The Best Time to Trade Forex in the Netherlands

The best time to trade Forex in the Netherlands has not been identified, but it is believed that the time period between the overlapping U.S. and London markets, from eight in the morning to noon EST, is the best time for trading globally

Navigating the dynamic world of Forex trading requires a strategic understanding of timing and liquidity. In the Netherlands, where the vibrant financial landscape intertwines with global markets, choosing the right trading sessions and currency pairs can significantly impact trading success. In this insightful article, TU experts illuminate the path to effective Forex trading in the Netherlands time zone. Discover the best times for active trading and delve into the realm of the most liquid currency pairs as we unveil essential strategies to elevate your trading endeavors in this article.

Forex trading sessions in the Netherlands

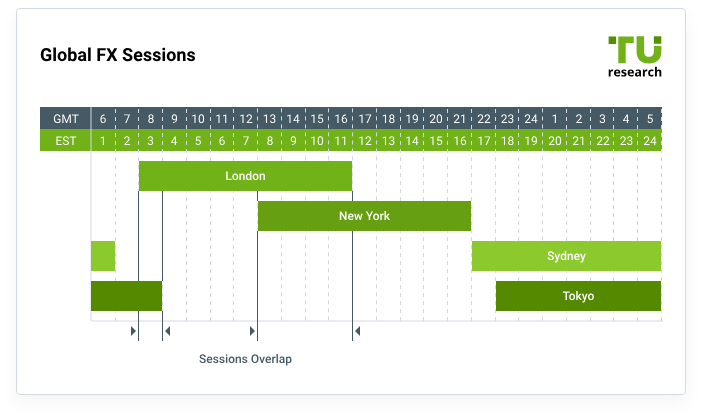

There are four different trading sessions in the Netherlands, and the Traders Union experts have highlighted the various Forex trading sessions below:

FX Sessions

Sydney session (Australian Session): This tranquil session marks the commencement of the forex trading week, aligning with the start of the business day in Australia and New Zealand. Taking place from 22:00 to 07:00 GMT (local time: 08:00 - 17:00 AEST), the Sydney Session is characterized by moderate trading volume and relatively lower volatility. During this period, traders engage in currency pairs such as AUD/USD, NZD/USD, and AUD/JPY, influenced by economic developments and news from the Asia-Pacific region.

Tokyo session (Asian Session): Emerging after Sydney, the Tokyo Session unfolds from 00:00 to 09:00 GMT (local time: 09:00 - 18:00 JST). This session showcases heightened volatility as traders from Japan, China, and other Asian nations participate. The session's volatility can escalate when significant economic data or news events concerning Asian markets are released. Key currency pairs like USD/JPY, AUD/JPY, and NZD/JPY take center stage, resonating with the rhythms of the Asian financial landscape.

London Session (European Session): The London Session, a dynamic force, thrives on the overlap with the Asian Session. From 07:00 to 16:00 GMT (local time: 08:00 - 17:00 BST), this session ushers in increased trading volume and heightened volatility. It resonates with the influence of major European financial centers. The euro (EUR), British pound (GBP), and EUR/GBP form the heart of this session's choreography, as traders respond to economic data, news releases, and market shifts.

New York Session (North American Session): Regardless of both the London and Tokyo sessions, the New York Session takes center stage from 12:00 to 21:00 GMT (local time: 08:00 - 17:00 EDT). This session, vibrant and bustling, emanates from the heart of the United States, a global economic powerhouse. High liquidity and volatility define this period, and currency pairs like USD/JPY, EUR/USD, GBP/USD, and USD/CAD see significant activity.

Time Zones in the Netherlands

In the Netherlands, standard time is observed as Central European Time (CET), and daylight saving time is observed as Central European Summer Time (CEST). The best times to trade currencies are greatly influenced by these time zones. When observing Central European Time (CET), the London trading session, starting at approximately 8:00 a.m. CET, aligns well with trading hours in the Netherlands. This session offers heightened market activity and is characterized by increased liquidity and volatility.

During Central European Summer Time (CEST), which is UTC+2, the timing remains consistent for Forex trading. The London session's opening time is around 8:00 a.m. CEST during this period maintains an advantageous overlap for traders. Traders in the Netherlands can optimize their Forex trading by focusing on the active London trading session, taking into account both Central European Time (CET) and Central European Summer Time (CEST) as relevant time references. This approach enables them to make well-informed trading decisions and harness market opportunities effectively.

What is the best time to trade Forex in the Netherlands?

The best time for trading foreign exchange in the Netherlands has not been identified, but it is believed that the time period between the overlapping U.S. and London markets, from eight in the morning to noon EST, is the best time for trading globally. According to TU experts, this time period has the highest trading volume and consequently presents Dutch investors with the best investment opportunities. Additionally, the Sydney and Tokyo markets overlap from two in the morning to four in the morning, but this period is not as well-known for its volatility as the U.S./London overlap. Investors in The Netherlands can still take advantage of significant investment opportunities during this time period.

Best time for Forex day trading in the Netherlands

The most relevant time for active Forex day trading in the Netherlands is during the overlap of the London and New York trading sessions. This overlap typically occurs between 1:00 PM and 5:00 PM CET (Central European Time), which is equivalent to 7:00 AM to 11:00 AM EST (Eastern Standard Time). During this overlap, both the London and New York sessions are open, leading to a substantial increase in trading activity and liquidity in the forex market. Higher liquidity leads to a larger number of trading opportunities, and traders can find suitable setups and enter or exit positions more easily, enhancing their ability to capitalize on market movements.

Best Forex pairs to trade in the Netherlands trading sessions

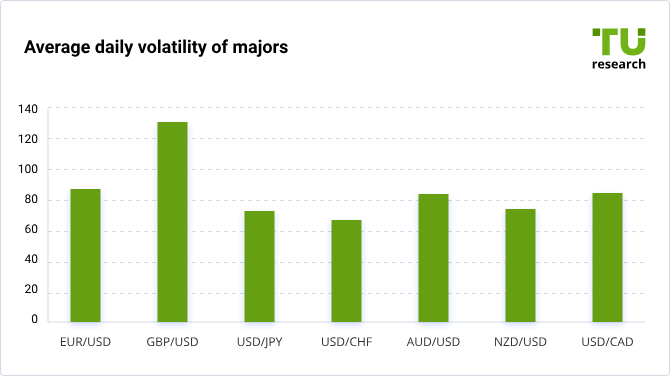

In the Netherlands, during different Forex trading sessions, specific currency pairs tend to exhibit better trading opportunities and volatility due to market activity and overlap with other major trading regions. Here are some TU-recommended Forex pairs to consider trading during different trading sessions:

Forex pairs recommended by TU

London session (8 AM - 4 PM CET): During this session, the European and US markets overlap, resulting in heightened trading dynamics. Optimal pairs to trade include EUR/USD, GBP/USD, and EUR/GBP. Traders can benefit from the release of significant economic data and news events from both regions, contributing to increased price movements and potential profit opportunities.

New York session (2 PM - 10 PM CET): Marking the intersection of London and New York trading hours, this session showcases substantial liquidity and volatility. EUR/USD, USD/JPY, and GBP/USD are noteworthy pairs to watch. The session is punctuated by the unveiling of key US economic indicators, central bank statements, and geopolitical developments, amplifying trading prospects.

Asian session (12 AM - 8 AM CET): Influenced primarily by the Tokyo market and the overlap with the Sydney session, the Asian session offers unique prospects. USD/JPY, AUD/USD, and NZD/USD take the spotlight as economic data from Japan, Australia, and New Zealand shapes market sentiment. Traders in the Netherlands can capitalize on these pairs' movements driven by regional factors during this time frame.

Time to pause Forex trading in the Netherlands

It's advisable to pause Forex trading in the Netherlands around the daily rollover time of 10:00 p.m. CET (4:00 p.m. EST). During this period, market liquidity is low, leading to wider spreads and potential price swings. Additionally, interest rate adjustments occur, affecting trading costs. Technical issues and time zone differences can further disrupt trading. According to TU experts, traders should also be cautious during major holidays and closed trading sessions to manage risks effectively.

Best Forex brokers in the Netherlands

RoboForex

RoboForex stands out as the best Forex broker in the Netherlands for different reasons. The brokerage company, launched in 2009, offers the best trading interface, making it the best choice for novice and experienced investors.

According to experts, RoboForex is a reliable financial market expert. They are properly regulated and hold a European license from CySEC and an international license to offer services from FSC Belize. Consider RoboForex if you are a trader looking for a trustworthy broker with good trading conditions, low spreads, and low commissions.

FxPro

FxPro, which caters to all levels of traders, from novices to professionals, is among the best Forex brokers in the Netherlands. As a top-regulated broker (regulated by the FCA, CySEC, FSCA, and SCB), FxPro is the broker for traders seeking a reliable and secure broker. This broker's layout is appropriate for traders with diverse levels of Forex expertise and experience.

Additionally, the broker makes sure to safeguard the interests of its clients, incorporate the negative balance option, and provide the highest level of client service. Since its debut in 2006, FxPro has won over 85 awards and is renowned for providing the best trading tools.

They offer stock indices, metals, and energy resources with over 70 currency pairs, futures, and stocks (including Twitter, Apple, and Google).

IC Markets

IC Markets is ranked third among the best Forex brokers in the Netherlands by TU experts. Reputable financial institutions like SFSA, ASIC, and CySEC supervise the trading operations of this reliable Forex broker.

IC Markets, which was established in 2007, is the ideal broker for traders in the Netherlands who are into scalping and automated trading. It is also the best Forex broker for beginners and traders seeking a trading platform with an insurance fund.

FAQs

Can I trade Forex in the Netherlands?

Yes, residents of the Netherlands can trade Forex. The Netherlands has a well-developed financial infrastructure that allows individuals to participate in the forex market.

What is the best time to trade Forex?

The best time to trade Forex is during overlapping market sessions, like the London-New York overlap. This is when two major markets are open simultaneously, leading to higher trading activity and increased chances of profitable trades.

What time is the Forex session in Europe?

The main Forex session in Europe is the London session, which typically starts around 8:00 a.m. GMT. During this session, market participants closely watch economic announcements and news releases that can impact currency movements.

What is the best trading time in Europe?

The best trading time in Europe is during the London session, as it has high trading volume and volatility.

Team that worked on the article

Winnifred Emmanuel is a freelance financial analyst and writer with years of experience in working with financial websites and businesses. Her expertise spans various areas, including commodities, Forex, stocks, and cryptocurrency. Winnifred tailors her writing to various audiences, including beginners, while also providing useful insights for those who are already familiar with financial markets.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).