TD Ameritrade (Charles Schwab) Review 2025

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $1

- Thinkorswim

- Classic web platform

- NextGen web platform

- TD Ameritrade Mobile

- 1:2

- Margin trading is available after making a deposit of $2,000 or more

Our Evaluation of TD Ameritrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TD Ameritrade is a moderate-risk broker with the TU Overall Score of 6.79 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TD Ameritrade clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

TD Ameritrade (Charles Schwab) is a broker with a wide range of investment assets and high-quality trading platforms, which is mainly aimed at seasoned US-based traders.

Brief Look at TD Ameritrade

TD Ameritrade (Charles Schwab) is an American broker that provides top-notch online services for trading and investing in securities on the OTC markets. The company was founded in 1975 under the name First Omaha Securities. It was reimagined as an online broker in 1998. TD Ameritrade (Charles Schwab) is a member of FINRA (CRD#: 7870/SEC#: 801-60469,8-23395 ) and SIPC and currently serves over 11 million client accounts. The broker offers simple pricing, high-tech trading platforms with professional analytics, and a wide range of markets and investment products. TD Ameritrade (Charles Schwab) was named Best Online Broker 2020 by StockBrokers.com and ranked first in the Platforms & Tools, Beginners, Education, and Customer Service categories.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- The broker's regulators are FINRA and SIPC, which guarantee the protection of client funds and their return in the event of TD Ameritrade's (Charles Schwab) bankruptcy or other default.

- Clients have open access to the securities market, OTC, derivatives trading, and legal work with Forex instruments.

- The broker offers a vast array of investment products for generating passive income.

- The company does not charge fees for trading in American and Canadian stocks, options, and ETFs.

- There are no requirements for the size of the minimum deposit on cash accounts.

- The broker offers high-tech author's terminals that work from desktop or mobile device.

- A high entry threshold has been set for margin trading and investment in managed portfolios.

- The broker offers a limited selection of payment systems for deposits and withdrawals.

- There is no online chat on the company's website. It is available only in some versions of trading platforms.

TU Expert Advice

Author, Financial Expert at Traders Union

TD Ameritrade, a subsidiary of Charles Schwab, provides a comprehensive range of trading and investing platforms, including Thinkorswim and TD Ameritrade Mobile, covering stocks, ETFs, options, and Forex. With Standard, Retirement, and Education accounts, the broker allows flexible trading and investment strategies. The platforms are feature-rich, suitable for experienced traders, offering zero fees on U.S. and Canadian stocks and derivatives, and providing access to managed portfolios for passive investment.

However, TD Ameritrade has drawbacks, including a high entry threshold for margin trading and limited payment methods, specifically excluding credit and debit cards. Furthermore, the absence of live chat may be less convenient for users needing prompt support. These disadvantages suggest that while TD Ameritrade may suit experienced traders seeking diverse investment opportunities, it may not be optimal for beginners or those looking for lower entry investment options.

TD Ameritrade Summary

Via TD Ameritrade's (Charles Schwab) secure website. Your capital is at risk.

| 💻 Trading platform: | Classic web platform, NextGen web platform, TD Ameritrade Mobile, Thinkorswim (web, desktop, mobile) |

|---|---|

| 📊 Accounts: | Paper Account (Demo), Standard (Cash, Cash and Margin, Cash and Option, Cash, Margin and Option), Retirement (Traditional IRA, Roth IRA, Rollover IRA), Education (529 Plan, Coverdell), Specialty, Managed Portfolios |

| 💰 Account currency: | USD |

| 💵 Deposit / Withdrawal: | Electronic bank deposit (ACH), wire transfer, asset transfer from another brokerage company, by check via mobile app, physical certificates of shares |

| 🚀 Minimum deposit: | From $1 |

| ⚖️ Leverage: | 1:2 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 EUR/USD spread: | Missing |

| 🔧 Instruments: | Stocks, options, ETF, mutual funds, futures, bonds, annuities, IPO, CDs, Forex, cryptocurrency |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | JP Morgan, Citadel Securities, XTX Markets, HC Technologies, Virtu Financial |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Order execution: | Market execution |

| ⭐ Trading features: | Margin trading is available after making a deposit of $2,000 or more |

| 🎁 Contests and bonuses: | Welcome bonus |

The broker TD Ameritrade (Charles Schwab) offers favorable conditions for active traders and passive investors. The minimum deposit for investment and trading starts at $1. The company's clients can trade US stocks, US and Canadian ETFs, and options with zero commissions. Access to margin trading opens after a deposit of $2,000 or more. The broker does not support transfers through electronic payment systems. Also, credit and debit cards cannot be used to deposit and withdraw funds.

TD Ameritrade Key Parameters Evaluation

Video Review of TD Ameritrade

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

You can start trading on the TD Ameritrade (Charles Schwab) platform after creating your personal account and opening a trading account. Below is a short step-by-step guide to getting started with a broker:

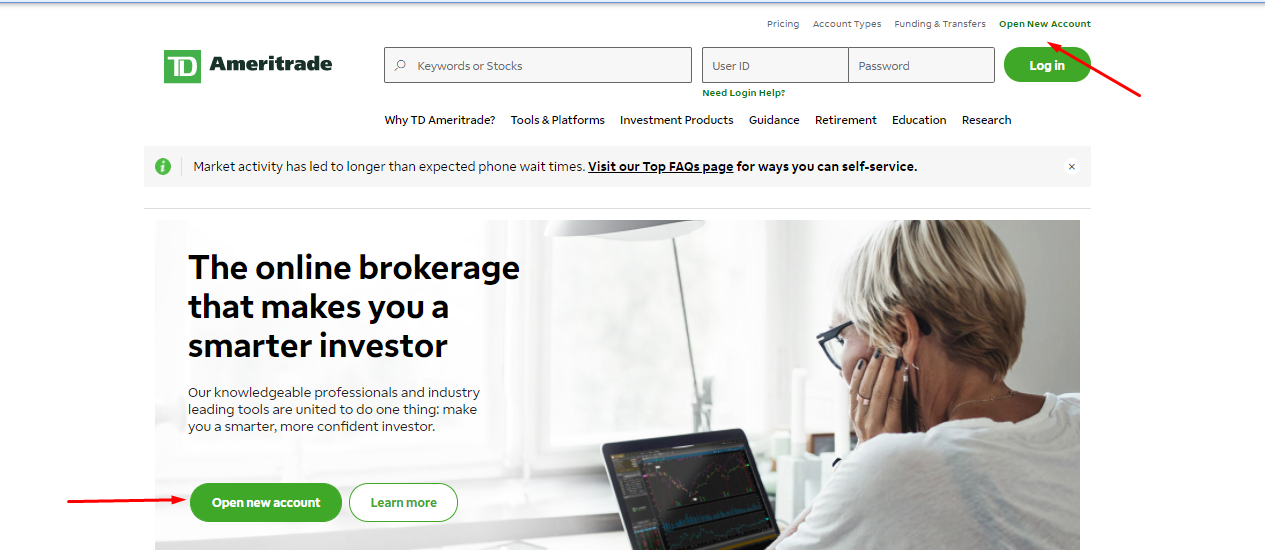

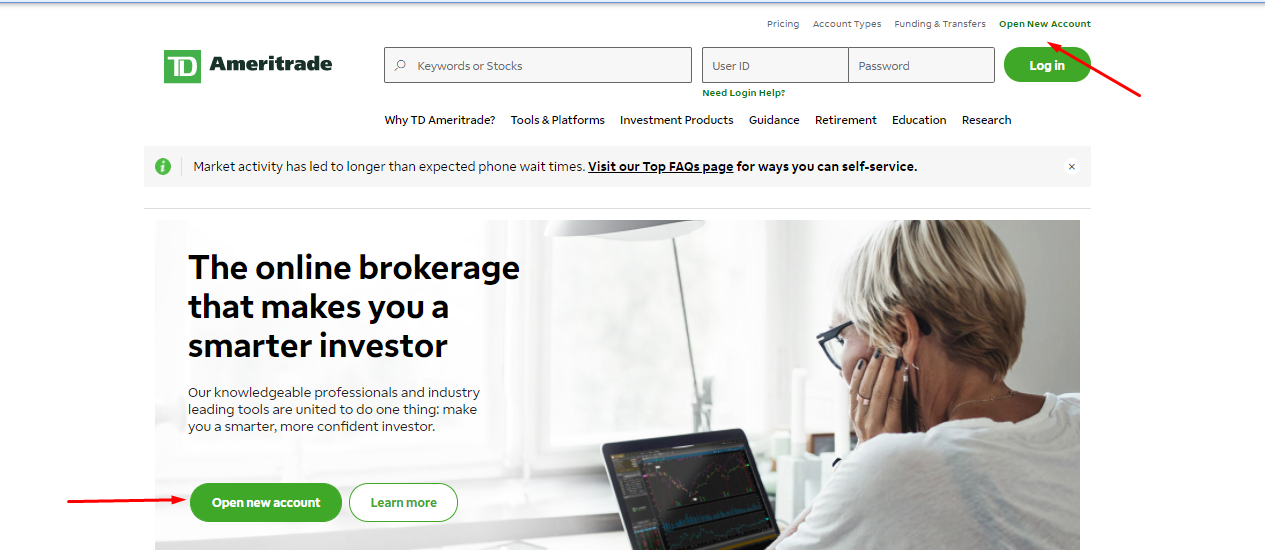

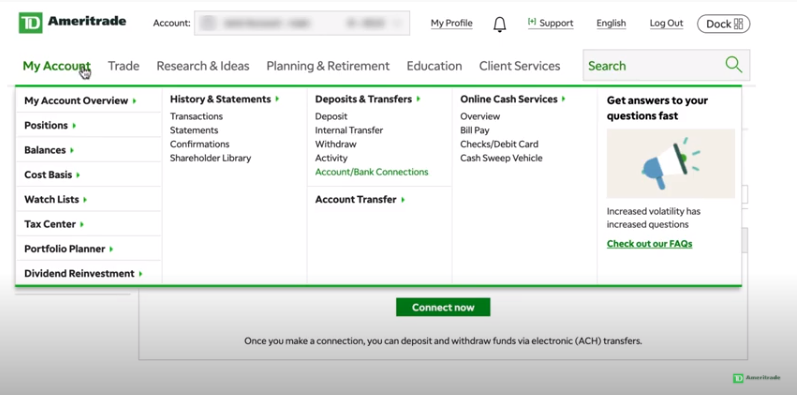

Before opening a trading account on the TD Ameritrade (Charles Schwab) platform, register on the Traders Union website. Opening an account through the traders Union rebate service will allow you to receive compensation for trading commissions in the future. Then, on the broker's main page, click the Open New Account button.

In the registration form that opens, select the Individual account, and then enter your full name, email address, country, city and address of residence, zip code, and phone number. In addition to personal and financial information, you must provide a Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you are not a citizen or permanent resident of the United States, you must provide your foreign taxpayer identification number, passport details, or visa number. The required field is the name, address, and telephone number of your employer (if you are employed). All specified data must be confirmed by providing scanned copies of the above documents.

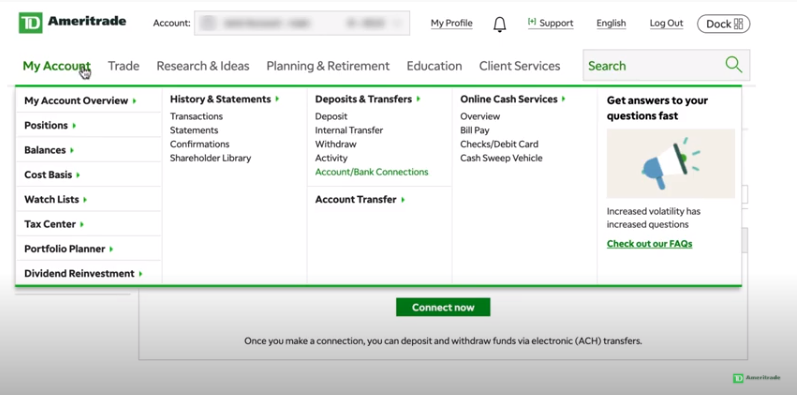

The main features of the TD Ameritrade (Charles Schwab) personal account:

Also in the personal account, a trader can:

-

Connect to a web terminal for trading through a browser on a desktop or mobile device.

-

View training materials. They are grouped by asset class to quickly find the information you need.

-

Track trending news and trading ideas.

Regulation and safety

The TD Ameritrade (Charles Schwab) broker, a subsidiary of the financial holding Charles Schwab Corporation, is registered under the trademark TD Ameritrade (Charles Schwab), Inc. The activities are supervised by FINRA, the US Financial Services Regulatory Authority.

TD Ameritrade (Charles Schwab) is a member of the SIPC (Securities Investor Protection Corporation), which protects broker clients up to $500,000 (including $250,000 in case of cash claims). SIPC payments are only available on securities accounts. It is not Corporation policy to protect accounts that are used for cryptocurrency trading.

Advantages

- Segregated accounts are used to store customer funds

- In case of violations by the broker of the offer, the trader can file a claim with the regulator

- Availability of insurance policy

Disadvantages

- The regulator limits the choice of available payment systems

- Full verification of the client's personal and billing information is required

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standart | From $1.65 | No |

The broker does not withhold commissions for non-trading operations; however, they can be charged by banks that accept and send payments. Traders Union analysts compared the average trading fees for equities and ETFs from Ameritrade and other popular stock brokers. Based on these assets, all three companies enable traders to trade with zero commissions.

| Broker | Average commission | Level |

|---|---|---|

|

$1.65 | |

|

$0.53 | |

|

$1 |

Account types

TD Ameritrade (Charles Schwab) offers standard trading, investment, retirement, savings, and specialized accounts. To start trading with stock market instruments, a trader needs to open a Standard account.

Account types:

The broker provides a demo account called PaperMoney but only through the Thinkorswim trading platform. TD Ameritrade (Charles Schwab) offers a vast array of trading accounts with various functions, which allows traders with any experience and available capital to successfully trade.

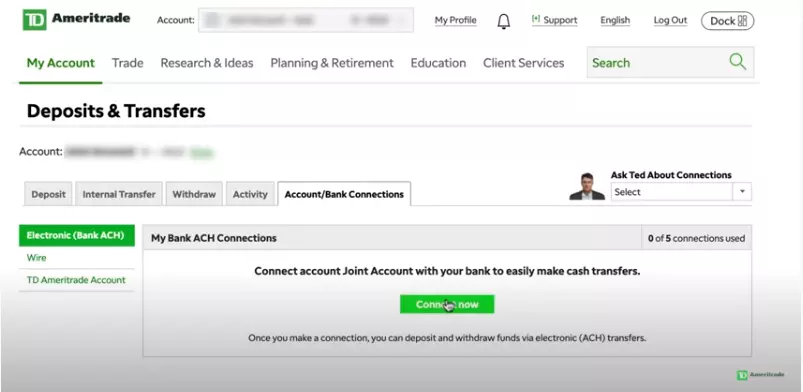

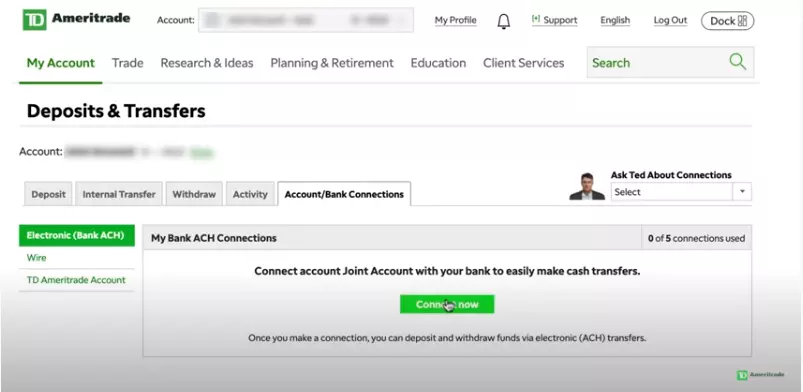

Deposit and withdrawal

-

The broker offers the following methods for depositing and withdrawing funds from accounts: electronic bank transfer via ACH (Automated Clearing House) or wire transfer, transfer of assets from another brokerage company, by check via a mobile application or email, physical certificates of shares.

-

Withdrawals through ACH are commission-free.

-

Additional commissions can be charged by the bank to the sender, the intermediary, and/or the recipient.

-

Verification is a prerequisite for the ability to perform financial transactions on accounts.

-

The terms for crediting funds on the broker's website are not indicated.

Investment Options

The Ameritrade broker allows its clients not only to trade securities but also to invest free capital in stocks, options, ETFs, mutual funds, IPOs, and annuities. The company has developed a range of diversified portfolios managed by investment professionals. Also, TD Ameritrade (Charles Schwab) customers can invest in pensions, special instruments (includes trusts, limited partnerships, small businesses, charitable organizations, etc.), and other accounts for further education.

Selective and managed portfolios

TD Ameritrade (Charles Schwab) invites its clients to invest in managed portfolios and thus diversify possible financial risks. If you want to invest in portfolios, you need to answer several questions regarding the investment goal, risk tolerance, and the planned timing of the placement of funds. Based on the data obtained, TD Ameritrade (Charles Schwab) Investment Management specialists recommend a specific investment solution. Types of portfolio solutions:

-

Selective portfolios. Target portfolios composed of ETFs and mutual funds, adapted to different investment objectives and risk levels, with constant rebalancing and monitoring. Designed for long-term investors looking for more sophisticated strategies and practical expert advice. The minimum investment amount is $25,000. The consultation fee is 0.75-0.90% for the first $100,000, depending on the portfolio and the amount of investment. The investor is provided with a financial advisor and a dedicated support team that regularly provides reports on the effectiveness of the chosen strategy. Also, the investor can track the profitability through a convenient online dashboard.

-

Personalized portfolios. Personalized portfolios are targeted at long-term investors who want personalized advice and asset management services. Account-holders who have invested over $250,000 are assigned a personal finance and portfolio advisor. A comprehensive digital dashboard allows you to track all available investments, goals, and performances not only for TD Ameritrade (Charles Schwab) accounts but also for accounts opened at other financial institutions. The commission fee is 0.60-0.90%.

TD Ameritrade (Charles Schwab) offers investment solutions not only to clients with accumulated experience of passive investments but also to newcomers who need professional support and sound advice.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

TD Ameritrade’s (Charles Schwab) affiliate program

-

Referral program. A partner receives $50 for each attracted client who deposited $3,000 within 90 days from the date of opening an account. A partner can link a maximum of 10 friends and family members per day, but no more than 50 referrals per month.

Not only a partner but also a referral can get from 150 to $1,000 to the account if they top it up with $50,000 or more. The offer is not available for individual retirement accounts (IRA) or for other accounts that are not taxed.

Customer support

Account service and support are available 24/7, with technical support available Monday through Friday, from 7:00 am to 6:00 pm ET.

Advantages

- It is possible to contact the technical support via the trading platform

- Multilingual support

Disadvantages

- There is no online chat on the site

- There is no 24/7 technical support

You can contact the broker's representatives using:

-

calls to international phone numbers specified in the Contact Us section;

-

fax;

-

feedback forms;

-

messengers via Facebook or Twitter;

-

teletype (a service for people with hearing impairments);

-

chat in the trading platform (the function is available in Next-Gen Web Platform, TD Ameritrade (Charles Schwab) Mobile, Thinkorswim (desktop and mobile);

-

personal visit to one of the company's 175 offices in the United States.

Both customers with active accounts and users who are not registered on the company's website can ask for help from technical support specialists.

Contacts

| Foundation date | 1975 |

|---|---|

| Registration address | 200 S 108th Ave, Omaha, NE, USA |

| Regulation | FINRA, SIPC |

| Official site | tdameritrade.com |

| Contacts |

800-454-9272

|

Education

The broker's website has an extensive section on training. Here, a novice trader will find information on the basics of trading in the stock and OTC market, as well as news, useful articles, and a detailed analysis of trading and investment accounts.

Traders can solidify theory into practice by opening and practicing on a demo account on the Thinkorswim platform.

Detailed Review of TD Ameritrade (Charles Schwab)

TD Ameritrade (Charles Schwab) is a US-regulated broker that provides its clients with access to the exchange, over-the-counter (OTC), and foreign exchange markets. The company offers a vast array of investment products, including savings and trust accounts, small business plans, and personalized asset portfolios. TD Ameritrade’s (Charles Schwab) trading platforms are primarily designed for experienced market participants, but a simplistic and user-friendly interface allows novice traders to work with them.

On the success of TD Ameritrade (Charles Schwab) in numbers:

-

Over 46 years of experience in the financial sector and over 23 years in the online services industry.

-

More than 175 brick-and-mortar branches of the company operate in the USA.

-

More than 11 million clients have opened accounts.

-

The total amount of client assets exceeds $1 trillion.

-

Every day, clients make about 500,000 transactions on average.

Ameritrade has a wide range of analytical instruments

Ameritrade is committed to providing a best-in-class experience for independent investors and traders. Clients have free access to in-depth analytics from renowned independent vendors such as Morningstar, CFRA (S&P Capital IQ), and TheStreet. The broker supplies advanced Nasdaq TotalView quotes of the second level and offers unique tools for tracking potentially profitable assets.

A vast array of trading platforms are available to traders with TD Ameritrade (Charles Schwab) accounts. The broker's clients can make transactions in the Web Platform (classic version and more advanced platform of the next generation) and through the applications of TD Ameritrade (Charles Schwab) Mobile. Futures and currency pairs are traded through the Thinkorswim terminal, but they can also be used to trade the stock market and OTC assets.

Useful TD Ameritrade (Charles Schwab) services:

-

Market heat map. An interactive map displays the dynamics and quotes of the main stock indices around the world.

-

Ticker Tape. Up-to-the-minute market analysis and trend reports, brand-new insights from TD Ameritrade (Charles Schwab) experts, and insights from third-party industry professionals.

-

Market Edge. Technical analysis, ratings of thousands of assets, as well as commentary and guidance on stock markets, bond markets, portfolio management, and specific investment opportunities.

-

Screener. A tool to find stocks, options, mutual funds, or ETFs that match user-specified criteria.

Advantages:

Trading is possible from installed desktop and mobile applications. Also, the browser app does not require traders to download software onto their devices as long as they are connected to the internet.

The broker provides top-notch streaming news, market data and free Nasdaq Level II quotes.

Clients receive optimal trading conditions for individual assets.

There is a low fee for consulting investment experts on target portfolio management.

Customer funds are held in bank accounts that are segregated from the capital of the broker.

The broker does not charge a fee for opening an account, providing platforms, supplying market data, inactivity, or depositing and withdrawing funds.

Articles that may help you

Check out our reviews of other companies as well

User Satisfaction i