Fake Forex Brokers List in Spain

The Forex Brokers that have been blacklisted by CMNV are:

-

1

Open Markets – Lack of ASIC regulation and offers unauthorized services

-

2

LODEN SERVICESS Ltd – Operates without FCA regulation; provides unauthorized services

-

3

Clair Capital – Lacks authorization and operates with anonymity

-

4

FXMUNDO – Operates without a valid license along with warnings from CNMV, FSMA, CONSOB, and IOSCO

-

5

Oxshare – Unlicensed and potential manipulation of trades

-

6

TSA Forex – False claims of regulation and warnings from CySEC, CONSOB, and CNMV

-

7

EU Finance – Lacks essential regulatory approval, operates offshore and questionable transparency

-

8

Panpacific Capital Group – Faces severe regulatory violations; on the CNMV warning list for unauthorized services

-

9

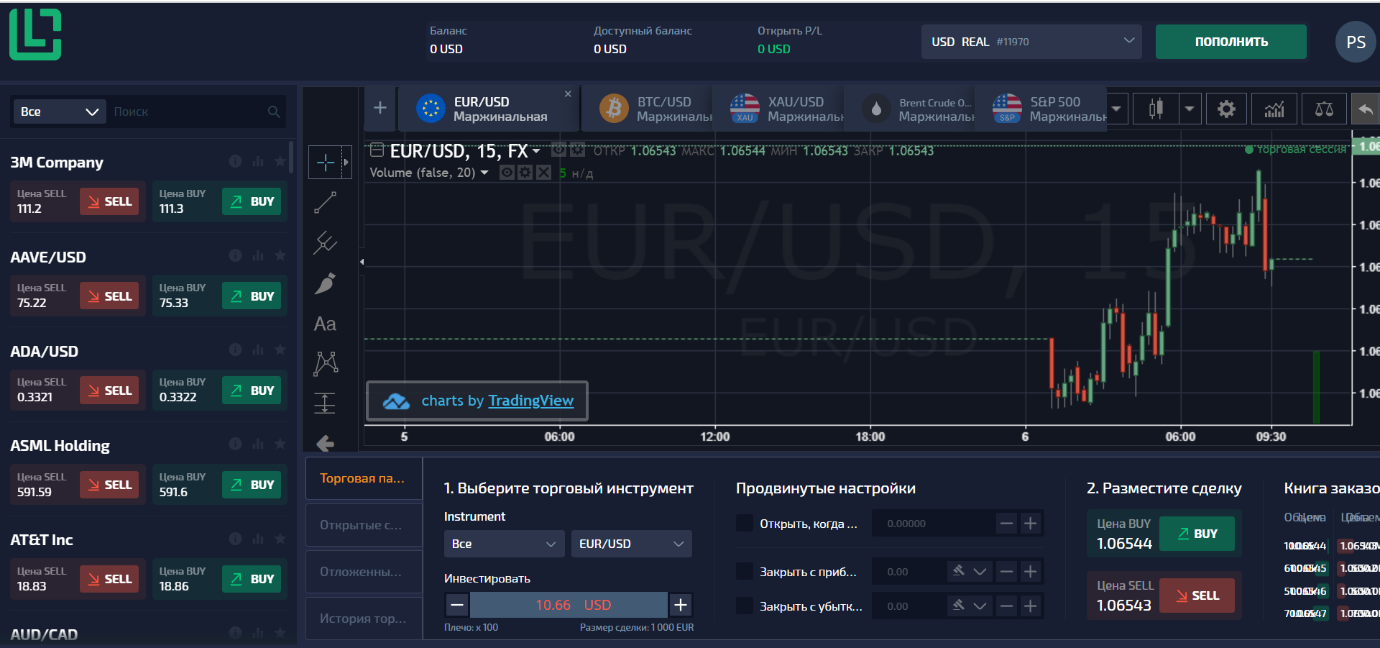

Piu Trading – Offshore and unregulated and lack of transparency

-

10

LECS Crypto – Falsely claims FCA, Belize FSC, and Mauritius FSC regulation, warnings from FCA and CNMV

In this article, TU experts have discussed the regulatory landscape in Spain for Forex brokers. Experts have given an overview of legitimate Forex trading practices under the watchful eye of the Comisión Nacional del Mercado de Valores (CNMV). Moreover, they have unveiled a list of fake brokers blacklisted by CMNV, exposing the reasons behind their banishment, providing essential insights for readers to safeguard their investments in the Forex Market.

-

Are fake forex brokers in Spain?

Yes, Spain has identified and blacklisted fake forex brokers due to regulatory violations and unauthorized services, ensuring investor protection.

-

Is forex trading legal in Spain?

Yes, Forex trading is legal and regulated in Spain under the oversight of the Comisión Nacional del Mercado de Valores (CNMV), providing a secure trading environment.

-

Is Spain a good country to trade with?

Spain, with its regulated forex market overseen by CNMV, offers a secure environment for trading, attracting a significant number of investors.

-

Is Spain free trade?

Spain, as part of the European Union, follows EU regulations, promoting free trade within the EU and adhering to established frameworks for financial markets.

Rules and Regulation

Forex regulation in Spain

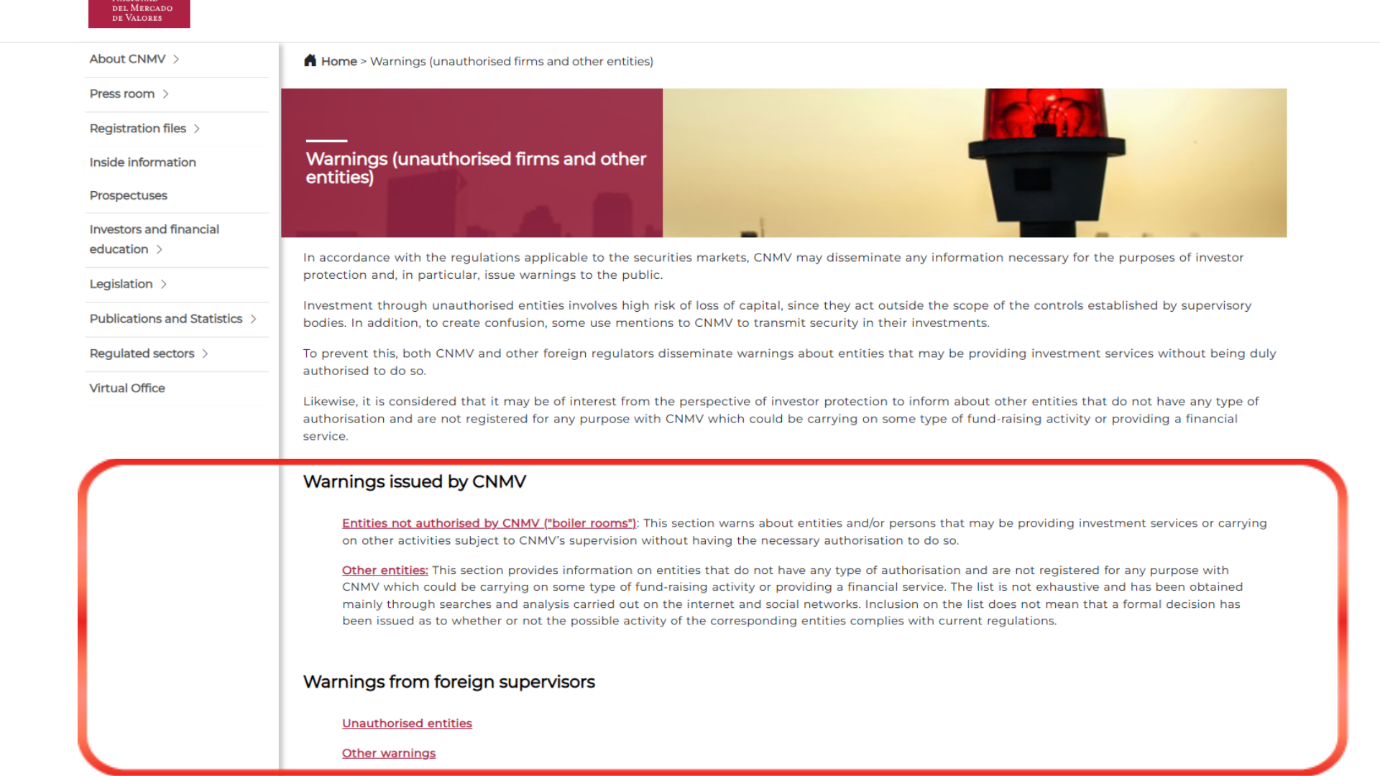

Spain’s financial regulator is the Securities and Exchange Commission (CNMV). This body ensures the issuance of licenses to brokers and monitors their compliance with regulations and legislation.

Investor protection

The Law on the Securities Market (Ley del Mercado de Valores) is a law that establishes general rules for the regulation of trading securities, including Forex. Spain is also a member of MiFID II, an organization that regulates brokers in the EU. In the event of the broker’s bankruptcy, traders can receive compensation from the European organization ESPIS - up to €20,000.

Taxation

In Spain, you have to pay income tax on Forex. The tax rate is progressive. 23% tax must be paid if the annual income does not exceed EUR 30,000. The interest rate increases progressively to 52%, if the trader receives more than EUR 600,000 per year.

Forex brokers blacklist in Spain

Experts have discussed below the brokers that have been blacklisted by CMNV, exposing the reasons behind their blacklisting.

1 Open Markets

Open Markets, despite appearing legitimate at first glance, raises concerns upon closer inspection. Despite claiming an Australian base, it lacks regulation by the Australian Securities and Exchange Commission (ASIC), which is a key oversight body. This regulatory gap is a significant red flag in the financial industry.

The broker lacks regulation, does not offer guaranteed funds, and does not maintain segregated accounts.

The Spanish CNMV added Open Markets to its warning list, citing unauthorized investment services. With Open Markets lacking proper regulation and transparency, it poses potential risks to investors. It is strongly recommended to steer clear of Open Markets to avoid possible financial harm and safeguard your funds.

2 LODEN SERVICESS Ltd

LODEN SERVICESS Ltd has raised serious concerns in the online trading community due to its unregulated status and subsequent blacklisting’s. Operating from the United Kingdom, this broker lacks registration or regulation from major authorities, notably the Financial Conduct Authority (FCA), raising significant red flags about its legitimacy.

Despite claiming registration with the Companies House (CH), it's crucial to understand that CH merely serves as a registrar and does not confer financial regulatory authority. The absence of matching records in the FCA registry underscores LODEN SERVICESS' unlicensed status. The Comisión Nacional del Mercado de Valores (CNMV) has also issued a warning against this broker for providing unauthorized investment services.

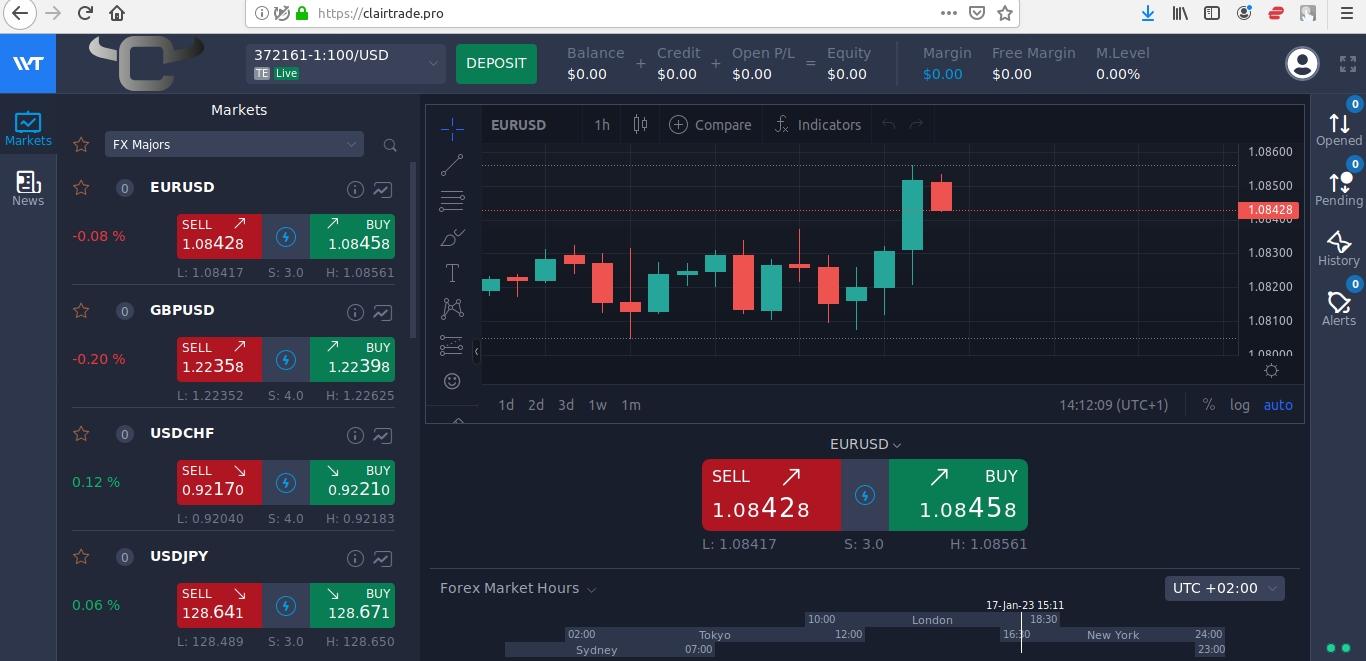

3 Clair Capital

Considering the multiple alarming indicators surrounding Clair Capital, a prudent approach is to avoid any involvement with this broker. The regulatory warning from CNMV, highlighting the lack of authorization, raises red flags about potential fraudulent activities. Deceptive claims of being an 'award-winning broker' without substantiated evidence, coupled with unverifiable statistics, contribute to suspicions regarding Clair Capital's credibility.

The broker's choice to operate in anonymity, concealing crucial details like company information and a physical address, further erodes trust. The absence of client feedback is a notable concern, as it suggests a lack of popularity and trust among traders. Additionally, Clair Capital's adherence to a market-maker model introduces conflicts of interest and unethical practices.

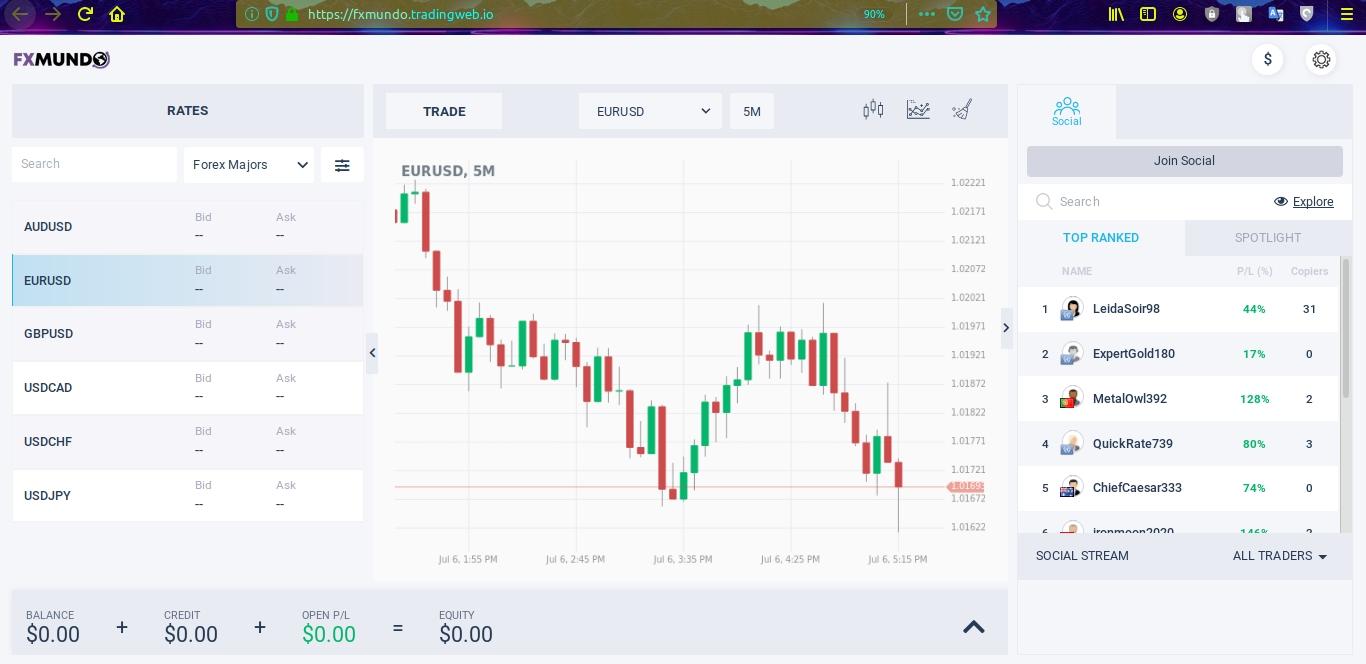

4 FXMUNDO

FXMUNDO operates without a valid license. The fact that FXMUNDO operates without regulatory oversight is a serious issue, leaving questions about the safety of your funds. Even though the broker claims to follow laws in the Marshall Islands, the absence of supervision from any FX regulatory body is a red flag, indicating an unregulated operation.

FXMUNDO has received warnings from reputable authorities such as CNMV, FSMA, CONSOB, and IOSCO, indicating potential compliance issues. The lack of regulation, undisclosed fees, limited transparency, and concerning user reviews all raise serious concerns about FXMUNDO

5 Oxshare

Oxshare, an unlicensed broker, is raising major concerns. The CNMV flags it for unauthorized activities in Spain. Their claimed 9 years of experience doesn't match up with a website registered in 2021, casting doubt on their credibility. Operating as a whitelabel CFDs broker, Oxshare may manipulate trades for profit.

Ignoring US regulations, they accept traders from a banned region. Adding to the deception, fake Google reviews aim to boost their image. In conclusion, Oxshare is a risky player, with an unstable history. Traders are advised to avoid the gamble, and keep your finances safe from this unauthorized broker.

6 TSA Forex

TSA Forex's assurance of being regulated in various countries like Cyprus, Spain, Italy, and France doesn't hold up under scrutiny. Despite their bold statements, respected regulatory bodies such as CySEC, CONSOB, and CNMV don't acknowledge TSA Forex. The CNMV, in particular, has issued explicit warnings, stating that the broker is not authorized and is involved in deceptive practices. This emphasizes the importance of being cautious with TSA Forex, as their regulatory claims appear to be false, and dealing with them may involve unnecessary risks to your investments.

A closer look at TSA Forex exposes several red flags that requires careful consideration. The platform's limited traffic, indicated by a low Tranco rank, raises questions about its appeal and trustworthiness. Also hosting poorly reviewed websites on its server adds to concerns about reliability. Additionally, associations with a registrar linked to scams cast doubts on TSA Forex's legitimacy.

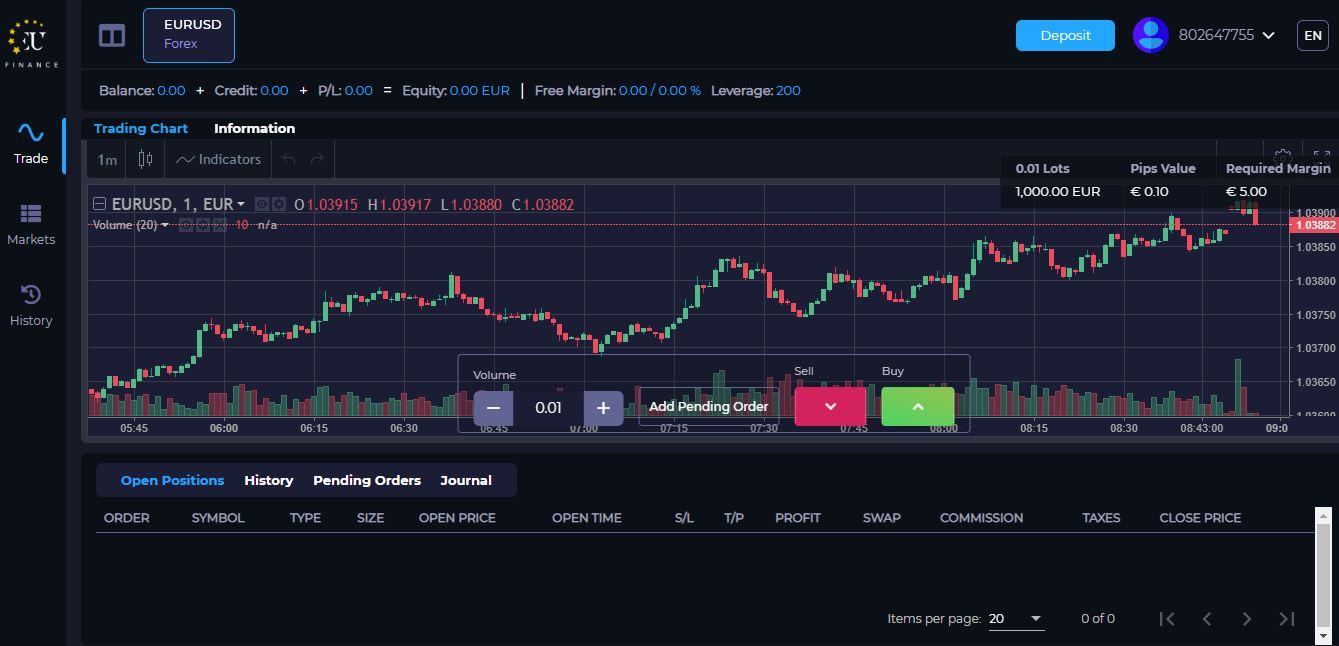

7 EU Finance

EU Finance, self-proclaimed as a leading Forex trader in Europe, lacks essential regulatory approval, casting doubt on its legitimacy. The absence of registration with key regulators such as FCA, ASIC, and CySEC is a glaring concern. The purported UK address doesn't align with FCA records, signaling a disregard for industry norms.

Operating from offshore locations like Saint Vincent and the Grenadines allows brokers to evade strict regulations. Offshore entities also escape accountability for paying out winnings, as there's no governing body to enforce such obligations. In numerous offshore jurisdictions, legal consequences for these offenses are minimal, enabling wrongdoers to evade prosecution.

The lack of transparency regarding regulatory compliance, coupled with the absence of a demo account, paints EU Finance as a potential scam, targeting European traders with inherent risks and potential financial losses. Beyond its questionable regulatory standing, EU Finance confronts explicit warnings from the CNMV.

8 Panpacific Capital Group

Panpacific Capital Group faces severe regulatory violations, landing it on the Spanish CNMV warning list for unauthorized investment services. The absence of disclosed regulatory information and licensing details signals a scam, and the CNMV's alert adds weight to this concern. Despite claiming a US address, a search in the National Futures Association reveals it's not under NFA oversight. The broker's lack of regulation poses a significant risk, lacking legal protections for investors' funds.

Panpacific Capital Group's negative reputation involves numerous accusations of scamming investors, evident in multiple negative reviews detailing financial losses and withdrawal issues. The undisclosed ownership structure further raises suspicions, indicating caution among potential traders and investors.

9 Piu Trading

Piu Trading raises significant concerns about its legitimacy and trustworthiness, signaling potential scam operations. As an offshore broker, it operates without regulation, leaving traders vulnerable to risks without legal protection. The lack of disclosed regulatory information and licensing data further weakens its transparency which is a key aspect of reputable brokers. Piu Trading's virtually anonymous website, lacking contact details or customer support, adds suspicion about its ownership. Additionally, non-transparent trading conditions contribute to confusion and uncertainty for potential traders.

The issuance of a warning by the CNMV of Spain, a respected European regulator, underscores Piu Trading's unauthorized and unregulated services. In light of these red flags, exercising caution and seeking regulated alternatives is strongly advised.

10 LECS Crypto

LECS Crypto, despite claiming regulation by the FCA, Belize FSC, and Mauritius FSC, is exposed as a scam with no records found in the respective agencies' registries. The FCA issued a warning against LECS Crypto, denying its alleged regulation and indicating potential unauthorized activities in the UK. The Spanish CNMV also added LECS Crypto to its warning list for providing investment services without authorization.

The broker's inaccessible website and striking resemblance to other fraudulent brokers raise significant red flags. The virtually anonymous nature of LECS Crypto makes it impossible for clients to trace or contact them, amplifying the risks associated with this scam.

In addition, LECS Crypto's offering of leverage, ranging from 1:100 for starting an account to 1:500 for Trader and Professional accounts, raises concerns. It's noteworthy that brokers in the UK and EU are mandated to enforce a maximum leverage of 1:30 for risk control.

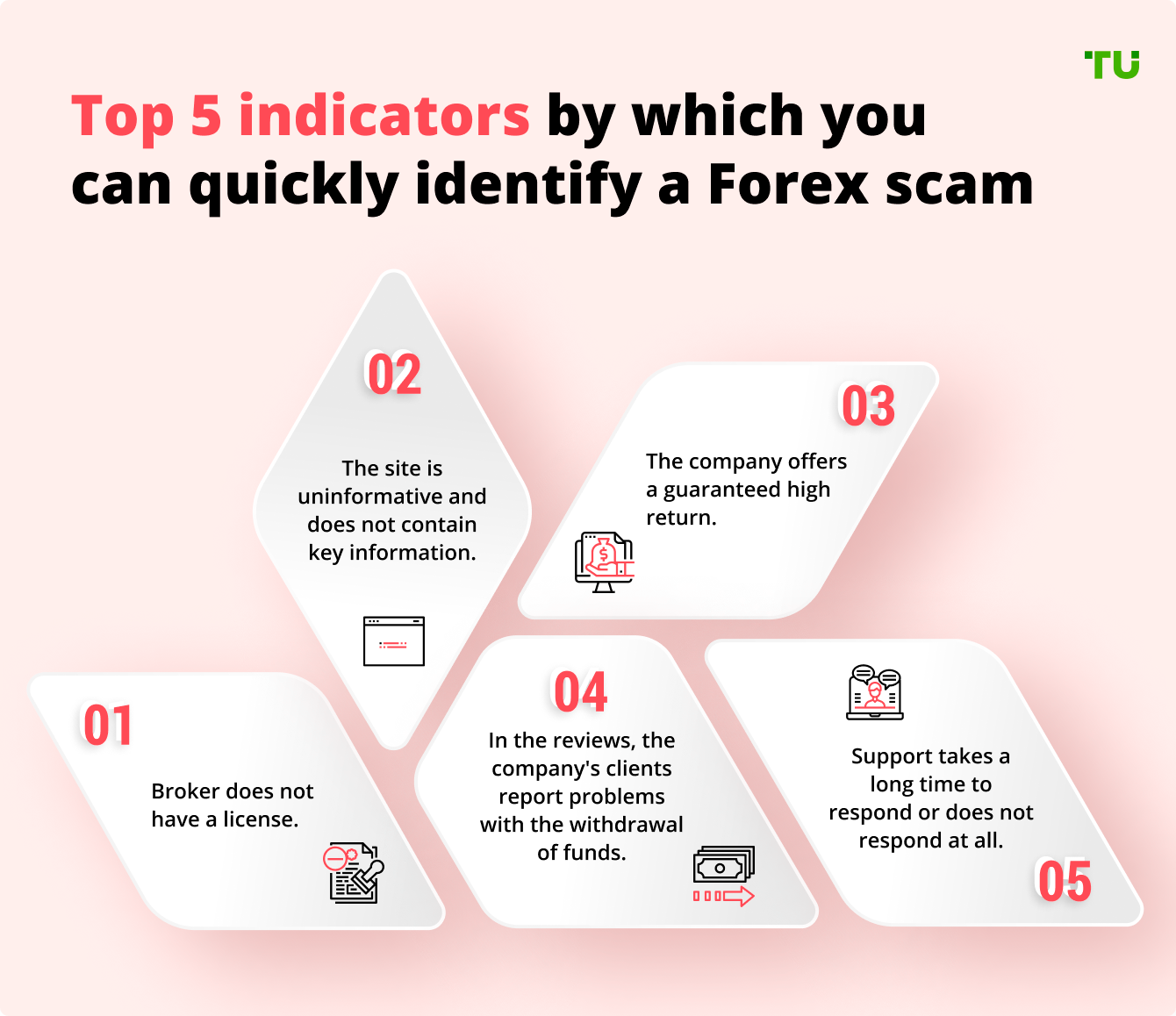

How to check if a forex broker is legit in 5 steps

Ensuring the legitimacy of your Forex broker is essential for a secure trading experience Below are the five expert-recommended steps to verify a broker's credibility and protect your investments.

1 Check Your Broker's Regulatory Info

Make sure your broker is regulated. Regulatory bodies like FCA, CySEC, CNMV set standards for financial integrity. Verify the broker's authorization, license, and adherence to industry norms. Also follow the steps in Traders Union's guide on How to Avoid Forex Trading Scams for details.

2 Check Regulator’s Website Database

Verify a forex broker's legitimacy by checking the regulator's website database. Identify the broker's registration country and visit the official website of the regulatory body. Search for the broker's name, trade name, or registration number in the database. Ensure the website has a secure connection (https) and clear contact information. Cross-verify information with reviews, forums, and news articles. Look for reported issues or complaints.

3 Learn Broker’s Website

A credible broker's website includes necessary info like risk disclosures and legal details. Check for these elements to ensure transparency and regulatory compliance.

4 Does Broker Guarantee Profit?

Watch out for brokers promising guaranteed profits. Legitimate brokers focus on risk disclosure, not unrealistic gains. If profit guarantees are emphasized, it's a red flag.

5 Read Client’s Reviews

Client reviews are crucial in Forex trading as they provide real experiences, evaluate a broker's reliability, assess customer service, and shed light on withdrawal processes. They help identify red flags, offering valuable community insights for informed trading decisions. It is advisable to use Traders Union's extensive customer review database. This will help traders in making informed decisions by offering valuable insights from the TU trading community.

Best Forex brokers in Spain

| Broker | Trading Platforms | Regulation | Max Leverage | Instruments | Other Key Benefits |

|---|---|---|---|---|---|

MT4, MT5, cTrader, R StocksTrader, R MobileTrader, R WebTrader |

FSC Belize |

1:2000 |

Forex, ETFs, index CFDs, oil CFDs, stock CFDs, crypto CFDs, securities |

Free webinars, articles, videos, ebooks, and courses on various trading topics |

|

MT4, MT5, Tickmill Mobile App |

FCA, CySEC, FSCA, Labuan FSA |

1:500 |

Forex, CFDs on indices, commodities, bonds, cryptocurrencies, shares |

Free market analysis, webinars, articles, videos, and ebooks on various trading topics |

|

MT4, MT5, cTrader, FxPro Edge |

FCA, CySEC, DFSA, FSCA, SCB |

1:500 |

Forex, CFDs on indices, commodities, shares, futures, cryptocurrencies |

Free market analysis, webinars, articles, videos, ebooks, and courses on various trading topics |

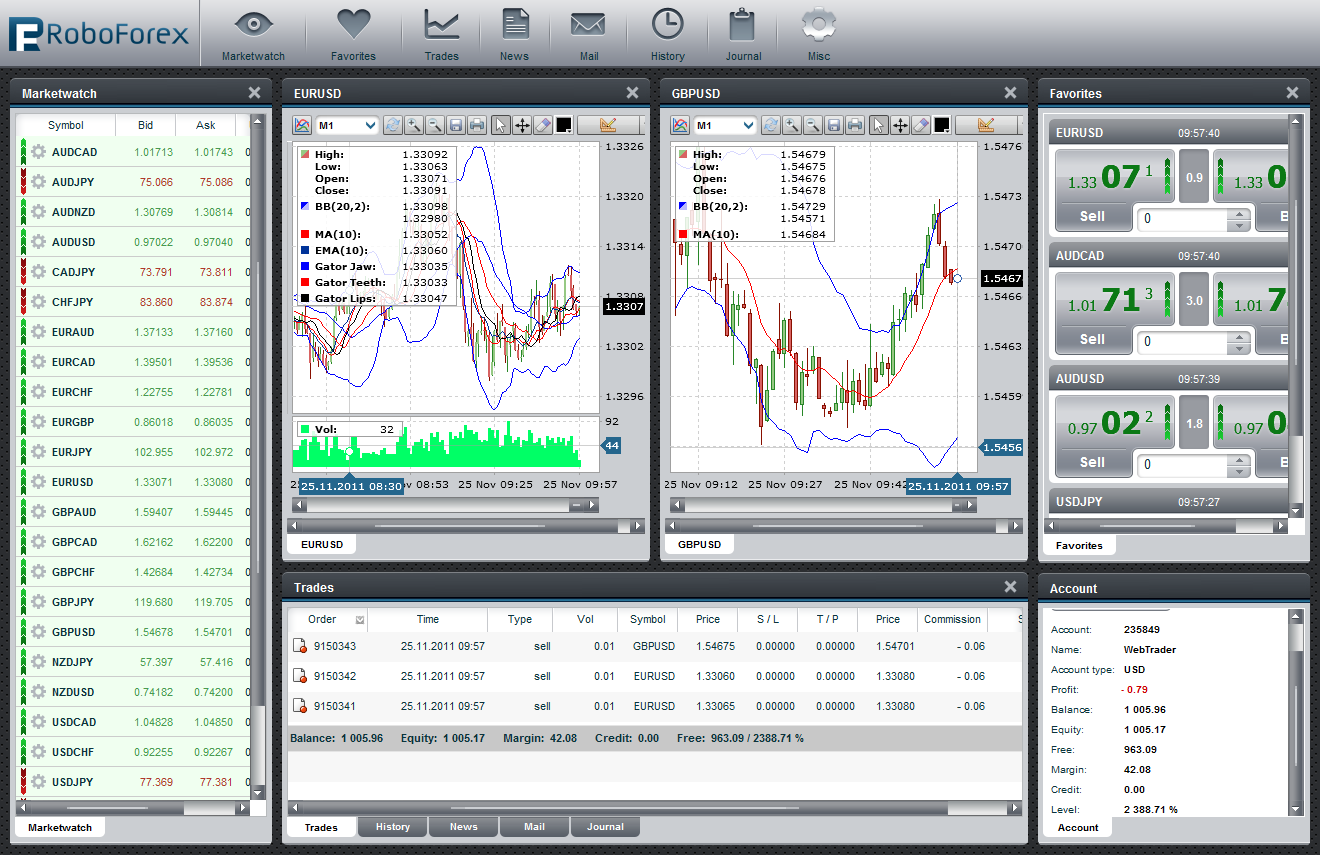

RoboForex

RoboForex, established in 2009, is a renowned brokerage firm offering diverse financial market trading services. With international licensing from FSC Belize, it has earned accolades for reliability. Providing access to over 12,000 instruments, including currencies, shares, indices, and cryptocurrencies, the broker demands a minimum deposit of $10, offering leverage up to 1:2000. Boasting platforms like MT4, MT5, and cTrader, RoboForex ensures negative balance protection and features a user-friendly interface. Suited for both novice and seasoned traders, the broker stands out with low transaction fees, quick withdrawals, and a profitable affiliate program. The company's bonus programs, including a $30 Welcome Bonus and up to 120% classic bonus, enhance its appeal, making it a top choice for traders seeking a reliable and rewarding trading experience.

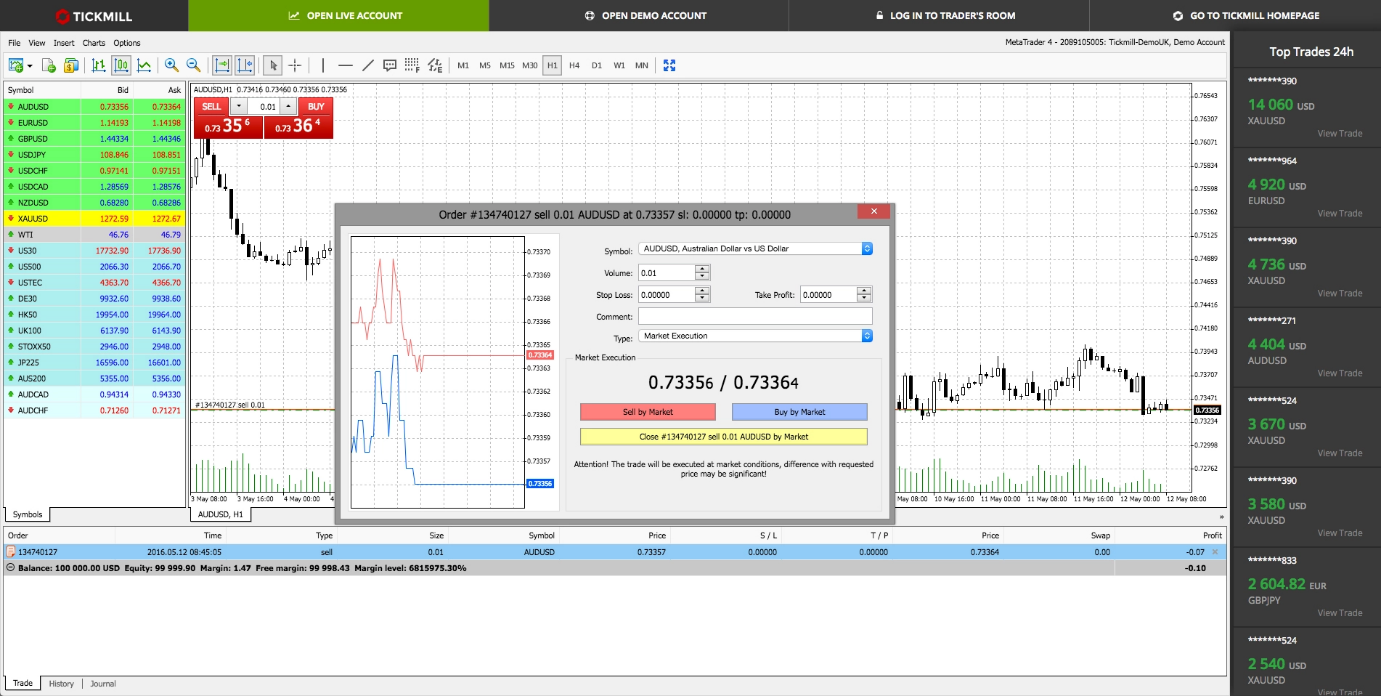

Tickmill

Tickmill, a reputable brokerage firm, facilitates financial market trading with an array of instruments, including forex, CFDs, stocks, and cryptocurrencies. Regulated by the Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), Tickmill ensures a secure trading environment. With three account types – Classic, Pro, and VIP – traders can choose based on their preferences and trading volumes. Offering platforms like MT4, MT5, and cTrader, including the web-based MT4 WebTrader, Tickmill ensures flexible accessibility. Educational resources, including webinars and seminars, empower traders. The minimum deposit of $100 for Classic and Pro accounts and varying leverage options cater to diverse trading needs. Overall, Tickmill stands out as a regulated and user-friendly platform, appealing to traders across experience levels.

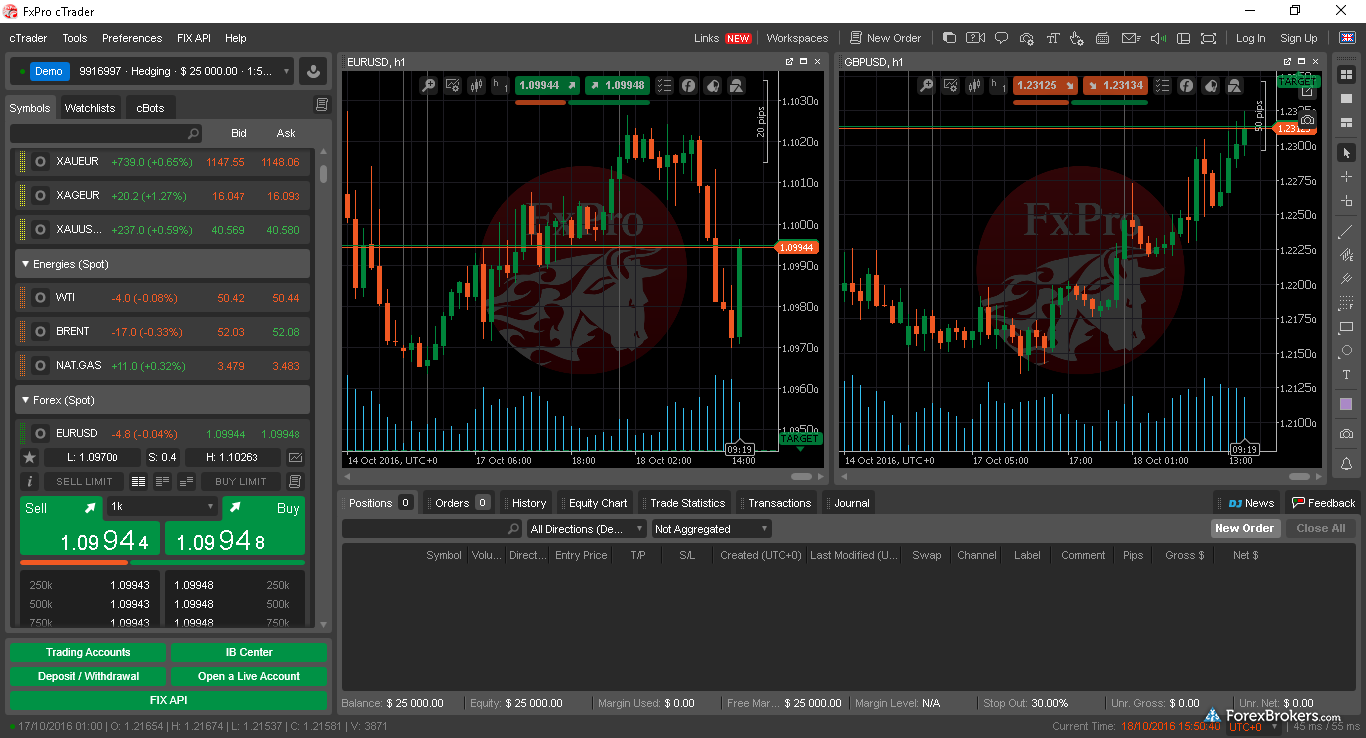

FxPro

FxPro, a distinguished brokerage, offers comprehensive trading services across the financial market. With regulation in four jurisdictions and a vast clientele exceeding 2 million globally, FxPro stands as a reliable choice. Providing access to an extensive array of instruments, including CFDs, forex, stocks, and cryptocurrencies, FxPro ensures diverse trading options. The platform boasts a range of renowned trading platforms like MT4, MT5, and cTrader, coupled with additional tools such as AutoChartist and TradingCentral. FxPro caters to varied trader preferences with three account types – Standard, Pro, and Premium. The broker emphasizes trader education through webinars, seminars, and video tutorials, fostering skill enhancement. FxPro's commitment to customer satisfaction is evident through its award-winning status, tight spreads, commission-free trading, and innovative features like the Quant custom indicator and detachable chart windows. Traders also benefit from a welcome bonus of up to $8 per lot traded, making FxPro an all-encompassing choice for traders worldwide.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).