What Are Digital Assets | Types And Where To Trade

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Digital assets are electronic forms of value, including cryptocurrencies, tokens, and digital stocks. They operate on blockchain technology, ensuring security and transparency of transactions. These assets open new opportunities for investors and users in the digital age.

In this article, we will explore digital assets, their various types, and how they function. We'll discuss cryptocurrencies, stablecoins, NFTs, utility tokens, and security tokens, highlighting their unique features and uses. Additionally, we'll cover the advantages and disadvantages of digital assets, focusing on their security, transparency, and market volatility. We'll also provide insights on how to trade digital assets safely and effectively, and discuss the role of blockchain and smart contracts in this evolving financial landscape.

What are digital assets?

Digital assets are a digital representation of value that can be owned, transferred, and utilized digitally. They encompass a wide range of assets, from cryptocurrencies to unique digital items. Examples of various tokens include:

Cryptocurrencies

Cryptocurrencies are digital currencies used primarily for transactions and investments. They operate on decentralized networks based on blockchain technology. Examples include:

Bitcoin (BTC): The first and most well-known cryptocurrency, used as a store of value and medium of exchange.

Ethereum (ETH): A cryptocurrency that also supports smart contracts and decentralized applications (dApps).

Stablecoins

Stablecoins are cryptocurrencies designed to minimize volatility by being pegged to a stable asset, such as a fiat currency or commodity. Examples include:

Tether (USDT): Linked to the US dollar, used for trading and as a safe harbor during market volatility.

USD Coin (USDC): Another US dollar-pegged stablecoin, widely used in various financial applications.

Non-Fungible Tokens (NFTs)

NFTs are unique digital items that represent ownership of a specific asset, often digital art, collectibles, or virtual real estate. Each NFT is distinct and cannot be exchanged on a one-to-one basis with another NFT. Examples include:

Artwork NFTs: Digital artworks sold on platforms like OpenSea.

Collectibles: Unique digital items, such as trading cards or in-game assets.

Utility Tokens

Utility tokens provide access to a specific service or function within a platform. They are often used within blockchain ecosystems to pay for services or gain access to features. Examples include:

Binance Coin (BNB): Used to pay for transactions on the Binance exchange at a discounted rate.

Chainlink (LINK): Utilized to pay for services within the Chainlink network, such as obtaining off-chain data.

Security Tokens

Security tokens represent ownership in an underlying asset, such as shares in a company, and are often subject to regulatory scrutiny. They function similarly to traditional securities but are issued and traded on blockchain platforms.

Governance Tokens

Governance tokens allow holders to participate in the decision-making process of a project or platform. These tokens grant voting rights on key issues such as protocol upgrades and policy changes. Examples include:

Uniswap (UNI): Allows holders to vote on changes to the Uniswap protocol.

Maker (MKR): Grants voting rights for decisions in the MakerDAO ecosystem.

Besides the primary categories, there are several other types of digital assets that play significant roles in the digital economy: platform tokens (like Solana (SOL)), representative tokens (such as Wrapped Bitcoin (WBTC) and RenBTC), resource tokens (Filecoin, Energy Tokens), Social tokens.

To trade digital assets, it is important to find a reliable cryptocurrency exchange. We have studied the conditions of various trading platforms and invite you to familiarize yourself with the comparative table:

| Cryptocurrency exchange | Minimum deposit (USD) | Trading assets | Fiat Supported | Fee, % | Open an Accoutn |

|---|---|---|---|---|---|

| ByBit | $1 | 1500+ | USD, EUR, GBP, AUD, CAD, AED | For regular users, maker and taker fees are 0.10% for spot trading, and 0.06% (taker) and 0.01% (maker) fee for perpetual and futures trading. | Open an account Your capital is at risk. |

| MEXC Global | $1 | 2200+ | EUR, USD, GBP, VND. RUB, KRW, JPY, BRL, TRY, HKD, AUD, CHF, CAD, THB, PHP | 0% Maker fee and 0.1% Taker fee on spot 0% Maker fee and 0.01% Taker fee on futures. | Open an account Your capital is at risk. |

| Binance | $1 | 2000+ | EUR, GBP, BRL, AUD, UAH, RUB, TRY, ZAR, PLN, NGN, RON. | For regular users, a 0.10% maker taker fee is charged for spot trading. | Open an account Your capital is at risk. |

| OKX | $1 | 1000+ | AUD, CAD, CHF, EUR, GBP, JPY, UAH, USD and + 20 other currencies | Trading fees on the platform start at 0.10% and decrease as trading volume increases. | Open an account Your capital is at risk. |

| Lbank | no | 700+ | EUR, USD, CAD, GBP, AUD, JPY, INR, CHF, ZAR, RON | Open an account Your capital is at risk.

|

How digital assets work

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code on the blockchain. They automate the execution of agreements between parties without the need for intermediaries. Key features and advantages of smart contracts include:

Automation of Transactions:

Smart contracts execute automatically once the conditions written in their code are met. This reduces the need for manual transaction processing and minimizes the risk of errors or fraud.

Transparency and Trust:

Since the code of smart contracts is recorded on the blockchain, it is available for verification by all network participants. This allows parties to ensure the fulfillment of contract terms and promotes trust among participants.

Examples of Real Applications:

In the field of decentralized finance (DeFi), smart contracts are used to create various financial services such as lending, borrowing, asset exchange, and insurance without the involvement of traditional financial institutions. For example, platforms like Uniswap and Aave use smart contracts to automate cryptocurrency exchanges and provide loans.

Examples of smart contracts in real applications:

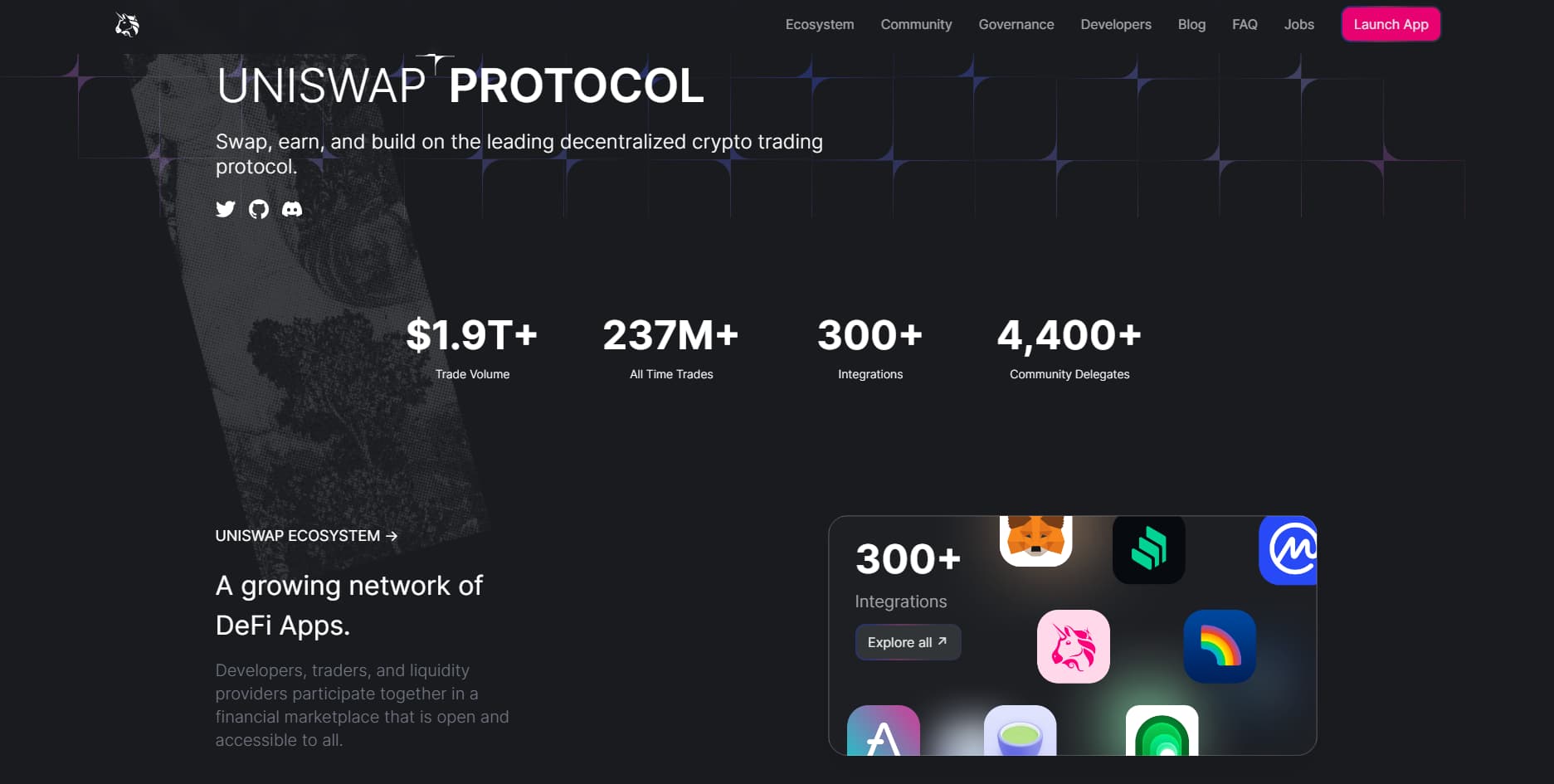

Uniswap: a decentralized exchange for cryptocurrencies, allowing users to trade tokens directly with each other without intermediaries.

Uniswap dashboard

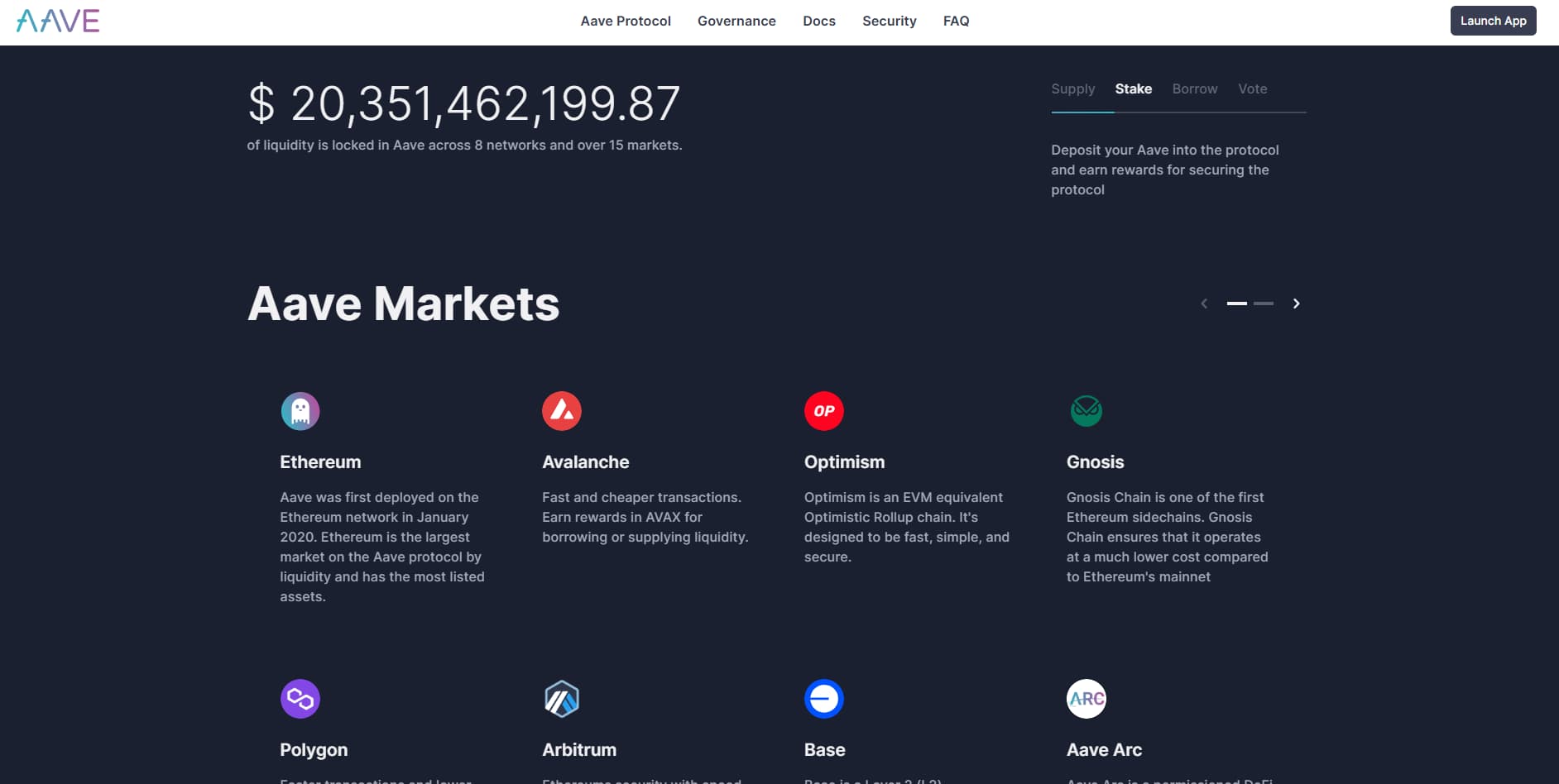

Uniswap dashboardAave: a platform for decentralized lending where users can borrow and lend assets using smart contracts to automate processes.

Aave dashboard

Aave dashboardChainlink: a network of oracles that provides external data to smart contracts, enabling them to use real-world information to fulfill contract terms.

Chainlink

ChainlinkAdvantages and disadvantages of digital assets

Digital assets offer numerous benefits but also come with their own set of challenges. Here’s a detailed look at both sides to help you understand the pros and cons.

- Advantages

- Disadvantages

- Enhanced Security - Digital assets utilize cryptography and distributed ledger technology, making them more secure against forgery and unauthorized access.

- Transparency - All transactions are recorded on the blockchain, providing transparency and auditability.

- Increased Transaction Efficiency - Transactions with digital assets can be faster and cheaper than traditional financial operations.

- New Investment Opportunities - Digital assets provide investors access to new markets and instruments such as cryptocurrencies, stablecoins, NFTs, and other tokens.

- Lack of Regulation - The absence of unified legal regulation can lead to legal uncertainty and risks for investors.

- Risks of hacking and fraud - Digital assets are susceptible to cyberattacks, hacks, and fraud, which can result in significant losses.

- Market Volatility - The digital asset market is known for its high volatility, which can lead to significant price fluctuations and risks.

Risks and warnings

Cybersecurity Risks

Digital assets face significant cybersecurity threats that can lead to substantial financial losses. Here are some common risks and ways to protect against them:

Phishing Attacks - involve fraudulent attempts to steal sensitive information by pretending to be a trustworthy entity.

Mitigation: Users should be educated about phishing techniques, such as suspicious emails or fake websites. Always enable two-factor authentication (2FA) to add an extra layer of security.

Hacks - exploit technical vulnerabilities to gain unauthorized access to digital wallets or exchanges.

Mitigation: Regularly update all software to patch vulnerabilities, use strong, unique passwords, and store assets in hardware wallets, which are less susceptible to online hacks.

Malware and Ransomware - designed to steal private keys or hold data hostage until a ransom is paid.

Mitigation: Install reputable antivirus software, avoid downloading files from untrusted sources, and regularly back up important data to prevent loss.

Social Engineering - manipulative tactics aimed at tricking individuals into divulging confidential information.

Mitigation: Train users to recognize and resist social engineering tactics, and always verify the identity of individuals requesting sensitive information.

Market Volatility

Digital asset markets are known for their high volatility, which can lead to significant price fluctuations. This instability is influenced by various factors, including market sentiment, regulatory news, and technological developments.

Strategies to Manage Volatility:

Diversification: Spread investments across different asset classes to reduce risk.

Stablecoins: Use stablecoins, which are tied to fiat currencies, to mitigate price swings.

Technical Analysis: Employ technical analysis tools to predict market trends and make informed trading decisions.

Long-term Holding: Focus on long-term investments to ride out short-term volatility and potential market downturns.

Regulatory Changes

The regulatory landscape for digital assets is constantly evolving. Changes in regulations can significantly impact the market, influencing factors such as:

Market Access: New regulations may restrict or expand the ability to trade digital assets, affecting market liquidity and participant access.

Taxation: Changes in tax laws can affect the profitability of digital asset investments, potentially increasing costs.

Compliance Requirements: Increased compliance requirements may lead to higher operational costs for digital asset businesses, affecting market dynamics.

Importance of Regulatory Compliance:

Legal Protection: Compliance with regulations provides legal protection and reduces the risk of penalties.

Market Stability: Clear regulations can enhance market stability by reducing uncertainty.

Investor Confidence: Adherence to regulatory standards builds investor confidence and promotes market growth.

Digital assets: Setting new standards in financial technology

In my seven years deeply immersed in digital assets, I've seen how they're revolutionizing finance. These assets, such as cryptocurrencies and tokenized securities, are breaking down old barriers and liberating financial transactions from the control of middlemen. Tokens lie at the heart of this transformation, serving not only as units of value but also as representations of rights in the digital realm. They fuel decentralized applications and smart contracts, enhancing the efficiency and transparency of transactions.

Another significant development is the advent of digital shares, which are traditional company shares digitized through blockchain technology. This digitization makes them more accessible and easier to trade for investors.

Security and trust are significant in this digital landscape, and cryptographic technology serves as the bedrock of digital assets. It ensures the integrity and confidentiality of transactions, fostering widespread adoption and innovation.

As we navigate this evolving landscape, it's essential to recognize the vast potential digital assets offer. They are not merely financial tools but also gateways to new frontiers in finance and technology. Embracing this change involves more than just adaptation; it requires harnessing the full potential of blockchain to redefine finance for the better.

Conclusion

Digital assets represent a significant innovation in the financial and technology landscape, offering new ways to store, transfer and use value. Using blockchain technology, these assets provide increased security, transparency and efficiency, creating new opportunities for users of financial systems.

Understanding the different types of digital assets such as cryptocurrencies, stablecoins, NFTs, utility tokens, and security tokens is critical for anyone who wants to participate in this space. Each type serves different purposes and carries its own functionality, set of advantages and risks. Cryptocurrencies offer decentralized financial transactions, stablecoins provide protection against volatility, NFTs allow ownership of unique digital items, utility tokens facilitate platform-specific services, and security tokens represent investment assets.

As digital assets continue to evolve, it is critical to stay current to implement best practices in digital asset security, regulatory compliance, and investment portfolio diversification to effectively manage risk. By doing so, the full potential of digital assets can be unlocked.

FAQs

What are digital assets?

Digital assets are digital representations of value that can be owned, transferred, and used electronically. They are built on blockchain technology, which ensures enhanced security, transparency, and immutability. Examples include cryptocurrencies, stablecoins, NFTs, utility tokens, and security tokens.

How does blockchain technology underpin digital assets?

Blockchain technology is a decentralized ledger that records all transactions across a network of computers, ensuring that the data cannot be altered retroactively. Key principles of blockchain include decentralization, transparency, and immutability, which collectively provide a secure and trustworthy environment for managing digital assets.

What are smart contracts, and how do they function in the context of digital assets?

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They run on blockchain networks, such as Ethereum or Solana, and automate transactions by enforcing the terms of the contract without the need for intermediaries. This makes processes more efficient and reduces the risk of human error. Smart contracts are widely used in decentralized finance (DeFi) applications, facilitating lending, borrowing, and trading activities.

What are the main risks associated with digital assets, and how can they be mitigated?

The main risks associated with digital assets include cybersecurity threats (e.g., hacking, phishing), market volatility, and regulatory uncertainty. To mitigate these risks, should, for example, use hardware wallets and enable two-factor authentication.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

A Security Token is one of the latest exchange instruments. It is a digital analog of physical securities (stocks, bonds), running on blockchain and representing a smart contract (as a non-fungible token).

The idea behind mitigation is to recognize and effectively trade mitigation blocks. These blocks consist of specific price action patterns that signal a change in market sentiment or demand-supply dynamics.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.