How To Trade Divergence In Forex

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to trade divergence in Forex:

Identifying divergence (hidden or regular).

Identify the trend.

Look for divergence between the price and the indicator.

Confirm the divergence with additional signals.

Enter the trade in the direction of the anticipated trend reversal (for regular divergence) or of the existing trend (for hidden divergence).

Divergence occurs when the price of an asset moves in the opposite direction of a technical indicator, such as the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD). This discrepancy can signal a potential change in the trend's direction. There are two main types of divergence: regular and hidden. Regular divergence indicates a possible trend reversal, while hidden divergence suggests trend continuation. Both types can be further classified as bullish or bearish.

In this article, we will explore how to identify divergence and strategies for trading it effectively. We will also cover practical tips, common mistakes, advanced techniques, and provide real-world case studies to enhance your understanding.

How to trade divergence in Forex

Trading divergence in Forex involves spotting when price movements and indicators like RSI or MACD move in opposite directions, signaling potential trend reversals or continuations. To begin with, you must identify regular divergence for reversals and hidden divergence for trend continuations. Confirm these signals with other indicators, then set entry and exit points with stop-loss and take-profit.

How to trade divergence in Forex:

Identifying divergence

To spot divergence, compare the price action on a chart with the movement of an oscillator indicator (RSI or MACD). Look for points where the price makes a higher high or lower low, while the indicator makes a lower high or higher low, respectively.

Trading regular divergence

Forex divergence is manifested in the comparative assessment of price and technical indicator readings. Almost all oscillatory type indicators can be used to assess divergence: CCI, all types of stochastics, RSI, MACD, AO. Trend direction is usually evaluated by moving average, preferably exponential. The trend line is built by closing prices, cutting speculative "tails". The greater the divergence (discrepancy) between the price and the indicator readings, the stronger the reversal signal is considered to be.

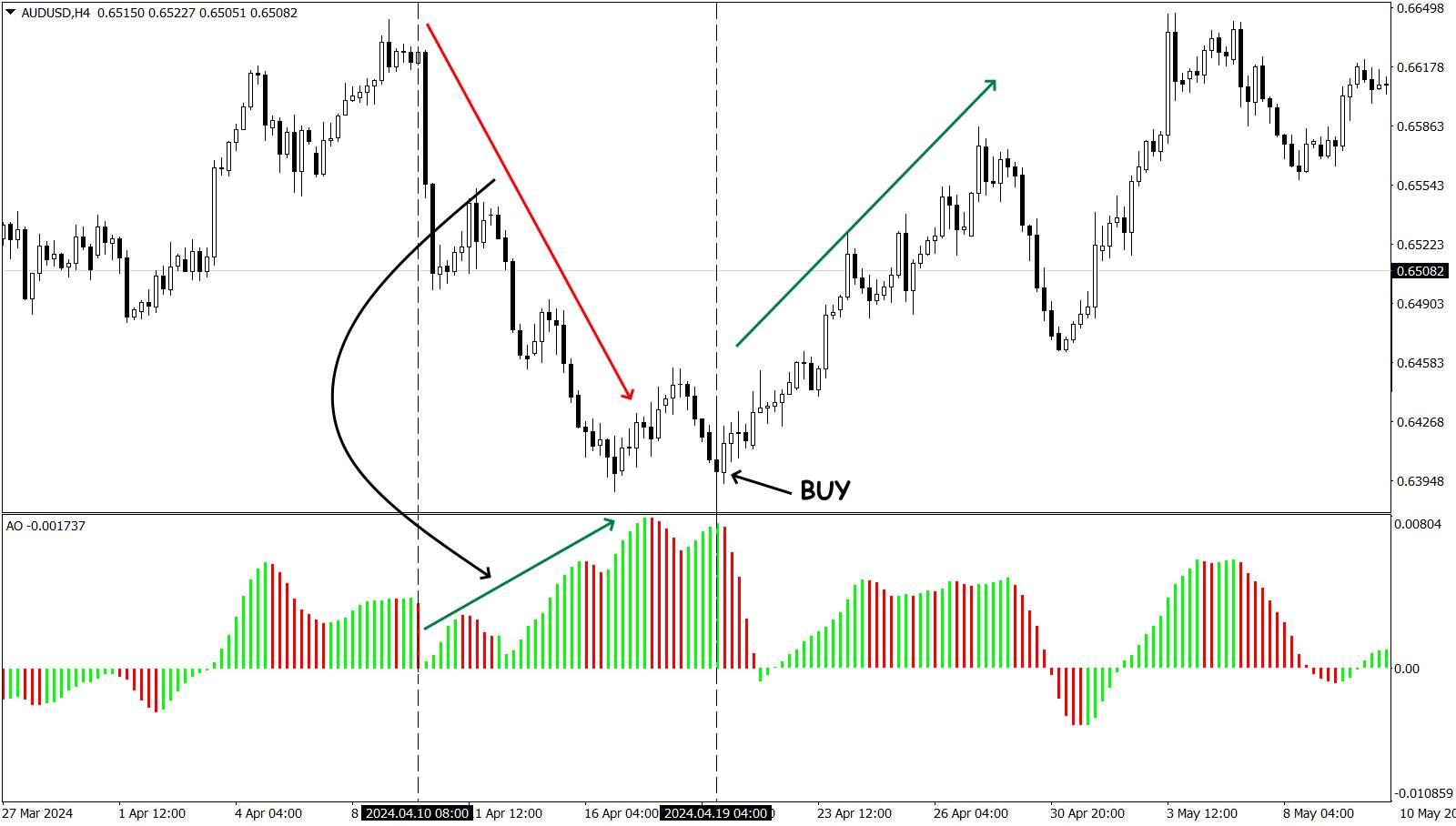

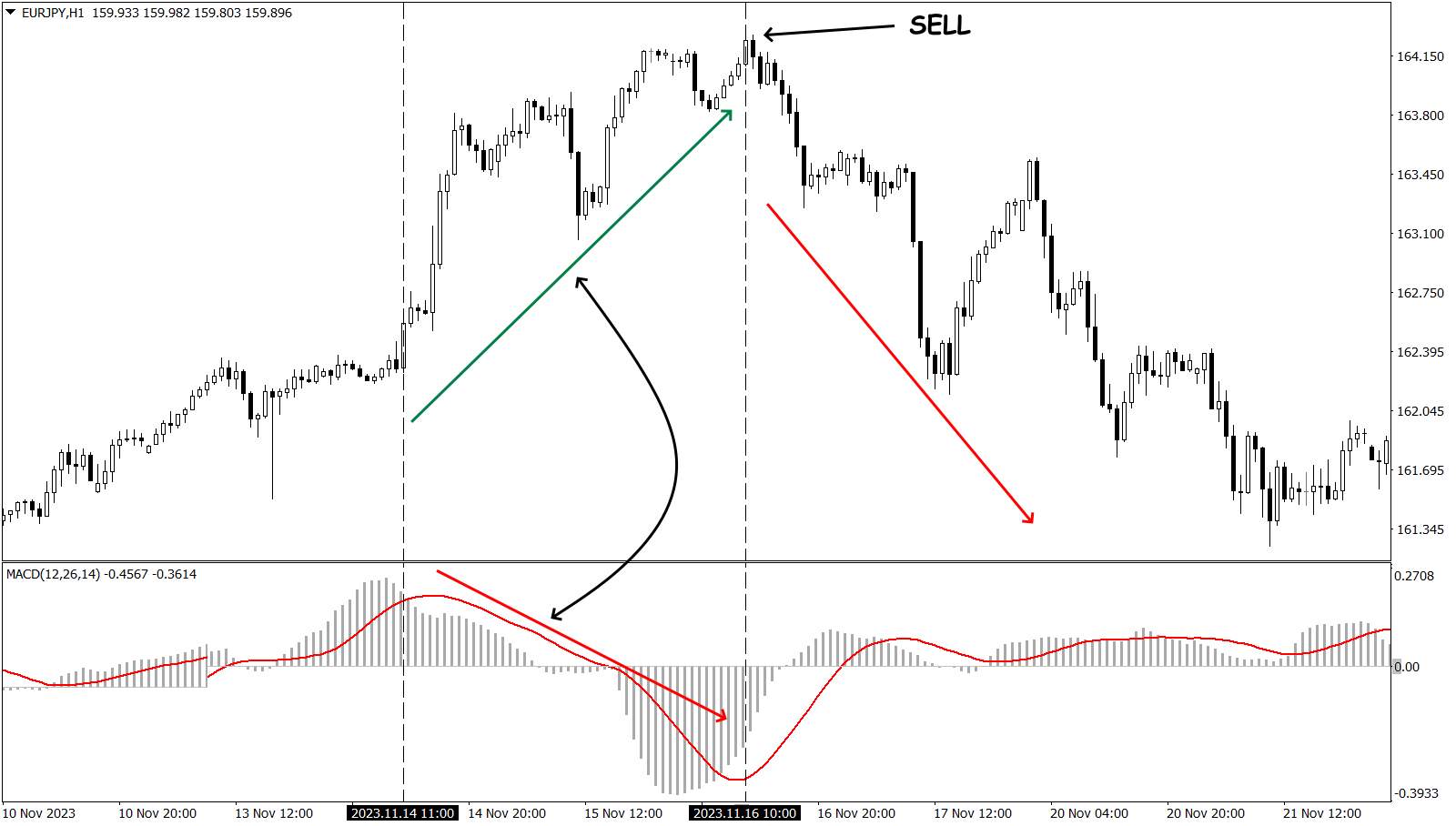

Regular bullish divergence occurs when the price makes lower lows, but the indicator makes higher lows, suggesting a potential uptrend. Regular bearish divergence happens when the price makes higher highs, but the indicator makes lower highs, indicating a possible downtrend.

Example strategy:

Identify the prevailing trend.

Look for divergence between the price and the indicator.

Confirm the divergence with additional signals.

Enter the trade in the direction of the anticipated trend reversal.

Trading hidden divergence

Hidden bullish divergence is seen when the price makes higher lows, but the indicator shows lower lows, suggesting trend continuation. Hidden bearish divergence occurs when the price makes lower highs, while the indicator makes higher highs.

Example strategy:

Identify the ongoing trend.

Look for hidden divergence between the price and the indicator.

Confirm the divergence with additional signals.

Enter the trade in the direction of the existing trend.

Combining divergence with other indicators

To improve the accuracy of your trades, combine divergence signals with other technical tools like support and resistance levels, and candlestick patterns. For example, if you see a bullish divergence at a support level, it strengthens the signal to buy.

Understanding divergence indicators

To effectively trade divergence, it's crucial to understand the indicators used to spot it.

Relative strength index (RSI): Measures the speed and change of price movements.

Moving average convergence divergence (MACD): Shows the relationship between two moving averages of a security’s price.

Commodity channel index (CCI): Identifies cyclical trends in a security.

Stochastic oscillator: Compares a particular closing price of a security to a range of its prices over a certain period.

We have compared brokers for you according to all these parameters and offer you to familiarize yourself with their conditions in the table below:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Investor protection |

€20,000 £85,000 SGD 75,000 | £85,000 €20,000 €100,000 (DE) | £85,000 SGD 75,000 $500,000 | £85,000 | $500,000 £85,000 |

|

Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Practical tips for trading divergence

For beginners:

Practice on demo accounts: Start with a demo account to gain experience without risking real money.

Focus on higher time frames: Higher time frames often provide more reliable signals.

Use clear and simple indicators: Stick to basic indicators like RSI and MACD to avoid confusion.

For advanced traders:

Multiple time frame analysis: Use multiple time frames to confirm signals.

Advanced technical analysis: Combine divergence with other advanced techniques for better accuracy.

Risk management: Implement strict risk management practices to protect your capital.

Common mistakes in divergence trading

Note: what is offered in the Forex trading terminal as a divergence in the role of a reversal signal has no connection with real trading volumes, and therefore only allows you to assess the "trading inertia" of the market at the current moment - whether players want to run after the changed price or will go quietly. Remember that even the strongest diver will not survive if the price reaches strong price levels with pending orders and large volumes get involved in the fight.

Avoiding common mistakes in divergence trading requires a disciplined approach and attention to detail. Here are some key strategies to help you navigate divergence trading successfully:

Confirm divergence with multiple indicators: Relying on just one indicator can lead to false signals. Use multiple indicators, like RSI, MACD, and stochastic oscillators, to confirm divergence and strengthen your trade signals.

Understand the market context: Divergence can occur in any market condition, but its effectiveness can vary. Ensure you understand the broader market context and combine divergence signals with other technical analysis tools, such as trend lines, support and resistance levels, and candlestick patterns.

Avoid overtrading: Not every divergence is a strong signal. Be selective and only trade divergences that occur in significant market conditions or at key levels.

Wait for confirmation: Don’t jump into trades too early. Wait for confirmation of the divergence signal, such as a price reversal or a breakout, to improve the accuracy of your trades.

Manage risk: Always use stop-loss orders to protect your capital and manage risk. Set your stop-loss levels based on the volatility of the currency pair and the timeframe you’re trading.

By following these strategies, you can enhance the reliability of your divergence trading and minimize common mistakes.

Advanced divergence trading techniques

Mastering divergence trading involves not only understanding the basics but also employing advanced techniques to refine your strategy and improve trading outcomes. Here are some advanced techniques for divergence trading:

Multiple time frame analysis:

Utilize multiple time frames to confirm divergence signals. A divergence identified on a higher time frame (e.g., daily chart) is generally more reliable than one found on a lower time frame (e.g., 15-minute chart). Use lower time frames to fine-tune entry and exit points.

Divergence with confluence:

Combine divergence signals with other technical analysis tools to create confluence. For example, if a divergence occurs at a major support or resistance level, or in conjunction with a Fibonacci retracement level, the signal becomes more robust.

Hidden divergence:

Incorporate hidden divergence into your strategy. Hidden divergence occurs when the price makes a higher low (in an uptrend) or a lower high (in a downtrend), but the indicator shows a lower low or higher high, respectively. This indicates trend continuation rather than reversal.

Divergence with volume analysis:

Analyze volume in conjunction with divergence signals. A divergence that occurs with increasing volume can indicate a stronger potential reversal. Conversely, divergence with decreasing volume may suggest a weaker signal.

Dynamic stop-loss and take-profit levels:

Use ATR (Average True Range) to set dynamic stop-loss and take-profit levels based on market volatility. This helps to protect against sudden market swings and allows for more flexible trade management.

Divergence in different market conditions:

Adjust your divergence trading strategy according to different market conditions. In trending markets, look for regular divergences to signal potential reversals. In ranging markets, focus on hidden divergences to trade within the range.

Algorithmic divergence trading:

Develop or use algorithmic trading systems that can automatically detect divergence signals and execute trades. This reduces the emotional aspect of trading and ensures consistency in applying your strategy.

Backtesting and optimization:

Conduct rigorous backtesting of your divergence trading strategy across different currency pairs and time periods. Optimize your strategy by adjusting parameters to find the best-performing settings.

By incorporating these advanced techniques into your divergence trading strategy, you can enhance your ability to identify high-probability trade setups and improve your overall trading performance.

A few practical remarks

Only classic divergence situations on timeframes not lower than H1 can be considered the most probable for reversal, and the asset should show stable volatility at least for the past day (or several days!).

All strong speculations (news, closing of large options, etc.) easily break any divergence and increase the risk of false situations.

All direct divergence (divergence) situations are more reliable than convergence options.

The second max(min) can be used to evaluate classical divergence, for hidden divergence only the final extremum can be used.

The higher the interval on which the divergence is clearly visible, the higher the probability of its working out.

To evaluate divergence, you need to reduce the analysis period: if there is a repeat of the situation, you can work with taking into account the lowest level, i.e. enter on signals on H4 or D1, and fix profit on reversals on smaller time frames.

Setting StopLoss when trading on any Forex divergence schemes is mandatory!

Trading divergence is a powerful strategy that has significantly improved trading outcomes

In my experience, trading divergence in Forex is a powerful strategy that has significantly improved my trading outcomes. By carefully analyzing the discrepancies between price movements and indicators like RSI or MACD, I can often predict potential trend reversals or continuations with greater accuracy.

This method requires patience and practice to master, but it offers a valuable edge in understanding market dynamics and making informed trading decisions. Combining divergence analysis with other technical tools and strategies has further enhanced my ability to identify high-probability trade setups, making it an essential part of my trading toolkit.

Summary

Trading divergence in Forex involves identifying discrepancies between the price movements and technical indicators, such as RSI or MACD, to predict potential trend reversals or continuations. This strategy relies on spotting when the price chart and an indicator diverge, suggesting a weakening trend and potential trading opportunities.

By combining divergence analysis with other technical tools and strategies, traders can enhance the accuracy of their trade signals and make more informed decisions in the Forex market. Mastery of this approach requires practice and a keen eye for detail, but it can provide a significant edge in understanding market trends.

FAQs

What is divergence in Forex trading?

Divergence in Forex trading refers to a situation where the price of a currency pair moves in one direction while an indicator (like RSI or MACD) moves in the opposite direction, signaling a potential trend reversal.

How do I identify divergence in Forex trading?

Divergence is identified by comparing the peaks and troughs of the price chart with the corresponding peaks and troughs of an indicator, looking for discrepancies that suggest a weakening trend.

What are the types of divergence in Forex trading?

There are two main types of divergence: regular divergence, which signals potential trend reversals, and hidden divergence, which suggests trend continuation.

Which indicators are best for spotting divergence in Forex trading?

Popular indicators for spotting divergence include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and the stochastic oscillator.

Can divergence trading be used with other trading strategies?

Yes, divergence trading can be combined with other strategies, such as support and resistance levels, trend lines, and candlestick patterns, to enhance the accuracy and reliability of trade signals.

Related Articles

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trading divergence in Forex involves identifying when the price of a currency pair and an oscillator (such as RSI, MACD, or Stochastic) move in opposite directions, indicating potential trend reversals or continuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Divergence serves as a valuable concept for predicting potential shifts in market direction. It happens when the price movement of a currency pair and a particular technical indicator do not conform, but rather go in opposite directions.

Backtesting is the process of testing a trading strategy on historical data. It allows you to evaluate the strategy's performance in the past and identify its potential risks and benefits.

Algorithmic trading is an advanced method that relies on advanced coding and formulas based on a mathematical model. However, compared to traditional trading methods, the process differs by being automated.