Best Forex Alerts 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Plus500 - Best Forex broker for 2025 (United States)

Best Forex alerts services 2025:

- Learn2Trade – free and premium with monthly, yearly, and lifetime subscription options.

- Exness – free signals in the Exness Markets app.

- HowToTrade – free trial, paid.

- TradingView – advanced alerts for price and indicators.

- Forex GDP – free and premium monthly, quarterly, and yearly plans.

Forex alerts and signals can often mean the difference between a profitable trade and one that ends up in loss. In this article, we will list and review seven of the best forex alerts providers that can help you become a pro at forex trading.

Thanks to technology like artificial intelligence, we have a slew of forex trading alerts providers that can provide different types of signals with a high level of accuracy. While there are different types of signals in forex trading, we will mostly focus on signals regarding forex prices.

Top 7 Forex Price Alerts 2025

| Forex Alerts Provider | Alert channel | Markets | Term of use |

|---|---|---|---|

| Learn2Trade | Telegram group | Forex, CFDs, Stocks, Commodities, Crypto | Free and premium with monthly, yearly, and lifetime subscription options |

| Exness | Web, app | Forex, stock and commodity, cryptocurrencies | Free |

| HowToTrade | Web | Forex | Free trial, paid |

| TradingView | Web, app | Forex, Stocks, CFDs, Crypto | Free and paid |

| Forex GDP | Whatsapp, Email | Forex, Commodities | Free and premium monthly, quarterly, and yearly plans |

| 1000pip Builder | Forex | Premium monthly, quarterly, and yearly plans | |

| MQL5 | Web | Forex | Free and paid |

Learn2Trade

Learn2Trade is hands-down the best platform to receive signals forex, with high probability and success rates. It's a one-stop solution for both beginners and professionals alike, giving insightful trade ideas, market news, and price alerts.

Furthermore, it's not limited to a single geographic market or financial instrument. In addition to forex, you can also receive information and signals regarding stocks, CFDs, crypto, and commodities.

What sets Learn2Trade apart from the rest is that this platform exclusively focuses on signals for trading. So regardless of the broker you're using for your forex trades, you can sign up with Learn2Trade to receive alerts for different currency pairs.

It's available as both free and paid, with the premium paid version offering more features and benefits. The signals are provided via a Telegram group, so you can receive them directly on your phone as well through the Telegram app.

They provide signals mainly through manual deliberation and analysis by forex experts, who have over 15 years of experience in the field, according to the website. Since it's based in the UK, the analysts are also UK-based.

Learn2Trade has over 50,000 members currently, so the community is quite widespread as they accept members from everywhere.

The price alerts usually contain a lot more than just prices, giving ample information for traders to make a move. This includes stop loss and taking a profit.

Exness

Exness provides advanced notification functionality, enabling traders to stay informed about important updates and efficiently manage their trading activities. Here's an overview of what makes the notification system on Exness unique:

Customizable Notifications

General Notifications:

Access the Profile section and go to Settings.

In the Notifications tab, choose which types of alerts to receive by disabling those you don’t need.

Instrument-Specific Notifications:

Alerts are sent only for instruments marked as favorites.

Add instruments to your favorites by tapping the star icon on the instrument page. Favorites can also be managed via the Trading tab.

Push Notifications for Higher Margin Requirements (HMR)

On the chart, tap the HMR icon and select Notify Me to enable push notifications for HMR periods.

To disable these alerts, select Remove Notification.

This highly customizable system ensures that traders receive timely and relevant information, tailored to their preferences.

HowToTrade

HowToTrade is another helpful resource for traders, especially those new to forex trading. Like Learn 2 Trade, their price alerts come from professionals with years of trading experience. However, that's not all, as those mentors often also do live streams to educate traders and give them trade ideas for different forex currencies.

The price alerts are sent daily if you subscribe to the premium version. Unfortunately, the free alerts are very limited in terms of the information they provide. So if you want to get the best out of it, you have to go with the premium version.

The good news is that its premium subscription is more on the economic end with monthly, three-month, and six-month subscription options.

In addition, you join an extensive community of traders through their Trading Room feature, where you can learn from other forex traders and share your ideas to gain insights and opinions. There are thousands of traders on the platform, and the community is gradually growing even bigger.

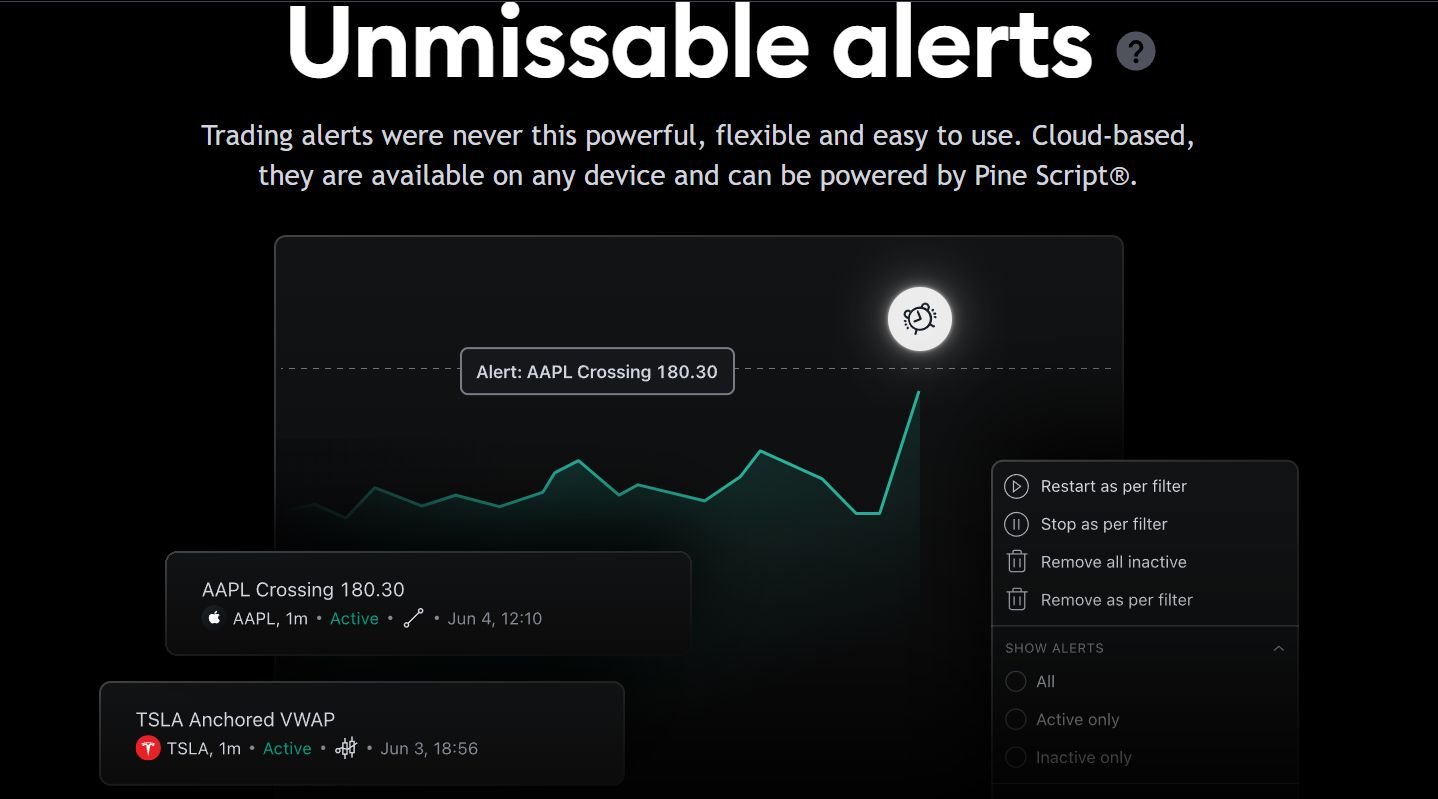

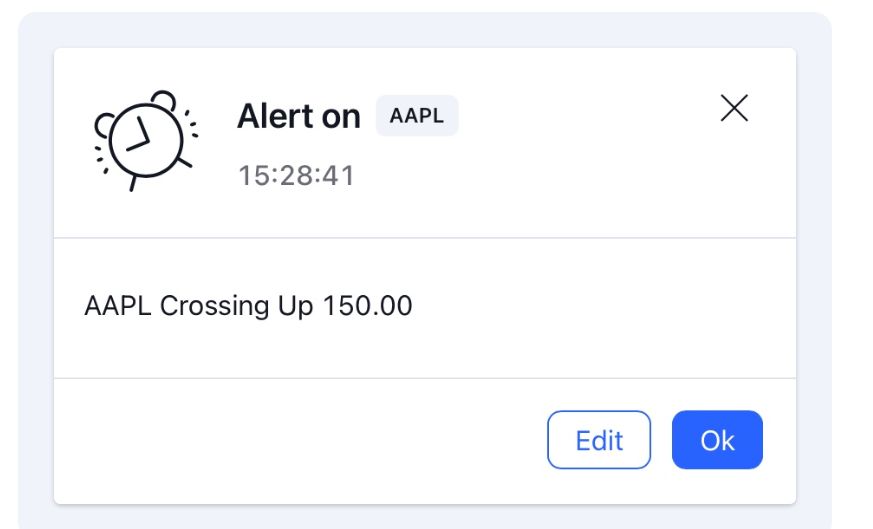

TradingView

TradingView offers a robust and flexible alert system designed to keep traders updated on market conditions and their trading strategies. Here's a detailed review of its key features and benefits:

Core Features

Customizable Alerts:

Set alerts on price levels, indicators, strategies, or custom conditions created via Pine Script.

Alerts can trigger when conditions are met for specific timeframes, providing precision for intraday and long-term traders.

Wide Range of Notification Types:

Receive alerts through email, SMS, mobile push notifications, or desktop pop-ups.

Webhooks allow integration with external systems for automated trading or advanced workflows.

Real-Time Execution:

Alerts are processed instantly when conditions are met, ensuring timely notifications in fast-moving markets.

Cross-Platform Accessibility:

Alerts are available across devices, including desktops, tablets, and mobile apps, ensuring traders are always informed.

Key Benefits

Strategy Automation: When combined with webhooks, alerts can integrate with trading bots, automating trade execution.

Personalization: Custom alert messages let traders include details about why the alert is triggered.

Comprehensive Coverage: Alerts can be applied to any asset or market available on TradingView, from stocks and Forex to cryptocurrencies and indices.

Forex GDP

Forex GDP

Forex GDPForex GDP is yet another forex alerts provider that offers both free and paid subscriptions for forex trading alerts. The free signals are pretty basic and provided through Whatsapp groups. The info only includes entry and exit levels.

With the free model, you can receive two to four alerts only in a month. That's enough for a seasonal trader or those looking for some short-term gains. However, for regular traders, it would make sense to go with the paid subscription, which is competitive in terms of cost and benefits.

In terms of pips profits, the free signals range between 90 to 150 pips while the paid signals range between 300 to 700 pips. With a paid subscription, you receive detailed email alerts with entry and exit points as well as trading ideas. The frequency of paid signals is up to 12 signals a month.

The subscription fee is lower if you go for a longer term. However, there's also a Supreme plan that's more expensive and includes 16 to 25 monthly signals. However, with the Supreme plan, you can also receive alerts for commodities.

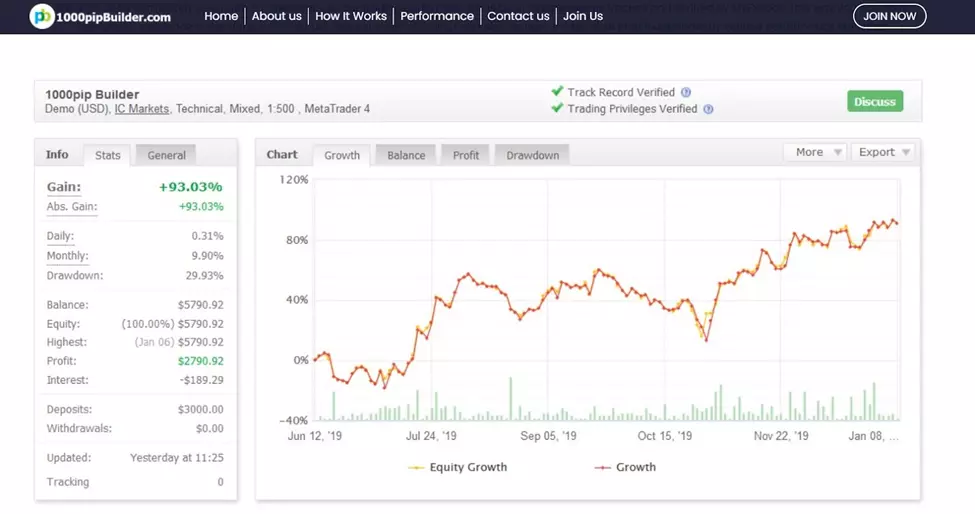

1000pip Builder

1000pip Builder

1000pip Builder1000pip Builder is one of the top forex signal providers with historically accurate price forecasts. That's because they use verifiable historical data. You know the signals are reliable when even MyFXBook, the social community for forex traders, tracks them.

They have been in the game for far too long, which only works in their favor. Those who don't like taking risks and want something sure to count on can go with 1000pip Builder purely based on their reputation alone.

With good ratings and reviews, their price alert is backed by data. In fact, many new traders have even gotten support from an established lead trader on the platform, receiving mentoring for forex trading, in general.

So if you want a mix of forex alerts, knowledge base, and community, 1000pip Builder is the right place for you to start your forex trading journey.

It sends price alerts for 15 currency pairs, with up to seven trades for five trading days in 24 hours period.

1000pip Builder is a paid forex signal platform with monthly, quarterly, and yearly subscription options. The rates are comparatively higher for this provider.

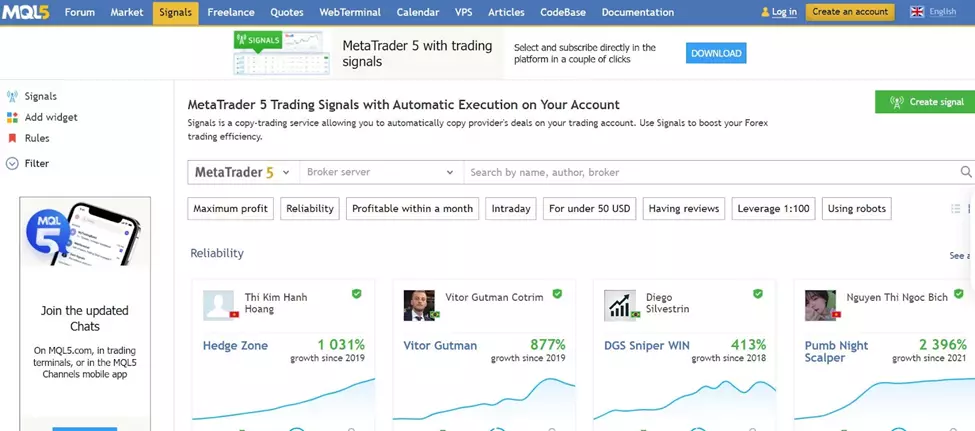

MQL5

MQL5

MQL5If you're looking for forex alerts from real-life, experienced traders, particularly those trading on MT4 and MT5 platforms, MQL5 is a good choice. Particularly, its signals page is designed for those looking to copy trade forex.

As such, there's a huge variety of traders to receive signals from and copy. Once you receive a signal and decide to proceed with the trade, you can do so almost instantaneously with the MetaTrader platform.

It's a mix of free and paid signals, with many traders charging a fee for sending price alerts and other signals. Some pro traders with a good track record can charge hundreds of dollars. Also, anyone can join the platform to provide copy trading signals, which is why you have to be a little more discerning when choosing which trader to receive signals from.

At the same time, there are many free signal providers, and MQL5 itself doesn't charge any fee for sending those signals, at least not to the trader receiving the signals.

The signals page does provide detailed stats about the traders and rates them based on their own ROI on forex trading over a span of time, which is also indicated. It also mentions the drawdowns and trading frequency. So all the information is there for traders to make the choice for whom to receive trading signals from.

More importantly, all this trader info is independently verified by MQL5, so it's trustable. You can use different filters to select traders that meet your selection criteria because there really are a lot of traders to copy.

Can I Use Alerts in My Trading Platform?

Alerts are essential tools for monitoring market conditions and executing trading strategies effectively. Here's a detailed comparison of how alerts function in MT4/MT5, cTrader, and TradingView:

| Feature | MT4/MT5 | cTrader | TradingView |

|---|---|---|---|

| Customizable Alerts | Basic alerts based on price levels and indicators. Limited flexibility. | Advanced alerts with price, time, and indicator-based triggers. More customization. | Highly flexible alerts for price, indicators, strategies, and custom conditions. |

| Indicator-Based Alerts | Limited to built-in indicators. Requires manual setup. | Supports built-in and custom indicators with advanced conditions. | Supports all indicators, including custom Pine Script strategies. |

| Notification Types | Email and platform pop-ups. No push notifications. | Email, mobile push, desktop pop-ups. More integrated. | Email, SMS, mobile push, desktop pop-ups, and webhooks for automation. |

| Real-Time Processing | Alerts may experience slight delays depending on server conditions. | Real-time execution with minimal delays. | Instant processing with high reliability. |

| Automation Capabilities | Requires external EAs or plugins for automation. | Built-in automation features for alerts. | Supports automation via webhooks, integrated with trading bots. |

| Ease of Use | Simple but lacks intuitive interfaces for advanced customization. | Intuitive and user-friendly. Easy setup for complex conditions. | Highly intuitive with drag-and-drop features for conditions. |

| Free vs Paid Plans | Available on all accounts. No additional charges. | Available for free but integrated best with paid accounts. | Limited alerts on free plans; premium plans unlock higher limits. |

Top 3 Forex brokers with free alerts

Brokers offering MT4 and MT5 provide essential alert functionalities, including price notifications and indicator-based triggers. MT5 enhances these features with multi-asset trading support and improved tools, making it ideal for more advanced traders.

cTrader delivers customizable alerts with advanced indicator integration, appealing to technical traders. TradingView offers the most versatile alerts, supporting price levels, indicators, and automated strategies via webhooks. Additionally, brokers with Copy Trading features enable traders to replicate successful strategies, while Autochartist Signals provide automated market analysis for identifying trading opportunities.

| MT4 | MT5 | cTrader | TradingView | Copy trading | Autochartist signals | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| No | No | No | Yes | No | No | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | Yes | Yes | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | Yes | Yes | Yes | 6.79 | Open an account Your capital is at risk. |

What is the Best Forex Price Alert App?

NetDania Stock and Forex Trader is the best mobile app to receive forex price alerts. It's very popular with forex traders worldwide with instant price alerts and up-to-date interbank exchange rates for major currency pairs.

It's also a viable option for those forex traders who also dab in stocks and commodities because the app also provides real-time prices for those. Therefore, it basically bundles alerts for all these potential investments in just one mobile app.

Overall, it covers over a whopping 20,000 financial instruments, including many forex currency pairs.

Another advantage is that it provides free signals for forex, which makes it a feasible option for newbies who would rather put all the capital into forex than subscribe to an alert service. You can also see live streaming charts with currency pairs and their prices. Furthermore, you can set alerts for your choice of currency pairs.

The user interface of the app is basic, which makes it easier to understand and utilize. In addition to setting up forex price alerts, you can also latest forex market news from Market News International and FxWirePro.

The app is available for both Android and iOS.

The experts at Trader's Union have also reviewed other useful Forex alert apps and shared insights on what to consider when choosing such an application.

How Do Forex Alerts Work?

The way forex alerts work depends on the type of signal, and there are two types of forex signals: automatic and manual.

Forex alerts are generated by an automated system and delivered to traders via different notification mechanisms. At the core, Forex alert systems use algorithmic rules to scan the market for trading opportunities or conditions that match predefined criteria.

When one of these opportunities arises, the algorithm instantly generates an alert that contains key details. The minimum information included in every alert is the currency pair, intended trade direction (buy/sell), recommended entry price, and stop loss level. Some providers also include a suggested target price.

The alert is then pushed out to traders through their preferred delivery channel. The notification appears nearly simultaneously with the signal being triggered, allowing traders to act on the opportunity with very little delay:

For email/text alerts, traders will receive a message with all the trade parameters ready to copy into their broker's platform.

Desktop notifications pop up a small window on the screen with the alert details.

Within-platform alerts display alongside active charts for easy review and order entry.

Additionally, advanced automated trading systems can be programmed to place trades directly upon receiving an alert signal. This provides a fully hands-free way to automatically capitalize on opportunities generated by the algorithmic rules.

By receiving alerts from the system in real-time, traders can access trading insights and opportunities generated by the algorithm much faster than researching the markets themselves. This maximizes their ability to capture potential profits.

How to Compare the Best Forex Price Alerts

This section will explore the critical elements to weigh up when comparing various providers of forex alerts.

Reputation and Trust

The first issue to keep in mind is the popularity and trustworthiness of the Forex market alert provider. Look for opinions from other investors and any expert accreditation or certification the company has obtained.

Number of Signals

Another crucial aspect to recall is the wide variety of forex alerts the issuer offers.

Time Zone

It is important to remember the time area wherein the Forex market alert gadget operates. Ensure the provider's indicators are according to your trading agenda and time sector.

Win Rate

A high win fee is critical when selecting a Forex Alert service. Service with a high win price offers more guarantee that its alerts will result in profitable trades.

Fees

Another critical factor is the value of the Forex market alerts carrier. Look for providers with obvious pricing, no hidden expenses, and reasonable charges aligned with their offerings' value.

Money Back Guarantee

This feature may be particularly crucial for buyers who strive for a risk-free service before committing to a subscription.

Tips for Using Forex Price Alerts

Set realistic goals and targets

Monitor the alerts closely

Use multiple alerts

Expert opinion

Forex Alerts Services complement traders' strategies but do not replace them entirely. When used correctly, these tools can enhance trading profitability by filtering valuable information from the "noise." For maximum effectiveness, set realistic goals, use multiple alerts, and monitor the situation to seize suitable moments for buying/selling assets. Alerts not only suggest optimal entry and exit points but also allow you to assess potential profits. When choosing Forex Alerts Services, pay attention to the signal type (automatic or manual), real user opinions, the quantity and types of available alerts, and subscription costs. This will help find providers without hidden costs and with high-quality signals, providing enough information for making informed trading decisions.

FAQs

Can I be profitable with forex signals?

Being profitable with forex signals is possible, but it's not guaranteed. Success depends on various factors, including the quality of the signals, your trading strategy, risk management, and market conditions. Forex signals can be a useful tool when integrated into a well-thought-out trading plan.

Does MetaTrader have alerts?

Yes, MetaTrader, a popular trading platform, offers alert features that allow traders to set up and receive alerts for various market conditions, including price levels, technical indicators, and news events. These alerts can help traders stay informed about potential trading opportunities.

Are free forex signals reliable?

Free forex trading signals can be reliable depending on the reliability and reputation of the provider. It's best to get alerts only from legit and trusted websites and apps.

Where is the best forex news?

Finding a reliable supply that provides timely and correct records is critical. Some popular resources for Forex news include Bloomberg, Reuters, and the Forex Factory.

Where to find good forex signals?

Good forex signals can be found through reputable signal providers, online forums, and social trading platforms. It's essential to conduct thorough research and verify the credibility of the signal source before relying on their recommendations.

Can I get free Forex signals?

Yes, numerous websites and services offer free foreign exchange signals. However, doing your studies and due diligence is critical before using free indicators.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.