Forex Lifestyle: Building Habits for Long-Term Success

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The key steps to building a Forex lifestyle are:

Adopting a disciplined Forex lifestyle can play an important role in achieving long-term success while developing good habits can reflect in your trading performance and overall well-being. This article explores the essential habits and strategies to help traders build a sustainable and successful Forex trading lifestyle.

Establishing these habits early on can lead to more significant, consistent profits and a more stable trading experience.

Step 1: Develop a trading plan

A trading plan should include key elements like entry and exit criteria, risk management strategies, and performance tracking. A well-defined plan acts as a roadmap, guiding your decisions and helping you stay disciplined.

Setting achievable and realistic financial and trading goals helps in staying motivated and focused. Unrealistic goals can lead to frustration and poor trading decisions.

Use strategies for setting and adhering to realistic goals, such as breaking down long-term goals into smaller, manageable tasks.

Define clear long-term goals

Start by defining what you want to achieve in the long run. This could be reaching a specific profit target, achieving a certain return on investment, or building a sustainable trading career.Use the SMART criteria

When setting goals, use the SMART criteria to ensure they are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework helps you create clear and actionable goals. For instance, instead of setting a vague goal like " improve trading skills," set a SMART goal like "complete a technical analysis course by the end of the month."Break down long-term goals into short-term objectives

Once you have your long-term goals, break them down into smaller, more manageable short-term objectives. For example, if your long-term goal is to achieve a 20% annual return, set monthly or quarterly targets that contribute to this overall goal.Set daily and weekly tasks

To ensure steady progress towards your short-term objectives, set daily and weekly tasks. These tasks could include specific trading activities, market analysis, learning new strategies, or reviewing past trades.Monitor and adjust your goals

Regularly monitor your progress towards your goals and adjust them as needed. Market conditions can change, and your goals should be flexible enough to adapt to these changes. If you find that you are consistently meeting your short-term objectives, consider setting more ambitious targets.Stay accountable

Share your goals with a mentor, trading partner, or community. Regular check-ins and feedback can provide motivation and help you stay committed to your goals.

Step 2: Consistent learning and improvement

Use resources such as books, online courses, and webinars to expand your knowledge. The Forex market is dynamic, and staying updated with the latest developments can give you a competitive edge.

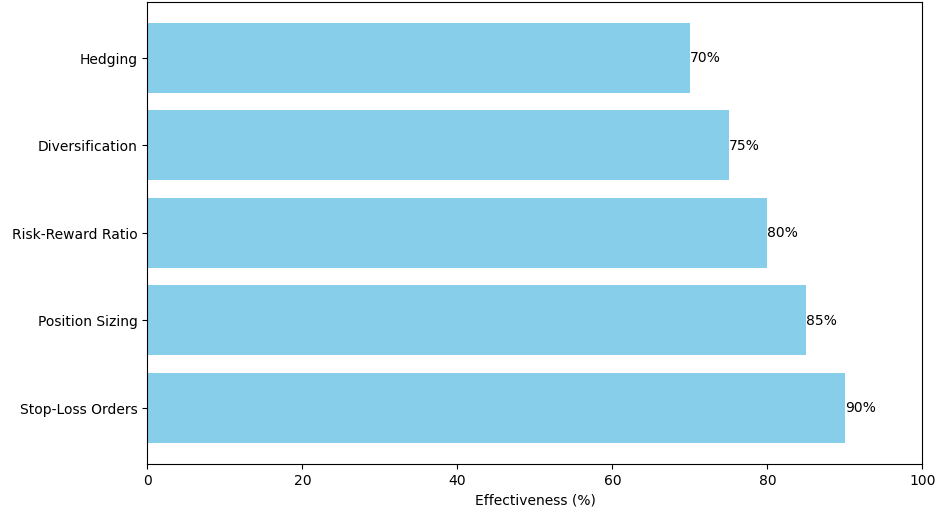

Step 3: Risk management

Implement strategies like setting stop-loss orders and managing leverage to mitigate risks. Proper risk management helps in preserving your trading capital and provides a safety net during market volatility. Find more useful information about trading strategies in our article Effective Forex Trading Strategies: Looking for a Winner's Way.

Step 4: Maintain discipline and emotional control

Avoid impulsive actions and stick to your trading plan. Techniques such as meditation and regular breaks can help maintain focus and reduce stress.

Also maintaining a healthy work-life balance can help prevent burnout . Traders should allocate time for personal activities and ensure they are not overwhelmed by trading.

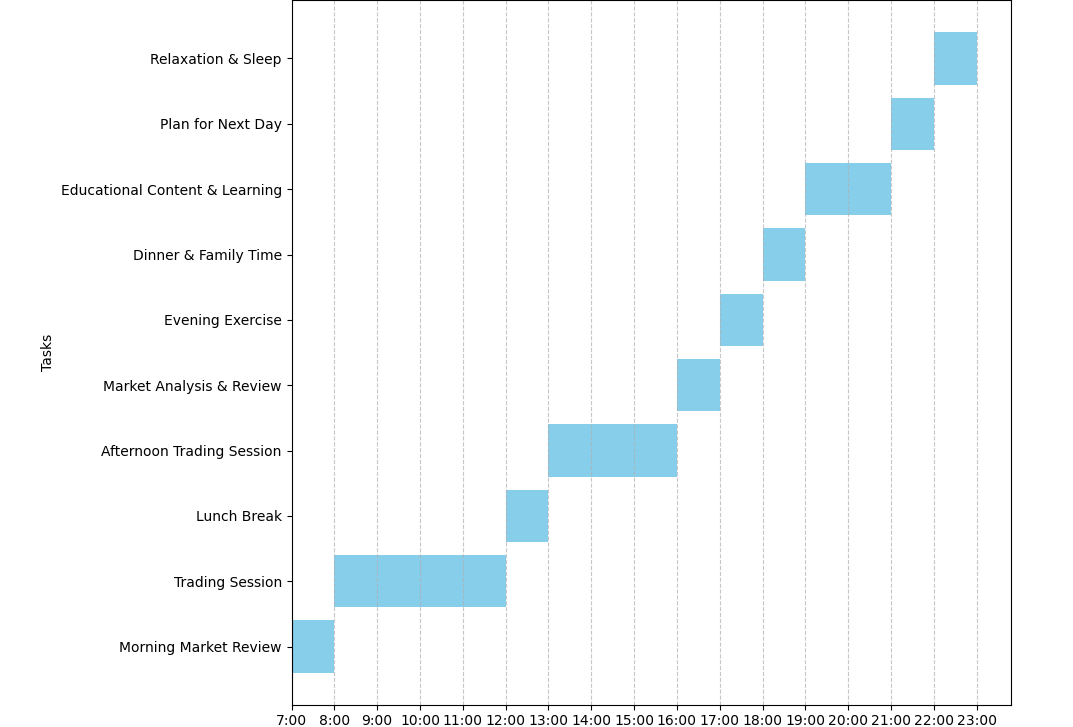

Effective time management tips, such as setting a daily trading schedule and taking regular breaks, can help traders maintain productivity and reduce stress.

Recommendations for beginners

Starting with a demo account

A demo account simulates real trading conditions, allowing you to practice and understand the market in a risk-free environment. Beginners cantest strategies and gain experience using these accounts to be better prepared for live market conditions. We have compared some of the top demo accounts to help you choose the best one as per your requirements:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Demo account |

Yes | Yes | Yes | Yes | Yes |

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Max Spread EUR/USD, pips |

0,9 | 1,5 | 0,5 | 1,2 | 0,8 |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Basic education and resources

Key educational resources for beginners include books, online courses, and trading forums. These resources help new traders build a strong foundation and understand the basics of Forex trading.

Use simple strategies

Basic strategies are easier to understand and execute, helping beginners build confidence and skills gradually. For example, using the Simple Moving Average trading strategy, one can generate trading signals easily. When a shorter-period moving average crosses below a longer-period moving average, it is a short signal and vice versa.

How to build the habits for success

From my experience, one of the biggest mistakes traders make is deviating from their trading plan . Having a clear plan and following it no matter what is the idea of trading discipline. Practicing this will help you build consistency.

Managing your risks is also essential . Always know how much you’re willing to lose on a trade before you enter it. Using stop-loss orders and never risking more than a small percentage of your capital on a single trade can protect you from significant losses.

Keep learning because the market is constantly changing . I personally prefer books, but you can also take courses, and join trading forums. Finally, understand that emotions like fear and greed can lead to poor decisions. Do not keep a short-term vision and give-in to these emotions. Always remember that your trading journey is a marathon, not a sprint.

Conclusion

Take the strategies and tips discussed in this guide and put them into practice. Continuously work on improving your trading habits, and don't be afraid to adapt and learn from your experiences. By following this structured guide and consistently applying these strategies, you can build effective habits and achieve long-term success in the Forex market. Stay disciplined, keep learning, and always strive for improvement. Your dedication will pay off in the long run.

FAQs

Can Forex make a living?

Yes, Forex trading can potentially provide a living, but it requires significant skill, experience, and capital. Many traders struggle to achieve consistent profits due to market volatility and the high risk involved. Success typically demands a solid trading strategy, strict risk management, and ongoing education.

What is the daily life of a Forex trader?

A Forex trader's daily life involves analyzing market trends, monitoring economic news, and executing trades. They start early to align with global market openings, reviewing overnight market activity. They use technical analysis tools and charts, set trading plans, and manage risks.

Why is continuous learning important in Forex trading?

Continuous learning is important in Forex trading because the market is constantly evolving. Staying updated with the latest market trends, news, and trading strategies helps you adapt to changes and make informed decisions. Use educational resources such as books, courses, webinars, and forums to enhance your knowledge.

What role does emotional control play in successful trading?

Emotional control is a must-have in trading because emotions like fear and greed can lead to impulsive decisions that result in losses. Maintaining emotional discipline can help you stick to your trading plan, make rational decisions, and avoid common pitfalls.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Time management is the coordination of tasks and activities to maximize the effectiveness of an individual's efforts.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.