Moomoo Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Fututrade

- 1:2 for long-term leverage, 1:1.67 for short-term leverage

- Access to margin trading opens when depositing funds starting from $2,500

Our Evaluation of Moomoo

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Moomoo is a moderate-risk broker with the TU Overall Score of 5.59 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Moomoo clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Moomoo is a trading and investment broker aimed at beginners and experienced investors as well as traders who rely on technical analysis.

Brief Look at Moomoo

Moomoo (moomoo.com) is a California-based broker-dealer and a member of FINRA, SIPC, DTCC, OSS, and NASDAQ. Moomoo Inc. was established in 2018 and is a subsidiary of Futu Holdings Ltd., which is registered with the SEC (0001667858). Moomoo is a member of the LSE and SGX, and is licensed by MAS. The broker offers an intuitive trading platform with professional fundamental and technical analysis tools, as well as interest-free trading in US stocks, ADRs, ETFs, and options. For experienced traders, the platform provides a customizable news feed with audible alerts that allow you to quickly respond to market changes. Users have access to quotations on the exchanges of the USA, China, Hong Kong, and Forex markets. They also have enhanced possibilities for building both standard charts (bars, hollow, full candlesticks, and lines) and multi-charts, including VWAP with different time frames.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- No commission when trading stocks, ETFs, options, and US ADRs.

- Analytical tools include third-party analyst ratings, graphical financial reports, and various charts with over 50 technical indicators.

- No minimum deposit required to open an account.

- All accounts open through a mobile application.

- Active trading community with over 100,000 users.

- No chat and phone support.

- Limited investment opportunities. You cannot use cryptocurrency, mutual funds, or bonds.

- Withdrawal of funds only via bank transfer and АСН.

TU Expert Advice

Author, Financial Expert at Traders Union

Moomoo offers trading stocks, ETFs, ADRs, and options on an intuitive platform equipped with professional analysis tools. The company does not require a minimum deposit and provides fee-free trading certain asset classes. Margin trading is accessible with leverage ranging from 1:1.67 for short-term to 1:2 for long-term trades. Additionally, Moomoo's platform allows access to multiple exchanges, alongside a robust set of graphical and technical indicators.

However, Moomoo lacks phone and live chat client support, with assistance only available via email, which may delay responses. The platform has limited investment options, excluding cryptocurrencies, mutual funds, and bonds, and withdrawal is only possible through bank transfer and ACH. Moomoo may be suitable for traders prioritizing stock and options trading, but those seeking comprehensive asset variety may need alternatives.

Moomoo Summary

| 💻 Trading platform: | Fututrade |

|---|---|

| 📊 Accounts: | Demo, individual margin |

| 💰 Account currency: | USD, SGD, HKD |

| 💵 Deposit / Withdrawal: | Bank account, АСН |

| 🚀 Minimum deposit: | from 1 USD |

| ⚖️ Leverage: | 1:2 for long-term leverage, 1:1.67 for short-term leverage |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 EUR/USD spread: | absent |

| 🔧 Instruments: | Shares, options, ETFs, ADRs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | No |

| ⭐ Trading features: | Access to margin trading opens when depositing funds starting from $2,500 |

| 🎁 Contests and bonuses: | available |

Moomoo allows you to trade stocks, ETFs, and options. The broker does not charge a fee for opening a brokerage account. It allows clients to trade on margin with leverage from 1:1.67 to 1:2.

Moomoo Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

It’s easy to start trading with Moomoo. Follow the following algorithm:

Open the official website Moomoo.com. On the main page, click the “Open Account” or “Get Started” buttons.

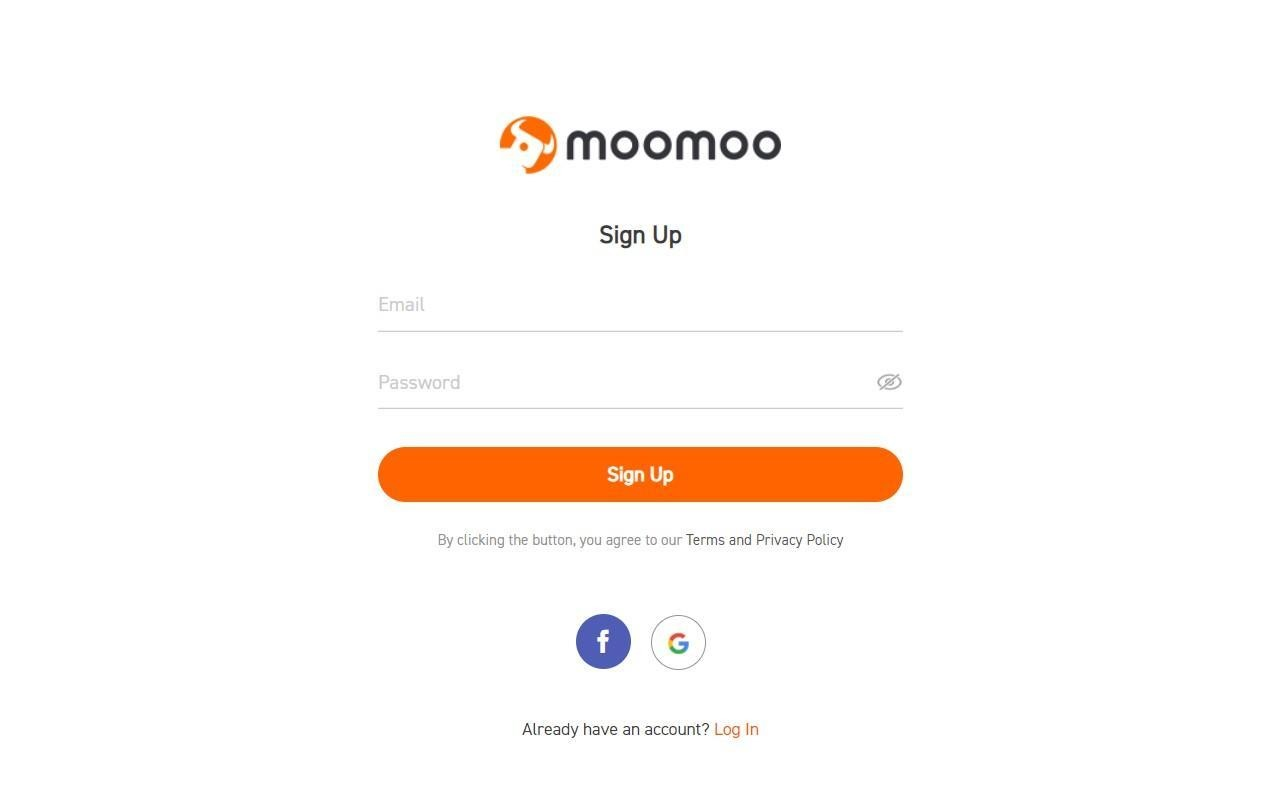

After that, you will see a form where you have to enter your email and password, and then confirm them. The system will ask you to enter your US Social Security number, and then confirm your phone number and residential address. You can provide a bank statement/utility bill/certificate of house rent as a document for checking registration.

In Moomoo’s personal account, traders can:

Also in the personal account, the user can:

-

Divide the workspace of the screen into several parts to simultaneously see information about the company and its assets, as well as diagrams for effective decision-making.

-

Set up notifications about events that are necessary for successful trading to receive sound notifications about any changes in the monitored parameters.

-

Use technical indicators simultaneously or by choice.

Regulation and safety

Moomoo is a subsidiary of Futu Holdings Ltd., a broker-dealer, with insurance of $500,000. It is registered with the Securities and Exchange Commission (SEC). It is also a member of the Financial Industry Regulatory Authority (FINRA), and is licensed by the Monetary Authority of Singapore (MAS). The company is part of the Securities Investor Protection Corporation (SIPC).

Moomoo has additional insurance from Interactive Brokers LLC. It does not cover the fall in the value of securities, but it protects the company from bankruptcy.

Advantages

- Clients of Futu Inc. are insured for up to $500,000 (including $250,000 in the event of a cash claim)

- Claims arising from the trader against the broker can be considered by the regulatory authorities of the United States and Singapore.

Disadvantages

- No negative balance protection

- There is no Better Business Bureau profile where users can leave comments about Moomoo

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Individual Margin Account | 6.8% | Yes |

We compared the trading fees of moomoo.com with those of other popular brokers.

| Broker | Average commission | Level |

|---|---|---|

|

$0.04 | |

|

$4 |

Account types

Moomoo offers its customers the opportunity to open an individual margin account.

Account types:

Moomoo has a demo account that can be used in both mobile and desktop versions of the terminals.

The broker attracts experienced traders with a variety of analytical tools and allows beginners to get comfortable with the stock market.

Deposit and withdrawal

-

Moomoo’s clients can withdraw funds using ACH or bank transfer. According to Moomoo’s support service, withdrawals through ACH are possible without commission. The process takes from 3 to 5 business days.

-

It is also possible to withdraw funds by bank transfer. Moomoo charges a fee of $20 from American clients and $25 from traders from other countries. The broker warns that for making a bank transfer, additional fees of $30-50 within the United States and $50-70 for non-US residents.

-

The broker makes withdrawals in US dollars. If the client needs to withdraw money in a different currency, he can use the conversion service. Moomoo has restrictions on the number of transactions. For example, the client cannot withdraw more than $10,000 at a time.

Investment Options

Moomoo’s clients can invest their funds in over 5,000 stocks, municipal, corporate, and US Treasury bonds, options, ETFs, and ADRs.

Exchange-traded funds (ETFs) and investments at Moomoo

Moomoo users have the option to invest in ETFs. The broker allows you to use different types of ETFs for income generation, speculation, price increases, hedging, or partial risk recovery. Commodity ETFs, Currency ETFs, and Bond ETFs are available to investors. Features of ETF trading on Moomoo are:

-

You can track geographic, industry, commodity, and other ETF parameters.

-

You can set market, limit, and stop orders.

-

ETF trading is carried out without charging a brokerage commission.

-

You can customize and save screeners for ETFs.

-

You can manage the account from any device.

-

24/7 trading on market days.

ETFs are open-ended investment funds that are listed on stock exchanges. They are also trading instruments.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Moomoo’s affiliation program

At the moment, the broker does not offer affiliate programs to users.

Customer support

The broker has an assistance service that the trader can contact by email. Waiting for a response takes from 1 to 3 days.

Advantages

- Email support with fast response to customer inquiries

Disadvantages

- No way to contact support in real-time by phone or chat

Assistance service’s emails:

-

cs@fututrade.com — for US clients;

-

clientservice@futusg.com — for Singapore clients.

To organize effective assistance, Moomoo support recommends attaching a screen image to the message as well as specify the Moomoo identifier.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | 720 University Ave, Suite 100, Palo Alto, CA 94301, US |

| Official site | Moomoo.com |

| Contacts |

Education

The broker’s website does not contain a training section, but information useful for clients is available in the Help Center. In the News section, clients have access to current stock news (7x24), political and economic news affecting the markets (Highlights), and the Financial Calendar.

Detailed Review of Moomoo

Moomoo allows its clients to trade shares and ETFs using margin accounts even before a deposit is made to an open account.

Moomoo advantages by the numbers:

-

You can trade US shares, options, and ETFs with a $0 / 0% commission.

-

Insurance coverage for clients is up to USD 500,000.

-

Its trading community has over 100,000 users.

Moomoo is a broker for experienced investors who use a variety of analytical tools that are not easy for beginners to understand.

Moomoo is a broker that allows you to trade American, Chinese, and Hong Kong stocks, options, and ETFs. Clients gain access to NYSE Arcabook, NYSE Open book, and Nasdaq Total View Level 2 quotes. You can open up to 40 different orders at the same time.

The Moomoo platform is available in desktop and mobile versions. It is compatible with Windows and Mac operating systems, as well as Android and iOS mobile operating systems. Synchronization of the platform on various devices provides the user with mobility, allows trading both at home and while moving around the city or when in the countryside.

Moomoo useful services:

-

Option Analysis. An optional profit-and-loss charting tool that allows the user to combine charts and make forecasts for options execution.

-

Single Moomoo. A tool that allows you to build a diagram of the major situation in the options market to determine the maximum and minimum losses and the break-even point.

-

Futu Bull. A set of customizable technical indicators that an investor can use to analyze current market trends.

-

Indicators. There are MACD and RSI oscillators, Bollinger bands, moving averages, and cash flow indices, etc.

-

Economic calendars. They display upcoming reports on business earnings, IPOs, and other financial events.

-

Smart reminders. Automatic notifications about changes to parameters are monitored by the user.

Advantages:

The possibility to trade from various devices.

Access to exchange information in real-time with a stable internet connection.

The possibility to trade from 4:00 to 20:00 ET.

No minimum deposit required to open an account and no charges for providing second-level market data.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i