Best Silver Stocks To Buy Now

Top commission-free stock broker - eToro

The top 7 silver stocks and mining companies to invest are:

-

1

Pan American Silver - (NYSE: PAAS) – Consistent dividends, significant silver reserves, sustainable mining.

-

2

Wheaton Precious Metals - (NYSE: WPM) – Precious metals streaming, global reach, strong financials.

-

3

First Majestic Silver Corp. - (NYSE: AG) – Productive mines, undervalued stock, strategic growth initiatives.

-

4

Americas Gold and Silver Corporation - (NYSE: USAS) – Multiple assets, commercial production, operational resilience.

-

5

Hecla Mining Company - (NYSE: HL) – Over 130 years of history, robust financial performance, strategic locations.

-

6

Fortuna Silver Mines Inc. - (NYSE: FSM) – Strong Q3 2023 performance, diversified portfolio, commitment to sustainability.

-

7

Endeavour Silver Corp - (NYSE: EXK) – Dual prospects for growth, strategic vision, commitment to sustainability.

In this article, TU experts delves into the domain and analysis of silver stocks and investments, exploring the top companies, their financial performance, and the factors influencing silver mining stocks in the middle term. From strategic initiatives to unique business models, the experts analyze opportunities and risks, guiding investors through the dynamic world of precious metals. Whether you're a seasoned investor or new to silver, this guide covers various aspects, offering valuable information on stock analysis, benefits, and risks associated with investing in silver mining.

-

Should I keep silver in my portfolio?

Yes, silver can be a valuable addition to a portfolio due to its role as a hedge against inflation and economic uncertainties. Consider diversifying with a mix of physical silver, silver stocks, or ETFs.

What are silver stocks and investments?

Silver stocks and investments involve buying shares in companies engaged in the exploration, mining, and production of silver. This approach allows investors to tap into the silver market without physically owning the precious metal. There are various avenues for investing in silver stocks, including purchasing individual stocks, investing in exchange-traded funds (ETFs), or opting for mutual funds focused on silver stocks.

Silver is widely recognized as a store of value and a hedge against economic uncertainties and inflation. Its value tends to rise during periods of increasing living costs, making it a valuable tool for safeguarding against inflation. Additionally, Silver exhibits a negative correlation with stocks and other financial instruments, making it a diversifying investment.

Beyond its role in financial portfolios, silver is often considered a crisis asset, maintaining its value during times of financial and geopolitical instability. This characteristic further enhances its appeal to investors seeking stability and preservation of wealth amid uncertain conditions. Maybe, you are also interested in information about whether silver will ever reach $100 an ounce.

Top silver stocks to invest in

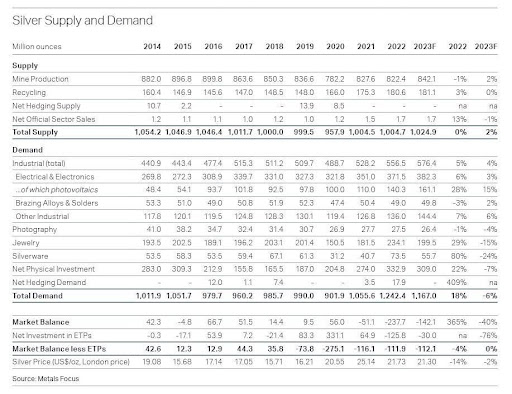

Metal Focus

The table reveals a convincing case for investing in silver due to a consistent increase in demand across various sectors. Industrial demand, notably in electronics and photovoltaics, has been rising steadily. Additionally, there's a notable uptrend in net physical investment, reflecting growing interest in silver as a tangible asset. These factors, coupled with the positive trajectory of total demand, suggest potential investment opportunities for investors and traders.

On November 8, 2023, a report from Oxford Economics, a reputable economic advisory firm in London, shed light on the dynamic landscape of global silver demand. The study, titled "Fabrication Demand Drivers for Silver in the Industrial, Jewelry, and Silverware Sectors Through 2033," commissioned by the Silver Institute, provides insights into the significant sectors fueling annual silver consumption.

In 2022, industrial, jewellery, and silverware sectors emerged as the driving forces, collectively constituting nearly three-quarters of the global silver demand. This contrasts with the sturdy 27 percent attributed to investment demand.

Looking forward, the report predicts a 46 percent increase in the need for silver in industries, with jewellery and silverware also going up by 34 and 30 percent.

The report says that the combined production of companies making things with silver is expected to go up by 42 percent, which is twice as fast as it grew in the last ten years (from 2014 to 2023). The report also talks about the growing need for silver in brazing alloys, which made up 9 percent of the world's demand in 2022.

Based on the positive outlook for increased silver demand, experts have highlighted top silver stocks as promising investment opportunities below

| Stock name | Dividend yield | Forward P/E ratio | EPS growth next 5 year |

|---|---|---|---|

|

Pan American Silver |

2.65% |

18.76 |

NA |

|

Wheaton Precious Metals |

1.26% |

36.3 |

4.90% |

|

First Majestic Silver Corp. |

0.46% |

21.14 |

46.80% |

|

Americas Gold and Silver Corporation |

NA |

NA |

NA |

|

Hecla Mining Company |

0.64% |

58.77 |

NA |

|

ColumnValue1 |

NA |

13.73 |

NA |

|

ColumnValue1 |

NA |

30.48 |

NA |

Pan American Silver (NYSE: PAAS)

Investing in Pan American Silver (PAAS) seems like a smart move for a few key reasons. This Canadian mining company, specializing in silver exploration, has been consistently paying dividends for 13 years, showing a commitment to giving back to investors. Right now, the dividend yield is at 2.65%, which is a good sign for potential returns.

Experts are feeling positive about PAAS, giving it a 12-month stock price forecast of $22, suggesting a potential increase of almost 50.89%. Overall, it's generally considered a buy, which indicates confidence in its future performance.

What makes PAAS stand out is its significant silver reserves and efforts to grow silver production. They're putting $14.0 million into the La Colorada Skarn project, showing they're serious about exploration and economic progress. The ongoing work on the ventilation shaft at La Colorada is a big investment expected to improve mine conditions by mid-2024.

PAAS is also making strides in responsible and sustainable mining, like engaging with the Xinka Indigenous representatives in Guatemala. With the recent acquisition of Yamana Gold, PAAS is set to up its production of both silver and gold.

Wheaton Precious Metals (NYSE: WPM)

As a top-notch precious metals streaming company, WPM provides upfront capital to mining companies, helping them avoid tapping into capital markets and boosting project returns. This benefits shareholders with high cash operating margins, a competitive dividend, and potential growth through smart acquisitions.

Wheaton's global reach is evident in the successful completion of the Salobo III expansion project in Brazil, showcasing increased reliability and strong performance. Strategic agreements to acquire existing royalty streams on projects like Ivanhoe Mines’ Platreef and BMC Minerals’ Kudz Ze Kayah highlight their growth-oriented approach.

Financially, WPM is doing well, with the recent third-quarter report showing adjusted earnings per share exceeding estimates and a 29% year-over-year increase. Their ability to generate revenue without incurring interest costs during the investment period, combined with a commitment to ESG principles, makes Wheaton Precious Metals an appealing investment.

First Majestic Silver Corp. (NYSE: AG)

Operating in Mexico and the United States, the Canadian company oversees four productive mines, including San Dimas Silver/Gold Mine, Santa Elena Silver/Gold Mine, La Encantada Silver Mine, and Jerritt Canyon Gold Mine.

At a current stock price of $5.47, the market suggests an undervaluation, making it an attractive prospect for investors eyeing potential growth. Despite temporary operational suspensions and slightly reduced production at certain mines, the company reported an encouraging average realized price of $22.41 per AgEq ounce in Q3 2023, marking a 14% increase from the same period in 2022.

First Majestic's mine operating earnings notably improved to $13.0 million, a significant jump from $3.3 million in Q3 2022.

While a net loss was reported for the quarter, largely due to restructuring costs, adjusted net earnings, excluding non-cash or non-recurring items, painted a more favorable picture. With a robust cash balance of $257.3 million as of September 30, 2023, including $138.3 million in cash and cash equivalents, First Majestic is well-prepared for future growth. The recent establishment of a minting facility and plans to sell 700,000 ounces of silver in 2024 further highlight the company's commitment to expanding revenue streams.

Americas Gold and Silver Corporation (NYSE: USAS)

The company, with multiple assets in North America, operates the Relief Canyon mine in Nevada, the Cosalá Operations in Sinaloa, Mexico, and manages the Galena Complex in Idaho, USA. The recent declaration of commercial production at Relief Canyon and the strategic positioning of its mining operations underscore the potential for growth.

In Q3-2023, despite macroeconomic challenges, the company reported revenues of $18.3 million, reflecting higher silver production and prices from the Galena Complex. The net loss of $10.5 million, a significant improvement from the prior year, was mainly due to a decrease in net loss attributed to the recognition of an impairment in the previous period. With consolidated attributable production of approximately 1.0 million ounces of silver equivalent, Americas Gold and Silver Corporation demonstrates operational resilience.

The ongoing development in the San Rafael Upper Zone and Zone 120, coupled with discussions for concentrate prepayment financing for the EC120 Project at the Cosalá Operations, signals a commitment to future growth. Despite challenges in Q3-2023, the company's silver production guidance for 2023 remains steady, and expectations for consolidated silver equivalent production to further increase in 2024 demonstrate a positive outlook.

Hecla Mining Company (NYSE: HL)

With over 130 years of operational history, Hecla has consistently delivered value to its shareholders, showcasing its resilience and experience in the industry.

The company's robust financial performance is evident in its Q3-2023 results, with a reported adjusted loss per share of one cent, outperforming the Zacks Consensus Estimate of two cents. Hecla's revenues surged by 25% year-over-year, reaching around $182 million, driven by higher realized prices for gold, silver, lead, and zinc. Exploration and pre-development activities, particularly at key sites like Greens Creek, Keno Hill, Casa Berardi, and Aurora, highlight Hecla's commitment to future growth.

Financially, Hecla is in a solid position, ending Q3-2023 with $100.7 million in cash. The average one-year price forecast for Hecla Mining stands at $6.20 representing a substantial potential upside of 47.43% from the current share price. However on the upside the price can even move to $9.

Hecla Mining Company stands as one of the largest silver producers in the United States, with operating mines in strategic locations and exploration properties in world-class mining districts.

Fortuna Silver Mines Inc. (NYSE: FSM)

Investing in Fortuna Silver Mines Inc. (FSM) presents a compelling opportunity in the precious metals mining sector, evident from the company's strong performance in Q3 2023. Net income reached an impressive $27.5 million or $0.09 per share, showing substantial growth from Q2 2023. Fortuna's financial strength is highlighted by adjusted net income and EBITDA at $29.6 million and $104.6 million, respectively.

Operational success is reflected in silver production of 1,680,751 ounces, marking a significant increase from the previous quarter. The integration of Séguéla Mine and the acquisition of Chesser Resources Limited with its Diamba Sud project showcase Fortuna's commitment to growth and development.

Looking ahead, the average stock price forecast for 2024 is projected to be $6.56, indicating a substantial 79.72% potential increase from the current price of $3.65. Fortuna's diversified portfolio, commitment to sustainability, environmental responsibility, and social engagement further enhance its investment appeal.

Endeavour Silver Corp (NYSE: EXK)

Investing in Endeavour Silver Corp (NYSE: EXK) presents a promising opportunity in the precious metals mining sector. The company, specializing in silver and gold mining, stands out with its dual prospects of near and long-term growth, supported by a stable production platform. Endeavour's recent financial and operational updates highlight its resilience and strategic vision.

The key growth project, a third mine in Mexico, is on track, securing funding and targeting production commencement by the end of 2024. This project, expected to be Endeavour's largest mine, has the potential to double the annual production, significantly contributing to the company's future success.

Financially, Endeavour Silver Corp boasts a market capitalization of $402.16 million, with robust revenues of $236.95 million and a net income of $11.04 million. The Q3 2023 results indicate that the company is aligning with its annual guidance, producing 1,148,735 silver ounces and 9,089 gold ounces. The Terronera project's construction progress nearing 40% further highlights Endeavour's commitment to growth.

What will influence silver mining stocks in the middle term

Experts have explored the diverse factors influencing silver mining stocks in the mid-term, from cost challenges and global business risks to the impact of innovative financing, and silver's versatility in various industries, providing valuable insights for traders in this dynamic market in the below table.

| Factors | Description |

|---|---|

Global Business Risks |

Location choice for mining operations is crucial. Changes in taxes and regulations, especially in resource-rich countries like Australia and Chile, can impact profitability. |

|

Capital Project Management |

Fluctuating commodity prices and demand pose challenges for capital projects. Assessing how well companies manage risks associated with these projects is crucial for consistent production. |

|

Innovative Financing |

Silver mining companies may struggle to find capital for growth despite cash reserves. Investors should look at efforts to secure alternative funding and access foreign markets. |

|

Silver's Versatility |

Silver's demand in electronics, solar panels, industries, and healthcare impacts prices. Understanding its versatility is key for investors in predicting market movements. |

|

Currency Movements |

Changes in the strength of the U.S. dollar, in which silver is priced, influence silver prices. A weaker dollar often makes silver more attractive to investors. |

|

Interest Rates |

Silver tends to move inversely with interest rates. Lower interest rates can make non-interest-bearing assets like silver more attractive to investors. |

|

Inflation Hedge |

Silver's historical role as an inflation hedge attracts investors during rising inflation. Its enduring value in the face of inflation adds to its investment appeal. |

Best stock brokers

How to choose silver stocks to buy?

Selecting appropriate stocks is crucial for making potential gains. Experts have listed down the stages to be considered before choosing silver stocks.

| Stage | Key Aspect | Description |

|---|---|---|

Research the Company |

History and Management |

Investigate the company's history, leadership, and the management team's qualifications to assess the company's potential. |

Financial Performance |

Scrutinize financial statements for revenue, profit margins, and debt levels to gauge the company's financial stability. |

|

Analyze the Market |

Market Trends |

Stay informed about market trends affecting silver prices by monitoring financial news, stock market indices, and economic indicators. |

External Factors |

Consider external factors like geopolitical events or economic indicators that may influence silver prices for informed investment decisions. |

|

Mining Operations |

Quality and Scale |

Evaluate the quality, scale, and productivity of the company's mining operations, considering factors like location for indicators of potential success. |

Safety and Environmental Practices |

Examine the company's mining methods, safety protocols, and environmental policies for responsible practices contributing to sustainable and ethical investments. |

|

Financial Performance Assessment |

Balance Sheet Analysis |

Delve into the balance sheet, income statement, and cash flow statement to assess debt levels, revenue trends, and profit margins for insights into financial health. |

Profitability Metrics |

Examine metrics like return on equity (ROE) and earnings per share (EPS) to understand the company's profitability and efficiency. |

|

Management Team Evaluation |

Experience and Qualifications |

Research the management team's experience and qualifications, as a competent and seasoned team is crucial for effective decision-making and execution. |

Financial |

Red Flags |

Look out for red flags such as lawsuits or regulatory violations associated with the management team, which may indicate potential risks. |

Risk Mitigation |

Diversification |

Mitigate risk by diversifying your investment portfolio with a mix of silver stocks and other assets, enhancing the potential for returns. |

Consultation with Advisor |

Seek advice from a financial advisor before making investment decisions to gain valuable insights tailored to your financial goals and risk tolerance. |

Benefits and risks of investing in silver mining companies

Experts have discussed below the benefits and risks associated with investing in silver mining companies

Benefits

Portfolio Diversification

Silver mining stocks contribute to portfolio diversification, reducing overall risk. Their low correlation with the broader stock market makes them a valuable addition, providing a different risk profile compared to traditional equities.

Higher Liquidity

Compared to physical silver, investing in silver mining stocks offers higher liquidity. Investors can buy and sell stocks more easily, providing flexibility in managing their investment positions.

Protection Against Inflation

Similar to gold, silver is seen as a hedge against inflation. Investing in silver mining companies provides investors with protection against the erosion of purchasing power that may result from inflationary pressures.

Risks

Price Volatility

Silver prices are known for their unpredictable swings. Global economic conditions, market speculation, and geopolitical events can cause rapid fluctuations, introducing volatility and risk for investors.

Operational Risks

Mining operations face various risks, including accidents, labor disputes, and natural disasters. These operational challenges can disrupt a company's production and impact its financial performance.

Exploration and Production Risks

Mining companies deal with uncertainties related to exploration success, production efficiency, and the development of new mining projects. Delays or setbacks in these areas can affect a company's growth potential.

Regulatory and Environmental Risks

The mining industry is subject to various regulations, and evolving environmental policies can impact mining operations. Adhering to changing standards poses challenges for mining companies.

Silver stocks vs Silver ETFs: What to choose?

| Consideration | Silver Stocks | Silver ETFs |

|---|---|---|

Nature of Investment |

Shares in silver mining companies |

Investment funds tracking the price of silver |

Influencing Factors |

Company-specific factors, global economic conditions |

Supply and demand, geopolitical risks, global economic conditions |

Liquidity and Tradability |

Less liquid compared to ETFs, influenced by company performance |

More liquid and tradable like stocks, influenced by silver price movements |

Investor Type |

Pro investors with ability to analyze specific companies |

Beginners seeking simplicity and diversification |

Diversification and Research |

Requires thorough research on individual companies |

Provides diversification without complexities of individual stocks |

Glossary for novice traders

-

1

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

2

Investor

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

-

3

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

4

Diversification

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

-

5

Volatility

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).