Binance Crypto Portfolio: An Overview

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

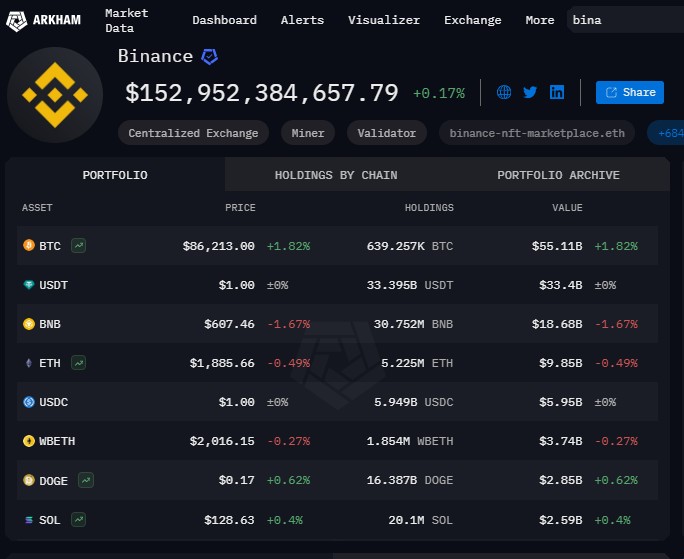

Binance holds one of the largest crypto portfolios in the world, valued at over $150 billion. Its top assets include 631,044 BTC ($55.34B), 33.7B USDT ($33.71B), 30.8M BNB ($19.37B), 5.16M ETH ($10.63B), and other major cryptocurrencies such as USDC, SOL, DOGE, LINK, and FDUSD. Additionally, Binance has invested in over 250 blockchain projects through Binance Labs, including DeFi, NFT, and Layer 1 infrastructure platforms.

Binance stands as more than a typical crypto trading platform — it plays a central role in shaping the digital asset landscape. Recognized among the world’s largest exchanges, Binance supports trading activities while also managing a wide-ranging collection of digital assets. This portfolio reveals the company’s strategic choices, shapes how investors perceive the market, and significantly contributes to both liquidity and overall confidence in the crypto space.

Breakdown of Binance crypto holdings

According to recent figures, Binance’s digital asset holdings are valued at roughly $152.95 billion. These assets extend across different blockchains and fulfill roles beyond standard exchange use. Binance functions as a traditional exchange, participates in validation and mining, and oversees branches such as binance-nft-marketplace.eth — linked to over 683 wallet addresses. Its asset base highlights the company’s far-reaching involvement in both trading operations and blockchain infrastructure.

The exchange holds a diverse range of assets that fuel trading activity, power its blockchain infrastructure, and support user services like staking and DeFi access.

Here is a list of the largest crypto assets currently held by Binance:

Bitcoin (BTC). Binance holds 639,257 BTC, valued at approximately $55.11 billion.

Tether (USDT). The exchange possesses 33.395 billion USDT, worth around $33.4 billion.

Binance Coin (BNB). Binance holds 30.752 million BNB, totaling about $18.68 billion.

Ethereum (ETH). The platform holds 5.225 million ETH, valued at approximately $9.85 billion.

USD Coin (USDC).Binance maintains 5.949 billion USDC, worth around $5.95 billion.

Wrapped Beacon ETH (WBETH). The exchange has 1.854 million WBETH, valued at about $3.74 billion.

Dogecoin (DOGE). Binance holds 16.387 billion DOGE, totaling approximately $2.85 billion.

Solana (SOL). The platform’s holdings include 20.1 million SOL, worth around $2.59 billion.

Binance-Pegged Bitcoin (BTCB).Binance possesses 27,031 BTCB, valued at about $2.37 billion.

First Digital USD (FDUSD). The exchange holds 2.14 billion FDUSD, totaling approximately $2.14 billion.

Chainlink (LINK). Binance's holdings include 78.357 million LINK, worth around $1.24 billion.

Mantra DAO (OM). The platform possesses 176.857 million OM, valued at about $1.16 billion.

Binance-Staked SOL (BNSOL). Binance holds 7.212 million BNSOL, totaling approximately $1.09 billion.

Holdings by chain and utility

Binance’s portfolio spans multiple blockchains, including Ethereum, Binance Smart Chain (BSC), and Solana. This distribution allows the company to serve as a:

Centralized exchange. Providing liquidity and trading services.

Validator. Securing networks such as BSC and others.

Miner. Especially for BTC and related assets.

NFT Marketplace Operator. Through entities like binance-nft-marketplace.eth

Binance’s blockchain investments

Here’s a peek into Binance’s blockchain investments:

Binance has backed blockchains outside the Ethereum spotlight. They’ve quietly funded projects like Aptos and Sui — designed by former Meta devs — to push faster, developer-friendly ecosystems.

They're betting big on chains being able to talk to each other. Projects like LayerZero and Celer got support early on because they help apps work across multiple blockchains without friction.

They care a lot about behind-the-scenes tools. Binance has invested in services like NodeReal and Ankr that quietly power wallets, apps, and nodes, even if the average user never hears their names.

They jumped into zk tech before it got trendy. Binance backed zkSync and Scroll early — both use zero-knowledge proofs to make Ethereum cheaper and faster without losing security.

They’re excited about blockchains you can mix and match. With Celestia and Fuel Labs, Binance is exploring new types of blockchains where different parts (like security and execution) are built separately for more flexibility.

Ethical considerations and regulatory scrutiny

Despite Binance's global expansion, its regulatory dance has often involved exploiting legal gray zones. For instance, Binance’s now-defunct derivatives platform for U.S. users operated through a network of opaque shell entities and proxy firms, which later became part of a CFTC lawsuit. What’s wild is that internal chats cited in court documents show senior leadership acknowledging they were serving U.S. customers “under the radar.” That’s not just a regulatory misstep — it points to a culture that prioritized growth over compliance.

More surprisingly, a forensic blockchain firm found that during key investigation periods, Binance had unusually high withdrawal traffic to privacy coins like Monero, which may have complicated audits and raised flags with regulators looking into money laundering concerns.

Ethically, Binance has taken heat for its handling of market surveillance. A lesser-known case involved Binance’s internal market surveillance tool, which reportedly failed to flag high-frequency wash trading activities tied to a few VIP accounts.

Some leaked correspondence suggested these accounts were tied to large token issuers — raising questions about preferential treatment and whether Binance may have turned a blind eye to protect important clients. Even more eyebrow-raising is that Binance launched a “self-regulatory” Global Advisory Board, including high-profile ex-politicians, right around the time regulatory pressure was peaking globally. Critics saw this as a PR tactic to shield against enforcement rather than a real effort to clean house.

Future outlook: What’s next for Binance’s crypto portfolio?

Binance’s crypto portfolio is already one of the largest in the world, with over $150 billion in holdings spread across Bitcoin, stablecoins, altcoins, and strategic DeFi tokens. Moving forward, the platform is expected to further increase its presence in blockchain innovation through expanded investments and infrastructure development.

Here’s what to expect:

Push toward real-world assets (RWA) is heating up.Binance has been sniffing around projects tokenizing things like treasury bonds, real estate, and invoices —expect investments into platforms that turn traditional finance into on-chain assets.

More control without full ownership. Binance is leaning into governance-heavy tokens where they can influence ecosystems (like Uniswap-style protocols or L2s) without being majority stakeholders — power moves without the paperwork.

AI and crypto are on a collision course. Expect Binance to start backing protocols where blockchain meets AI — think decentralized GPU markets, data labeling DAOs, or tokenized AI model training (projects like Bittensor are early examples).

Regionalization is part of the survival game. Binance is likely to fund local DeFi and CeFi hybrids tailored for specific regions (Africa, LatAm), giving it legal breathing room while staying present in key markets.

Next-gen wallets will be a key play. They’re looking at smart contract wallets with features like social recovery, gas abstraction, and multi-chain routing — basically wallets that feel like apps, not crypto tools.

If you wish to begin your crypto investing journey, the first step is to open an account with a reputed crypto exchange. We have researched the market and prepared a list of the top crypto exchanges for beginners. You can compare them through the table below and choose one for yourself:

| Crypto | Foundation year | Min. Deposit, $ | Coins Supported | Spot Taker fee, % | Spot Maker Fee, % | Alerts | Copy trading | Tier-1 regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Yes | 2017 | 10 | 329 | 0,1 | 0,08 | Yes | Yes | No | 8.9 | Open an account Your capital is at risk. |

|

| Yes | 2011 | 10 | 278 | 0,4 | 0,25 | Yes | Yes | Yes | 8.48 | Open an account Your capital is at risk. |

|

| Yes | 2016 | 1 | 250 | 0,5 | 0,25 | Yes | No | Yes | 8.36 | Open an account Your capital is at risk. |

|

| Yes | 2018 | 1 | 72 | 0,2 | 0,1 | Yes | Yes | Yes | 7.41 | Open an account Your capital is at risk. |

|

| Yes | 2004 | No | 1817 | 0 | 0 | No | No | No | 7.3 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have over 14 years of experience in financial markets, evaluating cryptocurrency exchanges based on 140+ measurable criteria. Our team of 50 experts regularly updates a Watch List of 200+ exchanges, providing traders with verified, data-driven insights. We evaluate exchanges on security, reliability, commissions, and trading conditions, empowering users to make informed decisions. Before choosing a platform, we encourage users to verify its legitimacy through official licenses, review user feedback, and ensure robust security features (e.g., HTTPS, 2FA). Always perform independent research and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Binance invests in tokens that quietly control infrastructure and user flow

If you're just getting started and want to understand Binance’s portfolio, don’t just ask what coins they hold — ask what those coins do. Binance picks its spots really intentionally. Some of their holdings, like BNB, don’t just save users money on fees — they run tons of apps and services under the hood.

Others, like MULTI from Multichain, gave Binance control over how crypto moves between different blockchains at a time when that was becoming a huge deal. They’re not just holding tokens — they’re building the highways, not just driving on them.

Here’s something most people don’t notice: Binance often backs projects before they go big, especially ones that bring in crowds or fresh liquidity. They got into games like The Sandbox and Axie Infinity early — not because of hype, but because these games pulled in a wave of users that Binance could later plug into trading, staking, or new token launches.

Their portfolio isn’t just about gains — it’s a funnel. If you want to figure out their game plan, watch what brings users or key tech to their front door. That’s how you start to see moves that regular investors don’t catch.

Conclusion

Binance's crypto portfolio is one of the most extensive in the industry, with holdings in Bitcoin, Ethereum, BNB, stablecoins, and a range of altcoins and DeFi tokens. These assets support its exchange operations, liquidity management, blockchain infrastructure, and strategic investments. For anyone interested in market structure and institutional crypto behavior, understanding the composition and role of Binance’s crypto holdings is essential.

FAQs

What happens to tokens Binance delists but still holds?

When Binance delists a token but still holds it, those assets typically remain in cold wallets or treasury accounts. The exchange may wait for future utility, swap them for newer assets, or eventually liquidate them depending on market conditions.

Can Binance’s holdings affect token prices?

Absolutely. When Binance moves large amounts of a token or adds it to programs like Launchpool or Earn, it can cause noticeable price swings due to increased visibility and trading volume.

Why does Binance hold wrapped and staked versions of tokens?

Wrapped and staked tokens like WBETH or BTCB let Binance offer more features — like staking rewards or multi-chain liquidity — without locking up the base asset, improving flexibility and user services.

Is Binance’s portfolio managed like a hedge fund?

Not exactly. Binance’s portfolio is more strategic than speculative. While some positions are market-driven, many reflect operational needs, infrastructure support, or long-term ecosystem bets rather than short-term profit goals.

Related Articles

Team that worked on the article

Rinat Gismatullin is an entrepreneur and a business expert with 9 years of experience in trading. He focuses on long-term investing, but also uses intraday trading. He is a private consultant on investing in digital assets and personal finance. Rinat holds two degrees in Economy and Linguistics.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).