ETrade (E*TRADE) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

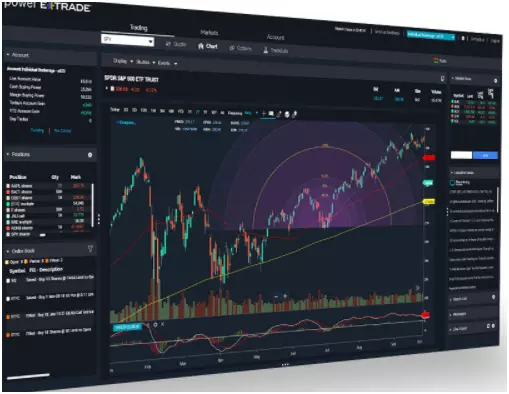

- Power E*TRADE

- E*TRADE

- Liberty

- Up to 1:1.5

- No commission when trading stocks and options on the US stock exchanges

Our Evaluation of ETrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

ETrade is a reliable broker with the TU Overall Score of 7.03 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by ETrade clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews showed that the broker’s clients are mostly satisfied with the company.

E-Trade specializes in e-trading and is primarily focused on working with the American stock market.

Brief Look at ETrade

The Etrade broker is a subsidiary of Morgan Stanley, the financial conglomerate, which has been operating since 1982. Today, E*TRADE is the leading online platform for financial instruments trading on the world's major exchanges. It offers operations with stocks, options, futures, bonds, ETFs, as well as investments in mutual funds. The broker is a member of FINRA (CRD#: 29106/SEC#: 8-44112), SIPC, NFA (0401545), and the FDIC, and provides services according to its license with the SEC, the US Securities and Exchange Commission.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- Fully adaptable to e-commerce through its mobile applications.

- No commissions when working with stock options on American exchanges.

- Twenty-four/seven customer support via online chat.

- The Forex market tools are not available for trading.

- Training is provided in English only,

- Leverage is limited and cannot exceed 50% of the trader's personal funds.

- You cannot open a demo account to test the broker's conditions.

- There is no support, the website is only in English.

TU Expert Advice

Financial expert and analyst at Traders Union

After analyzing all the main services of this broker, I concluded that E*TRADE is perfect for both active trading and medium-term investments in investment programs. However, the company is still focused on independent work within the stock market, because it was originally initiated as an online trading service. The mobile versions of both platforms offered by E*TRADE fully provide access to the entire range of services.

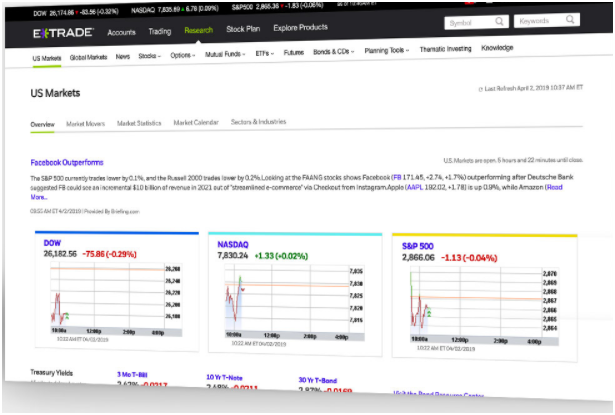

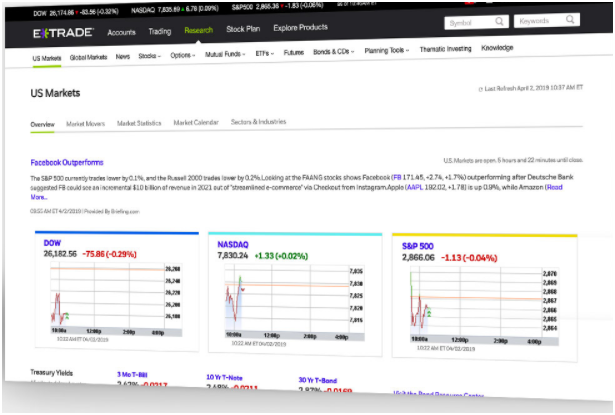

Training is highlighted in a separate website section. There are also information blocks, which may seem unusual to some users. News is divided into thematic subsections such as general overview, major shares dynamics, market statistics, and calendar. E*TRADE provides analysis of instruments within a particular field, but it is available only after registration. Also, a special press release section has been created to review the main trading events in the financial markets.

There are no commissions when trading stocks and options on American stock exchanges. That inspires clients to invest in this particular area of trading. However, E*TRADE offers banking services and pension insurance, which additionally stimulates interest in the company. The registration process is intuitive and simple.

ETrade Summary

| 💻 Trading platform: | Power E*TRADE and E*TRADE (for trading), Liberty (for investment portfolio management) |

|---|---|

| 📊 Accounts: | E*TRADE (for Power E*TRADE and E*TRADE portfolio) |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Replenishments: depositary checks (mobile and postal), bank transfer to the banking details Withdrawals: transfer to a bank account in E*TRADE Bank or to another financial institution account |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | Up to 1:1.5 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | Not indicated |

| 💱 EUR/USD spread: | No |

| 🔧 Instruments: | Stocks, options, futures, bonds, investments in mutual investment and ETF funds |

| 💹 Margin Call / Stop Out: | Not indicated |

| 🏛 Liquidity provider: | Not indicated |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Not indicated |

| ⭐ Trading features: | No commission when trading stocks and options on the US stock exchanges |

| 🎁 Contests and bonuses: | Welcome bonus up to $2,500. |

E-Trade terms are great for traders who prefer to work in the American stock and options market. There is no brokerage fee for trading this type of asset. But, you need to pay $25 for a partial withdrawal of capital from portfolios and $75 for a full transfer of funds. A commission is also levied on the client for the transfer of money between accounts. Trading is carried out through Etrade's proprietary terminals. Mobile versions are available. The broker delivers analytics with stock quotes and technical analysis.

ETrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start working in financial markets with this broker:

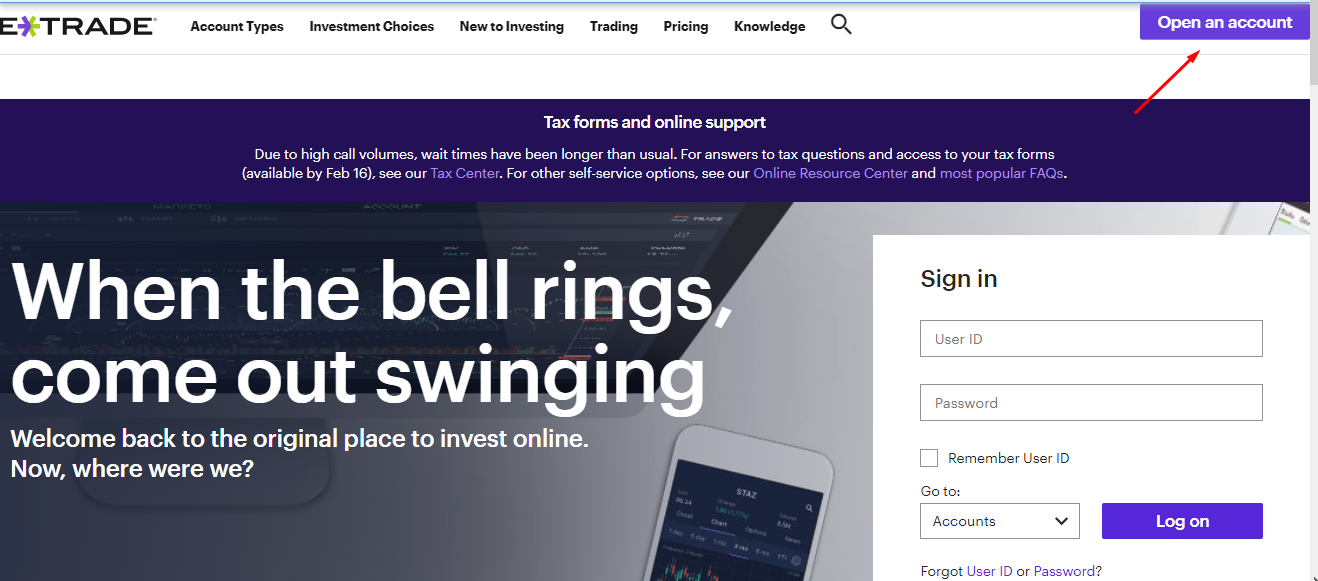

Open an account. Next, go to the registration form, click the "Open an account" icon, and select "Broker account" from among the available list.

Fill out the registration form. Indicate your passport information, country of residence, and contacts. Then you can install one of the offered broker platforms on your PC or mobile device. After that, log in to your account and go through the verification.

In the personal account of E*TRADE, you can:

You also get access to:

-

Training materials.

-

Investment prospectuses and analytical tools.

-

Historical charts of the dynamics of securities.

-

Risk calculation functions.

-

A button for communicating with the broker's representatives.

Regulation and safety

E*TRADE Financial Holdings, LLC, stock activities are regulated by the SEC, the US Securities and Exchange Commission.

The E*TRADE broker is a member of self-regulatory organizations FINRA (Financial Industry Regulatory Authority) and SIPC (Securities Investor Protection Corporation). The company also operates following the requirements of the NFA (National Futures Association) and the FDIC (Federal Deposit Insurance Corporation).

Advantages

- Carrying out activities under the laws of the United States

- Possibility of filing a complaint with the regulator

Disadvantages

- The regulator does not consider claims of non-residents of the United States

- Complicated account opening procedure and long verification process

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| E*TRADE | from $1 | There is a bank commission |

There are no swaps for transferring positions, but there are fees for keeping depositary receipts of American shares. We also compared the size of spreads of various brokers who provide access to the foreign exchange market. E*TRADE doesn’t trade in the Forex market and is added to the above table for general information.

Account types

The broker offers an E*TRADE account, which is available on both terminals of the company.

Account types:

Unfortunately, there is no demo account.

E*TRADE is competitive because it offers clients advanced technologies in online trading.

Deposit and withdrawal

-

Funds withdrawal shall be carried out in the following ways: by transferring money to the E*TRADE bank account or an account of another financial institution.

-

Withdrawal and replenishment currencies are carried out only in USD. The company does not convert money into other national currencies.

-

You have to go through verification to deposit and/or withdraw funds.

Investment Options

The following instruments are available to investors: stocks, bonds, fixed income securities, options, futures, and ETF shares. There are two types of programs to choose from, such as the exchange and mutual funds.

To start working with shares, deposit $500 or more to the account. For exchange instruments, the minimum investment amount is $2,500. Brokerage commission is not charged in either case. Expenses are reduced to the fees of the funds themselves, which covers the account maintenance.

Mutual funds on E*TRADE

The cost of investment account maintenance depends on the type of fund chosen for capital allocation.

The portfolio is formed individually, following the investor's trading strategy.

Program features:

-

The portfolio is a basket of securities selected by the company's professional analysts. All instruments shall be traded only once during the day.

-

Prices change only once at the end of each business day.

-

There is an automatic reinvestment of dividends function.

-

The portfolio is managed by the fund's employees.

Clients of E*TRADE can be a trader or passive investor, or both simultaneously. The ability to work with different types of funds allows you to diversify your investments. Generally, the company offers four options for strategies such as aggressive, moderate, conservative, and so-called "profitable" (with a focus on getting dividends).

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

E*TRADE affiliate program:

The “Member gets member” program is the only option for partnership offers for private traders. Unfortunately, its conditions are not provided on the broker's website. All information about remuneration is available only after you open an account. The company offers a range of solutions to improve efficiency for corporate clients under their brand and expands the provision of financial services.

Customer support

The support service is available to the company's clients every day, 24/7.

Advantages

- Round the clock online chats

- Support is available both from the website and from your personal account

Disadvantages

- No call back form

Support is available both from the website

and from your personal account

The client can contact technical support:

-

via telephone.

-

via online chat;

-

by sending a request by email (registered users only);

-

by sending a letter by regular mail.

Access to online customer support specialists is possible both on the company's website and from your personal account.

Contacts

| Foundation date | 1982 |

|---|---|

| Registration address | Harbourside 2 200 Hudson Street, Suite 501 Jersey City, NJ 0731, USA |

| Official site | etrade.com |

Education

The broker offers a library on the site to introduce the basics of stock trading to novice traders. It provides reviews, analytics, news, expert opinions, and useful tips to improve your trading efficiency.

The broker doesn’t have a demo account, but the knowledge gained academically can only be applied in practice using real assets.

Detailed Review of ETrade (E*TRADE)

The E*TRADE broker was created as a specialized e-platform for traders and investors. For now, the company focuses on providing favorable terms for trading on the American stock and options markets. E*TRADE also allows you to invest in two types of funds with the possibility to choose one strategy from among four. Professional investors can independently form portfolios from the set of instruments offered. The company's website is very convenient, and the news in a general block with educational information is E*TRADE’s idea.

A few figures about E*TRADE that could be interesting for traders choosing a broker:

-

30 departments in the USA.

-

4,100 employees on the company's staff.

-

Over 39 years of experience in the field of financial services provision.

E*TRADE is a regulated stockbroker

All E*TRADE services were designed to create terms for convenient and efficient e-commerce. The adaptation to the mobile version happened immediately after the appearance of phones with sufficient functionality. The broker offers favorable trading conditions for traders and investors at any experience level and with available capital. The commission-free condition varies from $0 to $1.5 depending on the instrument type. There are no minimum deposit requirements when opening an account.

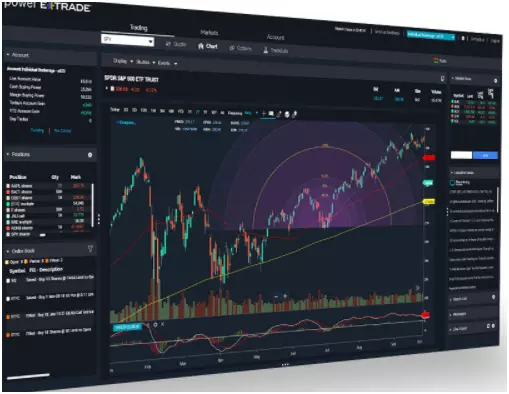

Trading is carried out on two of the company's proprietary platforms: Power E*Trade and E*Trade. Their main differences are the number of trading instruments available in their collective categories. The Power E*TRADE terminal offers the function of automatically filling the charts with the necessary instruments. Therefore, it is more suitable for professional work. The E*TRADE functionality allows users to get up-to-date educational materials directly during work.

Useful E*TRADE services:

-

Liberty: A simplified portfolio management platform with analytics, intuitive asset price tracking tools, and custom reports.

-

Market news. An overview of the current trends and market drivers affecting high-trading securities, with comments by E*TRADE's analysts.

-

Screeners. Tools for the selection of assets according to user-specified parameters.

-

Research. Fundamental and technical analysis for stocks, bonds, mutual funds, and ETFs.

Advantages:

No brokerage fees for US stocks and options (listed on major exchanges).

Flexible system for choosing investment programs.

Twenty-four/seven support.

A full library with useful materials.

Full adaptation of all services for mobile applications.

Intuitive website.

Active traders can apply any trading strategy. The only significant disadvantage of the broker is the inability to trade on the Forex market.

Articles that may help you

User Satisfaction i