Best Time To Trade Forex In South Africa

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In South Africa, the optimal time to trade Forex is between 10:00 AM and 4:00 PM SAST. This period aligns with the overlap of the London and New York sessions, leading to increased market liquidity and volatility, which can present more trading opportunities.

For South African Forex traders navigating changing market conditions, selecting optimal trading times requires careful strategy. While the 24-hour currency market is always active, liquidity, volatility and opportunities vary significantly across sessions. By understanding these global rhythms and how they intersect with local time zones, savvy Johannesburg-based traders can gain an edge. In the following report, we integrate these findings with disciplinary context on inter-session dynamics.

Best time for Forex trading in South Africa

The optimal days for Forex trading in South Africa are Wednesdays and Thursdays. The best trading windows are from 8 AM to 2 PM and 8 PM to 2 AM South African time. These periods coincide with high activity in the New York and London sessions, as well as their overlap.

Key factors to consider:

Liquidity and volatility play crucial roles in profitability. Higher liquidity typically leads to lower spreads and minimizes slippage, increasing profit potential. Staying updated on market conditions and indicators, news, and economic data releases will enhance your ability to trade effectively at any time.

When to avoid Forex trading in South Africa

Avoid trading during low liquidity periods, such as around 7 am South African time when the Tokyo session closes, to reduce the risk of slippage and execution delays. It's also wise to close positions before the end of a session to avoid overnight rollover fees.

Best Forex pairs to trade in South African trading sessions

Given the overlap of the New York and London sessions during peak trading hours, currency pairs involving the US dollar or European currencies are ideal. However, mastering market conditions and trading strategies can make any pair profitable.

Best time to Trade Forex - TU Research

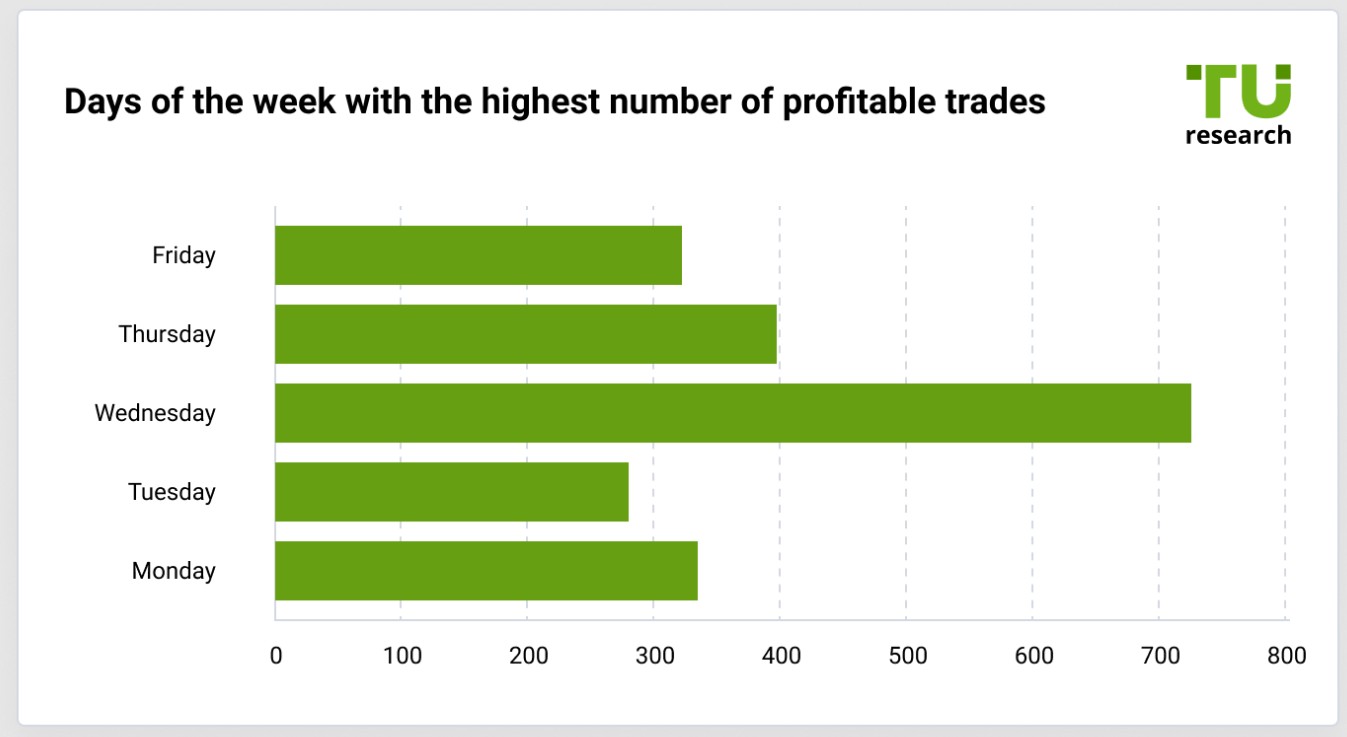

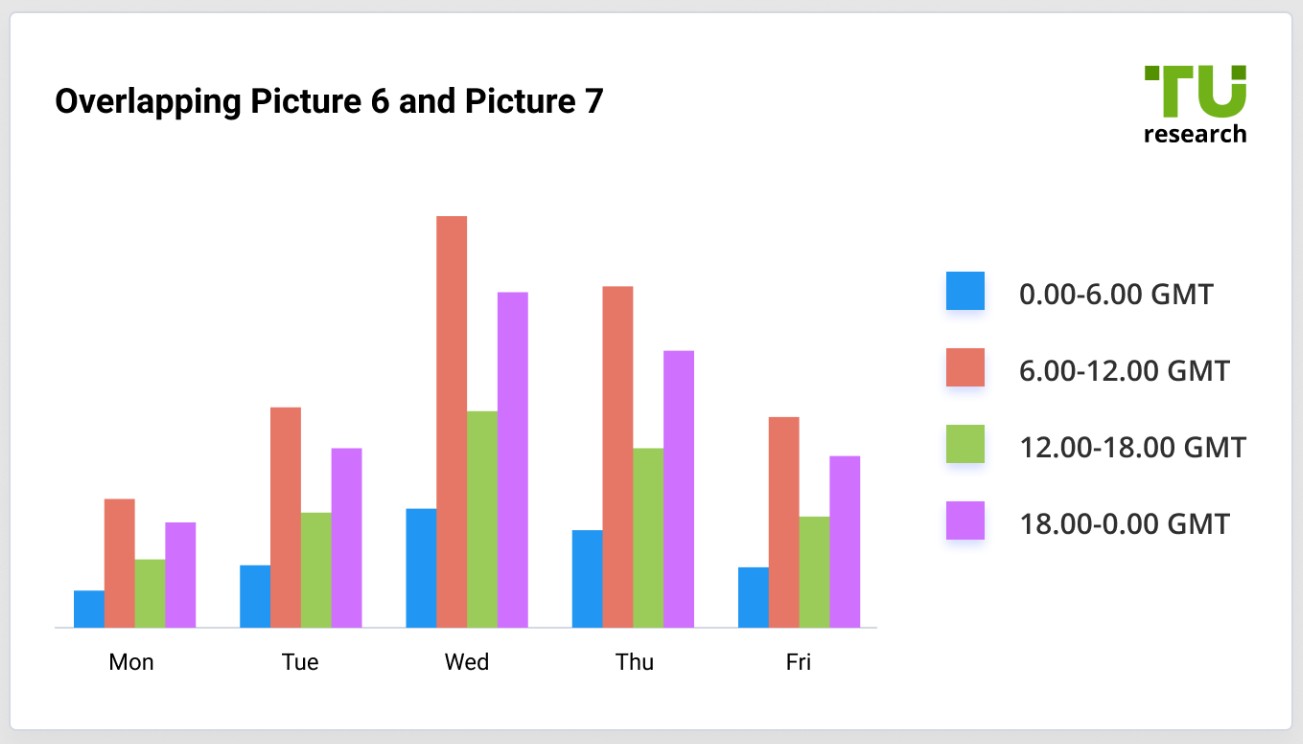

The first step to determine the best time to trade Forex in South Africa is to determine when the best times are to trade overall. Traders always believed that the times with the most liquidity and volatility in the market were the best times to trade Forex. Generally, these times fall on Thursdays and Fridays and, as a result, many traders believed that these days were the best days to trade Forex.

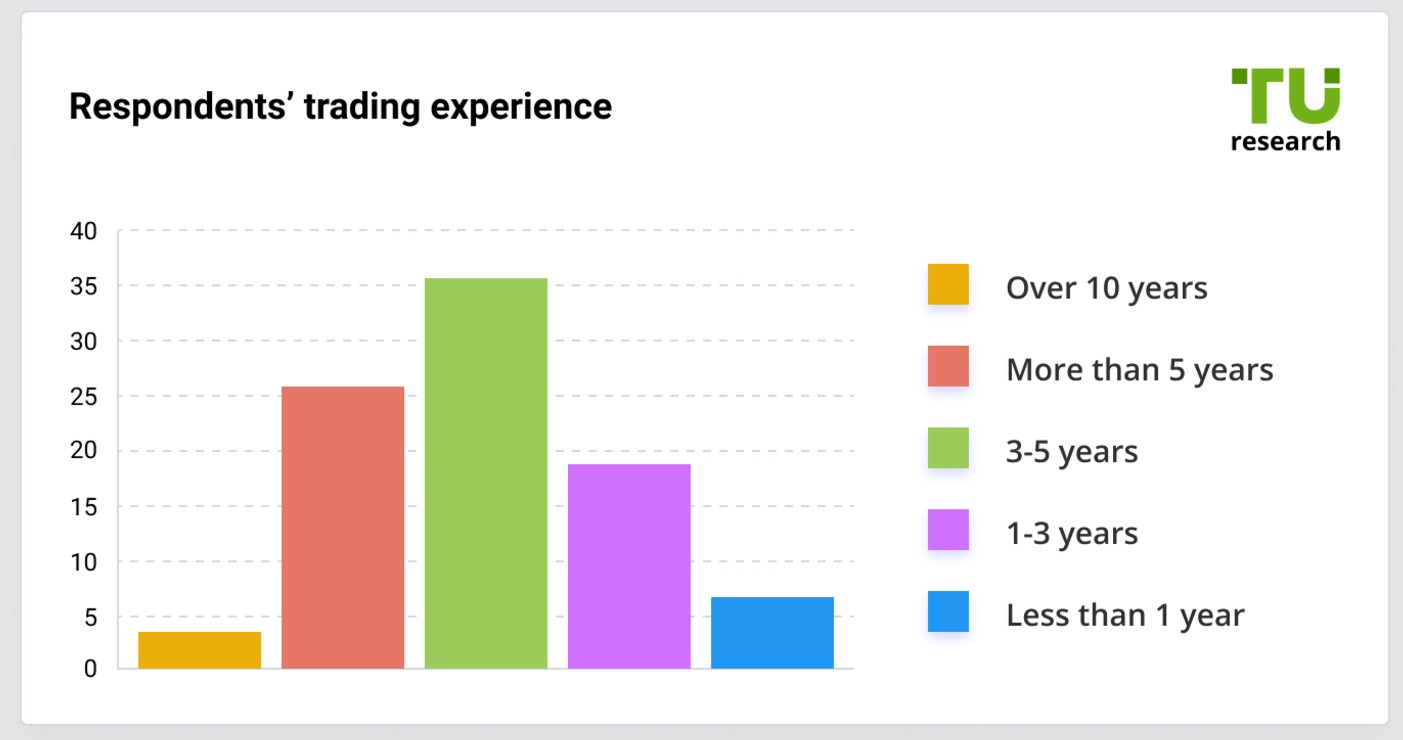

However, our experts have conducted research and can now disprove this myth. During this research, our experts interviewed 2,080 traders of whom 81% were men and 19% were women.

In the cohort, 4% of the traders have been trading Forex for over 10 years, 28% have been trading for more than 5 years, 38% have been trading between 3 and 5 years, 21% have been trading between 1 and 3 years, and 9% have been trading for less than a year.

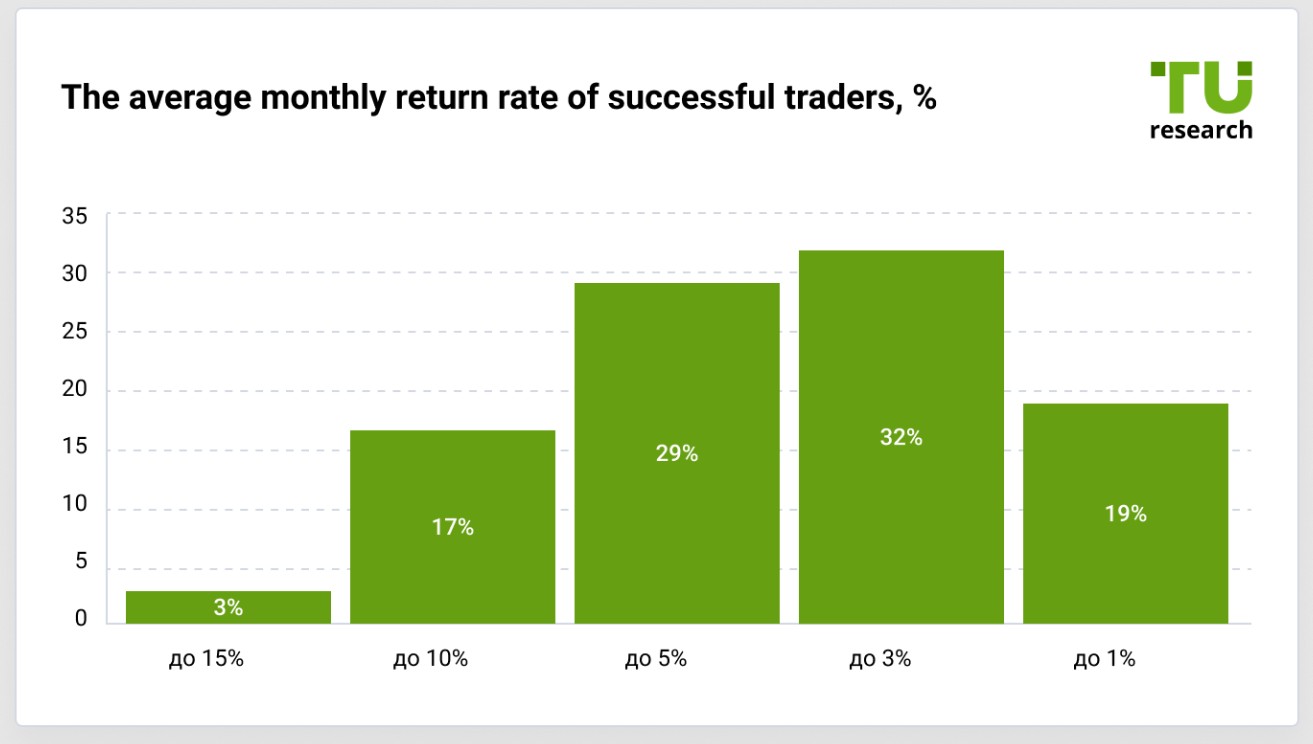

In respect of returns, 3% of the cohort showed an average monthly return of up to 15%, 17% showed monthly returns of up to 10%, 29% showed monthly returns of up to 5%, 32% showed monthly returns of up to 3%, and 19% showed monthly returns of up to 1%. To achieve these returns, 44% of the traders used intraday strategies while 44% used long-term strategies.

Now, based on the above research and the responses from the traders, what is the best time to trade Forex? Interestingly, an overwhelming majority of traders stated that their most profitable day of the week to trade Forex was Wednesday.

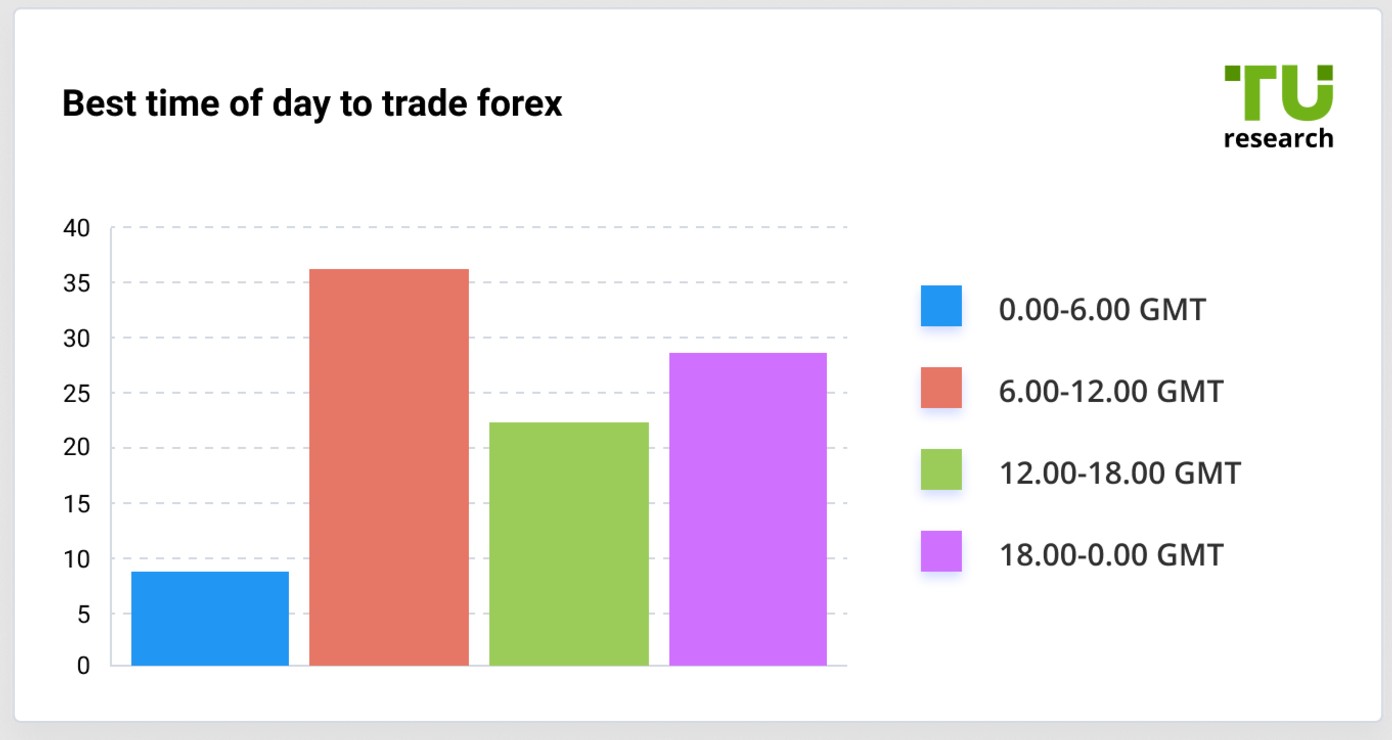

In respect of the best time to trade Forex, the majority (38%) of the traders stated that the best time to trade was between 6 am GMT (1 am EST) and 12 pm GMT (7 am EST). In turn, 31% of the traders stated that the best time for them to trade was between 6 pm GMT (1 pm EST) and 12 am GST (7 pm EST).

Now, if we combine the above results, it appears that Wednesdays are the best days to trade between 6 am GMT (1 am EST) and 12 pm GMT (7 am EST). It also appears that Thursdays are the second-best day to trade at the same times mentioned.

In addition, other results from the research show that, for long-term strategies, Wednesdays and Mondays are the most successful days for trading. Moreover, for short-term strategies, Wednesdays and Thursdays are best.

Classical Forex trading sessions

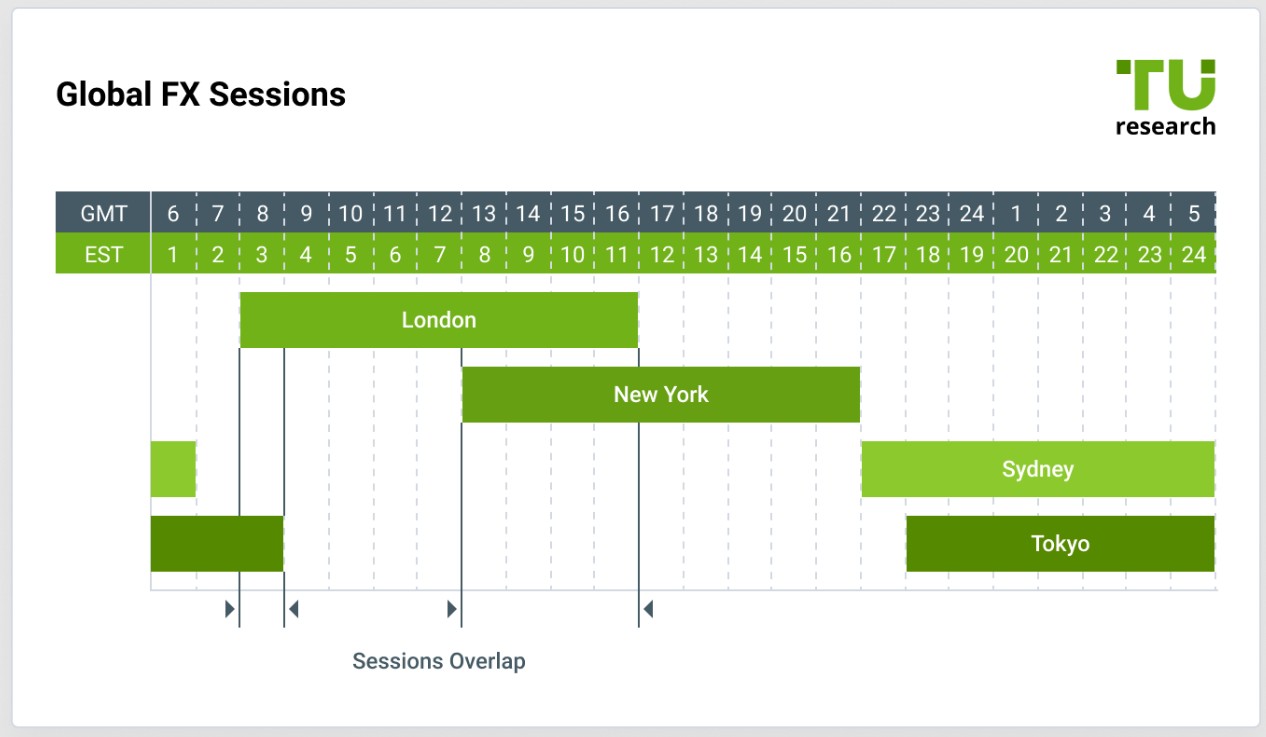

It’s important to first understand when the global Forex sessions are around the world. There are basically four main trading sessions around the world that account for over 65% of the volume of the global Forex market and most of the overall liquidity.

Global Forex trading sessions for South African traders:

1. Sydney session (Pacific region).

Local time (SAST). 12:00 AM to 9:00 AM.

Key currency pairs. AUD/USD, NZD/USD, and other pairs involving the Australian Dollar (AUD) and New Zealand Dollar (NZD).

Characteristics. The Sydney session is quieter, making it suitable for traders focusing on stable trends and pairs associated with the Pacific region. South African traders looking to trade the AUD or NZD can benefit from this session.

2. Tokyo session (Asian region).

Local time (SAST). 1:00 AM to 11:00 AM.

Key currency pairs. USD/JPY, EUR/JPY, GBP/JPY, and other pairs involving the Japanese Yen (JPY).

Characteristics. The Tokyo session is critical for South African traders interested in JPY pairs. It overlaps with Sydney, creating moderate volatility. Economic news from Japan or China can significantly impact market movements during this time.

3. London session (European region).

Local time (SAST). 10:00 AM to 7:00 PM.

Key currency pairs. EUR/USD, GBP/USD, EUR/GBP, USD/CHF, and other pairs involving the Euro (EUR) and British Pound (GBP).

Characteristics. This session aligns well with South African business hours, making it the most accessible and liquid session for local traders. Most major economic data from Europe is released during this time, creating increased volatility in European currency pairs.

4. New York session (American region).

Local time (SAST). 3:00 PM to 12:00 AM.

Key currency pairs. EUR/USD, GBP/USD, USD/JPY, and other pairs involving the U.S. Dollar (USD).

Characteristics. The overlap between the New York and London sessions, from 3:00 PM to 7:00 PM SAST, creates high volatility and trading volume. This period is particularly beneficial for South African traders dealing in USD-based pairs.

Session overlaps for South African traders

Sydney and Tokyo overlap. 12:00 AM to 9:00 AM SAST. Key pairs include AUD/JPY and NZD/USD.

Tokyo and London overlap. 10:00 AM to 11:00 AM SAST. This brief overlap provides opportunities in EUR/JPY and USD/JPY.

London and New York overlap. 3:00 PM to 7:00 PM SAST. This is the most active trading period, ideal for trading EUR/USD, GBP/USD, and USD/CHF.

Tailored advice for South African traders

South Africa’s time zone (SAST) aligns well with the London and New York sessions, offering strong opportunities for local traders to capitalize on high liquidity and volatility. To maximize trading efficiency, focus on the London session during the day and the London-New York overlap in the afternoon and evening.

Understanding these sessions and overlaps from a South African perspective helps traders plan their strategies effectively, allowing them to trade during the most profitable times.

Rules and regulation

Forex regulation in South Africa

In South Africa, the Forex market is regulated by the Financial Sector Conduct Authority (FSCA), an independent institution responsible for overseeing financial markets and ensuring consumer protection. The FSCA mandates that all Forex brokers operating within the country obtain proper licensing, which involves meeting specific criteria such as maintaining minimum capital requirements, implementing robust risk management systems, and employing qualified personnel. Additionally, brokers are required to segregate client funds from their operational accounts to safeguard traders' assets.

Investor protection in South Africa

Investor protection is further reinforced by the Protection of Investment Act 22 of 2015, which aims to balance the rights and obligations of investors and the government. The Act ensures that all investments are treated equitably and provides mechanisms for dispute resolution between investors and the state. However, it does not offer compulsory investor-state arbitration, directing disputes to be settled within South African courts.

Taxation in South Africa

Regarding taxation, South African Forex traders are subject to specific tax obligations. Profits from Forex trading are considered taxable income and must be declared to the South African Revenue Service (SARS). The applicable tax rate depends on individual circumstances, including total income and tax residency status.In South Africa, traders are subject to income tax on Forex gains, typically at a rate ranging from 18% to 45%. Value Added Tax (VAT) may also be applicable to professional traders.

Which Forex brokers to choose for trading in South Africa?

To trade Forex in South Africa, prioritize brokers regulated by the Financial Sector Conduct Authority (FSCA) for compliance and security. Opt for brokers offering ZAR (South African Rand) accounts to avoid conversion fees. Look for competitive spreads, low commissions, and strong local customer support to enhance your trading experience and success.

| Available in South Africa | Currency pairs | Demo | Min. deposit, $ | Max. leverage | ZAR | FSCA | Regulation level | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | 40 | Yes | 100 | 1:500 | No | No | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 57 | Yes | 5 | 1:1000 | Yes | Yes | Tier-1 | Open an account Your capital is at risk. |

|

| Yes | 40 | Yes | 10 | 1:2000 | No | No | Tier-3 | Open an account Your capital is at risk. |

|

| Yes | 100 | Yes | 10 | 1:2000 | Yes | Yes | Tier-1 | Open an account Your capital is at risk.

|

|

| Yes | 55 | Yes | 100 | 1:500 | No | Yes | Tier-1 | Open an account Your capital is at risk. |

Consider focusing on the overlap between the London and New York sessions

To optimize your Forex trading strategy in South Africa, consider focusing on the overlap between the London and New York sessions, which occurs between 3 pm and 7 pm SAST during standard time and 2 pm to 6 pm during daylight saving time. This period typically offers increased liquidity and volatility, especially for major currency pairs like EUR/USD and GBP/USD, presenting more trading opportunities.

Additionally, pay close attention to South Africa's economic indicators, such as GDP growth rates, inflation figures, and political developments, as they can significantly impact the value of the South African Rand (ZAR). Understanding these local factors, alongside global market trends, can provide a more comprehensive view of potential market movements, enabling more informed and strategic trading decisions.

Conclusion

Understanding the best times to trade Forex in South Africa is key to maximizing profitability. By focusing on high-liquidity periods, such as the overlap of the London and New York sessions, and avoiding low-activity times, traders can minimize risks like slippage and rollover fees. Aligning trading strategies with these optimal hours and staying informed about market conditions ensures a successful trading experience.

FAQs

What are the best trading hours for Forex in South Africa?

The best times to trade Forex in South Africa are from 8 am to 2 pm and 8 pm to 2 am South African time. These periods coincide with high activity during the London and New York sessions.

Why is liquidity important when trading Forex?

High liquidity reduces spreads and slippage, increasing profitability. Trading during peak hours ensures better execution and minimizes trading costs.

Which days are the most profitable for Forex trading in South Africa?

Research shows Wednesdays and Thursdays are the most profitable days due to increased market activity and optimal trading conditions.

How does South Africa’s time zone impact Forex trading?

South Africa’s time zone aligns well with major global sessions, such as London and New York. However, traders should monitor daylight savings time changes globally, even though South Africa itself doesn’t observe DST.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).