According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $2000

- WebTrader

- CapTrader Mobile

- Client Portal (Desktop)

- from 1:5 (on CFDs on stock indices), up to 1:20 (on CFDs on stocks)

- Inactivity fee

Our Evaluation of CapTrader

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

CapTrader is a reliable broker with the TU Overall Score of 7.51 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by CapTrader clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

CapTrader — works according to the ECN scheme and thus provides its clients with direct access to liquidity providers. The company's clients can access such instruments as Forex, futures, options, stocks, ETFs, etc. In addition, CapTrader offers two programs for investing through MAM accounts. CapTrader is an Interactive Brokers Introducing Broker targeted at a European audience. The broker's minimum deposit is $2,000, and the maximum leverage is 1:20.

Brief Look at CapTrader

CapTrader is a Forex broker, which was founded in Germany in 1997. The company is headquartered in Dusseldorf. CapTrader is an Introducing broker to Interactive Brokers. The platform uses Interactive Brokers software, which is why the brokers have identical user accounts, trading platforms and products. CapTrader provides access to 7 categories of assets and trading instruments: Forex, commodities, stocks, ETFs, futures, options and CFDs. The company is regulated by the Federal Financial Supervisory Authority (BaFin, 10156708). In addition it is an introducing broker and the European licenses from the regulators of Ireland and the UK (208159) held by Interactive Brokers apply to it as well.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Partnership with a well-known broker – International Brokers.

- Access to 145 global stock markets.

- 70,000+ trading instruments.

- 3 types of trading platforms.

- Access to analytical service Trading Workstation.

- High minimum deposit – $2,000 or an equivalent.

- Limited education options.

- Technical support is available 24/5.

TU Expert Advice

Financial expert and analyst at Traders Union

CapTrader is an example of how you can build a successful brokerage company based on the Introducing Broker partnership program. The company appeared in 1997 as a partner of the globally known brand Interactive Brokers and took all the best from it – a user-friendly account interface, trading platforms, Investor’s Marketplace platform, where professionals offer their services.

CapTrader offers its clients one type of trading account, which makes trading conditions equal for all. The commission limits set by the broker are worth taking notice of. The minimum commission is USD 3.75. The broker also provides low leverage for retail traders. The broker has a professional analytical instrument Trading Workstation, and 3 types of trading platforms. There is automated trading and there are no limitations on trading strategies.

CapTrader is regulated under the licenses of Interactive Brokers, namely by the regulators of Ireland and the UK. The broker also holds a license in Germany. It is an important factor in terms of reliability. Therefore, CapTrader is a reliable platform with a wide set of features, targeted primarily at the professional traders.

CapTrader Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | WebTrader, Client Portal (Desktop), CapTrader Mobile |

|---|---|

| 📊 Accounts: | Demo, Standard |

| 💰 Account currency: | EUR, GBP, USD, CHF, CZK, PLN, DKK, NOK, SEK |

| 💵 Deposit / Withdrawal: | Wire transfer |

| 🚀 Minimum deposit: | USD 2,000 |

| ⚖️ Leverage: | from 1:5 (on CFDs on stock indices), up to 1:20 (on CFDs on stocks) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 EUR/USD spread: | from 0.3 pips |

| 🔧 Instruments: | Currency pairs (105), stocks (7,100), ETF (13,000), options (33), futures (32), CFD |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | over 20 major banks |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Inactivity fee |

| 🎁 Contests and bonuses: | No |

CapTrader offers its clients access to trading over 70,000 assets and trading instruments, including currency pairs, stocks, ETFs, mutual funds, commodities, futures, options and CFDs. Marginal trading is available and the leverage ranges from 1:5 to 1:20. The broker’s clients can test the platform and the trading conditions of CapTrader using a free demo account.

CapTrader Key Parameters Evaluation

Video Review of CapTrader

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

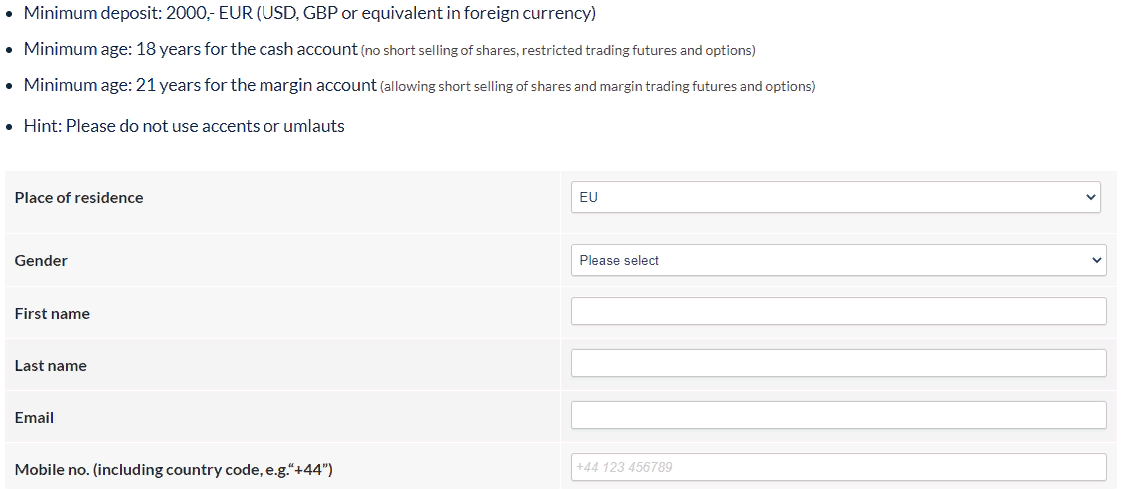

In order to start trading with CapTrader, you need to become the broker’s client by opening a trading account. Here is a brief guide to account opening:

In the upper menu of the website, select the Account tab and click on Live Account.

Next you will see a short review of trading conditions and a registration form, where you will need to provide your place of residence, first name and last name, gender, age and other information.

Next, the broker will ask you to provide detailed information. You will need to provide your address and country of residence, nationality, financial information, date of birth, etc. You will also need to specify the types and numbers of documents that will be used for verification.

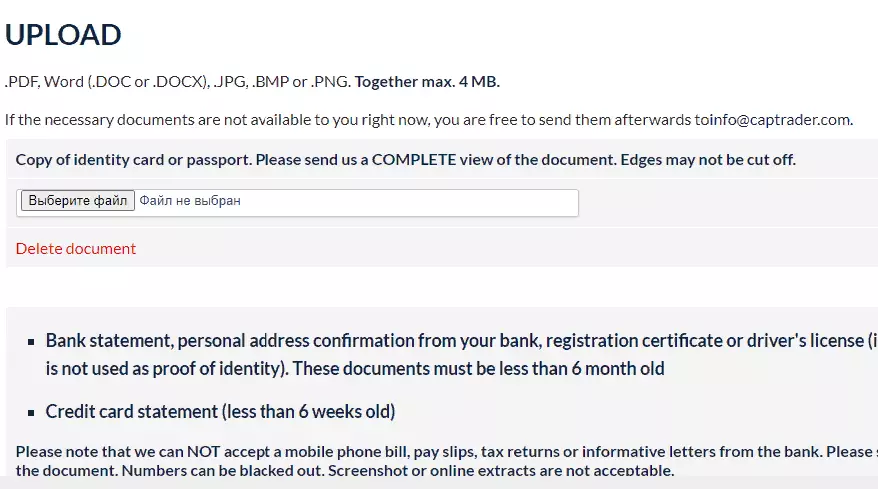

The last stage of registration is verification. Without it, you will not be able to access your trading account, deposit or withdraw funds. You will need to upload scanned copies of your passport or ID card and proof of your address.

The following features are available in Personal Account:

-

Reports. This section features detailed information about the trades performed by the trader, trading assets the client works with, etc.

-

Trading. In this tab, the clients get access to all trading platforms and analytical services available on CapTrader.

-

Investor’s Marketplace. This is a feature borrowed from Interactive Brokers. The company’s clients can use it to promote their services on asset management, education, consulting, etc.

Regulation and safety

CapTrader was founded in Germany and continues to operate there in 2021. The company’s headquarters are located in Dusseldorf. The company operates on the Introducing Broker program by Interactive Brokers and is regulated by the same regulators and the same licenses.

In particular, CapTrader operates in the UK on the FCA licenses No. 208159. The operation in other countries is regulated by the financial institution of Ireland – Central Bank of Ireland, license No. C423427. The company is also registered and regulated by the German regulator BaFin.

Advantages

- The funds of the clients are separated from CapTrader’s capital and are kept on segregated bank accounts

- Negative balance protection

- In the broker violates the obligations envisaged by the offer, the client can file a complaint with the regulator

Disadvantages

- Opening an account requires provision of detailed financial information

- It is impossible to deposit and withdraw funds without verification

- Limited choice of electronic payment systems for deposit and withdrawal transactions

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $3.75 | Yes |

The broker charges swaps (commission for position rollover to the following day). Traders Union analysts also compared average commissions of CapTrader, Admiral Markets and FXPro. You can see the results of the comparison in the table below.

Account types

CapTrader offers its users only one trading account type, which is why the trading conditions are the same for all clients. The minimum deposit is USD 2,000 or an equivalent in another currency. Marginal trading, which depends on the chosen type of trading instruments, is available to the traders. Also, the broker provides access to marginal trading with the following leverage:

Demo accounts of the broker are available for all trading platforms.

CapTrader is an ECN broker that provides beneficial trading conditions, a wide selection of assets and trading platforms for the clients.

Deposit and withdrawal

-

CapTrader processes a withdrawal application within 2-3 working days.

-

The money can be withdrawn via a wire transfer. Debit/credit cards, electronic wallets and cryptocurrencies are not supported by the broker.

-

In order to withdraw funds, you need to link the details of your bank account to your trading account. You will need to specify the name of the bank, country of its registration and IBAN.

-

The broker charges EUR 8 withdrawal fee for the first withdrawal of the month and EUR 1 for every following withdrawal transaction.

-

A trader needs to pass verification in order to be able to deposit funds.

Investment Options

CapTrader offers solutions not only to traders, but only to investors. Specifically, the company’s clients can use managed accounts (MAM). The company offers MAM accounts to investors with different risk levels, minimum investment amount, types of used assets and trading instruments, etc. The clients of the company are also awarded additional bonuses through referring new traders.

MAM accounts – passive income solutions

CapTrader offers its clients investment accounts managed by the company’s specialists. They are available to all broker’s clients, who deposit the required minimum amount. There are two types of MAM accounts on the platform:

-

Rating A. The minimum investment amount for opening this type of trading account is EUR 10,000. The expected return on this account type is 10-20% per annum. The key instruments to earn the return are options, benchmark – EuroStoxx 50. This type of MAM account has been available since 2011.

-

WHITE². The minimum investment amount for this type of trading account is EUR 20,000. The expected return is 10-20% per annum. The key instruments to earn the return are options, stocks, ETFs. Benchmark – S&P 500. This type of MAM account has been active since 2017.

The clients get direct access to positions and trades via the trading platform. The commission on MAM accounts ranges from 10% to 20% of the return depending on the risk level chosen by you.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

CapTrader’s partnership program

-

CapTrader partnership program envisages financial bonuses for referring new clients to the platform. In order to participate in the program, a trader needs to fill out and submit a corresponding application.

According to the conditions of the program, a client is considered referred once he/she registers and funds the account. If the referral deposited EUR 2,000 to the account, the user who referred him/her will be credited EUR 74. For deposit amounts from EUR 2,000 to EUR 25,000, the premium is EUR 150. If the initial deposit exceeds EUR 25,000, the user who referred the new client will be awarded EUR 250.

Customer support

Customer support on CapTrader operates 24 hours a day from Monday to Friday. The support is not provided on the weekends.

Advantages

- You can ask a question in the online chat without being the company’s client

- Support is available in English and German

Disadvantages

- Operates 24/5

The broker offers the following methods of contacting customer support:

-

Phone (specified in the Contact section);

-

email;

-

online chat on the website or in the Personal Account;

-

feedback form;

Both registered and unregistered users can submit their enquiries to the technical support.

Contacts

| Foundation date | 2001 |

|---|---|

| Registration address | Elberfelder Str. 6, 40213, Dusseldorf, Germany |

| Regulation | FCA, BaFin |

| Official site | https://www.captrader.com/ |

| Contacts |

Education

Education on the platform is rather limited to only webinars. At that, CapTrader does not provide the schedule of the events; you can find out about it only by contacting the technical support.

The broker does not offer a cent account, which is why the demo account is the only option to test your knowledge in real life.

Detailed Review of CapTrader

CapTrader aspires to offer its clients the best prices and the widest variety of trading instruments. The company operates based on the Introducing Broker program at Interactive Brokers, one of the top platforms for trading and investment in the world. The order execution type available to the broker’s clients is Market Execution. Also, automated trading is allowed on the platform and the trader can use the company’s analytical services.

CapTrader in figures:

-

Over 24 years in the market.

-

Over 70,000 trading instruments.

-

Over 145 markets.

CapTrader is a broker for trading and investment

CapTrader operates based on the ECN (Electronic Communication Network) technology, providing its clients with direct access to Forex liquidity providers. Thanks to this, order execution is very quick and it is possible to trade with minimum market spreads. Clients of the company have access to 7 classes of assets: Forex, commodities, stocks, ETFs, futures, options and CFDs. For passive investment, the traders can use MAM accounts, which CapTrader offers. The broker has two MAM account programs for different budgets and with different types of used instruments. There is also an option for setting up risks, on which the commission per trade depends.

CapTrader provides access to trading via WebTrader, Client Portal (Desktop) and CapTrader Mobile platforms. The company does not have any limitations on the use of trading strategies.

Useful services offered by CapTrader:

-

Trader Workstation – an analytical platform provided to the company’s clients for free. Using it, you can quickly and conveniently analyze charts and receive news. You can connect up to five charts and monitor them simultaneously.

-

Agena Trader – CapTrader’s software for trading automation. Clients can set up risk management criteria, automate calculation of orders, use an integrated trading diary, etc.

Advantages:

7 classes of assets are available for trading.

All funds of the traders are kept on segregated accounts, separately from the broker’s funds.

Negative balance protection.

Spreads from 0.3 pips.

MAM accounts managed by the company’s specialists are available to investors.

The broker provides analytics, online instruments for fundamental and technical analysis for all clients.

All trading instruments of the broker are provided for free to all traders, who opened an account with the company. Also, automated trading is available on CapTrader.

Articles that may help you

Check out our reviews of other companies as well

PK Multan

PK Multan

User Satisfaction i