How To Buy Silver In Zerodha

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to buy silver via Zerodha:

Commodity derivatives trading – trade silver futures and options on MCX with leverage and hedging opportunities.

Silver Exchange-Traded Funds (ETFs) – invest in Silver ETFs that track silver prices without the need for physical storage.

Silver Mutual Funds – gain exposure to silver through mutual funds that invest in Silver ETFs, available without a Demat account.

This article will guide you through the nuances of purchasing silver via Zerodha, detailing the various methods available, the steps involved, and the strategic considerations you should make to optimize your investments.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

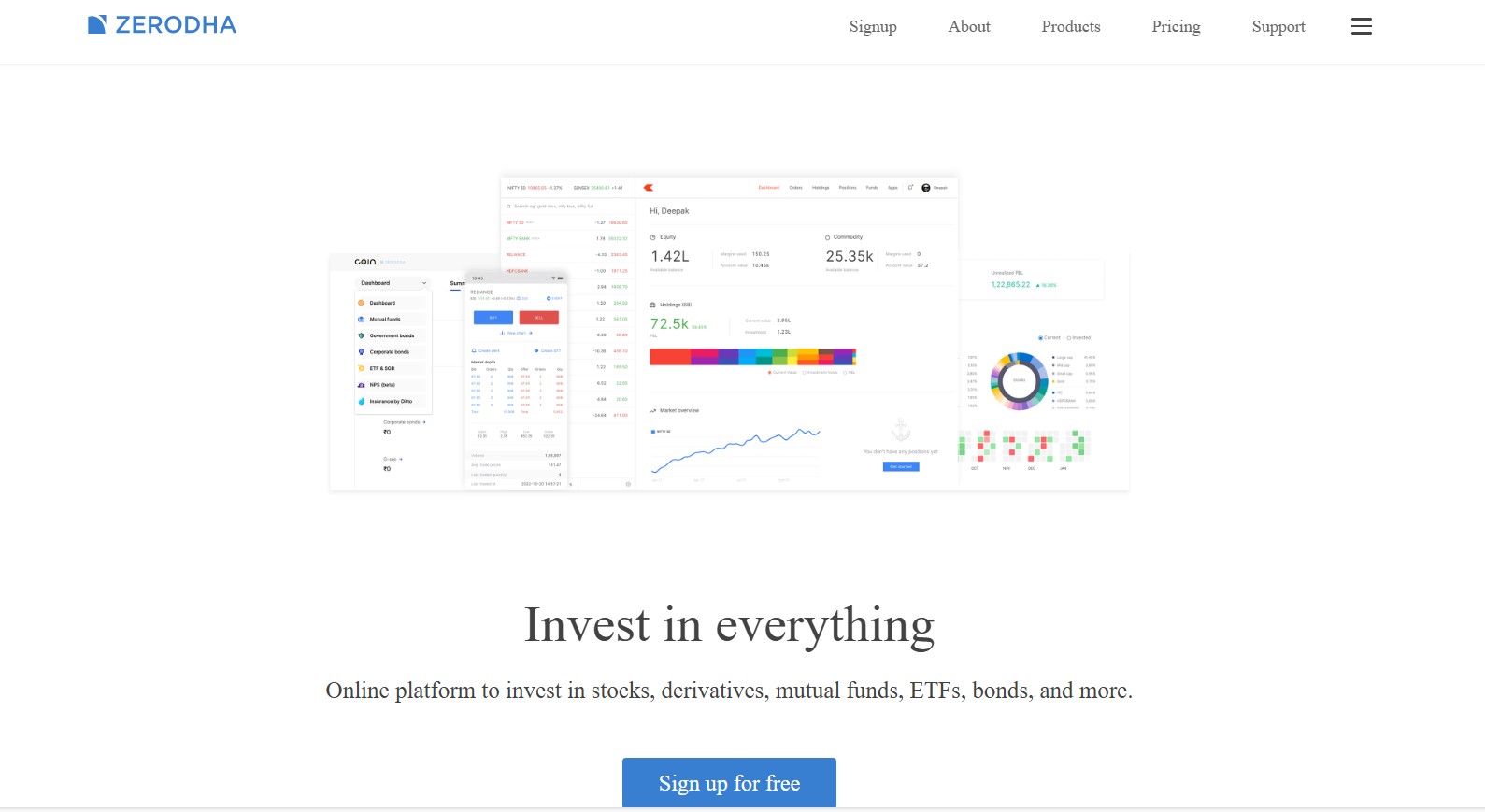

Understanding silver trading on Zerodha

Silver trading on Zerodha is available through different investment options, each designed to suit various investor strategies and market conditions. Zerodha, a leading Indian brokerage firm, provides a structured platform for trading commodities, including silver. Its user-friendly interface and in-depth market insights make it a convenient choice for investors looking to trade silver efficiently.

The primary way to trade silver on Zerodha is through the Multi Commodity Exchange (MCX), where silver is traded in the form of futures contracts. This allows traders to speculate on silver prices without physically owning the metal. Silver futures are highly liquid and offer leverage, making them attractive for short-term trading. However, market volatility increases the risk, requiring traders to have a solid risk management strategy.

Recent updates on Zerodha have streamlined the trading process. Now, traders can use funds from their equity accounts for commodity trading, thanks to the integration of Zerodha Broking Limited's services. This means investors can manage both equity and commodity trades under a single account, making portfolio management more efficient.

This section of our guide explores the mechanics of silver trading on Zerodha, focusing on the trading process, risk factors, and potential advantages. By understanding these key aspects, investors can make informed decisions, diversify their portfolios, and take advantage of opportunities in the silver market.

Methods to buy silver on Zerodha

Investors can gain exposure to silver through futures trading, ETFs, and mutual funds on Zerodha. Each method has its own advantages and drawbacks, making it important to choose based on investment goals and risk appetite.

1. Commodity derivatives trading (silver futures and options)

Zerodha allows trading in silver futures and options listed on the Multi Commodity Exchange (MCX). These contracts offer leveraged exposure to silver price movements.

Available silver contracts on Zerodha

Silver (SILVER). Lot size of 30 kilograms.

Silver mini (SILVERM). Lot size of 5 kilograms.

Silver micro (SILVERMIC). Lot size of 1 kilogram.

How to trade silver futures on Zerodha

Activate the commodity segment. Log in to the Zerodha Console and complete activation by submitting required documents.

Access the Kite platform. Once activated, log in to Kite for trading.

Add silver contracts. Search for the contract (SILVER, SILVERM, or SILVERMIC) and add it to the watchlist.

Place orders. Choose the contract, specify the quantity, select the order type (limit or market), and place a buy or sell order.

- Pros

- Cons

High leverage. Requires only a fraction of the total contract value as margin.

Profit from both rising and falling prices. Traders can go long or short.

No storage costs. Eliminates the need to hold physical silver.

High risk. Leverage can amplify both gains and losses.

Expiry concerns. Futures contracts have fixed expiration dates.

Regulatory restrictions. Physical delivery is mandatory for some contracts.

2. Silver exchange-traded funds (ETFs)

SilverETFs are an easy way to invest in silver without dealing with futures contracts. These funds track silver prices and are traded on stock exchanges like regular shares.

Popular silver ETFs on Zerodha

Zerodha silver ETF. This ETF invests primarily in physical silver with a purity of 99.9 percent.

Nippon India silver ETF fund of fund (FOF). Indirectly invests in silver through an ETF.

Tata silver ETF fund of fund. Another FOF that invests in Tata silver ETF.

How to invest in silver ETFs via Zerodha

Using Coin by Zerodha. Zerodha’s mutual fund platform allows investors to buy ETF units easily.

Through the Kite platform. After listing, silver ETFs can be traded like regular stocks.

- Pros

- Cons

No storage concerns. Investors do not need to hold physical silver.

High liquidity. Can be bought and sold anytime during market hours.

Lower risk than futures. Ideal for long-term investors.

Expense ratio. Some ETFs charge management fees.

No leverage. Unlike futures, ETFs do not offer margin trading.

Tracking errors. ETFs may not always perfectly match silver price movements.

3. Silver mutual funds

Silver mutual funds invest in silver-related assets, providing diversified exposure. These funds are managed by professionals and can include physical silver, mining stocks, or silver-backed ETFs.

How to invest in silver mutual funds on Zerodha

Use Coin by Zerodha. Log in to the Coin platform and search for silver-based mutual funds.

Select a fund. Compare past performance, expense ratios, and investment strategy before investing.

- Pros

- Cons

Professional management. Fund managers handle investment decisions.

Diversification. Some funds invest in both physical silver and mining companies.

Good for long-term investors. No need for active trading.

Higher expense ratios. Management fees can reduce returns.

No intraday trading. Unlike ETFs, mutual funds are not tradable in real time.

Lock-in period. Some funds have restrictions on early withdrawals.

Taxation and charges

Short-term capital gains (STCG). Profits from silver holdings for less than one year are taxed as per income tax slabs.

Long-term capital gains (LTCG). Profits from holdings beyond one year are taxed at 12.5 percent.

Brokerage fees. Zerodha charges 0.03 percent or ₹20 per executed order, whichever is lower, for commodity futures and options.

Step-by-step guide to buying silver on Zerodha

Buying silver through Zerodha is a straightforward process, thanks to its intuitive platform, Kite. Here’s a detailed guide to help you navigate the steps:

Log in to your Zerodha account. Start by logging into your Zerodha Kite account. If you don’t have an account, you'll need to create one. This involves providing your personal details, completing KYC (Know Your Customer) requirements, and setting up your trading profile.

Activate the commodity segment. If you haven’t already activated the commodity trading segment in your Zerodha account, you need to do this before you can trade silver. Go to the “Profile” section of your dashboard, select “Segment Activation”, and choose “Commodities”. You may be required to provide additional financial information and documentation to complete this step.

Add funds to your account. Ensure you have sufficient funds in your account to cover your silver trades. Transfer funds into your trading account using the “Funds” section on the dashboard. Remember, the funds should be available in the commodity segment of your account.

Search for silver instruments. In the Kite search bar, type “Silver” to find available instruments, such as silver futures (e.g., SILVERM, SILVERMIC), which are commonly traded on the MCX.

Place your order. Once you select the appropriate silver instrument, you can place an order. Choose between different types of orders, such as market orders, limit orders, or stop-loss orders, depending on your trading strategy. Specify the quantity (e.g., number of lots) and the price at which you wish to buy.

Review and execute. Review your order details to ensure everything is correct. Once you’re satisfied, execute the order by clicking “Buy” or “Sell” depending on your intent. Your order will then be processed according to the current market conditions and the specifics of your order type.

Monitor your investment. After purchasing silver, monitor your investment through the “Positions” tab on your Kite dashboard. This will help you manage your position according to market movements and your investment strategy.

This section of the article aims to demystify the process of buying silver on Zerodha, making it accessible even to those new to commodity trading. By following these steps, you can engage confidently in silver trading, taking advantage of market opportunities as they arise.

Best Forex brokers for silver trading

Choosing the right broker is crucial when trading silver, especially through contracts for difference (CFDs). Here’s a comparative analysis of several leading Forex brokers in India that offer silver trading on their platforms.

| Silver | Min. deposit, $ | Deposit fee, % | Withdrawal fee, % | Demo | Regulation | Open an account | |

|---|---|---|---|---|---|---|---|

| Yes | 100 | No | No | Yes | ASIC, SCB, CySEC, FCA | Open an account Your capital is at risk. |

|

| Yes | 5 | No | No | Yes | CySEC, FSC (Belize), DFSA, FSCA, FSA (Seychelles), FSC (Mauritius) | Open an account Your capital is at risk. |

|

| Yes | 10 | No | 0-4 | Yes | FSC | Open an account Your capital is at risk. |

|

| Yes | 10 | No | No | Yes | FCA, CySEC, FSA (Seychelles), FSCA, BVI FSC, CBCS, CMA | Open an account Your capital is at risk.

|

|

| Yes | 100 | No | 1-3 | Yes | ASIC, FSCA, FSC Mauritius | Open an account Your capital is at risk. |

|

| Yes | 10 | No | No | Yes | SVGFSA | Open an account Your capital is at risk. |

|

| Yes | 5 | No | No | Yes | MISA | Open an account Your capital is at risk. |

Legal and regulatory considerations for trading silver in Zerodha

Trading silver, like any commodity, is subject to various legal and regulatory considerations that can significantly impact the strategy and operations of traders. Here's what you need to know when trading silver through platforms like Zerodha:

Regulatory oversight

In India, commodity trading, including silver, is regulated by the Securities and Exchange Board of India (SEBI). SEBI oversees the activities of commodity exchanges like the Multi Commodity Exchange (MCX), ensuring that trading is conducted transparently and fairly.

Compliance with SEBI regulations is mandatory. These rules cover aspects from the accreditation of traders to the reporting of transactions. Non-compliance can result in penalties or suspension from trading.

Tax implications

Profits from silver trading are subject to tax under the Income Tax Act, 1961. Depending on the holding period, profits can be classified as either short-term capital gains (STCG) or long-term capital gains (LTCG), with different tax rates applying to each.

STCG on silver trading is taxed at the normal income tax rates applicable to the trader, while LTCG is taxed at a lower rate if the investment is held for more than three years.

Compliance requirements

Traders need to ensure compliance with Know Your Customer (KYC) norms when opening an account on platforms like Zerodha. This involves submitting personal identification and address proof to prevent fraud and meet anti-money laundering regulations.

Periodic updates and verifications may be required to keep the trading account active.

Exchange rules and regulations

The MCX stipulates specific rules regarding the trading of silver, including contract specifications, margin requirements, and trading hours. Traders must familiarize themselves with these details to ensure they do not inadvertently violate exchange policies.

Failure to adhere to exchange rules can result in fines, trading restrictions, or other disciplinary actions.

Contract specifications and delivery

Silver contracts on MCX come in various sizes:

Silver (30 kg). Standard contract with mandatory physical delivery upon expiry.

Silver Mini (5 kg). Offers both cash and physical settlement options.

Silver Micro (1 kg). Also provides both settlement options.

Timing and strategy: The key to smart silver trading on Zerodha

Most beginners think buying silver on Zerodha is as simple as picking an ETF or futures contract, but the real trick is knowing when to enter. Commodity margins change based on market volatility, meaning if you buy at the wrong time, you might need way more capital than necessary. A common mistake traders make is jumping in when margins are high, only to get hit with extra margin calls. A smarter move is to wait until volatility cools down, as exchanges lower margin requirements after sharp price swings. This simple strategy can help you enter trades with less capital and reduce the chances of your position getting forcefully closed.

Another key factor that most traders ignore is how silver prices move in global markets before the Indian market even opens. Silver is traded worldwide, and big price swings often happen in the US or London markets while India is asleep. If you're not tracking these movements, you could end up buying high or selling low when the Indian market reacts the next day. Instead of blindly placing orders, keep an eye on international silver prices and wait for price pullbacks during Indian market hours. This way, you're not just reacting to price moves — you’re planning your entries for the best possible price.

Conclusion

Investing in silver through Zerodha offers diverse opportunities, catering to different trading styles and risk appetites. This guide has walked you through the essential aspects of silver trading on Zerodha, from understanding the platform's capabilities to navigating the legal and regulatory frameworks. Whether opting for physical silver, ETFs, futures, or digital formats, each method presents unique advantages and challenges.

Effective silver trading requires not only an understanding of these methods but also a strategic approach to market analysis, regulatory compliance, and risk management. By leveraging Zerodha's comprehensive tools and staying informed about market trends and legal requirements, traders can enhance their potential for success in the commodities market.

FAQs

How can I start trading silver on Zerodha?

To start trading silver on Zerodha, first, ensure that your commodity trading segment is activated on your Zerodha account. You'll need to log into the Kite platform, navigate to your profile, and activate the commodity segment if it hasn't been activated already. After that, you can add funds to your account and begin trading silver using the various instruments available on the MCX.

What types of silver can I trade on Zerodha?

On Zerodha, you can trade silver in the form of futures contracts on the MCX. These contracts are available in different sizes (e.g., Silver Micro, Silver Mini, and Silver), allowing traders of all volumes to participate.

Are there any specific risks involved in trading silver on Zerodha?

Yes, trading silver, like all commodity trading, involves risks. The price of silver can be highly volatile, influenced by global economic conditions, currency fluctuations, and changes in supply and demand. Leveraged products like futures can amplify both gains and losses, so it’s important to understand the risks and your own risk tolerance.

What are the trading hours for silver on Zerodha?

Silver trading on the MCX via Zerodha is available from Monday to Friday, starting at 9:00 AM and closing at 11:30 PM or 11:55 PM, depending on daylight saving time adjustments.

Related Articles

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).