According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $10

- MT4

- MT5

- SVGFSA

- 1994

Our Evaluation of TeleTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

TeleTrade is one of the top brokers in the financial market with the TU Overall Score of 8.6 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by TeleTrade clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the broker’s clients are fully satisfied with the company.

TeleTrade is a broker for traders who value the variety of trading instruments and trade using their PC or a mobile app. The company is a good broker both for beginners and experienced traders.

Brief Look at TeleTrade

TeleTrade is a global broker serving clients worldwide. They offer trading on Forex, indices, stocks, metals,cryptocurrencies, and energies. While lacking PAMM accounts and certain investment options, TeleTrade boasts a robust copy trading service, a strong affiliate program, and diverse account types (ECN, NDD, crypto). With sufficient leverage (up to 1:1000) and spreads from 0 pips, the broker caters to various trading styles, including scalping, intraday trading, and medium to long-term strategies.

TeleTrade supports traders with market analytics, expert forecasts, an economic calendar, and a comprehensive education section on their website.

We've identified your country as

US

We have thoroughly analyzed all companies legally providing trading services in your country and created a ranking of the best ones. Our analysis highlights companies that offer optimal working conditions, uphold a strong reputation, and consistently receive the highest number of positive reviews from traders on our website.

Explore the 5 top-rated companies in

US :

- detailed analytical section;

- informative training section;

- Invest Start risk-free investment service;

- interest accrual on deposit;

- copytrading service;

- several affiliate programs with high payouts.

- no PAMM accounts or other money management options;

- few withdrawal options;

- support is available 24/5;

- withdrawals delayed;

- technical support responds slowly;

- sometimes it takes a long time to verify data.

TU Expert Advice

Author, Financial Expert at Traders Union

TeleTrade provides a variety of trading services, including access to Forex, indices, stocks, metals, cryptocurrencies, and energies through MT4 and MT5 platforms. The company supports trading with three account types, offering a broad range of financial instruments and accommodating different trading styles with copy trading and a minimum deposit of $10.

However, TeleTrade has several drawbacks, including limited withdrawal options and slow data verification. Client support is available only 24/5. Regulation by the SVG FSA, not a Tier-1 authority, may concern more risk-averse traders. Despite these disadvantages, TeleTrade may be suitable for individuals looking for diverse trading instruments and educational resources, but it may not meet the needs of traders prioritizing stringent regulation and immediate support.

- You are mostly interested in CFDs. In addition to currency pairs, TeleTrade provides access to trading CFDs. The broker’s clients can trade CFDs on U.S. and EU stocks, indices, agricultural commodities, energies, precious metals, cryptocurrencies, and ETFs.

- You want to have access to expert analytics and multiple tools. The website provides calculators, calendars, newsfeeds, analytics, technical analysis, and the broker’s proprietary SignalCenter.

- You require full transparency before registration. The broker claims it has floating spreads from 0.2 pips and low trading fees, but it doesn’t provide exact information on these and other parameters on its website.

- You aim at additional income without participating in an affiliate program. TeleTrade’s clients can only participate in a standard referral program, as PAMM/MAM accounts are not available.

TeleTrade Trading Conditions

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, МТ5 |

|---|---|

| 📊 Accounts: | ECN, NDD, CENT, Demo |

| 💰 Account currency: | Euro, dollar |

| 💵 Deposit / Withdrawal: | Visa, MasterCard, Skrill, Neteller, Fasapay e-wallets, Crypto, P2P and bank transfer |

| 🚀 Minimum deposit: | USD 10 |

| ⚖️ Leverage: | 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 lots |

| 💱 EUR/USD spread: | 0,2 pips |

| 🔧 Instruments: | Forex, metals, indices, energies, stocks, cryptocurrencies, ETF, Bonds |

| 💹 Margin Call / Stop Out: | 70% / 20% |

| 🏛 Liquidity provider: | Thomas Reuters |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Order execution: | Market Execution |

| ⭐ Trading features: | Cryptocurrency trading; Social trading; Cashback 10%; Negative Balance Protection |

| 🎁 Contests and bonuses: | Yes |

TeleTrade offers its clients rather enticing trading conditions. The minimum trade volume is 0.01 lots for all trading accounts, and the minimum spread is 0.2 pips. The minimum deposit is $10. The company's clients can trade on three types of real accounts, as well as copy trades of experienced traders. The broker offers wide range of financial instruments: in addition to currency pairs, you can trade indices and cryptocurrencies.

TeleTrade Key Parameters Evaluation

Video Review of TeleTrade

Share your experience

- Best

- Last

- Oldest

Ferrara

Ferrara Accurate and efficient

None

Catania

Catania Everything’s clear and the platform is easy to use.

Financial conditions can change quickly

Kyiv

Kyiv Fast and clear customer support, high-quality educational resources and market analytics, helpful website with regular news and analysis

Requires time investment to go through all the educational materials

Italy Orvieto

Italy Orvieto The trading conditions are solid, Everything is clear: first confirmation, then processing, and the funds are quickly transferred.

Spreads aren’t the tightest on the market,

Italy

Italy Flexibility in setting up synchronous (copy) trading Ability to control risk by adjusting the copying ratio Real-time monitoring of trader actions Opportunity to learn through observation and practice Suitable for growing as a trader while using expert support

Financial conditions can change quickly

Romania Iași

Romania Iași Reliable license and quality analytics

Haven’t found any significant drawbacks

Estonia Tallinn

Estonia Tallinn For me, the main advantage of TeleTrade is the length of its work on the market. 30 years of work deserve respect and trust.

I didn't find any, there are all the necessary services for trading.

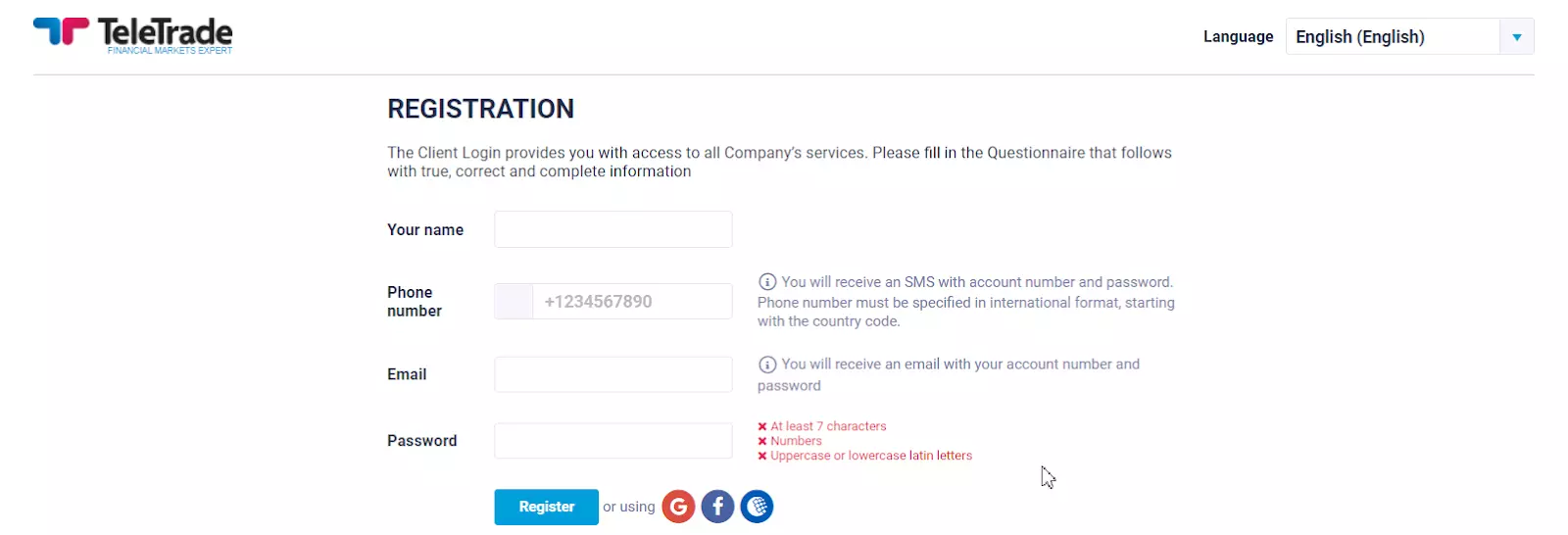

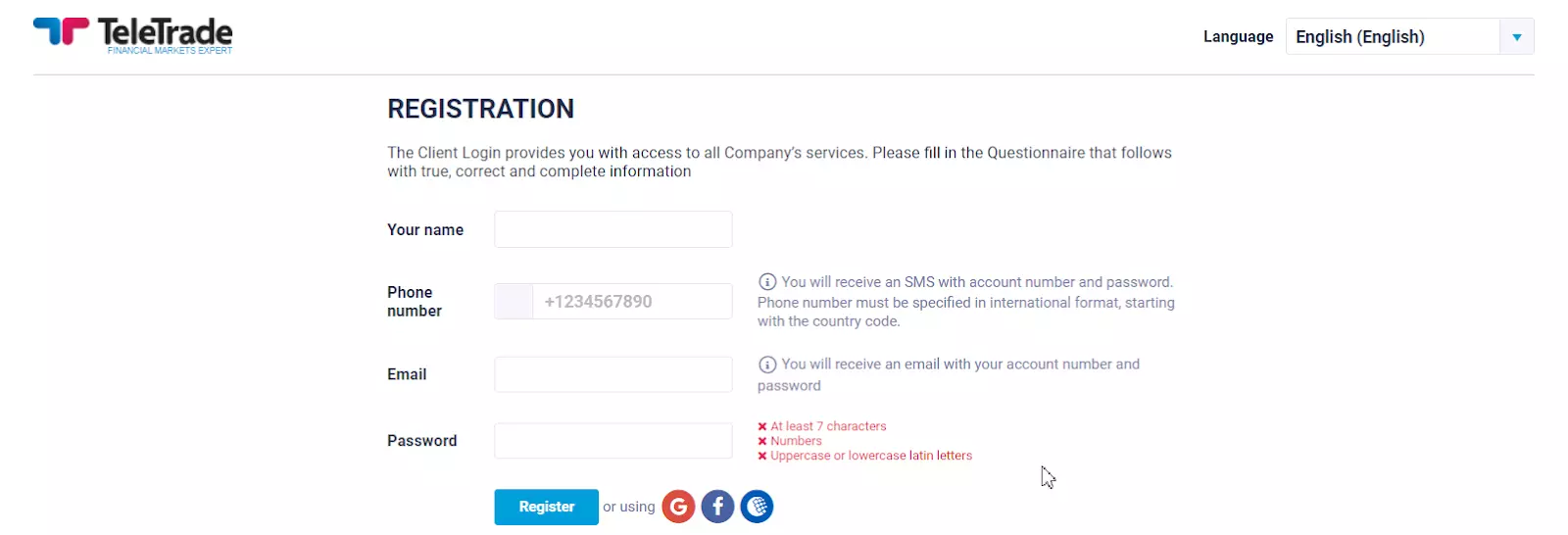

Trading Account Opening

In order to make it easier for you to start working with TeleTrade, we suggest that you learn the following information:

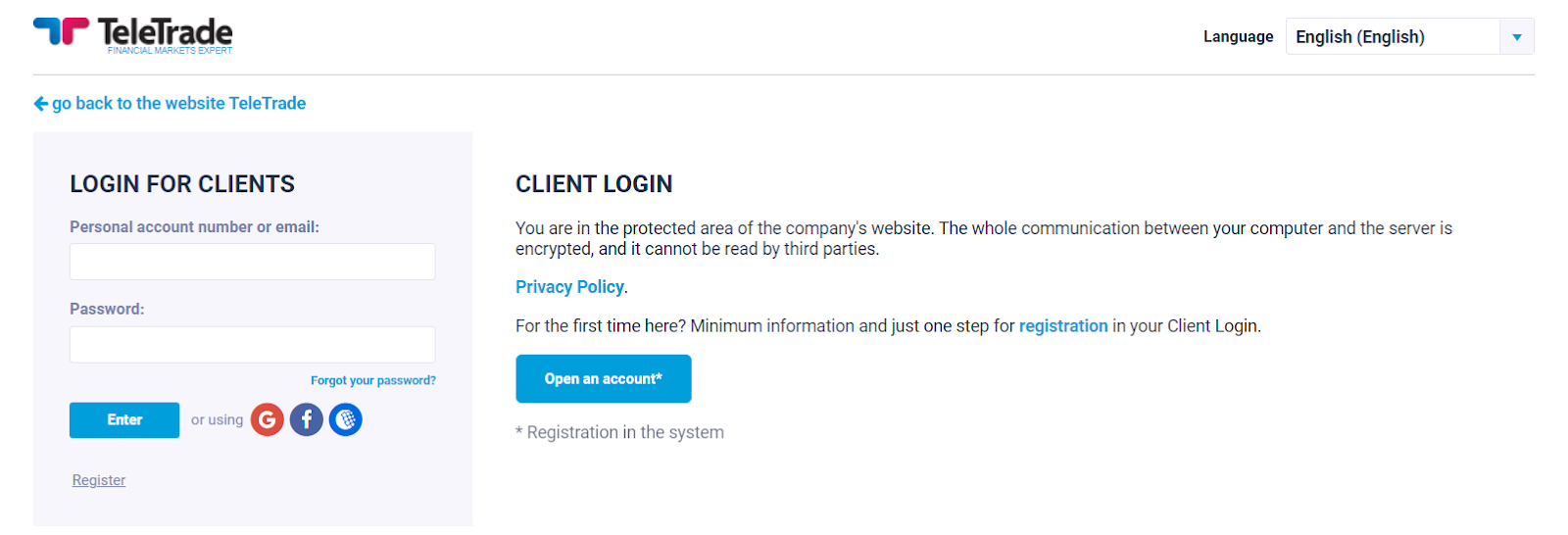

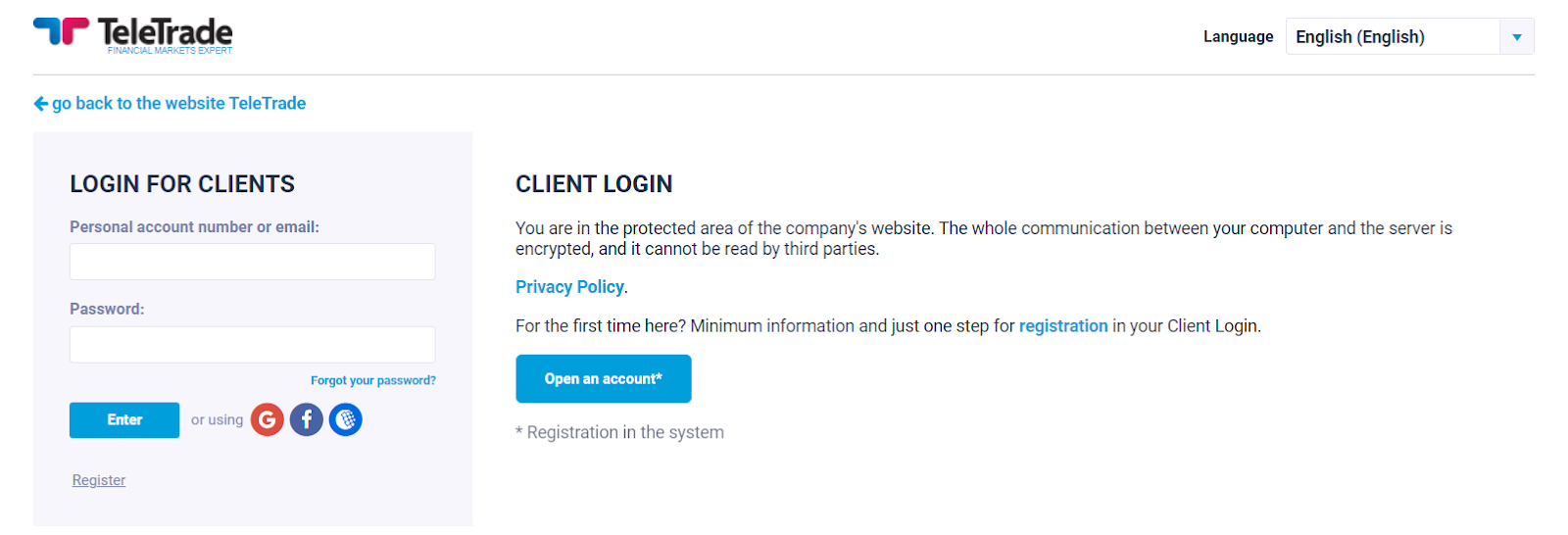

You can register or log into your Personal Account on TeleTrade from the home page of the broker’s website. Just click Personal Area.

To log in, you must enter your email or Personal Account number and password. You can also use quick authorization via Google, Facebook or WebMoney Transfer.

If you have not registered with a broker yet, click Open an account on the same page. To register, you will need to provide your name, phone number, email address and password. You will also need to verify your identification document. You can also use the quick registration option through Google, Facebook or WebMoney Transfer.

After authorization/registration, you can download and launch the trading platform and make a deposit.

In your Personal Account, you can use the company's bonuses, choose a trading instrument, review analytics and perform trades.

Other features available in your Personal account on TeleTrade:

-

latest analytics and news;

-

trading statistics through robots;

-

useful educational information;

-

access to trading history and deposits/withdrawals;

-

current quotes;

-

support service for professional advice;

-

the possibility to contact a personal manager - for VIP clients;

-

statistics on the effectiveness of affiliate programs;

-

bonuses and contests from the broker.

Regulation and safety

TeleTrade has a safety score of 4.7/10, which corresponds to a Low security level. The safest brokers are those with Tier-1 regulation, a long history (over 10 years in the market), and participation in investor compensation schemes.

- Is regulated

- Negative balance protection

- Track record over 31 years

- Not tier-1 regulated

TeleTrade Regulators and Investor Protection

| Abbreviation | Full Name | Country of regulation | Investor Protection Fund | Regulation Level |

|---|---|---|---|---|

SVG FSA SVG FSA |

Financial Services Authority of St. Vincent and the Grenadines | St. Vincent and the Grenadines | No specific fund | Tier-3 |

TeleTrade Security Factors

| Foundation date | 1994 |

| Negative balance protection | Yes |

| Verification (KYC) | Yes |

Commissions and fees

The trading and non-trading commissions of broker TeleTrade have been analyzed and rated as Medium with a fees score of 7/10. Additionally, these commissions were compared with those of the top two competitors, Pepperstone and OANDA, to provide the most comprehensive information.

- Tight EUR/USD market spread

- No inactivity fee

- No deposit fee

- No withdrawal fee

- Above-average Forex trading fees

Trading Fees and Spread

Below, we evaluated and compared the trading commissions of TeleTrade with those of two competitors. We focused on the spreads and other transaction fees directly associated with executing trades (e.g commission per lot on an ECN account). This comparison aimed to provide a clear understanding of the cost efficiency of each broker.

Standard Account Spread

For Standard accounts, TeleTrade’s commissions are part of the floating spread, which varies with market conditions. Typical values are provided, but during high volatility, the spread may exceed these.

TeleTrade Standard spreads

| TeleTrade | Pepperstone | OANDA | |

| EUR/USD min, pips | 0,8 | 0,5 | 0,1 |

| EUR/USD max, pips | 1,4 | 1,5 | 0,5 |

| GPB/USD min, pips | 0,1 | 0,4 | 0,1 |

| GPB/USD max, pips | 0,5 | 1,4 | 0,5 |

RAW/ECN Account Commission And Spread

The spread on ECN/RAW accounts is market-based and fluctuates, with average values given during active hours. It may vary during volatility spikes. A commission per lot is also charged.

TeleTrade RAW/ECN spreads

| TeleTrade | Pepperstone | OANDA | |

| Commission ($ per lot) | 3,5 | 3 | 3,5 |

| EUR/USD avg spread | 0,2 | 0,1 | 0,15 |

| GBP/USD avg spread | 0,2 | 0,15 | 0,2 |

Non-Trading Fees

We conducted a detailed analysis of the non-trading fees associated with TeleTrade. This review offers a comprehensive overview of the additional costs that may impact traders beyond regular trading activities.

TeleTrade Non-Trading Fees

| TeleTrade | Pepperstone | OANDA | |

| Deposit fee, % | 0 | 0 | 0 |

| Withdrawal fee, % | 0 | 0 | 0 |

| Withdrawal fee, USD | 0 | 0 | 0-15 |

| Inactivity fee ($, per month) | 0 | 0 | 0 |

Account types

TeleTrade provides clients with a choice of several trading account types. Standard currencies for replenishment are dollars and euros.

The maximum leverage is up to 1:1000. The company also grants privileges to traders who actively trade and make large deposits.

Account types:

Before opening a main account, a trader can evaluate the functionality of the platform and learn the capabilities of a brokerage company on a free demo account.

TeleTrade - How to open, deposit and verify a trading account | Firsthand experience of Traders Union

Deposit and withdrawal

TeleTrade received a Medium score for the efficiency and convenience of its deposit and withdrawal processes.

TeleTrade provides a reasonable range of deposit and withdrawal options with moderate fees, in line with industry standards.

- No withdrawal fee

- Bitcoin (BTC) accepted

- Low minimum withdrawal requirement

- BTC available as a base account currency

- PayPal not supported

- Only major base currencies available

- Limited deposit and withdrawal flexibility, leading to higher costs

What are TeleTrade deposit and withdrawal options?

TeleTrade provides a basic range of deposit and withdrawal options, covering essential methods in line with industry standards. This set of options is sufficient for most traders, with available methods Bank Card, Bank Wire, Skrill, Neteller, BTC, USDT.

TeleTrade Deposit and Withdrawal Methods vs Competitors

| TeleTrade | Plus500 | Pepperstone | |

| Bank Wire | Yes | Yes | Yes |

| Bank card | Yes | Yes | Yes |

| PayPal | No | Yes | Yes |

| Wise | No | No | No |

| BTC | Yes | No | No |

What are TeleTrade base account currencies?

A wide range of base account currencies minimizes the need for currency conversion, potentially reducing transaction costs for clients worldwide. TeleTrade supports the following base account currencies:

What are TeleTrade's minimum deposit and withdrawal amounts?

The minimum deposit on TeleTrade is $10, while the minimum withdrawal amount is $10. These minimums may vary depending on the chosen account type and payment method. For specific details, please contact TeleTrade’s support team.

Markets and tradable assets

TeleTrade offers a limited selection of trading assets compared to the market average. The platform supports 300 assets in total, including 60 Forex pairs.

- Crypto trading

- Passive income with bonds

- 60 supported currency pairs

- Limited asset selection

- Futures not available

Supported markets vs top competitors

We have compared the range of assets and markets supported by TeleTrade with its competitors, making it easier for you to find the perfect fit.

| TeleTrade | Plus500 | Pepperstone | |

| Currency pairs | 60 | 60 | 90 |

| Total tradable assets | 300 | 2800 | 1200 |

| Stocks | Yes | Yes | Yes |

| Commodity futures | Yes | Yes | Yes |

| Crypto | Yes | Yes | Yes |

| Stock indices | Yes | Yes | Yes |

| Options | No | Yes | No |

Investment options

We also explored the trading assets and products TeleTrade offers for beginner traders and investors who prefer not to engage in active trading.

| TeleTrade | Plus500 | Pepperstone | |

| Bonds | Yes | No | No |

| ETFs | Yes | Yes | Yes |

| Copy trading | No | No | Yes |

| PAMM investing | No | No | Yes |

| Managed accounts | No | No | No |

Trading platforms & tools

TeleTrade received a score of 8.4/10, indicating a strong offering in terms of trading platforms and tools. The broker provides broad access to popular platforms and supports a variety of features designed to enhance both manual and automated trading.

- One-click trading

- MetaTrader is available

- Free VPS for uninterrupted trading

- Trading bots (EAs) allowed

- No access to a proprietary platform

- Strategy (EA) Builder is not available

- No access to API

Supported trading platforms

TeleTrade supports the following trading platforms: MT4, MT5, WebTrader. This selection covers the basic needs of most retail traders. We also compared TeleTrade’s platform availability with that of top competitors to assess its relative market position.

| TeleTrade | Plus500 | Pepperstone | |

| MT4 | Yes | No | Yes |

| MT5 | Yes | No | Yes |

| cTrader | No | No | Yes |

| TradingView | No | Yes | Yes |

| Proprietary platform | No | Yes | Yes |

| NinjaTrader | No | No | No |

| WebTrader | Yes | Yes | Yes |

Key TeleTrade’s trading platform features

We also evaluated whether TeleTrade offers essential trading features that enhance user experience, accommodate various trading styles, and improve overall functionality.

Supported features

| 2FA | Yes |

| Alerts | Yes |

| Trading bots (EAs) | Yes |

| One-click trading | Yes |

| Scalping | Yes |

| Supported indicators | 68 |

| Tradable assets | 300 |

Additional trading tools

TeleTrade offers several additional features designed to enhance the trading experience. These tools provide greater automation, deliver advanced market insights, and help improve trade execution.

TeleTrade trading tools vs competitors

| TeleTrade | Plus500 | Pepperstone | |

| Trading Central | Yes | No | No |

| API | No | No | Yes |

| Free VPS | Yes | No | Yes |

| Strategy (EA) builder | No | No | Yes |

| Autochartist | Yes | No | Yes |

Mobile apps

TeleTrade supports mobile trading, offering dedicated apps for both iOS and Android. TeleTrade received 2/10 in this section, which suggests limited user interest or weak performance of the apps.

- Android and iOS apps

- Weak user feedback on Android

We compared TeleTrade with two top competitors by mobile downloads, app ratings, 2FA support, indicators, and trading alerts.

| TeleTrade | Plus500 | Pepperstone | |

| Total downloads | No data | 10,000,000 | 100,000 |

| App Store score | No data | 4.7 | 4.0 |

| Google Play score | No data | 4.4 | 4.0 |

| Mob. 2FA | No | Yes | Yes |

| Mob. Indicators | No | Yes | Yes |

| Mob. Alerts | No | Yes | Yes |

Education

The TeleTrade website features a large educational section where every trader can find information for successful Forex trading and more. The broker provides information on the basics of analysis, trading strategies, and also offers educational courses, video tutorials. The company also holds webinars.

You can test the knowledge you gained on the TeleTrade website by using a demo account. The broker’s specialists believe it can give novice traders the experience and skills to trade on a live account.

To support traders, a separate analytical section has been created on the website with an economic calendar, news and market overview.

Customer support

The broker's customer support is prepared to answer traders' questions 24 hours a day, 5 days a week.

Advantages

- Lots of contact options

- Multilingual support

- You can type your question in the search bar on the website

Disadvantages

- Doesn’t work on weekends

There are several ways to contact customer support:

-

call the phone number indicated on the website;

-

order a callback;

-

write ane-mail;

-

fill out the feedback form;

-

via live chat in your account.

Support is available from the TeleTrade website and from your personal account.

Contacts

| Foundation date | 1994 |

|---|---|

| Registration address | Teletrade D.J. Limited 20599 IBC 2012 First Floor, First St. Vincent Bank Ltd Building James Street, Kingstown St. Vincent and the Grenadines |

| Regulation | SVGFSA |

| Official site | https://www.teletrade.org/ |

| Contacts |

+442080895636

|

Comparison of TeleTrade with other Brokers

| TeleTrade | Bybit | Eightcap | XM Group | FxPro | FBS | |

| Trading platform |

MT4, MT5 | MetaTrader5 | MT4, MT5, TradingView | MT4, MT5, MobileTrading, XM App | MT4, MobileTrading, MT5, cTrader, FxPro Edge | MT4, MobileTrading, MT5, FBS app |

| Min deposit | $10 | No | $100 | $5 | $100 | $5 |

| Leverage |

From 1:1 to 1:1000 |

From 1:1 to 1:500 |

From 1:30 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | 1.00% | No | No | No | No | No |

| Spread | From 0.2 points | From 0 points | From 0 points | From 0.8 points | From 0 points | From 1 point |

| Level of margin call / stop out |

70% / 20% | No / 50% | 80% / 50% | 100% / 50% | 25% / 20% | 40% / 20% |

| Order Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | Yes | No | No | No | No | No |

Detailed Review of TeleTrade

TeleTrade is a fairly young company that provides services to clients almost all over the world, offering them latest products for trading. Also, the broker is a member of the Association of Forex Dealers, a self-regulatory organization.

TeleTrade is the right broker for beginners and experienced traders

TeleTrade is one of those companies that combine wide functionality and technological effectiveness. The broker offers a lot of educational materials to help novice traders learn how to trade in the Forex market. The company's clients can start trading with a $10 deposit.

The brokerage company is suitable for traders who prefer various strategies: pipsing, light intraday trading, as well as medium-term and long-term trading. TeleTrade offers quick order execution (Market Execution, Instant Execution). Traders working with the broker can use popular trading platforms MetaTrader 4 and MetaTrader 5 for trading and market analysis Both desktop and mobile versions of the platforms are available for devices running on Android and iOS.

The company offers a lot of services for forecasting the market situation and price movements for selected financial instruments.

TeleTrade provides the following analytical services:

-

quotes from major banks;

-

banks’ interest rates;

-

market and central bank news;

-

economic calendar and holiday calendar;

-

technical analysis;

-

market reviews;

-

trading signals.

Advantages:

rather good trading conditions: three types of accounts, not including the demo account; relatively low spreads - from 0.2 pips;

many trading instruments: currency pairs, stocks, indices, cryptocurrencies and energies;

plenty of educational materials - a beginner can quickly learn the trading basics;

a good fundamental and technical market analysis toolkit;

social trading - you can earn money without trading yourself.

Latest TeleTrade News

Articles that may help you

User Satisfaction i