10 Best P2P Crypto Exchanges for 2024

Best P2P Crypto Exchange in 2024 - Bybit

TOP P2P Crypto Exchanges in 2024:

Bybit — an innovative cryptocurrency derivatives exchange;

Binance — a great platform for anyone looking to exchange cryptocurrencies;

Paxful — one of the best P2P crypto exchanges for streamlining the transaction process;

Huobi P2P — best for 0 fees exchange;

OKX — huge choice of payment options.

NOTE!

If you are planning to trade cryptocurrencies, and not just keep your savings in crypto wallets, we recommend that you choose one of the top brokers with reliable regulation and access to trading crypto CFDs. This type of trading will help you avoid holding your cryptocurrency in e-wallets of exchanges, which quite regularly get hacked. Also, availability of leverage will allow you to trade crypto CFDs for amounts much higher than your deposit.

Traders Union experts recommend considering Top 3 companies from our rating:

P2P crypto exchanges may be a strange term to those new to the crypto world. Many beginners wonder: What does it mean, and how does it differ from other crypto exchanges? This category of exchanges is mainly known for connecting one trader to another.

In simpler words, all transactions are direct and decentralized, meaning no banks or other authorities are involved. So if you're curious about P2P crypto exchanges and how they work, keep reading. We've also included 10 of the best P2P crypto exchanges to use in 2023 and how you can choose the ideal one for yourself.

TOP 10 P2P Crypto Exchanges in 2023

Below you will find all the information.

What is P2P Crypto Exchange?

A peer-to-peer (P2P) crypto exchange is a type of crypto exchanges which allows traders to exchange cryptos with each other without the interference of an intermediary, like banks or other authoritative entities.

As a result, verified users can conduct all trading of cryptocurrencies without any hassle. In addition, P2P crypto exchanges don't have to use order books to pair the buy and sell orders and control all cryptocurrencies on their platform.

Instead, these exchanges give their users the flexibility to interact with one another directly to simplify the transaction. This way, users don't have to use a go-between for the retention of funds or the process of transactions.

However, the lack of an intermediary makes it much easier for users to sign up without ID verification. This can weaken the security of the crypto exchange, which is why most decentralized exchanges have many different security measures in place. Maybe, you also can be interested in information about types of cryptocurrency exchanges.

In addition, P2P crypto exchanges allow you to browse through a wide range of traders and see what they can offer you. You don't have to lose custody of your funds, and you can look through different payment methods with varying transaction fees.

One of the main reasons people prefer decentralized crypto exchanges over centralized ones is that there's no single point of failure. These digital assets aren't stored on the exchange; each trader owns them independently. The platform is simply used for the transaction.

How Does P2P Exchange Work?

When you first read about the anonymous and decentralized nature of P2P crypto exchanges, you may think that the platform is susceptible to scams, frauds, and crypto thefts. However, you'll change your mind when you find out how P2P crypto exchanges work.

When signing up for P2P crypto exchange, you'll only have to provide an email address and password. In addition, you won't have to provide any ID verification to work on a P2P crypto exchange most of the time.

Then, you'll find various buy and sell offers for Bitcoin and other cryptocurrencies. Each seller or buyer will demand a different rate, payment method, and maximum or minimum purchase amount.

Once you've found the offer that suits you best, the transaction begins. Some P2P exchanges require both parties to send some collateral to an escrow contract to be released once the transaction is successful.

If there's a conflict, the exchange will compensate the affected party with the collateral. Other P2P exchanges only require the seller to send collateral which they'll receive again once the buyer confirms the transaction.

Pros

Here are a few advantages of using a P2P crypto exchange:

Flexible Payment Methods

The best part about P2P crypto exchanges is that they provide a wide range of payment methods to choose them, and the availability depends on the seller. That includes a gift card, digital payments, or even checks.

In simpler words, there are no limitations when it comes to payment methods on P2P crypto exchanges. In comparison, you'll find that traditional, centralized crypto exchanges only accept credit or debit card payments.

Lower Fees

Of course, all P2P crypto exchanges require a transaction fee for all trades, but they are much lower than centralized crypto exchanges. You'll also find that these platforms only charge escrow fees since they have no intermediary.

Security

Despite popular belief, most P2P crypto exchanges have improved their security systems significantly. In addition, they're much safer than most trading platforms because of their third-party nature.

The escrow system required by most P2P crypto exchanges helps protect each party involved in the trade. That includes the exchange as well. Since the digital assets are not stored on the platform, users don't have to worry about losing their crypto as they never hand over custody.

Accessibility

P2P crypto exchanges are more accessible than other trading platforms because they don't require users to have bank accounts. As a result, traders in underbanked regions can easily buy and sell crypto.

As long as you have internet access, a smartphone, and a risk appetite, you can send and receive crypto with no hassle.

Cons

Here are a few disadvantages of using a P2P crypto exchange:

Hard to Use

Since P2P crypto exchanges don't have an intermediary to regulate the platform and its operations, the interface can be pretty hard to use. In addition, the platforms aren't very intuitive, so there's a learning curve in the onboarding process.

Speed

The lack of an intermediary also slows down the platform's operations significantly as each transaction takes a lot more time. In addition, there's no way to streamline the choice between the various payment methods without intermediaries.

Anonymity

Contrary to popular belief, P2P crypto exchanges provide less anonymity for users than OTC crypto exchanges. This is because each user trades directly with another user, and it may also display your trading history on the platform's built-in reputation system.

P2P vs. OTC Crypto Exchanges

Other than P2P crypto exchanges, over-the-counter (OTC) crypto exchanges are the other most popular type of crypto trading platform. OTC crypto exchanges are also known as centralized crypto exchanges. These two platforms differ more than one; here are a few of their fundamental differences.

Speed

In terms of trading speed, OTC crypto exchanges win the race. That's because OTC crypto exchanges regulate the transaction with the help of a broker or administrator. As a result, the trade completes almost instantly.

On the other hand, P2P crypto exchanges leave users responsible for regulating their transactions. This involves finding the buyer/seller, initiating the trade, agreeing to the trade, sending the crypto and escrow fees, and verifying the payment.

Overall, the speed of the transaction depends entirely on the availability of each party to verify each step. As long as both the buyer and seller complete their part of the transaction timely, the trade can be much faster.

Associated Risks

The two types of crypto platforms also differ in terms of their risks. For example, with an OTC crypto exchange, you can expect to face counterparty risks when one party fails to complete its payment.

Other than that, you also risk under-pricing due to a lack of transparency in the system. On the other hand, P2P crypto exchanges risk lower liquidity, which means the trader may lose interest in the trade due to the time-taking transaction process.

Best P2P Crypto Exchange in 2024

Here are the top 10 P2P crypto exchanges to consider in 2023. To pick out only the best exchanges for our readers, we considered the exchange process, available assets, fees, supported coins, and ease of use. We've also included pros and cons for each exchange.

ByBit

Bybit offers an innovative cryptocurrency derivatives exchange that has been popular since its launch in March 2018. Boasting support for over 40 fiat currencies and four cryptocurrencies, Bybit has become a dependable source for investors to trade securely. What makes Bybit's P2P market even more attractive is the zero transaction fees for makers and takers.

On top of that, the platform also avails more than 350 payment methods, so traders have the option to pay via debit cards, credit cards, or even in-person cash payments. Some users may still incur payment costs based on their preferred payment provider. Still, this makes Bybit's P2P market one of the most competitive options available in the cryptocurrency industry today. When it comes to fees, ByBit has a multi tiered structure.

ByBit P2P trading allows users to trade 24/7, giving them a wide variety of opportunities that can fit into their schedules. To ensure a safe and secure trading experience for all traders, ByBit requires users to complete and pass KYC verification. The process requires individuals to verify their identity by submitting documents such as a passport or identity card issued by their country of origin. In addition, traders need to undergo KYC verification if they would like to withdraw more than 2 BTC per day.

👍 Pros

• Zero transaction fees

• Multiple fiat currencies

• Over 350 payment options

• Zero maker/taker fees

👎 Cons

•Limited cryptocurrencies

Binance

Binance P2P is a great platform for anyone looking to exchange cryptocurrencies. Established in late 2018, it is a safe and secure way to transact on the user's terms. Currently, Binance P2P supports six different cryptocurrencies: BTC, ETH, BNB, BUSD, DAI, and USD. Furthermore, users can take advantage of more than 700 payment methods and 100 fiat currencies when buying and selling cryptocurrency in the P2P marketplace.

To ensure the highest level of security during each transaction, Binance P2P also provides an escrow service and top-notch service speeds - where you complete a trade only 15 minutes after initiating it.

Binance is a leading name in the crypto world, so it's no surprise that its P2P channel stands out from its competitors. With liquidity combined with a 0% fee structure, traders are already winning upon signing up. P2P traders also get integration with the Binance Ecosystem for added security and reassurance for all transactions.

Moreover, all merchants (sellers) wishing to use this platform must adhere to strict standards set by Binance P2P or risk being kicked off from the platform. This ensures that users interact only with reputable merchants who have gained good customer reviews.

👍 Pros

•Zero fees

•Multiple supported cryptocurrencies

•Integration with the Binance ecosystem

•Over 700 payment options

•A wide array of fiat currencies

•Fast transaction speeds

👎 Cons

•Not available in the US

Paxful

Paxful is also one of the best P2P crypto exchanges for streamlining the transaction process. Plus, trading on Paxful is safer than any other P2P crypto exchange since the platform requires biometric data for users in the verification process.

The transaction fee for this platform ranges from 0% to 0.5%, but buying crypto is always free. The selection of supported coins on Paxful P2P is small, but it includes the most popular cryptos, such as Bitcoin, Ethereum, and Tether.

In addition, the P2P crypto exchange offers over 250 payment methods to choose from, including credit or debit cards, wire transfers, PayPal, and more. The process of signing up is also pretty straightforward, but you must meet the mandatory ID requirements to become a user.

👍 Pros

• Low trading fees

•Over 250 payment methods

• Mobile and web interface

👎 Cons

•Very few cryptos available

•Must meet the mandatory ID requirements to become a user

Huobi P2P - Best for 0 fees exchange

Huobi has made its name in the crypto world, so its P2P platform is so reliable and sought-after. For P2P crypto exchange, Huobi's services are faster and smoother than you would expect.

The best part about this P2P platform is that it takes no transaction, whether you're a buyer or a seller. It also supports an impressive selection of cryptocurrencies, such as Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH), Litecoin (LTC), and Monero (XMR), Huobi Token (HT), Huobi USD (HUSD), and Tether (USDT).

In addition, Huobi P2P offers over 90 payment methods, including wire transfer, bank transfer, credit card, debit card, Apple Pay, etc. The sign-up process for this exchange is uncomplicated, only requiring an email address, password, and nationality.

👍 Pros

• Impressive user interface.

• Over 90 payment methods

• Impressive selection of cryptocurrencies

👎 Cons

•Lengthy verification process

•It does not support fiat deposits and withdrawals

OKX P2P

Established in 2017, OKX has become one of the go-to platforms for P2P trading. All you need to do to start trading is register an account, verify your email or mobile number, and complete at least KYC Level 1 – personal info verification. After that, you can easily access the marketplace and start buying and selling crypto. If you're an experienced trader, we recommend getting verified with KYC Level 2 - photo verification so that you can become an advertiser and trade on the platform.

One great advantage of OKX P2P is that there are no service fees associated with it. Also, OKX uses advanced escrow technology to make sure all trades happen securely, meaning this platform is a great choice for both beginners and experienced traders alike. Plus, they support over 20 payment currencies and multiple methods, including bank transfers, eWallets, and credit cards.

👍 Pros

•No service fee

•Offers educational resources

•Allows a wide array of fiat currencies

•High staking APYs

•Hundreds of trading pairs

•Easy-to-use buy/sell dashboard

👎 Cons

•Complex multi-tiered fee structure

HODL HODL

HODL HODL allows you to trade Bitcoin, Ethereum, XRP, Terra, and Solana. Crypto.com, Cardano, and Avalanche directly with other users. In addition, the platform offers a lending service and only charges 0.5% to 0.6% as transaction fees.

You can even reduce this fee by referring another user to their exchange. The best part about this platform is its ease of use and intuitive layout, making it easy for you to sign up and instantly start trading. Lastly, the payment method on this platform depends entirely on the seller.

👍 Pros

•Low transaction fees

• Impressive range of supported coins

•Reduction of fees by user referrals

👎 Cons

• Lower daily trading volume

•Fewer payment methods

Bisq

Bisq P2P is another decentralized exchange that doesn't rely on a third-party authority for crypto transactions. Instead, the platform supports an impressive range of coins, such as Bitcoin (BTC), BSQ (BSQ), Monero (XMR), Ethereum (ETH), and more.

In addition, it charges a 0.1% transaction fee for the seller and a 0.7% transaction fee for the buyer. In other words, traders pay 0.001 BTC for the transaction fee and an extra 0.003 BTC for the mining fee. Bisq P2P offers over 20 different payment methods.

👍 Pros

•No KYC required

• Instant approval for withdrawals

• 20 different payment methods

👎 Cons

•Higher transaction fees

•Not fit for experienced traders

WazirX

WazirX is another reliable decentralized exchange based in India and acquired by Binance in 2019. The platform takes a reasonable 0.2% Taker Fee and 0.2% Maker Fee. In addition, it supports cryptocurrencies such as Bitcoin, Ethereum, Ripple, Litecoin, and more.

However, it only allows users to buy and sell USDT stablecoin. WazirX makes up for that fact by supporting eight fiat currencies, such as Indian Rupees, Turkish Liras, and more. In addition, the payment methods are somewhat limited, only allowing traders to pay in cash.

👍 Pros

•Easy to deposit/withdraw money through UPI, NEFT, and P2P

•Backed by Binance

•Inr trade pairs are available

👎 Cons

•Less liquidity

•Less trading pairs

LocalCoinSwap

LocalCoinSwap is ideal for crypto beginners since it has an intuitive and easy-to-navigate interface. In addition, it charges a flat 1% transaction fee and supports coins like Bitcoin (BTC), Ether (ETH), Dash, Tether (Stablecoin), USDC (Stablecoin), DAI (Stablecoin), LCS (LocalCoinSwap's loyalty token), and Nexo.

Option KYC checks are an additional feature offered by the platform. Lastly, the P2P crypto exchange offers various payment methods, such as cash in person, transferwise, local bank transfer, cash deposit, PayPal, Skrill, and PayID.

👍 Pros

•Supports 20+ cryptos and 160+ fiat currencies

•Low transaction costs and trading fees

•Backed by Escrow protection smart contract

👎 Cons

•Security depends on the chosen trader

•Too many options can discourage beginners

KuCoin

Lastly, KuCoin is known for its advanced platform that caters more to experts and community leaders. It supports most of the best and most popular crypto coins, including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), Cardano (ADA), XRP (XRP), USD Coin (USDC), and even Dogecoin (DOGE).

It charges a flat 0.1% on all transactions and offers payment methods like credit or debit card, Apple Pay, and Google Pay.

👍 Pros

•Wide range of supported coins

•Low transaction fees

•Strong user base

👎 Cons

•Limited payment methods

•Not for new traders

P2P Exchanges Comparison

| Exchange | Fees | Supported Coins | Payment Methods |

|---|---|---|---|

ByBit |

$0 fees |

40 fiat currencies Cryptos - USDT, BTC, ETH and USDC |

Over 350 options |

Binance |

$0 fees |

100 fiat currencies 6 cryptocurrencies BTC, ETH, BNB, BUSD, DAI and USD |

Over 700 options |

Paxful |

0.1% to 5% |

Bitcoin, Ethereum, & Tether |

250+ payment methods |

Huobi P2P |

0% |

Bitcoin (BTC) Dogecoin (DOGE) Ethereum (ETH) Litecoin (LTC) Monero (XMR) Huobi Token (HT) Huobi USD (HUSD) Tether (USDT) |

90+ payment methods |

OKX P2P |

Multi-tierd |

Over 350 |

Over 40 options |

HODL HODL |

0.5% to 0.6% |

Bitcoin, Ethereum, XRP, Terra, Solana. Crypto.com, Cardano, Avalanche. |

Depends on the seller |

Bisq |

0.1% for seller, 0.7% for buyer |

Bitcoin (BTC) BSQ (BSQ) Monero (XMR) Ethereum (ETH) |

20+ payment methods |

WazirX |

0.2% Taker Fee. 0.2% Maker Fee |

Bitcoin, Ethereum, Ripple, Litecoin, and more |

Cash-in, cash-out |

LocalCoinSwap |

1% |

Bitcoin (BTC) Ether (ETH) Dash Tether (Stablecoin) USDC (Stablecoin) DAI (Stablecoin) LCS (LocalCoinSwap's own loyalty token) Nexo. |

Cash in person. Transferwise. Local bank transfer. Cash deposit. PayPal. Skrill. PayID. |

KuCoin |

0.1% |

Bitcoin (BTC) Ethereum (ETH) Tether (USDT) Binance Coin (BNB) Cardano (ADA) XRP (XRP) USD Coin (USDC) Dogecoin (DOGE) |

Credit or debit card, Apple Pay, and Google Pay |

How to Choose the Best P2P Crypto Exchange?

Here are a few factors to consider while choosing a P2P crypto exchange in 2023:

Trading Fees

The first factor you must consider is the trading fees required by the P2P crypto exchange. Typically, you'll find that most P2P exchanges don't charge any transaction fees, while some charge approximately 0.5% of the trading volume.

However, the trading fees of the P2P platform should be no more than 1%.

Security

Since you're dealing with the other party of the trade directly, you're entirely responsible for your coins and their safety. Therefore, you must opt for P2P crypto exchanges with extra security measures, such as escrow fees or two-factor authentication.

Volume

The direct nature of P2P crypto exchanges results in a lower daily trading volume for most decentralized exchanges. Higher trading volume indicates that an exchange has the most users. This is a testament to its credibility.

Payment Methods

You must ensure that the exchange you opt for has various payment methods. Since you'll be dealing with the buyer or seller directly, both parties should have the flexibility of paying in any way that suits them best.

Bank transfers, credit or debit cards, crypto, PayPal, gift cards, rewards points, and even goods and services are just a few examples to keep in mind.

How to Buy Bitcoin Without Verification on a P2P Crypto Exchange

Here is a complete step-by-step guide on buying Bitcoin without verification on Binance P2P:

Register on the Binance app by entering your email and password. Read the terms and conditions before moving forward.

After logging in, click on the user icon to complete identity verification. Click on "Payment Methods" and complete SMS authentication before setting up your payment methods.

On the home page, click on "P2P Trading."

On the P2P page, click on the "Buy" tab. Find an ad that interests you.

Enter the quantity you require before confirming the payment method and clicking on "Buy (Crypto)."

Transfer the money to the seller based on the information provided and the method selected. Click on "Transfer the fund."

Click on "Transferred, next." Do not click "Transferred, next" before finishing the transaction. This violates the P2P User Transaction Policy.

The status will say "Releasing."

The transaction will complete once the seller releases the crypto. Click "Transfer to Spot Wallet" to transfer it to your Spot Wallet.

Trader's Union experts have also prepared an article that explains how to buy cryptocurrency using P2P, outlining the advantages and disadvantages of this method. You might also be interested in learning about the best no KYC crypto exchanges.

How to Exchange Crypto P2P

To start trading P2P, you need to first look for a reputable P2P trading platform that supports the cryptocurrency you want to trade. Create an account on the chosen P2P trading platform, complete the verification process, and add funds to your account. You may also need to set up a digital wallet to store your cryptocurrency. Here we'll give you an example of a step-by-step guide on how to exchange crypto P2P on ByBit to help you understand how.

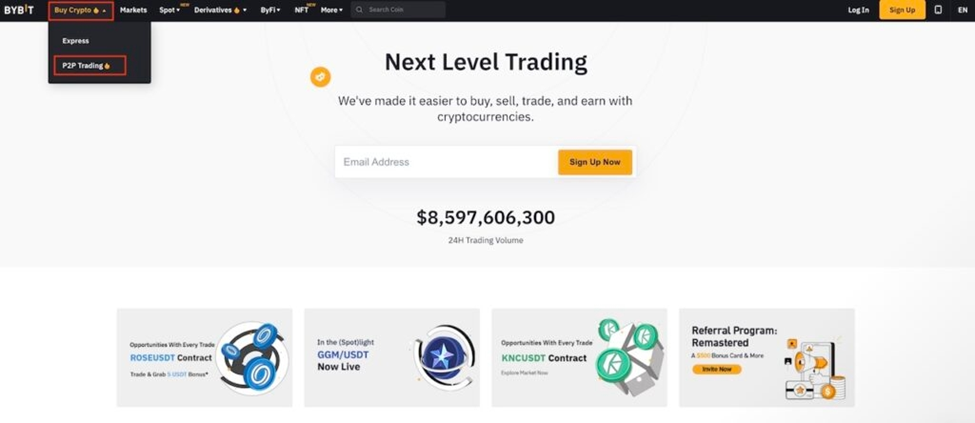

1. To buy or sell crypto, first, click on the Buy Crypto button at the top left corner of the screen. That will lead you to a drop-down menu where you'll click on P2P trading.

How to Exchange Crypto P2P

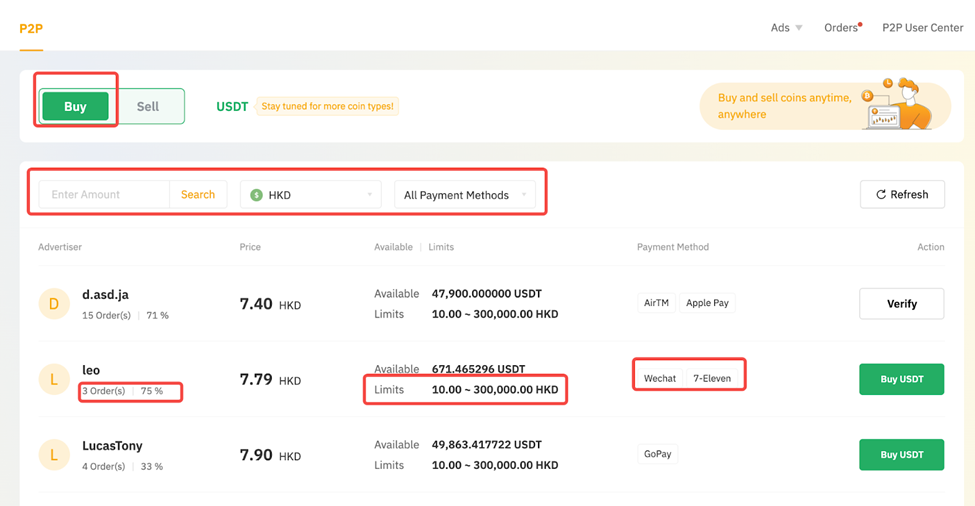

2. When you click on P2P Trading, the site will take you to the buy/sell page. To buy, click on Buy, then proceed to choose your currencies, payment method, and amount. To see, click on Sell instead and proceed to choose your currencies, payment methods, and amount.

How to Exchange Crypto P2P

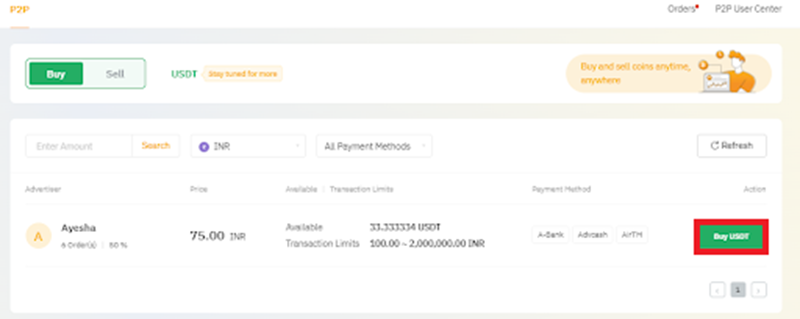

3. From there, choose your advertisement of choice, then click on Buy USDT or Sell USDT.

How to Exchange Crypto P2P

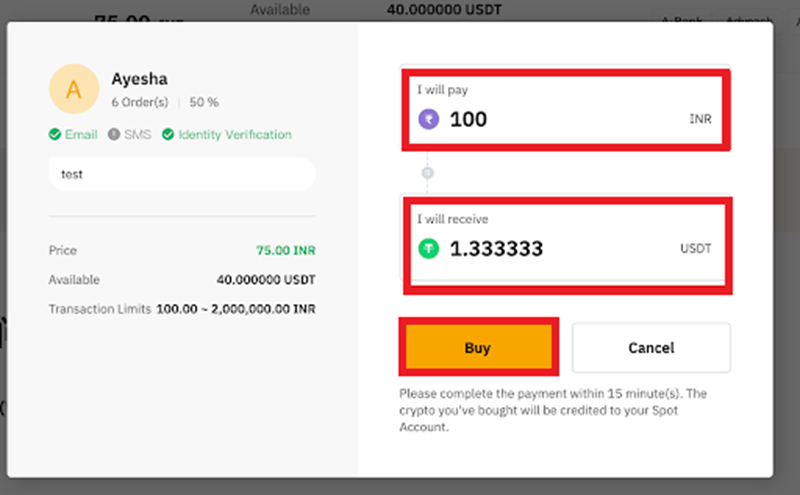

4. Enter the amount of money you want to spend or the coins/fiat you want to receive. To proceed, click on Buy or Sell.

How to Exchange Crypto P2P

The site will take you to the order page. If you're buying, you'll have 15 minutes to transfer funds to the seller. If you're selling, you'll give the buyer 15 minutes to send funds to you.

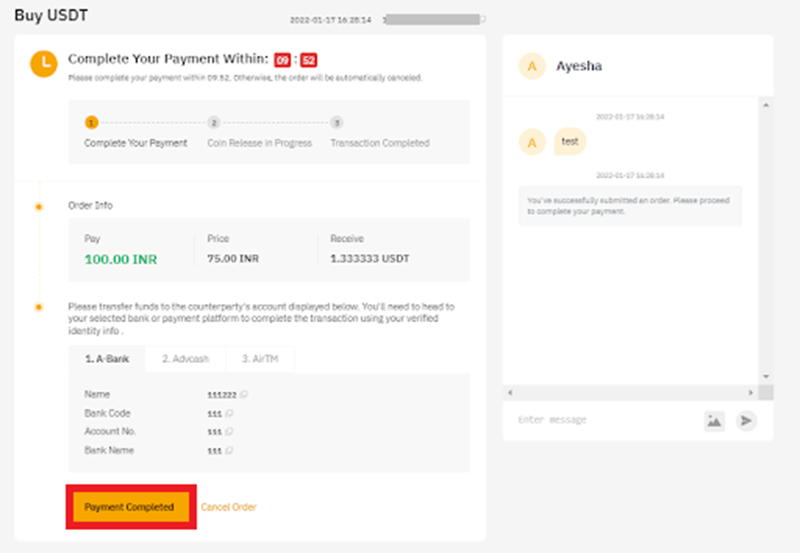

5. If you're buying, click on Payment Completed when you complete the payment.

How to Exchange Crypto P2P

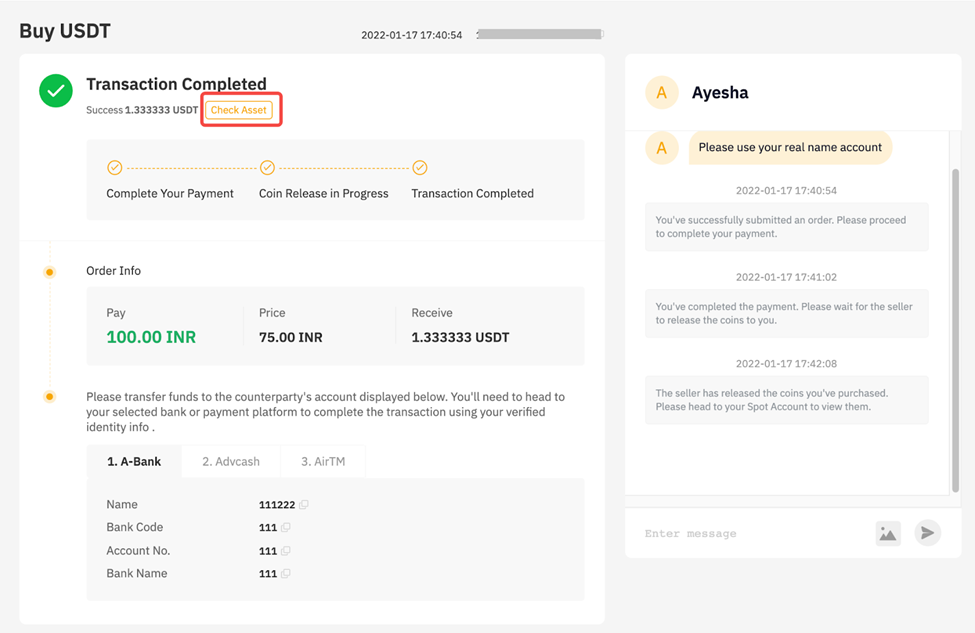

6. When the seller releases the coins to you, click on Check Asset to view your coins.

How to Exchange Crypto P2P

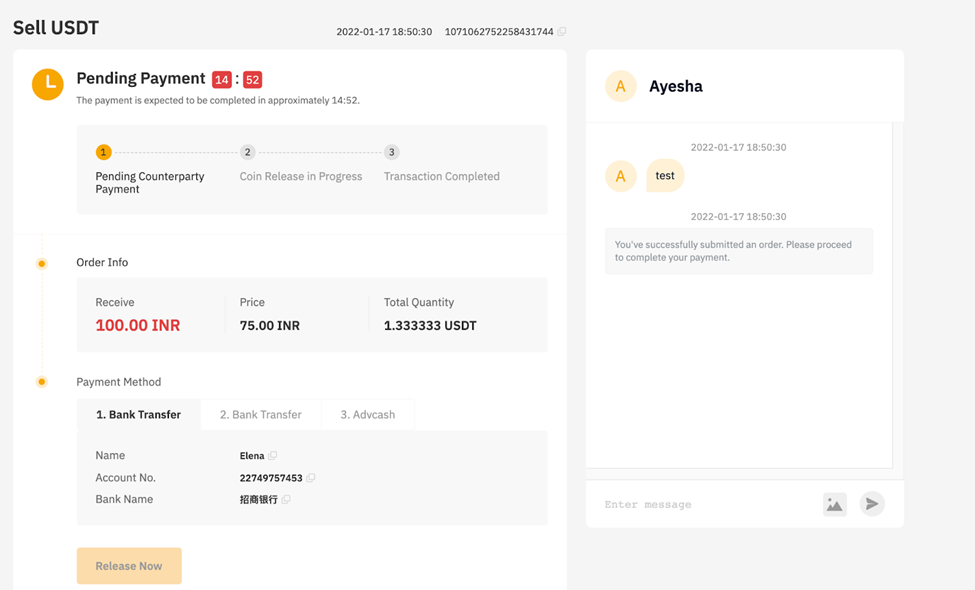

7. If you're selling, click on Release Now to get your coins once the buyer completes payment.

You can click on P2P order history to see your order status.

How to Exchange Crypto P2P

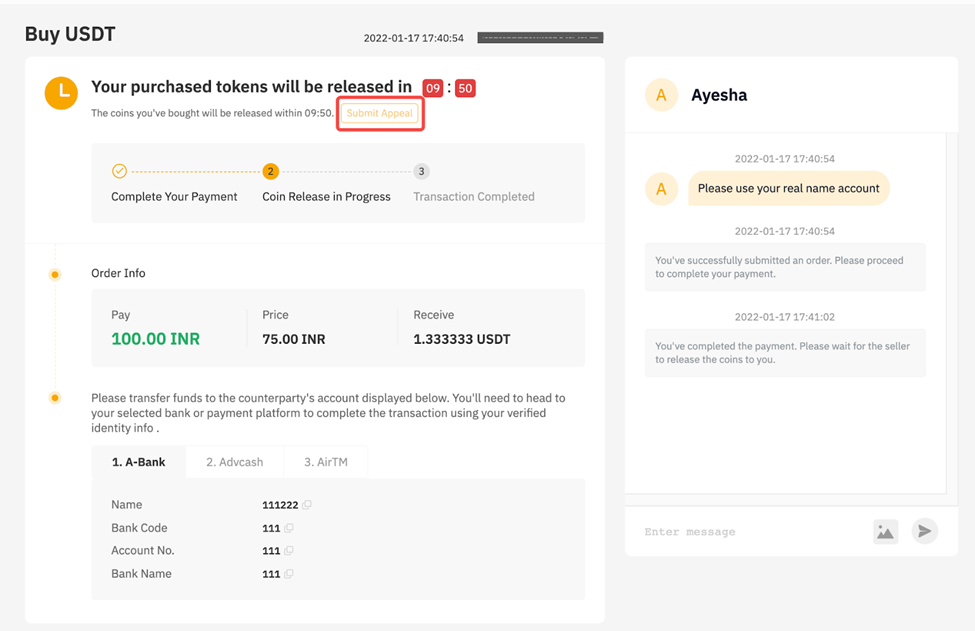

If the seller/buyer takes too long, click on Submit Appeal.

How to Exchange Crypto P2P

Are P2P Crypto Exchanges Cheap?

Yes, P2P crypto exchanges are generally cheaper than centralized crypto exchanges because they don't require a middleman to facilitate trades, which eliminates some of the overhead costs that centralized exchanges incur.

For example, Binance, one of the largest centralized crypto exchanges, does offer a P2P trading service with zero transaction fees. Other P2P crypto exchanges, such as Paxful and Hodl Hodl, typically charge fees ranging from 0.1% to 0.5% of the transaction amount.

It's worth noting that some P2P exchanges may also charge additional fees for certain features, such as deposit or withdrawal fees, so it's important to read the fee schedule carefully before using a particular platform.

Are P2P Crypto Platforms Risky?

P2P crypto platforms can carry a certain level of risk, just like any other financial product or service. However, leading P2P crypto platforms like Binance and ByBit have implemented various security measures to protect their users' assets, including crypto escrow mechanisms, triple-layer asset protection, and 24/7 customer service support.

A crypto escrow mechanism is a security feature that holds funds in a third-party account until a transaction is completed. This can help prevent fraud and provide an added layer of protection for users. For example, both Binance and ByBit use escrow services to hold funds until both parties confirm the completion of the transaction.

Platforms like Binance and ByBit have triple-layer asset protection where they store client funds in cold wallets and then use a combination of advanced multi-signature Threshold Signature Schemes (TSS) and Trusted Execution Environment (TEE). Some platforms also conduct regular Proof of Reserves audits and monitor and analyze user behavior in real-time. Other platforms like ByBit have Bug Bounty Programs for external security support to catch vulnerabilities.

Finally, providing 24/7 customer service support can also help reduce risk and increase user confidence in P2P crypto platforms. Professional platforms have customer support teams available around the clock to help users resolve any issues or concerns they may have.

Summary

P2P crypto exchanges are a better option for those that prefer not to lose custody of their coins and handle the transactions themselves. Although more time-consuming, these platforms are much more secure than centralized exchanges.

Binance P2P is one of the best when it comes to decentralized exchanges, covering all the features required to facilitate a quick and seamless crypto trade. Follow our guide while choosing a P2P crypto exchange in 2023.

FAQs

Here are the answers to the most frequently asked questions about P2P crypto exchanges:

What is the biggest P2P crypto exchange?

The biggest P2P crypto exchange is Binance.

Which crypto exchange supports P2P?

Several crypto exchanges support P2P, including Binance, ByBit, Paxful, and more.

Is P2P the best way to buy crypto?

P2P is considered one of the best ways to buy crypto because it offers more privacy, lower fees, and greater accessibility. With P2P, users can buy and sell cryptocurrencies directly with other individuals without the need for a centralized exchange or intermediary.

Is P2P risky on Binance?

Yes, there is a level of risk involved with using P2P on Binance, as with any P2P platform. Binance has implemented various security measures to protect users' assets, such as storing the majority of funds in cold storage and using escrow services. However, you still need to be vigilant and aware of potential scams, such as fake receipt scams, fake customer rep scams, chargeback fraud, and wrong transfer scams.

Can I Use P2P Without Verification?

Most P2P platforms don't require ID verification as any banks or other authorities do not mediate them. So you may only need to provide an email address and password.

How Long Does it Take to Receive Payment on P2P?

Depending on the P2P platform and seller you choose, the transaction can take a few seconds to a few business days. Binance P2P makes sure to expedite the transaction as much as possible.

Are P2P Payments Safe?

P2P payments are safer than OTC payments since the assets aren't stored on the exchange. As the traders never lose custody of their coins, they don't have to worry about data breaches and theft.

Can You Get Scammed in P2P Binance?

A counterparty may try to convince you to trade with them outside the Binance P2P platform. This is a scamming tactic used to lure you away from the exchange's security, so we wouldn't recommend it.

Methodology for compiling our ratings of crypto exchanges

Traders Union applies a rigorous methodology to evaluate crypto exchanges using over 100 quantitative and qualitative criteria. Multiple parameters are given individual scores that feed into an overall rating.

Key aspects of the assessment include:

User reviews. Client reviews and feedback are analyzed to determine customer satisfaction levels. Reviews are fact-checked and verified.

Trading instruments. Exchanges are evaluated on the range of assets offered, as well as the breadth and depth of available markets.

Fees and commissions. All trading fees and commissions are analyzed comprehensively to determine overall costs for clients.

Trading platforms. Exchanges are assessed based on the variety, quality, and features of platforms offered to clients.

Extra services. Unique value propositions and useful features that provide traders with more options for yield generation.

Other factors like brand popularity, client support, and educational resources are also evaluated.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Olga has extensive experience in writing and editing articles about the specifics of working in the Forex market, cryptocurrency market, stock exchanges and also in the segment of financial investment in general. This level of expertise allows Olga to create unique and comprehensive articles, describing complex investment mechanisms in a simple and accessible way for traders of any level.

Olga’s motto: Do well and you’ll be well!

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO). Mirjan is a cryptocurrency and stock trader. This deep understanding of the finance sector allows her to create informative and engaging content that helps readers easily navigate the complexities of the crypto world.