free Forex charting softwares

Get live data. Free Forex charting software provides real-time price updates, letting you see price changes as they happen. This allows beginners to make smarter trading decisions in the moment without waiting for updates.

No cost involved. These tools are perfect for beginners who are still learning the ropes. You can explore essential charting tools without worrying about monthly fees, giving you the freedom to learn without financial commitment.

Try different strategies. With free charting software, you can test out various chart types and indicators to see what works best for your trading style. This is a great way to figure out which strategies suit you before risking actual money.

Make your setup work for you. Many free platforms allow you to customize your trading environment. Organizing your layout in a way that fits your workflow helps improve your trading efficiency and makes things more intuitive.

Learn as you go. A lot of free charting software includes built-in tutorials, webinars, and articles to help you learn as you trade. These resources are valuable for beginners looking to deepen their understanding of technical analysis and chart reading.

How to use Forex charting software?

Here’s how to use Forex charting software:

Start by arranging your chart. Choose a chart style that suits your needs, such as candlestick, bar, or line charts. Beginners often find candlestick charts the most helpful as they offer clear insights into market sentiment.

Pick the chart style that suits you. Add basic indicators like Moving Averages or RSI to your chart. Start with just one or two, and as you become more familiar, add more to better predict price movements.

Understand timeframes for your method. Pick timeframes that align with your trading style. If you're a scalper, go for shorter timeframes like 1m or 5m, but if you prefer swing trading, use longer ones like 1H or 4H.

Find key price levels. Use the charting tools to mark support and resistance levels. These points are crucial for identifying where prices might reverse or continue their trend.

Test your strategy with past data. Before you start trading with real money, use backtesting to simulate how your chart patterns and strategies would have worked in the past. This helps you refine your method and gain confidence in your approach.

With consistent practice, you’ll become adept at interpreting charts and making data-driven trading decisions. Remember to integrate your analysis with other trading strategies, such as fundamental analysis, for a holistic approach.

How to find the best free Forex charting software?

Here’s how to find the best free Forex charting software:

Know your trading habits. Begin by identifying your trading style, whether it's scalping, swing trading, or day trading. Different charting software offers tools tailored to specific styles, so it’s crucial to first determine what you’ll need the most — real-time updates, technical indicators, or detailed chart analysis.

Easy to use. The software should be simple and intuitive, especially for beginners. Look for a platform with an interface that is easy to navigate and charting tools that you can use right away. Features like drag-and-drop or customizable layouts can help you get started quickly without feeling overwhelmed.

Test the software’s performance. Try the software on both demo and live accounts. Make sure it performs well without lagging, particularly during volatile market conditions. A responsive charting tool ensures you don’t miss any critical trade opportunities due to technical delays.

Indicators you can count on. For accurate technical analysis, ensure that the software provides essential indicators like moving averages, RSI, and Fibonacci levels. Platforms that let you adjust and customize these indicators are especially helpful for tailoring them to your specific strategy.

Make sure it works with your broker. Check if the charting software can integrate seamlessly with your broker's platform. Some free charting tools might not allow you to trade directly from the chart, so it's important to choose one that supports easy linking to your trading account. For the top brokers, we have outlined the support for popular charting software in the table below

| MT4 | MT5 | cTrader | TradingView | Demo | Min. deposit, $ | Max. Regulation Level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| No | No | No | Yes | Yes | 100 | Tier-1 | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | Yes | No | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | Yes | Yes | No | Tier-1 | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | Yes | Yes | 100 | Tier-1 | 6.95 | Study review | |

| No | No | No | Yes | Yes | No | Tier-1 | 6.9 | Open an account Your capital is at risk. |

Beginners should prioritize user interface

Always remember that the top Forex charting platforms aren’t just about flashy features — they should help you make real-time, informed decisions. One key feature is the ability to tailor the layout and chart settings to fit your trading style.

A flexible platform allows you to adjust your indicators, chart types, and timeframes, ensuring you’re making decisions based on what matters most to your strategy. This flexibility is essential in developing your own approach without feeling limited. Additionally, having a software platform that integrates well with live market data feeds ensures you have fast execution and accurate data, which is vital for effective analysis.

Another important consideration is how well the charting software supports backtesting and simulation. Relying solely on live data isn't enough; it's important to have the ability to test your strategies in a risk-free environment before applying them in real trades. Backtesting allows you to assess how your strategy would have worked in previous market conditions, giving you greater confidence.

Some platforms offer paper trading, where you can practice without any real risk, helping you get familiar with the system before trading with real funds. Finding software that combines customization, fast data, and testing options will set you up for success in the long run.

Conclusion

To wrap up, choosing the best Forex charting software is about more than just technical tools; it’s about finding one that fits your unique trading style. Whether you’re a scalper who needs fast data and quick charts or a long-term trader looking for in-depth analysis, the software should grow with you as you advance in your trading. Flexibility, speed, and support make the difference, so be sure to test a few options to find the one that helps you trade with confidence and precision.

FAQs

How do I choose the right charting tool for my trading style?

The right Forex charting tool depends on your style. If you're into technical analysis, pick software with solid charting features, indicators, and drawing tools to help you track price shifts. For short-term traders, look for apps that offer up-to-date market data and fast execution. Beginners should go for platforms with simple designs, easy-to-use tools, and resources to learn while they trade. Ultimately, choose a tool that matches your strategy and helps you make smarter choices.

Can beginners use Forex charting software?

Yes, many platforms offer beginner-friendly interfaces and tutorials.

Do I need to download Forex charting software?

Not necessarily. Many tools, such as TradingView, are web-based and require no download.

What’s the difference between free and paid charting software?

Paid versions often include advanced features like automated trading, in-depth analytics, and priority customer support.

How do I customize my charts?

Most platforms let you add indicators, change chart types, and adjust time frames to suit your strategy.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Swing trading is a trading strategy that involves holding positions in financial assets, such as stocks or forex, for several days to weeks, aiming to profit from short- to medium-term price swings or "swings" in the market. Swing traders typically use technical and fundamental analysis to identify potential entry and exit points.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.