Top Secrets Strategies Professional Forex Traders Know

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Top secrets professional Forex traders know:

Forex trading involves the exchange of currencies in a global marketplace that operates 24/5. With daily trading volumes exceeding $7.5 trillion, it is one of the largest financial markets in the world. In this article, we will explore the top strategies and techniques used by successful Forex traders to achieve consistent profits and stay ahead in the market. Learn about solid trading plans, effective risk management, and key trading strategies like trend following, range trading, and breakout trading.

Top secrets professional Forex traders know

Secret 1: Develop a solid trading plan

A trading plan is your roadmap to success in Forex trading. It defines your trading goals, risk tolerance, and strategies. Here are the key components of a trading plan:

Timeframe. Determine the timeframe you will trade, whether it's intraday, daily, or weekly.

Currency pairs. Focus on specific currency pairs that you are familiar with.

Risk-Reward ratio. Define the risk-reward ratio you are comfortable with, ensuring that potential rewards outweigh risks.

Entry and exit points. Establish clear criteria for entering and exiting trades.

| Component | Description |

|---|---|

| Timeframe | Daily |

| Currency Pairs | EUR/USD, GBP/USD |

| Risk-Reward Ratio | 1:3 |

| Entry Points | Technical indicators (RSI, Moving Averages) |

| Exit Points | Stop-loss at 1% loss, take-profit at 3% gain |

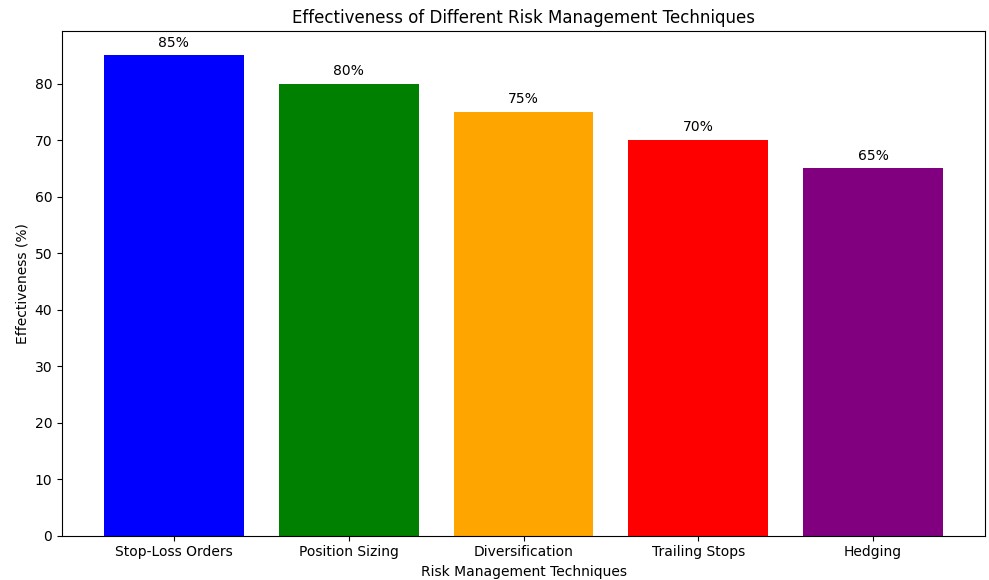

Secret 2: Master risk management

Risk management is the cornerstone of successful trading. Without proper risk management, even the best strategies can fail. Professional traders use techniques such as stop-loss orders and position sizing to manage their risks effectively.

Stop-loss orders. Automatically close a trade if the market moves against you beyond a certain point. Suppose you buy EUR/USD at 1.2000 and set a stop-loss at 1.1880, which is 1% below your entry point. If the price drops to 1.1880, the trade is automatically closed, limiting your loss to 1%.

Position sizing. Never risk more than a certain percentage of your trading capital on any single trade. If your total trading capital is $10,000 and you decide to risk 2% per trade, you should not risk more than $200 on any single trade. This means that if your stop-loss is set at 1% below your entry point, your position size should be such that a 1% move against you would result in a $200 loss.

Secret 3: Trend following

This strategy capitalizes on the momentum of price movements and aims to ride the trend until it shows signs of reversal.

Tools and indicators

Moving Averages (MA). Used to smooth out price data and identify the direction of the trend. Common types include the Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Moving Average Convergence Divergence (MACD). A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Example:

Imagine you are trading the EUR/USD currency pair. You notice that the 50-day EMA is consistently above the 200-day EMA, indicating an uptrend.

Entry Point: You decide to enter a long position when the price pulls back to the 50-day EMA and starts to move upwards again.

Exit Point: You plan to exit the trade if the price falls below the 200-day EMA, signaling a potential trend reversal.

Secret 4: Range trading

It focuses on identifying key support and resistance levels and trading within those ranges. This strategy is effective in stable markets where prices fluctuate between established levels.

Tools and indicators

Support and resistance levels. Horizontal lines drawn at price points where the currency has repeatedly reversed direction.

Relative strength index (RSI). An oscillator that can indicate overbought or oversold conditions, helping to identify potential reversal points within the range.

Example:

Consider trading the USD/JPY currency pair, which has been oscillating between 108.00 (support) and 110.00 (resistance).

Entry Point: Enter a long position near 108.00, the support level.

Exit Point: Exit the trade near 110.00, the resistance levels.

Secret 5: Breakout trading

Breakout trading involves entering trades when the price breaks out of a defined range or pattern. This strategy aims to capture significant price movements that follow a breakout.

Tools and Indicators

Trendlines and channels. Drawn to define the boundaries of the range or pattern.

Volume. Increased trading volume often accompanies breakouts, confirming the strength of the move.

Example:

You are watching the GBP/USD currency pair, which has been trading within a range of 1.3000 to 1.3200. You notice a buildup in volume and a potential breakout above 1.3200.

Entry Point: Enter a long position when the price breaks above 1.3200 with increased volume, confirming the breakout.

Exit Point: Set a stop-loss order just below the breakout level at 1.3180 to manage risk. Plan to take profit at a higher resistance level or based on a trailing stop.

Secret 6: Understand fundamental analysis

Integrating fundamental analysis into your trading strategy involves monitoring these indicators and understanding their potential impact on the Forex market.

Key economic Indicators

Gross Domestic Product (GDP). A strong GDP report typically indicates a growing economy, which can lead to currency appreciation as investors gain confidence in the country's economic stability. Example: If the United States reports a higher-than-expected GDP growth rate, the USD might appreciate against other currencies due to increased investor confidence.

Inflation rates. Higher inflation can lead to higher interest rates, which can attract foreign investment and cause currency appreciation. Conversely, hyperinflation can devalue a currency. Example: If the Eurozone experiences a significant rise in inflation, the European Central Bank (ECB) might increase interest rates, leading to the appreciation of the EUR.

Employment data. Employment data, such as the unemployment rate and non-farm payrolls, provides insight into the labor market's health. Strong employment data suggests a robust economy, which can lead to currency appreciation. Poor employment data can have the opposite effect. Example: A lower-than-expected unemployment rate in Canada can boost the CAD as it signals economic strength.

Interest rates. Central banks set interest rates to control inflation and stabilize the economy. Interest rates influence the flow of global capital. Higher interest rates attract foreign capital, leading to currency appreciation. Lower interest rates can lead to depreciation. Example: If the Bank of England raises interest rates, the GBP might appreciate as investors seek higher returns.

Trade balance. A trade surplus can lead to currency appreciation as foreign buyers purchase the currency to pay for the country’s goods and services. A trade deficit can lead to depreciation. Example: If Japan reports a trade surplus, the JPY might appreciate due to increased demand from foreign buyers.

Secret 7: Understand sentiment analysis

| Tool/Method | Description | Example |

|---|---|---|

| Commitment of Traders (COT) Report | The COT report provides a breakdown of positions held by commercial and non-commercial traders in various futures markets. | Analyze the distribution of positions to identify potential market trends. Example: Increased long positions by non-commercial traders indicate bullish sentiment. |

| Sentiment Indicators | Various sentiment indicators measure the mood of market participants. Examples include the CNN Fear & Greed Index and IG Client Sentiment. | Use indicators to measure market emotions. Example: Extreme greed on the CNN Fear & Greed Index suggests overbought conditions. |

| Social Media and News Analysis | Analyzing social media platforms, financial news, and forums to provide real-time insights into market sentiment. | Tools like sentiment analysis algorithms scan and interpret large volumes of text to gauge overall market mood. Example: Negative sentiment on social media about Brexit suggests bearish movements in GBP/USD. |

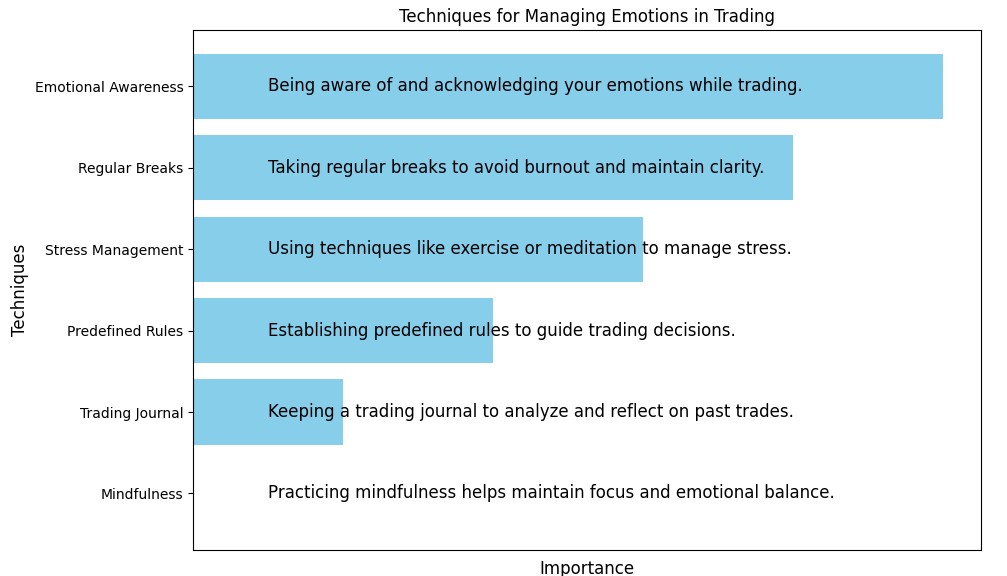

Secret 8: Maintain emotional discipline

Emotions can cloud judgment and lead to impulsive decisions. Professional traders use several techniques to manage their emotions:

Mindfulness. Practice mindfulness to stay calm and focused.

Trading journal. Keep a journal to track trades and reflect on emotional responses.

Predefined rules. Establish rules to guide trading decisions and stick to them.

Risk and warnings

Forex trading carries several risks that traders must be aware of:

Market volatility. Rapid price changes can lead to significant losses.

Leverage risks. High leverage can amplify both gains and losses.

Psychological risks. Emotional reactions can negatively impact trading decisions.

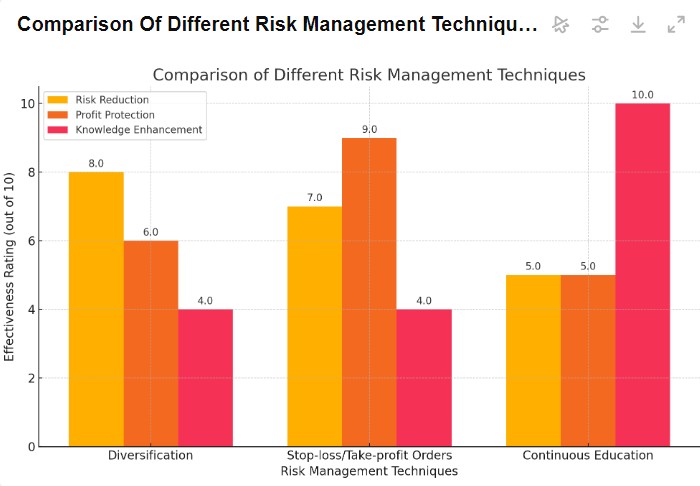

Implementing effective strategies can mitigate these risks:

Diversification. Spread investments across different currency pairs.

Stop-loss and take-profit orders. Use these orders to limit losses and lock in profits.

Continuous education. Stay informed about market conditions and trends.

Key secrets to success is developing a solid trading plan

Here are some insights and advice based on my experience that can help you achieve consistent profits.

One of the key secrets to success is developing a solid trading plan. Your trading plan is your roadmap, outlining your trading goals, risk tolerance, and specific strategies. It should define your trading timeframe, the currency pairs you’ll focus on, and your risk-reward ratio. Additionally, having clear entry and exit points based on technical indicators or other criteria will help you make informed decisions and stick to your plan even in volatile market conditions. Of course, use tools like Moving Averages (MA) and Moving Average Convergence Divergence (MACD) to identify the direction of the trend and potential entry and exit points.

I also consider fundamental analysis to be essential. Monitoring key economic indicators such as GDP, inflation rates, employment data, interest rates, and trade balances provides insight into a currency’s potential movement.

Conclusion

Forex trading, a dynamic and fast-paced arena, involves the exchange of currencies in a global marketplace that operates 24/5. With daily trading volumes exceeding $6 trillion, it stands as one of the largest financial markets worldwide. Understanding the strategies and techniques employed by successful traders is pivotal for anyone looking to improve their trading performance. By incorporating the secrets and strategies discussed, you can enhance your performance and work towards achieving consistent profits in the Forex market.

The stories of successful traders provide valuable lessons and inspiration, underscoring the importance of dedication, patience, and a commitment to ongoing education. With the right approach, aspiring you can navigate the complexities of the Forex market and strive for success.

FAQs

What makes a successful Forex trading plan?

A successful Forex trading plan includes clear goals, defined risk tolerance, specific strategies for entering and exiting trades, and a detailed analysis of the markets you plan to trade. It should also include a plan for ongoing evaluation and adjustment based on market conditions and your trading performance.

How can I effectively implement risk management in Forex trading?

Implementing risk management involves setting stop-loss orders to limit potential losses, deter mining position sizes to avoid risking too much capital on a single trade, and diversifying your trades across different currency pairs.

How can I continuously improve my Forex trading skills?

Continuous improvement in Forex trading involves ongoing education, staying updated with market trends and news, practicing with demo accounts, and analyzing past trades to learn from mistakes and successes. Joining trading communities and following experienced traders can also provide valuable insights and support.

How do professional traders stay updated with market conditions?

Professional traders stay informed by following financial news such as Bloomberg, Reuters, and CNBC, subscribing to market analysis reports, using economic calendars to track key events, and participating in trading forums and communities. For example, Ray Dalio, founder of Bridgewater Associates, emphasizes the importance of learning from peers and mentors in the trading community.

Related Articles

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Economic indicators — a tool of fundamental analysis that allows to assess the state of an economic entity or the economy as a whole, as well as to make a forecast. These include: GDP, discount rates, inflation data, unemployment statistics, industrial production data, consumer price indices, etc.

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.