Best TradingView Brokers 2025: Fees & Features

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

If you're too busy to read the entire article and want a quick answer, the best TradingView broker is Eightcap. Why? Here are its key advantages:

- Is legit in your country (Identified as Hong Kong

)

- Has a good user satisfaction score

- Full integration with TradingView

- A wide range of available instruments, such as stocks, forex, cryptocurrencies and futures, allows you to diversify your portfolio.

Best TradingView brokers:

- Eightcap - Best broker to trade directly from TradingView charts

- Vantage Markets - Best for trading CFDs on major U.S. Stocks (zero fees apply)

- IC Markets - Biggest Forex broker by trading volume (average volume over 29B per day)

- FBS - A reliable broker with affordable offers (ASIC regulation, min. deposit 5$)

- Fusion Markets - Best for low cost Forex trading (ECN fee is only $2.25 per side)

Choosing a broker that supports platform TradingView is key for traders who want easy-to-use and powerful analysis tools. TradingView offers a wide range of features, from advanced charting to technical analysis settings, making it an indispensable resource for making informed trading decisions. It is also a social network where you can share experiences. In this article, we will review the best brokers integrated with TradingView and compare them based on fees, functionality, and service quality. The brokers presented will help traders effectively use TradingView to improve their trading results. We will also walk through the unique features and potential benefits of each broker to make your choice easier.

Best Forex brokers with TradingView

TradingView is not a brokerage platform but serves as a tool for technical analysis and sharing ideas among traders and investors. The platform offers various features for analyzing assets and the market, attracting a large community of users. Brokers that integrate with TradingView enable traders to link their accounts, making it possible to trade Forex, stocks, and cryptocurrencies directly through the platform.

Choosing a broker that supports TradingView enhances a trader’s experience by offering detailed analysis tools and charts. We have evaluated and listed the top brokers connected with TradingView to assist you in selecting the right trading partner.

| TradingView | Min. deposit, $ | Max. leverage | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 100 | 1:500 | 0,4 | 1,5 | Open an account Your capital is at risk. |

|

| Yes | 50 | 1:2000 | 0,3 | 1,4 | Open an account Your capital is at risk. |

|

| Yes | 200 | 1:500 | 0,8 | 1,0 | Open an account Your capital is at risk. |

|

| Yes | 5 | 1:3000 | 0,7 | 1,3 | Open an account Your capital is at risk. |

|

| Yes | 1 | 1:500 | 0,1 | 0,4 | Open an account Your capital is at risk. |

How to connect an account to TradingView

Integrating a broker with TradingView is done in a few steps after registering accounts on both platforms.

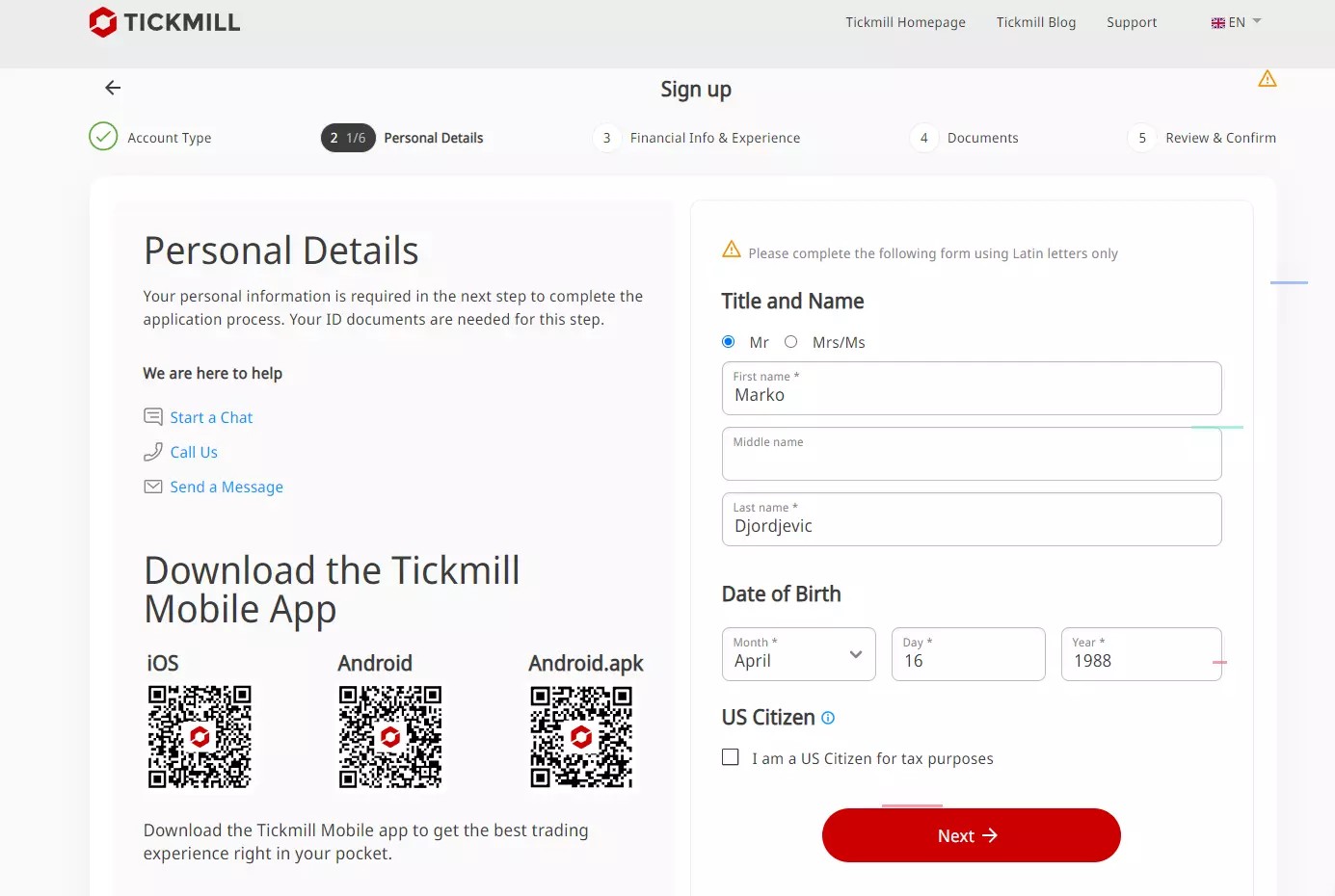

Register with a broker. Choose a broker that supports TradingView, for example from the list offered by our experts in this article. As an example we took the broker Tickmill, which supports integration with Tradingview.

The registration process may vary, but generally includes the following steps:

Click "Create an account" or "Register".

Select the account type - individual or corporate.

Enter personal details and upload documents to verify your identity.

Verify the details and complete the registration.

It may take some time for the platform to verify the documents and activate your account.

Create a TradingView account. Traders Union experts recommend starting with a free plan to test the platform, with the option to upgrade to a paid plan later. Click “Get Started” in the upper right corner of the TradingView home page. Select a plan and follow the instructions to register.

In addition to using email, you can speed up the process and sign up through Google, Facebook, LinkedIn, and a number of other options.

Confirm your email address to activate your TradingView account. You will then be automatically logged in. On the home page, check if you need to log in again. Your profile photo will appear in the upper right corner, and the main menu will be available on the right.

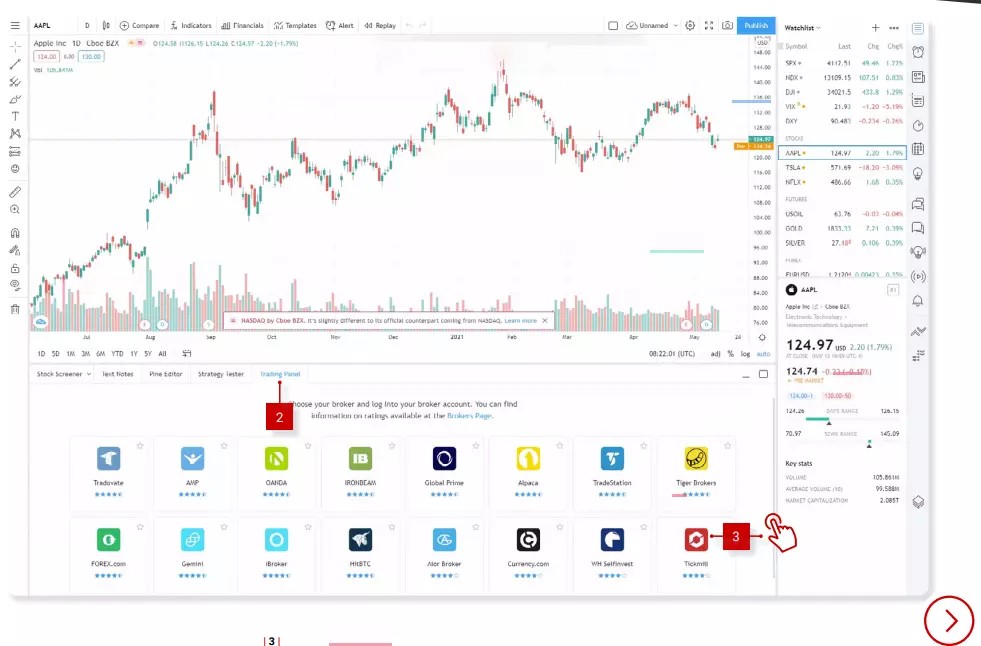

Open any chart in your TradingView account. The Trading Panel menu will display brokers available for integration. Select the desired broker and click on its logo.

In the window that appears, enter the broker account details, check that they are correct, and click "Connect". The broker's functions will now be available through TradingView.

How to trade on TradingView

TradingView offers advanced charting tools, technical analysis, and a strong community for traders and investors. While not a brokerage itself, it lets users connect their brokerage accounts to trade directly from its platform. Here’s how to trade on TradingView:

Set up your trading space

Customize charts: Use the chart tools to analyze markets, add indicators, draw trend lines, and choose chart types.

Watchlists: Create and manage lists to track your favorite assets.

Place trades

Order placement:

Right-click on the chart at your target price and select “Trade” to open an order.

Use the “Order Panel” to fill in order details like type (market, limit, stop), quantity, and price.

Manage orders:

Check active orders on the chart or in the “Order Panel”.

Adjust or cancel orders as needed.

Use additional features

Alerts: Set price alerts to get notified when an asset hits a specific price.

Community: Share ideas, follow other traders, and join discussions.

Practice with paper trading

For new traders or strategy testing, use TradingView's paper trading feature to simulate trades without risking money.

By linking your brokerage account with TradingView, you can use its analysis tools and easy-to-use platform for better trading. Make sure you understand the terms of both TradingView and your broker to trade confidently.

Should you use TradingView brokers?

TradingView is a popular platform for charting and technical analysis, offering a variety of tools for traders and investors. Although it isn’t a brokerage, TradingView allows users to link their brokerage accounts, enabling trading directly from its interface. This integration can enhance the trading experience by combining analysis tools with trade execution.

Benefits of using TradingView-connected brokers

Advanced charting tools. TradingView provides different chart types, drawing tools, and indicators for thorough market analysis.

Unified platform. Connecting a brokerage account to TradingView lets traders analyze and trade from one place, making the process more efficient.

Community insights. TradingView has a large user base that shares trading ideas and strategies, giving traders more perspectives to consider.

Things to consider

Broker compatibility. Not all brokers are linked with TradingView. Check if your chosen broker is supported.

Feature access. Some advanced features may need a subscription. Certain brokers may not offer all TradingView functions.

Regulatory compliance. Ensure the broker follows regulatory standards in your area for secure trading.

How much does it cost to access TradingView

TradingView is available for free, but with limited functionality. The basic account only allows one chart per tab, saves one layout, and does not support custom time frames or data export. Paid plans are available for advanced features.

The Pro plan removes ads and adds custom time frames. Pro+ includes exotic intraday charts and additional features. The Premium plan provides maximum data access, opening up more possibilities for analysis.

Here is an overview of the available TradingView plans.

| Price | Basic | Essential | Plus | Premium |

|---|---|---|---|---|

| Monthly fee | Free forever | $12.95 | $24.95 | $49.95 |

| Annual fee | Free forever | $155.40 | $299.40 | $599.40 |

Backtesting on TradingView

TradingView offers comprehensive backtesting features, allowing traders to evaluate their strategies using historical data. Key features include:

Strategy tester. This tool lets users apply trading strategies to past market data, providing insights into potential performance.

Custom strategies with Pine Script. Traders can develop and test personalized strategies using TradingView's Pine Script, tailored to specific trading needs.

Extensive historical data. Access to a wide database across various markets ensures reliable backtesting results.

Performance metrics. The platform generates reports with key metrics such as net profit, drawdown, and win rate, helping assess strategy effectiveness.

User-friendly interface. TradingView's design supports easy visualization and analysis of backtesting outcomes, making it accessible even for beginners.

Community sharing. Users can share their strategies with the TradingView community, encouraging collaboration and the exchange of ideas.

Make sure the broker you choose offers full access to TradingView features

When choosing a broker to work with TradingView, there are a few technical features that can significantly affect your trading process. One of them is the type of integration the broker has with TradingView: some brokers support full trading directly through the platform, while others only offer data viewing and analysis. Make sure the broker you choose offers full access to TradingView features if you need trading functionality.

Also consider not only the fees for trades, but also possible fees for access to data or advanced analytical tools. In some cases, brokers may charge extra for using charts or historical data on TradingView, which can affect your final costs. Compare the available plans and pay attention to reviews about the quality of integration and the speed of trade execution.

For users who regularly analyze data on different time frames, I recommend evaluating the support for different markets and the availability of up-to-date information for each of them. Some brokers offer access to a wider range of markets through TradingView than others, and this can be a big deal for traders interested in a variety of assets, whether stocks, cryptocurrencies, or Forex pairs.

Methodology for compiling our ratings of Forex brokers

Traders Union applies a rigorous methodology to evaluate brokers using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

-

Regulation and safety. Brokers are evaluated based on the level/reputation of licenses and regulations they operate under.

-

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

-

Trading instruments. Brokers are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

-

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

-

Trading platforms. Brokers are assessed based on the variety, quality, and features of platforms offered to clients.

-

Other factors like brand popularity, client support, and educational resources are also evaluated.

Find out more about the unique broker assessment methodology developed by Traders Union specialists.

Conclusion

Choosing the best broker with TradingView support in 2025 depends on your needs for functionality and available markets. Optimal integration with TradingView allows traders to use advanced analytical tools and test strategies on historical data, which improves the quality of analysis and trading efficiency. When choosing a broker, pay attention to fees, type of data access, and reviews on the speed of trade execution. Compare available options to find a broker that best suits your needs. This approach will help you effectively use TradingView to achieve your trading goals.

FAQs

Which brokers work with TradingView?

The platform currently supports 50 brokers. TradingView continues to expand its list of partners to offer users more trading opportunities.

Can I trade directly from TradingView?

Yes, you can trade through TradingView, but only if your broker is integrated with the service, which allows you to trade directly from the platform. All trading operations, including placing orders and managing positions, can be performed without having to switch between applications.

Is there a fee to connect my brokerage to TradingView?

No, connecting a brokerage account to TradingView is free for users. However, please note that your broker may charge its own fees for trading operations and data usage.

Can I add my broker to TradingView?

You can only choose from the list of brokers provided by TradingView, and you cannot add a new broker yourself. However, TradingView regularly updates its partner list, adding new providers as partnerships are established.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Paper trading, also known as virtual trading or simulated trading, is a practice where individuals or traders simulate real-life trading scenarios without using real money. Instead of placing actual trades with real capital, participants use a simulated trading platform or keep track of their trades on paper or electronically to record their buying and selling decisions.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.