How To Withdraw Bitcoin Into Bank Account: A Quick Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to withdraw Bitcoin into bank account:

Converting Bitcoin to fiat currency for everyday use typically involves a few steps. You’ll first need to exchange your Bitcoin for fiat currency (like USD, EUR, etc.) using a cryptocurrency exchange or P2P platform. Afterward, the funds can be sent directly to your bank account via wire transfer, allowing easy access to the converted amount. Most users prefer reputable exchanges that offer secure transactions and require KYC (Know Your Customer) verification, ensuring both compliance and security. Keep in mind that bank transfers may take some time due to banking hours, network processing, and, in some cases, additional verification.

How to wire transfer bitcoins to bank account

The steps for withdrawing fiat funds from a cryptocurrency exchange to a bank account are generally similar across all platforms. As an example, we chose Binance exchange as an example.

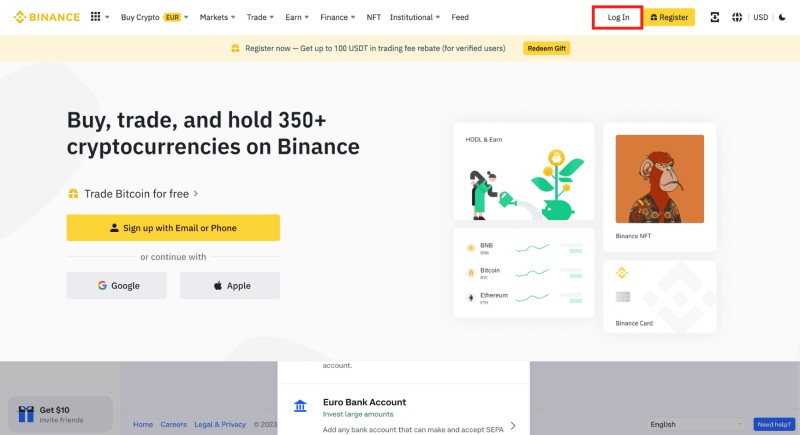

Step 1. Visit crypto exchange

login to Binance.com or Binance.us if you are in the US.

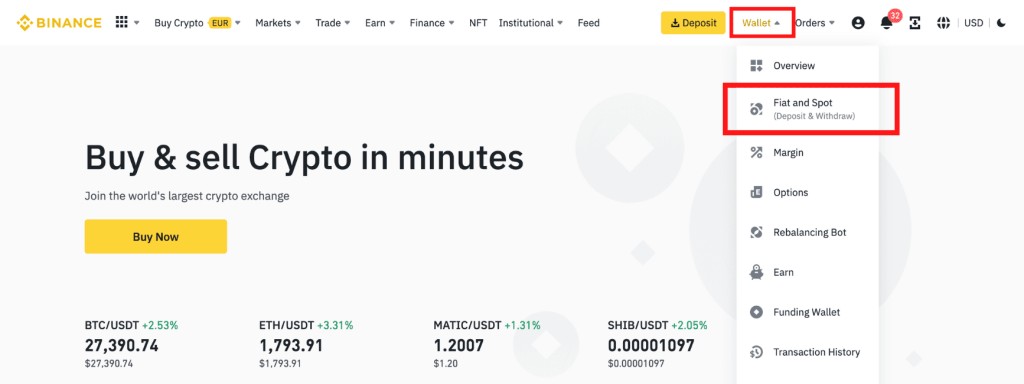

Step 2. Access wallet

On the Binance homepage, go to Wallet > Fiat & Spot. This is where you’ll manage your balances and withdrawals.

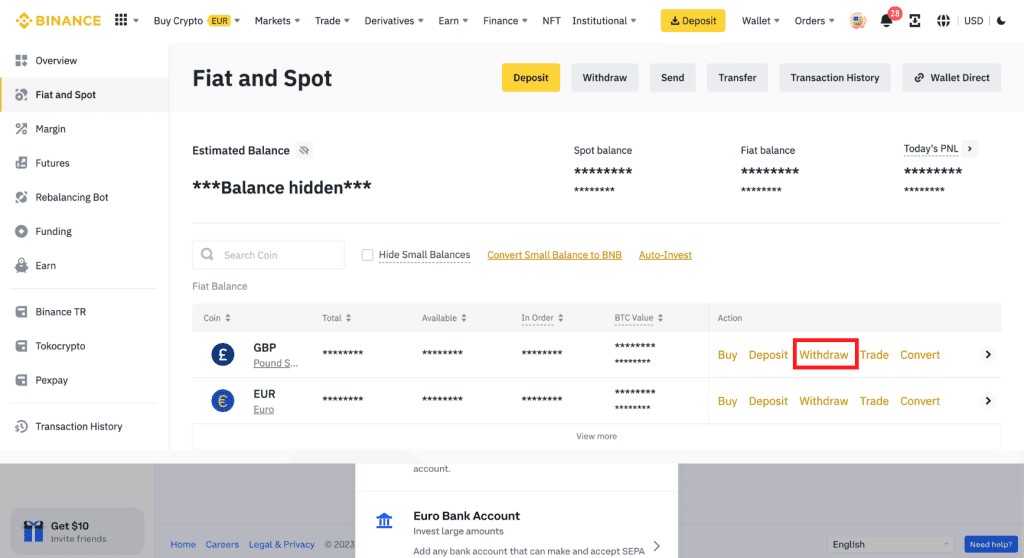

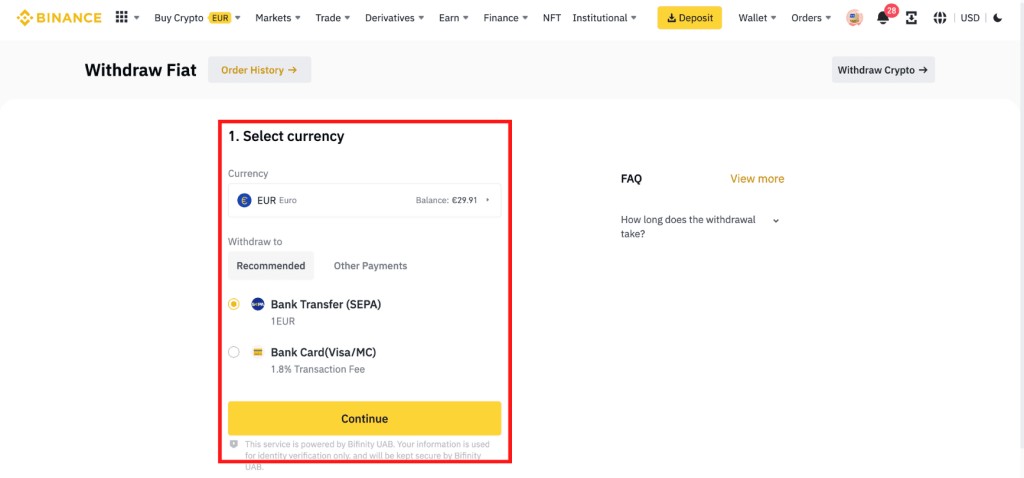

Step 3. Select your currency and withdrawal option

Choose the currency you want to withdraw and click Withdraw. Make sure your selected currency supports bank transfers as a withdrawal option.

Step 4. Enter the withdrawal address and network

On the cryptocurrency withdrawal page, enter the withdrawal address "Address". The best way to do this is to copy or scan the QR code "Receive" address.

Then select the network within which the withdrawal will be made. The recipient address must support the network you choose, otherwise the funds will be lost.

Note: Payment methods and fees will vary depending on the fiat currencies you are withdrawing.

Step 5. Enter withdrawal details

Enter the amount you want to withdraw or click "Max". The withdrawal fee will be shown on the screen as the total amount you will receive.

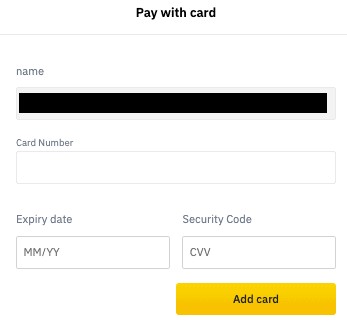

Also add your bank card (Add new card) and click "Continue", then enter your payment details. This step will depend on the payment method you selected. Here you may need your recipient account details for the bank transfer.

Step 6. Confirm security checks and complete

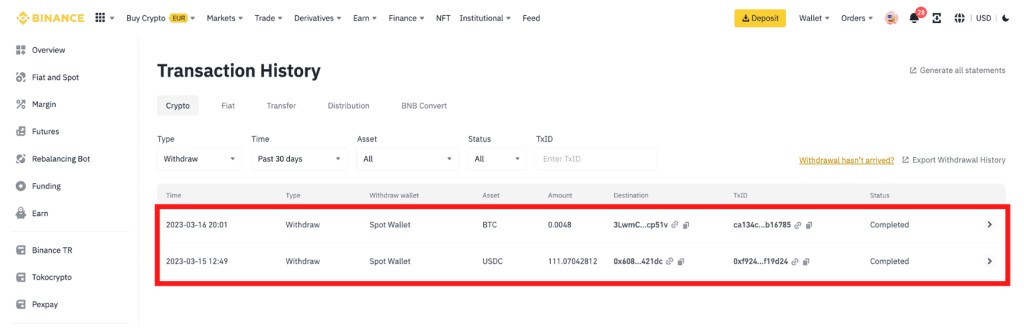

Select "continue". Depending on your two-factor authentication method, you may be asked to complete a security check (such as entering a Google verification code) before withdrawing your money. Once your withdrawal is confirmed, the funds will be deposited into your bank account, and you can review the details in your Withdrawal History.

| Wire transfer | Min. Deposit, $ | Coins Supported | Deposit fee, % | Withdrawal fee, % | Open an account | |

|---|---|---|---|---|---|---|

| Yes | 10 | 278 | No | 0,0005 BTC | Open an account Your capital is at risk. |

|

| Yes | 1 | 250 | No | 0,0005 BTC | Open an account Your capital is at risk. |

|

| Yes | 1 | 72 | No | 0-0,1% | Open an account Your capital is at risk. |

|

| Yes | 10 | 249 | No | Fixed fee - 25 USD PayPal - 1,5% USDC - 10 USD | Open an account Your capital is at risk. |

|

| Yes | 50000 | 56 | No | Network fees apply | Open an account Your capital is at risk.

|

Tax and legal aspects

In many countries, selling Bitcoin for cash or another currency is generally treated as a taxable event, similar to selling property. This means that when you sell, you may be liable for capital gains tax on the profit made from the sale. The tax amount is determined by the difference between what you paid for the Bitcoin and what you sold it for, with the exact rate varying based on how long you held it and your income level.

For instance, in the US, selling Bitcoin after holding it for less than a year means it’s subject to short-term capital gains tax, which aligns with regular income tax rates of 10-37%, depending on your income. However, if you hold it for more than a year, the rate decreases to 0-20%. In the UK, Bitcoin gains over a certain threshold are taxed at 10% for basic taxpayers and 20% for higher earners.

Some jurisdictions also let you offset any losses from cryptocurrency sales against other gains, potentially lowering your tax bill. In the US, for example, you can subtract crypto losses from capital gains on other investments, helping to reduce the overall taxable amount.

Legal requirements and regulation

Many countries, including the European Union and the U.S., require cryptocurrency platforms to follow strict Know Your Customer (KYC) and Anti-Money Laundering (AML) standards. These regulations help combat financial crimes in the crypto sector. In 2024, the EU took a step further with a Single Rulebook and the new Anti-Money Laundering Authority (AMLA), ensuring all member states apply consistent checks, especially for high-risk entities like cryptocurrency services. For users in the U.S., brokers must now disclose details of digital asset transactions, adding transparency and supporting tax compliance.

To meet these evolving rules, it’s essential to stay updated, keep detailed transaction records, and consult tax experts to avoid penalties tied to incorrect reporting.

Potential risks and how to minimize them

A major risk in withdrawing Bitcoin to your bank account is phishing attacks, where scammers set up fake websites or applications to impersonate real crypto platforms. These fake sites prompt users to enter their login details or private keys, which can lead to losing funds. To avoid falling into phishers' traps, you need to:

only use trusted websites,

monitor the correctness of the URL,

avoid clicking on links in suspicious emails or messages.

Always ensure the site has a secure connection (look for HTTPS) and check the domain closely for authenticity to avoid fake sites — even small differences can mean a fake site.

For an extra layer of security, turn on two-factor authentication (2FA) on any crypto platform you use. Apps like Google Authenticator or Authy offer more security than SMS for 2FA, as they’re less vulnerable to attacks. You might also consider using a hardware security key, like Yubikey, to secure your account even further.

How to avoid withdrawal scams

To avoid fraud, use only trusted and reliable cryptocurrency platforms. As a rule, these are large exchanges with a positive reputation. Before choosing a platform, read recent reviews and ensure the platform is registered with relevant financial authorities. Avoid newer, lesser-known services that may pose a risk, and be cautious of any hidden fees or restrictions that could make withdrawals difficult.

In case of suspicious situations, such as an unexpected offer to help with a withdrawal or a request to transfer cryptocurrency, you should be especially careful. Never share your private key or wallet recovery code with third parties and avoid any "under-the-table deals" — these are classic signs of fraudulent schemes.

Timing can make a big difference

When you're ready to move Bitcoin to your bank, timing can make a big difference. The Bitcoin network can get crowded, and fees go up when there’s lots of activity. Instead of just choosing a "low fee" option, aim to withdraw when the network is quieter — like weekends or early mornings. A quick look at transaction volume online can tell you if it’s a good time. If you’re in a rush, some services even have a "fast pass" option for a bit more cost, letting you skip the line and get quicker processing.

For extra peace of mind, especially if you're withdrawing a larger amount, consider using a wallet setup that requires two or three “sign-offs” before a transaction goes through. It’s a bit like needing two keys to open a safe. You might keep one on your phone, one on your computer, and another backup somewhere secure. This way, even if one device is compromised, the extra layers make it much harder for anyone else to access your funds. It's a smart setup that adds both security and flexibility, especially if you’re getting serious about managing your crypto funds.

Use a separate bank account for cryptocurrency transactions. This helps to avoid confusion in financial accounting and makes it easier to track transactions for tax purposes. Opening a separate account for cryptocurrency transactions will reduce the likelihood of the main account being blocked by the bank, as banks are sometimes wary of transactions with digital assets.

Conclusion

Transferring Bitcoin to your bank account can be straightforward with a secure platform and careful steps. Ensure your account is protected with two-factor authentication, and be mindful of any tax rules in your region. Check platform processing times as well as fees to complete the transaction smoothly. These tips can help you safely bridge Bitcoin to fiat with ease.

FAQs

How to reduce fees when withdrawing BTC to a bank account?

When withdrawing funds, you can reduce fees by choosing exchanges with a fixed rate or using P2P platforms where the fees are set by the sellers. Another tip is to make transfers during off-peak hours when network activity is lower—fees tend to drop when the blockchain isn’t as crowded.

What should I do if my bank account was blocked after withdrawing cryptocurrency?

If the bank has blocked the account, you must provide all documents confirming the legality of the transactions, including statements and confirmations of the exchange. It is also recommended to notify the bank in advance of upcoming cryptocurrency transactions can sometimes help avoid issues.

Do I need to declare all cryptocurrency transactions?

Yes, it is recommended to declare all cryptocurrency transactions, including purchases, sales, and exchanges, even if they don’t make you a profit. In some countries, this is required by laws.

What are the alternative ways to convert cryptocurrency to fiat?

Beyond bank transfers, you can cash out crypto via debit cards for instant fiat, P2P platforms for direct cash exchanges, or by using crypto as loan collateral. Each of these methods has its own terms and potential fees that should be taken into account.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

A wire transfer is a method of electronic funds transfer in which money is sent from one bank or financial institution to another, typically across international or domestic boundaries. It involves the sender providing their bank with specific instructions, including the recipient's bank details and the amount to be transferred, and the funds are then electronically moved from the sender's account to the recipient's account.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.