Is NFT Halal? Full Islamic Analysis Based On Latest Findings (2025)

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Is NFT halal:

Depends on content. NFTs tied to halal assets (e.g. Islamic art, education) are generally permissible.

Speculation risk. Over 80% of NFT trading in 2023–24 involved speculation, which may resemble gambling (Maysir).

Shariah compliance criteria. NFTs must avoid Riba, Maysir, Gharar, and be tied to clearly defined ownership and use.

Treasure NFT case. Permissibility depends on usage. If game assets are used ethically, they may be halal; speculative use is not.

NFTs (Non-Fungible Tokens) have become a fast-growing part of the digital economy, offering a way to establish ownership over unique assets such as digital art, music, in-game items, and collectibles. But for millions of Muslim investors and traders, one key question still needs careful attention: are NFTs halal, or do they go against the principles of Islamic finance?

In this article, we examine recent scholarly views on NFTs, explore platform-specific examples like Treasure NFT, and outline clear guidelines to help Muslim users make informed decisions about NFT-related opportunities.

What is an NFT?

An NFT (Non-Fungible Token) is a unique, indivisible digital asset stored on a blockchain that proves who owns a digital item and that it’s the real deal — whether digital art, in-game content, or real-world assets. Unlike cryptocurrencies like Bitcoin or Ethereum, which are fungible and can be exchanged 1:1, every NFT is one-of-a-kind and has its own value.

In 2024, the global NFT market was valued at $25.3 billion with over 10.8 million NFT sales recorded across major blockchains such as Ethereum, Solana, and Polygon. Experts expect the market to keep growing into 2025, potentially surpassing $31 billion, thanks to growing interest in areas like games, fashion, and the metaverse.

NFTs are now widely used in at least five major sectors:

Art & collectibles. Platforms like OpenSea, Rarible, and Foundation help artists turn their work into digital collectibles they can sell.

Gaming & in-game assets. Projects like Treasure DAO, Axie Infinity, and Gods Unchained let players own in-game items like characters, weapons, or land.

Virtual real estate & metaverse. Platforms such as Decentraland and The Sandbox allow people to buy virtual land and prove ownership through NFTs.

Event ticketing. NFT-based tickets are being used for concerts, sports, and festivals to cut down on fraud and scalping.

Digital identity & credentials. NFTs are being tested to hold digital IDs, certifications, and school records.

This explosive adoption brings up important questions for Muslims about whether trading NFTs is halal when used for investment or as digital assets. As the line between innovation and speculation gets blurry, Shariah compliance is becoming a serious concern for Muslim users trying to make money while still staying true to their beliefs.

Key Islamic finance principles

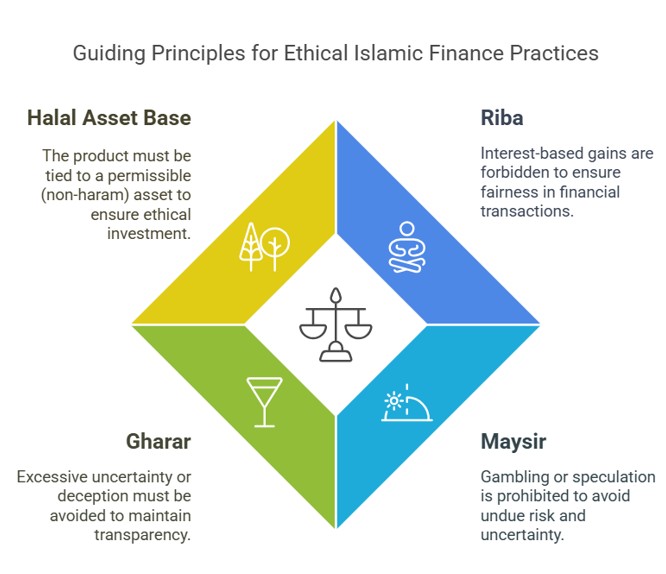

Islamic finance operates based on strict ethical guidelines from Shariah. For any financial product to be halal (even crypto), it must avoid:

| Principle | Description |

|---|---|

| Riba | Interest-based gains are forbidden |

| Maysir | Gambling or speculation is prohibited |

| Gharar | Excessive uncertainty or deception must be avoided |

| Halal Asset Base | The product must be tied to a permissible (non-haram) asset |

When are NFTs considered halal?

Islamic scholars and recognized fintech platforms — such as Amanah Advisors, Musaffa Academy, and Halal Times — have provided detailed guidance on when NFTs can be considered Shariah-compliant. Based on their research and rulings, NFTs may be deemed halal if they fulfill three key conditions:

Halal underlying asset

The nature and content of the NFT must align with Islamic principles. That means the asset represented by the NFT must be free from anything explicitly forbidden under Shariah law — such as nudity, gambling, or alcohol-related themes.

Permissible (halal) examples include:

Digital Islamic art collections, such as Arabic calligraphy NFTs listed on platforms like OpenSea.

NFTs that unlock Quranic learning resources, educational content, or digital access to Islamic books.

Gaming-related NFTs, like character skins or in-game assets, provided the game avoids violence, sexual themes, or addictive mechanics (e.g., Muslim 3D or Halalverse).

Impermissible (haram) examples include:

NFTs linked to adult content or platforms promoting explicit imagery.

NFTs that serve as access passes to online casinos or in-game gambling features.

NFT projects that promote alcohol brands, unethical messaging, or anything contradicting Islamic morals.

In short, when asked whether an NFT is halal or haram, the first step is to assess the content and underlying asset. If it’s associated with prohibited themes — even indirectly — it is considered haram.

Purpose and usage

The intention behind purchasing or interacting with an NFT also plays a critical role in determining its permissibility. Scholars distinguish between using NFTs for ethical, constructive reasons and using them purely for speculation or high-risk profit.

Acceptable use cases include:

Buying an NFT to support a Muslim artist, educator, or dawah initiative.

Holding culturally or religiously significant NFTs as digital collectibles.

Gifting NFTs that represent knowledge or Islamic teachings.

Prohibited use cases include:

Flipping NFTs rapidly in hopes of short-term price spikes without engaging with the asset itself.

Participating in pump-and-dump schemes aimed at manipulating prices.

Investing in NFTs purely for speculative profit, which is associated with Maysir (gambling) and thus impermissible.

For example, when considering whether an NFT is halal, the question becomes: Am I supporting something meaningful, or am I speculating for quick gains with no real utility or benefit behind the token?

“O you who have believed, indeed, intoxicants, gambling, [sacrificing on] stone alters [to other than Allah], and divining arrows are but defilement from the work of Satan, so avoid it that you may be successful.”

Chainalysis did report in its 2024 Crypto Crime Report that the total value received by illicit cryptocurrency addresses declined to $40.9 billion, indicating a broader trend of reduced suspicious activity across digital assets. Many of these involved price manipulation and quick resale — often within 24 hours — closely mimicking gambling behavior. Such activity is inconsistent with Shariah principles and is therefore deemed non-compliant.

Transparent and fair transactions

Islamic finance emphasizes clarity, fairness, and the absence of deception. For an NFT to be considered halal, its ownership rights must be clearly defined, and the transaction must avoid Gharar (excessive uncertainty).

Features of a halal transaction:

Smart contracts that clearly define the buyer’s rights — such as full copyright use or display rights.

Transparent ownership history recorded on the blockchain.

A clear explanation of what the buyer receives — such as access, utility, benefits, or future upgrades.

Problematic scenarios:

Vague or misleading promises within the NFT’s smart contract.

No real asset, service, or benefit linked to the NFT.

Unclear terms around resale rights, royalties, or intellectual property ownership.

If you have understood the crux of halal NFT investing, you can get right into it by creating an account with any crypto exchange that supports NFT trading. Below are some of the most reputed options:

| Foundation year | NFT | Coins Supported | Demo account | Min. Deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| 2017 | Yes | 329 | Yes | 10 | No | 8.9 | Open an account Your capital is at risk. |

|

| 2011 | Yes | 278 | No | 10 | No | 8.48 | Open an account Your capital is at risk. |

|

| 2016 | Yes | 250 | No | 1 | Malta Financial Services Authority | 8.36 | Open an account Your capital is at risk. |

|

| 2012 | Yes | 249 | No | 10 | No | 6.89 | Open an account Your capital is at risk. |

|

| 2018 | Yes | 1000 | No | No | No | 6.57 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

When are NFTs haram?

NFTs sit in a tricky ethical and religious zone, and understanding when they cross into haram territory is very important.

NFTs tied to speculation, not value, are a red flag. If the NFT’s worth is purely based on hype or FOMO trading, not actual utility or ownership of something meaningful, it leans toward Gharar (excessive uncertainty), which is haram in Islamic finance.

If the NFT is linked to haram content, so is the trade. This includes art with nudity, gambling themes, or content promoting impermissible behavior — even if the blockchain transaction is clean, the content makes it haram.

Earning from NFTs without clear effort or creation may count as unjust enrichment. Buying low and flipping high with zero value addition can be seen as making profit without labor (Riba-like), especially if you're doing it repeatedly.

NFT games can be problematic if they mirror gambling mechanics. When games involve staking money for unpredictable returns or prizes (like loot boxes or pay-to-win NFTs), they echo Maysir (gambling), which is prohibited.

Creating NFTs of religious texts or sacred imagery is deeply controversial. Turning verses of the Quran or religious icons into digital assets for sale introduces issues of commercialization and disrespect, making it clearly impermissible for many scholars.

Is Treasure NFT halal or haram?

The rise of Treasure NFTs — especially through the Treasure DAO platform built on Arbitrum — has sparked discussion. These NFTs play a central role in games like Bridgeworld, where in-game economies, characters, and virtual items are tokenized as assets.

So, is Treasure NFT halal? Here's what we found:

If the NFTs are used in gameplay that avoids violence, gambling-like behavior, and speculation — and instead offer educational, creative, or harmless entertainment — some scholars may view them as permissible.

However, if the NFTs serve only as speculative assets or are tied to reward mechanisms resembling gambling, they would likely be considered haram under Islamic principles.

This means the permissibility of Treasure NFTs depends entirely on how they're used and the nature of the game itself. The ruling is context-based, not a blanket judgment.

So when someone asks, “Treasure NFT is halal or haram” — the honest answer is: it can be halal, but only if the game avoids prohibited content and offers a fair, beneficial, or value-driven experience. The permissibility depends on how the NFT is structured, whether it involves speculation (Gharar), and if real ownership or utility is involved in a Shariah-compliant way.

Latest proven findings (2024–2025)

As the NFT market continues to evolve, Islamic scholars and fintech experts have started offering grounded, research-based perspectives on how NFTs fit within Shariah principles. Between 2024 and early 2025, a growing number of studies and official rulings have helped clarify the conditions under which NFTs may be considered halal or haram.

These conclusions are drawn from close examination of blockchain functionality, NFT utility, and how these assets align with key Islamic financial ethics — particularly the avoidance of Riba (interest), Maysir (gambling), and Gharar (excessive uncertainty).

What follows is a practical summary of the latest verified insights from recognized Islamic finance institutions, trusted fatwa platforms, and blockchain compliance analysts. This information is intended to support Muslim investors in making informed, Shariah-conscious decisions when assessing whether a particular NFT offering aligns with Islamic ethical and legal standards.

| Source | Key Insight |

|---|---|

| HalalTimes | NFTs tied to Islamic art and culture are generally permissible |

| Amanah Advisors | NFTs must have tangible utility or intellectual value to be halal |

| Musaffa Academy | NFTs are halal when used with clear intention and non-speculative use |

| SeekersGuidance | Urges traders to avoid NFTs without clear ownership rights |

| Halal Crypto Guide | Projects like Treasure DAO should be judged case-by-case |

Practical steps for muslim traders

As NFTs explode in popularity, Muslim traders are seeking ways to engage in the space without compromising Islamic ethics.

Start with niyyah (intention) beyond profit. NFTs shouldn’t just be money machines — set an intention rooted in value creation or preserving something meaningful, like digital Islamic art or knowledge.

Avoid NFTs with ambiguous ownership rights. Many NFT contracts don’t grant true ownership of the asset — only a link. From a Shariah lens, this can be Gharar (uncertainty), so verify what's actually being sold.

Use platforms that allow direct wallet ownership. Third-party platforms that hold your NFT for you can raise custodial concerns — opt for self-custody platforms like those supporting MetaMask or hardware wallets.

Ensure no Riba (interest) is baked into the platform. Some NFT ecosystems include staking or “rewards” systems that mimic interest structures — stay away unless they’re clearly equity or value-driven.

Don’t mint or trade NFTs with haram content — direct or indirect. It’s not just about avoiding nudity or gambling; even memes, music, or references that mock religion or promote unethical themes should be avoided.

Utility, not hype, defines whether NFTs are halal in Islamic finance

Many Muslims exploring NFTs start by asking if they’re halal or haram — but the real question should be: how is the NFT used, and what value does it represent? The mistake many beginners make is thinking that all NFTs fall into the same category. In reality, an NFT linked to real-world ownership — like property deeds, halal art, or educational licenses — can pass Sharia scrutiny if it avoids Gharar, Maysir, and Riba. But when an NFT is just a speculative token with no backing or purpose, the transaction often resembles gambling.

Another overlooked aspect is the platform and payment method. Even if the NFT itself is halal in purpose and structure, buying it with interest-based credit or through platforms involved in non-compliant activities could taint the entire process. Beginners often ignore the importance of the transactional environment, but in Islamic finance, the path to ownership matters just as much as the asset itself.

Scholars increasingly emphasize that NFT compliance is not just about the end product — it’s about the full journey, from minting to sale to resale. This makes NFTs one of the few digital assets where Shariah compliance can actually be baked into the code if done with proper intention and transparency.

Conclusion

The rise of NFTs presents both exciting opportunities and complex challenges for Muslim investors and traders. While NFTs are not inherently halal or haram, their permissibility depends on several critical factors — most notably the nature of the underlying asset, the intent behind their use, and the transparency of the transaction. For those wondering whether NFT is halal or haram in Islam, the answer lies in context.

When NFTs are tied to ethical, Shariah-compliant content and used in a way that avoids speculation and uncertainty, many scholars agree they can be permissible. However, the prevalence of haram content and speculative trading in the broader NFT market means caution is essential.

FAQs

Can NFTs be used for Islamic charitable purposes like zakat or waqf?

Yes, NFTs are beginning to be explored as digital tools for waqf and sadaqah. For example, some projects mint NFTs that fund Islamic schools or charitable work, offering a new, traceable form of donation. Scholars suggest these could be halal if structured transparently and without profit motives.

Does the blockchain network itself affect whether an NFT is halal?

Absolutely. If the blockchain supports haram activities (e.g., gambling DApps), using it could taint the NFT transaction. Scholars recommend using networks focused on ethical or Islamic principles, or at least avoiding chains with heavy involvement in haram ecosystems.

Is it halal to create NFTs from AI-generated Islamic art?

This depends on the intention and content. If the AI-generated art respects Islamic values and isn’t misleading (e.g., falsely presented as traditional or sacred), it may be permissible. However, scholars caution against using AI to simulate religious texts or figures due to risks of disrespect.

Do royalties in NFTs conflict with Islamic inheritance rules?

In some cases, yes. NFTs that pay perpetual royalties to creators — even after death — can complicate how assets are divided under Islamic inheritance laws. It’s best to define royalty terms clearly and consult a scholar if the creator intends for it to continue after their passing.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Pump and dump" is a fraudulent scheme commonly seen in financial markets, especially in the context of stocks or cryptocurrencies. In a pump and dump scheme, manipulative individuals or groups artificially inflate the price of an asset, often through spreading false or misleading information to attract unsuspecting investors.

FOMO in trading refers to the fear that traders or investors experience when they worry about missing out on a potentially profitable trading opportunity in the financial markets.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.