What Is The Psychology Of A Crypto Trader?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The psychology of crypto trading plays a vital role in a trader's success. It involves understanding and managing emotions such as fear, greed, and the fear of missing out (FOMO), which can significantly impact trading decisions. By recognizing cognitive biases and developing emotional resilience, traders can make more rational and informed decisions, ultimately improving their trading performance.

Grasping the psychological factors behind successful crypto trading is essential for investors aiming to excel in this market. Psychological pressure is intensified by the strong speculative nature of the crypto market and the lack of usual fundamental information. Even experienced traders successfully trading on Forex and the stock market are more likely to make a loss in crypto deals. Emotional control and mental resilience can significantly impact trading outcomes, often more than technical analysis or market knowledge. This article delves into the psychological aspects that influence trading decisions and offers strategies to manage them effectively.

Crypto trading psychology

The psychology of crypto trading is a crucial aspect that can significantly impact a trader's performance. Understanding and mastering trading psychology can make the difference between consistent profitability and ongoing losses.

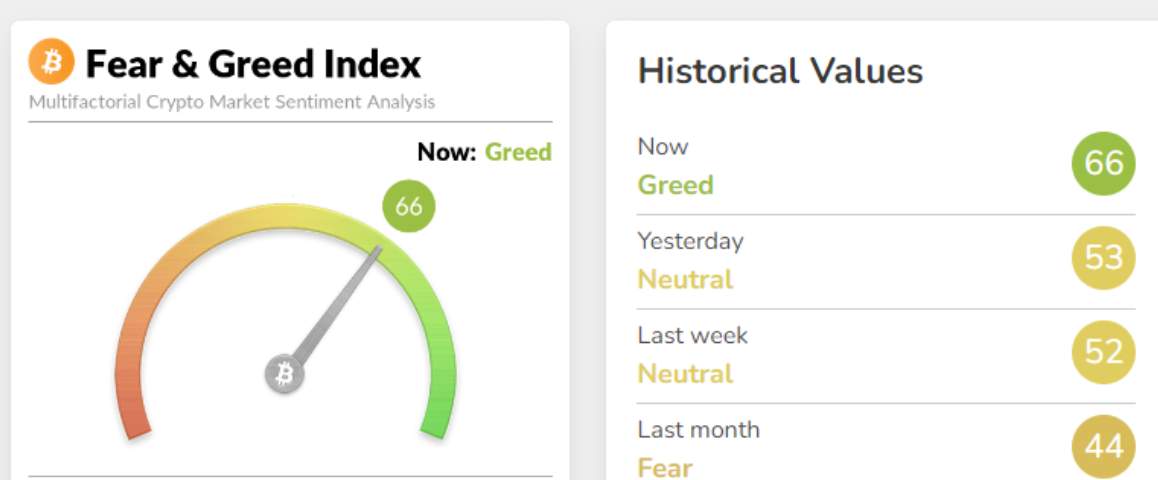

Emotions and trading. Emotions play a central role in trading decisions. Fear can lead to missed opportunities, while greed can push traders to take unnecessary risks. Fear of missing out (FOMO) often leads to impulsive actions, which usually result in panic selling and inevitable losses. Recognizing and controlling these emotions is essential for maintaining a rational and disciplined trading approach.

Patience and discipline. In the fast-paced crypto market, patience is a valuable trait. Rushing into trades without thorough research can lead to significant losses. Successful traders know that waiting for the right opportunities and sticking to a well-defined trading plan yields better results over time.

Risk management. Effective risk management is not just about numbers; it involves controlling emotions to prevent panic during market volatility. Setting appropriate stop-loss levels, diversifying investments, and maintaining a healthy risk-to-reward ratio are critical strategies. These practices help protect trading capital and reduce emotional stress.

Mindset and learning. Adopting a growth mindset, where losses are seen as learning opportunities rather than failures, is crucial for long-term success. Continuous learning and self-reflection help traders improve their strategies and decision-making skills. Keeping a trading journal to track decisions and emotions can provide valuable insights into personal trading behavior and areas for improvement.

Self-realization and independence. We recommend getting used to the fact that cryptocurrency trading is an individual activity. Analyze market situations on your own, take any advice critically and do not let anyone interfere in your trading process. Be confident in yourself, make crypto trading a tool of your success.

Community and support. Trading can be an isolating activity, but engaging with a community of like-minded traders can offer support, shared knowledge, and accountability. This social aspect helps maintain a positive trading mindset and motivates traders to stay disciplined and focused.

How psychological biases can affect crypto traders

Psychological biases significantly impact decision-making in crypto trading, often leading to suboptimal outcomes. Understanding these biases can help traders mitigate their effects and improve their trading strategies.

Confirmation bias. Confirmation bias is the tendency to search for, interpret, and remember information that confirms pre-existing beliefs while ignoring contradictory evidence. In crypto trading, this can lead traders to favor information that supports their investment choices and overlook warning signs, increasing the risk of losses.

Overconfidence bias. Overconfidence bias causes traders to overestimate their knowledge and predictive abilities. This can result in excessive trading, taking on too much risk, and ignoring market signals that suggest the need for caution. Overconfident traders are more likely to make impulsive decisions, which can be detrimental in the volatile crypto market.

Loss aversion. Loss aversion refers to the tendency to prefer avoiding losses over acquiring equivalent gains. In crypto trading, this bias can cause traders to hold onto losing positions for too long, hoping to break even, rather than cutting their losses and reallocating their resources to more promising opportunities.

Herd mentality. Herd mentality is the inclination to follow the actions of a larger group, often disregarding personal analysis and market signals. In the crypto market, this can lead to buying into hype or selling during panic, which often results in poor timing and financial losses.

Recency bias. Recency bias is the tendency to weigh recent events more heavily than earlier ones. For crypto traders, this can lead to overreacting to short-term market movements and making decisions based on recent trends rather than a comprehensive analysis of market conditions.

How crypto traders can manage their psychology

Managing psychology is crucial for crypto traders due to the volatile nature of the cryptocurrency market. Here are several strategies that can help traders maintain a healthy mindset and improve their trading performance:

1. Set clear goals and limits

Establish clear trading goals and limits for each trading session. This includes setting profit targets and stop-loss limits to prevent emotional decision-making. Knowing when to exit a trade, whether it’s at a profit or loss, helps maintain discipline and reduces stress.

2. Develop a trading plan

A well-defined trading plan includes specific criteria for entering and exiting trades, risk management strategies, and guidelines for capital allocation. Sticking to a plan helps mitigate impulsive decisions driven by market movements.

3. Embrace risk management

Effective risk management is essential for maintaining psychological balance. This involves:

Position sizing: Only invest a small percentage of your total capital in a single trade to minimize potential losses.

Diversification: Spread investments across various assets to reduce risk exposure.

Use of stop-loss orders: Automatically close positions at predetermined loss levels to prevent significant losses.

4. Stay educated and informed

Keeping up with the latest market trends, news, and analysis helps traders make informed decisions. Education reduces uncertainty and builds confidence in trading strategies.

5. Accept losses as part of trading

Losses are inevitable in trading. Accepting this reality helps in maintaining a healthy mindset. Analyze losing trades to understand what went wrong and avoid similar mistakes in the future.

6. Maintain emotional control

Emotional control is critical in trading. Here are ways to maintain it:

Avoid overtrading: Trading excessively can lead to emotional exhaustion and poor decision-making.

Take breaks: Step away from the screen regularly to avoid burnout.

Mindfulness and relaxation: Practices like meditation and deep breathing can help manage stress and improve focus.

7. Keep a trading journal

Documenting each trade, including the rationale behind it, the outcome, and the emotions experienced, can provide valuable insights into your trading behavior. Reviewing your trading journal helps identify patterns and improve decision-making.

8. Surround yourself with a supportive community

Engage with other traders through forums, social media, or trading groups. Sharing experiences and learning from others can provide support and reduce the feeling of isolation.

9. Continuous improvement

Treat trading as a continuous learning process. Regularly review and refine your strategies based on performance and market conditions. Stay adaptable and open to new ideas and techniques.

We have selected several cryptocurrency exchanges where you can buy a variety of digital assets, ranging from basic cryptocurrencies BTC, ETH to popular meme tokens, trade them freely, place bets and easily withdraw money to your bank accounts. These cryptocurrency exchanges are good places to test your trading skills and resilience in trading psychology.

| Coins Supported | Min. Deposit, $ | Spot Taker fee, % | Spot Maker Fee, % | Extra tools | Open account | |

|---|---|---|---|---|---|---|

| 329 | 10 | 0,1 | 0,08 | 0.00 | Open an account Your capital is at risk. |

|

| 278 | 10 | 0,4 | 0,25 | 0.00 | Open an account Your capital is at risk. |

|

| 250 | 1 | 0,5 | 0,25 | 0.00 | Open an account Your capital is at risk. |

|

| 72 | 1 | 0,2 | 0,1 | 0.00 | Open an account Your capital is at risk. |

|

| 1817 | No | 0 | 0 | 0.00 | Open an account Your capital is at risk. |

Understanding and managing trading psychology is crucial for success in the highly volatile cryptocurrency market. Here are the key advantages associated with crypto trading psychology:

1. Improved decision-making

Rational decisions: A strong grasp of trading psychology helps traders make rational, data-driven decisions rather than impulsive ones based on emotions like fear or greed. This can lead to more consistent trading performance.

Discipline and consistency: Developing psychological discipline helps maintain consistency in trading strategies, reducing the likelihood of deviating from planned actions due to emotional reactions.

2. Better risk management

Controlled risk-taking: Understanding your psychological responses to risk helps in setting appropriate risk management strategies, such as stop-loss orders and position sizing, to protect capital.

Avoiding overtrading: Recognizing the emotional triggers that lead to overtrading can help traders avoid excessive trading and the associated risk.

3. Enhanced emotional stability

Stress reduction: Techniques like mindfulness and meditation can help traders manage stress and maintain emotional balance, which is crucial for making clear-headed decisions.

Resilience: Building psychological resilience helps traders recover from losses more quickly and prevents the development of a negative mindset that could affect future trading.

Trading is not only about logic, but also about constant self-improvement

In cryptocurrency markets, where volatility and uncertainty are the norm, the importance of mental toughness cannot be overstated. In my opinion, successful traders are not those who are simply good at technical analysis or have access to cutting-edge information, but those who know how to manage their emotions and make informed decisions in stressful situations.

The main recommendation for traders is the development of emotional intelligence. The ability to be aware of your emotions, manage them, and understand how they influence your behavior is a fundamental skill. When the market plummets, it is very easy to panic and start making rash decisions. In such situations, it is important to remain calm and stick to your trading plan rather than giving in to the herd mentality.

Another important tip is regular self-reflection and analysis of your actions. Keeping a trading journal that records all trades and emotions experienced while trading can help identify behavioral patterns and mistakes. By analyzing your mistakes and successes, you can better understand your weaknesses and strengths and, accordingly, improve your strategy. Remember that trading is not only about mathematics and logic, but also about constant self-improvement.

Conclusion

Psychology plays a key role in the success of a cryptocurrency trader. It is important not only to have technical skills and market knowledge, but also to be able to manage your emotions and make informed decisions. Successful traders develop emotional intelligence and regularly analyze their actions. Community support and continuous self-improvement are also important components of success. The combination of these factors helps traders remain resilient in the face of market volatility. Therefore, mastering the psychological aspects of trading can greatly improve your chances of success in the world of cryptocurrencies.

FAQs

How can the emotional impact on trading decisions be reduced?

One effective way to reduce the emotional impact is through automated trading. Using trading bots or algorithms helps eliminate the emotional component from decision-making and ensures adherence to a predetermined strategy.

How can impulsive decisions in cryptocurrency trading be avoided?

To avoid impulsive decisions, it is important to establish and strictly follow a clear trading plan. Additionally, using stop orders that automatically close positions at specific loss or profit levels can help minimize the influence of emotions.

Why are rest and breaks important in the trading process?

Regular breaks and rest help traders maintain mental clarity and prevent burnout. Frequent short breaks and adequate rest reduce stress and facilitate a more objective analysis of market conditions.

Why is it important to keep a trading journal?

Keeping a trading journal helps traders track their actions and emotions, allowing them to identify behavioral patterns and mistakes. Analyzing the journal helps improve trading strategies and increase discipline, ultimately leading to more successful trading.

Related Articles

Team that worked on the article

Vuk stands at the forefront of financial journalism, blending over six years of crypto investing experience with profound insights gained from navigating two bull/bear cycles. A dedicated content writer, Vuk has contributed to a myriad of publications and projects. His journey from an English language graduate to a sought-after voice in finance reflects his passion for demystifying complex financial concepts, making him a helpful guide for both newcomers and seasoned investors.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.