Cobra Trading Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $30 000

- Cobra TraderPro

- DAS Trader Pro

- RealTick® EMS

- RealTick Express

- Margin trading is available. During day trading, the leverage will be 1:4, at night it is 1: 2

- Trading in futures and Forex assets is available in a subsidiary of Cobra Trading brokerage company - Venom Trading

Our Evaluation of Cobra Trading

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Cobra Trading is a moderate-risk broker with the TU Overall Score of 6.07 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Cobra Trading clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Cobra Trading is focused on cooperation with professional investors. Lack of educational information and exorbitant minimum deposits make the broker unsuitable for newbies.

Brief Look at Cobra Trading

Seasoned US traders choose Cobra Trading as their broker. The company has been providing financial services since 2003, and is registered in the United States and regulated by three bodies: FINRA (CRD#: 132078/SEC#: 8-66548), SIPC, and NFA (0402075). SIPC acts as a guarantor for the payment of monetary compensation to Cobra Trading clients. The broker offers optimal trading conditions for working in the stock market. Clients have access to eight types of accounts, like corporate, joint, and individual accounts, as well as options for retirement investment. Cobra Trading provides clients with direct access to the stock markets through four trading platforms, each of which the user can customize to suit his needs.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- A vast array of trading platforms with diverse functionality.

- The broker is regulated by three bodies: SIPC, FINRA, and NFA.

- The company offers trading accounts for investors with different needs: individual, general, corporate, etc.

- Contact support via online chat is available 24/7.

- Client funds are reliably protected, and financial compensation is provided in case of force majeure circumstances.

- A high level of minimum deposit, which is not great for novice investors.

- There are few training materials.

- The broker's website contains superficial information regarding trading conditions.

TU Expert Advice

Financial expert and analyst at Traders Union

Cobra Trading is a stockbroker for professional investors in America. The broker is licensed and regulated by three independent bodies: SIPC, NFA, and FINRA, which guarantee maximum protection for traders and investors in case of unforeseen circumstances. Also, the regulation guarantees the financial protection of clients. In case of bankruptcy of Cobra Trading, investors have the opportunity to receive financial compensation up to $500,000.

The company provides investors with a vast array of accounts and trading platforms, which allows them to choose the appropriate investment method and get the maximum benefit from using all the opportunities offered by the broker. In particular, both independent investment and corporate work are available to users.

Only residents of America may open a trading account, where the minimum deposit on any of the accounts is $30,000. Non-trading fees are paid separately.

Cobra TraderPro, Sterling Trader Pro, and DAS Trader Pro trading platforms are available only on a personal computer or laptop. But on the RealTick® EMS and RealTick Express platform, you can also work from a mobile device. All platforms include free access to investment instruments, analytics, news, and Level 2 quotes. DAS Trader Pro offers advanced functionality, while RealTick is used to manage a large number of accounts and work with complex assets.

Cobra Trading Summary

| 💻 Trading platform: | Cobra TraderPro, Sterling Trader Pro, DAS Trader Pro, RealTick® EMS, RealTick Express |

|---|---|

| 📊 Accounts: | Individual, Joint (JTWROS), Individual Retirement Accounts (IRAs), Roth IRA, Miscellaneous, Corporate, LLC, Trust, Partnership |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | ACA, bank transfer, check, ACH |

| 🚀 Minimum deposit: | $30,000 |

| ⚖️ Leverage: | Margin trading is available. During day trading, the leverage will be 1:4, at night it is 1: 2 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 EUR/USD spread: | From $0.002 per stock |

| 🔧 Instruments: | Trading options, stocks, securities, futures |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Available on the RealTick® EMS trading platform and RealTick Express |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | Trading in futures and Forex assets is available in a subsidiary of Cobra Trading brokerage company - Venom Trading |

| 🎁 Contests and bonuses: | No |

Cobra Trading offers its clients investment accounts for individual work as well as shared accounts. The size of the deposit starts at $30,000, and the trader's balance must be at least $25,000 for comfortable work. The main trading instruments are stocks and options. Futures and currency pairs are available on the Venom Trading broker website, which is owned by Cobra Trading. Margin trading is available to traders, as well as four trading platforms that allow you to customize the workflow to your liking. News, charts, and instruments for market analysis are built into the platforms.

Cobra Trading Key Parameters Evaluation

Video Review of Cobra Trading

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

Access to trading platforms and investment instruments opens after a trader opens a trading account. Below is a guide on how to open an account with Cobra Trading.

Go to the main page of the Cobra Trading broker. To open a trading account, click on any of the offered buttons that say Open Account.

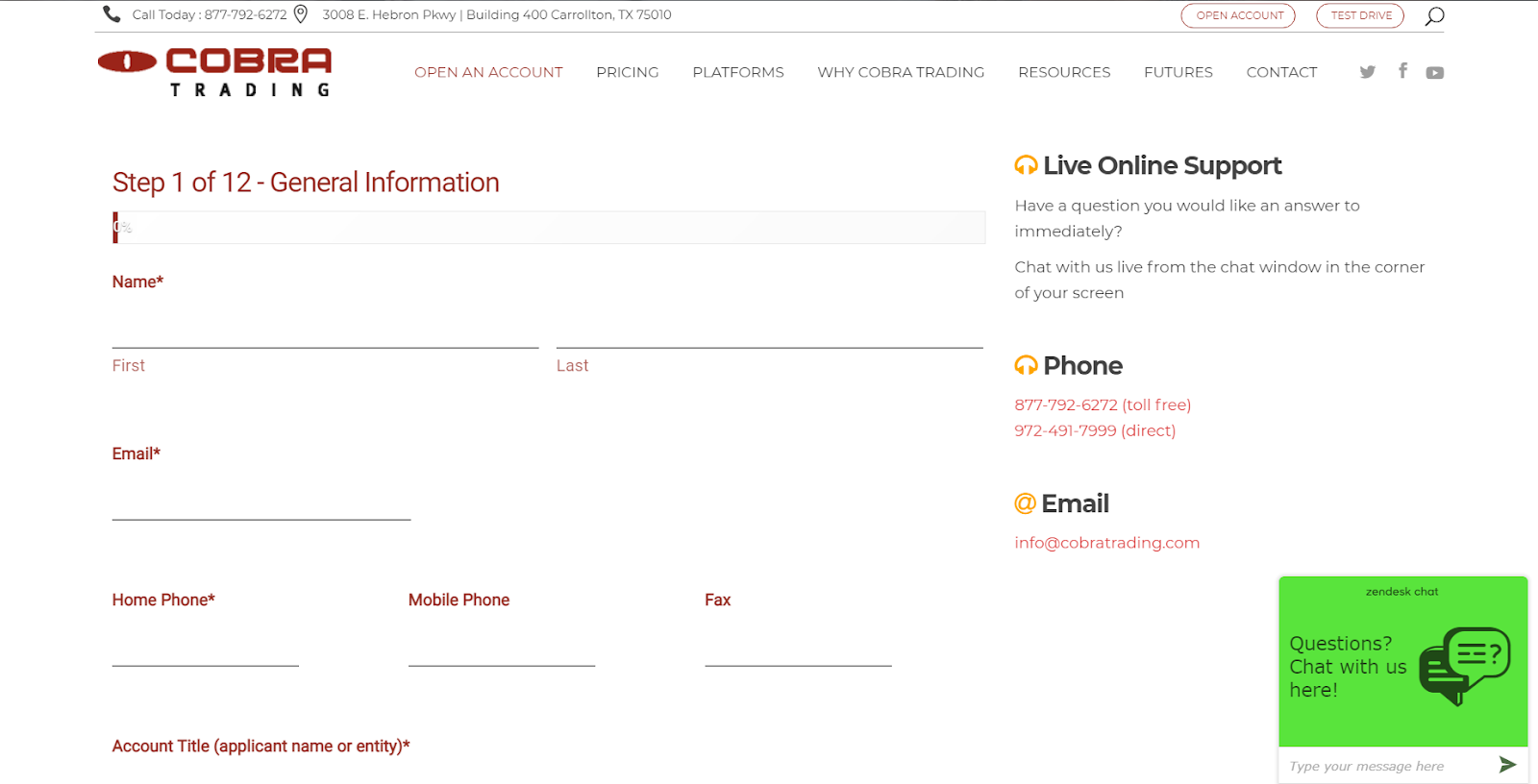

A questionnaire will open in front of you, which must be filled in with personal data: name, surname, phone number, email. Here you also need to choose the type of trading account, trading platform and answer questions that relate to your experience in investing, and knowledge of all possible risks.

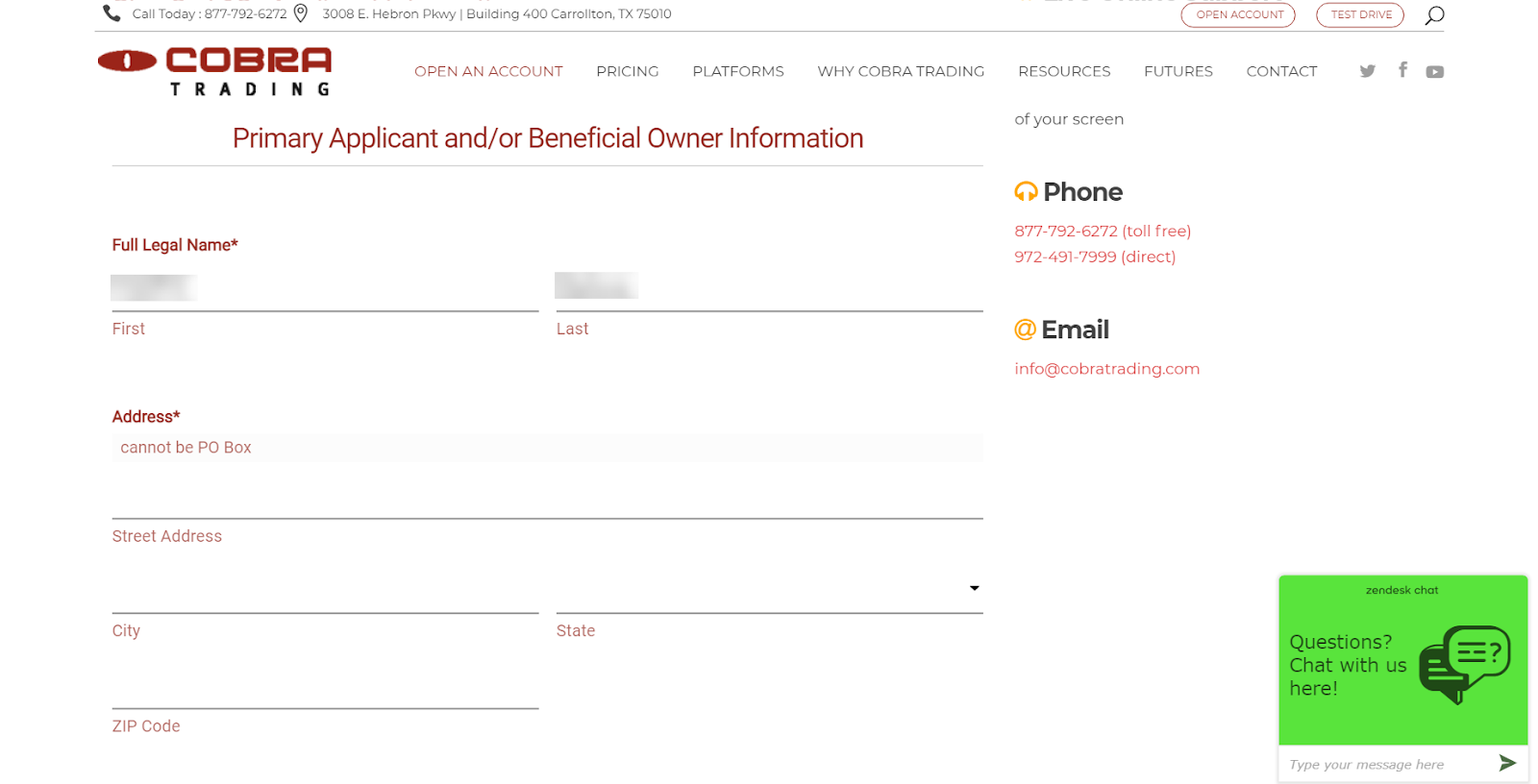

Indicate the state, city, and place of residence, zip code, information about your place of work, passport details, driver's license, or other documents confirming your identity.

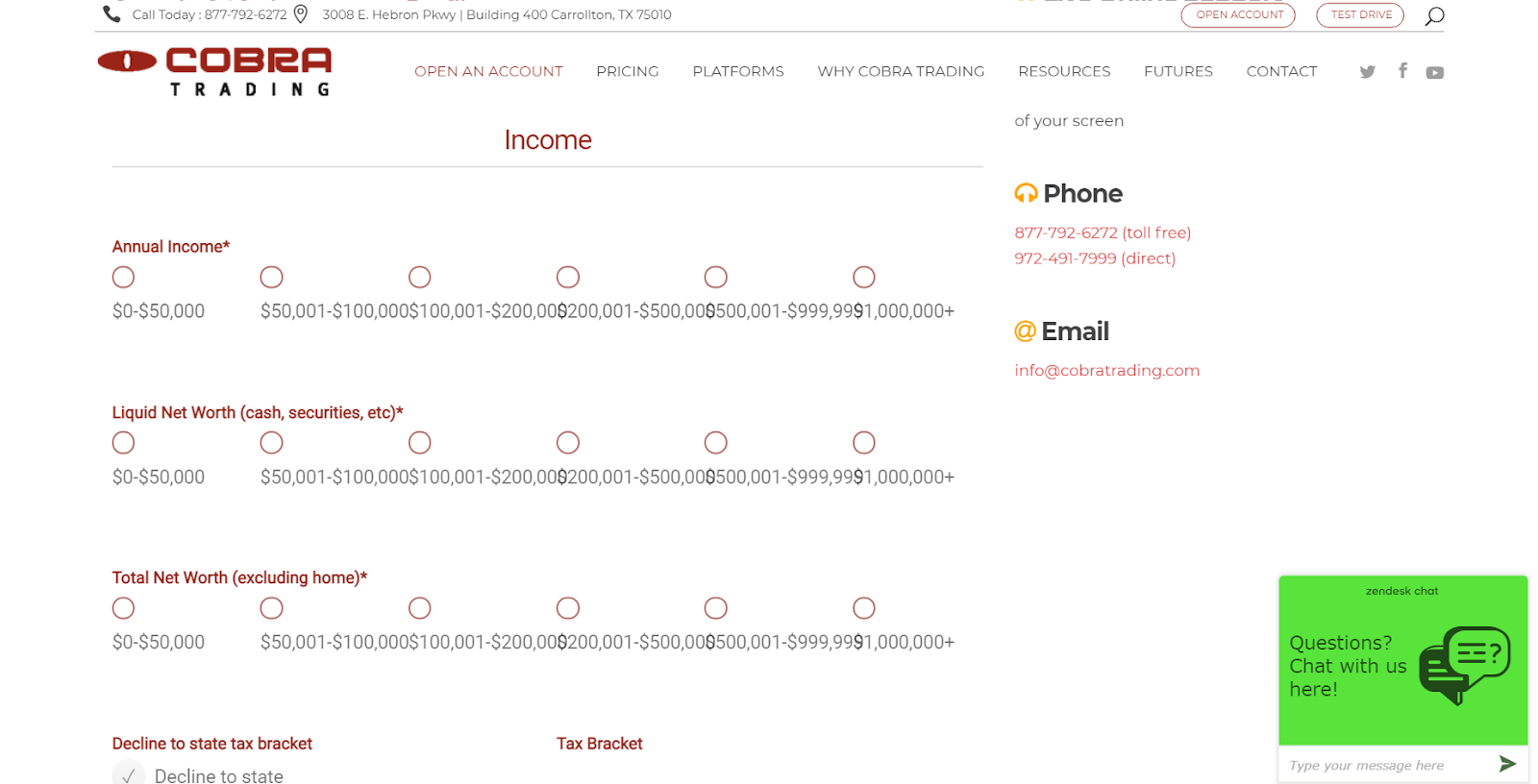

The next step is to enter data about your finances like sources of income and the amounts that you are ready to use for investment.

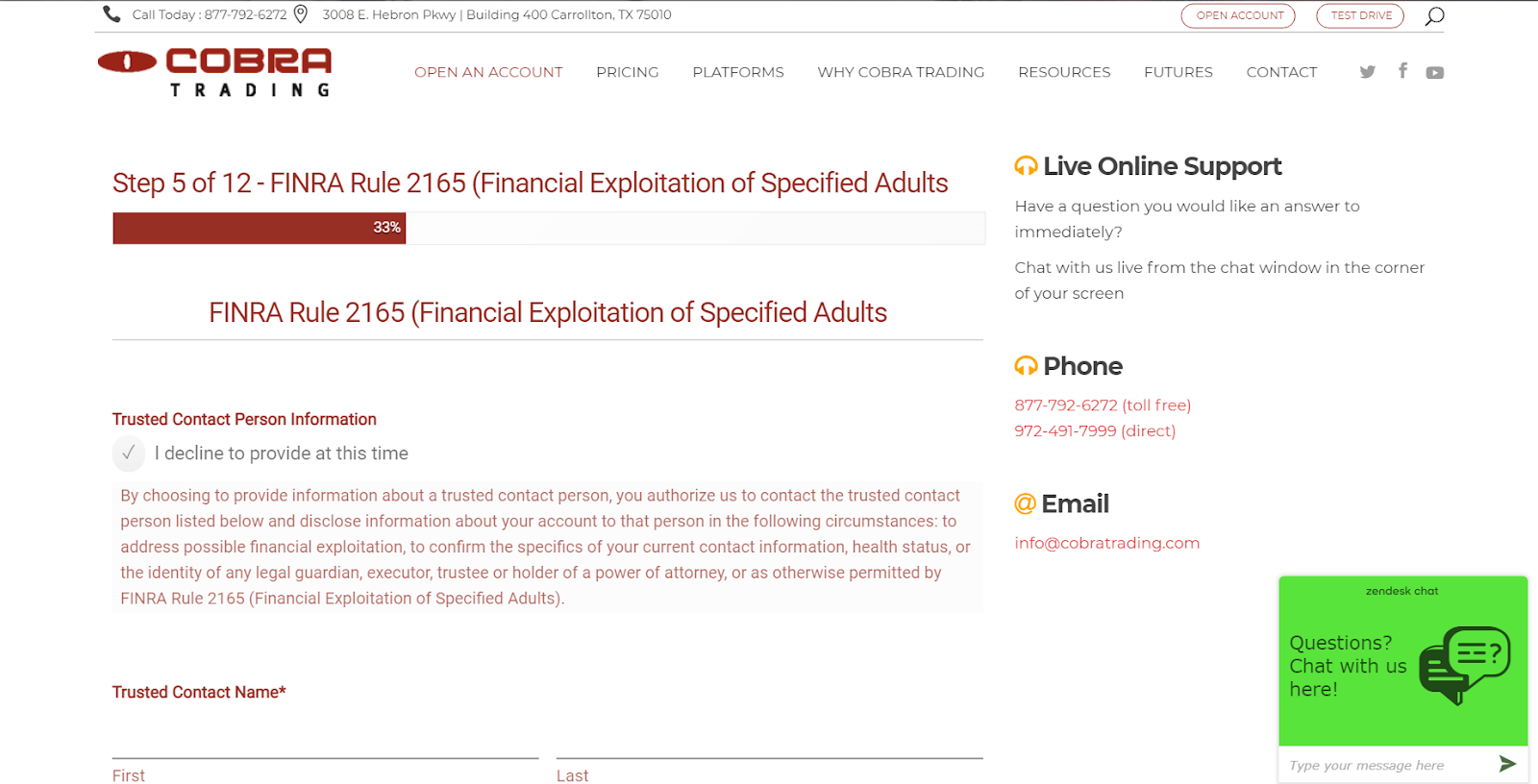

Enter information about the authorized person: name, surname, residential address, phone numbers, and email.

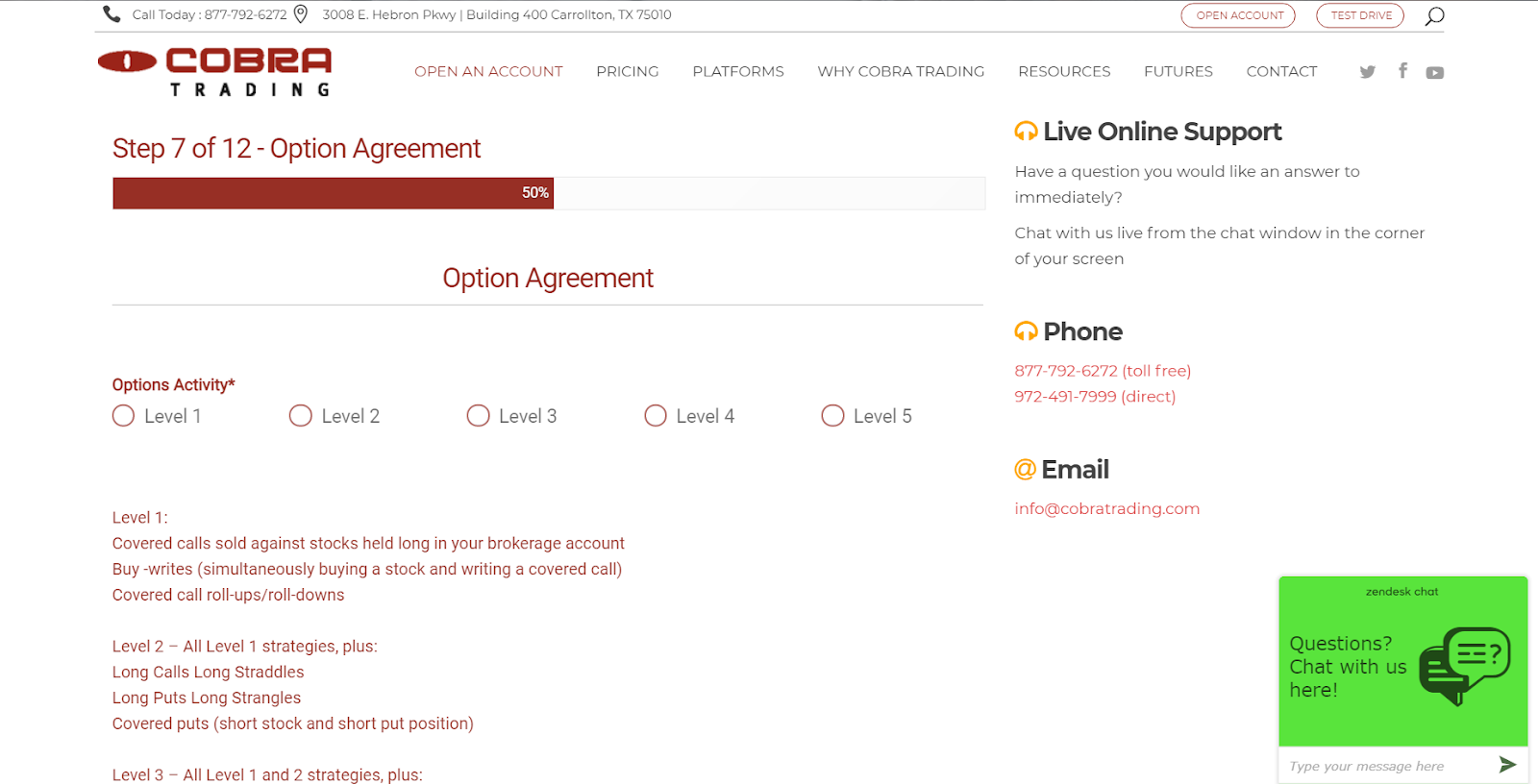

Fill out the consent to the use of options, if you have previously chosen the opportunity to trade this instrument, and also indicate your experience with different assets.

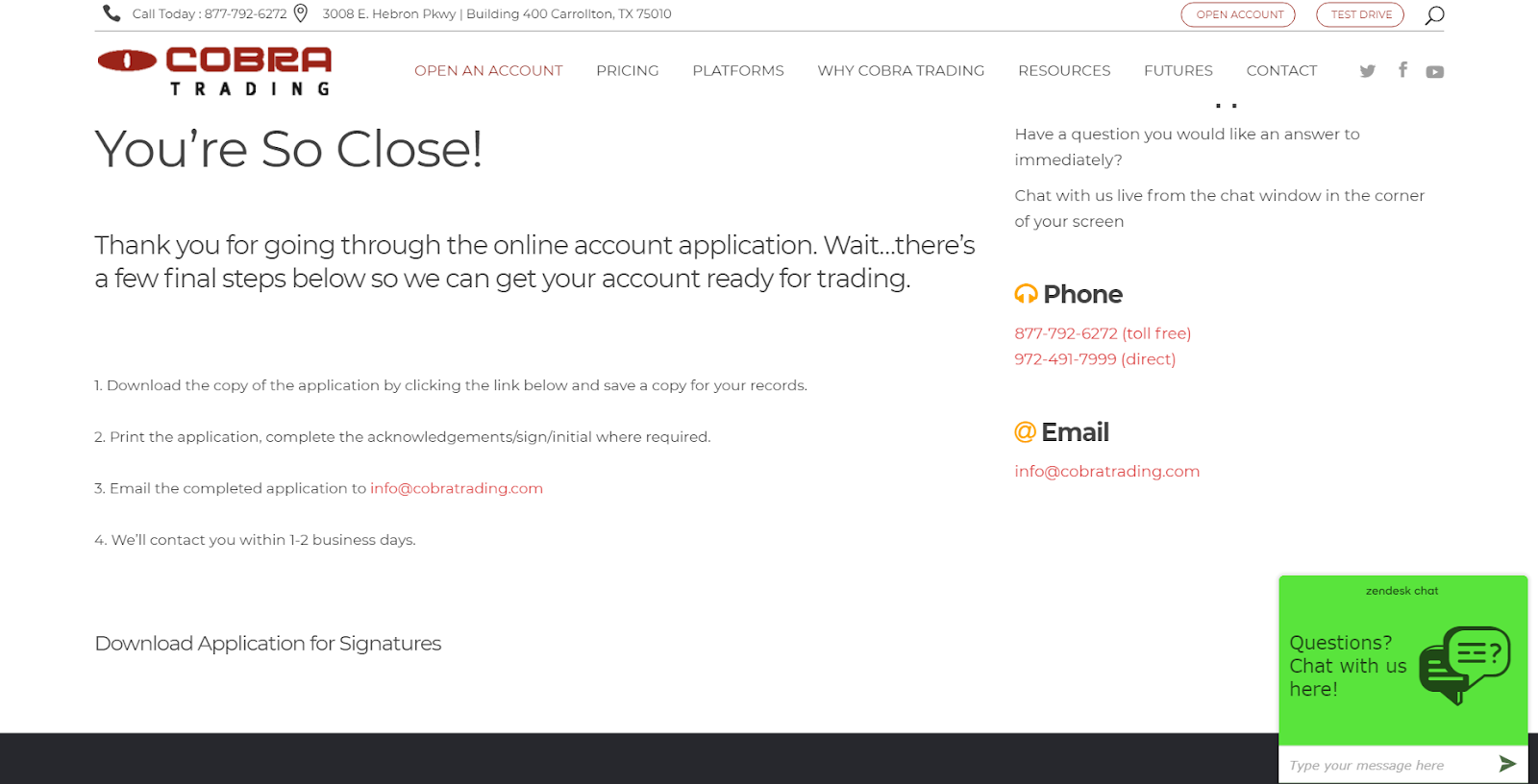

After filling out the questionnaire in detail, follow these four steps. Within 1-2 business days, the broker will contact you and notify you of opening an account or refusal to open an account.

In the personal account of Cobra Trading, clients also have the opportunity to:

-

Contact the broker's support service.

-

Monitor financial transactions on the account.

-

Study the statistics of trading activity.

-

Study financial news and analytics.

-

View current quotes online.

Regulation and safety

Cobra Trading is regulated by three regulatory bodies: NFA (National Futures Association), FINRA (America's Financial Industry Regulatory Authority), and SIPC (Securities Investor Protection Corporation).

Cooperation with SIPC means a guarantee for the protection of funds in the amount of up to $500,000. In the event of a financial collapse of Cobra Trading, SIPC undertakes to pay investors financial compensation for $250,000 if the client requests a payment.

Advantages

- The broker is regulated by three independent organizations

- The investor can receive financial compensation in the event of bankruptcy of the company

Disadvantages

- Investor capital is not protected by segregated accounts

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Individual | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Joint (JTWROS) | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Individual Retirement Accounts (IRAs) | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Roth IRA | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Corporate | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| LLC | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Trust | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

| Partnership | For trading stocks - from $0.002; per contract - from $1 | ACH transfer - free of charge, ACAT transfer - $95, internal bank transfer - $20, international bank transfer - $25 |

A trader who has transferred a position to the next day is charged an additional commission, i.e., a swap fee. The swap fee depends on the trading volume and the trading instrument used. Traders Union experts also compared the performance of Cobra Trading and its main competitors such as stockbrokers Webull and Ally. Analysis of the data showed that the commission for trading stocks in Cobra Trading is slightly higher.

| Broker | Average commission | Level |

|---|---|---|

|

$0.3 | |

|

$0.02 | |

|

$4 |

Account types

Cobra Trading offers users several types of accounts for personal and joint investment. The minimum deposit for all accounts is the same. Trading conditions and account maintenance fees may vary slightly depending on the characteristics of the account.

Account types:

To check the trading conditions on different types of accounts, the user can request permission to open a demo account with virtual funds.

Cobra Trading offers trading accounts for investors with a variety of needs, from personal investment to corporate trading, retirement investment, and co-management.

Deposit and withdrawal

-

To top up a trading account and withdraw funds, the broker offers the following methods: internal and external bank transfer, ACAT (transfer of funds from a trading account opened with another broker to an account with Cobra Trading), and ACH. Replenishment by check is also available.

-

The broker charges a transaction fee. The amount of the fee depends on the method of depositing or withdrawing funds. So, for an internal or external bank transfer, the fee will be $20-25, and $95 for a transfer from another brokerage account.

-

Additional fees for financial transactions may be charged by the bank.

-

The ability to make transactions appears only after confirming the identity of the trader.

-

There is no data on the speed at which funds are credited to a trading account or a client's personal account on the broker's website.

Investment Options

Cobra Trading specializes in investments and offers its clients several options for making a profit. The company has eight types of accounts with various types of ownership:

-

Individual - an account for personal use by one investor.

-

Partnership, Joint, Trust-Shared accounts.

-

Roth IRA, Individual IRA-retirement investment accounts.

-

Corporate, LLC - accounts for companies.

All accounts involve active trading in assets or the selection of stocks for investment. There are no automated programs for making a profit: the broker prioritizes live communication with the client, and the company's employees help to set up the workflow so that the client gets the maximum possible profit.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Cobra Trading’s affiliate program

The broker specializes in providing investment services and does not offer its clients any alternatives to generate passive income. In particular, the company does not have a referral program, so Cobra Trading users do not have the opportunity to receive income for activity not related to trading.

Customer support

Working with different trading platforms and assets can raise questions from both beginners and professional traders. Cobra Trading has set up a support department to help resolve any issues or questions that arise. Each user can ask a question of interest to the company's employees and receive a comprehensive answer or help.

Advantages

- The chat on the Cobra Trading website works around the clock

- Qualified specialists answer the traders' questions

Disadvantages

- The support service is not multilingual and provides assistance in English only

- You can contact the broker by phone or mail only during the specified opening hours.

Available communication channels with customer support specialists include:

-

send a letter to the broker's email;

-

call one of the phone numbers listed in the Contact section;

-

fill out the feedback form on the website;

-

write a message to the chat on the broker's website;

-

send a fax (the address is specified in the Contact section).

The possibility to reach out to the support staff and ask questions is available not only for traders who have opened an account with Cobra Trading but also for users who are considering cooperation with a broker or want to clarify trading conditions.

Contacts

| Foundation date | 1999 |

|---|---|

| Registration address | 3008 E Hebron Pkwy Building 400, Carrollton, TX 75010 |

| Regulation | FINRA, SIPC |

| Official site | cobratrading.com |

| Contacts |

877-792-6272

|

Education

The Cobra Trading company is focused on cooperation with experienced investors, therefore, the site contains a small number of materials that will be useful to traders when they start working with a broker.

If necessary, the trader can request to open a demo account that matches the desired trading account with Cobra Trading. If approved, the investor can test the broker's work and his knowledge of working in the futures market without financial risks. The earned funds on the account are virtual, so they cannot be withdrawn or used for trading on a real account.

Detailed Review of Cobra Trading

Cobra Trading is an American licensed broker that has been providing financial services since 2003. The company is focused on cooperation with professional investors and offers several investment options. Thus, Cobra Trading clients can open an individual, joint, or corporate trading account. The broker also provides a choice of four trading platforms, including the Real Tisk platform, which allows you to simultaneously manage multiple accounts. Also, all platforms have built-in charts, indicators, and a section with news and quotes of the 2nd level.

For investors who are considering Cobra Trading for cooperation, we suggest looking at the broker in numbers:

-

$0.002 is the minimum fee for operations with stocks.

-

3 official regulatory bodies guarantee reliable cooperation with the company.

-

4 trading platforms are available to customize for personal needs.

-

9 types of trading accounts, including both joint and individual.

-

The broker has been providing its services on the market for 17+ years.

-

$500,000 is the maximum amount of financial compensation that a trader can receive according to the SIPC.

Cobra Trading is the optimal broker for professional investors

Cobra Trading is a real catch for investors that strive to independently manage their capital and find ways to increase it. The broker does not offer automated software to help traders make profits effortlessly. Instead, Cobra Trading offers its clients its live assistance and stimulates the development of traders in the field of investment and stock trading. The broker also gives a choice of four trading platforms, each of which provides direct access to the markets and displays market quotes of the 2nd level in real-time. This allows the investor to be aware of the current prices.

The main assets for trading in Cobra Trading are options and stocks. The broker also allows you to trade futures, currency pairs, and other active trading instruments through Venom Trading, its subsidiary. Also, Cobra Trading actively cooperates with the Wedbush Securities clearing company to provide clients with the highest possible probability of transactions.

Useful Cobra Trading services:

-

Video about the principles of operation of different trading platforms.

-

News is available directly on all trading platforms of the broker.

-

NASDAQ Level 2 Market Data are also included in the functionality of the platforms.

Advantages:

A vast array of trading accounts with different types of property.

Trading platforms are suitable for both private investors and investment companies, including general account management.

SIPC, FINRA, and NFA regulations guarantee traders the reliability of Cobra Trading and provide for monetary compensation if the broker becomes bankrupt.

All trading platforms of the broker are supplied with Level 2 quotes in real-time.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i