How To Use The Grid Trading Strategy?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

A grid trading strategy is a technique often used by Forex and cryptocurrency traders to open buy/sell positions above and below the price of an asset using pending orders. This method works only in a predetermined range. Grid trading’s systematic approach and simplicity make it both an attractive strategy for beginners and perfectly suited for trading bots.

The strategy, which works well in both bullish and bearish market conditions, is well-suited for automation and is simple enough for beginners to use. However, it can introduce limitless risk if a trend continues outside of the established range, and may be overly dependent on historical data and not suitable for future unpredictable price directions.

So, is the grid trading strategy actually worth it? In this article we’ll be breaking down the grid trading strategy, looking at the pros and cons, and preparing you to implement it.

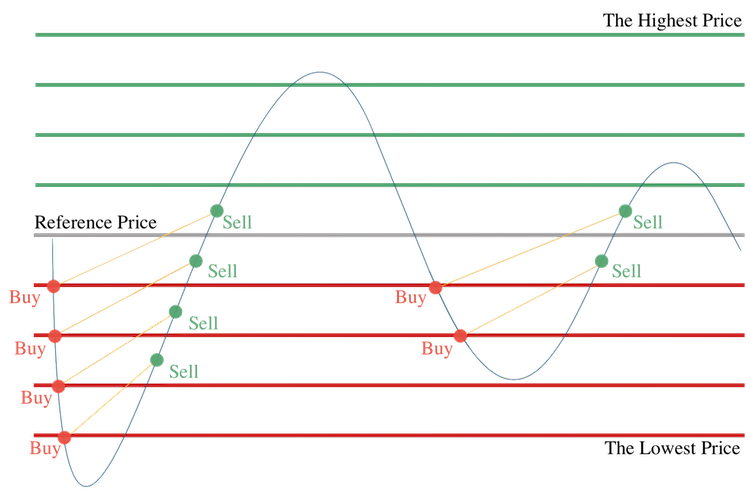

The grid trading strategy involves the systematic placement of pending buy orders above the initial price and pending sell orders below the initial price in the form of a grid to profit from price fluctuations in a wide enough range.

Understanding grid trading strategies

Grid trading is a somewhat sophisticated strategy employed by traders to navigate the complexities of financial markets, and is particularly prevalent in the Forex and crypto markets. At its core, grid trading revolves around the concept of placing a series of buy and sell orders at predefined intervals above and below a base price, forming a grid-like structure. This approach users of the strategy to capitalize on the natural ebb and flow of price movements, whether the market is trending or ranging.

The versatility of grid trading lies in its adaptability to various market conditions. In trending markets, traders strategically place buy orders above the base price and sell orders below, aiming to profit from the momentum of price movements. Conversely, in ranging markets characterized by sideways price action, traders may invert this approach by placing buy orders below the base price and sell orders above, anticipating price oscillations within a defined range.

Is dollar averaging a grid strategy?

No, though some traders confuse dollar averaging with the grid strategy. Dollar-cost averaging (DCA) involves investing a fixed amount of money at regular intervals, regardless of asset price fluctuations. The goal is to reduce the impact of market volatility over time by spreading out the investment across various price levels. DCA is commonly used in long-term investing to build wealth gradually and mitigate the risk of market timing. Grid trading on the other hand is a more active trading strategy where buy and sell orders are placed at predefined intervals.While both DCA and grid trading involve regular investments and can potentially mitigate risks, they serve different purposes and operate on distinct principles. DCA focuses on long-term wealth accumulation through consistent investments, while grid trading aims to profit from short to medium-term price movements using active trading strategies.

Best Forex brokers

How to use grid trading

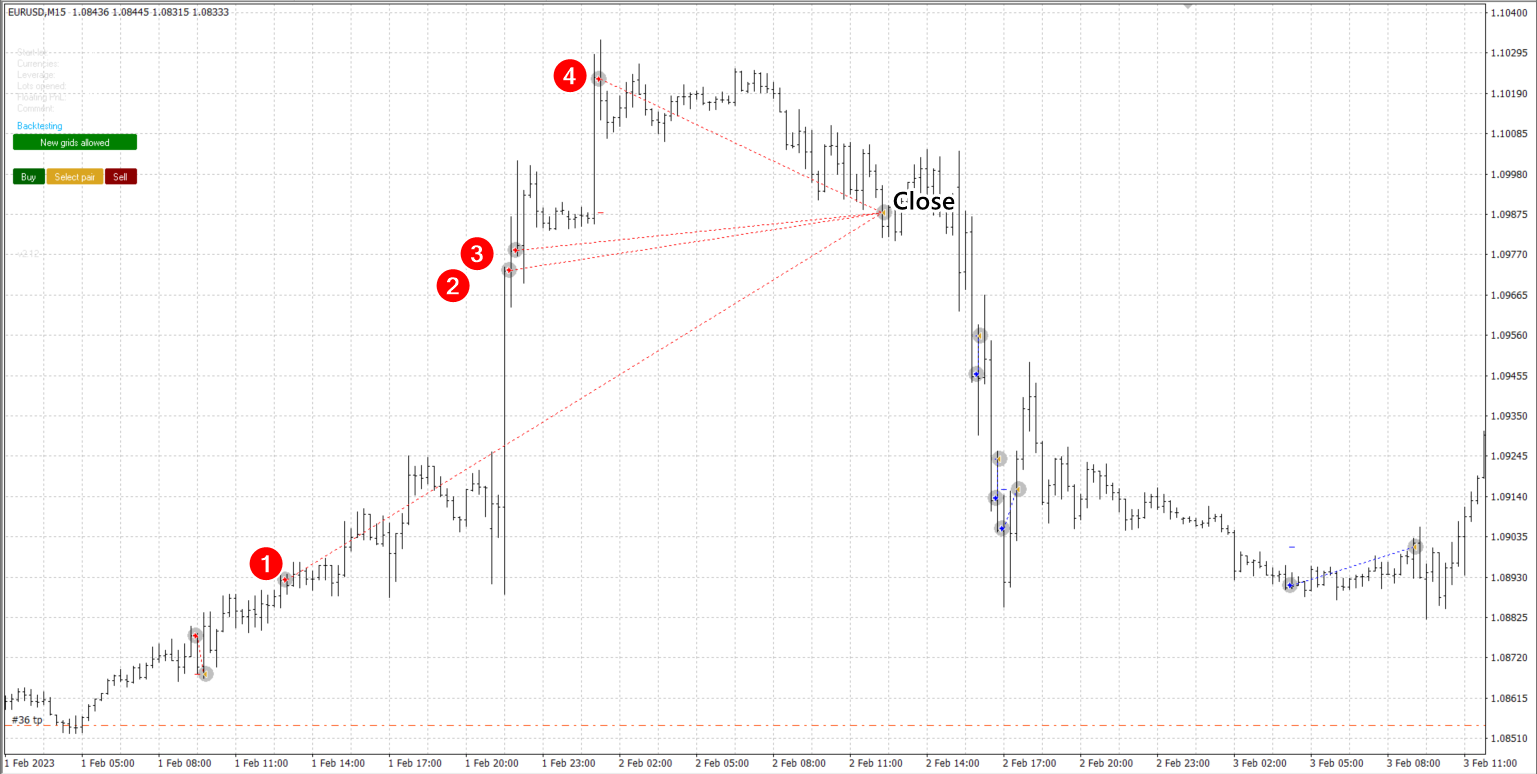

Let’s illustrate how a trader could apply the grid strategy to trading EUR/USD, with a starting price of 1.08510, (called the reference price) as seen in the image below.

An example of grid-based trading strategy implementation

An example of grid-based trading strategy implementationWe’ll break it down into steps:

Choose an interval: The trader decides on a 100-pip interval for this example.

Determine starting price: Given the current price of 1.08510, the trader sets this as the starting point.

Decide on grid direction: For this example, let's consider a with-the-trend grid strategy, meaning that trades will be placed in the direction of the upward trend.

If the trader is applying the grid strategy with the trend, his buy orders are placed at intervals above the current price, and sell orders are placed at intervals below the current price. The trader continues this pattern, placing orders at regular intervals above and below the starting price. As the price moves in the desired direction, the grid expands to capitalize on the trend. The trader places buy orders at regular intervals above the current price, with a sell order 100 pips below the buy order, allowing them to anticipate a change in price direction. The trader sets an exit strategy to lock in profits when conditions are favorable.

Grid trading strategies

Grid trading strategiesIs grid trading a good strategy?

Grid trading can be a viable strategy under specific market conditions and for those with a particular risk appetite, but it's essential to recognize that there is no universally "best" strategy in trading. Each strategy, including grid trading, comes with its own set of advantages and drawbacks, and its effectiveness can vary depending on various factors such as market volatility, liquidity, and trends.

While the grid trading approach can be automated and requires minimal forecasting of market direction, it's not without its risks. When using it, you must carefully manage your positions, set appropriate stop-loss orders, and be prepared for the possibility of incurring losses, especially if the market moves strongly in one direction.

It's crucial that you conduct thorough research and understand the intricacies of grid trading. This includes studying historical data, backtesting the strategy, and assessing its compatibility with your trading goals and risk tolerance. Additionally, you should stay informed about market developments, economic indicators, and geopolitical events that can impact your trading decisions.

Ultimately, the suitability of grid trading depends on your individual preferences, trading objectives, and market conditions. Let’s take a look at some of the advantages and disadvantages of using a grid trading strategy.

Benefits of using grid trading strategy

Market Neutrality: Grid trading strategies can offer a degree of market neutrality, allowing you to profit from both bullish and bearish market conditions. By placing buy and sell orders at predefined intervals, you make it possible to capitalize on price movements regardless of the market direction.

Automation Potential: Grid trading strategies can be automated using trading bots or algorithms, which execute trades based on predefined parameters and rules. Automation eliminates the need for manual intervention and allows you to capitalize on trading opportunities around the clock, even when you’re away from the platform.

Simplicity: Grid trading strategies are relatively simple to understand and implement compared to more complex trading techniques. All you need to do is establish a grid of buy and sell orders at regular intervals above and below a base price, to try and profit from price fluctuations within a predetermined range. This simplicity makes grid trading accessible even if you’re a beginner.

Why you shouldn’t use grid strategy

Risky in Trending Markets: Grid trading strategies can be incredibly risky, particularly in trendy markets characterized by prolonged and directional price movements. During strong trends, grid trading can result in accumulating losses as the price continues to move against the established grid levels. You may find it challenging to effectively manage risk and limit losses in such market conditions, potentially leading to significant drawdowns and even complete account depletion.

Margin Requirements: Grid trading strategies usually require you to maintain sufficient margin levels to support multiple open positions simultaneously. As the grid expands with additional buy and sell orders, the margin requirements can escalate rapidly, tying up a significant portion of your capital. High margin requirements increase the risk of margin calls and potential liquidation of positions, especially in volatile market conditions.

Over-Optimization: You run the risk of falling into the trap of over-optimizing grid trading strategies to historical price data, thereby creating overly complex and curve-fitted systems that perform well in backtests but fail to deliver consistent results in live trading environments. Over-optimized grid strategies may struggle to adapt to changing market conditions or unexpected price movements, leading to suboptimal performance and losses.

You can read more about his analysis of grid trading, as well as other trading strategies, here: Which Forex Trading Strategy Is Best For Me?

Expert opinion

Grid trading is good for using in different market environments. Grid trading provides flexibility for traders to navigate different market scenarios. The most widespread use of grid strategies is in the forex market, with the expectation that the rate of a stable currency cannot move in one direction all the time. However, too aggressive parameters (small grid spacing or multiples of the martingale volume) lead to the fact that grid strategies are considered dangerous.

Summary

In conclusion, the grid trading approach is a simple-to-use strategy that can work in most market conditions, though does usually require a well-established range of price movements. Its simplicity makes it ideal for traders of all levels of experience, even beginners, and is perfectly suited for automation using trading bots. However, if an asset’s price continues to trend in one specific direction outside of the established range, the risks posed by using this strategy can be almost limitless and would require high levels of margin. Make sure to do your own research before trying out grid trading.

FAQs

What are grids in crypto trading?

The term "grid" in trading applies to a trading strategy in which pending buy/sell orders are placed at regular intervals above and below the current market price. These orders create a system of trades that allows traders to profit from price movements within a predetermined range. The technique aims to capitalize on market volatility while minimizing risk.

What is a grid trading bot?

A grid trading bot is an automated trading tool designed to execute grid trading strategies in the cryptocurrency markets. The bot continuously monitors price movements and automatically places orders according to the predefined grid parameters based on the grid strategy being applied by the trader. As the bot is systematically placing trades both below and above the current price, it can profit from price fluctuation within a predetermined range regardless of the market direction.

Is grid trading illegal?

Grid trading itself is not illegal. However, regulations regarding trading practices vary by jurisdiction. Traders should ensure compliance with local laws and regulations governing financial markets and trading activities. Additionally, some online brokers may prohibit grid trading, so be sure to check with them beforehand.

Is grid trading always profitable?

Grid trading strategies can be profitable in certain market conditions but may also incur losses in others. Success depends on various factors such as market volatility, asset liquidity, and the effectiveness of the grid trading strategy employed. The most serious disadvantage of using a grid trading strategy is that the volume of trades that can potentially be opened creates a heavy load on the deposit, which means higher transaction costs for spreads/commissions and negatively affects the amount of profit.

Related Articles

Team that worked on the article

Jason Law is a freelance writer and journalist and a Traders Union website contributor. While his main areas of expertise are currently finance and investing, he’s also a generalist writer covering news, current events, and travel.

Jason’s experience includes being an editor for South24 News and writing for the Vietnam Times newspaper. He is also an avid investor and an active stock and cryptocurrency trader with several years of experience.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

In the Forex market, a “trend” is the label used to describe the general direction that the prices of currency pairs are moving in, over a specific period of time. Trends are basically the pattern that a currency pair appears to be following and can help traders determine when to enter and exit a trade.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.